HARRY'S BI-WEEKLY UPDATE 2.21.23

February 21, 2023

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

SPRING BUYING AND SELLING SEASON IS ALMOST HERE

The Wall Street Journal 2.16.23

As I was preparing to write this eNewsletter, The Wall Street Journal had an article with some great information about the same things I was going to tell you. I’ll share that, and more, right here.

While the market frenzy of the past several years is now behind us, don’t expect the spring buying and selling season to be a “walk in the park” so to speak.

The affordability crunch, given the median single-family home prices and the mortgage interest rates, is working against some buyers, and most especially for first-timers.

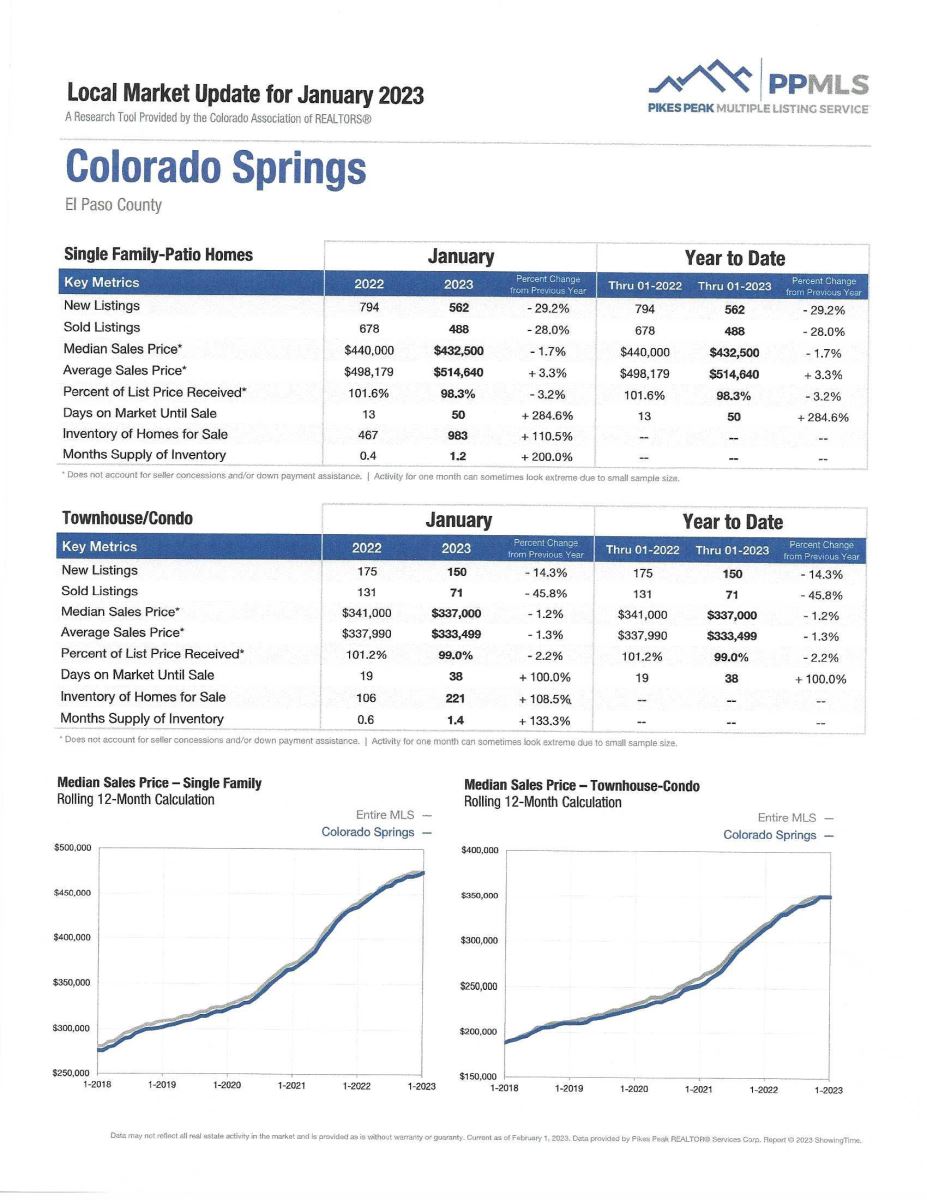

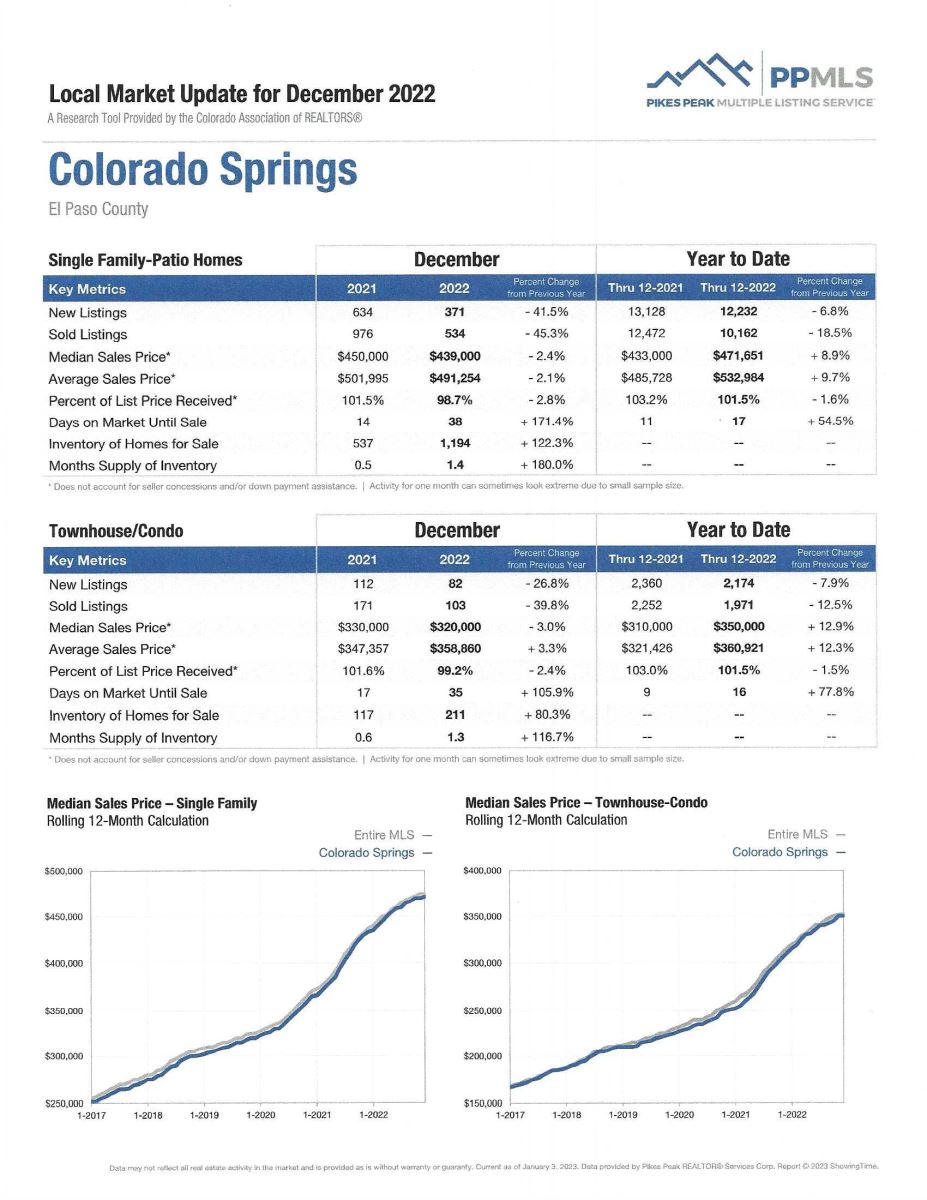

However, potential buyers are entering an improved market where bidding wars are less common, and homes are staying on the market longer. In January, homes nationwide were on the market a median 51 days, an increase of more than three weeks from a year ago, according to Redfin. In Colorado Springs, it was essentially the same.

Seller and Buyers should both be prepared to make reasonable concessions to get to the closing table. This could mean a Seller offering x-amount to the Buyer to use for whatever the Buyer may feel the home might need or the Buyer offering to let the Seller lease back the home for a specified time to facilitate a move to a new home.

Whatever the concession, it’s worth considering to get an offer accepted. According to Redfin, Buyers received concessions in 42% of home sales in the fourth quarter, up from 31% a year earlier.

And continuing a trend that began during the recent market frenzy, cash offers and strong financing continue to often win out over higher offer prices. Buyers should aim for a down payment of 20%.

Problems with financing and home inspection are among the most common reasons for contracts falling through.

While a cash offer is “king” for a Buyer looking to play hardball, for many Buyers it isn’t an option. Being fully pre-approved from a lender is the next best thing to help facilitate the sale rather than a simple pre-approval letter that hasn’t gone through the lender’s underwriting process yet.

Homes that have been on the market for several months this winter may offer discounts to Buyers who are now ready to make a deal.

What I’m saying is that NOW is a great time to get ready for the spring season. Buyers will be looking, and Sellers are ready. That’s a win-win situation when properly matched.

That’s why you’ve got me. Not only am I the “real estate Therapist”, I’m also a great Matchmaker. With my almost 51 years of experience in the local Real Estate arena, I’ve become an expert at putting together deals that work.

Yes, interest rates are higher than they’ve been, and home prices are not getting cheaper, but there is almost always a way to find a home that can meet your wants, needs and budget requirements. And my guess is that this spring is going to be a great time to make that happen.

But whether you’re buying or selling, it begins with a phone call to me at 719.593.1000 or an email to Harry@HarrySalzman.com . Together we can make all your Residential real estate dreams come true.

AND, A LITTLE BIT OF BRAGGING…

Once again, I’m happy to report that I have achieved a top honor at ERA real estate. As a member of the Circle of Honor I was recently honored for my “extraordinary efforts and commitment to success”.

I don’t work for any reason other than to make certain I do the very best for my clients, but I must admit that it’s nice that my company also appreciates what I do. So, when you see the decal below, you’ll know what it means!

COLORADO SPRINGS HOME PRICES ARE HIGHER IN FOURTH QUARTER…AMONG MOST EXPENSIVE IN THE COUNTRY

The National Association of Realtors, 2.9.23

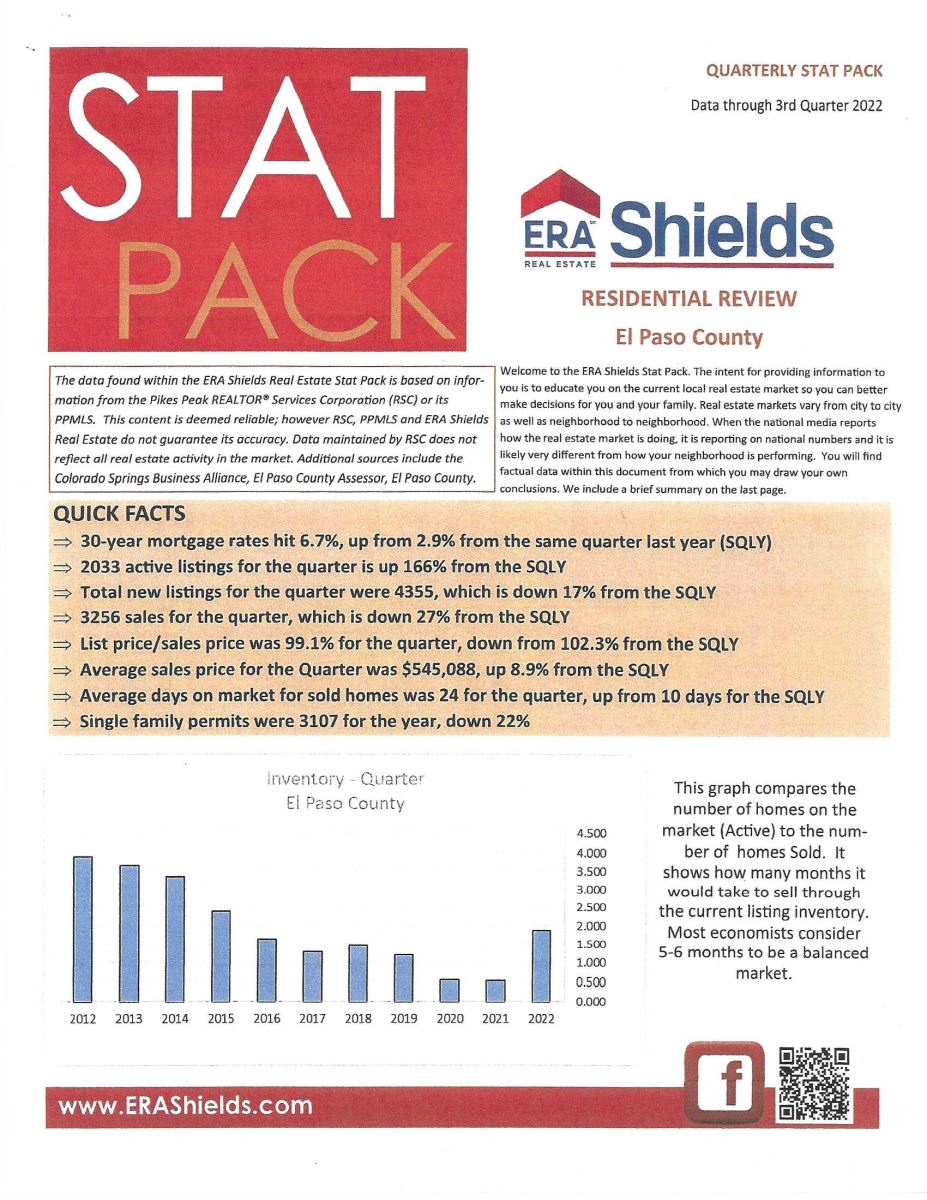

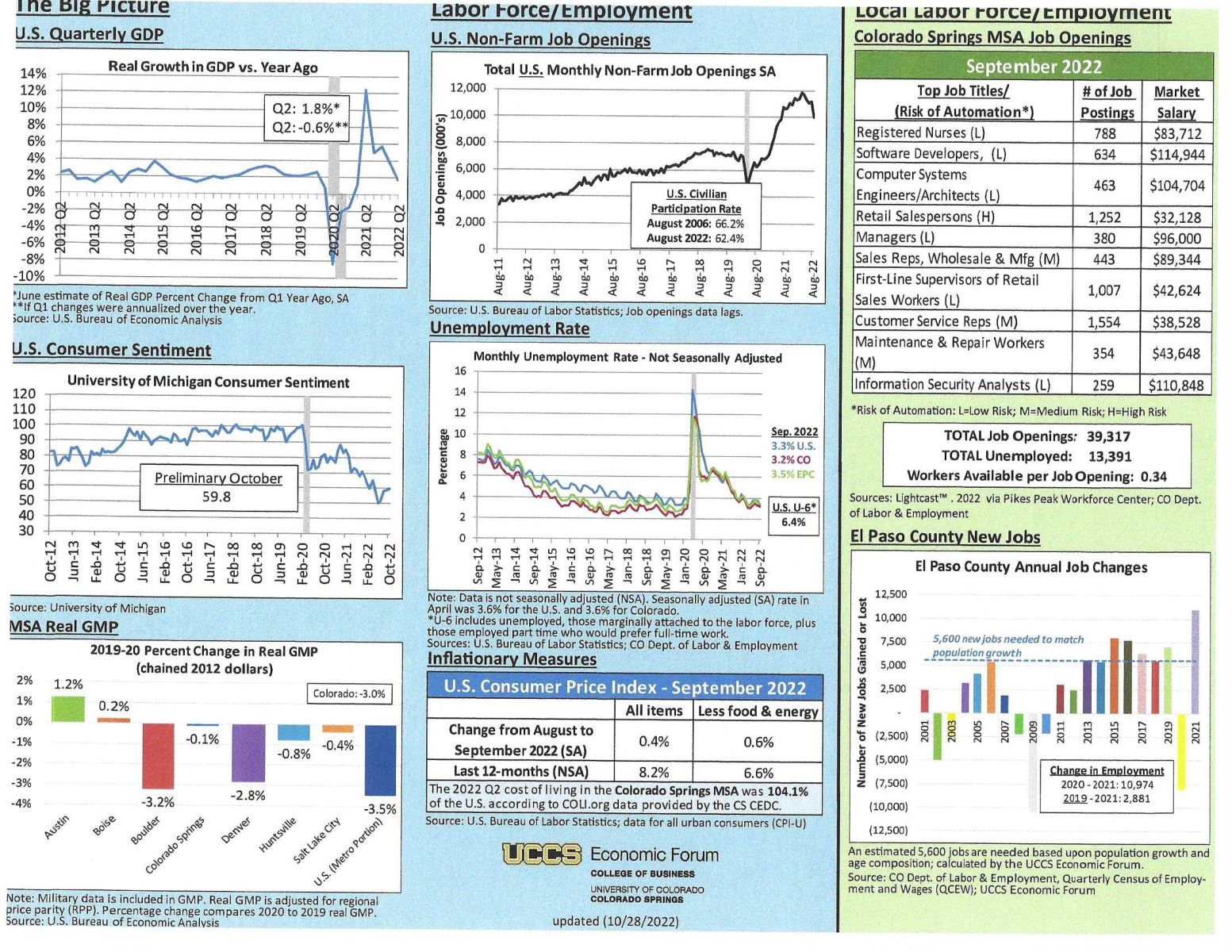

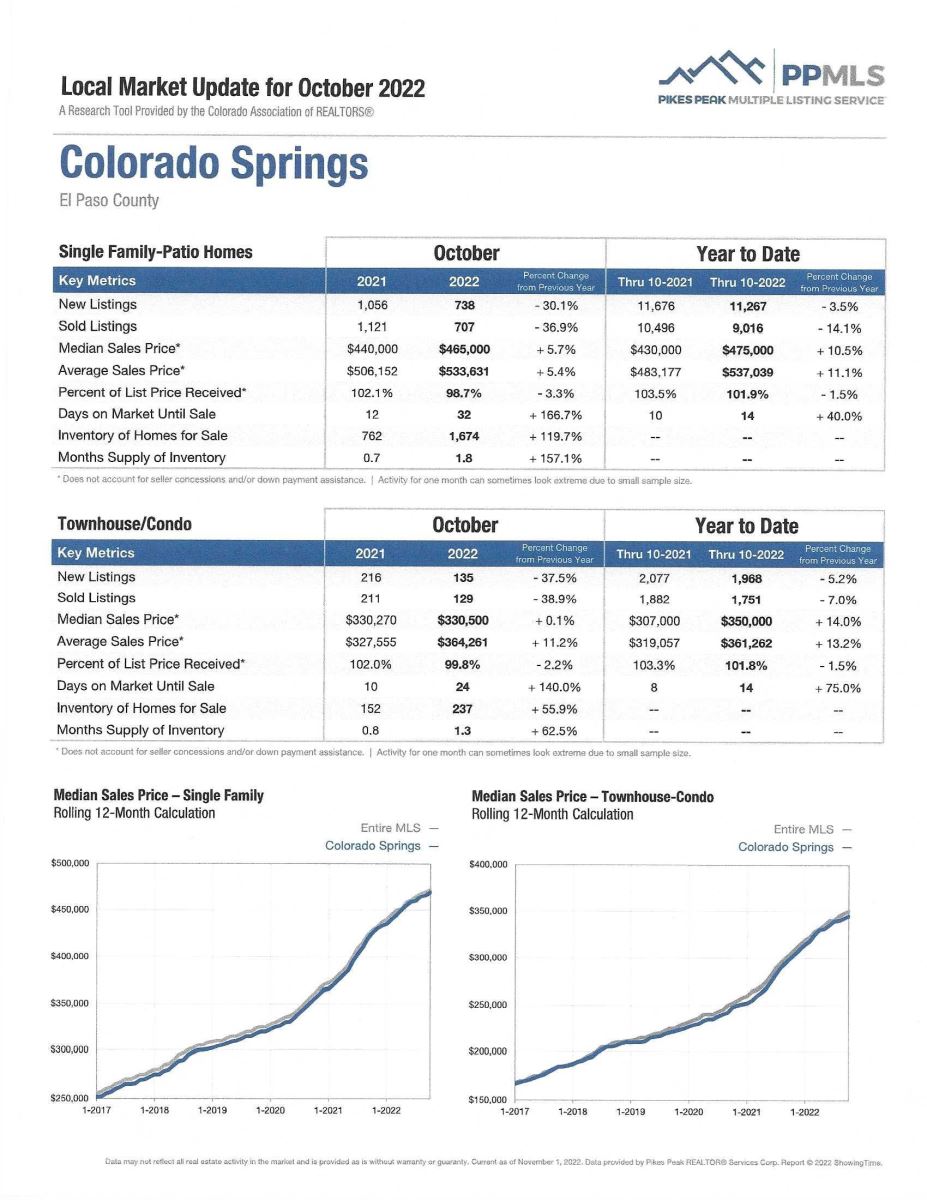

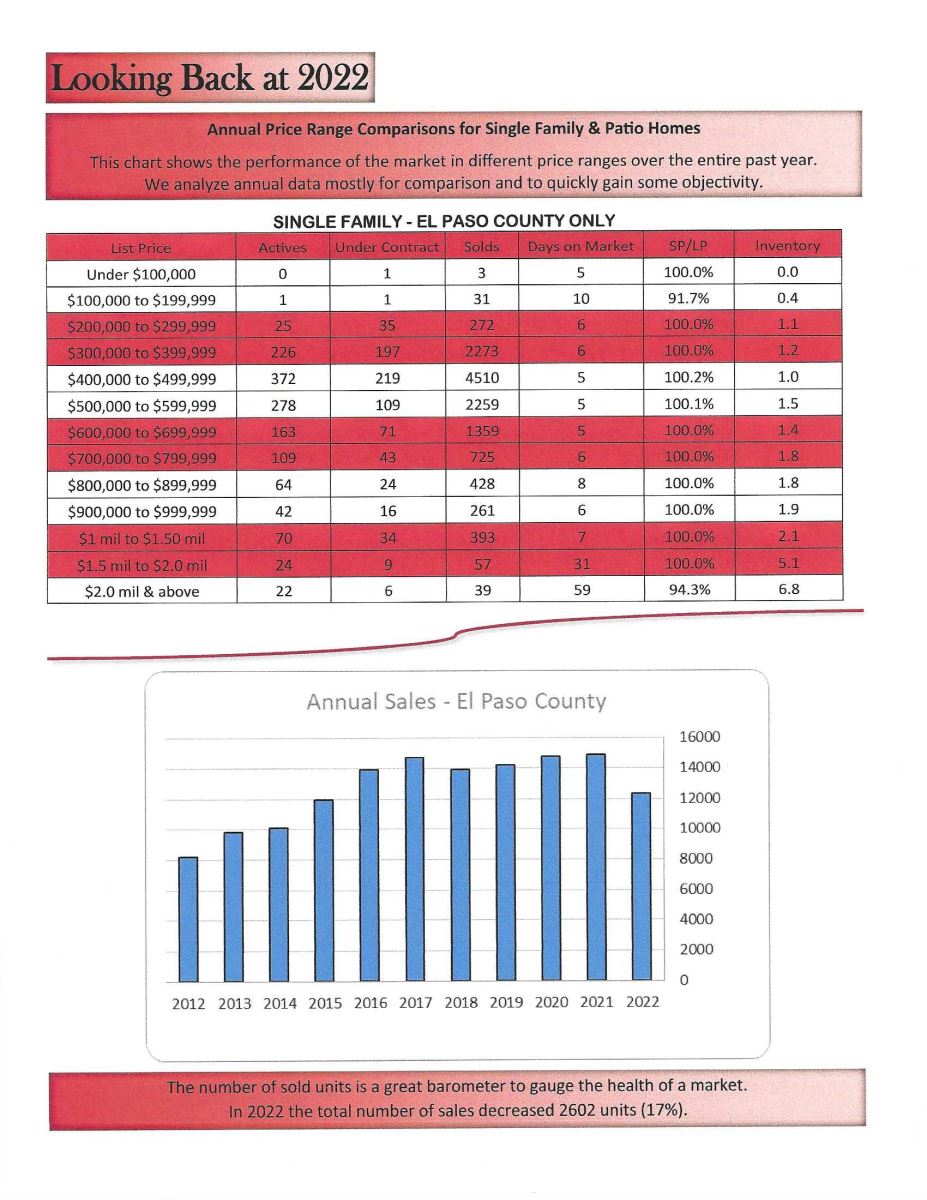

Median prices of single-family homes across the nation rose for Quarter Four 2022 in 90% of the 186 metro areas surveyed quarterly by The National Association of Realtors (NAR), with the median price nationally rising 4.0% to $378,700 from one year ago.

Home prices in Colorado Springs rose less than 1% for that same time period but was still ranked number 36 based on Median Sales Prices of the 186 cities surveyed. The Median Sale Price here for the end of Quarter Four 2022 was $443,400. Prices reflect detached, single-family and patio homes but not townhomes or condominiums.

And once more, the good news is that while our home values are increasing, they are still less than those in the Denver, Boulder, and Ft. Collins areas, which makes our city more attractive to potential companies and others wanting to relocate here.

Qualifying income for local mortgages continues to rise. However, increased home value in your present home can likely give you a larger down payment. That could possibly keep your monthly output lower than you might expect, even in a more expensive new home.

To see all 186 metro areas in alphabetical order, please click here. To see them in ranking order, click here. To see the qualifying income necessary for mortgages, click here.

And if you have any questions, you know where to reach me.

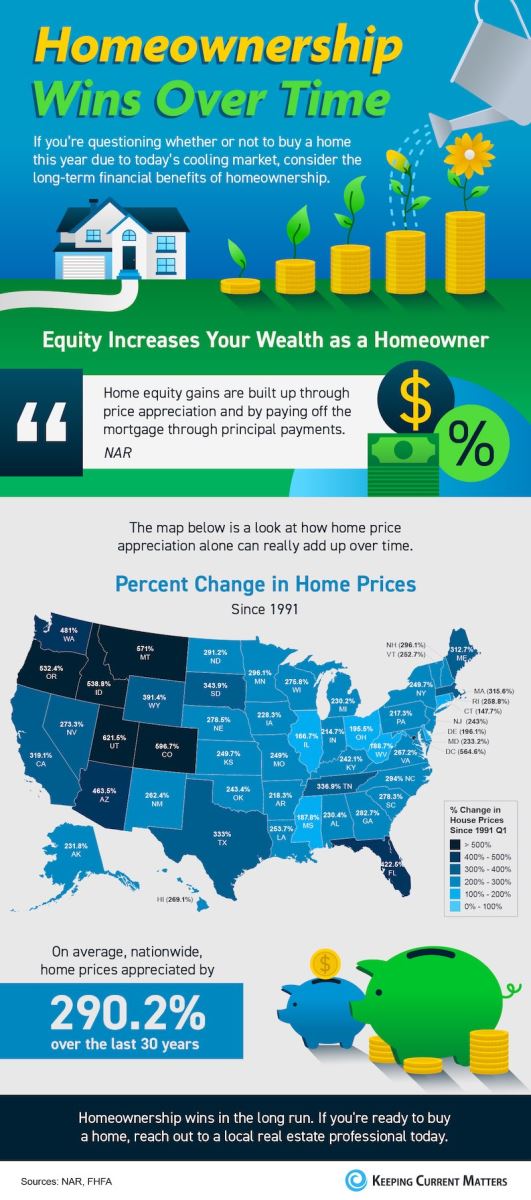

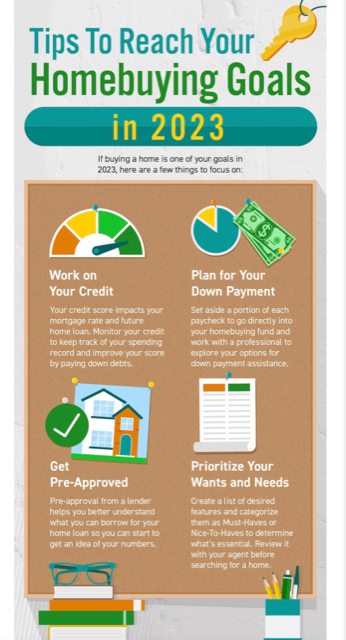

THE SPRING housing market CAN STILL BE A SWEET SPOT FOR SELLERS---AN INFOGRAPHIC

KeepingCurrentMatters, 2.17.23

Some Highlights:

- The biggest challenge in the housing market is how few houses there are for sale compared to the number of people who want to buy.

- The number of homes for sale is up from last year but below pre-pandemic numbers, and that means we’re still in a Seller’s market.

- The housing market needs more homes for sale to meet the demand of today’s buyers. If you’ve thought about selling, now’s the time to contact me.

SHOULD YOU CONSIDER BUYING A NEWLY BUILT HOME?

KeepingCurrentMatters, 2.15.23

While you might be focusing on previously owned homes in your search for a new home, with so few choices today it might make sense to consider all options, which include a home that’s newly built.

Even though there are more homes for sale today than a year ago, there’s still an historically low number of available homes on the market. One reason for that is years of underbuilding—meaning there haven’t been enough new homes built to keep up with the demand.

During the past 14 years, the number of new homes being built each year is on the rise and that’s good news for Buyers. According to Mark Fleming, chief economist at First American:

“While existing-home inventory remains limited, the silver lining for home buyers is that new-home inventory is on the rise, and a new home at the right price is a pretty good substitute.”

And, while there is a growing number of newly constructed homes for sale, builders are slowing the pace until they sell more of their current inventory. According to Logan Mohtashami, Lead Analyst at HousingWire:

“The builders have to work off the backlog of homes, but instead of 3%-4% mortgage rates, they’re dealing with 6% plus mortgage rates, which means they have to provide many incentives to make sure those homes sell.”

Many builders are now offering incentives to help Buyers purchase these homes. Fleming also explains:

“The National Association of Home Builders reported that nearly two-thirds of builders were offering incentives, including mortgage rate buydowns, paying points for Buyers and price reductions, which could entice home Buyers.”

A builder who is willing to pay to reduce your mortgage rate could be a game changer. Ksenia Potapov, Economist at First American puts it this way:

“A one percentage-point decline in mortgage rates has the same impact on affordability as an 11 percent decline in house prices.”

Should you buy a brand-new home? There are many things to consider, including location, and the only way to determine that is to meet with a knowledgeable real estate professional like me who can help you determine if that is the best way for you to go.

And did I mention that new home purchasing advice is one of the services I provide my clients at no additional charge to them?

I have long time working relationships with a number of local builders, so if you are considering new home purchasing, just give me a call and let’s see if that fits into your long term Residential real estate plan. It might be just the right decision for your individual situation.

HARRY’S JOKE OF THE DAY:

.jpg)

.jpg)

.jpg)

.jpg)