HARRY'S BI-WEEKLY UPDATE 1.24.23

January 24, 2023

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

WHETHER IT’S YOUR PERSONAL HOME, OR A HOME YOU PURCHASE FOR SPECIFIC INVESTMENT PURPOSES, ALL real estate IS AN INVESTMENT

As you know by now, I don’t just sell Residential real estate, I totally believe in it, and most especially as a means of investment. It can be the home you live in or the home you buy to rent out to others, ALL Residential real estate is an investment. And like any investment, it’s not going to appreciate overnight. While Residential Real Estate has traditionally outperformed the stock and bond market over the long haul, the key to that is “time”, or the “long haul”.

I may be celebrating almost 51 years in the local residential real estate arena, but prior to that I was a Finance major at Arizona State University. After graduation I moved to Denver, associated with a Wall Street type firm, and began my professional career for three years as an Investment Banker.

Wanting to move to a smaller community, I relocated to Colorado Springs and decided that with my finance background, and knowledge about the mortgage market, selling Residential real estate might be a good fit. That way I was able to help others invest in themselves by purchasing real estate and I could assist clients in finding the best mortgages and more. The rest, as they say, is history.

I still start each morning reading The Wall Street Journal, with particular emphasis on the numbers—the prices of lumber, steel, aluminum, and more since they affect new home construction prices. Then I look at all different types of current mortgage rates which are the average of 4800 mortgage companies. From that I can determine the best mortgage products for my clients for either purchasing a personal residence or investment properties.

Why is this of importance to you? If you haven’t figured it out by now, my experience, in Residential real estate as well as financial matters concerning same, is why I’ve consistently been one of the top agents in the Springs. I would have retired by now except that it’s still a pleasure for me to help people on their road to financial success in real estate, and I have enjoyed working with not only the children, but recently some grandchildren, of clients and friends. I don’t call it work, although at times the recent market swings did require a lot of finagling for sure. The satisfaction I get from helping folks is what keeps me going, and I’m always learning new ways in which to help.

Some folks have been timid about jumping into today’s market due to the higher mortgage rates coupled with higher prices on homes. I’ve been around long enough to see rates as high at 20% so when I look at the 6%+ of today I don’t think “high”. I also know that once inflation settles down, rates will go back down a bit as well.

Will they go back to the 3% of several years ago? I seriously doubt it. That was unrealistic and created a Sellers’ market like none I had ever experienced. It also created unrealistic home value appreciation that could never be sustained. We are now experiencing a more normal appreciation and that is a boon for both Buyers and Sellers.

Since I am a “numbers” guy, and one who totally believes in Residential real estate as an investment in all areas, I decided to look at the type of home appreciation that we saw over the last 15 years. I put it in chart form, and it is reproduced below.

Basically, what you will see is that even through the mortgage crisis of 2007, as well as the ups and downs of the past several years, Residential real estate as an investment has held its own very well.

I have compared the realized gains of both the average and median single-family home prices in Colorado Springs over the past 15 years and the chart will show you the 5-year, 10-year and 15-year gains to homeowners.

Those numbers and more are why I totally believe in Residential real estate as an investment. After all, in most cases, your home is your greatest asset. And over the long haul, it’s likely to provide you an excellent return on your investment, as well as providing you with tax benefits not available to renters.

.jpg)

Any questions regarding my chart, please give me a holler.

And if you are wanting to move but think now isn’t the “right” time, you owe yourself a call to me. There are a number of ways to make buying a home, either for yourself or for investment purposes, a reality but you won’t know unless we sit down and look at all the numbers.

I can be reached at 719.593.1000 or emailed at Harry@HarrySalzman.com and I look forward to talking with you soon.

WHY INVESTING IN real estate IN 2023 COULD BE A GOOD DECISION

Transactly 12.30.22

Here are some valid reasons from other professionals on real estate investment property purchases in 2023:

Strong rental demand

One of the most compelling reasons to invest in real estate is the potential for steady rental income. With so many people opting to rent rather than buy, the demand for rental properties is strong, which often leads to higher occupancy rates and higher rent prices. This trend is likely to continue in the coming years, as rising housing prices and tighter lending standards make it hard for many to become homeowners.

Potential for long-term appreciation

While it’s not possible to predict exactly how much a property will appreciate over time, real estate has a history of increasing in value over the long term, as I portrayed in the chart above. This is due to a number of factors, including inflation, population growth, and economic expansion. By holding onto a property for a number of years, you may be able to sell it for a significantly higher price than you paid for it.

Diversification of your investment portfolio

Investing in real estate can help diversify your investment portfolio. While stocks and bonds are often a significant part of any investment strategy, adding real estate to the mix can help reduce risk and increase potential returns. This is because the performance of real estate tends to be less correlated with other asset classes, meaning it can provide a buffer against market volatility such as we’ve seen in recent times.

Potential tax benefits

Owning rental properties can also offer a number of tax benefits. For example, you may be able to deduct certain expenses related to your rental property, such as mortgage interest, property taxes and repairs. As always, I would advise you to contact your investment and tax advisors to see how owning a rental property can provide you with these type of benefits.

Opportunity for passive income

Investing in real estate can also provide a source of passive income, which can be especially attractive for those who are looking to supplement their retirement income or simply want to generate additional income without having to work full-time. By hiring a property manager to handle the day-to-day responsibilities of the property, you can potentially earn rental income without having to put in a lot of time or effort.

Ability to leverage your investment

Another advantage of investing in real estate is that it can be done with leverage, meaning you can borrow money to make a larger investment than you could afford to make with your own cash. This can allow you to acquire more property or invest in more expensive properties, which can lead to higher returns. However, it’s important to be mindful of the risks associated with leverage, such as the possibility of defaulting on your loan or losing your investment if the value of the property decreases.

Overall, investing in real estate in 2023 has the potential to be a good decision for those who are looking for a long-term investment with the potential for steady rental income, appreciation, and tax benefits. While it’s important to carefully consider the risks and do your due diligence before making any investment, real estate can be a valuable addition to a well-diversified portfolio.

HOME SALES NUMBERS NATIONALLY IN 2022 WERE THE WORST SINCE 2014

The Wall Street Journal, 1.21-22. 2023, The Gazette, 1.21.2023

Home sales nationally last year were the lowest in nearly a decade according to a recent report from the National Association of Realtors (NAR). This was the biggest annual decline since 2008, during the housing crisis of the late 2000’s.

According to NAR, the median national home price for last year jumped 10.2% to $386,300 and it’s up 42% from 2019 before the ultralow interest rates and pandemic-fueled demand sent the market into a frenzy. That translates to a median $114,000 increase in housing wealth in three years.

“So, homeowners have done well during this housing (market) from 2019 through Covid until now,” said Lawrence Yun, chief economist for NAR. “The one big negative for home sales is home prices, which have risen dramatically, much faster than peoples’ income.”

Mortgage rates more than doubled in 2022, climbing to a two-decade high of 7.08% in the fall with the Federal Reserve continuing to boost its key lending rate in a quest to cool the economy and tame inflation.

Home sales slowed from the fast pace at the start of 2022 as the surge in borrowing costs limited the buying power of home hunters.

While rates have come down since the high of late last year, they are still significantly higher than the beginning of 2022.

According to Yun, “Mortgage rates have fallen in the recent past weeks, so I’m very hopeful that the worst in home sales is probably coming to an end. Maybe this latest monthly figure (from December) will be the cyclical low point.”

Homebuilders and sellers are offering incentives to potential buyers and cutting prices in response to the low demand. And a measure of U.S. home-builder confidence rose this month, ending a 12-month streak of declines, according to the National Association of Home Builders.

Home sales typically lag during the winter months and pick up during the spring buying season. While this was not the case in the last several years during the frenzy, getting back to “normal” seasonal based buying could see more homes on the market and more sales during that period this year.

Pricing and incentives are going to be very important in homes sales this spring and having a seasoned, knowledgeable real estate professional on your side will make the difference between a sale and disappointment.

That’s where I come in. Having someone like me on your side can make the difference whether you are looking buy or sell. Spring buying season will be here before you know it, so if you’re looking to buy or sell, give me a call and let’s map out your strategy early. Knowing in advance your individual needs, wants and budget will make you more prepared as a buyer and understanding the true value of your present home will make you equally prepared as a seller. I can help with both.

Give me a call sooner than later and let’s see how we can make your Residential real estate wants and needs a reality.

AVERAGE LONG-TERM U.S. MORTGAGE RATE IS LOWEST SINCE SEPTEMBER

The Gazette, 1.20.2023

As I mentioned earlier, mortgage rates are down from their high in the fall of last year and are now at their lowest since September.

This is a significant plus for the spring buying season and while home prices are still high, some sellers are lowering sales prices in order to attract potential buyers.

Colorado Springs has been like the rest of the nation with low sales numbers but with interest rates hopefully on their way down, we are likely to see sales numbers go up.

Important to note is that over the next few years Colorado Springs is getting some relocating companies that are bringing with them very high paid employees. These folks will be looking for homes and will be able to afford them. This is one of the reasons that while we’ve had a slow selling of homes for six months during the latter part of 2022, things are likely to pick up over the next year and into the foreseeable future.

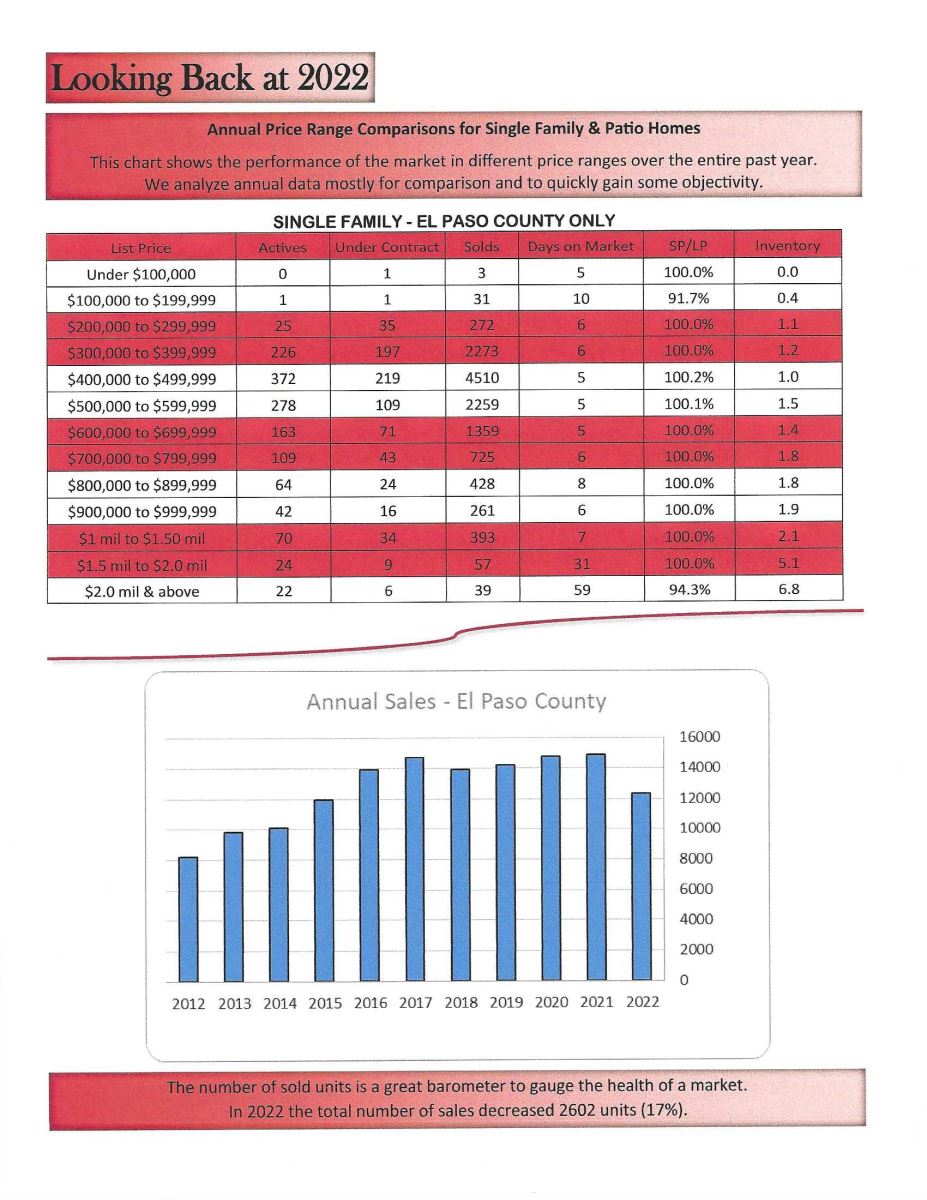

COLORADO SPRINGS RESIDENTIAL real estate ANNUAL REVIEW OF 2022 AND 2023 FORECAST

ERAShields real estate, 1.2023

It is my pleasure to share with you some local data compiled by my company. It provides you with a look back at 2022 and a forecast for 2023.

I am reproducing one page below and to read the report in its entirety, click here.

If you have any questions, please ask.

FYI….

Conventional and VA new loan limits for El Paso County are now $726,200.

And VA can exceed that when a buyer doesn’t own property with the VA, with no down payment required.

FHA loan limits:

El Paso and Teller Counties: $517,500

Pueblo and Fremont Counties: $472,030

Denver areas: $787,750