HARRY'S BI-WEEKLY UPDATE 2.5.26

February 5, 2026

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

MEMO TO THOSE WHO HAVE BEEN WAITING:

IT’S FINALLY A TRUE BUYER’S MARKET…BOTH NATIONALLY AND HERE IN COLORADO SPRINGS

Yes, you read that right. It was starting to happen toward the end of last year but it’s now official.

Home sales are picking up as the market is shifting back toward an advantage for buyers. Sales had been stuck at a 30-year low but now buyers are enjoying discounts at the highest rate in years.

Last year, about 62% of buyers nationally purchased a home below the original listing price. That was the highest proportion since 2019 according to a new analysis by real estate brokerage Redfin.

The average discount for the homes that sold below their original listing price was around 8%--the largest since 2012.

Buyers are receiving concessions from sellers, including cash that can be used for closing costs or to buy down a buyer’s mortgage.

The many discounts and incentives being offered is the latest evidence that the housing market is tilting back in favor of buyers, in contrast to the robust seller’s market from 2020 to 2022.

Home sales both here and nationally showed their highest gain in nearly 2 years and while January was a bit slower, it was likely due to fewer folks home shopping in late December during the holidays.

I’m seeing an uptick in potential buyers in the last several weeks and am expecting that to continue to grow as we approach the traditional spring buying and selling season.

Folks are getting tired of waiting and are beginning to realize that the historically low interest rates of the recent past are not coming back…at least any time in the near future.

Yes, interest rates are lower than they were last year but are holding relatively steady and are not likely to drop a whole lot over this year. I believe we are approaching what could be called a more “normalized” rate and don’t believe the historically low rates will be seen again.

As I mentioned last month, my personal rate forecast for 2026 is that the 30-year fixed-rate conventional mortgage will be between 5 ¾ % to 6 ½ % and I have seen several economists predict the same.

I also believe the housing market is going to see more action this year as those who have held off are slowly dipping their toes back in.

Folks who want to sell and trade up or move to a new neighborhood and those who are looking to buy for the first time are beginning to look at their options. I’ve even seen some investors beginning to check out what might be available.

And of course, we still have new companies looking to relocate or expand here and with them come employees looking for housing.

Prices are holding steady and those who are waiting for them to drop before they buy will likely not see this happen. This is reflected in the statistics below. You can see that homes are selling at close to listing price and home values are not depreciating. In fact, they continue to appreciate, although at a much slower rate than that of 4-5 years ago. And, like nationally, condo sales here are not moving nearly as fast as single family home sales.

If you are looking to sell, your present home possibly has more equity than you might think which could help keep your new payments lower by providing a larger down payment.

It’s important to note that with rising competition folks are starting to buy and sell earlier than normal. And with still relatively few existing homes for sale, if you are ready to enter the market you need to be prepared to know exactly what you want, need, and can afford PRIOR to beginning the search.

That’s where I come into the picture. The current market is not for the timid or inexperienced. It takes a lot of advanced planning and knowledge of how to navigate these waters.

My almost 54 years in the local residential real estate arena, coupled with my investment banking background, give me an edge that my clients have found to be crucial in helping them and their families realize their personal real estate visions.

If Residential real estate is among your hopes and dreams for 2026, please give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let me help make them come true.

The earlier you begin the process, the earlier you will be realizing those dreams for you and your family.

And now for statistics…

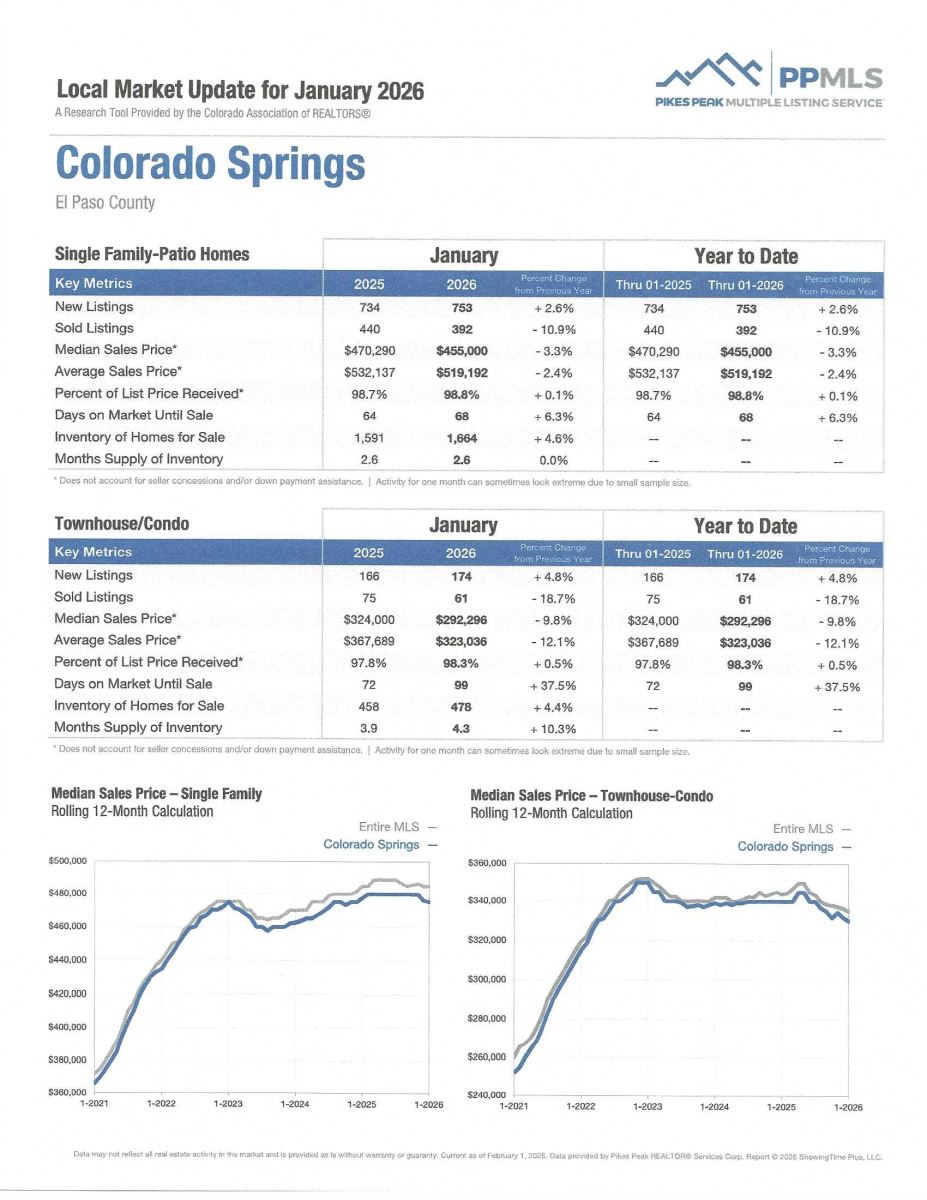

JANUARY 2026

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the January 2026 PPAR report.

In El Paso County, the average days on the market for single family/patio homes was 71. For condo/townhomes it was 99.

Also in El Paso County, the sales price/list price for single family/patio homes was 98.8% and for condo/townhomes it was 99.1%.

In Teller County, the average days on the market for single family/patio homes was 85 and the sales/list price was 99.1%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing January 2026 to January 2025 for All Homes in PPAR:

Single Family/Patio Homes:

- New Listings were 1,274, Up 4.2%

- Number of Sales were 637, Down 8.5%

- Average Sales Price was $543,847, Down 0.9%

- Median Sales Price was $469,950, Down 2.6%

- Total Active Listings are 2,843, Up 13.1%

- Months’ Supply is 4.5

Condo/Townhomes:

- New Listings were 204, 0.0% change

- Number of Sales were 69, Down 20.7%

- Average Sales Price was $332,289, Down 10.1%

- Median Sales Price was $300,000, Down 11.8%

- Total Active Listings are 535, Up 5.9%

- Months’ Supply is 7.8

Now a look at more statistics…

JANUARY 2026 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year to Date one-year change:

- Sold Listings for All Properties were Down 10.8%

- Median Sales Price for All Properties was Down 1.9%

- Active Listings on All Properties were Up 4.9%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

WHEN HOME SELLERS SET PRICES TOO HIGH, THEY’RE PAYING FOR IT

The Wall Street Journal, 11.25. 25

If you’re serious about selling your home, you might need to drop the price.

As I mentioned earlier, it’s now become a buyer’s market and that means sellers are needing to determine the “right” price for their home prior to listing it for sale.

Many sellers optimistically price their homes based on sales from earlier in the 2020’s when they saw neighbors get homes snapped up quickly at high prices.

Instead, it would be much wiser to calibrate the asking price by looking at what comparable homes in their neighborhood have sold for in the last several months.

This is a service I provide when helping my clients list their homes and I’ve found that many sellers-to-be have unrealistic ideas of what their home is actually worth in today’s market.

It is far better to list a home at a “realistic” price than to have to lower it once or even more when it doesn’t attract potential buyers.

Setting a price too high can make the sales process drag on. Listings that sold after a price reduction typically spent about five times as many days on the market as the average for homes priced right from the start, according to the National Association of Realtors (NAR).

Homes priced correctly from day one tend to sell more quickly and get nearly 100% of their asking price, per NAR. After three months, sellers usually trim prices by more than 5%, and after a year, by more than 12%.

About 57% of homes sold in 2025 through October had at least one price cut, per NAR, indicating that a significant number of sellers are entering the market with unrealistic expectations. Between 2020 and 2024, that share was closer to 47%.

When working with my seller clients, the first thing I do is comparisons so that they can get a realistic idea of what their present home might sell for. Having spent almost 54 years in this market I have a considerably better than average track record in helping set a price that will attract buyers and still get my sellers the highest price possible.

If you’re ready to sell, I’m ready to help. Give me a call and let’s see how we can make that happen in a time frame that works for you and your family.

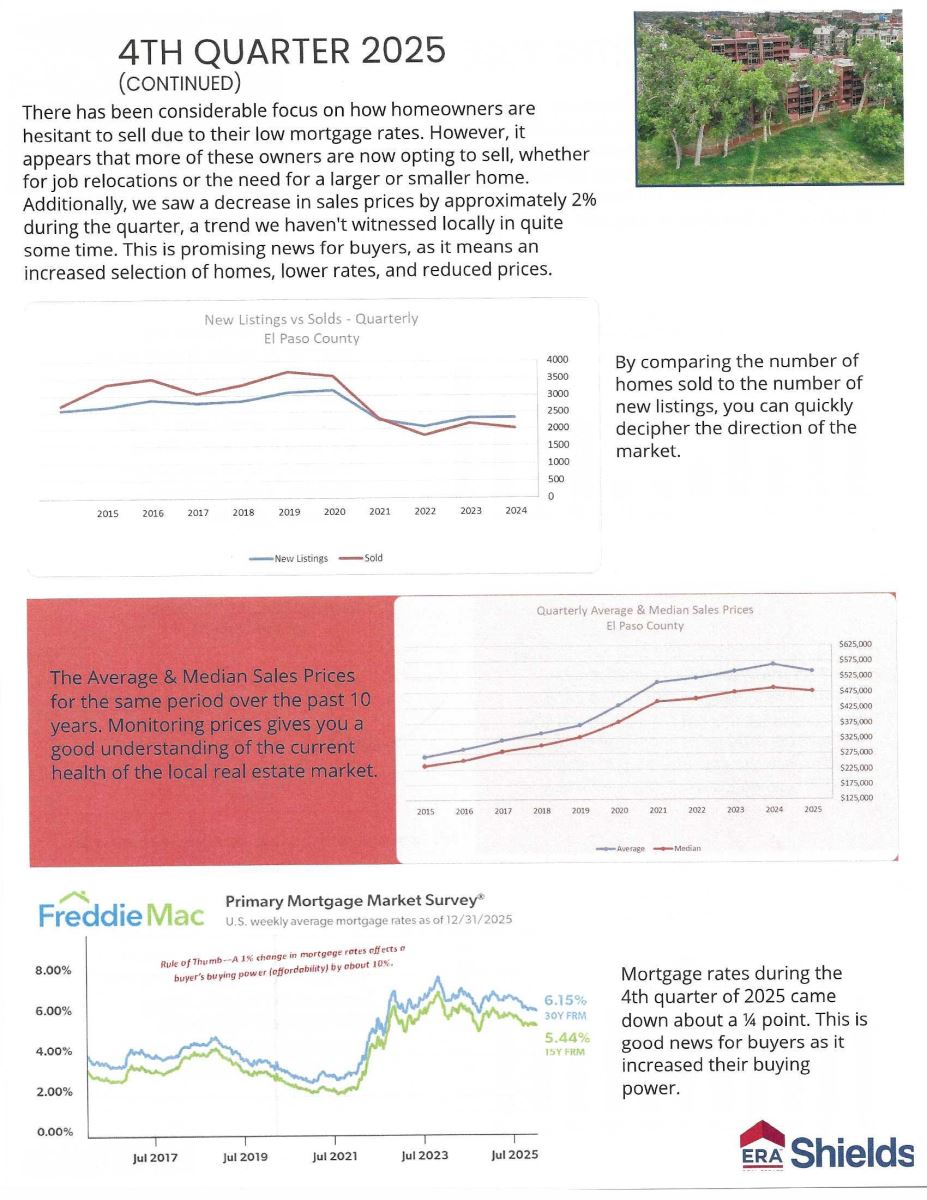

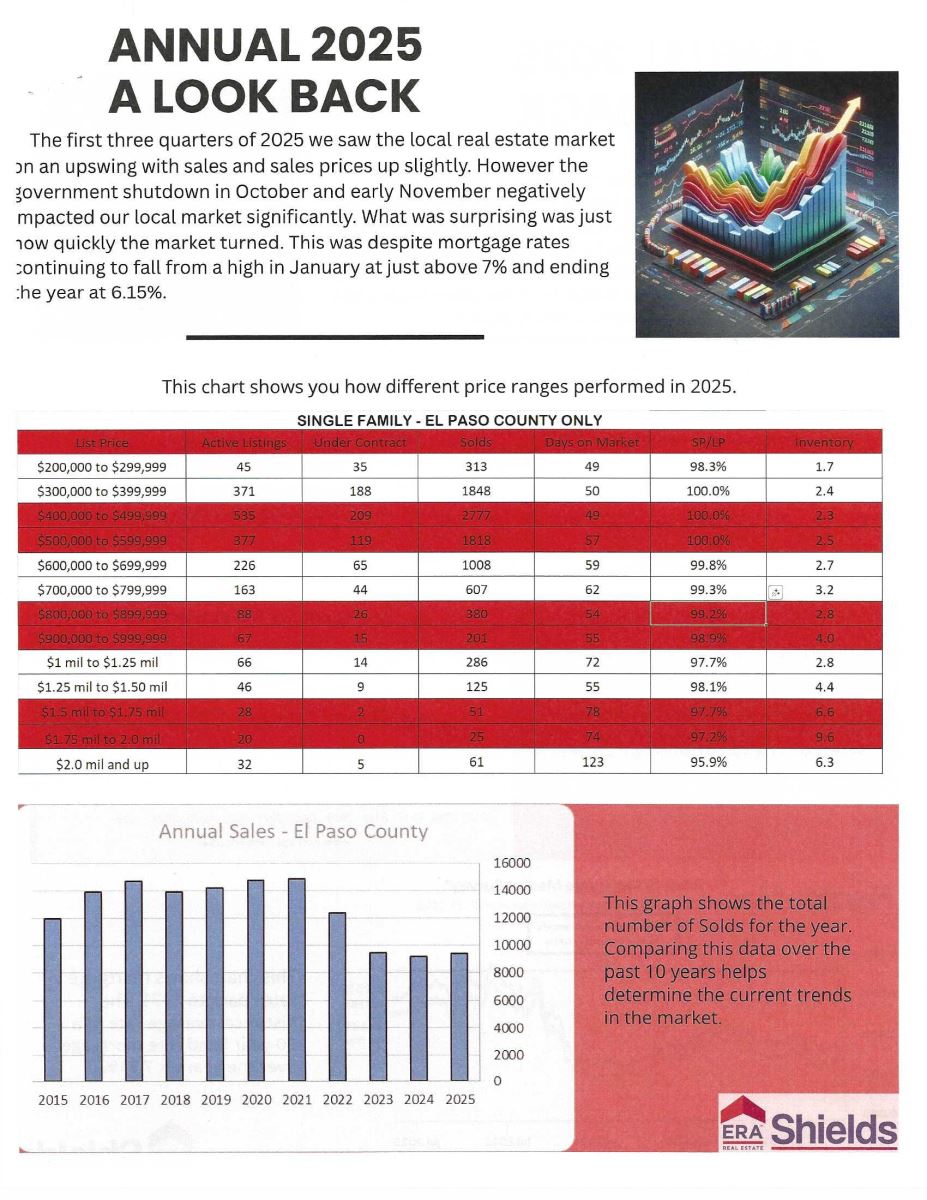

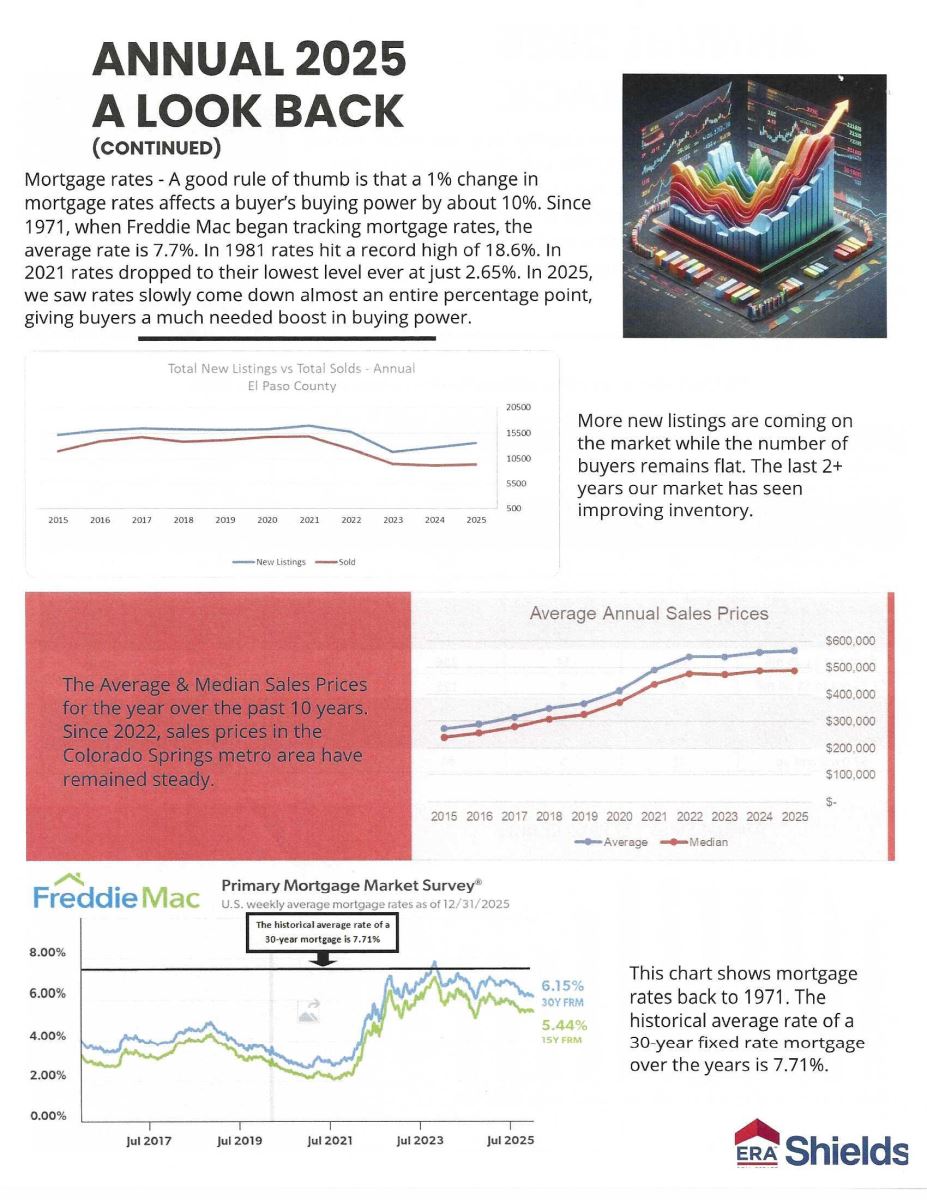

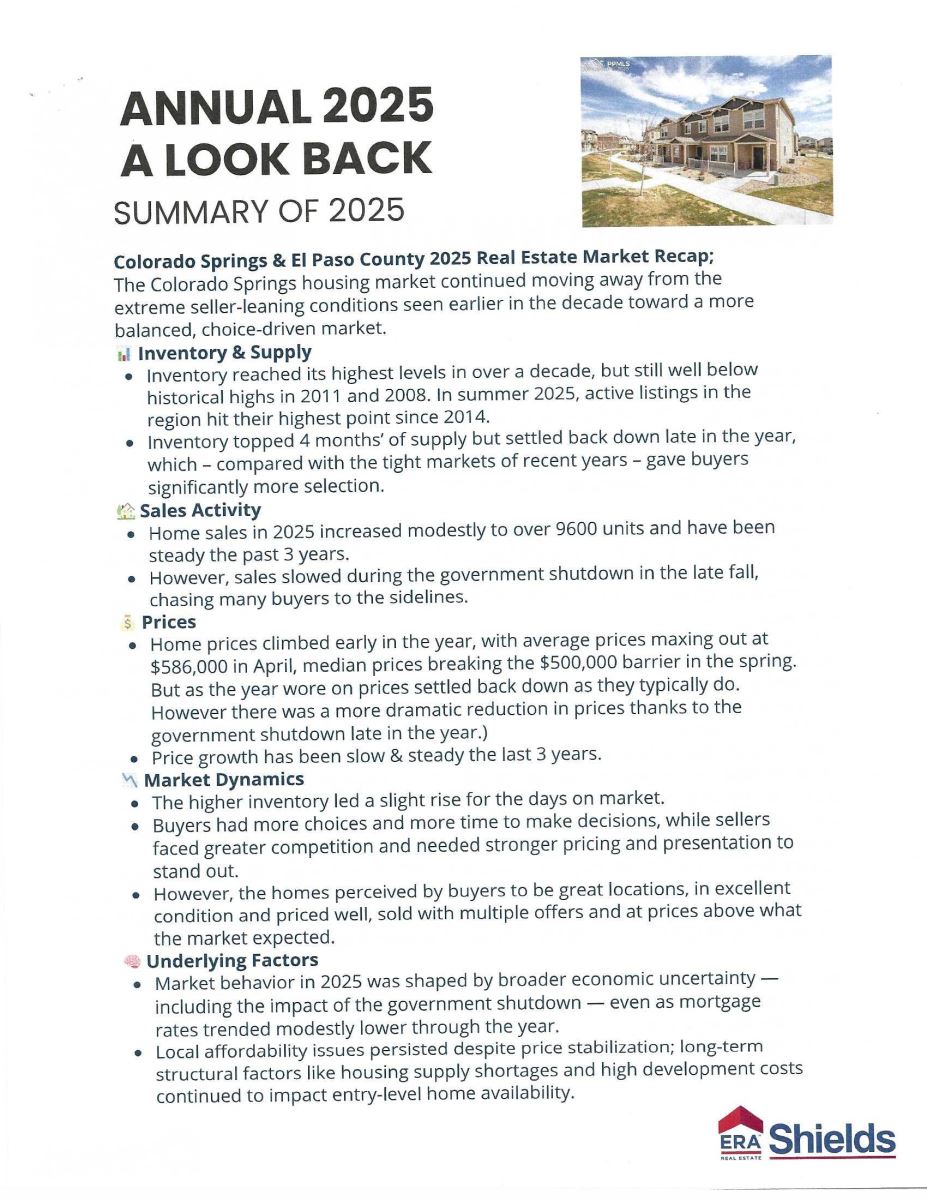

ERA SHIELDS 2025 ANNUAL real estate REPORT AND 2026 FORECAST

Attached is a copy of the ERA Shields Annual real estate Report which also includes the company’s forecast for 2026. If you have any questions, please call me.

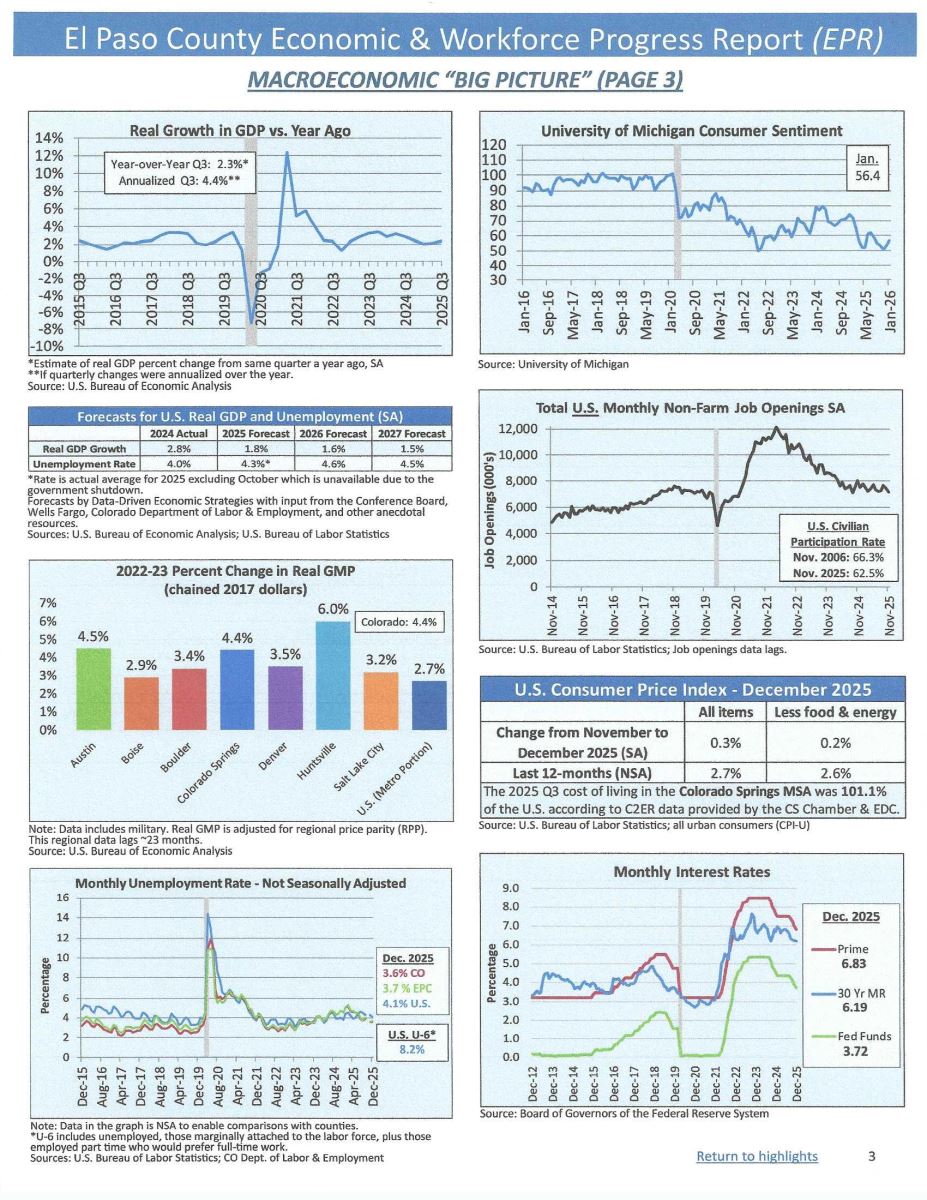

ECONOMIC & WORKFORCE DEVELOPMENT REPORT

Data-Driven Economic Strategies, January 2026

As always, I like to share the useful data I receive from our “local economist”, Tatiana Bailey. You will see in these charts what’s happening locally in terms of the economy as well as the most recent Workforce Progress Report.

This information is especially invaluable to business owners; however, I know you all will all find it worthwhile reading.

Below is a reproduction of the first page of graphics. To access the full report, please click here. And if you have any questions, give me a call.