HARRY'S BI-WEEKLY UPDATE 2.24.26

February 24, 2025

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

RESIDENTIAL real estate IS STILL IN FLUX….

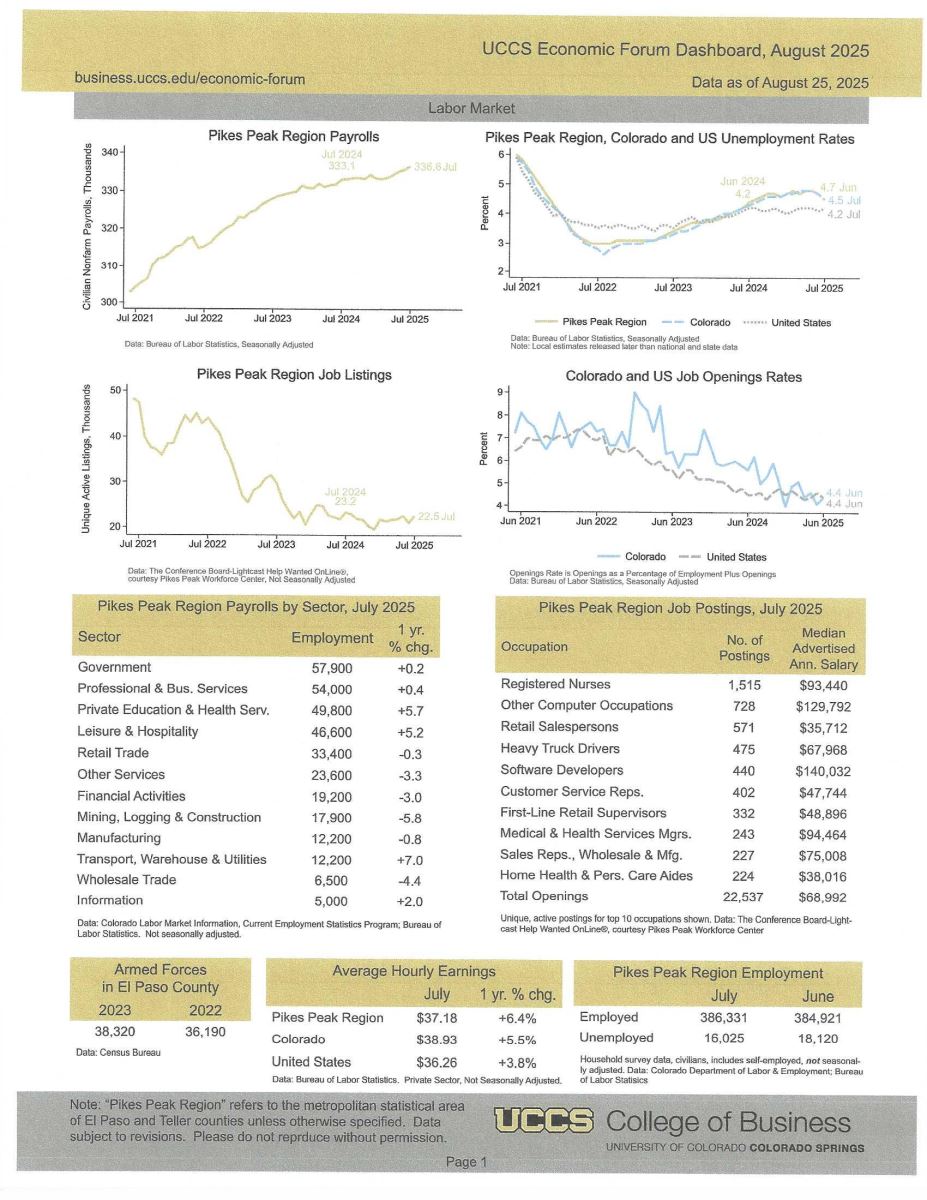

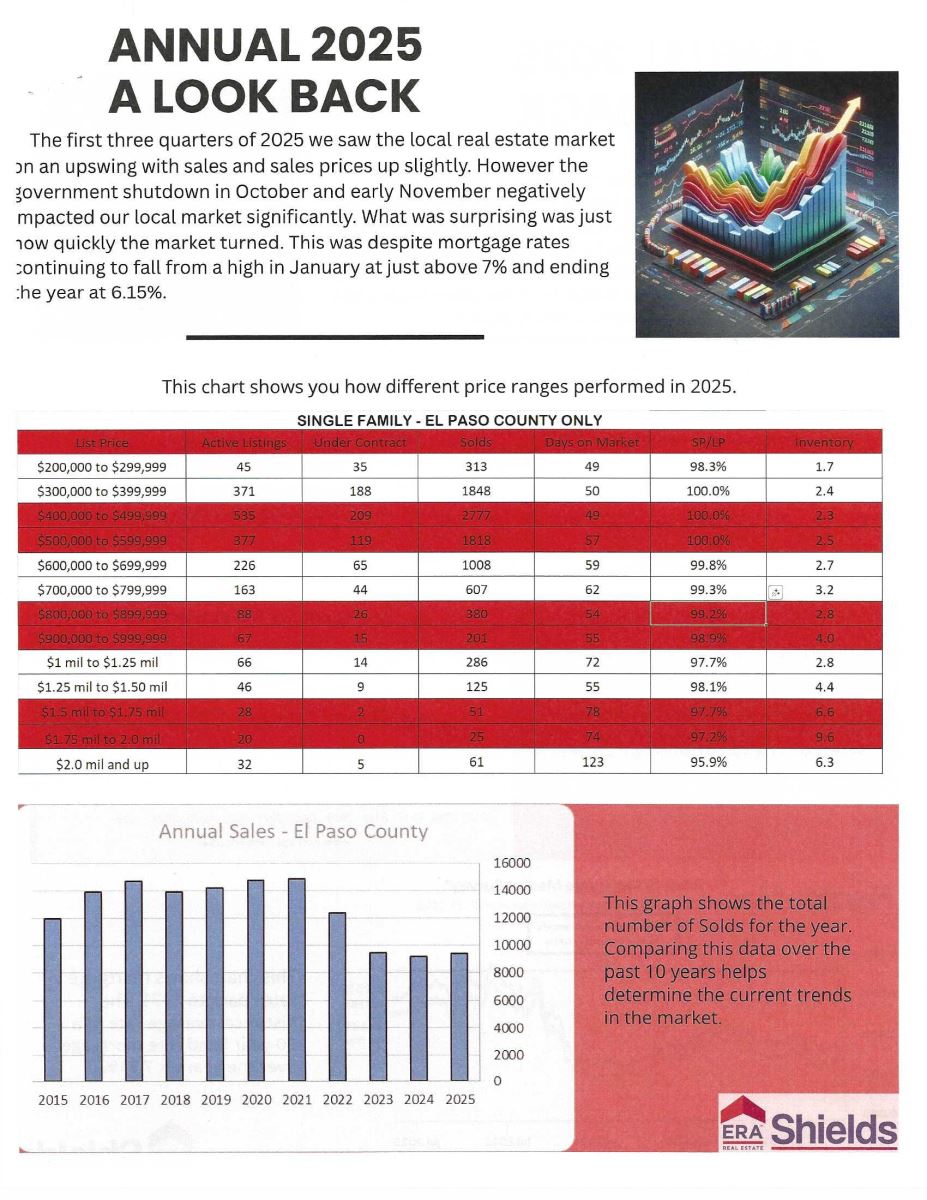

HOME PRICES CONTINUE TO RISE YET SALES IN JANUARY POSTED BIGGEST MONTHLY DECLINE IN ALMOST FOUR YEARS

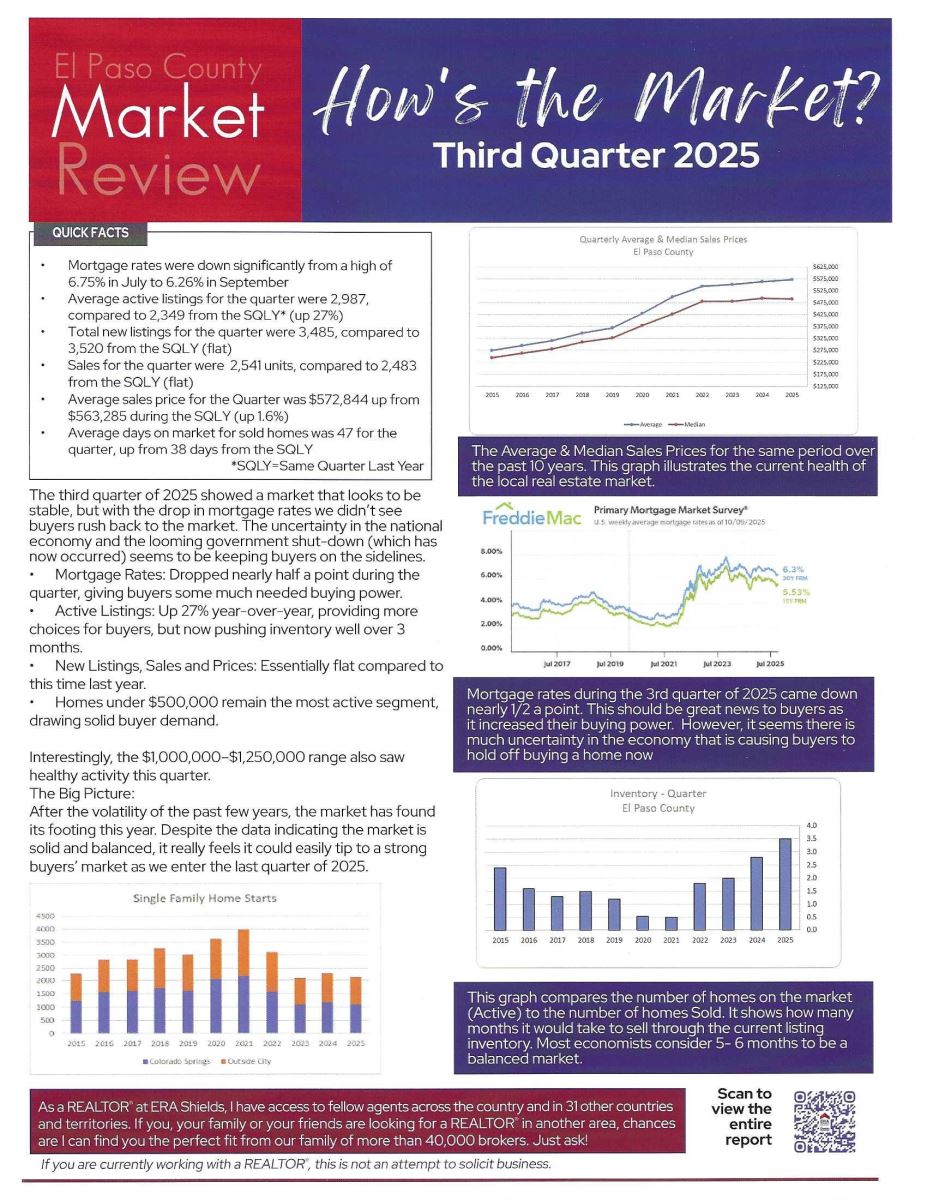

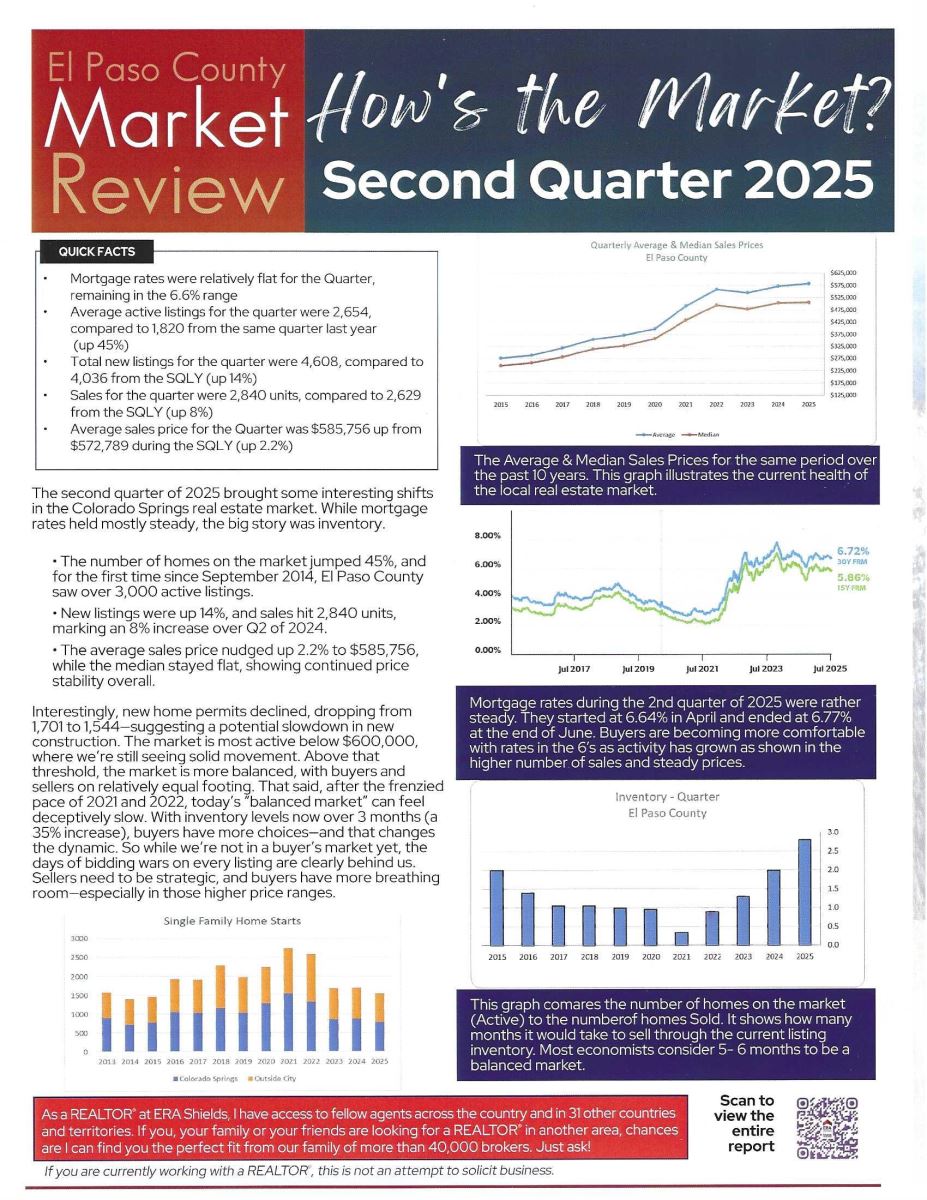

All things in the Residential real estate market keep changing so fast it’s often hard to give you information before it’s out of date.

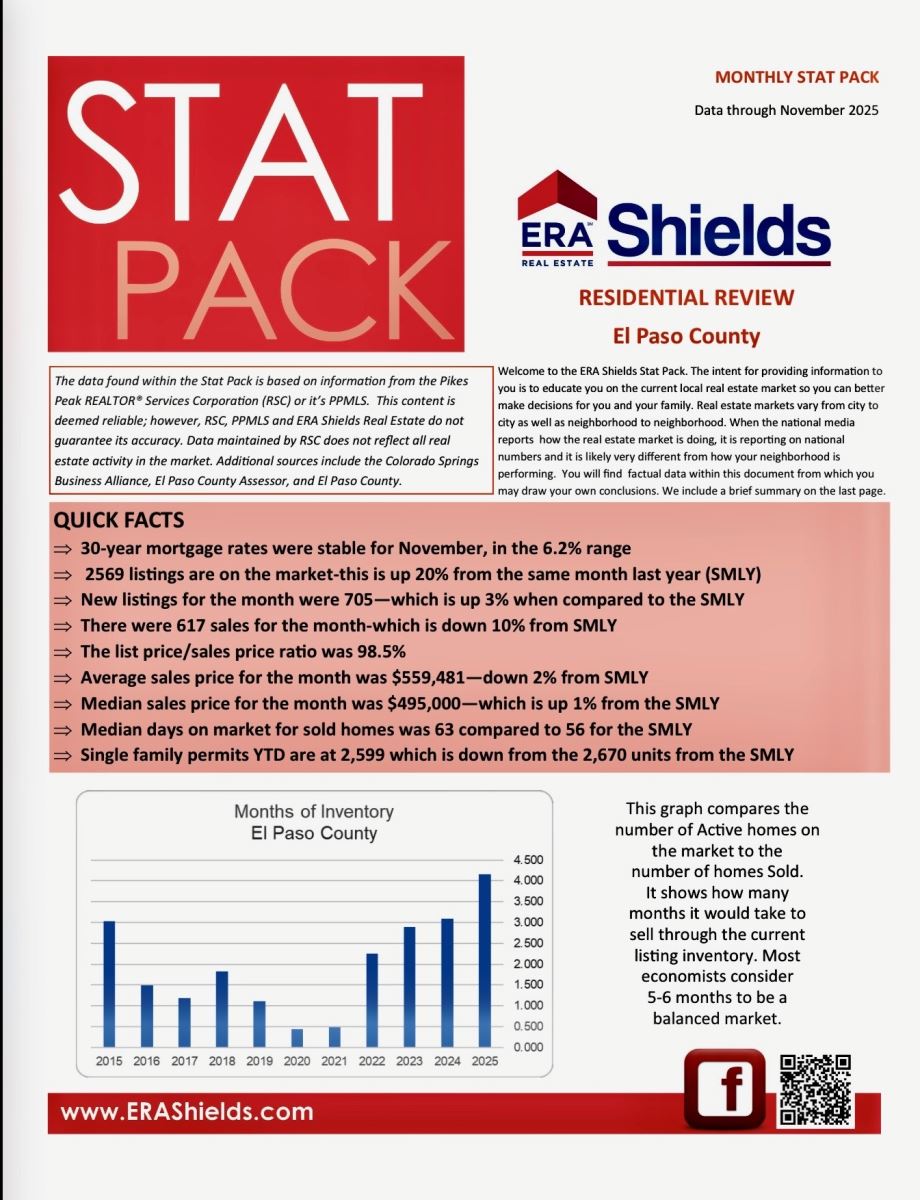

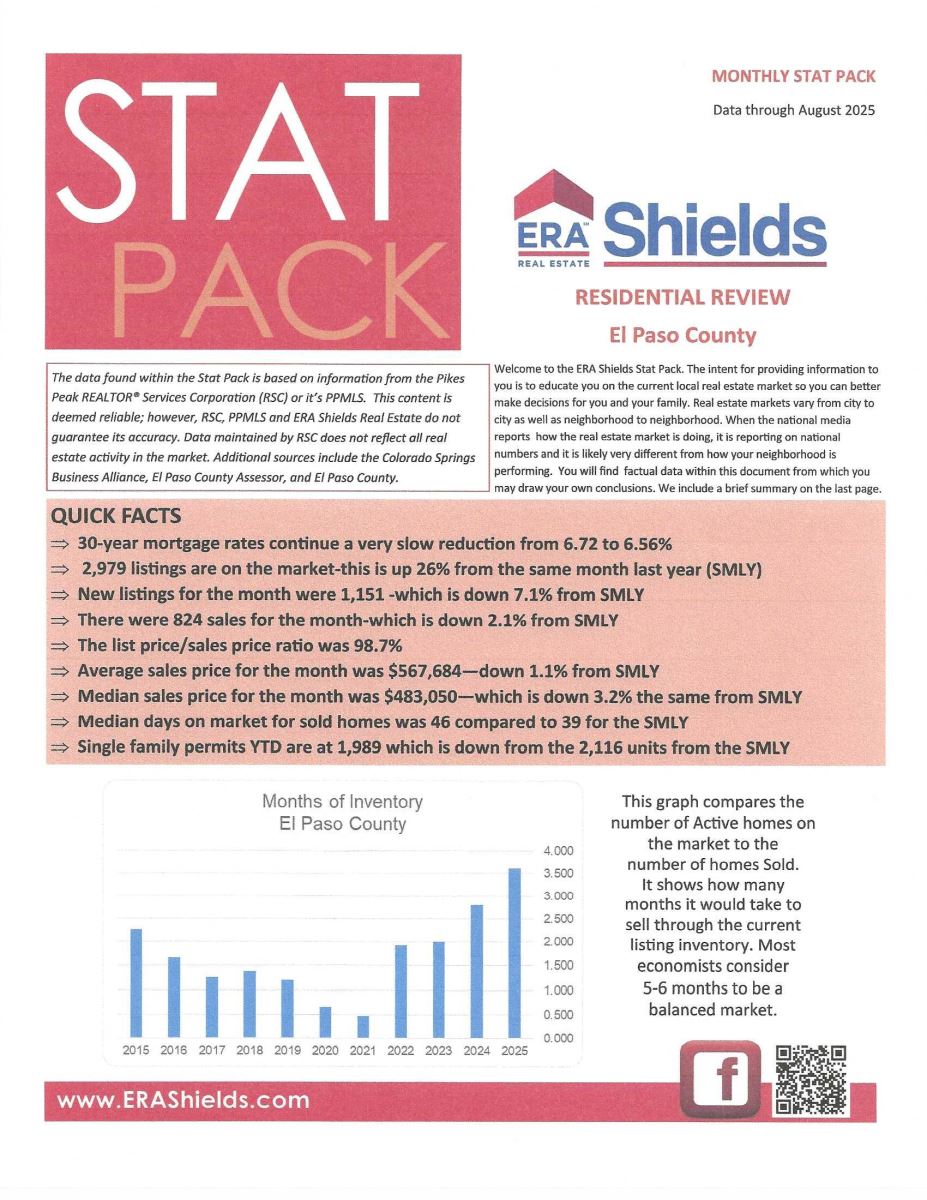

When I last wrote, sales were picking up and more existing homes were being listed for sale. I still see that happening here in the Springs, but a look at the national picture doesn’t reflect the same as of last week.

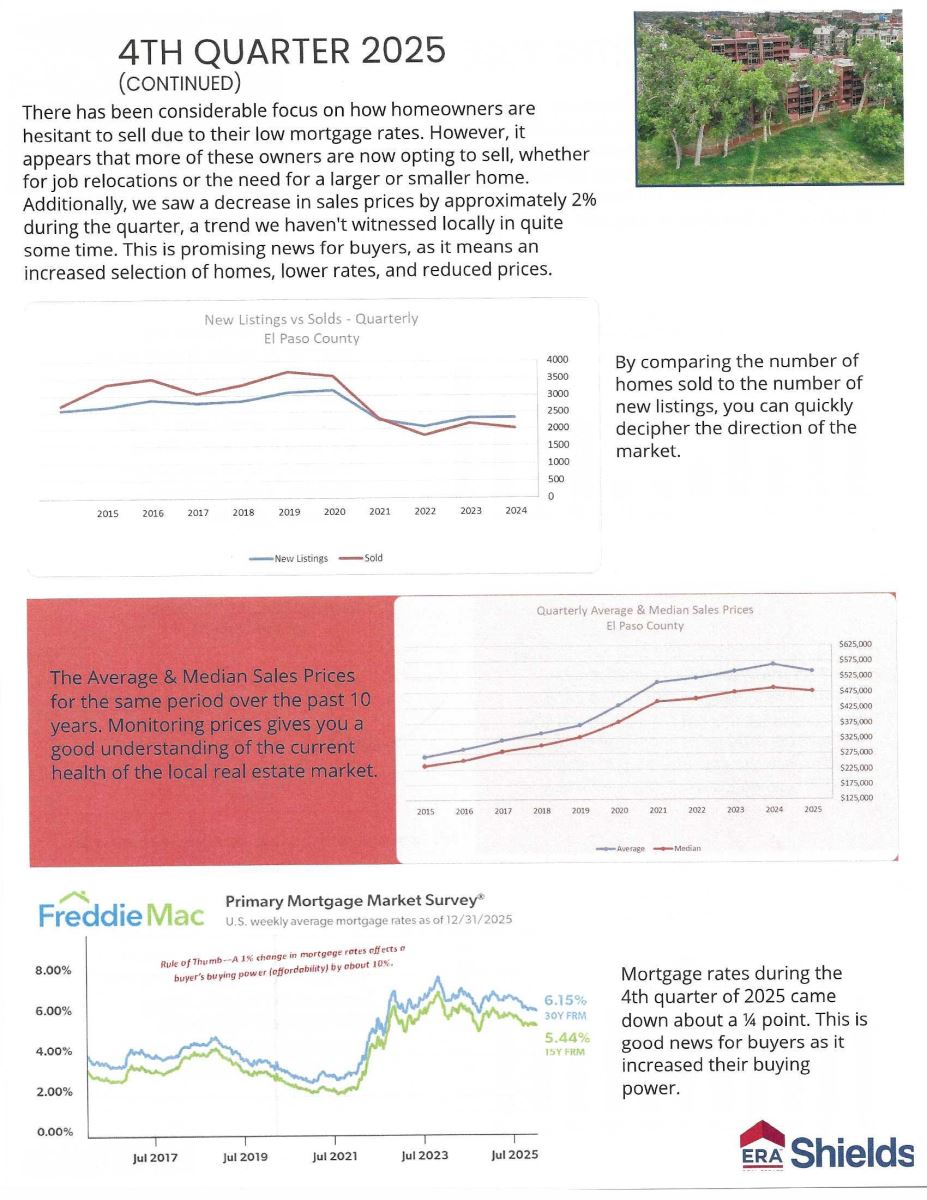

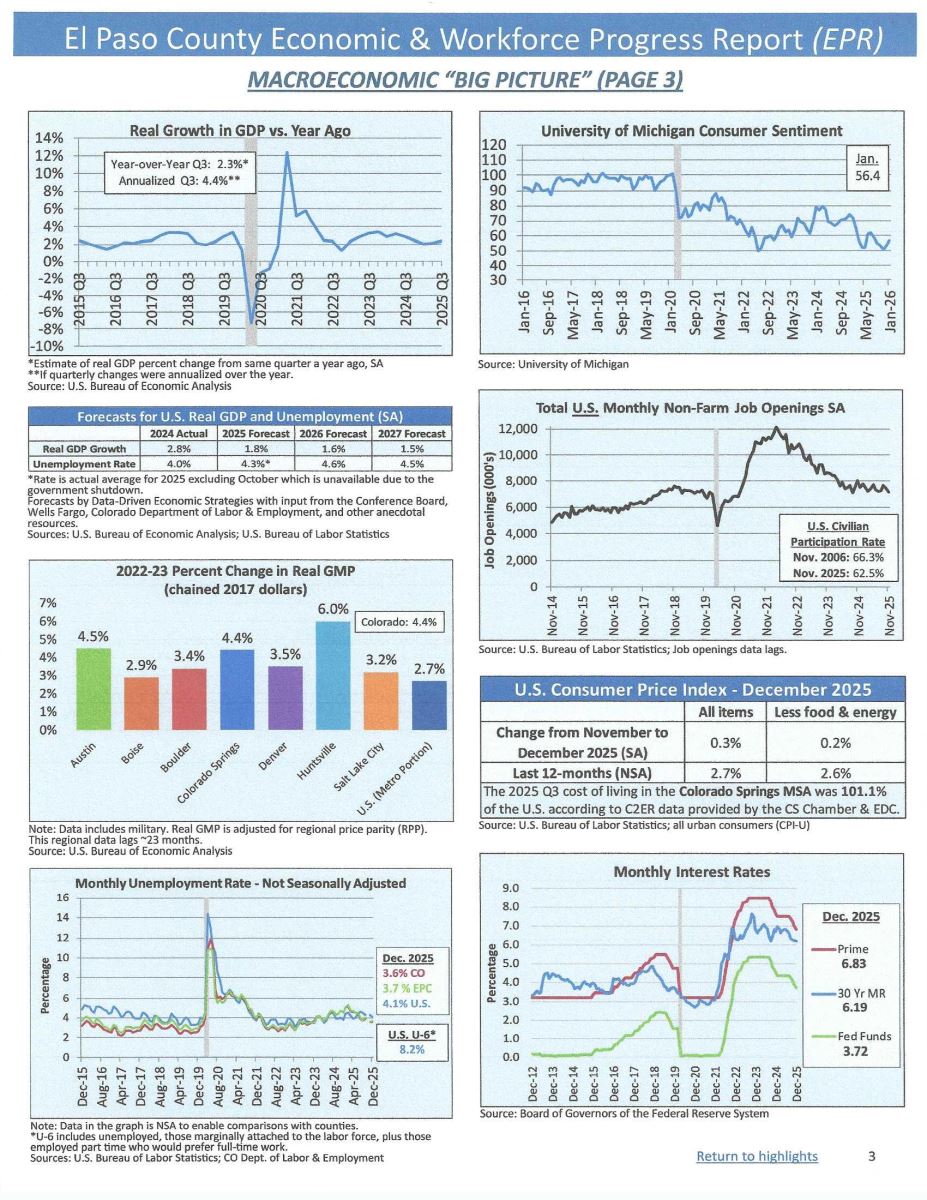

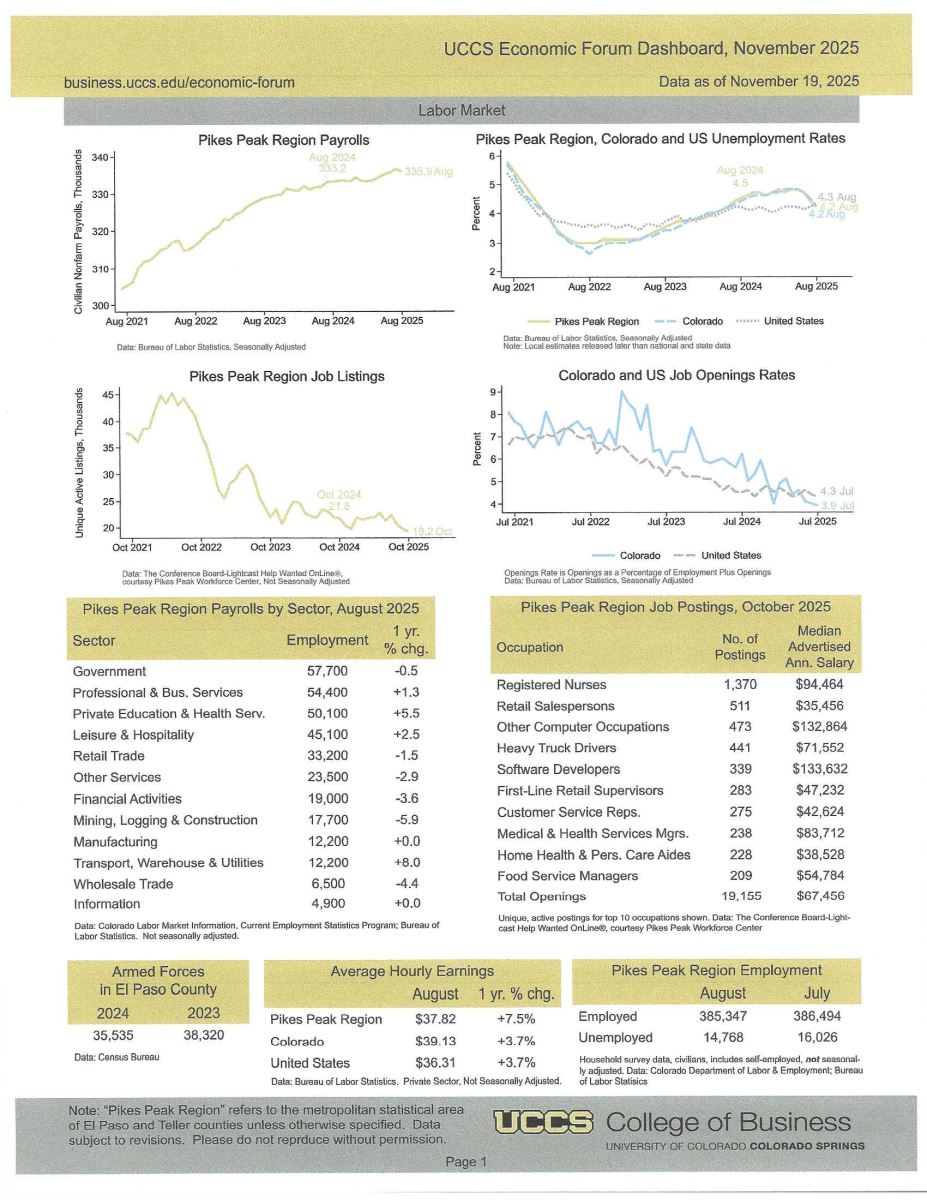

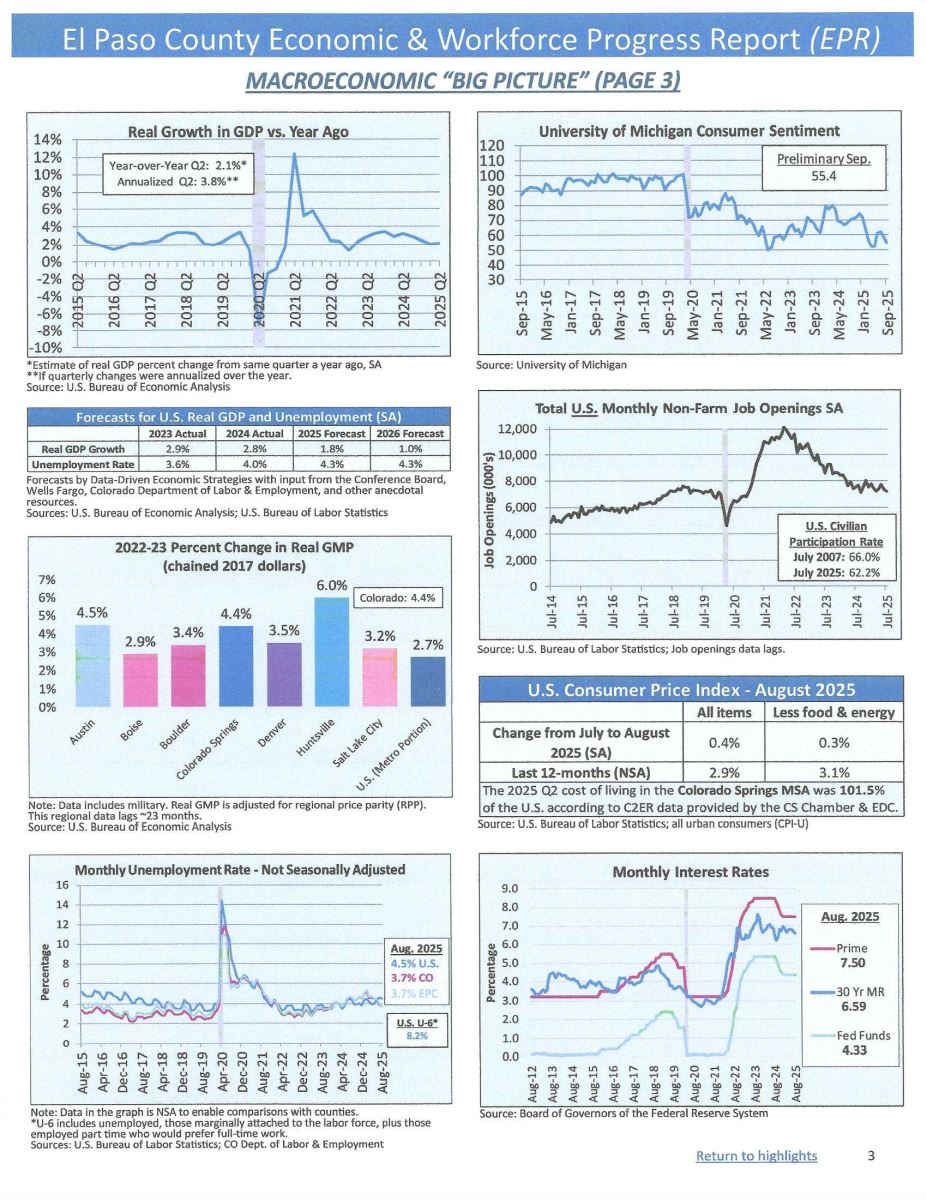

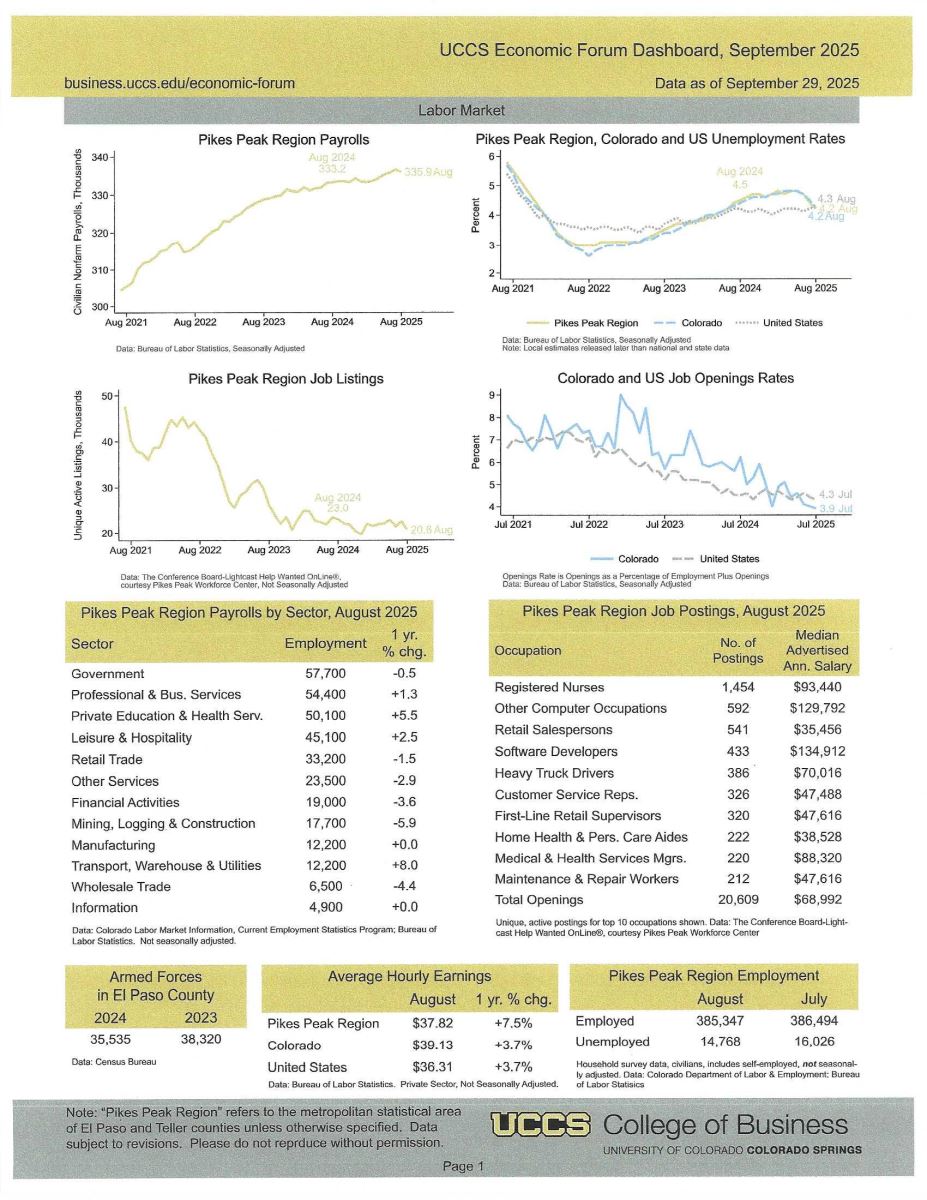

Home sales nationally in January posted their biggest monthly decline in nearly four years which is really saying a lot since sales have been down for most of the last several years. Some of this nationally can be attributed to freezing temperatures in a good part of the country which kept buyers at home. And of course, some can be attributed to the higher cost of homes for sale and low consumer confidence.

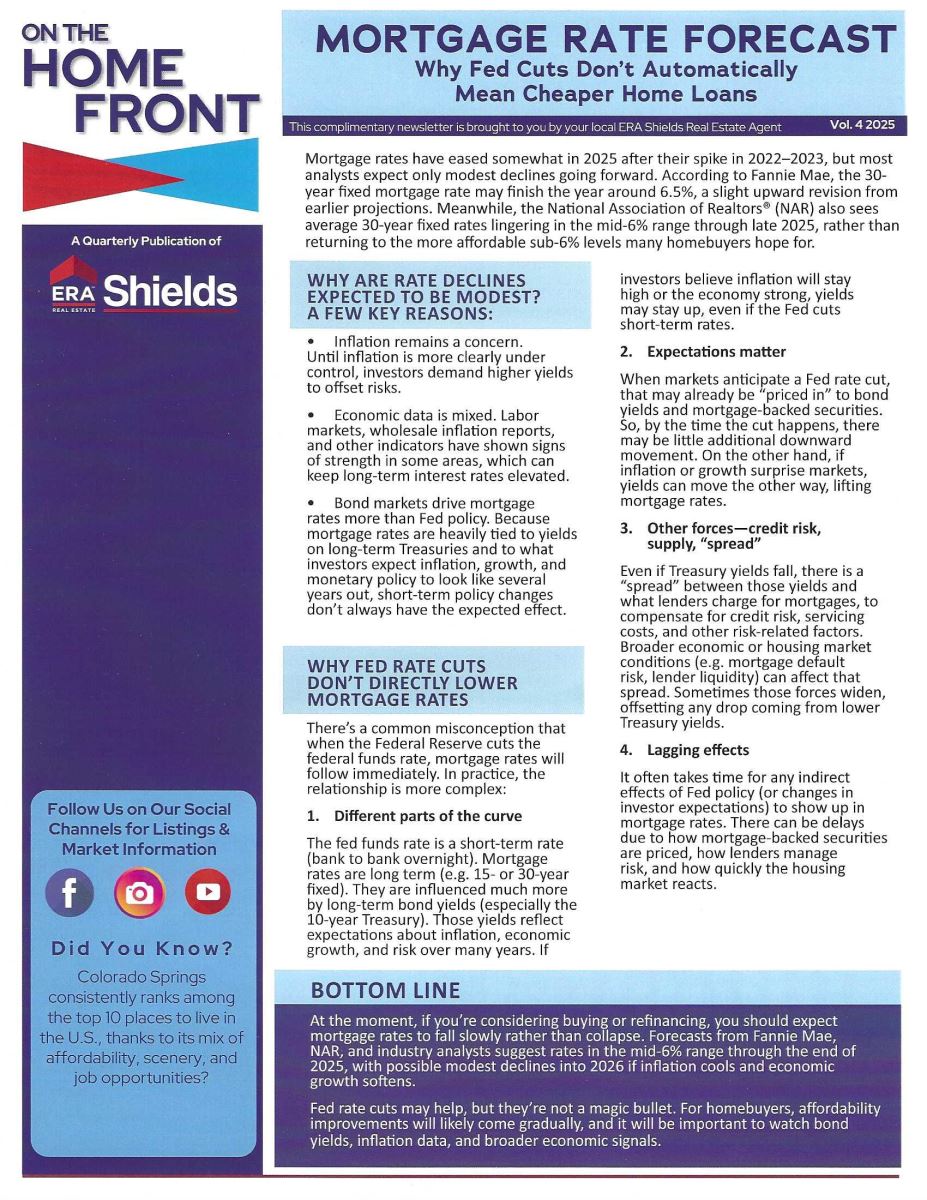

Stubbornly high home prices and average 30-year mortgage rates that are stuck above 6% are making buyers pickier and homes are sitting on the market longer. White-collar workers worried about their jobs and tend to avoid big ticket items like a new home.

According to Lawrence Yun, chief economist for the National Association of Realtors (NAR), “Improving affordability should have brought more people to the market. The sentiment about the economy is not there, and of course home buying does require some degree of people’s comfort levels, confidence to enter the market.”

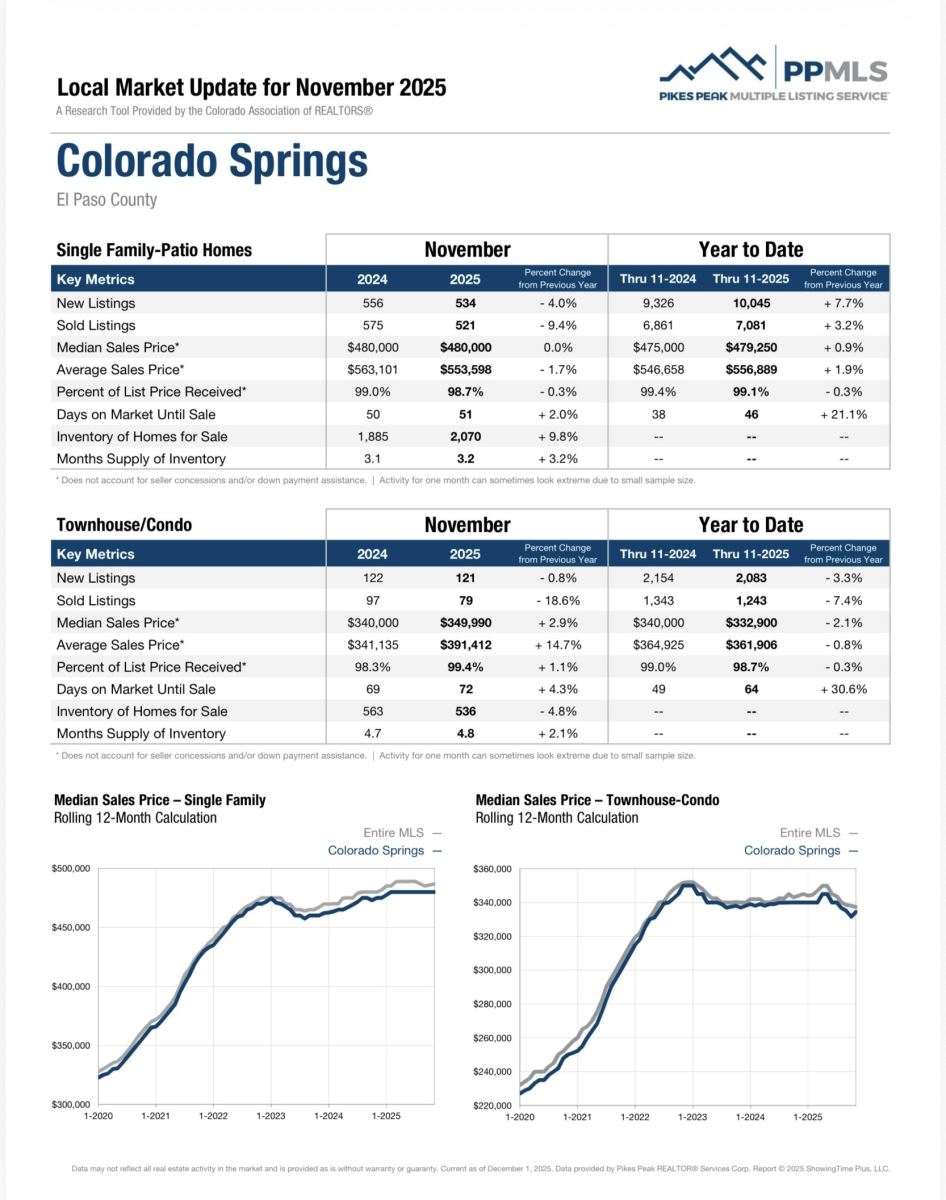

I wrote several weeks ago that the increase in sales in the last part of 2025 and in January spurred expectations that the housing market could start to pick up this year. And this is still happening here in Colorado Springs. For buyers who can afford a home purchase today, many are getting discounts: almost two-thirds of home buyers in 2025 paid below the original listing price, according to Redfin.

The upcoming spring buying and selling season will be key for determining whether the market here and nationally regains or continues momentum.

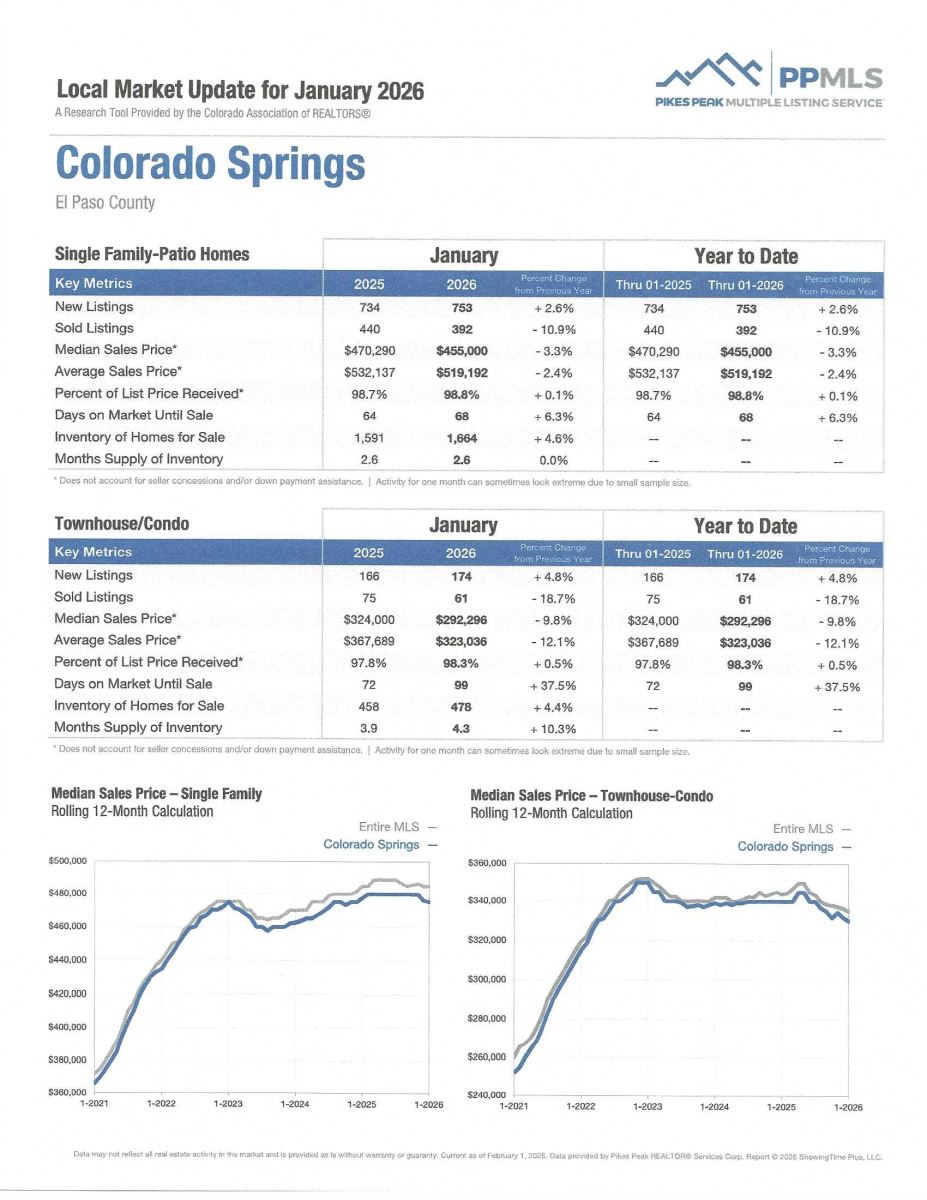

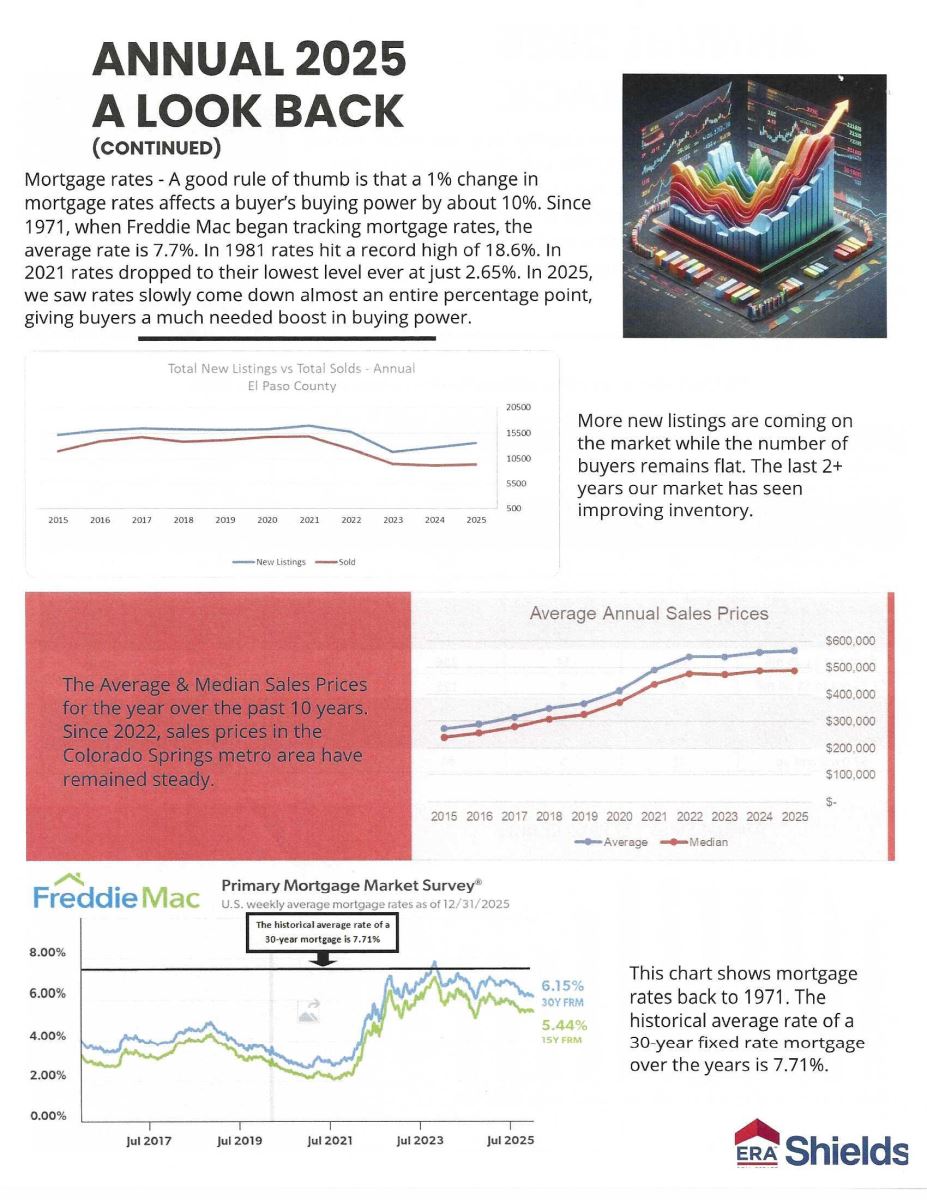

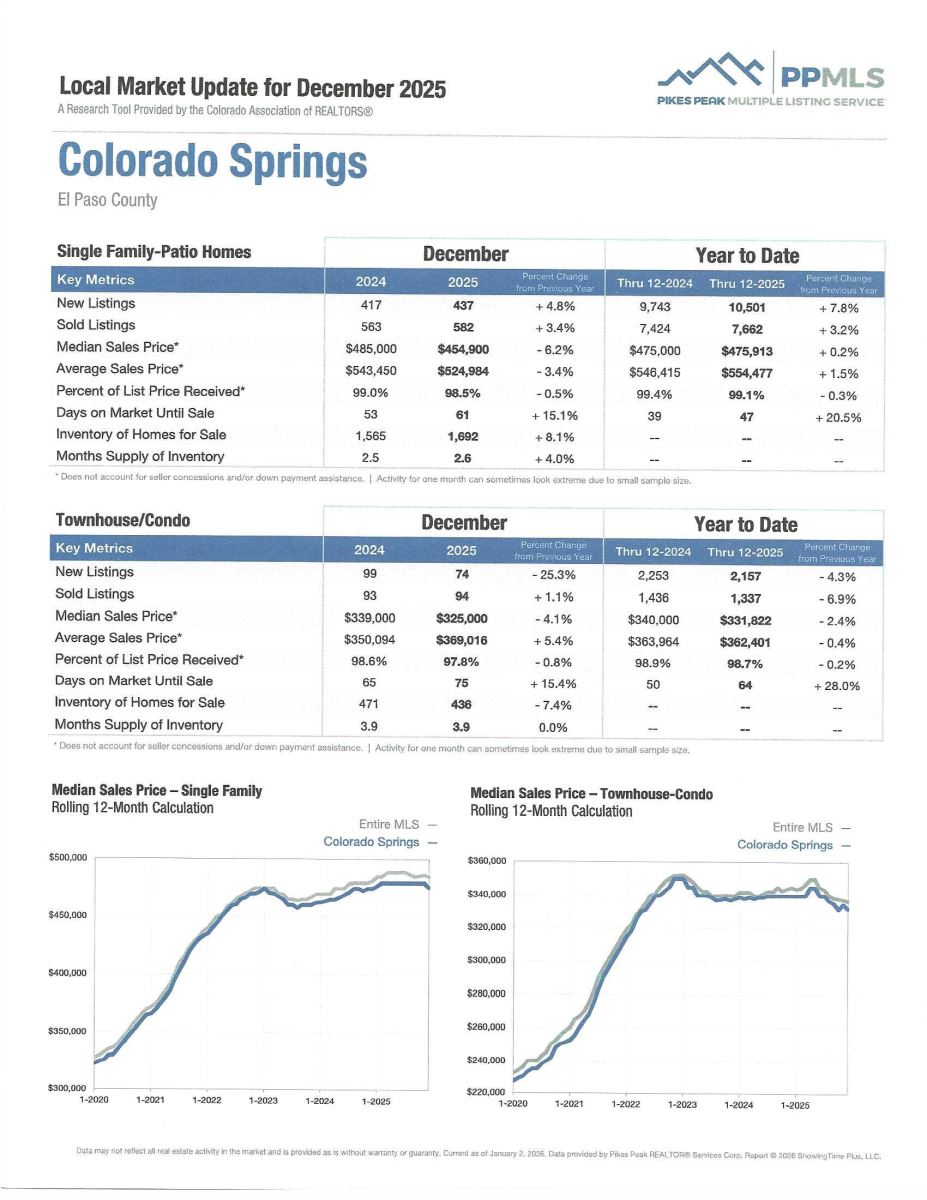

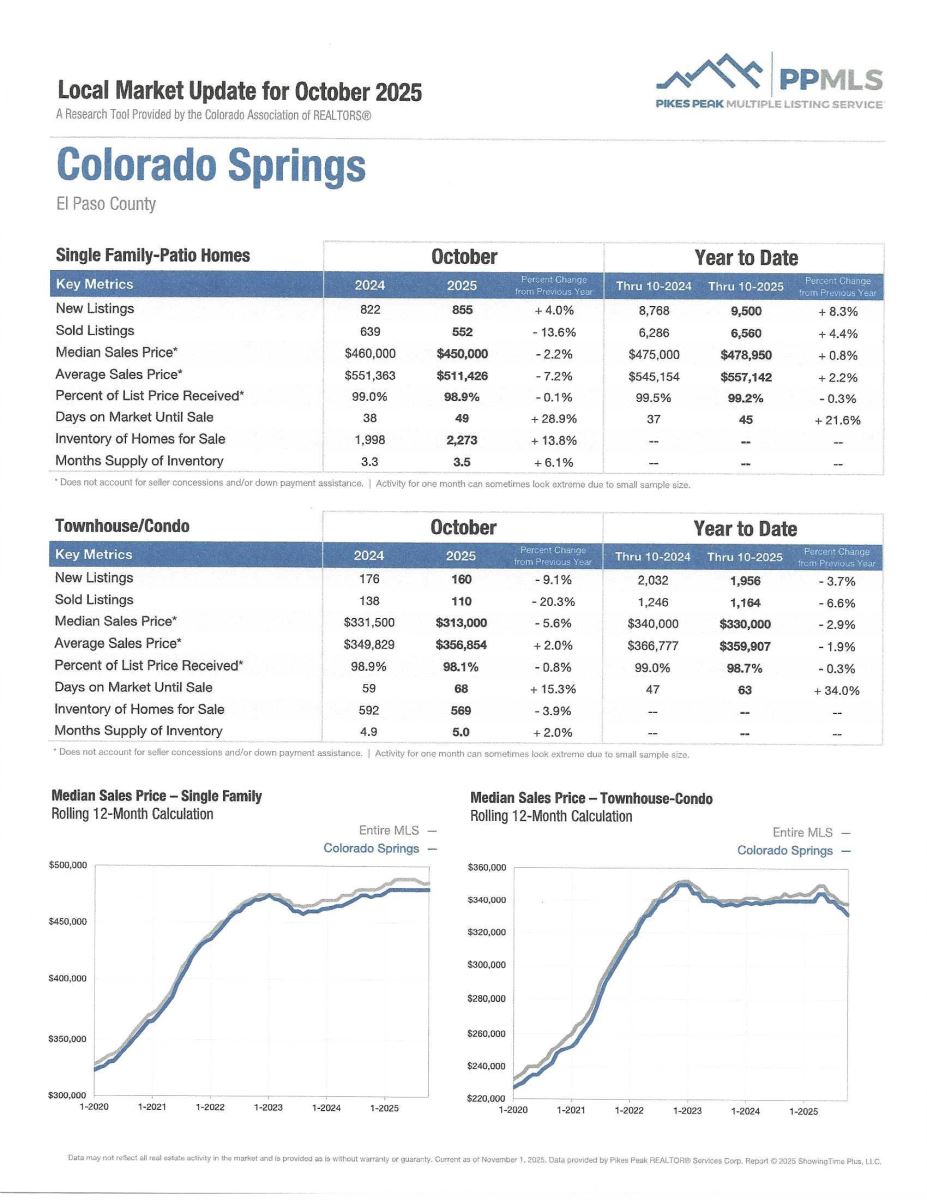

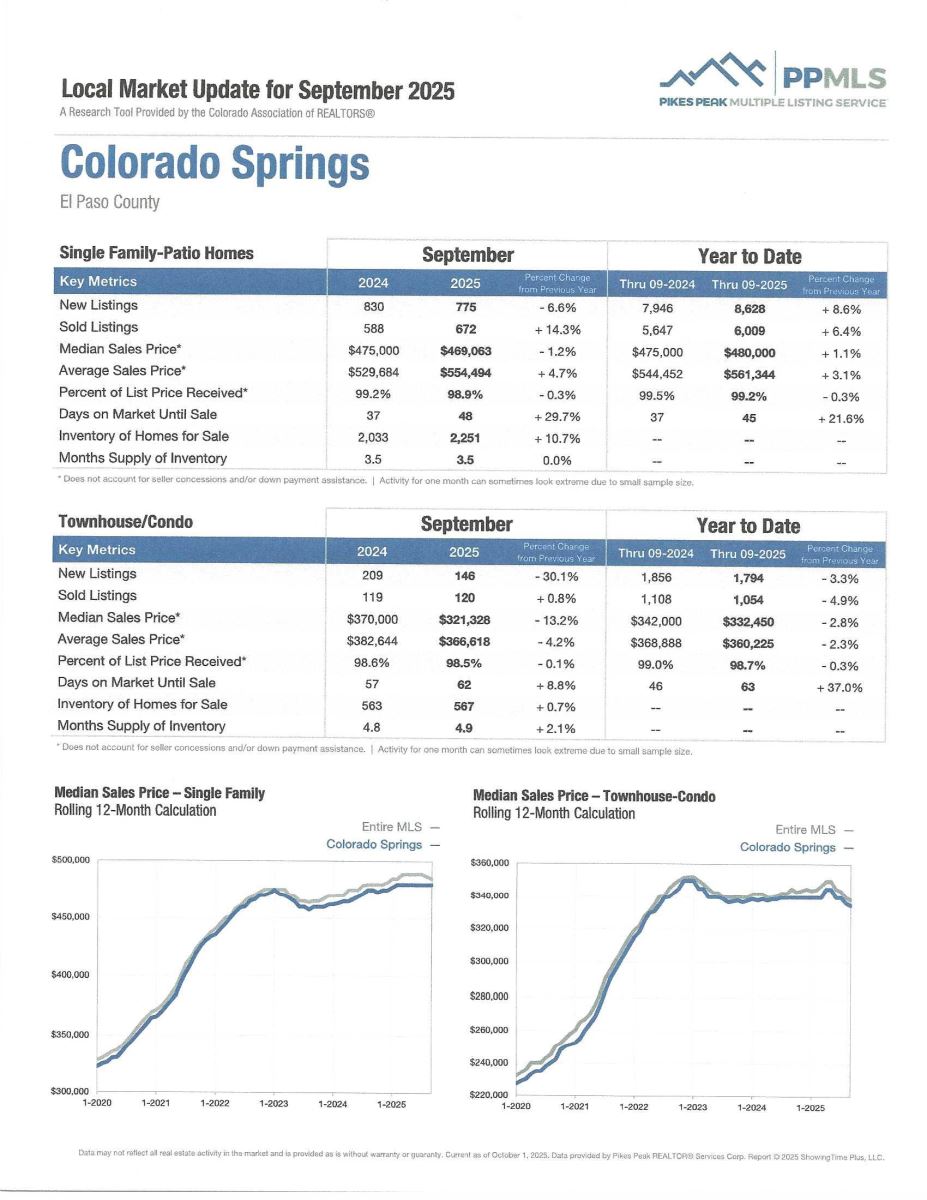

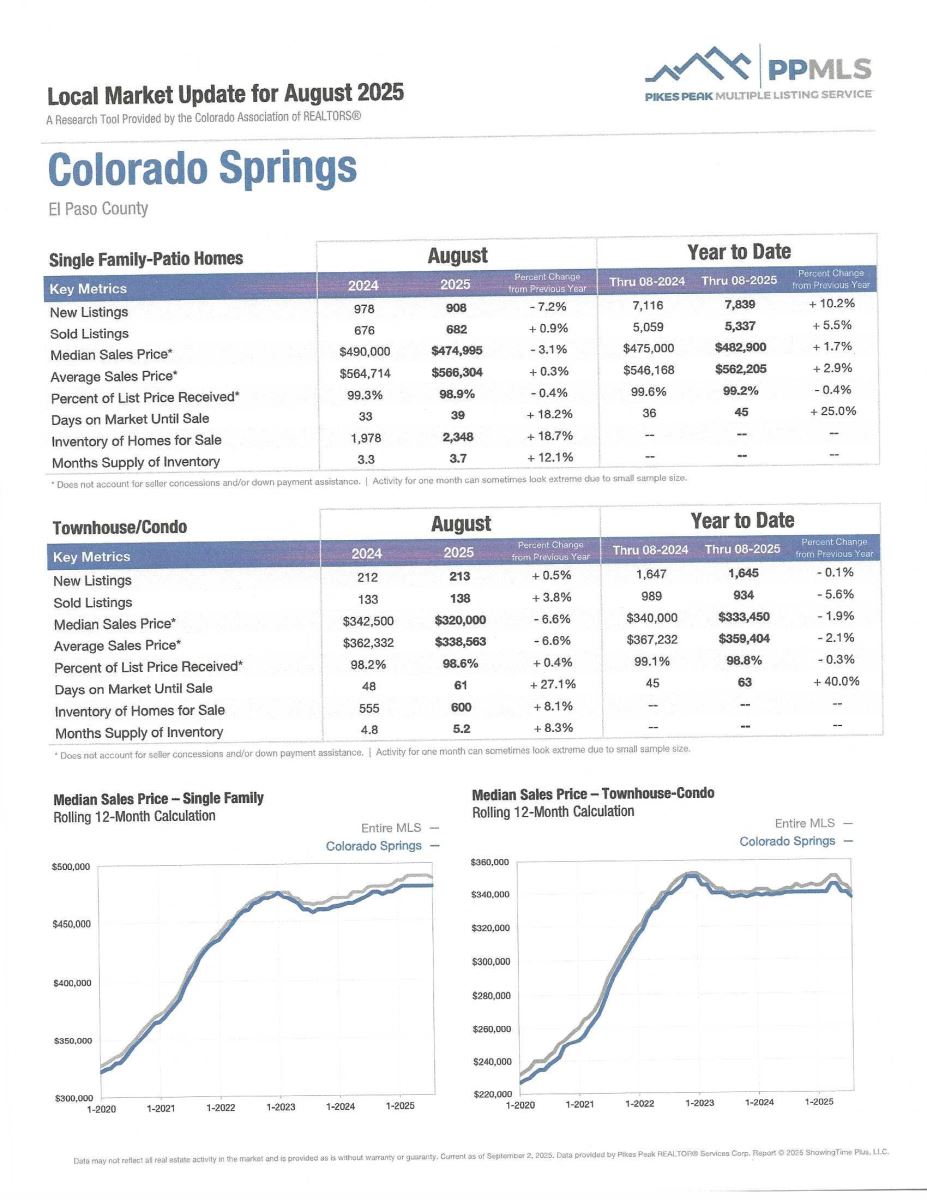

Home prices continue to rise in almost all markets nationally as you will see in the charts below, with the national median existing home price in January rising to $396,800, a little less than a 1% increase from a year earlier. Median prices here are higher and continue to rise, although at a much more normalized pace than several years ago. This is partly because the supply of existing homes for sale remains below normal historical levels.

With mortgage rates hovering around 6%, down from 6.9% a year ago, purchases are a little more affordable than they were.

Personally, I have had more calls from clients wanting to get back in the market and are tired of waiting. I’ve seen activity start to pick up sooner than normal this time of year and I believe that bodes better for our market than possibly for some other areas of the country.

It is more definitely a buyers’ market and that gives folks more time to make decisions and the ability to look for potential incentives from sellers.

If you’re looking to make a move, now is a great time to start the process.

I’m seeing folks starting to buy and sell earlier than normal here, yet still so few existing homes for sale. If you are wanting to enter the market you need to be prepared to know exactly what you want, need, and can afford PRIOR to beginning the search.

That’s where I come into the picture. Let me say once again that current market is not for the timid or inexperienced. It takes a lot of advanced planning and knowledge of how to navigate these waters.

My almost 54 years in the local residential real estate arena, coupled with my investment banking background, give me an edge that my clients have found to be crucial in helping them and their families realize their personal real estate visions.

If Residential real estate is among your hopes and dreams for 2026, please give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com sooner than later and let me help make them come true.

The earlier you begin the process, the sooner you will be realizing those dreams for you and your family.

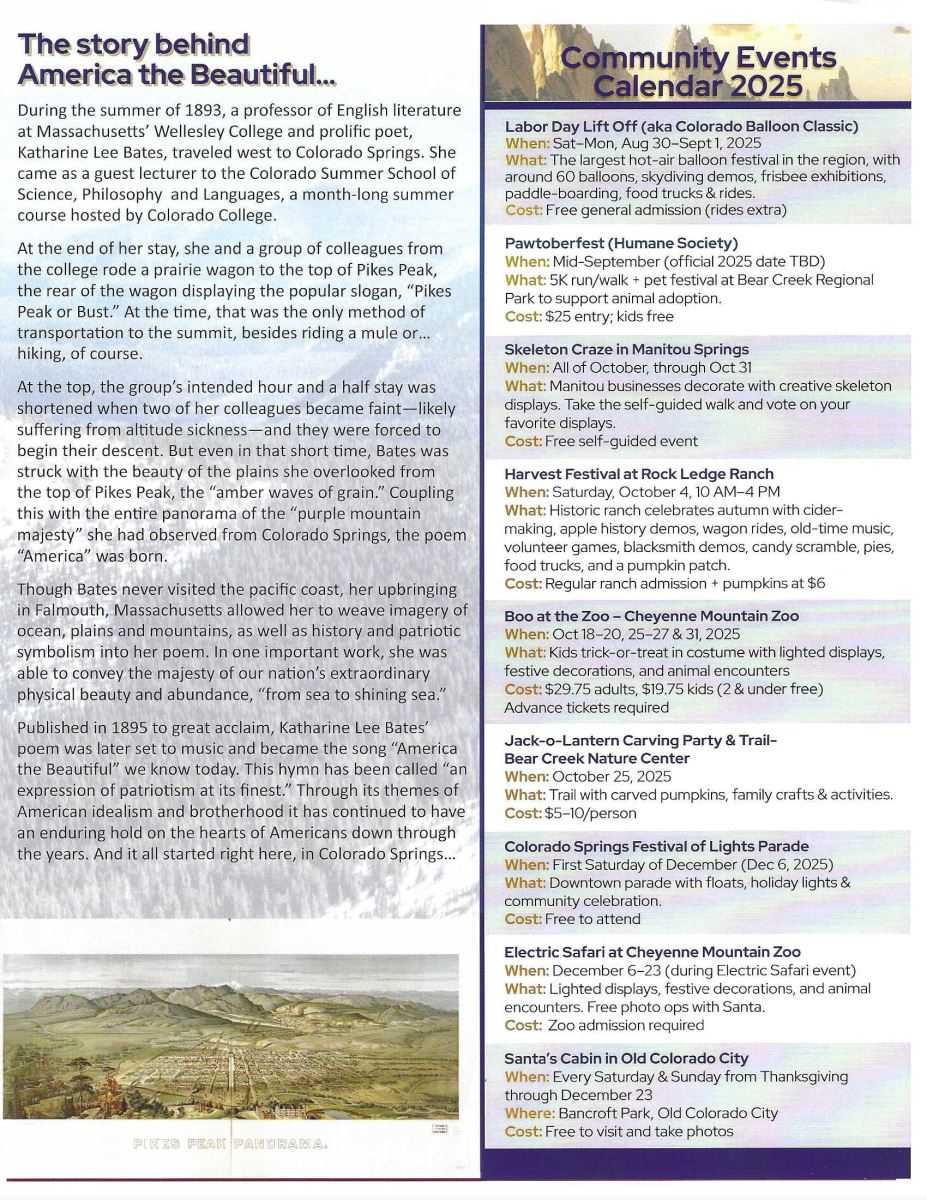

COLORADO SPRINGS IS RANKED #55 OUT OF 230 MEASURED METRO AREAS IN THE RECENTLY PUBLISHED NAR SURVEY

The National Association of Realtors, 2.4.26

In the recently published quarterly report from the National Association of Realtors (NAR), single-family, existing-home prices grew in 73% of measured metro areas. This is down from 77% the previous quarter.

Compared to a year ago, the national median single-family existing-home price climbed 1.2% to $414,900.

Also compared to a year ago, the median price of single-family homes in Colorado Springs decreased 1.7% to $456,200 per NAR. This price reflects detached, single-family and patio homes but not townhomes or condominiums.

The median home price increase in the Springs ranked 55th highest of the 230 cities surveyed.

To see all 230 metro areas in alphabetical order, please click here. To see them in ranking order, click here. Or click here to see what income levels are required to purchase homes based on either a 5, 10 or 20 percent down-payment.

If you have any questions, please give me a call.

HOMEOWNERS RETHINK MORTGAGE OPTIONS, EVEN AS RATES FALL

National Association of Realtors, 2.13.26

With existing-home sales prices hitting an all-time high in January, home buyers are looking for ways to lower their costs.

Home buyers, and most especially first-time buyers, are exploring alternative lending options to lower their rate.

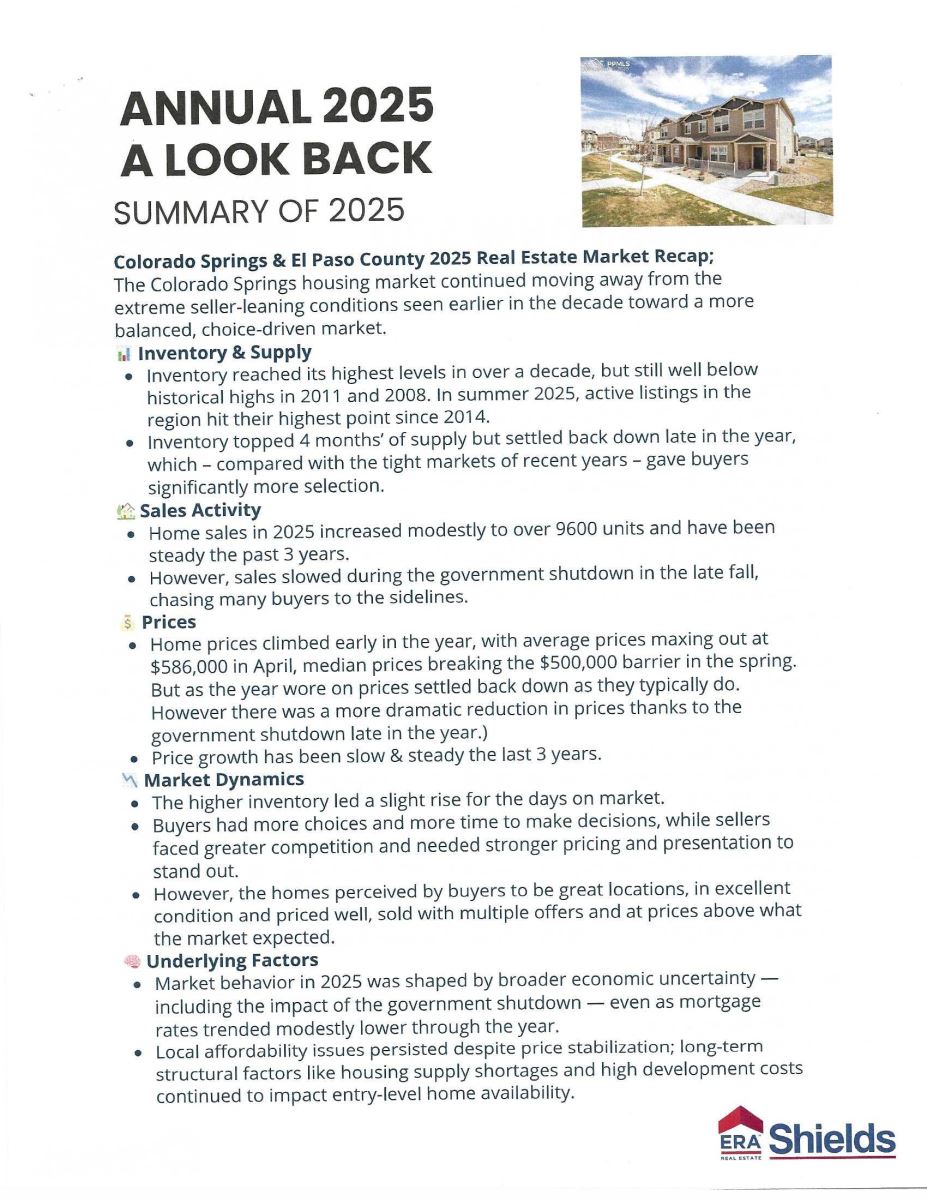

Adjustable-rate mortgages, rate buy-downs and Federal Housing Administration (FHA) loans are increasingly being used to help lower borrowing costs—even as 30-year rates are slowly coming down.

The 30-year fixed-rate mortgage has dropped to three-year lows, averaging 6.09% last week. The 15-year fixed-rate mortgage dropped to 5.44%.

That’s a big difference from a year ago when 30-year rates were close to 7%. For a home priced at $400,000 with a 10% downpayment, a monthly payment at a 6.87% rate from a year ago versus last week’s 6.09% rate could result in nearly $200 in monthly savings.

Buyers Look Beyond 30-Year Mortgages

When faced with higher home prices, home buyers are looking past the most popular lending option –the 30-year fixed-rate mortgage—in trying to find savings.

According to Shawn Yerkes, group president of financial services at Genstone Financial, “Adjustable-rate mortgages (ARMs) are seeing more attention, particularly among higher loan amounts, because these loans start with a lower rate”.

The share of adjustable-rate mortgages—rates that reset after a five-or seven-year period—rose to a seven-week high of 8% of all home purchase mortgage applications in the last several weeks, according to the Mortgage Bankers Association (MBA). ARM rates were tracking a full percentage point lower than fixed rates last week.

“Rate buy-downs from sellers are also popular,” Yerkes says. “They reduce payments for the first two to three years, helping buyers manage the initial costs of homeownership.”

Yerkes also noted the growing interest in FHA loans, particularly among buyers with less stellar credit profiles and higher debt-to-income ratios. MBA’s latest data shows an increase in FHA loans nationwide last week, coinciding with a declining FHA rate that is about 20 basis points lower than conforming 30-year fixed rates. Additionally, FHA loans also allow for down payments as low as 3.5%.

If home affordability is an issue, there are several ways to cut costs. I’ve been steering my clients toward the best options for their individual situations and if you are looking for the same, please give me a call.

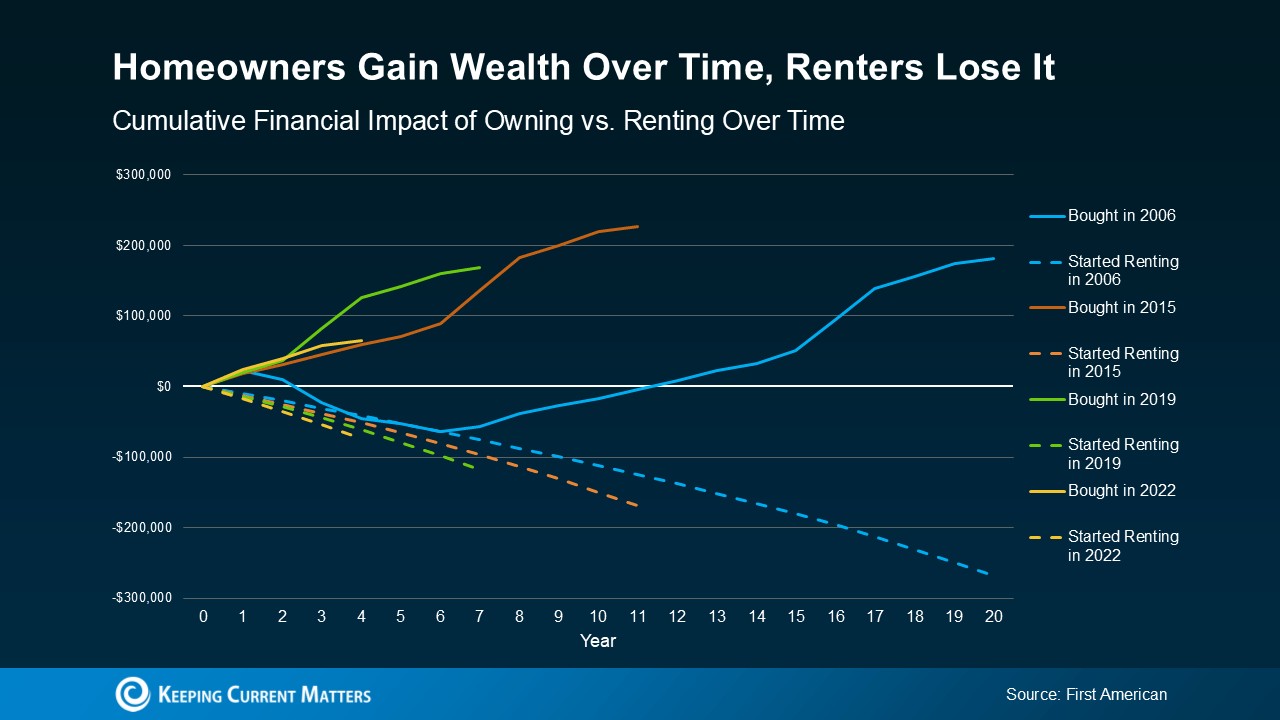

After all, homeownership is one of the primary ways of building wealth in this country and the sooner you can own a home the sooner it can start working for you.

HOW YOUR EQUITY COULD HELP YOUNGER GENERATIONS BUY A HOME

Keeping Current Matters, 2.23.26

For a lot of parents or grandparents watching a family member struggle to buy their first home right now is hard. That’s because they saw firsthand how homeownership gave them more stability and helped grow their net worth—and they want the same opportunities for their loved ones.

With all the affordability challenges in recent years that can feel like an uphill battle—even though it’s slowly improving lately.

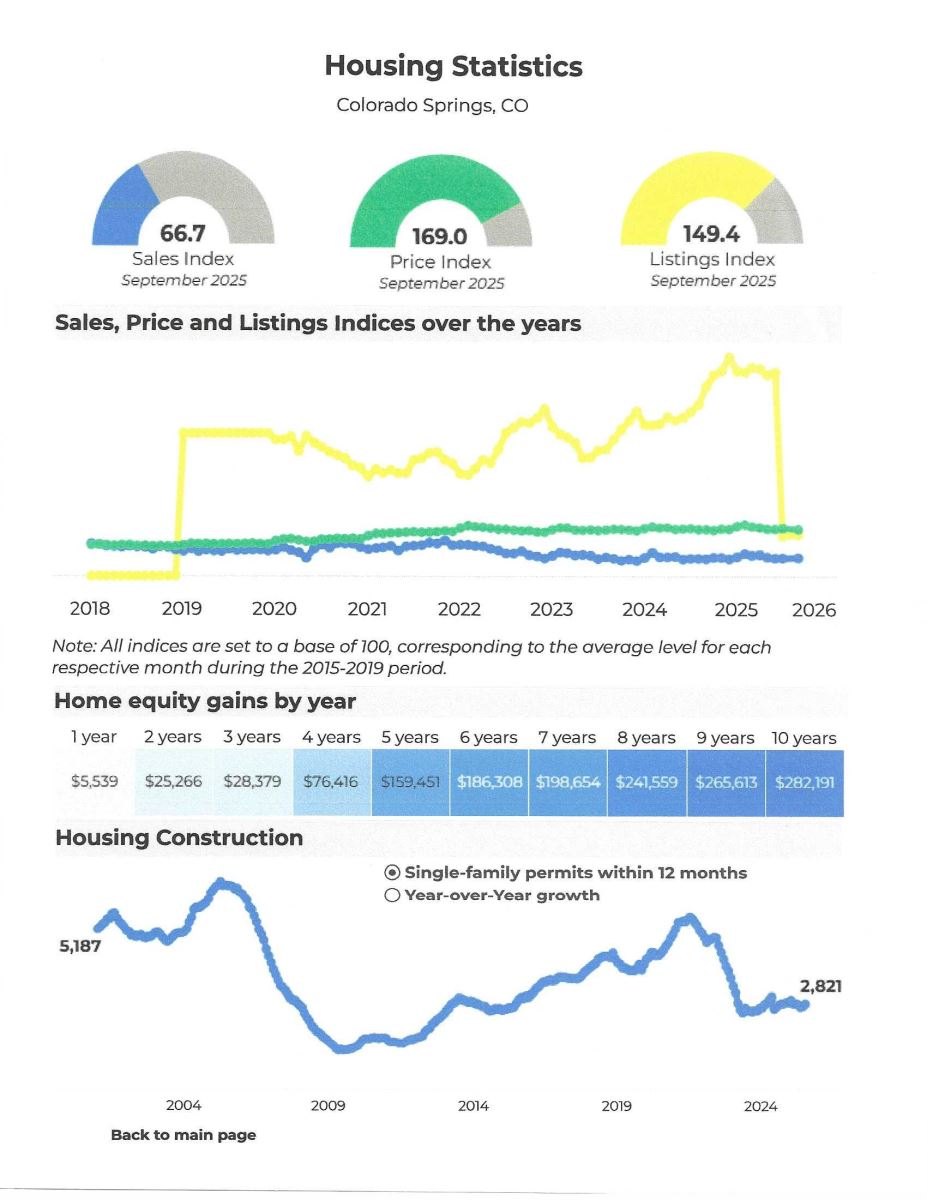

Here’s what many do not realize. You may be in a unique position to help thanks to the current equity in your current home.

The Equity Advantage You May Not Be Thinking About

You’ve likely owned your home for years, maybe even decades. And during that time, two things happened:

- Home values rose

- Your mortgage balance shrank (or you paid it off)

That combination has created substantial equity for many homeowners like you.

As an aside, you may not even be aware of the current equity in your home. If you are interested, please contact me and I will do a market analysis of your home at no cost to you.

And while you may think of that equity as something you want to have in your pocket for retirement, it can also serve another purpose: helping the next generation clear the biggest hurdle in their way.

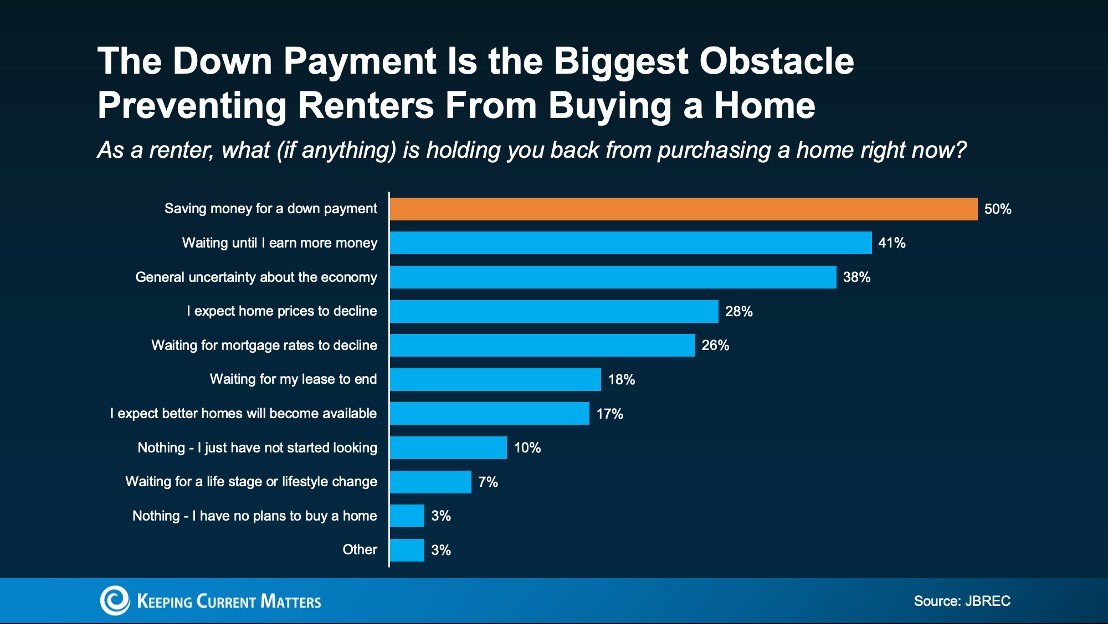

The #1 Thing Holding Young Buyers Back

When John Burns Research & Consulting (JBREC) asked renters what’s keeping them from buying, the top answer surprisingly wasn’t mortgage rates or home prices. It was the upfront cost, particularly saving enough for their down payment.

That’s where you may be able to make more of a difference than you realize. You can’t control rates or prices, but you may be able to use your equity to help with this upfront expense. And giving money to your loved one so they buy a home doesn’t mean putting your own future at risk.

Even a small portion of your equity can put them in a position to finally get the keys to their first place—and, if you’re strategic about it, you’d still have a lot leftover for when you retire.

With an estimated $68 to $84 trillion of wealth expected to transfer from older generations to younger ones over the next two decades, many families are already thinking differently about when and how that wealth will be passed down. Maybe it makes sense for your family to think about it too.

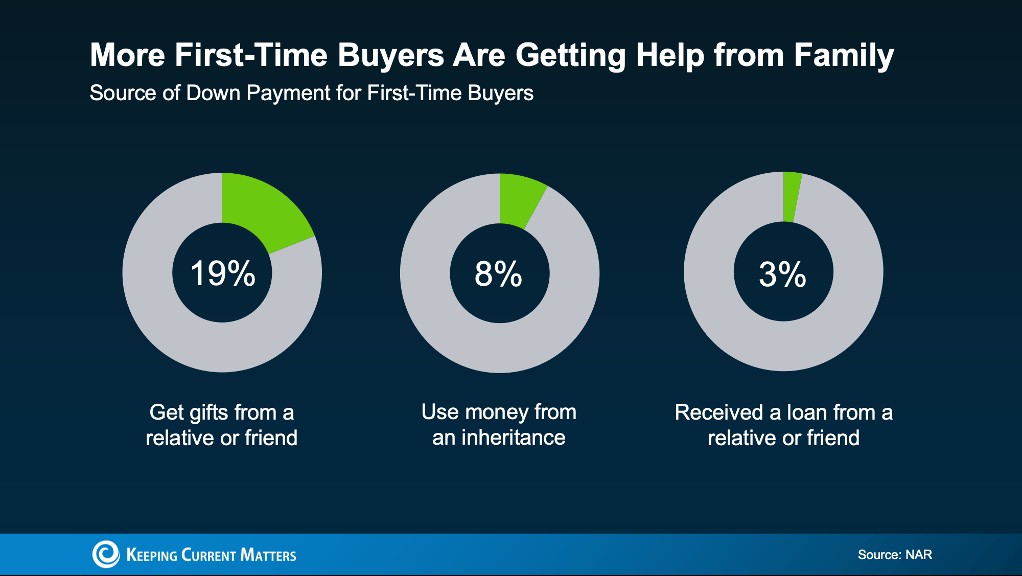

Help from Loved Ones Is Making a Move Possible for Many First-Time Buyers

A growing share of young buyers are using gifts and loans from their loved ones to springboard into homeownership. According to NAR, nearly I in 5 first-time buyers use a cash gift from their family or loved ones for their down payment.

And other young buyers are using their inheritance or a loan from someone they know to finally break into the market.

This Is About Opportunity. Not Obligation

Every family’s situation is different, and your decision should be made carefully. It’s just that, if you’ve built up a lot of equity, you many have more room to help than you think.

It’s not just a financial gift. It’s giving stability, security and a foundation that could change their lives for the better—especially at a time when they may not be able to do it on their own.

Bottom Line:

If you are curious as to what your home equity could make possible for you or your loved ones, simply give me a call today and let’s have a conversation about it.

Because sometimes the most meaningful investment you can make if for the next generation.

.jpg)

.jpg)