HARRY'S BI-WEEKLY UPDATE 12.4..25

December 4, 2025

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

NOT THE TRADITIONAL “BUYING AND SELLING SEASON” BUT...

I’ve been working with several folks lately who are tired of waiting and decided to make their move…literally.

In fact, home sales nationally rose to an 8-month high in October due to rate decline but we have a way to go to get back to normal.

As you might surmise from the statistics and articles below, things are looking up for those wanting to buy now or in the near future.

Home prices are not going down…in fact…while rising slower than several years ago, they are starting to normalize and they keep going UP.

And while listings are somewhat down, there are more homes to choose from than in the recent past.

When you couple that with mortgage rates that are lower than they have been, it most certainly is a good time to begin your quest if a move is in your future.

Something to also consider is financing that can help keep your interest rate down. We are again seeing more buyers opting for a 5-year Adjustable-Rate Mortgage, figuring that rates will go down during those five years which will allow them to refinance at the better rate for a traditional mortgage of 15 or 30 years.

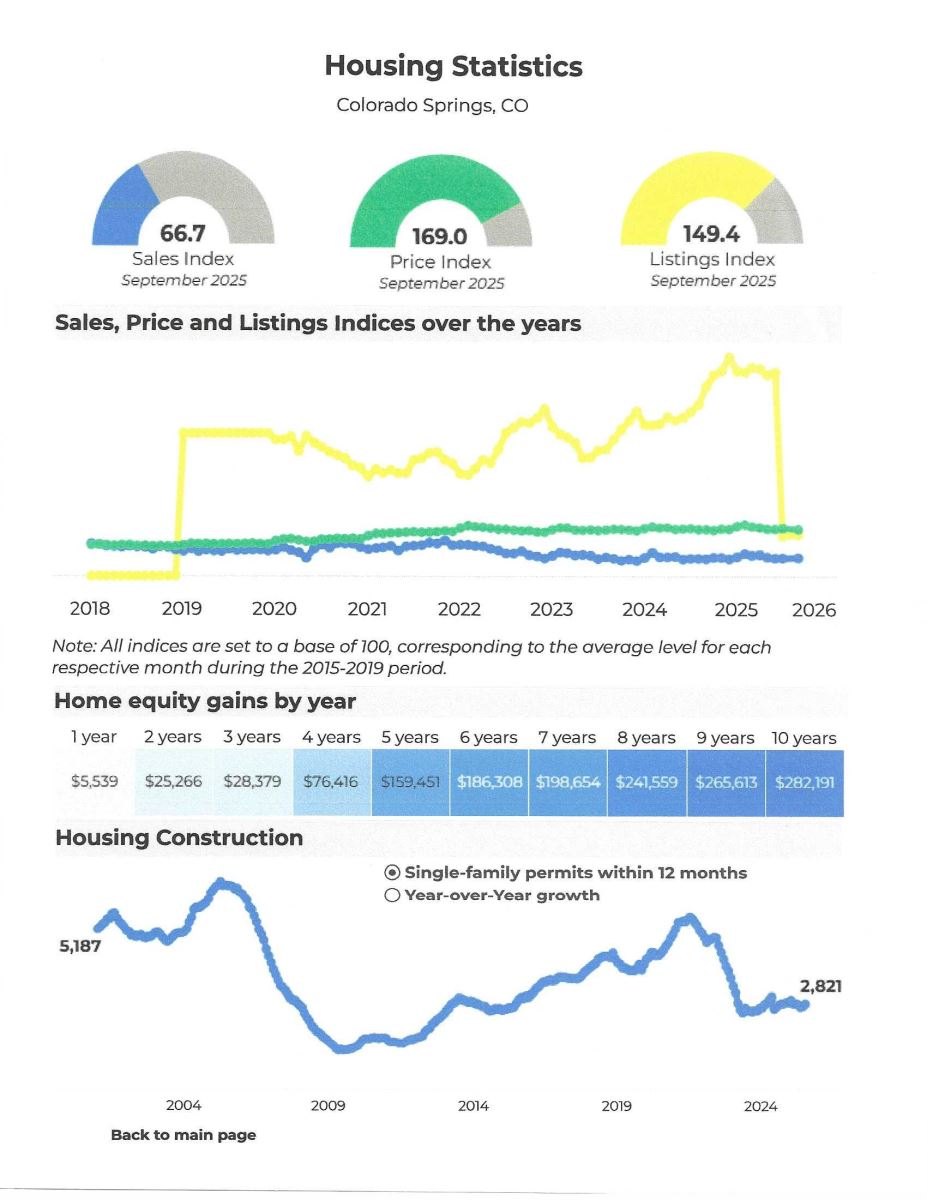

This chart from National Association of Realtors (NAR) shows Housing Statistics for Colorado Springs for September and you can see in our statistics below that it mirrors what I’ve been telling you.

Listings are down, but prices and sales remain steady or have increased somewhat.

Once we get into the spring buying and selling season I expect things to get busier than last year so if you’ve even considered a move, it’s not too early to begin.

NOW is a great time to sit down with me and together we can see what’s available for your personal situation and figure out how to put your wants, needs and budget requirements to the best use to find just the right place for you and your family.

You might find that your present home has more equity than you would imagine, thus providing more dollars for a down payment on the new home and keeping your payment lower.

The early bird gets the worm as they say, and you could be starting the new year getting ready for a new home.

Why not give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let’s see how your Residential real estate dreams can become reality in the best time frame and for the best financial situation for you?

And now for statistics…

NOVEMBER 2025

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the November 2025 PPAR report:

In El Paso County, the average days on the market for single family/patio homes was 54. For condo/townhomes it was 73.

Also in El Paso County, the sales price/list price for single family/patio homes was 98.6% and for condo/townhomes it was 99.3%.

In Teller County, the average days on the market for single family/patio homes was 58 and the sales/list price was 96.9%.

Please click here to view the detailed 12-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing November 2025 to November 2024 for All Homes in PPAR:

Single Family/Patio Homes:

- New Listings were 885, Down 0.9%

- Number of Sales were 837, Down 6.4%

- Average Sales Price was $551,605, Down 0.3%

- Median Sales Price was $491,990, Up 1.4%

- Total Active Listings are 3,555, Up 15.0%

- Months Supply is 4.2

Condo/Townhomes:

- New Listings were 149, Up 11.2%

- Number of Sales were 95, Down 13.6%

- Average Sales Price was $378,223, Up 10.4%

- Median Sales Price was $344,500, same

- Total Active Listings are 606, up 2.5%

- Months Supply is 6.4

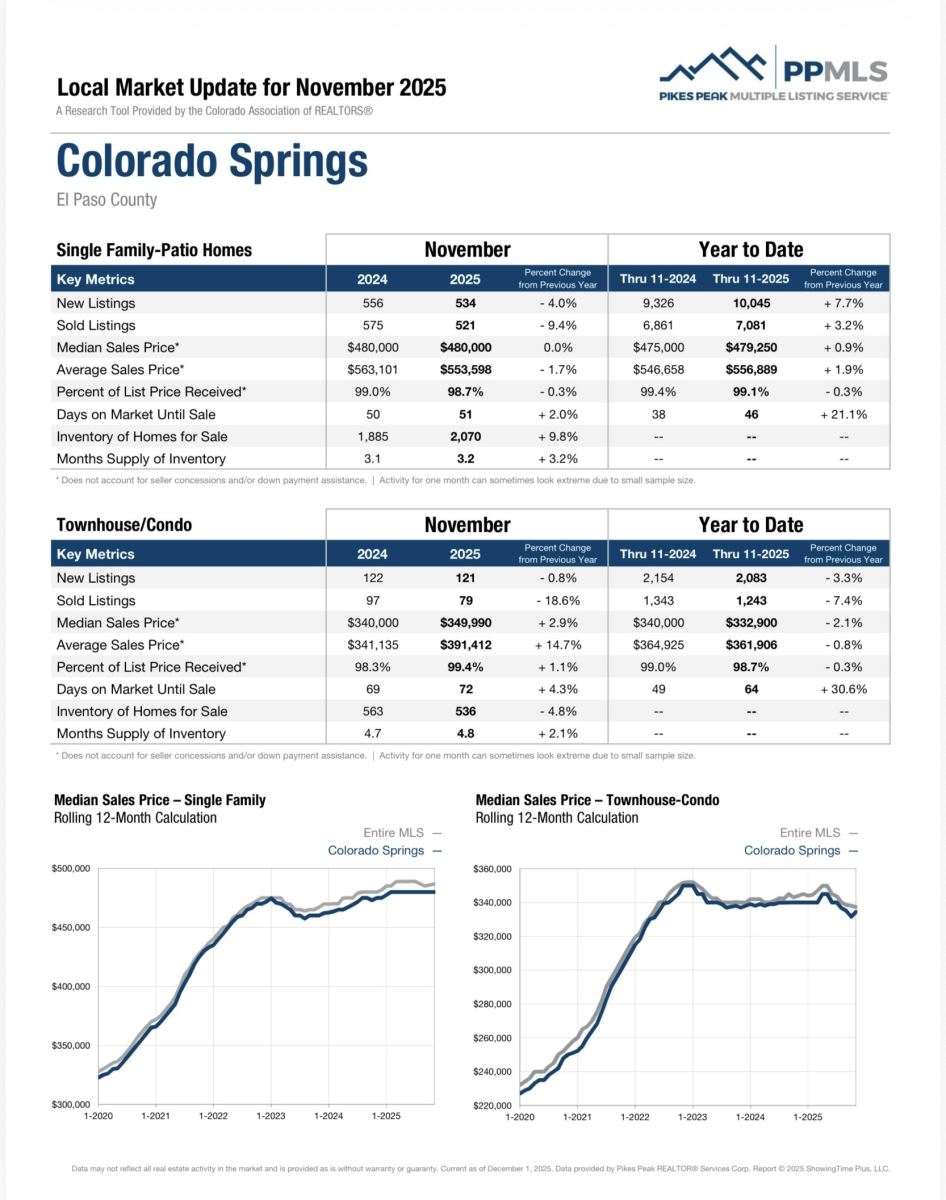

NOVEMBER 2025 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year-to-Date one-year change:

- Sold Listings for All Properties were Down 8.4%

- Median Sales Price for All Properties was Up 1.9%

- Active Listings on All Properties were Up 8.8%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

WHY BUYING A HOME STILL PAYS OFF IN THE LONG RUN

Keeping Current Matters, 11.26.25

Even in this very slow market, home values are still increasing and even though interest rates are higher than many remember, owning a home is still the best option if at all possible. When you rent you are still paying a mortgage…just someone else’s and they are gaining equity while you are simply paying rent.

Renting can feel much less expensive and much simpler than buying a home, especially right now. No repairs, no property taxes, no worrying about mortgage rates—you just pay the bill and go on with your life.

But---here’s the part people don’t talk about—renting doesn’t help you build our financial future. Meanwhile, homeowners grow their net worth just by owning a home.

If you’ve been wondering whether buying a home is still worth it—the long-term math is clearer than you might think.

Renting vs. Owning: How the Costs Really Compare

As I just mentioned, one of the key differences between renting and buying is that when you rent, your payment goes to your landlord and then it’s gone. When you own, part of your payments come back to you in the form of equity (the wealth you build as the value of your home increases, and you pay down your home loan).

So, while renting may seem more affordable at present, you need to remember it comes at a long-term cost—you’re not building your personal wealth. And, as it turns out, that’s a bigger miss than you might expect.

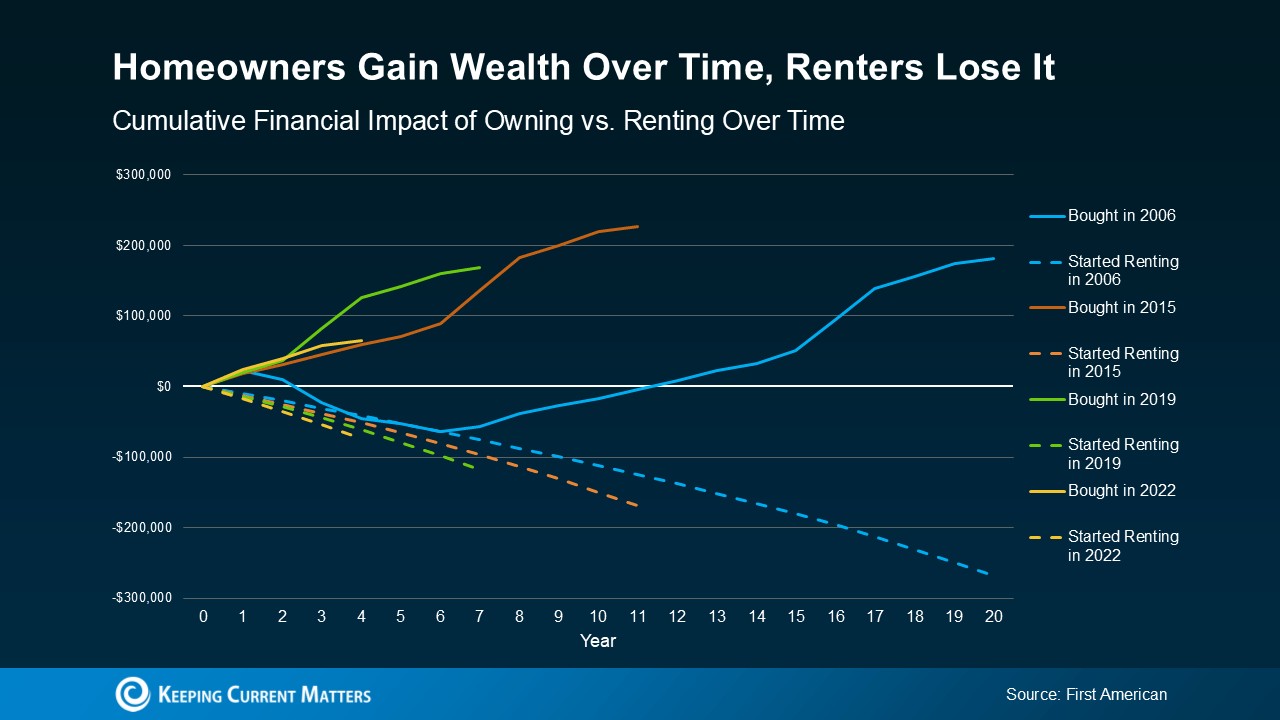

First American recently analyzed the long-term financial impact of renting vs. owning a home. They compared mortgage payments, property tax, insurance, repairs and maintenance against the equity gained through home price appreciation and paying down the mortgage. And they did that during several different time frames to see if it tells a consistent story:

- 2006: the start of the housing bubble

- 2015: 10 years ago

- 2019: just before the pandemic (the last normal years in the market)

- 2022: when mortgage rates jumped

In each time frame, two things were true: Renters ended up losing money over time. And homeowners gained it.

Here’s some data so you can see this in action:

- Each color represents one of the key time frames.

- The solid lines show the buyer’s investment over time and how their net worth actually grew the longer they lived in their home.

- The dashed line represents the renter’s investment. In the end they sank more and more cash into renting without gaining any financial benefit.

The takeaway is quite simple: Time in a home builds wealth. Time renting doesn’t.

Basically, homeowners come out ahead. And that analysis shows that’s even after you factor in the other expenses that come with homeownership. And that’s the case for every time First American looked into it.

And on the flip side, renters spent money on rent but didn’t gain any long-term financial benefit. And that’s true no matter what window of time you look at the study.

That doesn’t mean buying always beats renting in the short term. But the longer you own, the wider the wealth gap becomes.

Affordability is Starting to Improve

I understand you might be thinking that buying feels out of reach for your current situation. And that’s fair.

The last several years haven’t been easy for buyers. But…things are starting to shift. Mortgage rates have come down this year, home prices are softening, and incomes have been rising. And, according to Zillow, typical monthly payments have gotten a little easier compared to this time last year. Not by a lot, but enough to make a difference.

Bottom Line

Renting may feel less expensive today but owning is what builds real wealth over time. And with affordability starting to improve, the path to homeownership might be opening up more than you think.

If you’re wondering how you can make homeownership happen for you or a family member, let’s get together and see how we can make that happen. Give me a call today.

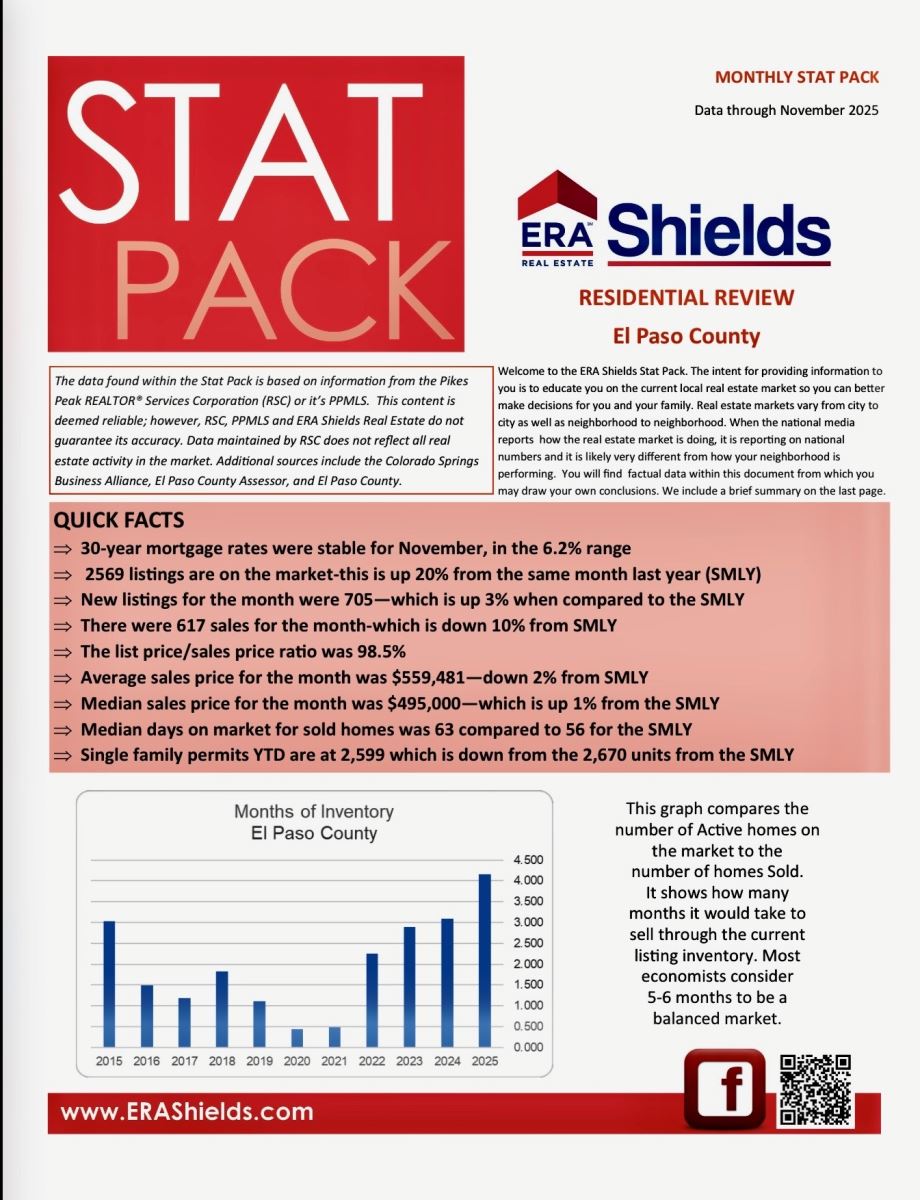

ERA SHIELDS STAT PACK

Data through 11.2025, ERA Shields

Here is data from my company’s “Stat Pack” that can better help you understand the local buying and selling reality. There are various statistics--some monthly, some quarterly and some annual. I have reproduced the first page, and you can click here to get the report in its entirety.

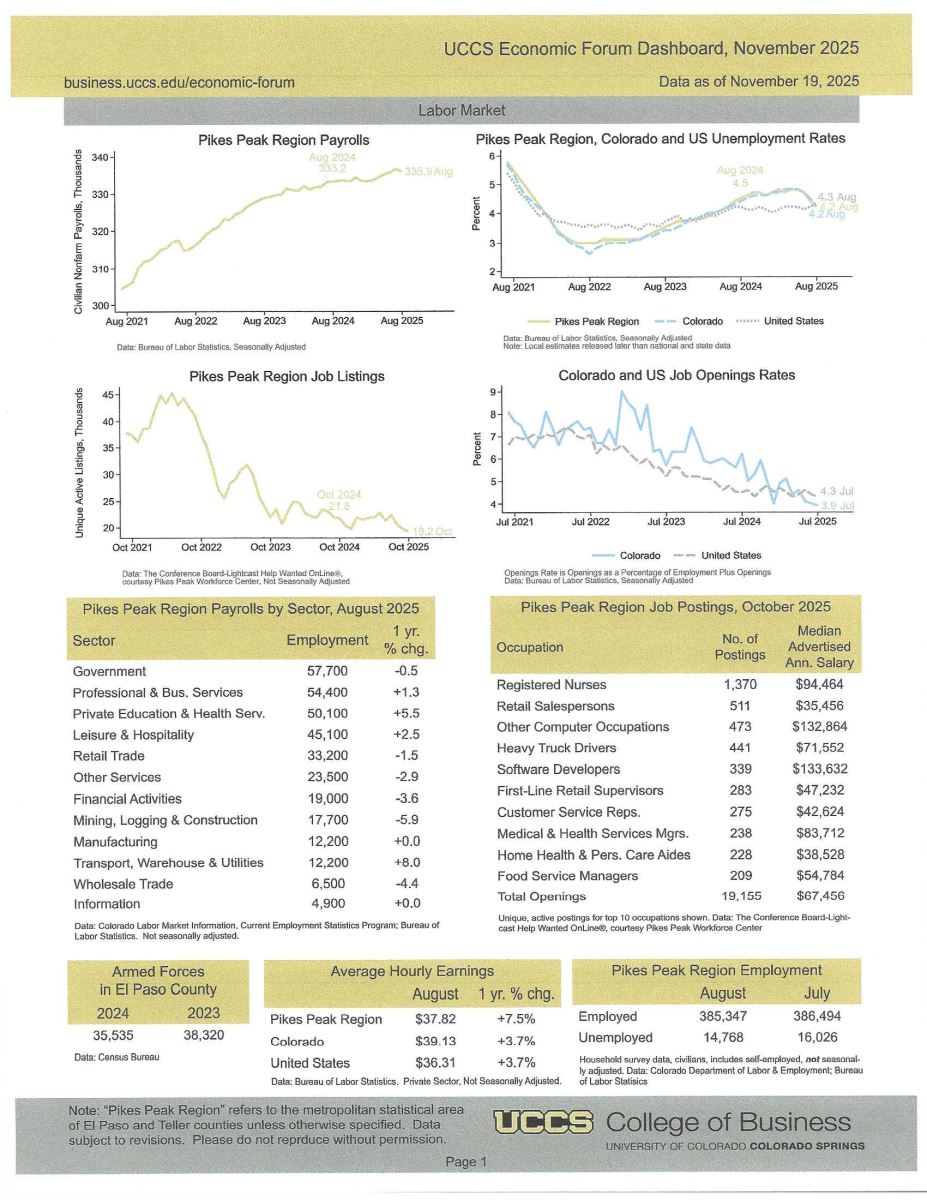

UCCS ECONOMIC FORUM MONTHLY DASHBOARD

Updated November 2025, UCCS College of Business/Economic Forum

Here is the monthly report from the UCCS College of Business Economic Forum. It is created by professor Dr. Bill Craighead, who is the Forum Director. He also publishes an on-line “Weekly Economic Snapshot” you might enjoy.

I know several of you who like statistics and use this information in your daily business life, and I will share it with you when I receive it each month.

I’ve reproduced the first page of the charts below. To access the report in its entirety, please click here.

HARRY’S JOKE OF THE DAY:

I found this in my files from ages ago and as you can see, people have had mortgage wishes for many, many years…and probably will for many, many years to come.