HARRY'S BI-WEEKLY UPDATE 3.24.23

March 24, 2023

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

HOMEOWNERSHIP IS A LONG-TERM INVESTMENT…AND OFTEN YOUR GREATEST ASSET

Several nights ago I had dinner with some long-time friends who also happen to be long-time real estate brokers. It was a social evening but naturally the talk eventually came around to the real estate market and how we and our clients are handling the “new normal”.

We discussed the higher mortgage loan interest rates and chuckled over the fact that we all had purchased first homes at rates considerably higher than they are today. I related that I was happy when rates fell from 9% to 8.5% prior to closing on my first new home.

Several of us remember the days of 12% VA loans and rates as high as 18%. So to us, 6% or 7% isn’t “high”. And maybe it was good that we started buying and selling homes when rates were so high so that we could appreciate the lower rates that eventually came to be.

However, as you might imagine, the prices of those first homes were as low as $25,000. And to us at that time, with the higher interest rates, our monthly payments were “high” in comparison to our income.

The one thing we all agreed on was that no matter what—homeownership contributed to our own personal wealth, and it continues to do so.

Residential real estate is a long-term investment and one that most always helps increase personal wealth. It provides tax benefits and is certainly far better than renting if at all possible for so many reasons.

The Pikes Peak Association of Realtors (PPAR) started keeping track of local sales in 1985 and I calculated the “average” sales price increase from 1985 to this month and it is 7%. When you consider how many various Residential real estate “cycles” this covers you can see what a fabulous long term investment homeownership is while at the same time providing you and your family a place to call “home”.

Another thing we discussed at dinner was how many different cycles we have seen over the years and how we’ve all found creative ways to help our clients succeed with their buying and selling wants and needs.

This just reinforced what I’ve been telling you forever. It’s so very important to have a seasoned, knowledgeable professional in your corner when you are buying or selling Residential real estate, either for the first time, to sell and trade up or for investment purposes.

Fortunately, you have me. My almost 51 years in the local arena, coupled with my Investment Banking background, give me a heads up on the competition. I spend the time to find out the individual wants, needs and budget requirements of each and every client. I do the homework to make sure you find the neighborhood that’s just right for you and your family.

That’s why I’m still working…and I don’t consider it work…I consider it a privilege …when I help past clients, their children and sometimes lately their grandchildren realize their Residential real estate dreams.

Yes, it’s a different market than it was a year ago and 50 years ago, but together we can navigate it and find the right fit for you.

And it all starts with a call to me at 719.593.1000 or an email to Harry@HarrySalzman.com .

I hope to hear from you soon.

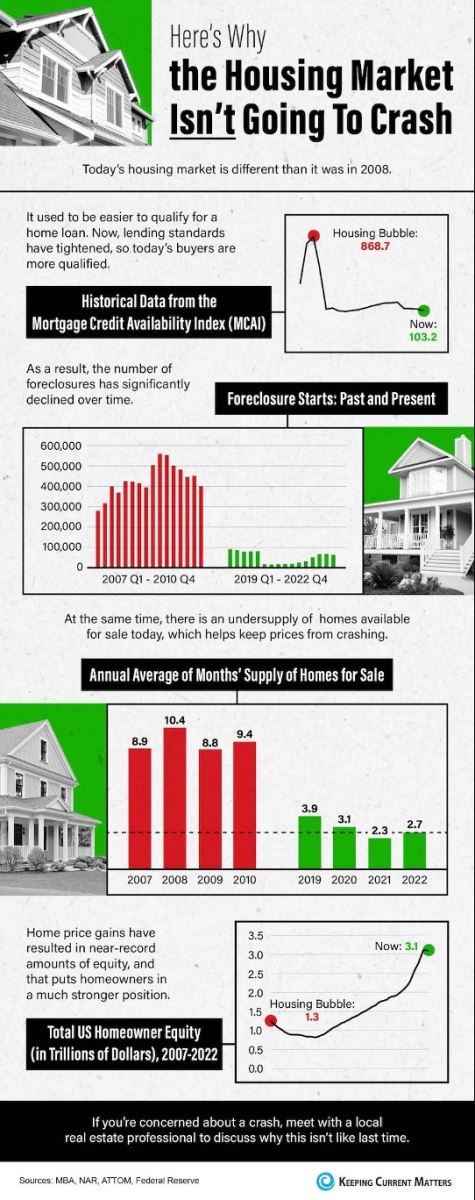

HERE’S WHY THE housing market ISN’T GOING TO CRASH…AN INFOGRAPHIC

KeepingCurrentMatters, 3.22.23

I get asked time and again about the 2008 housing market crash and how it compares to today’s market. To begin with, Colorado Springs did not get hurt as badly as the rest of the country back then and I don’t expect it to experience any great market swings at present, either.

Yes, interest rates are higher and home prices are not appreciating as much as they did over the last several years, but that’s not necessarily a bad thing. It’s simply the market “normalizing”, as I kept telling you it would.

While I don’t expect we will see the 2% or 3% interest rates again, I do expect them to go down from today’s rate. Remember, this is the fastest time ever that rates accelerated but they couldn’t stay that low forever. The buying frenzy those low rates created was not fun for anyone looking for a home and today buyers are able to take a little more time to find the “right” home for them.

With today’s high inflation, it’s time to come to terms with the fact that higher rates are here for the foreseeable future. However, as I mentioned earlier, they’ve been a lot higher, and folks were still buying homes. There is always someone who needs to buy and someone who needs to sell, and there are ways to make it work for each.

The infographic below gives you greater detail about why things are different today than they were in 2008:

HOME PRICES FELL IN FEBRUARY FOR THE FIRST TIME IN 11 YEARS

The Wall Street Journal, 3.21.23

And now some good news…

With the first year-over-year drop in home prices in more than a decade and a dip in the mortgage rates, the yearlong streak of declining monthly home sales has snapped, showing the effects of the Federal Reserve’s campaign to raise interest rates.

Nationally, sales of previously owned homes, which constitute most of the housing market, rose 14.5% in February from the prior month, but were down 22.6% from a year earlier, according to the National Association of Realtors (NAR). Sales had decreased for 12 consecutive months through January.

Buyers benefited from a slight improvement in affordability as home prices were slightly lower and interest rates eased from a 20-year high last fall.

If you’re wanting to step into the spring buying season to test the waters, give me a call sooner than later and let’s see how we can make all of this work for you.

NEW HOME CONSTRUCTION COULD PROVIDE SOME INCENTIVES FOR BUYERS

The Wall Street Journal, 3.10.23

New home builders today are facing a number of challenges from high construction costs to rising interest rates and buyer concerns about job security and inflation. According to the National Association of Home Builders, (NAHB), sales of newly built single-family homes last December increased by 2.23% due largely to builder incentives and lower mortgage rates. But sales were still down 16.4% compared to December 2021.

To stimulate sales, 57% of builders offered some type of incentive in last month, from mortgage interest-rate buydowns to closing-cost credits to free upgrades and options, while 31% reduced home prices, according to NAHB.

What that means is that savvy buyers who know what to look for and what to ask can find deals, particularly ones willing to pay cash or close quickly.

Again, you fortunately have me in your corner when it comes to new home construction as well. I have great relationships with a number of local homebuilders and can help you navigate those waters as well—all at no additional cost to you.

If this is something you want to explore, give me a call and let’s see how to make it happen.

HARRY’S JOKE OF THE DAY: