HARRY'S BI-WEEKLY UPDATE 1.7.26

January 7, 2026

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

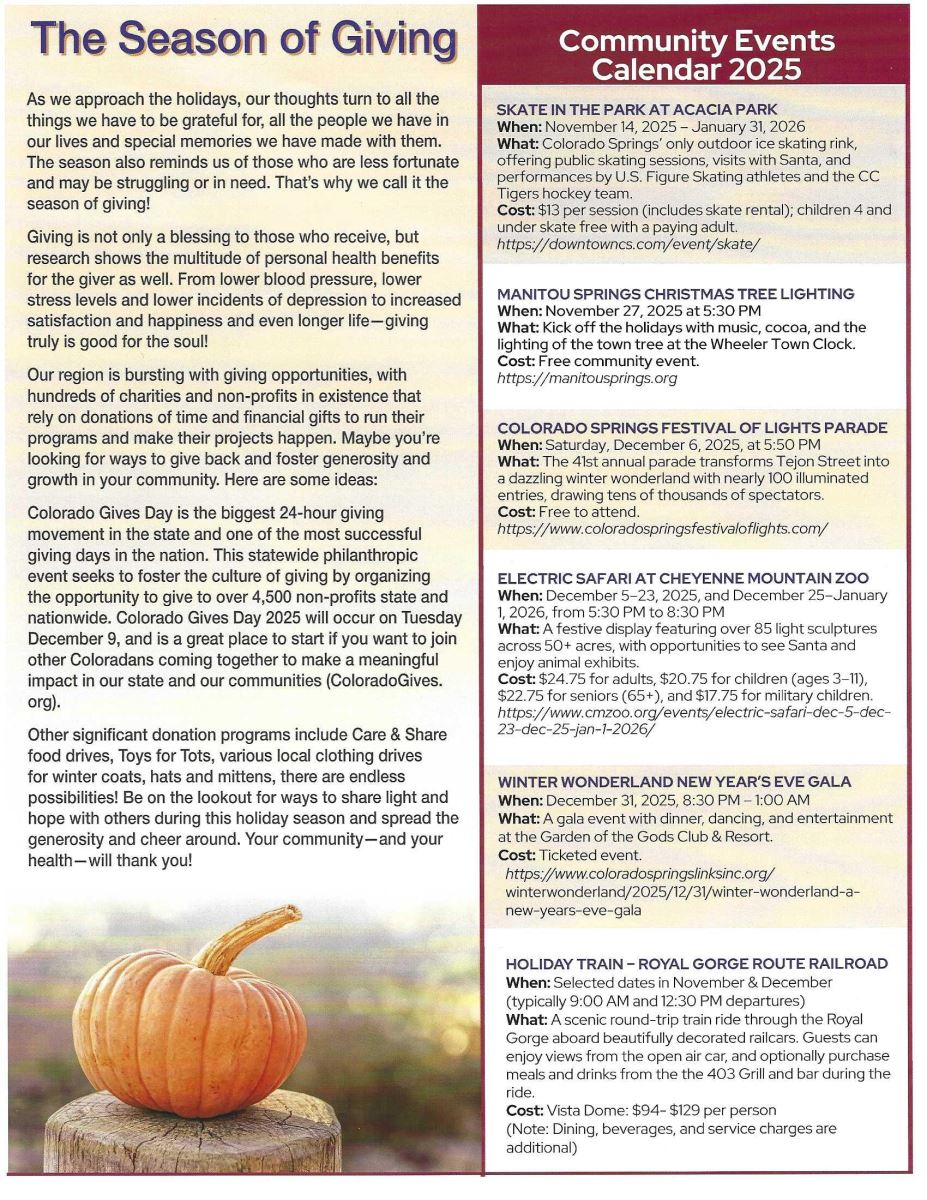

HAPPY NEW YEAR….AND WELCOME TO 2026

Let me begin by wishing you a happy, healthy, and prosperous year.

2025 was another year of trials and tribulations in the Residential real estate market, both nationally and here in Colorado Springs.

High interest rates and the lower number of existing homes for sale created the slowest market year in decades with home turnover hitting lows not seen since the early-to-mid 1990’s and even rivaling the early 1980’s by some measures.

The pace of sales and number of transactions were exceptionally low making it one of the quietest periods in the housing market in nearly 30-40 years, with some reports indicating the fewest sales since 1995. July 2025 saw homes nationally taking an average of 43 days to sell, the longest July period since 2015. Locally, our turnaround was a few days less, but still much longer than in the recent past. And that was during the normally busy buying and selling season.

However, on the bright side, U.S. pending home sales rose for the third straight month and hit a 3-year high in November. And as you will see from the statistics below, our listings and sales are on the rise as well.

And… as a holiday surprise in the last week of 2025, the average long-term mortgage rate fell to 6.18%, the lowest level of 2025 and hopefully a sign of even lower rates in 2026.

According to Lawrence Yun, chief economist for the National Association of Realtors (NAR), “Improving housing affordability—driven by lower mortgage rates and wage growth rising faster than home prices—is helping buyers test the market”.

We are seeing more listings for this time of year than in the recent past and I believe it’s due to a more optimistic outlook that seems to be permeating the housing market. Folks are realizing that interest rates are not going back to the historic lows of 4 or 5 years ago and home prices are continuing to rise.

I always start my new year by predicting how I personally see the Residential real estate market affecting not only the Colorado Springs area, but also how it will affect my clients in general.

My predictions for 2025 were pretty much “right on” but without a crystal ball a bit of that was a good, well thought out “guesstimate”!

For 2026 my predictions include the expectation that things will continue to be slow in terms of time. It will take a bit longer to sell, and pricing adjustments might be necessary, but home values will still rise by 2% to 3%. Nothing is “black and white” anymore and anything is negotiable, even interest rates.

I also believe:

- Demand for existing homes will be strong due to the low number of existing homes for sale.

- Interest rates on 30-year fixed-rate conventional mortgages will drop down to the 5.75-%--6.0% range by the end of 2026, which is great news since rates were as high as 7.0% in 2025.

- If homes are priced right, the probable number of days on the market will be around 60 days.

- Renters are going to continue to be looking to buy, if possible, due to higher rental rates.

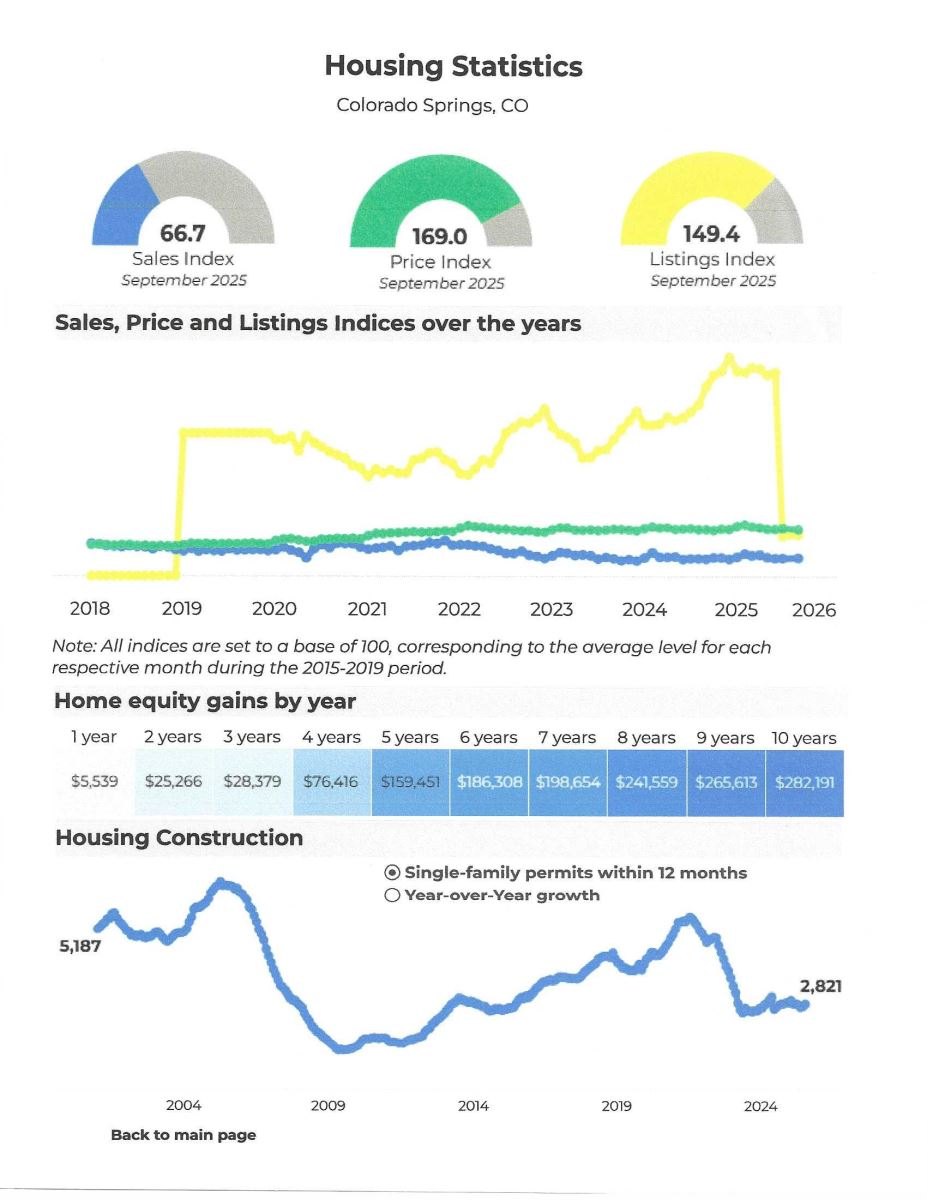

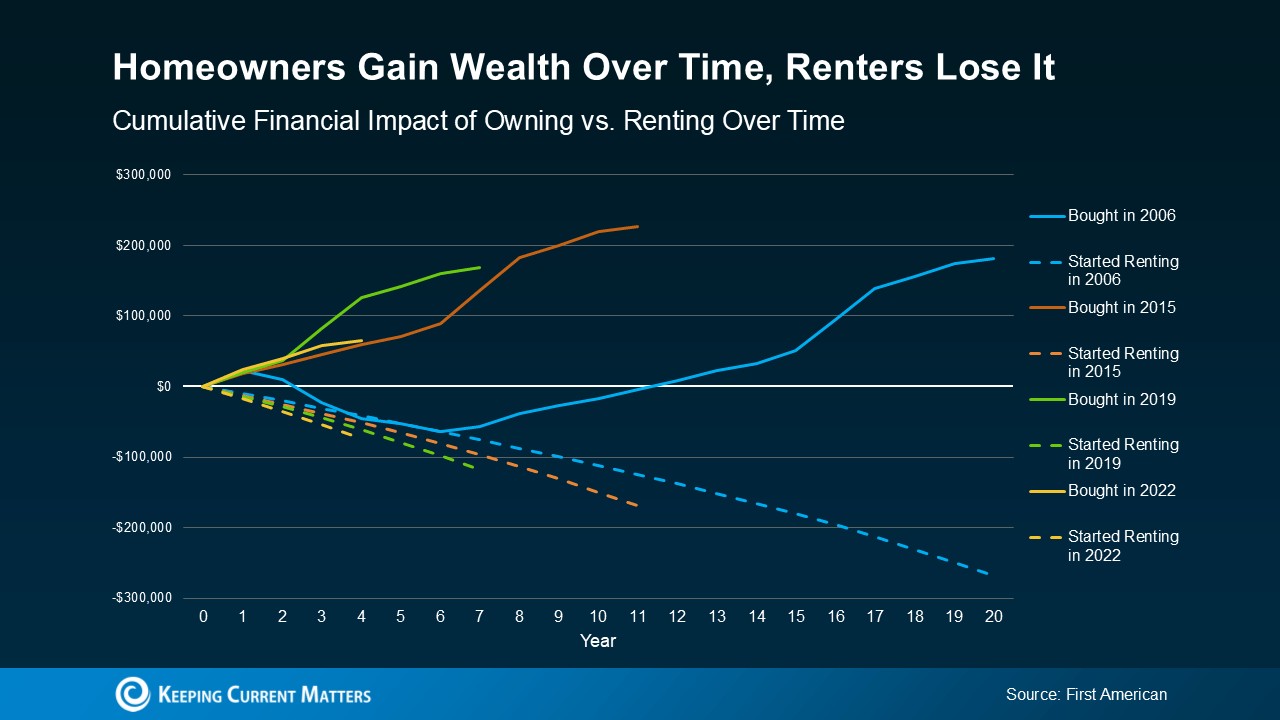

- Homes will continue to appreciate as they have in the past, although not as rapidly. As I’ve said time and again, you can’t only look at the last quarter or even the last couple of years. real estate is a long-term investment.

When you look at the value of home ownership compared to other investments, it’s still going to be extremely positive. And even in a slow market as we’ve recently seen, our home values keep appreciating…although at a more “normalized” rate.

- For most, your home will likely continue to be your largest and fastest growing investment.

I have always said that no one can expect to buy at the lowest price point, nor sell at the highest. It just isn’t possible and most anyone who thinks they can will likely lose in the long run.

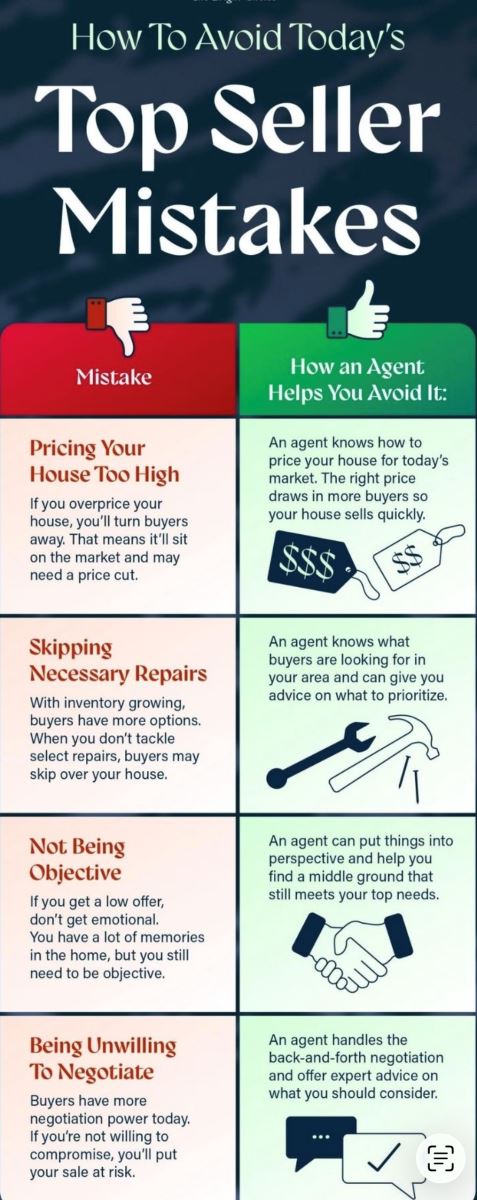

Yes, prices are holding steady and those who are waiting for them to drop before they buy will likely not see this happen. This is also reflected in the statistics below. You can see that homes are selling at close to listing price and home values are not depreciating. In fact, they continue to appreciate, although at a much slower rate than that of 4-5 years ago. And, like nationally, condo sales here are not moving nearly as fast as single family home sales.

And, while it may be more difficult today, it’s still possible for you to find what you need, want, and can afford in a home.

With new companies relocating to the Springs or others expanding their current business plans, we are seeing an influx of folks moving here for jobs and they are needing places to live. This is putting even more pressure on folks wanting to buy—either to sell and trade up, purchase a first home or even for investment purposes.

Since sales have been picking up recently, during what is traditionally the slowest time of the year, it appears that folks are starting to buy and sell much earlier than normal. They aren’t waiting for the “traditional” spring buying and selling season.

If you are looking to sell and trade up or move to a new neighborhood, your present home possibly has more equity than you might think which could help keep your new payments lower by providing a larger down payment.

Don’t forget—your income tax expense will be reduced by the interest expense if you have a mortgage payment. And even if you have no mortgage, you can deduct your property taxes and other home expenses—something renters cannot do.

It’s important to note that with rising competition, folks starting to buy and sell earlier than normal, and still so few existing homes for sale, if you are in the market you need to be prepared to know exactly what you want, need, and can afford PRIOR to beginning the search.

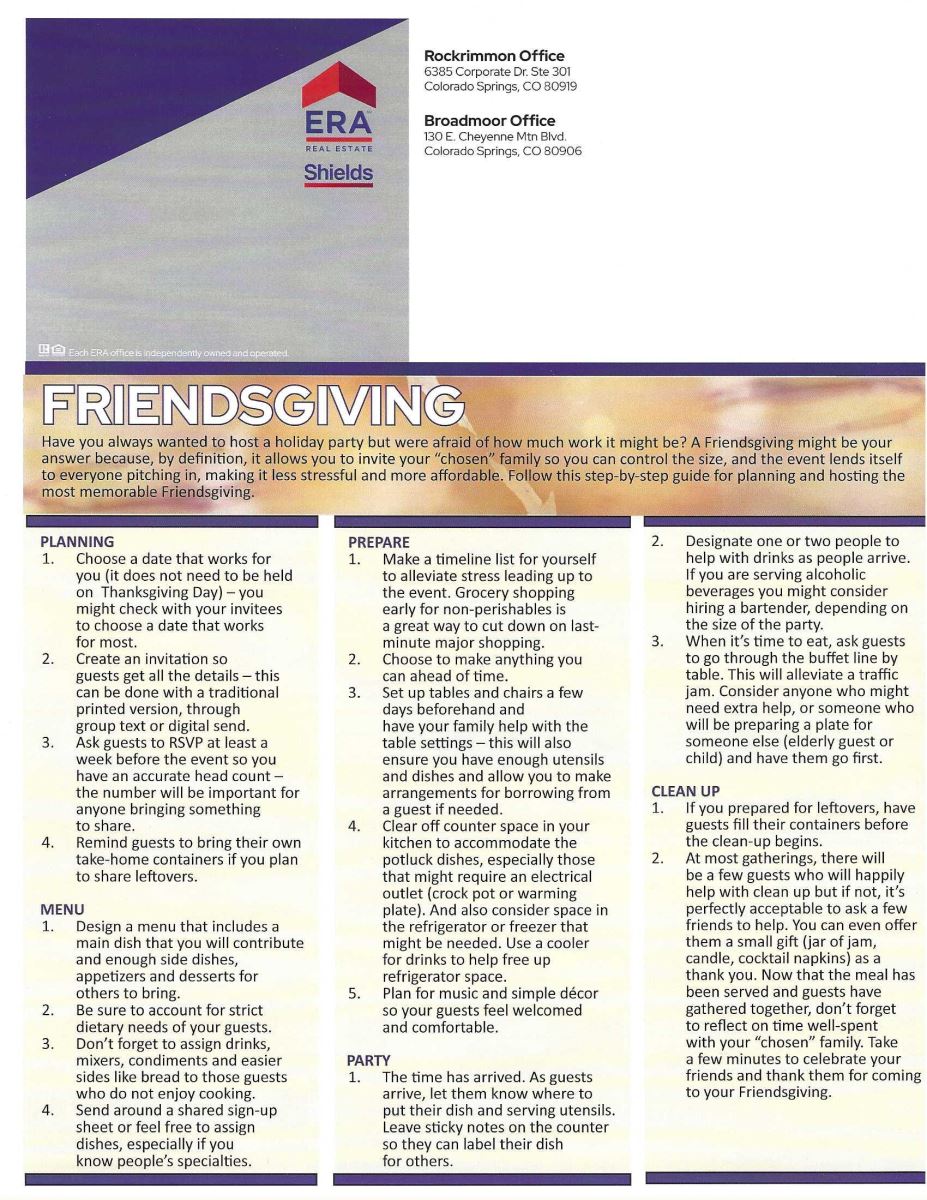

That’s where I come into the picture. The current market is not for the timid or inexperienced. It takes a lot of advanced planning and knowledge of how to navigate these waters.

My almost 54 years in the local residential real estate arena, coupled with my investment banking background, give me an edge that my clients have found to be crucial in helping them and their families realize their personal real estate visions.

A new year brings with it a lot of new hopes and dreams. If Residential real estate is among your hopes and dreams for 2026, please give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let me help make them come true.

The earlier you begin the process, the earlier you will be realizing those dreams for you and your family.

And…if you’ve got two minutes and 24 seconds, I recommend that you take a look at my newest “crystal ball prediction” podcast . Simply click on the link below and you will be directed to my personal YouTube channel.

To watch, click here:

While you’re at it you might want to subscribe to my channel, so you won’t miss future broadcasts. It won’t cost you anything. Well, it could cost you… if you miss some of my informative musings!

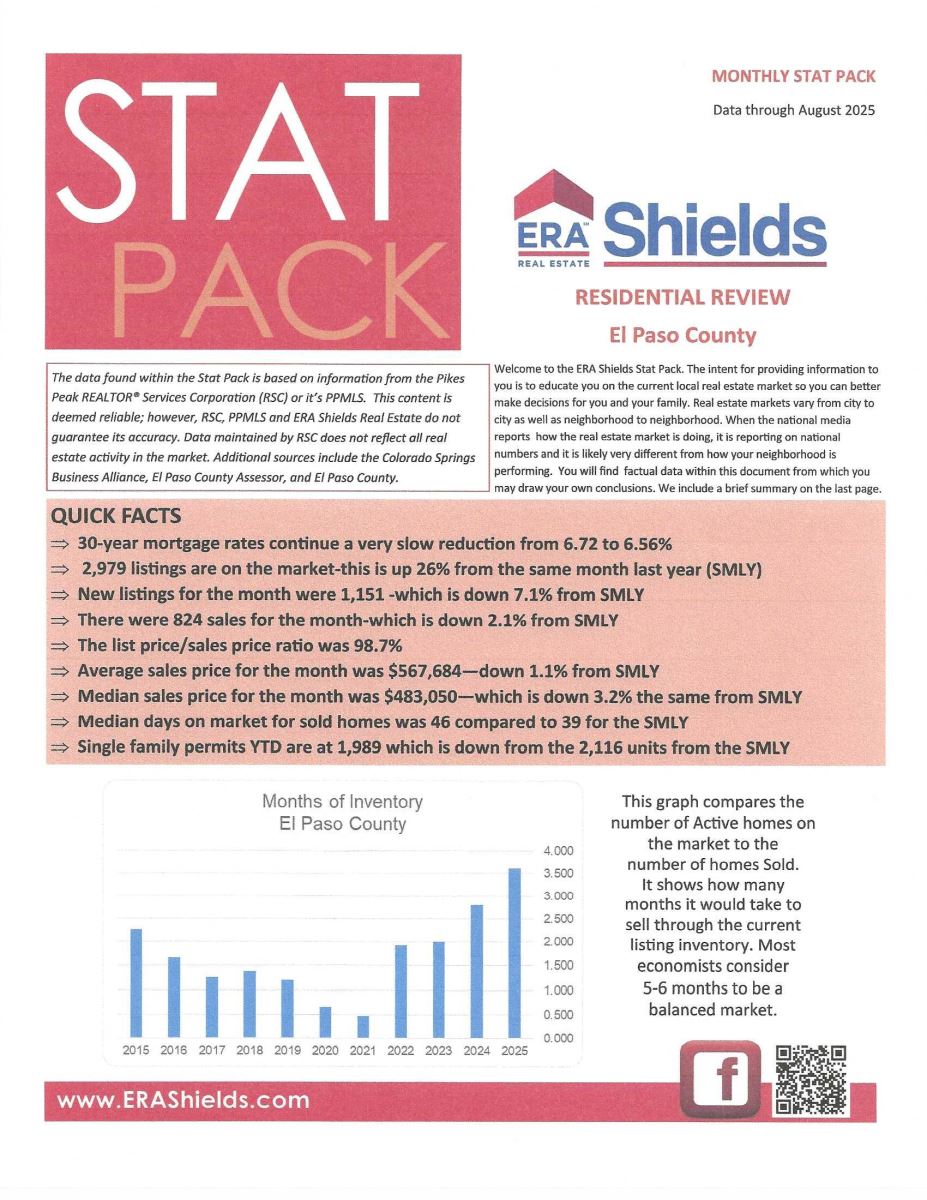

And now for statistics…

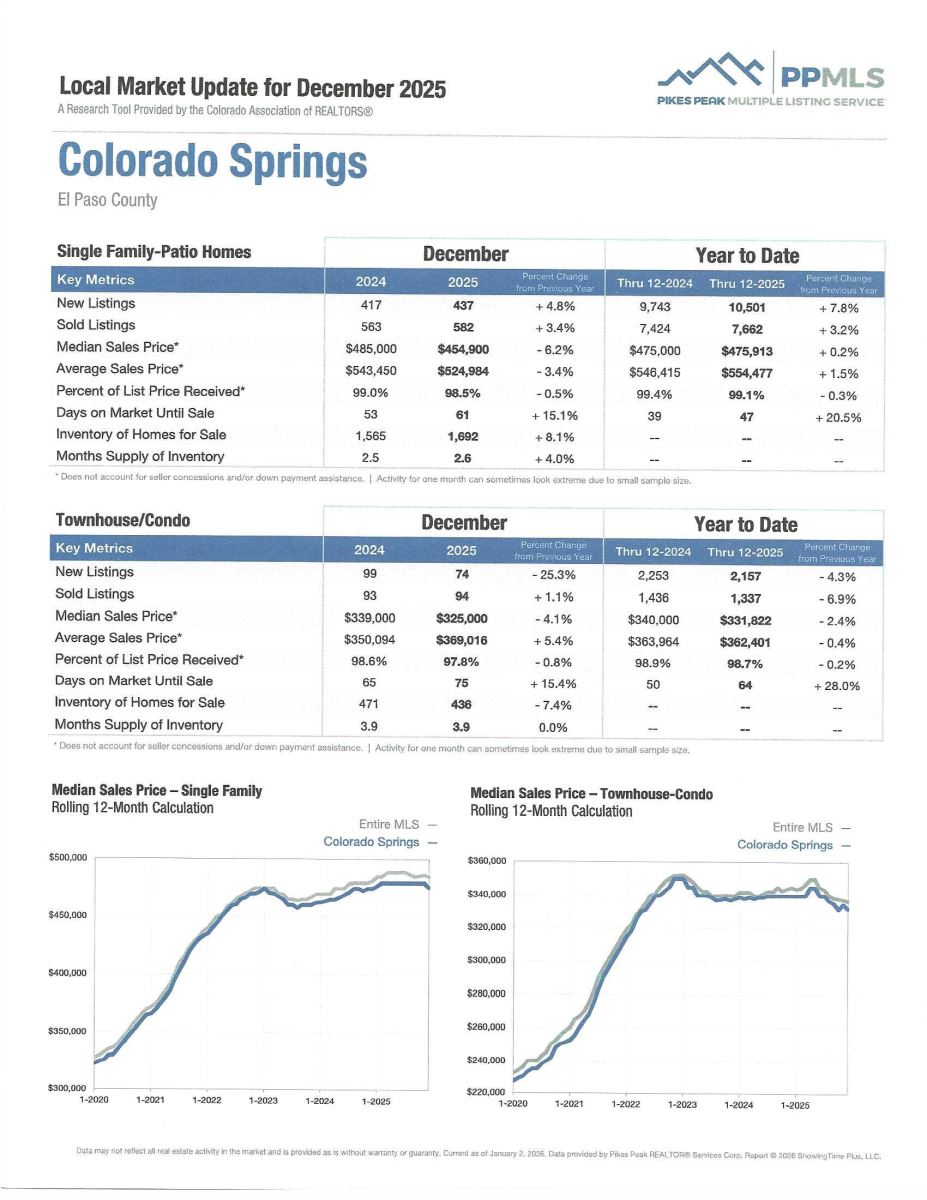

DECEMBER 2025

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

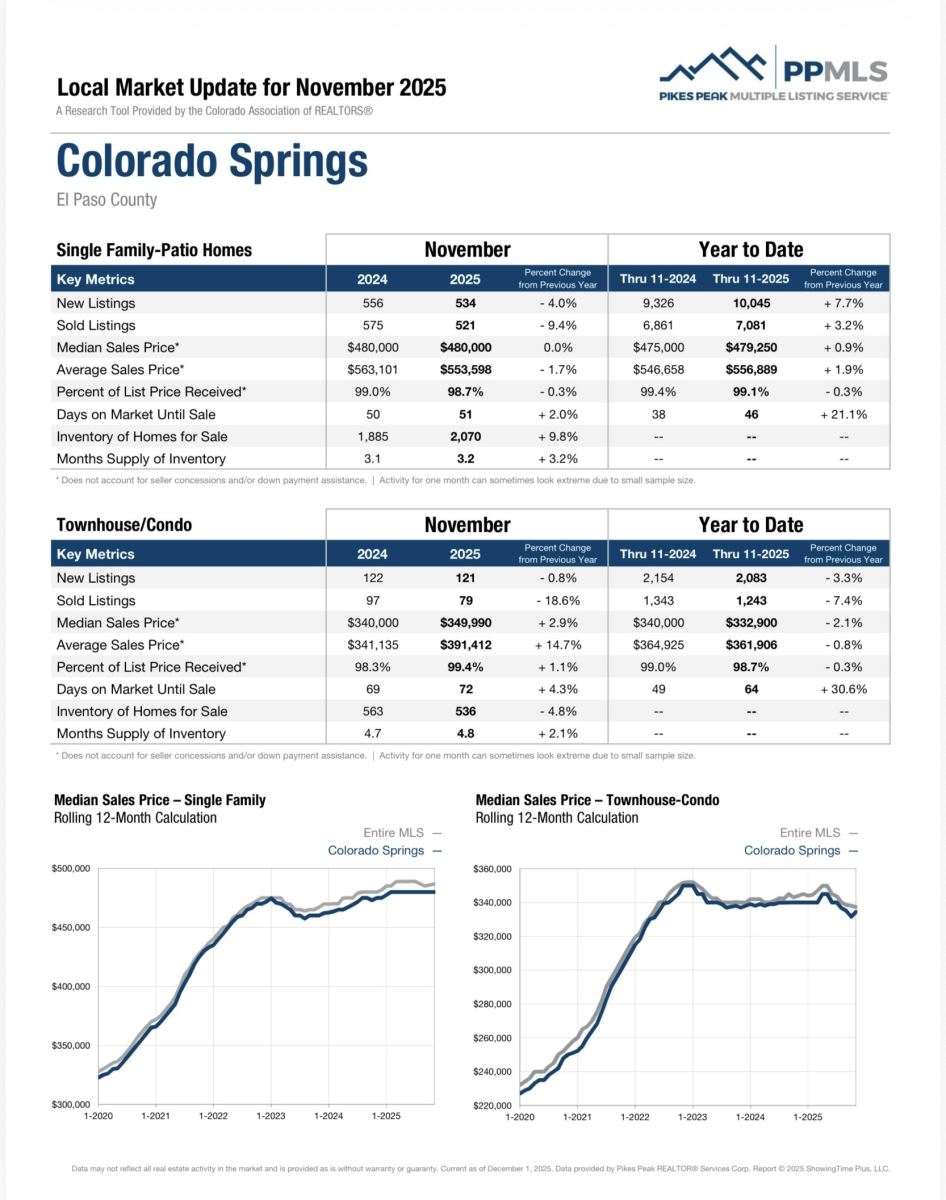

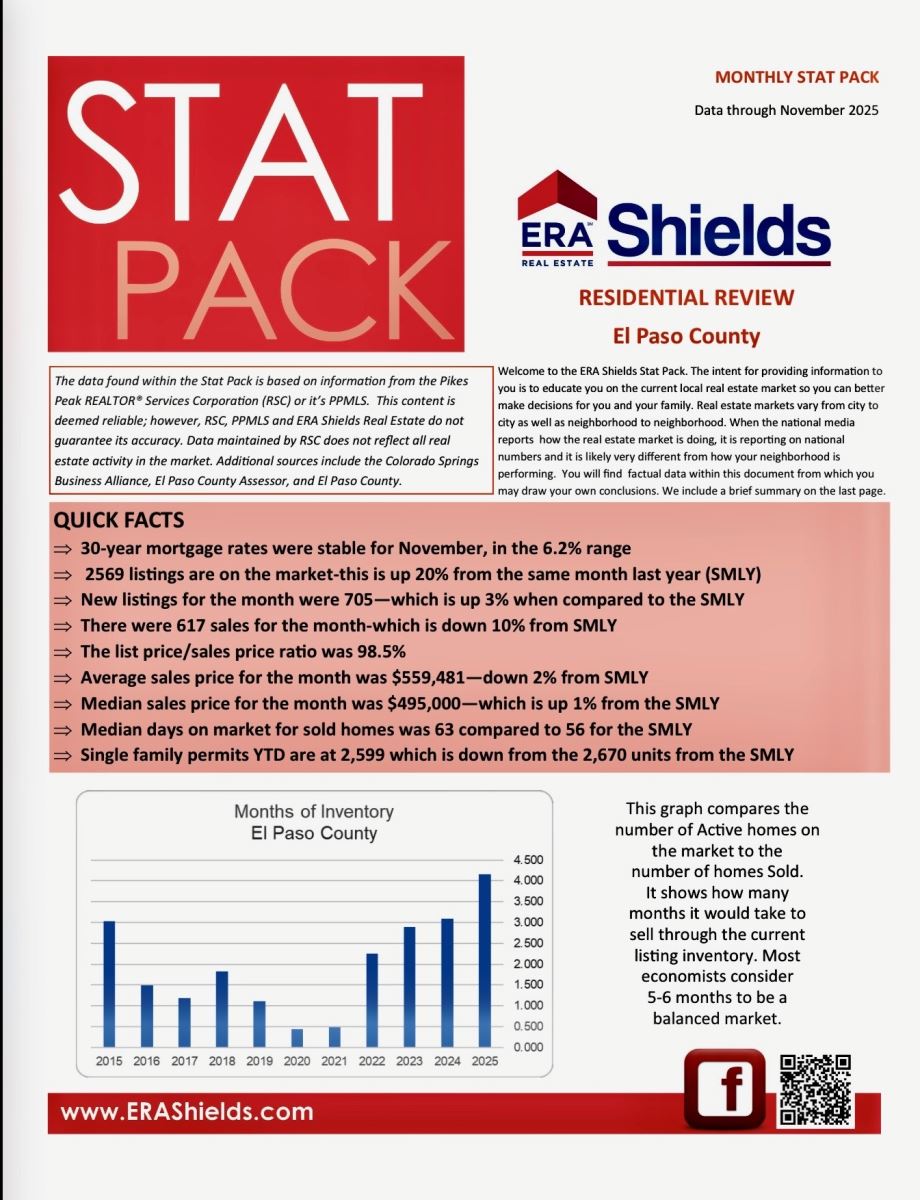

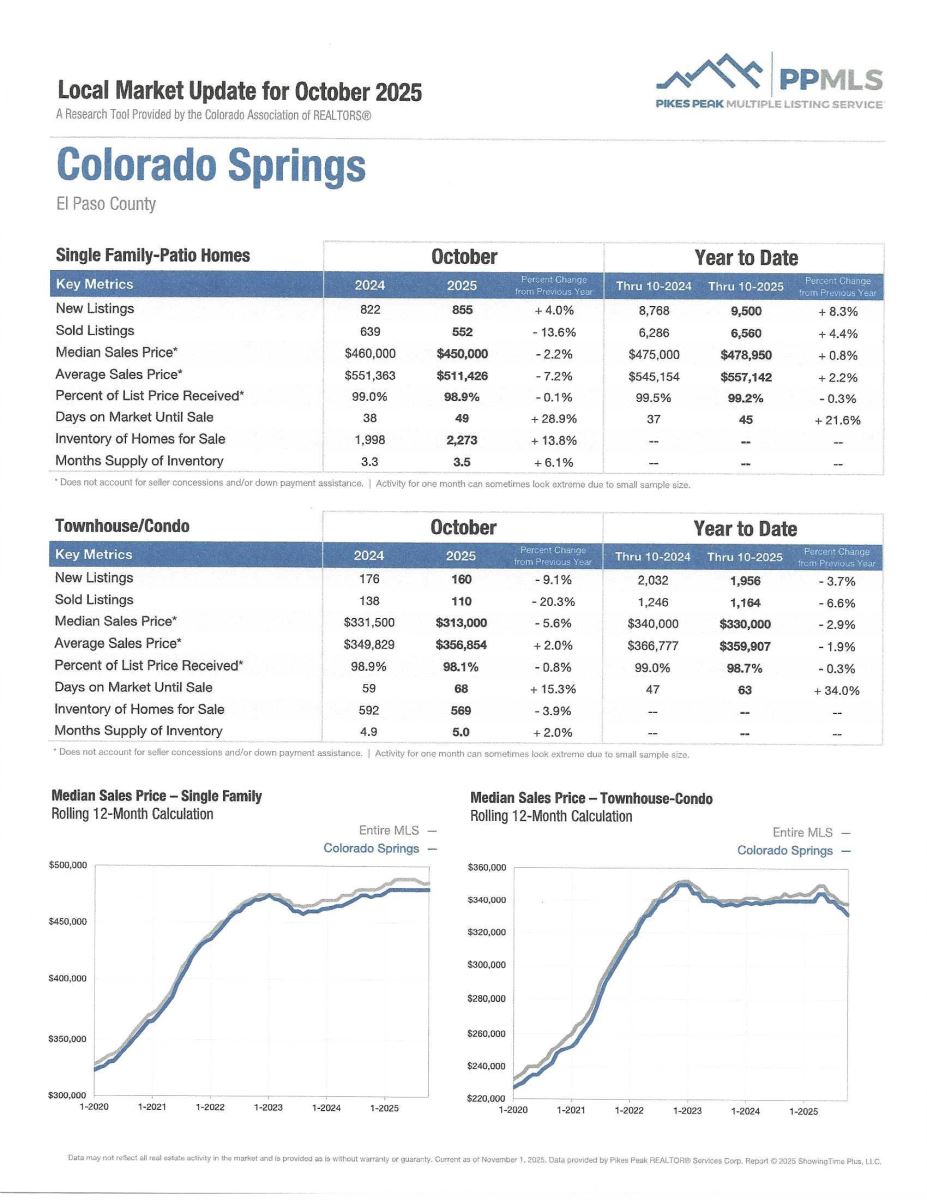

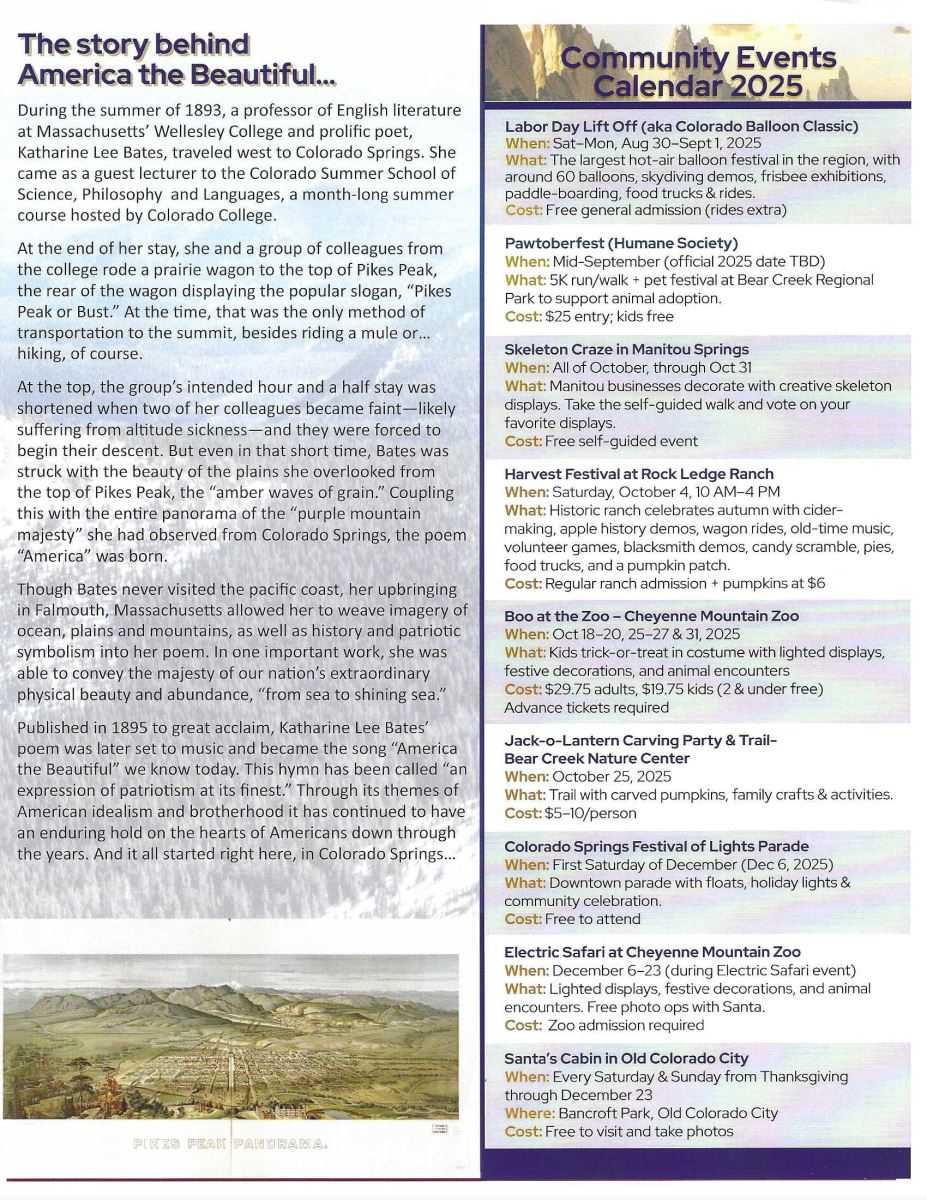

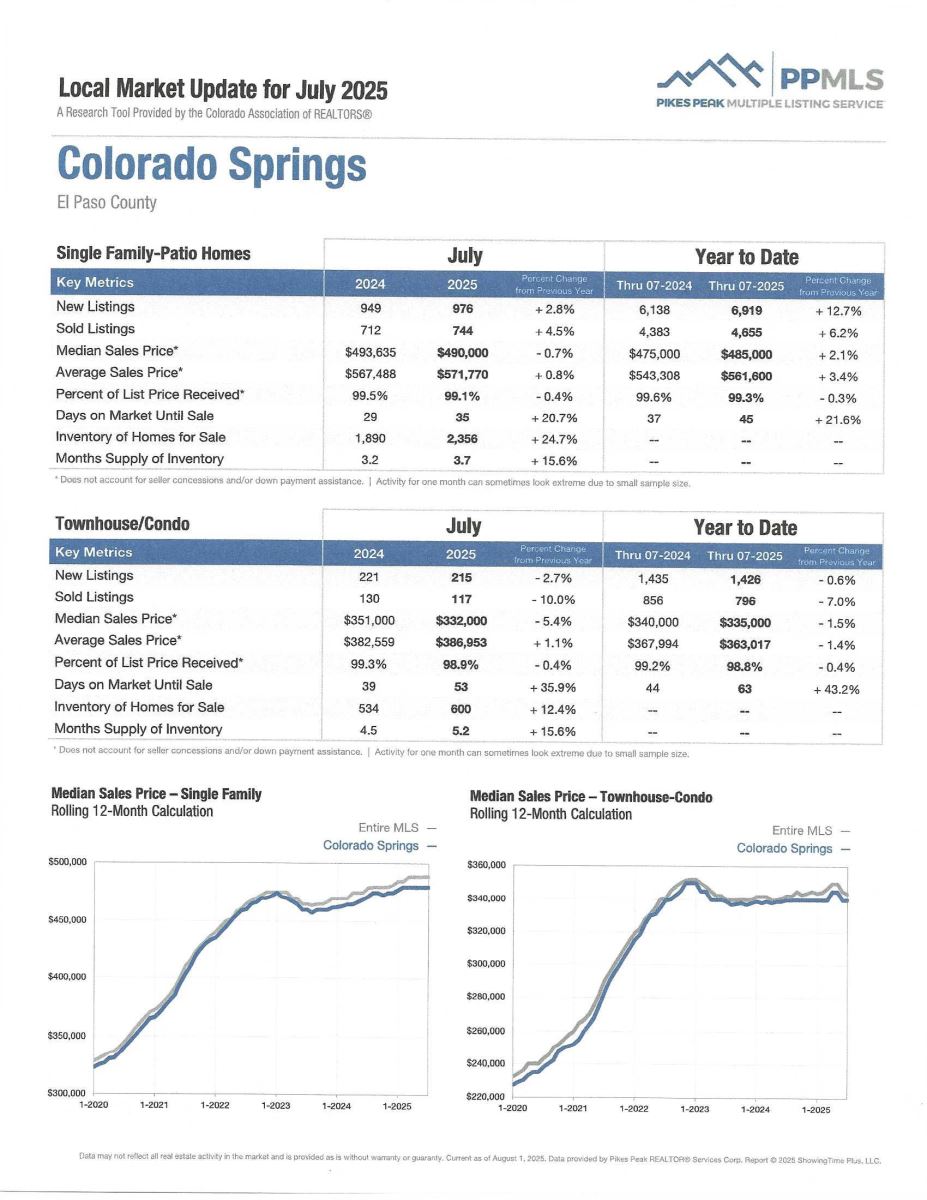

Here are some highlights from the December 2025 PPAR report.

In El Paso County, the average days on the market for single family/patio homes was 61. For condo/townhomes it was 116.

Also in El Paso County, the sales price/list price for single family/patio homes was 98.5% and for condo/townhomes it was 102.1%.

In Teller County, the average days on the market for single family/patio homes was 96 and the sales/list price was 97.0%.

Since these are year-end statistics, I am providing you with both the regularly posted year-over-year monthly stats as well as the cumulative year-to-date comparison of 2025 to 2024.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing December 2025 to December 2024 for All Homes in PPAR:

Single Family/Patio Homes:

- New Listings were 739, Up 4.5%

- Number of Sales were 909, Up 3.6%

- Average Sales Price was $531,469, Down 2.7%

- Median Sales Price was $460,000, Down 5.2%

- Total Active Listings are 2,837 Up 13.3%

- Months’ Supply is 3.1

Condo/Townhomes:

- New Listings were 91, Down 21.6%

- Number of Sales were 107, Down 3.6%

- Average Sales Price was $366,835, Up 4.4%

- Median Sales Price was $330,000, Down 2.9%

- Total Active Listings are 501, Down 0.2%

- Months’ Supply is 4.7

The Cumulative YTD Summary: (comparing Jan-Dec 2025 to Jan-Dec 2024)

Single Family/Patio Homes:

- New Listings were 17,358, Up 7.3%

- Sales were 11,788, Up 2.5%

- Average Sales Price was $559,340, Up 1.8%

- Volume was $6,593,499,920, Up 4.3%

Condo/Townhomes:

- New Listings were 2,577, Down 3.1%

- Sales were 1,572, Down 7.3%

- Average Sales Price was $363,437, Down 1.4%

- Volume was $571,322,964, Down 8.5%

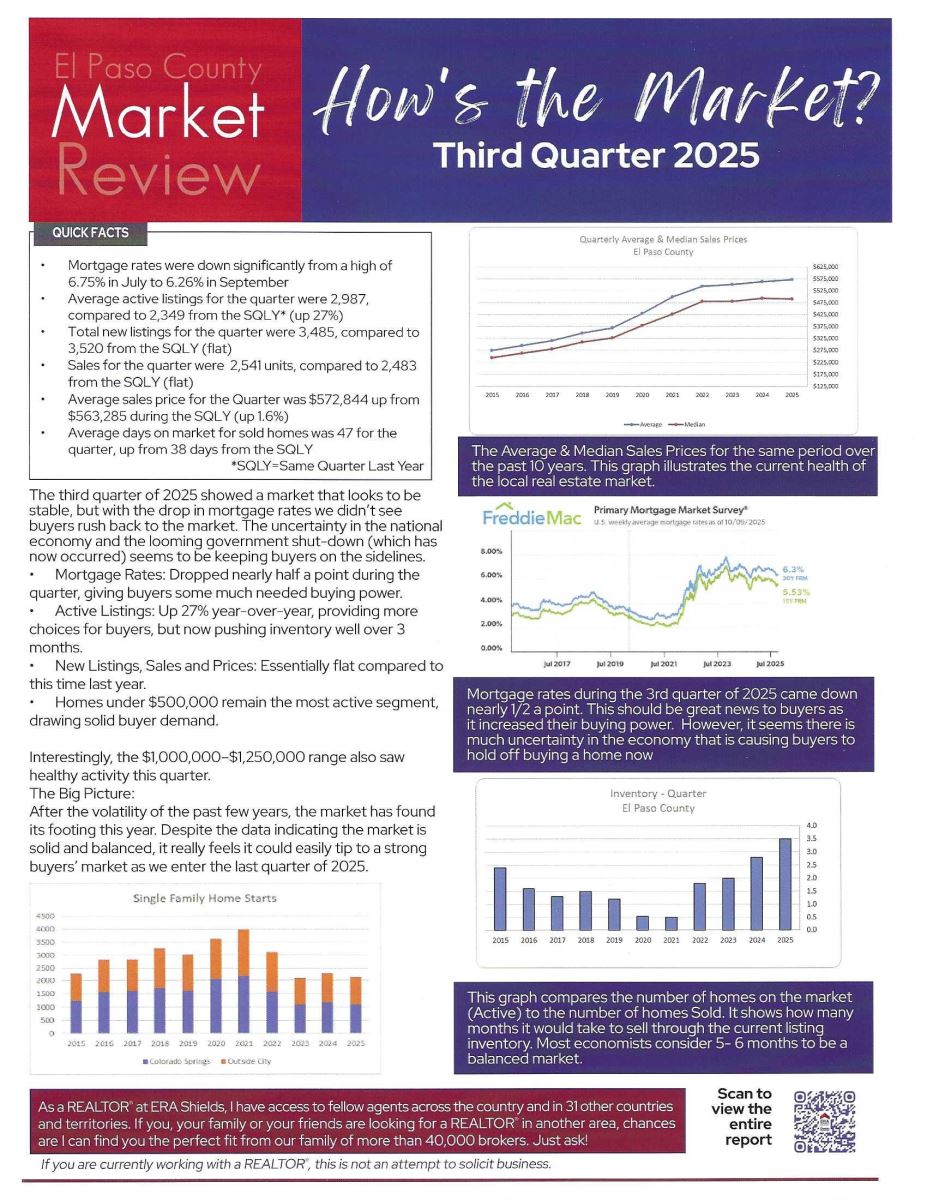

Now a look at more statistics…

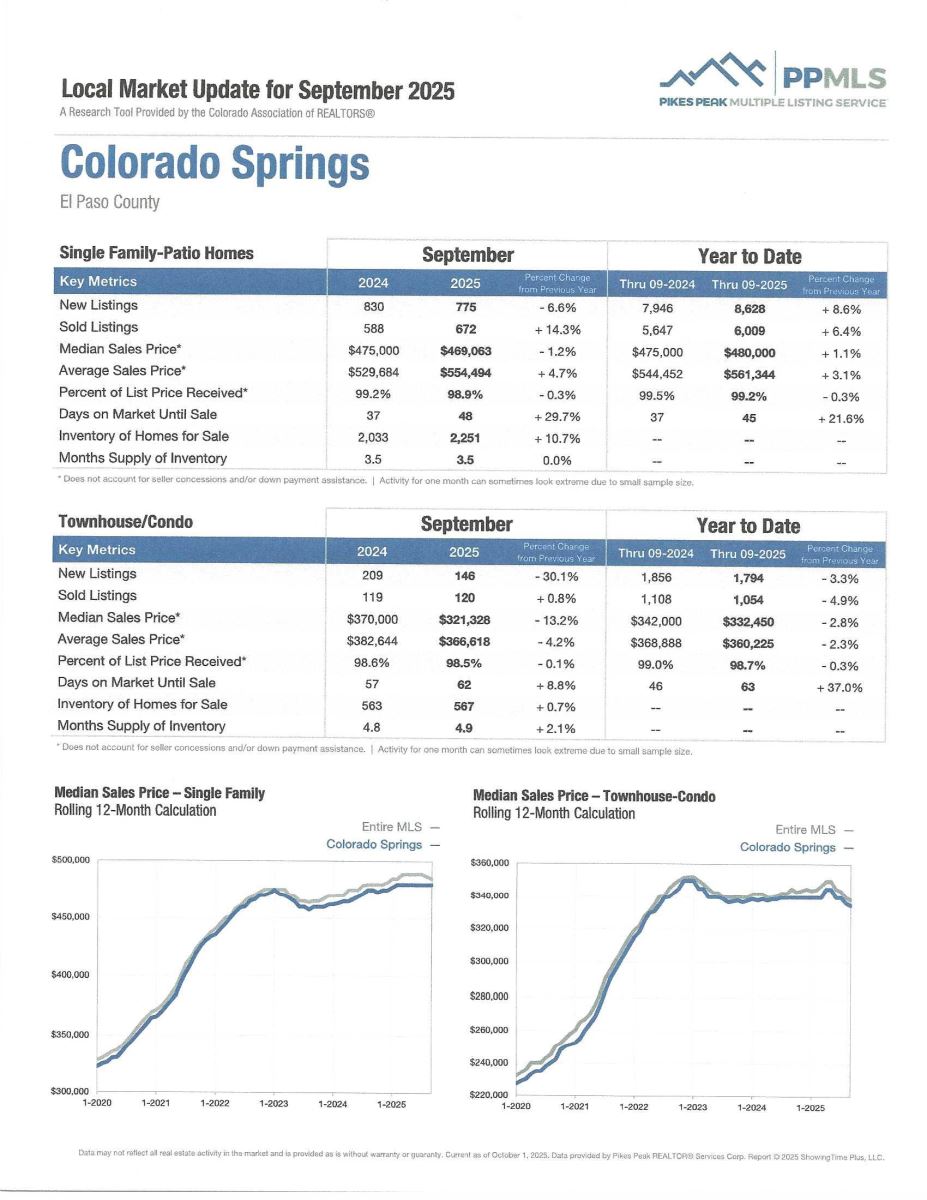

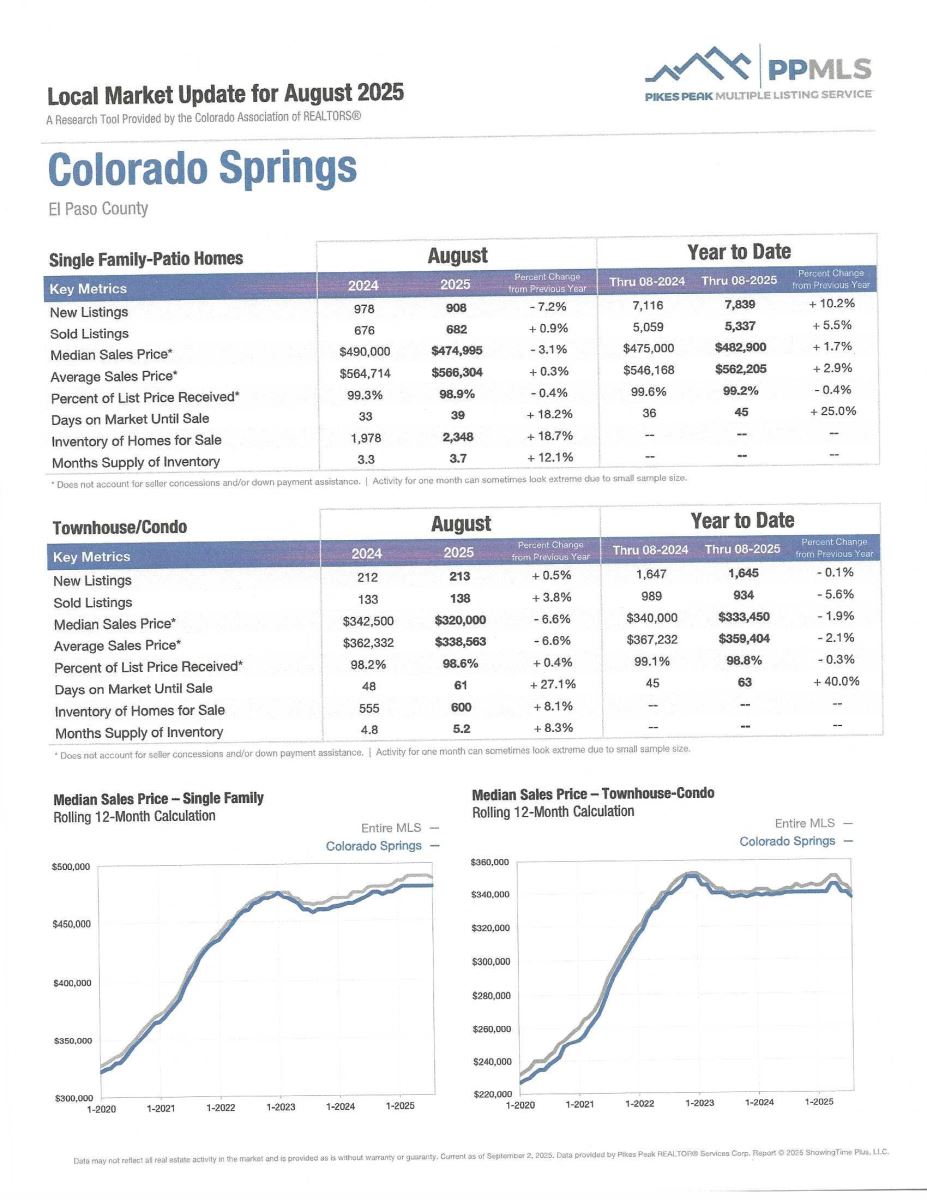

DECEMBER 2025 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year to Date one-year change:

- Sold Listings for All Properties were Up 2.2%

- Median Sales Price for All Properties was Down 5.2%

- Active Listings on All Properties were Up 6.4%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

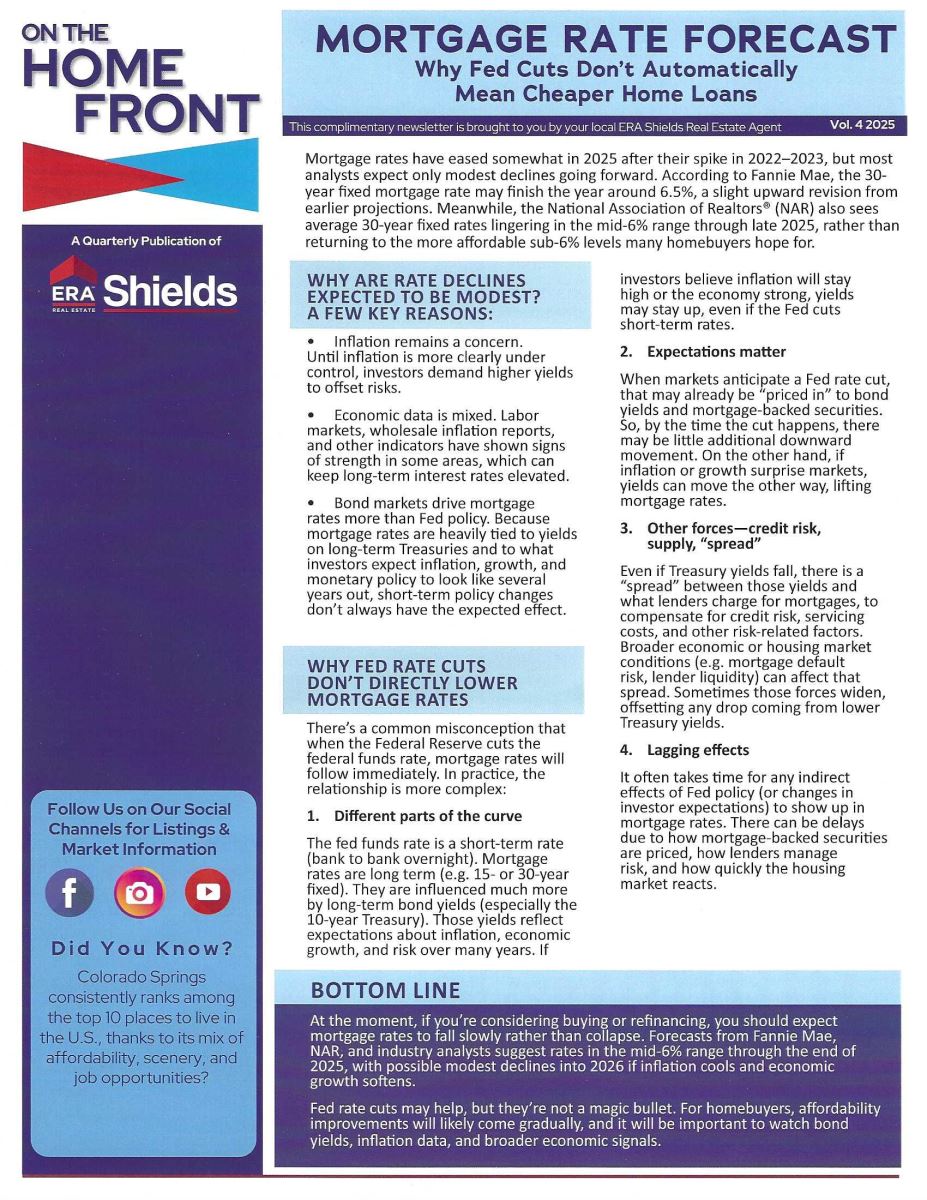

NAR FORECAST

National Association of Realtors, 12.10.25 & 1.5.26

Top economists have one word to sum up the housing market for 2026: OPPORTUNITY.

Lower mortgage rates and a rising supply of existing homes for sale are expected to open up the housing market in the new year—something the residential real estate industry and potential home buyers and sellers have been waiting for following three years of stagnation.

NAR is forecasting a double digit---14% increase---in existing homes for sale in 2026.

According to Lawrence Yun, NAR chief economist, “In 2026 we expect higher inventory, modest improvements in affordability and more accommodating monetary policy from the Federal Reserve will help more Americans buy their next home.”

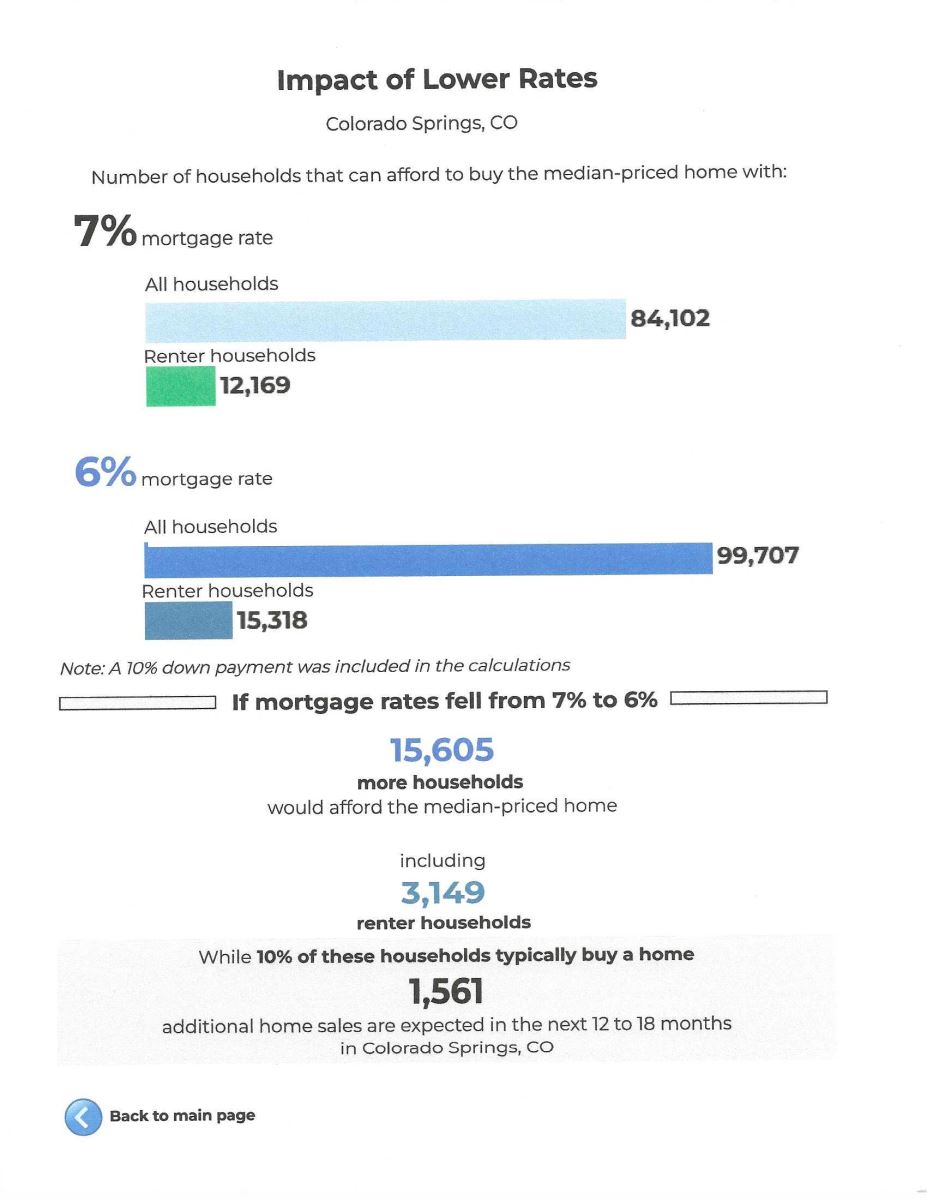

If mortgage rates drop to 6%--as NAR projects for 2026—it would mark a full percentage point drop from the roughly 7% average at the start of 2025. That shift could unlock an estimated 5.5 additional qualified home buyers nationwide, including about 1.6 million renters, who could finally make the leap into homeownership.

As the housing market enters 2026, leading economists point to a range of forces likely to shape the year ahead for buyers and sellers and while notable headwinds persist, they all agree on one thing—the housing market is showing signs of a rebalance—and a rebound—in 2026.

A Reawakening in Home Sales

Equity remains, but home prices moderate: Home price growth will be minimal—roughly 2% to 3%--about the same as overall consumer price inflation. Generally, wage growth will be above that so it’s a year where people’s income begins to rise a little faster than consumer price inflation and home prices—and this is a welcoming development.

It’s important to note that home prices are in no danger of any major decline, and even a 3% gain will bring smiles to many homeowners.

There will be less pressure on buyers as inventory levels are about 20% above one year ago, so there are more choices for them. We are not back to pre-Covid inventory yet, which would be considered “normal” so we are still in a housing shortage condition. However, buyers do not have to rush to make decisions the way they did before as there are more choices out there and less prevalence of multiple offers.

The American Dream is still alive: The desire for homeownership has not fallen. Many renters say that if the conditions are right they would like to become homeowners. The past couple of years have been frustrating because of elevated mortgage rates, but things will be much better to achieve that American Dream of homeownership in 2026—with more inventory choices and mortgage rates falling.

New homes vs. resale pricing—an unexpected dynamic: The median resale home price right now is actually more expensive than the median price of a newly built home. That’s only happened two or three times over the last few decades. The combination of builder incentives, including price cuts and the geography of where new construction is occurring has produced this odd situation where the typical resale home is more expensive than a newly built home.

And as an aside, if a newly constructed home is in your future, I can help you with that as well—at no additional cost to you.

Housing Affordability Improves

According to Danielle Hale, realtor.com chief economist: “The biggest trend that we’re most excited to see is an improvement in affordability. That’s going to be good news for buyers and a contributor to the fact that home sales will finally start to go up and get away from this 4 million home sales floor that we’ve been very stuck on over the last couple of years. Improving affordability is a really important component of that increase in home sales for 2026.”

Pricing sensitivity and balance: In recent data, we’ve noticed that the share of sellers pulling their homes off the market is higher than normal. Even then, it’s still only about 6% of listings, so it’s definitely not the norm. What it reflects is a more balanced housing market where not every seller is getting exactly what they want. Some are choosing to come down in price, and others are choosing to walk away and come back at a later date because they have the flexibility to wait.

Basically, buyers have a little more leeway, and sellers have to be more flexible, and that’s a big shift from the pandemic years when sellers had nearly all the leverage.

Monthly payments ease: According to most estimates this will be the first time we see monthly payments decline since 2020. Mortgage rates are expected to be lower, which helps offset the roughly 2% home price growth that we expect in 2026.

Demographic Trends Reshape the Market

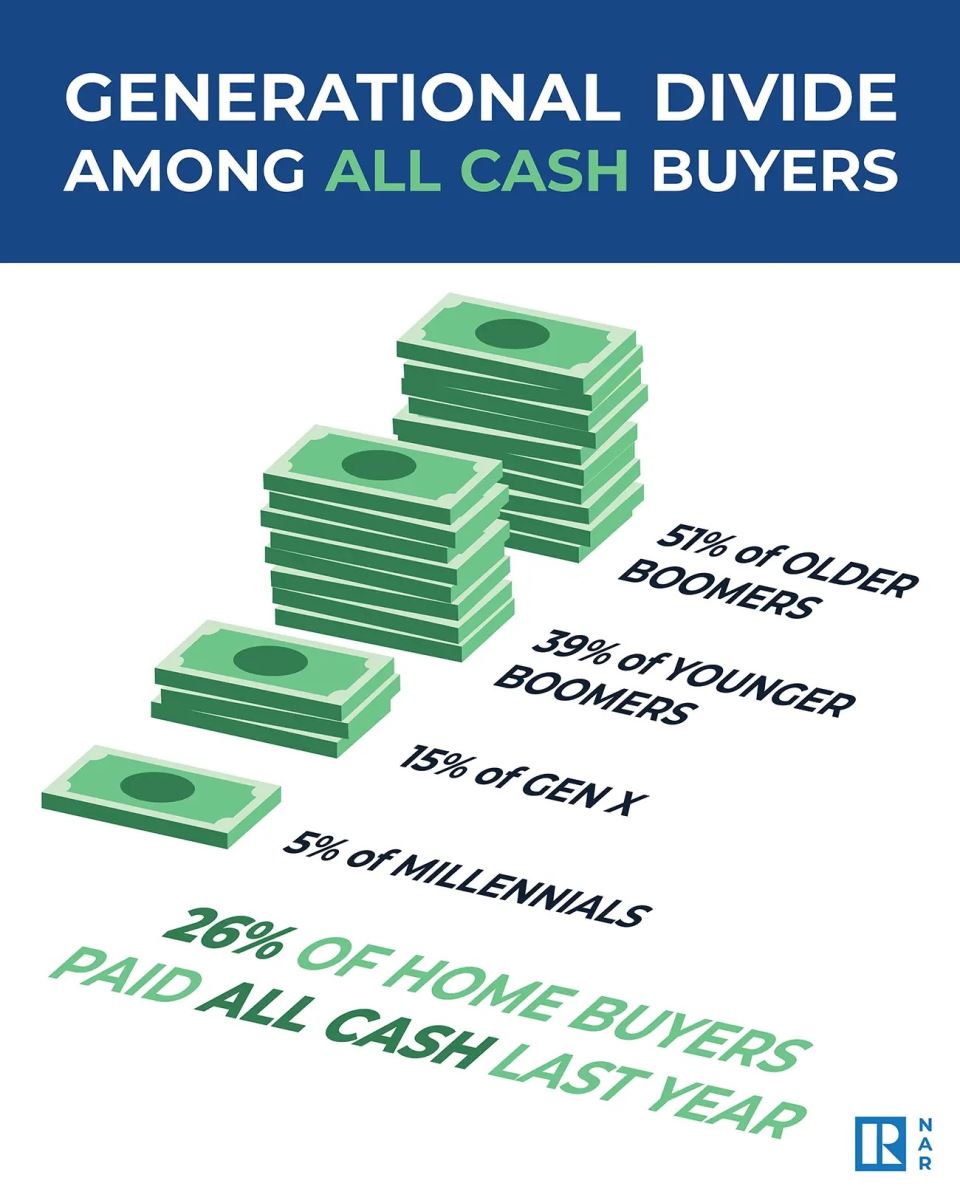

Jessica Lautz, NAR deputy chief economist said, “We’re watching the share of first-time home buyers and the share of all-cash buyers, because that push and pull has really dominated the market. Another trend I watch closely is the growing share of single female buyers: We’re seeing single women really growing as a force in the market and that reflects lower marriage rates and lower birth rates. There will continue to be people who buy homes, but it could be a different type of person than what we have seen historically. These demographic shifts are really shaping who is able to make moves in this housing market.”

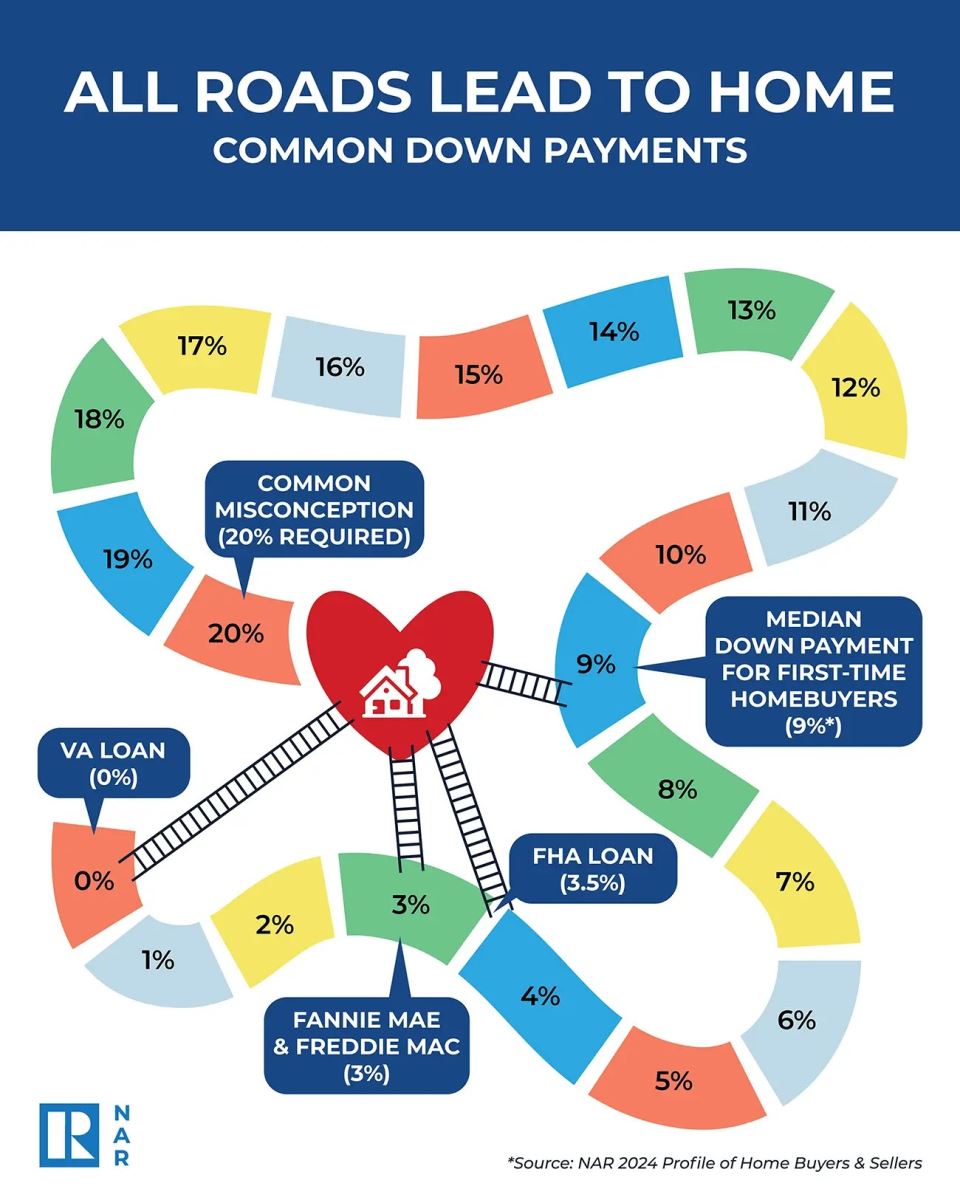

First-time buyers gradually re-emerge: With more inventory and slightly improved affordability conditions, that means an opportunity for first-time home buyers. Hopefully they can take advantage of these conditions because homeownership is a wealth-building tool.

Baby Boomers remain the dominant force: They have a ton of housing wealth and they’re able to make trades right now—move close to the grandkids and move where they want to be. They’re not making many concessions on their home choices. If we continue to see this large share of retirees, we could continue to see smaller households and different housing choices than what we’ve seen historically.

Just a quarter of buyers have kids. If you look at the demographics, we know that home size is shrinking and the number of people in the household is shrinking. With a larger share of retirees in the market, we’re seeing fewer buyers with young children.

All-cash Buyers aren’t going away: While mortgage applications have been trending up in the last couple of months, we are seeing more buyers enter the market who are not all-cash. That being said, it’s doubtful that all-cash buyers are going away anytime soon just because of all the wealth that is in this housing market and the ability of homeowners to make trades without a mortgage.

All Eyes on Mortgage Rates

NAR senior economist Nadia Evangelou said, “For the last few years we have been in one of the toughest affordability environments in modern housing history. Mortgage rates jumped from 3% in 2021 to above 7% in 2023, and that pushed the typical payment up by more than $1000 a month compared to pre-pandemic levels. But what happens if rates move down from 7% to 6%? We expect the buyer pool to increase significantly.”

Mortgage rates as a major unlock: As mentioned earlier, a one percentage point drop in mortgage interest rates nationally can expand the pool of households who can qualify to buy by about 5.5 million households, including about 1.6 million renters who could become first-time homeowners. Not all of these households will buy a home, but based on NAR’s analysis, about 10% typically do. That could translate to about 500,000 additional home sales in 2026—the main reason home sales are expected to increase this year.

More inventory needed to match incoming demand: Mortgage rates alone don’t make a stronger market. Inventory is another component that needs to cooperate. Inventory is rising—it’s higher than a year ago—but if more buyers come back, we’re going to need more homes available for sale.

Middle-income buyers still constrained: Even with progress in affordability, middle-income buyers can afford to buy just 21% of the homes currently available for sale. Before the pandemic they could afford about 50%. That a very dramatic difference and it shows why we need a target approach—homes that align with people’s income.

So, there you have it. The economists from NAR have spoken and I for one found this quite enlightening. Lots of good information here for both buyers and sellers.

Any questions? You know who to call.

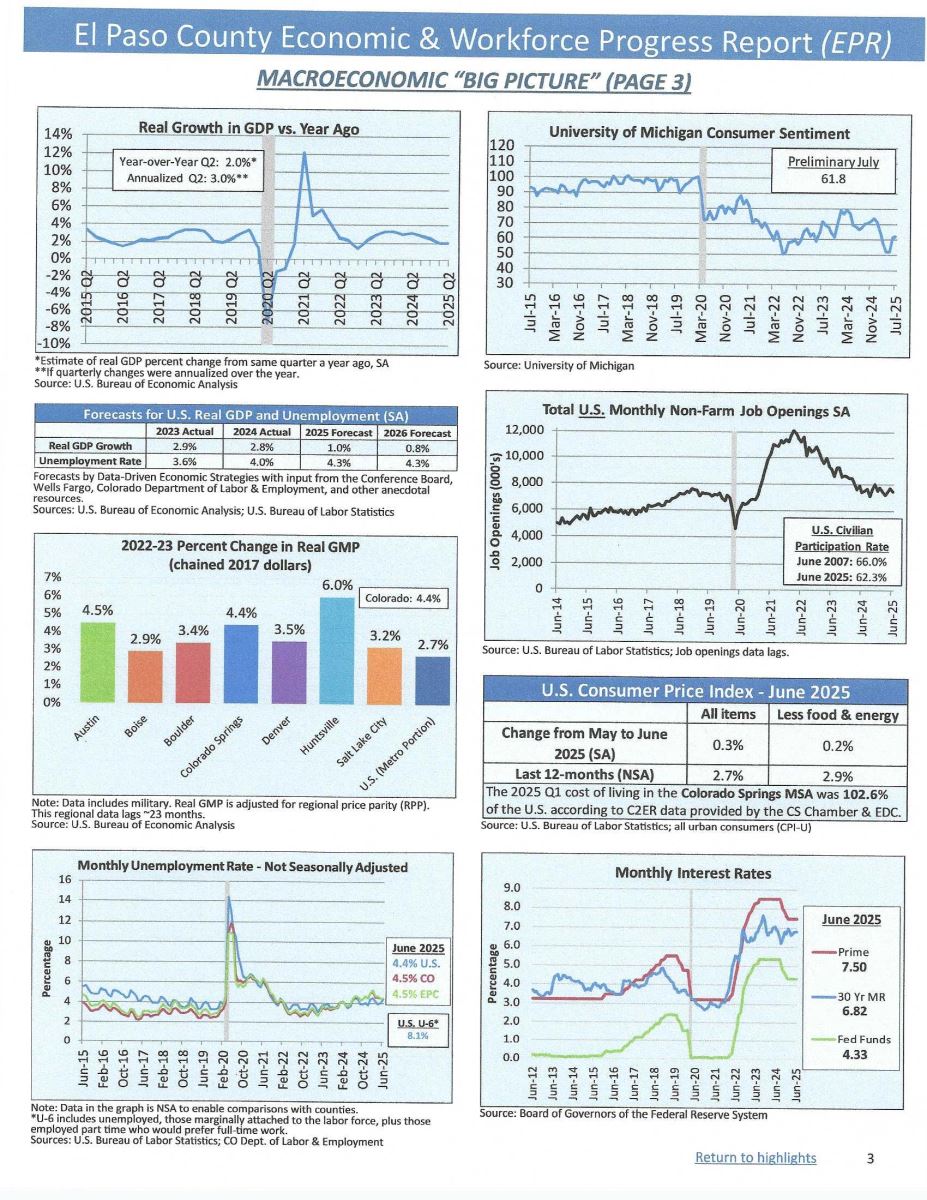

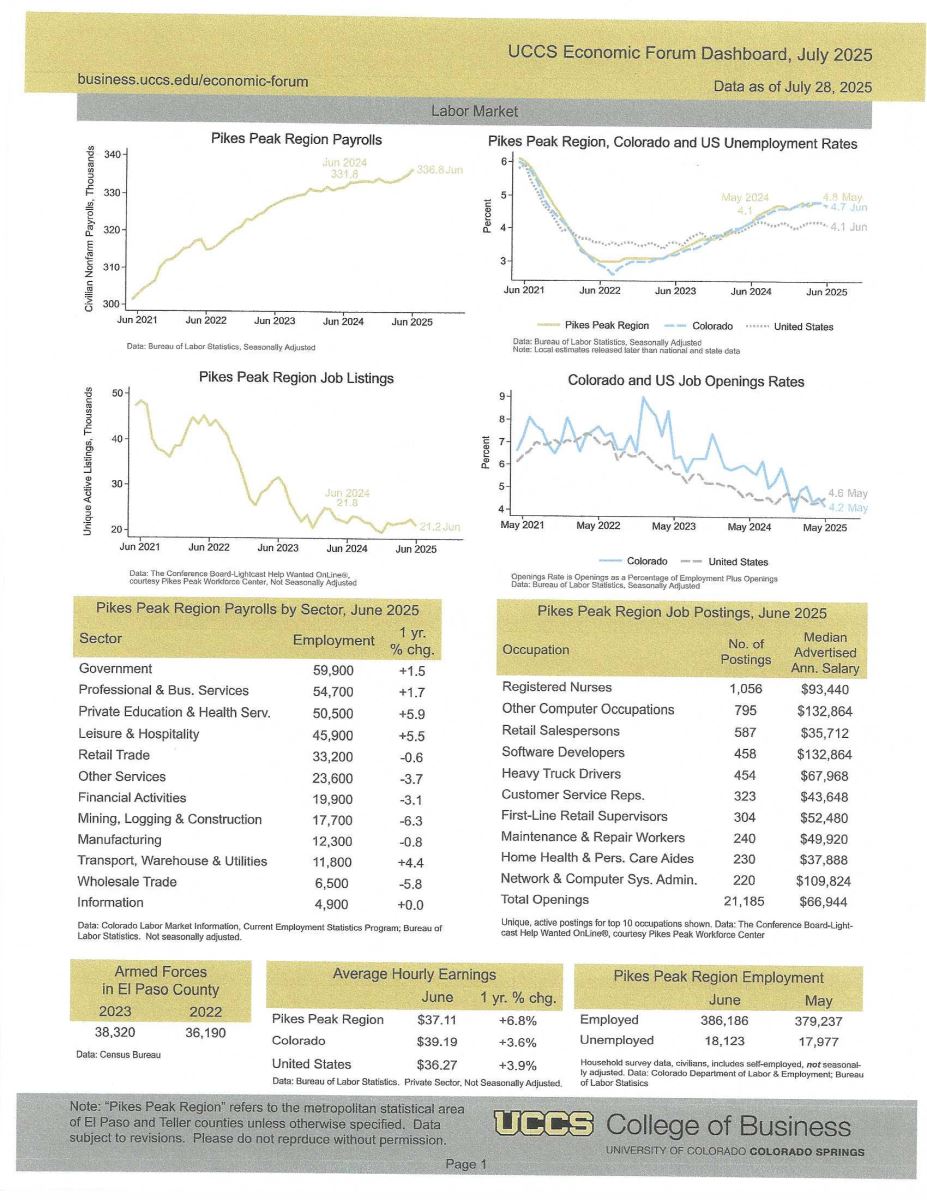

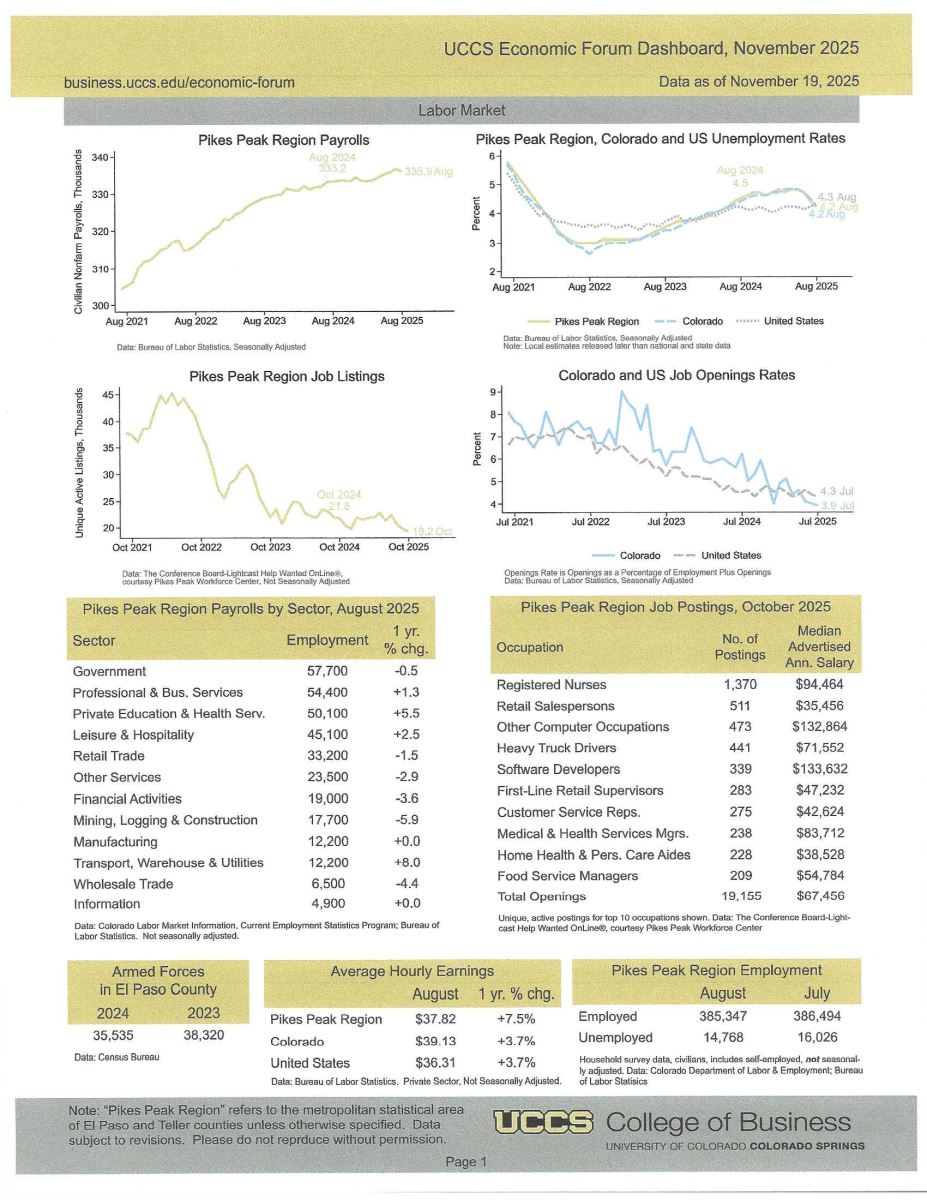

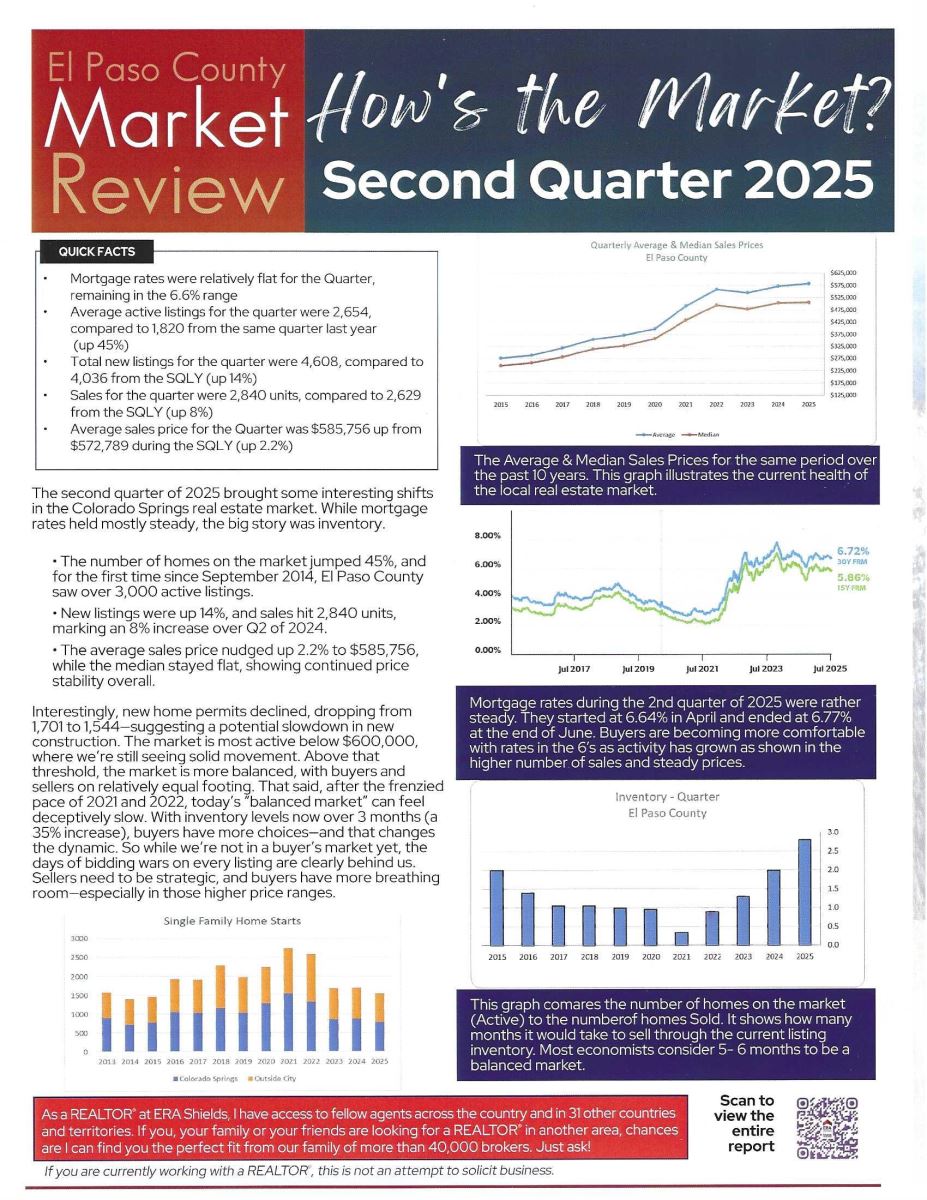

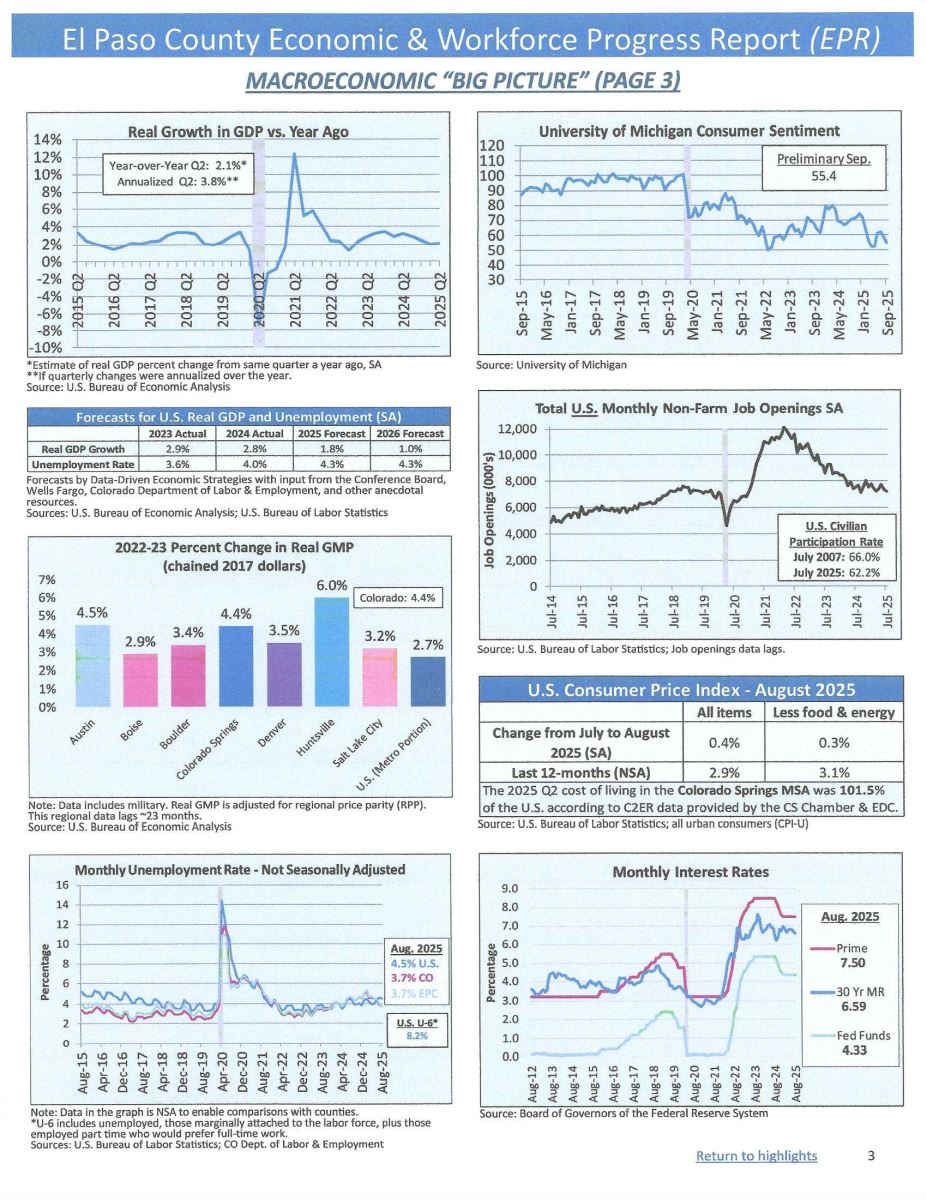

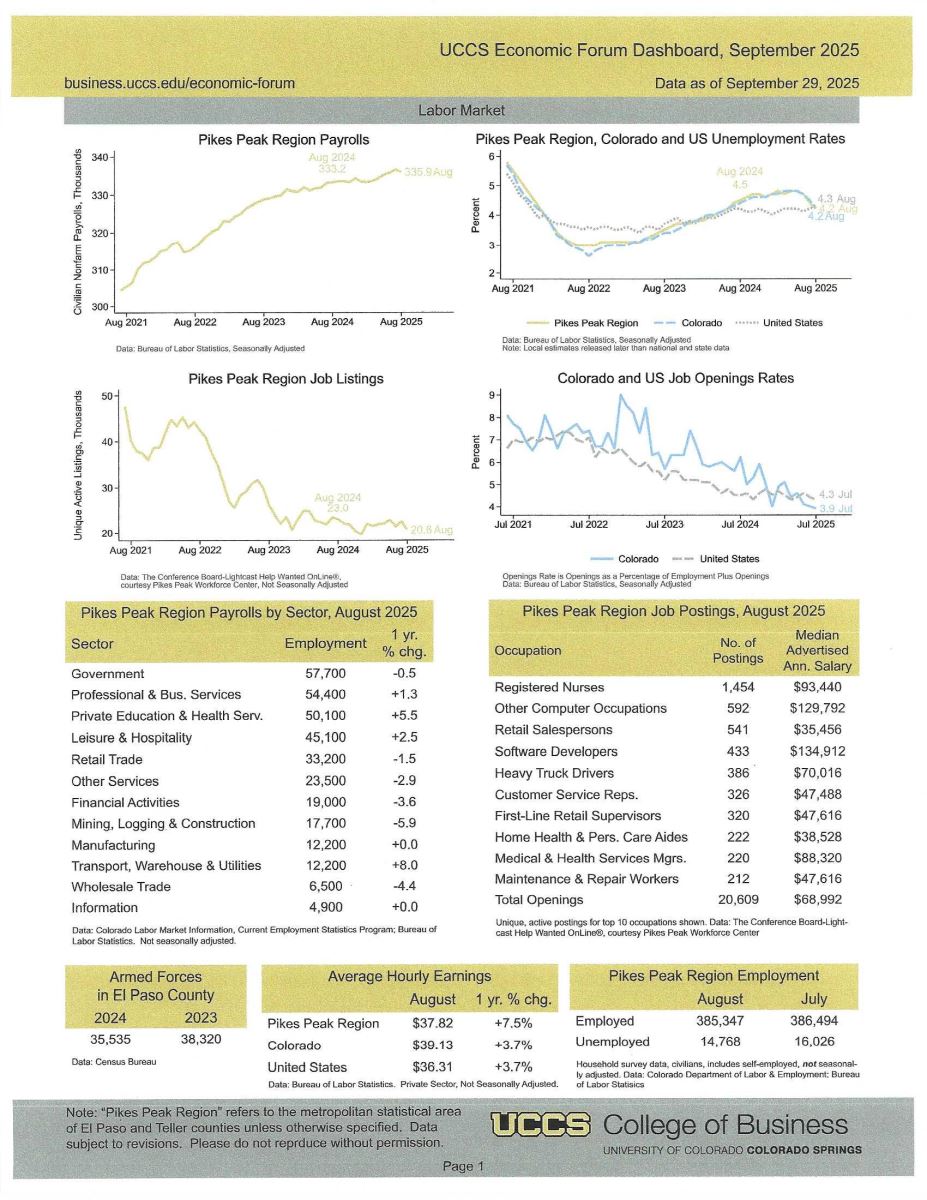

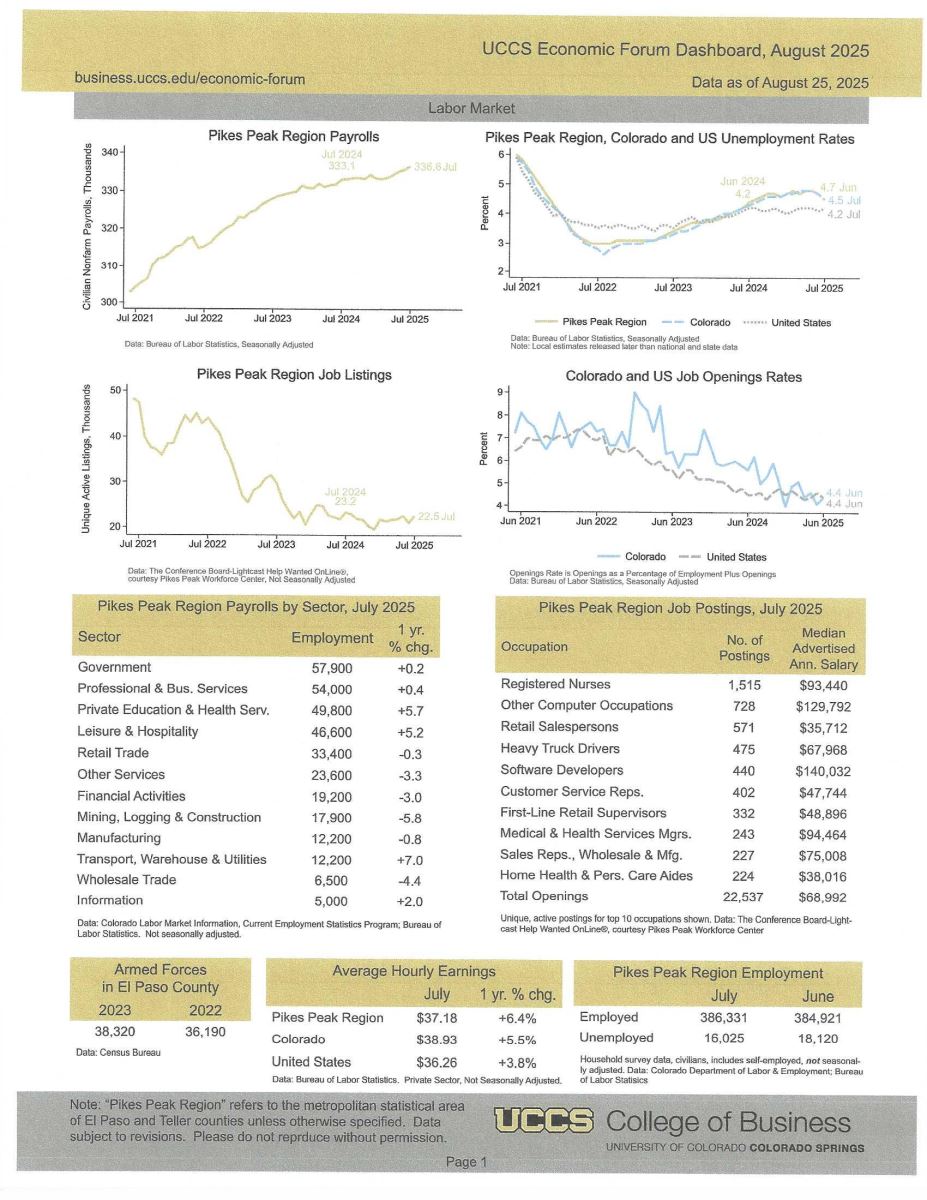

ECONOMIC & WORKFORCE DEVELOPMENT REPORT

Data-Driven Economic Strategies, November and December 2025

As always, I like to share the useful data I receive from our “local economist”, Tatiana Bailey. You will see in these charts what’s happening locally in terms of the economy as well as the most recent Workforce Progress Report.

This information is especially invaluable to business owners; however, I know you all will all find it worthwhile reading.

Below is a reproduction of the first page of graphics. To access the full report, please click here. And if you have any questions, give me a call.

.jpg)

.jpg)

.jpg)