HARRY'S BI-WEEKLY UPDATE 8.7.23

August 7, 2023

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

THINGS ARE BEGINNING TO TURN AROUND…

Those of you who have known me for 5 minutes or 50 years can attest to the fact that if nothing else, I can be called “Mr. Positivity”.

If there’s a way of turning anything at all into a positive, I will find the way. Lucky for me, some things happening in our community are playing right into my hands.

To begin with, the best news of recent days was President Biden’s decision to keep the U.S. Space Command right here in Colorado Springs. Not only is it the best decision for our national security, it means that so many folks who were uncertain of where they might live are now making plans to stay right here.

And several tech companies who work with the DOD are looking to increase their staffing and facilities as well.

Of course, my first thought was…wow, there are going to be a bunch of folks who will be looking for housing.

And then my second thought was…hmm…the inventory shortage is going to get worse before it gets better.

But, me being me, I just figure that things will work out just fine.

And sure enough, I attended a zoom conference last week that was led by Lawrence Yun, Chief Economist for the National Association of Realtors (NAR) and he was just as positive in his outlook as I’ve been.

So, I have devoted this eNewsletter to “positivity” and have provided some infographics that show the same.

And my newest YouTube video also attests to that. Yes, if you’ve got two minutes, I’ve got some news for you.

To watch, click here:

In fact, while you’re at it, you might want to subscribe to my channel, so you won’t miss my future broadcasts. It won’t cost you anything…well, it could cost you… if you miss some of my informative musings!

And, if you want to see the charts I referred to in my talk, please click here.

Yes, things are looking up in Residential real estate and if you’ve even considered buying or selling during the past year and held back for whatever reason, NOW is the time to get with me to figure out if it’s possible to begin the process.

So, as always, if Residential real estate is among your current hopes and dreams, please give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let me help make them come true.

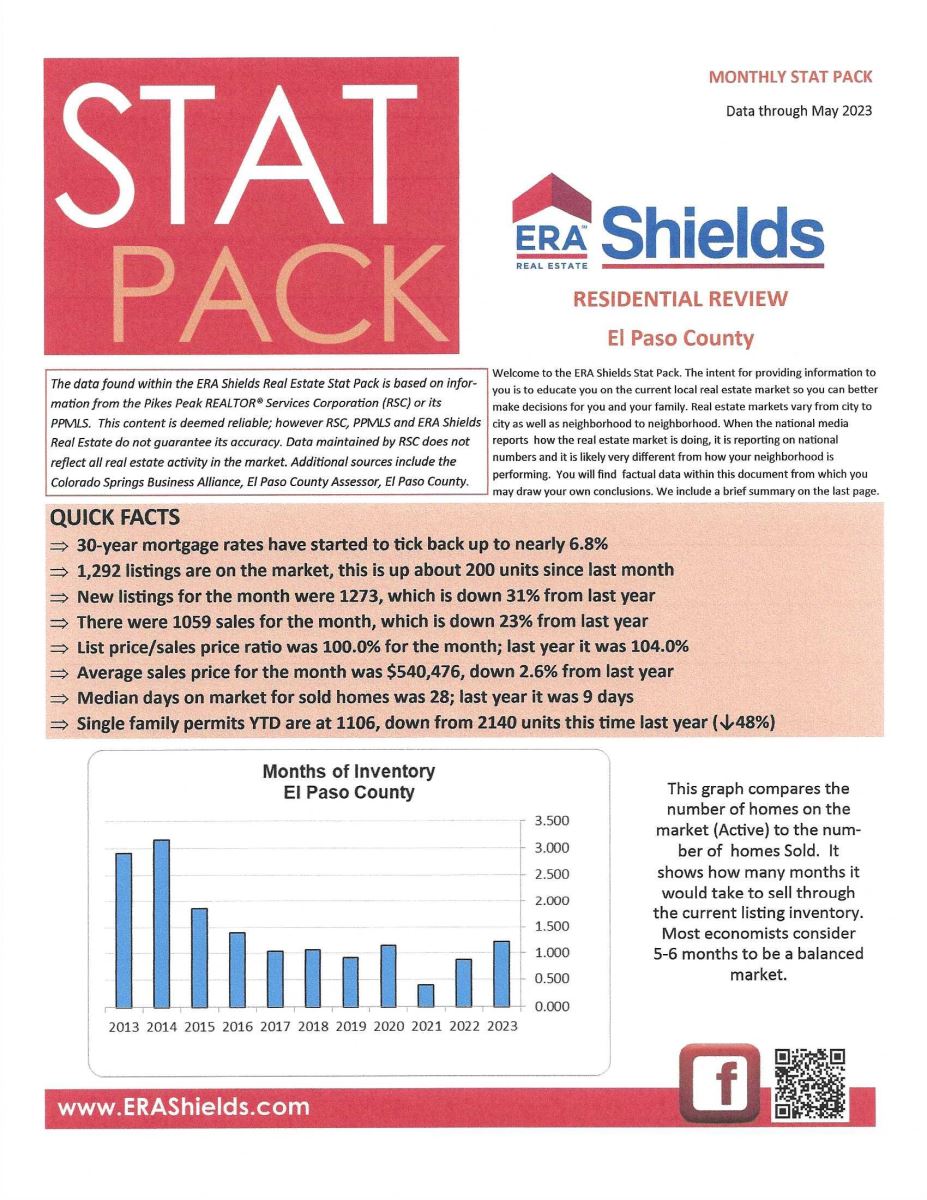

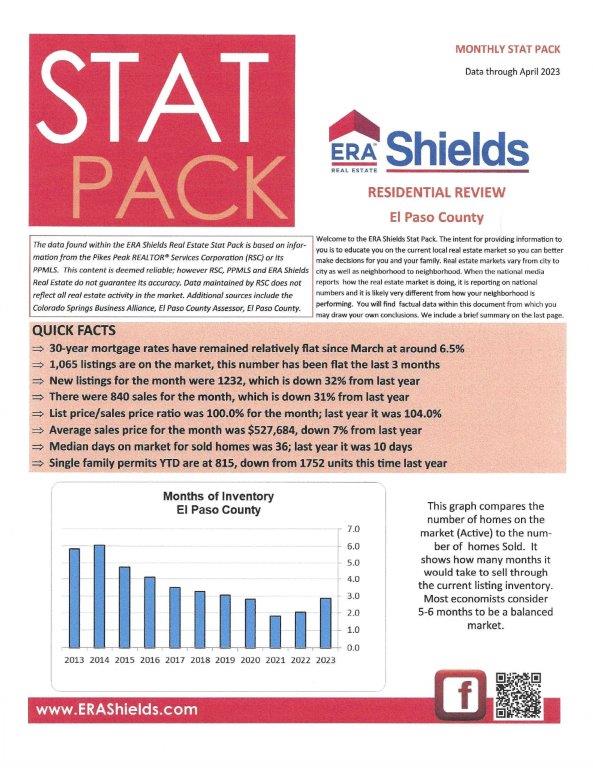

And now for statistics…

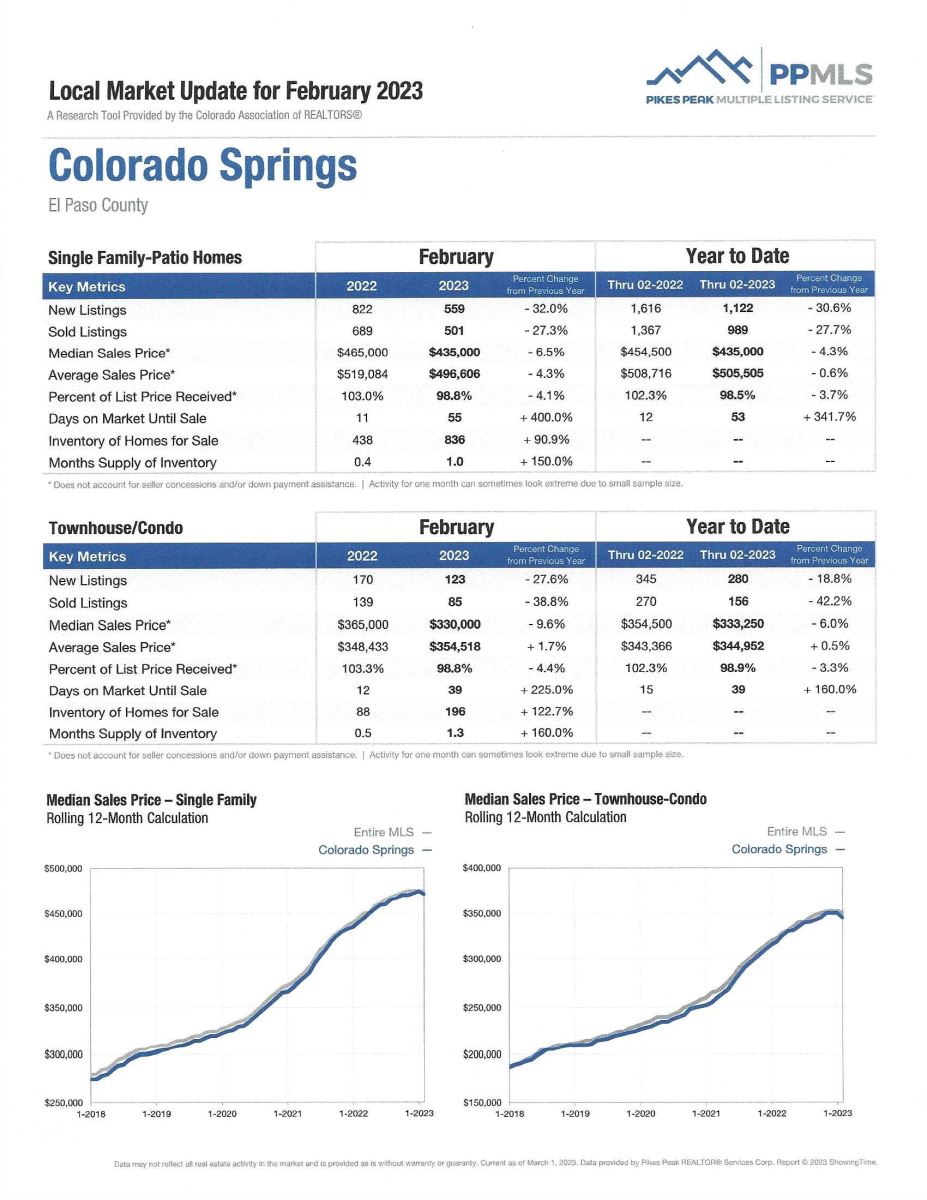

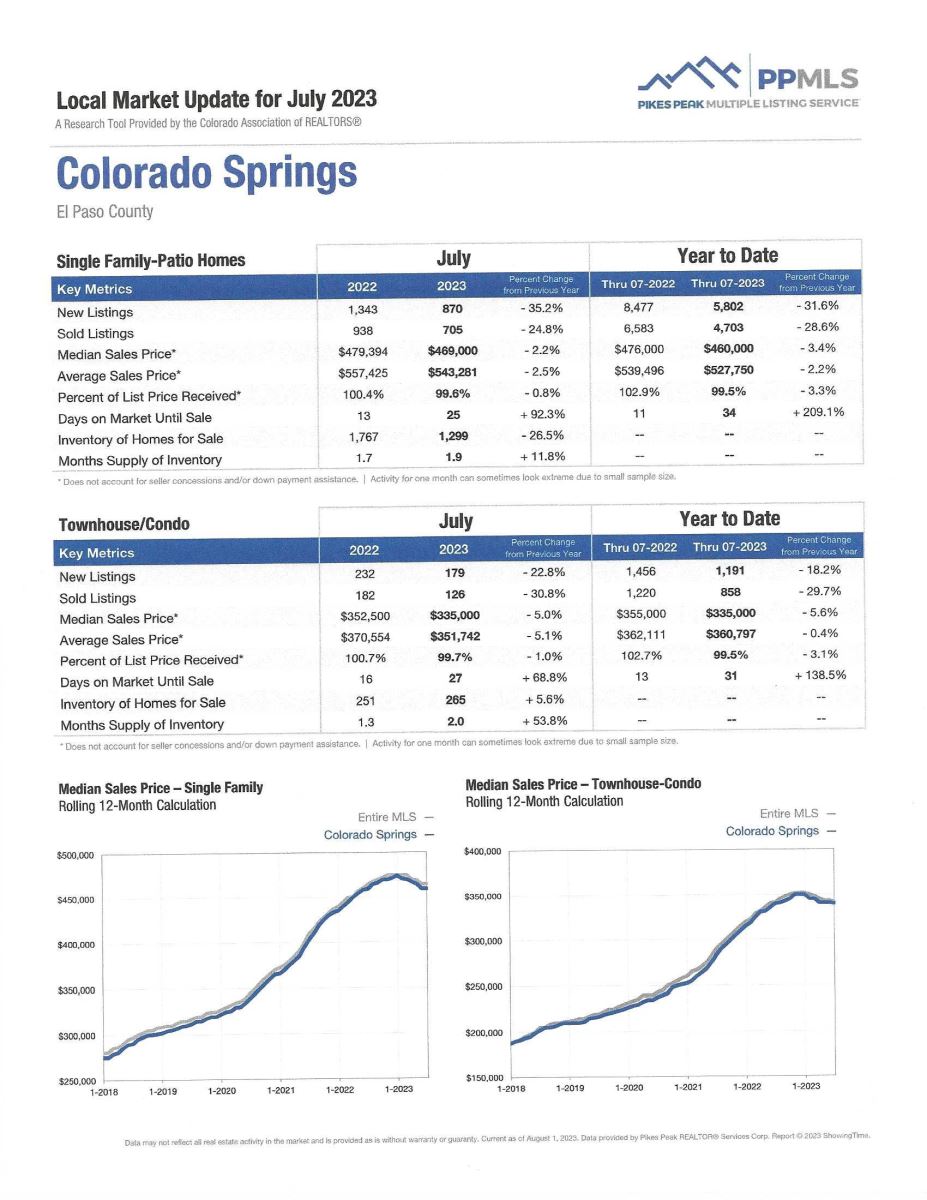

JULY 2023

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the July 2023 PPAR report.

In El Paso County, the average days on the market for single family/patio homes was a 24. For condo/townhomes it was 25.

Also in El Paso County, the sales price/list price for single family/patio homes was 99.7% and for condo/townhomes it was 99.6%.

In Teller County, the average days on the market for single family/patio homes was 31 and the sales/list price was 98.2%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing July 2023 to July 2022 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 1,464, Down 29.9%

· Number of Sales were 1119, Down 20.2%

· Average Sales Price was $540,443, Down 3.0%

· Median Sales Price was $472,000, Down 2.2%

· Total Active Listings are 2,254, Down 11.6%

· Months Supply is 2.0, Down 0.6%

Condo/Townhomes:

· New Listings were 224, Down 17.0%

· Number of Sales were 160, Down 23.1%

· Average Sales Price was $364,619, Down 2.6%

· Median Sales Price was $342,500, Down 2.8%

· Total Active Listings are 302, Up 29.1%

· Months Supply is 1.9, Down 1.3%

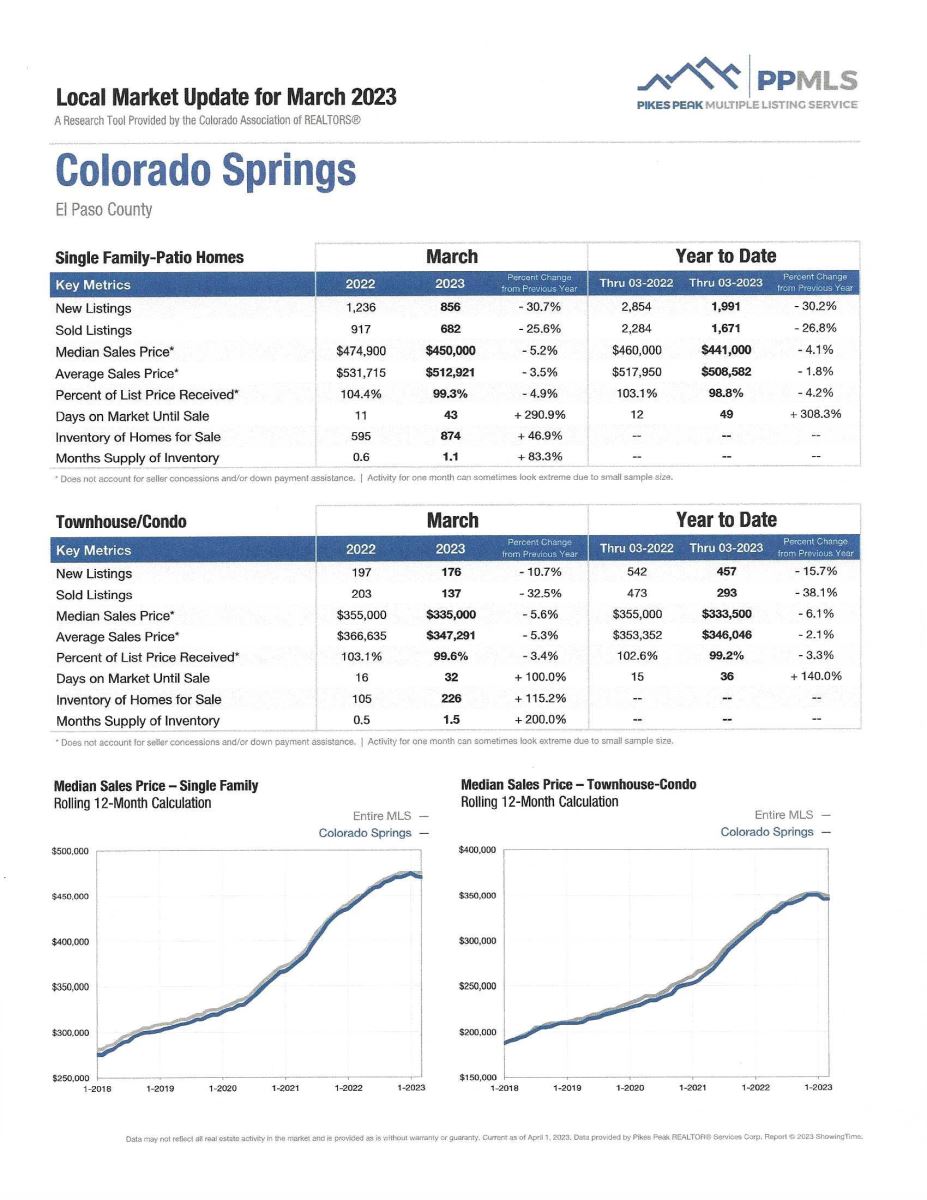

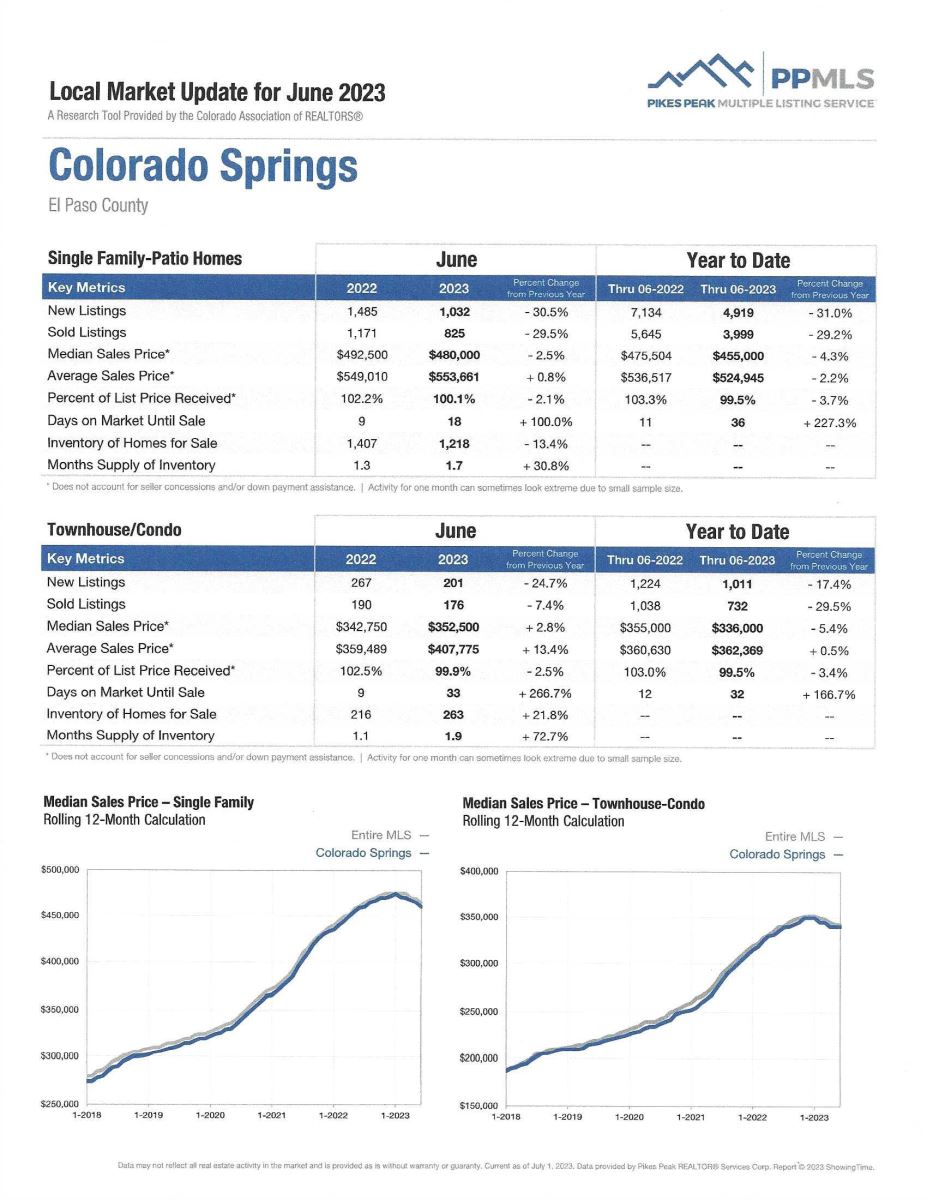

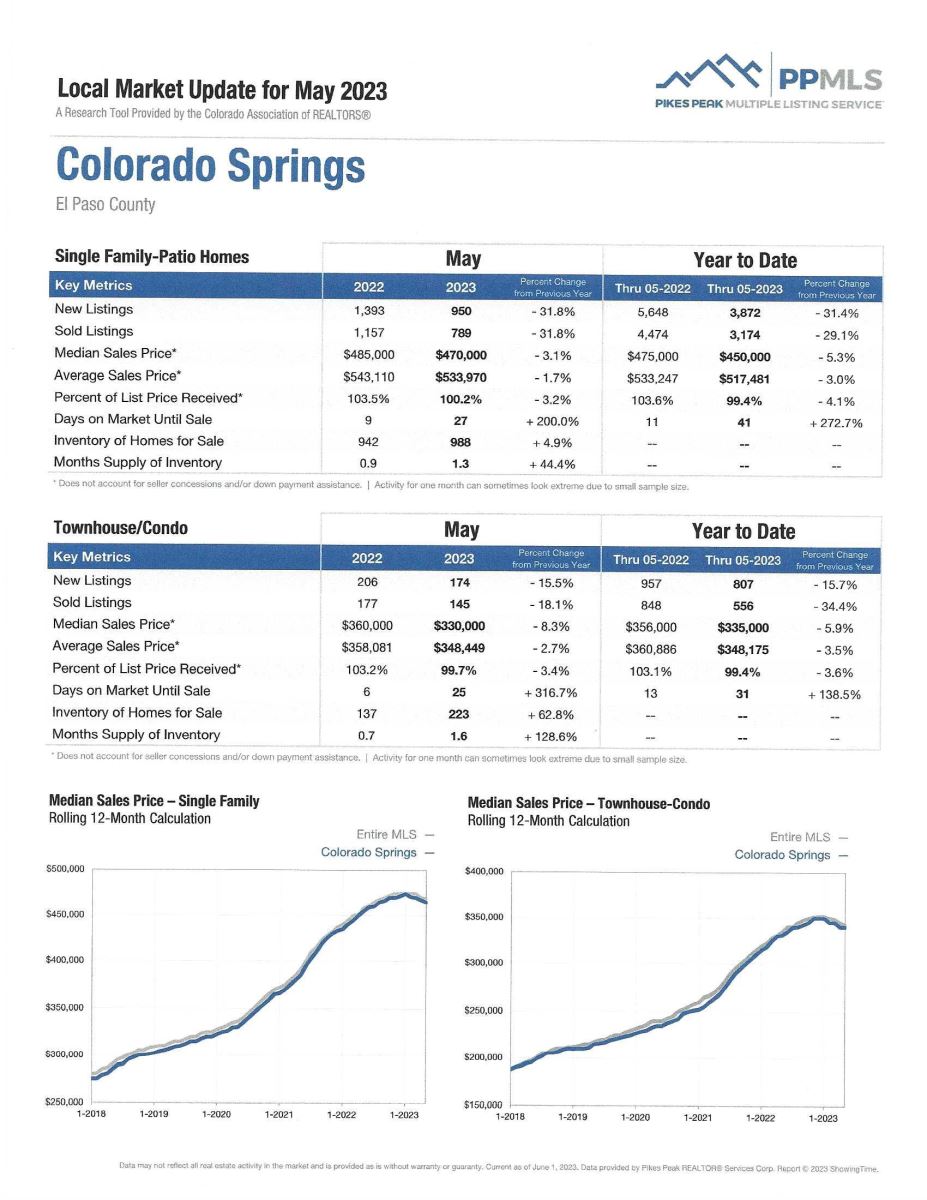

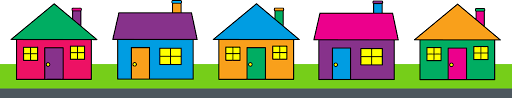

JULY 2023 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year-to-Date one-year change:

- Sold Listings for All Properties were Down 24.9%

- Median Sales Price for All Properties was Down 1.8%

- Active Listings on All Properties were Down 17.9%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering in order to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

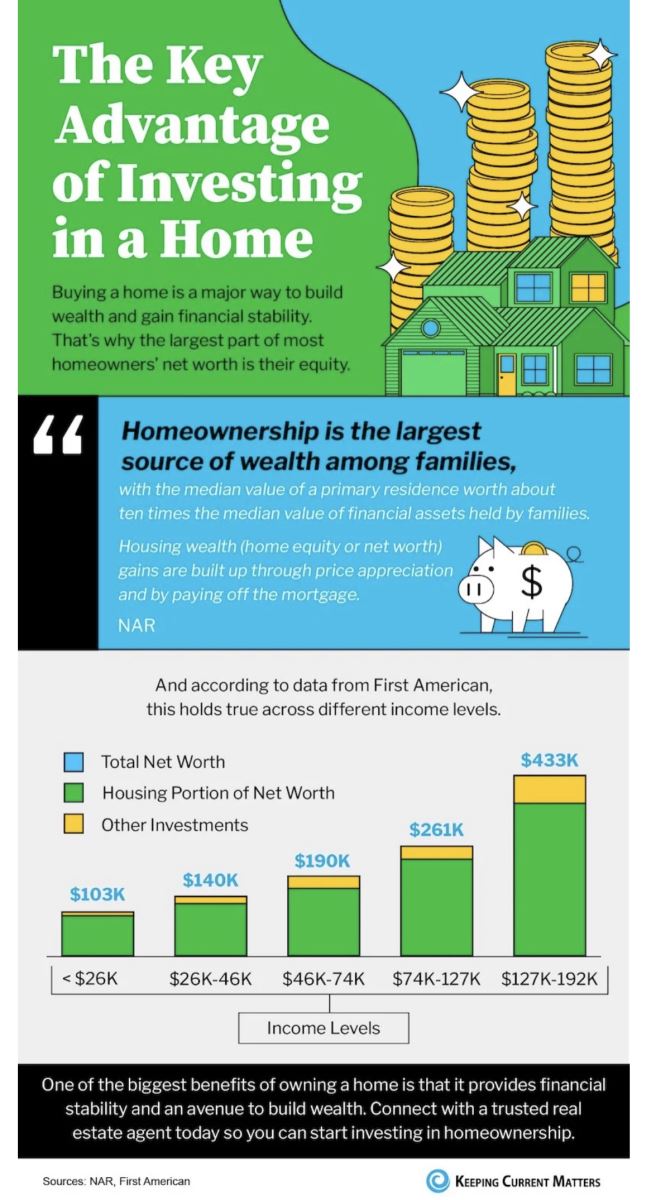

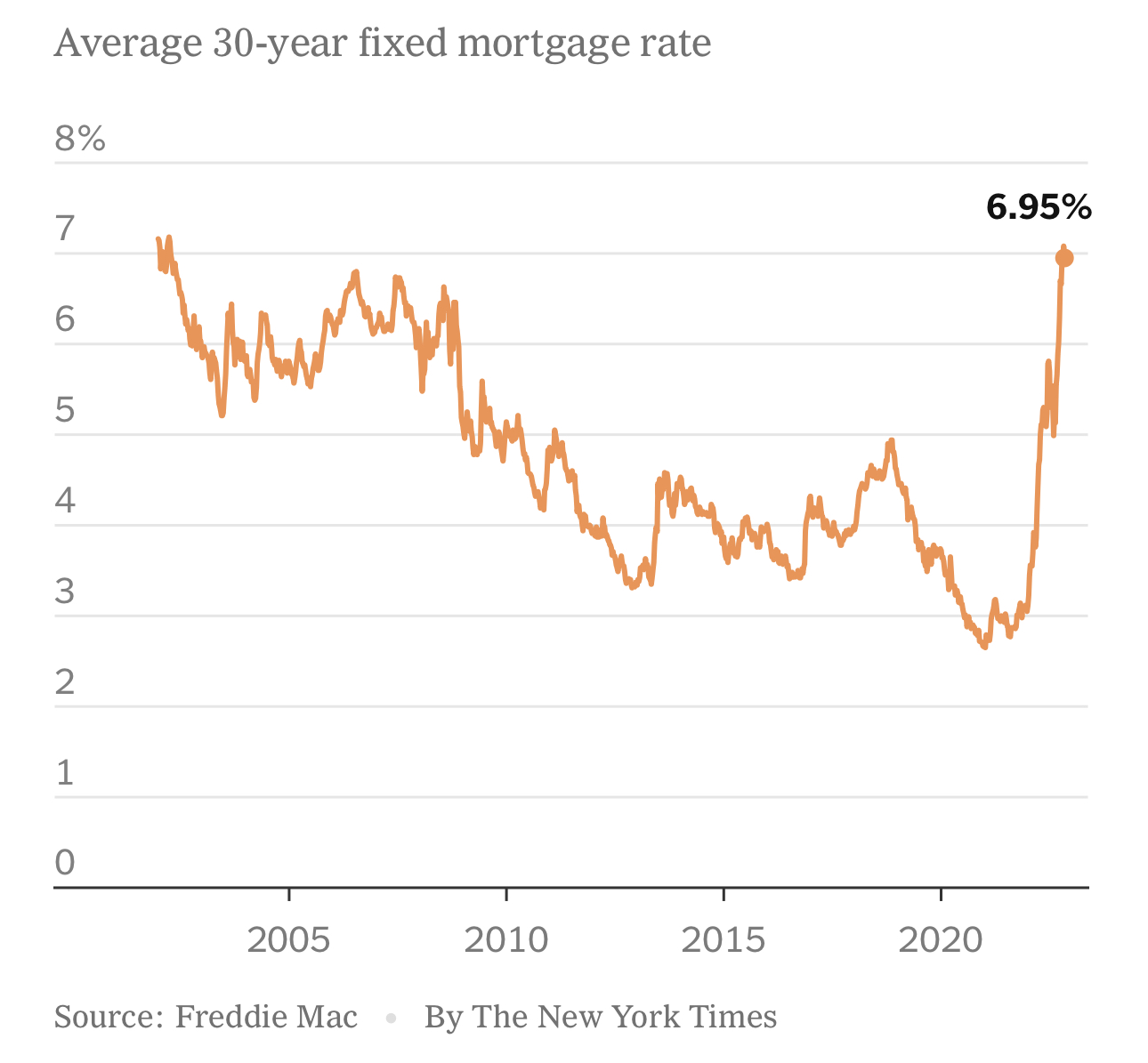

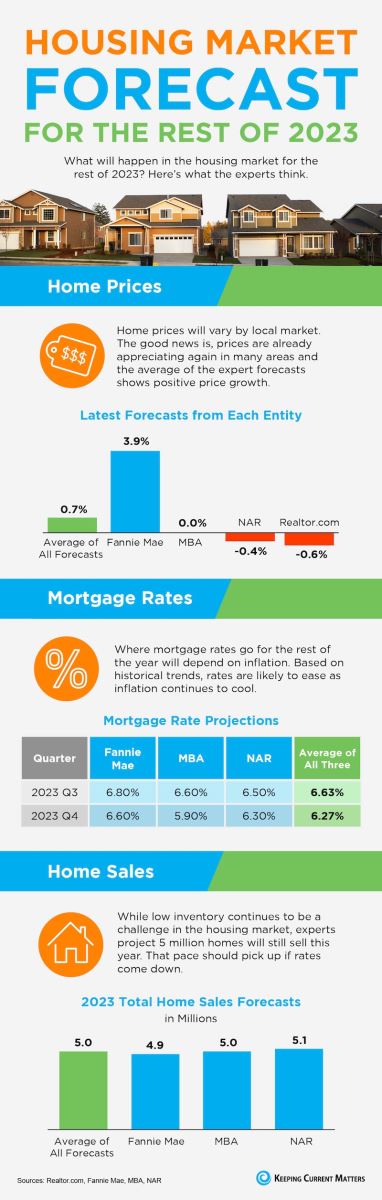

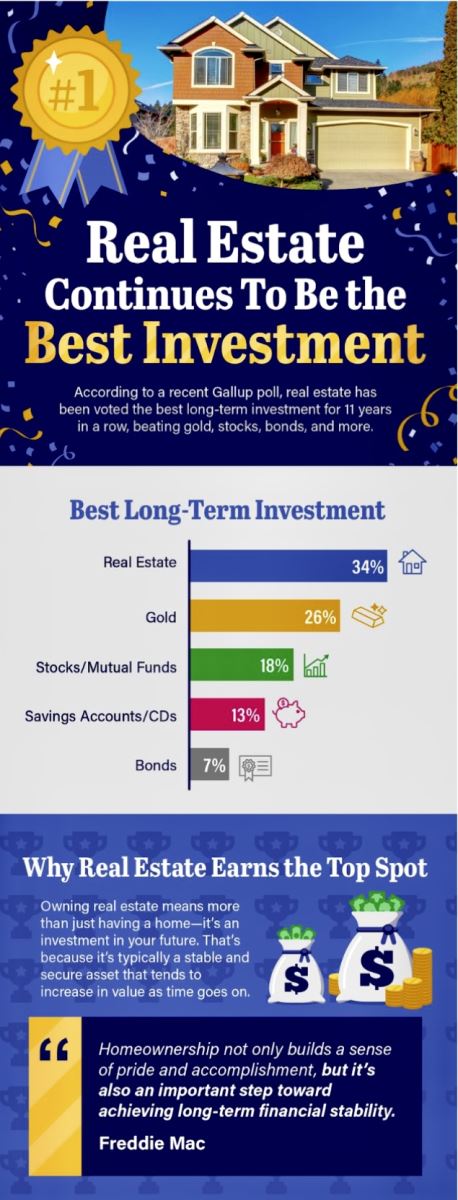

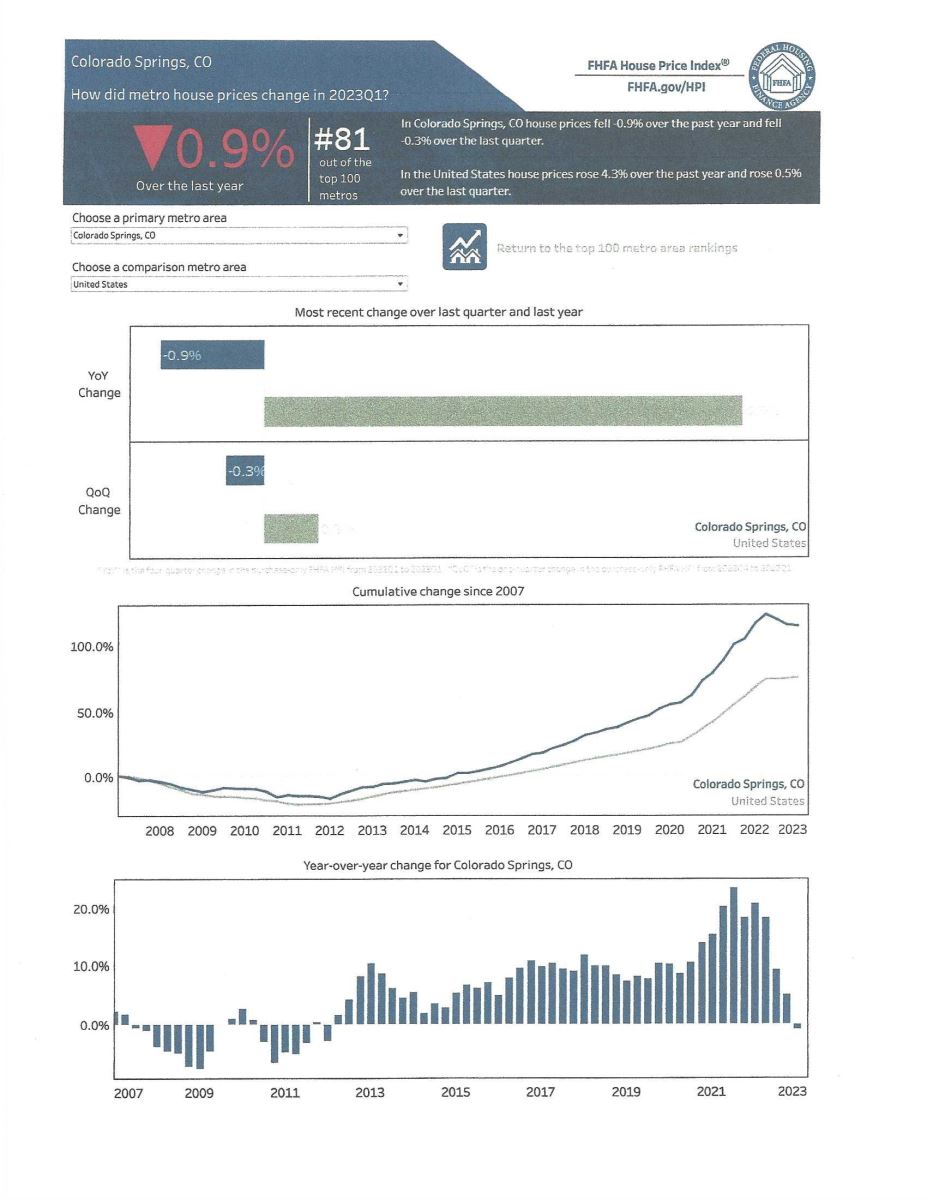

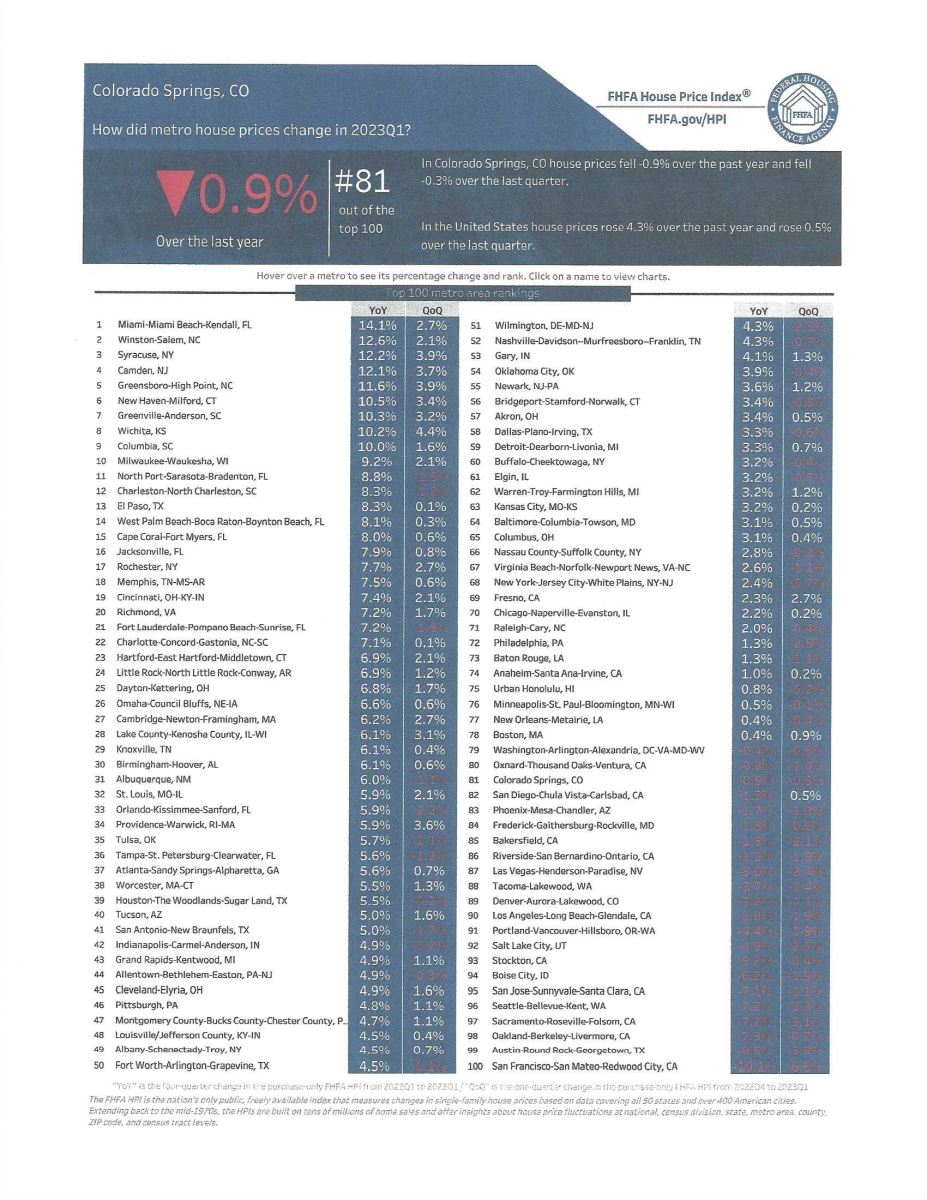

housing market FORECAST FOR THE REST OF 2023…AN INFOGRAPHIC

Keeping Current Matters, 8.4.23

Some Highlights:

- Want to know what experts are saying will happen in the rest of 2023? Home prices are already appreciating again in many areas. The average of the expert forecasts shows positive price growth.

- Where mortgage rates go for the rest of the year will depend on inflation. Based on historical trends, rates are likely to ease as inflation continues to cool.

- Even though low inventory here and in the rest of the nation continues to be a challenge, experts project 5 million homes will still sell this year. That pace should pick up if rates come down.

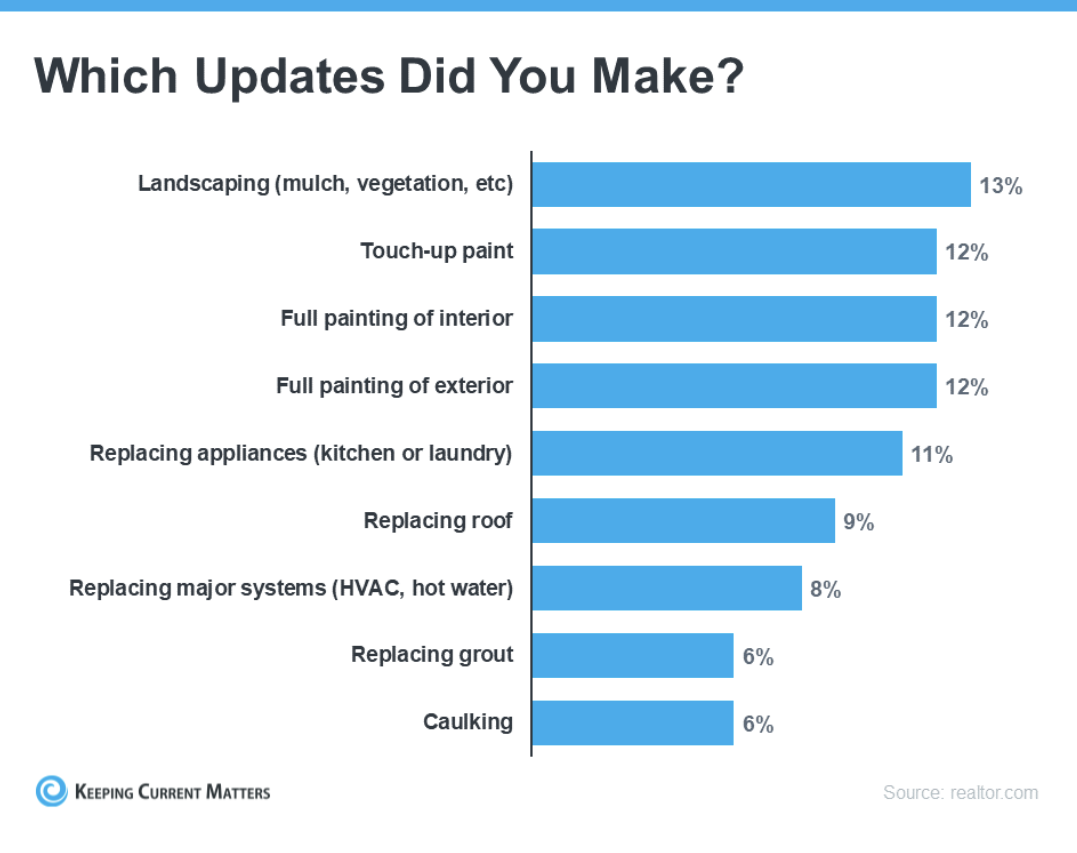

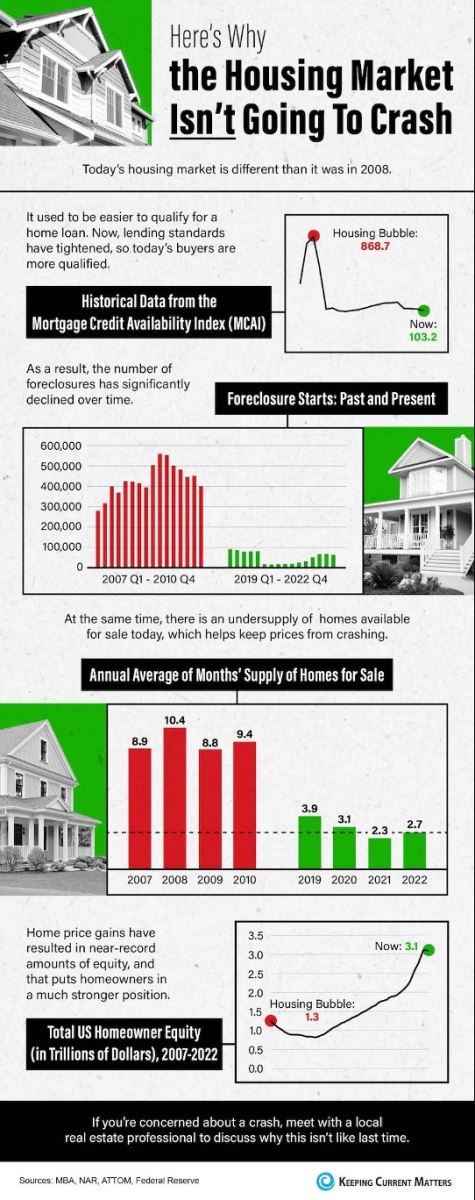

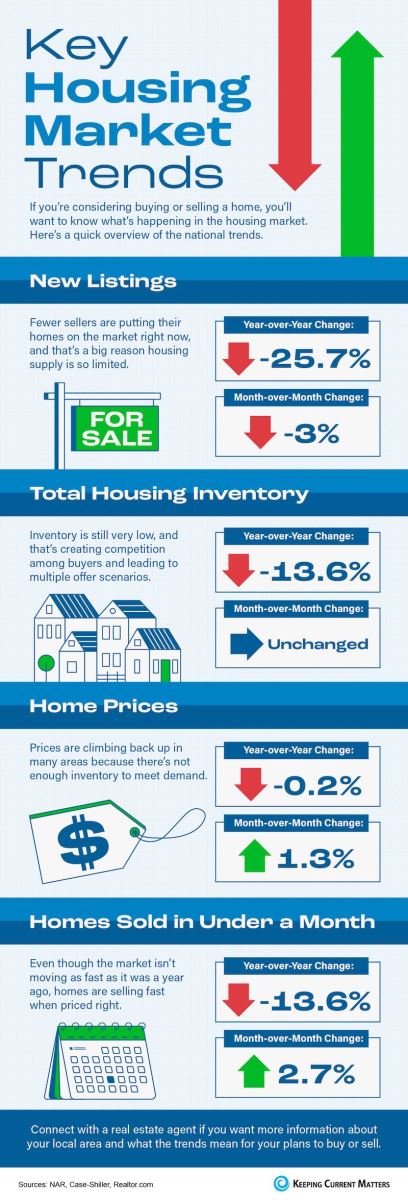

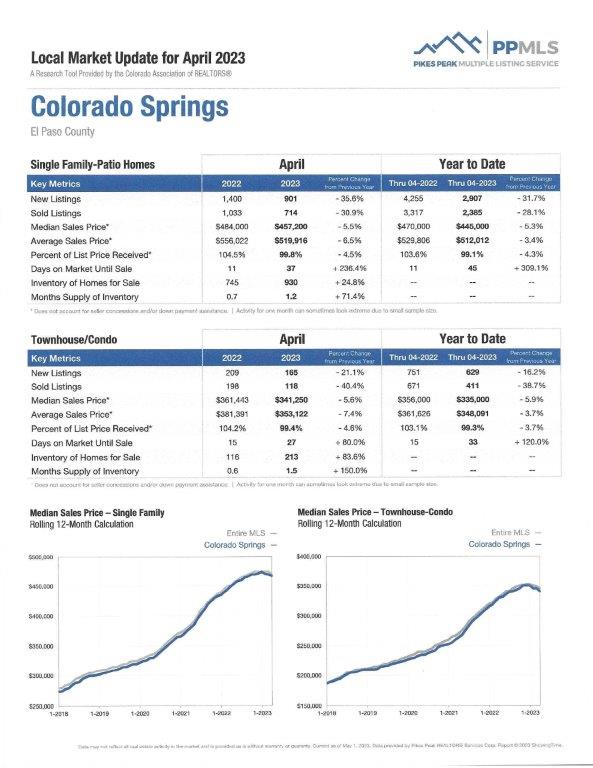

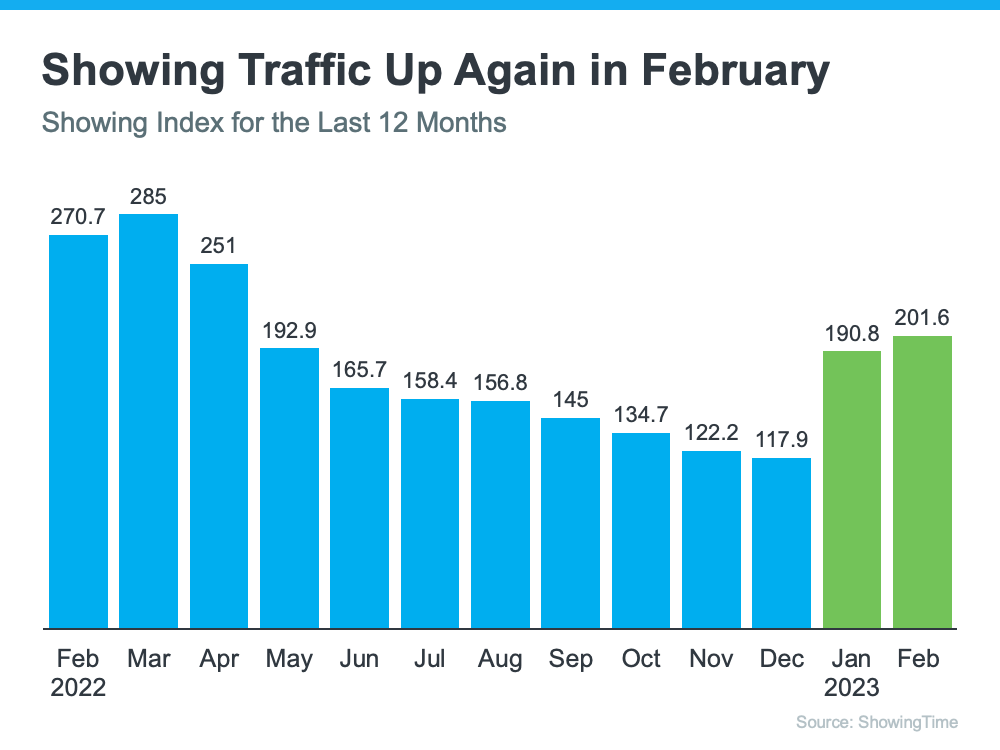

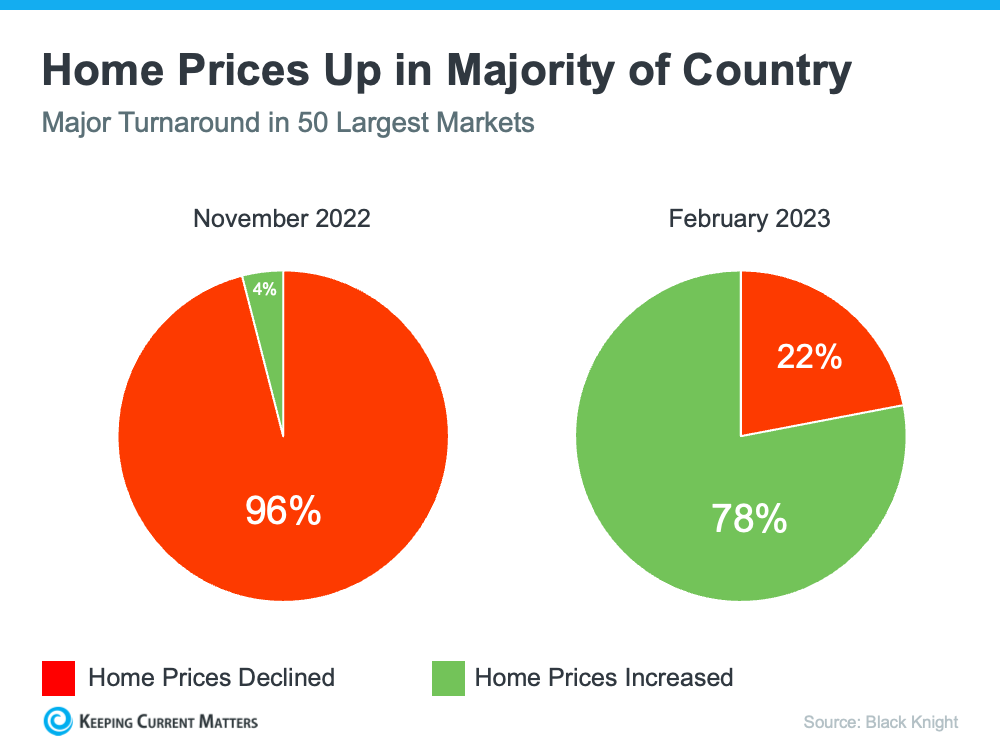

KEY housing market TRENDS…AN INFOGRAPHIC

Keeping Current Matters, 7.28.23

Some Highlights:

- If you’re considering buying or selling a home, you’ll want to know what’s happening in the housing market.

- Housing inventory is still very low, prices are climbing back up, and homes are selling fast when priced right.

ECONOMIC & WORKFORCE DEVELOPMENT REPORT

Data-Driven Economic Strategies, July 2023

As always, I like to share the useful economic data I receive from our “local economist”, Tatiana Bailey. You will see in these charts what’s happening locally in terms of the economy as well as the most recent Workforce Progress Report.

This information is especially invaluable to business owners; however, I think you all will all find it worthwhile reading.

To access the report, please click here and if you have any questions, please give me a holler.

SAVE THE DATE FOR THE 27TH ANNUAL UCCS ECONOMIC FORUM…

This is an always worthwhile event and registration is FREE. You can scan the above QR code for registration and more information.

AND A PARTING REC FOR SOME INTERESTING READING…

I am almost finished reading our former Mayor John Suthers’s autobiography and I can’t put it down. The book is a fascinating look at John’s life and career trajectory, and I highly recommend it to one and all.

The book is titled “All This I Saw And Part Of It I Was” and I’m guessing you can find it at most of our local bookstores.

Bravo, Mr. Mayor.

Not only did he do a great job for Colorado Springs, but he wrote a spellbinding book as well.

HARRY’S JOKES OF THE DAY:

.jpg)