HARRY'S BI-WEEKLY UPDATE 7.25.23

June 25, 2023

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

ATTENTION BUYERS…. IT’S FINALLY YOUR TURN

As you are aware from my eNewsletters of the past several years…. the near historic lack of available homes for sale created a Seller’s Market unlike any I had seen in my 51 plus years in Residential real estate.

Well, that has changed. And for several reasons.

To begin with, the current higher mortgage interest rates have kept a few folks from qualifying. And homeowners who have the historically low rates of the recent past, while possibly wanting to sell and trade up, are not wanting to give up those rates.

In the U.S., sales sank 18.9% compared with June of last year. However, while down from a year earlier, the median U.S. sales price rose from the previous month.

According to Lawrence Yun, chief economist for the National Association of Realtors (NAR), “Perhaps home prices are beginning to firm up or at least certainly any downward pressure is ending.”

Limited inventory is helping to keep prices up and the Colorado Springs Residential real estate market is a testament to that even while homes are slow to sell at the present time.

From what I’ve seen with my clients lately, their offers have been accepted close to the first shot at asking price and no bidding wars or offers over listing price.

This is great news for potential buyers. No more buying a home without ever seeing it or without an inspection. Those days are gone, at least for the present time.

Yes, interest rates are still considerably higher than they were, but with home prices continuing to rise, today’s buyers will be able to refinance when rates go down over the next few years.

It can be a bit complicated, but that’s not a problem for you, because you have me. My long-time experience in the local market, coupled with my Investment Banking background, makes me an asset to you when you are looking to buy or sell, even in this unusual market.

If you’ve even been thinking about a move, please give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let’s get together and see how together we can make your Residential real estate dreams come true.

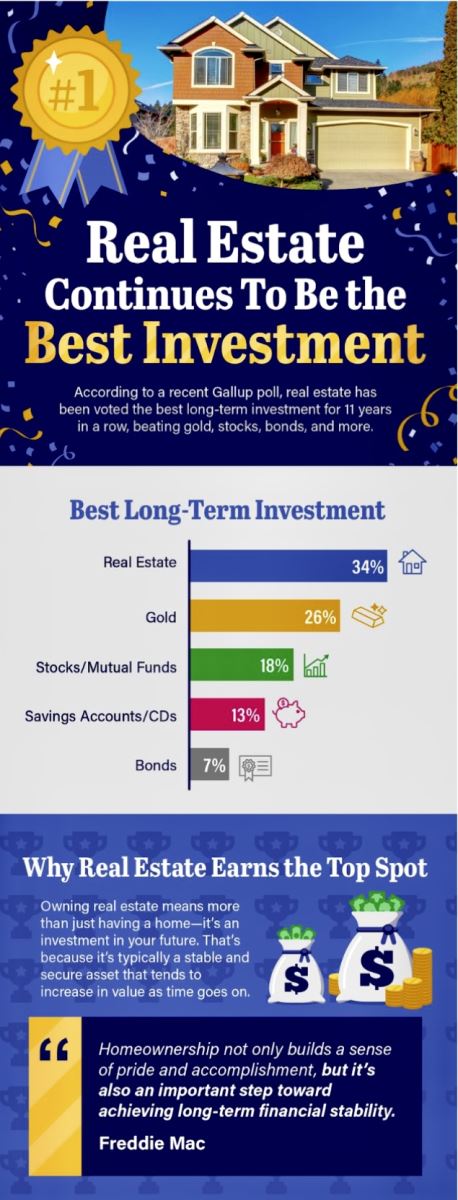

real estate CONTINUES TO BE THE BEST INVESTMENT

Keeping Current Matters, 7.21.23

Some Highlights:

- According to a recent Gallup poll, real estate has been voted the best long-term investment for 11 years in a row, beating gold, stocks, bonds and more.

- Owning real estate means more than just having a home—it’s an investment in your future. That’s because it’s typically a stable and secure asset that tends to increase in value as time goes on.

HOUSING’S RECESSION ALREADY HAPPENED

The Wall Street Journal, 7.21.23

While a lot of folks are waiting for the U.S. to fall into a recession, for the housing market the recession could be in the rearview mirror.

Builders are sounding a lot less downbeat than a year ago. The National Association of Homebuilders last week reported that its index of industry sentiment rose to 56 in July from 55 a month earlier—not a great reading, but considerably up from the low of 31 recorded in December and the highest level since last June.

On the basis of that, the Federal Reserve Bank of Atlanta’s gross-domestic-product tracking model estimates that residential investment nationally grew at a 0.1% annual rate in the second quarter from the first. That would be the first gain since the first quarter of 2021.

In addition, increases in the number of new building permits suggests growth in residential investment in the third quarter will be positive.

The rebound in housing is somewhat surprising in the context of mortgage rates that are still high, yet the largest stumbling block appears to be related to supply rather than affordability.

A press release from Harvard Joint Center for Housing Study stated that “housing costs remain well above pre-pandemic levels thanks to substantial increases over the last few years.” It was noted that “although home prices grew 1% compared to 21% in 2022, they are still nearly 40% over pre-pandemic prices.”

The upshot is that housing is probably providing a modest boost to GDP growth, and it looks as if it will continue to do so in the quarter ahead. That, in itself, is a strike against the possibility of the U.S. entering into a downturn since housing recoveries usually don’t start until the recessions are over.

The only thing that could go wrong is higher mortgage rates, but the Federal Reserve would have to signal that they intend to keep raising rates through this year and into the next—something that investors, who are betting on just one last rate increase, don’t think will happen.

If they are right, housing probably won’t be sliding back into a recession anytime soon.

So…you know exactly what I’m going to tell you…NOW is the time to start thinking about your Residential real estate wants and needs. Once the market starts back in full force you want to be ready to pounce.

You know who to call. Do it today!

SAVE THE DATE FOR THE 27TH ANNUAL UCCS ECONOMIC FORUM…

This is an always worthwhile event and registration is FREE. You can scan the above QR code for registration and more information.