HARRY'S BI-WEEKLY UPDATE 10.27.25

October 27, 2025

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

MORTAGE RATES ARE AT THEIR LOWEST AVERAGE IN MORE THAN A YEAR AND LOCAL LISTINGS ARE UP...BUT SALES ARE STILL SLOW…FOR NOW

Mortgage rates hit their lowest average rate since October 2024---with the 30-year, fixed-rate mortgage averaging 6.19% according to Freddie Mac---and it’s providing a bit of a boost to homebuyers. In fact, the last time the 30-year fixed-rate average was lower than today was October 3rd last year.

The 15-year, fixed-rate mortgage also decreased, averaging 5.44%, lower than the 5.52% two weeks ago and the 5.71% average from this time last year.

And, the Federal Reserve has indicated that there will be two more interest rate cuts before year end, which could in turn help reduce mortgage interest rates as well.

These are all positive signs for the Residential real estate market, and I expect to see local sales picking up sooner than later.

While this is traditionally not the most active buying and selling season, it appears that folks who have been waiting for better rates are looking to jump ahead while there are more available homes for sale.

I can’t agree more.

There is currently a ripple effect in the market—in a good way. Last week the National Association of Realtors (NAR) reported that its measure of pre-owned home sales increased 1.5% in September. According to Lawrence Yun, chief economist for NAR, “falling mortgage rates” are the reason and all told, existing home sales reached a seven-month high in September nationally.

While sales have been slow and it’s been much more of a buyer’s market of late, I’ve recently had calls from folks wanting to find out if this is the time for them to make their move…literally.

I tell them what I have told my clients forever—it’s only a good time if it’s a good time for your individual situation.

And there is only one way to find that out—by giving me a call and scheduling a time to get together and see how your wants, needs and budget requirements can be best used to find just the right place for you and your family.

If you’ve even considered a move in the last year or more NOW is the time to begin before others jump in to take advantage of the new rates and increased options. You might be surprised to find that the possible increased equity in your present home could provide you with a greater down payment, which in turn will result in less of a monthly output than you might expect.

As many of you are aware, I am a leading authority in the Residential real estate industry—with more than 50 years in the local real estate arena and a background in investment banking as well.

This helps me keep my clients well-informed, thus enhancing their ability to make timely and effective real estate decisions.

Give me a call today at 719.593.1000 or email me at Harry@HarrySalzman.com and together let’s see how your Residential real estate dreams can become reality in the best time frame for you.

NEW HOME SALES SENTIMENT HIT A SIX-MONTH HIGH

Reuters, 10.17.25

The lower interest rate has also affected U.S. homebuilders, with sentiment jumping to a six-month high this month.

Economic uncertainty and the lackluster job market nationally have offset some of the anticipated boost. However, those looking to buy a newly constructed home are seeing some builder incentives to make a sale more attractive.

Some builders are rolling back prices to bring more buyers to the table. In fact, 38% of builders reported cutting home prices in October, with the average reduction rising to 6%, according to the latest National Association of Home Builders/Wells Fargo housing market Index.

These cuts are narrowing the gap between new and existing homes, with economists calling this an “unprecedented pricing shift” since new homes have historically sold for much more than existing homes on average.

While existing homes prices continue to edge higher each month—although at a much slower pace lately—more builders are turning to price reductions and smaller floor plans to reach buyers who feel priced out.

Also, according to the survey, 65% of builders said they turned to additional incentives such as:

- Mortgage rate buydowns to shrink your monthly payment

- Price cuts that make homeownership more attainable

- Help with closing costs and even upgrades in some communities

This is great news for those looking to buy a newly constructed home and certainly not something to overlook.

And what’s even better news for you if this is a consideration?

I can help at no additional cost to you.

Yes, you read that right. If a newly constructed home is in your future, I can be of great assistance at no extra cost to you.

I can assist with home location, elevation and other factors that are important to you. More importantly, I can help direct you to a lender who can provide the best rates and service for your individual situation.

These incentives won’t be around forever so if this is something you have considered, give me a call and let’s discuss how to make them work in your favor today.

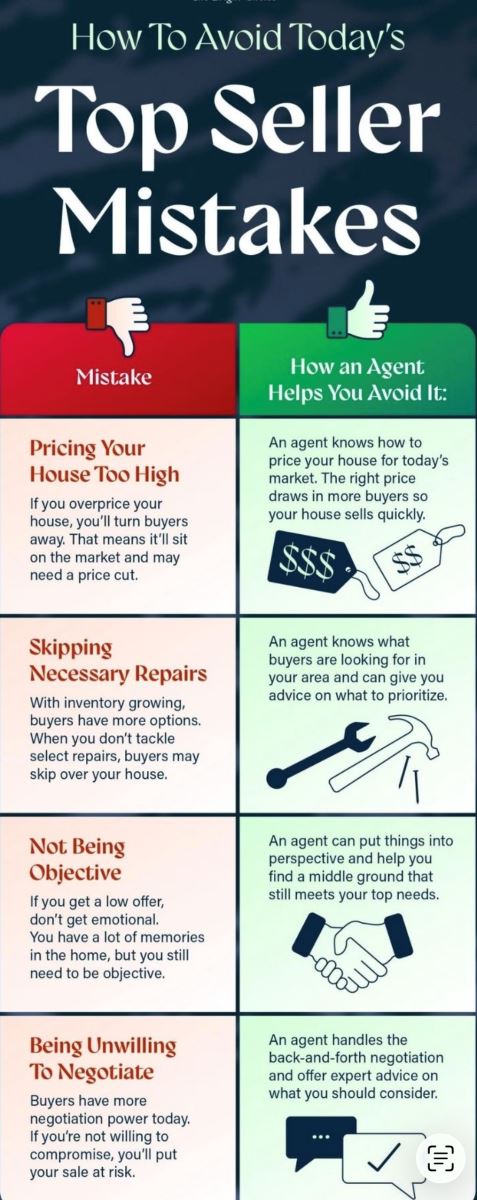

TOP SELLER MISTAKES…an infographic

There has been some talk about selling a home without an agent or through a national network. I’ve personally seen some folks try to do so and ultimately almost all have realized that without the help of a qualified, knowledgeable local agent they often got nowhere.

They lost time and possibilities due to the lack of individualized help and ended up turning to an agent in the end.

My advice? You get what you pay for—and when it comes to selling a home it is more than worth it to have someone like me in your corner working for you.

Just a “word to the wise”, as they say…