HARRY'S NEW YEAR GREETING

December 27, 2023

HARRY’S NEW YEAR GREETING

.jpg)

Harry Salzman

Displaying blog entries 51-60 of 496

December 27, 2023

HARRY’S NEW YEAR GREETING

.jpg)

December 8, 2023

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

MY MOST RECENT YOUTUBE VIDEO…UP FRONT AND PERSONAL…

If you’ve got one minute and 55 seconds, I wanted to give you a couple of statistics and to thank you for your business and referrals during this past year.

In fact, while you’re at it, you might want to subscribe to my channel, so you won’t miss future broadcasts. It won’t cost you anything…well, it could cost you… if you miss some of my informative musings!

You will see below that local home sales this year are at an 8-year low. For me personally, my sales have been great, but I know that’s because of your confidence in me and I never take that for granted.

As I’ve said time and again, there are always those who need or want to sell and those who need or want to buy. In today’s market, it takes a Realtor with a lot of finesse, coupled with years of experience and knowledge to make that happen.

I pride myself on looking at each individual situation and my job is to find the right fit for the client’s wants, needs and budget requirements when it comes to buyers. This is as tough a market as I’ve seen, due to the lack of available homes for sales and the current mortgage interest rates.

And for sellers, I’ve been seeing that potential buyers are even pickier than usual, also often due to the high interest rates.

My job is to find the best fit possible and to make certain my clients don’t suffer undo stress. Not always easy, but another slogan of mine has been “where there’s a will…there’s Harry”. I’ll get the job done “one way or another” if it’s at all possible and in the best interest of my clients.

So once again, thank you for your support. It means everything to me, and I will continue to work hard to earn it.

And…to repeat from my video…Happy First Day of Chanukah to all my friends and clients who celebrate.

On that note, as always, if Residential real estate is among your current hopes and dreams for 2024 or beyond, please give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let me help make them come true.

And now for statistics…

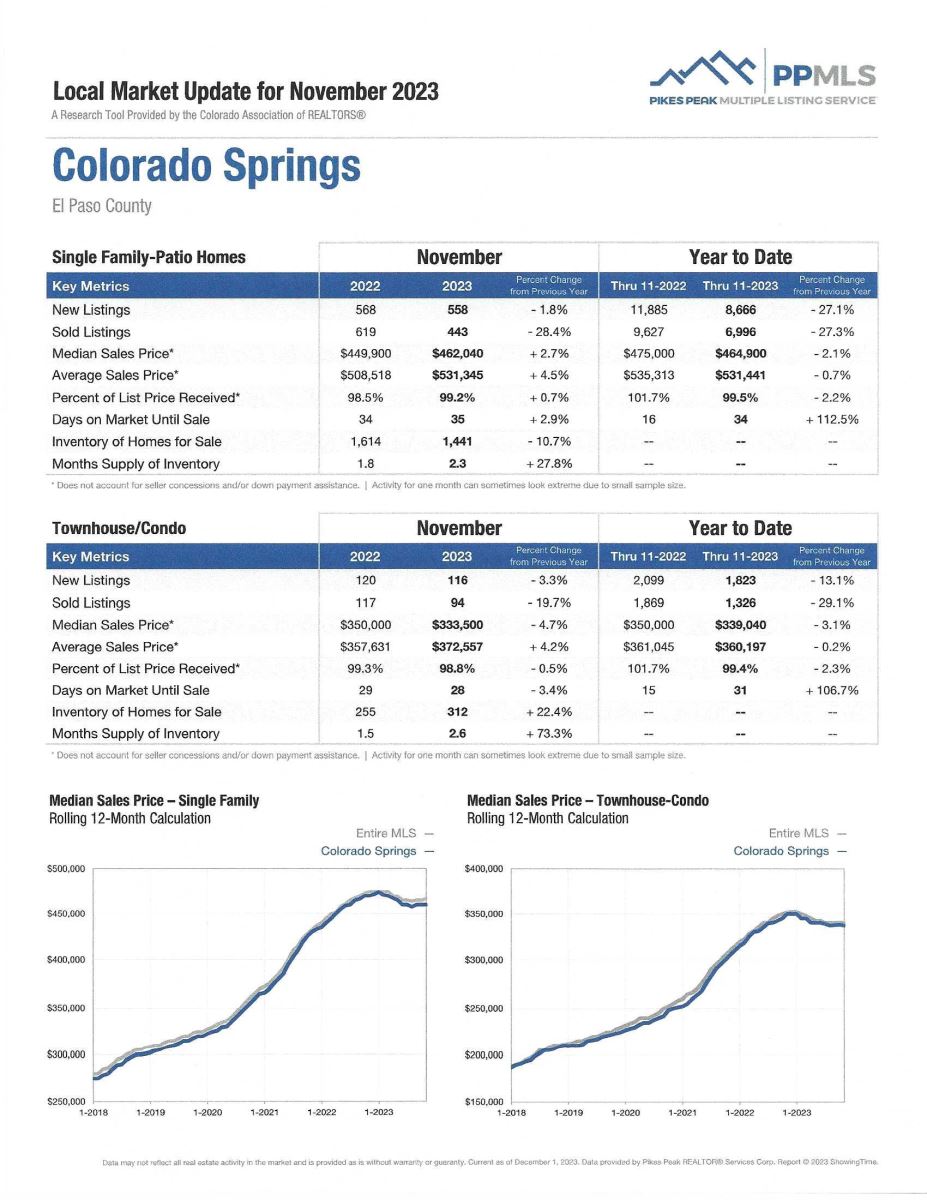

NOVEMBER 2023

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the November 2023 PPAR report.

In El Paso County, the average days on the market for single family/patio homes was 37. For condo/townhomes it was 28.

Also in El Paso County, the sales price/list price for single family/patio homes was 99.0% and for condo/townhomes it was 98.8%.

In Teller County, the average days on the market for single family/patio homes was 48 and the sales/list price was 132.0%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing November 2023 to November 2022 for All Homes in PPAR:

Single Family/Patio Homes:

Condo/Townhomes:

NOVEMBER 2023 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year-to-Date one-year change:

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering in order to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

HOME PRICE INDEX RISES AS SUPPLY FALLS SHORT

The Wall Street Journal, 11.29.23

Home prices hit a record high in September because of a shortage of homes for sale, even as rising interest rates made home purchases less affordable.

The S&P CoreLogic Case-Shiller National Price Index, which measures home prices across the nation, rose 3.9% from a year earlier in September, compared with a 2.5% annual increase the prior month. The September level was the highest since the Index began in 1987.

Home sales have slumped from a year ago because higher interest rates pushed buyers out of the market, but the decline in demand isn’t causing prices to fall, because inventory of homes on the market is unusually low.

Higher rates have prompted potential sellers to stay rather than give up their existing low mortgage interest rates.

The Case-Shiller Index, which measures repeat sales data, reports on a two-month delay and reflects a three-month moving average. Homes usually go under contract a month or two before they close, so the September data is based on purchase decisions made earlier this year.

Mortgage rates have declined in recent weeks after hitting two-decades high in October.

NEW MAXIMUM LOAN LIMITS FOR 2024

The Federal Housing Finance Agency (FHFA) raised their conforming loan limit by 5.56% to a maximum amount of $766,550 in 2024. In some geographical areas the limit is even higher.

These limits will take effect in January 2024.

REALTOR.COM 2024 HOUSING FORECAST

PR Newswire, 12.2.23

Lower mortgage rates and easing prices will help spark the beginning of an affordability turnaround in 2024 according to the recently released Realtor.com 2024 Housing Forecast.

However, the supply of existing homes for sale will still be tight and renting remains a competitive option in most U.S. markets.

This year’s forecast also includes price and sales predictions for the top 100 U.S. metro areas.

Overall in 2024, Realtor.com forecasts that buyers and sellers can expect:

Some key housing trends and wildcards:

Note that all surveys are based on national figures and when it comes to Residential real estate things need to be localized.

Colorado Springs is in an enviable position in that we have so many folks who want to relocate here and we have several new employers moving into the area. That’s not to say the above forecast isn’t meaningful to us because it is…it’s just that we often fare considerably better than the U.S. at large in terms of sales and pricing because of the desirability of our area.

Please call me if you have any questions.

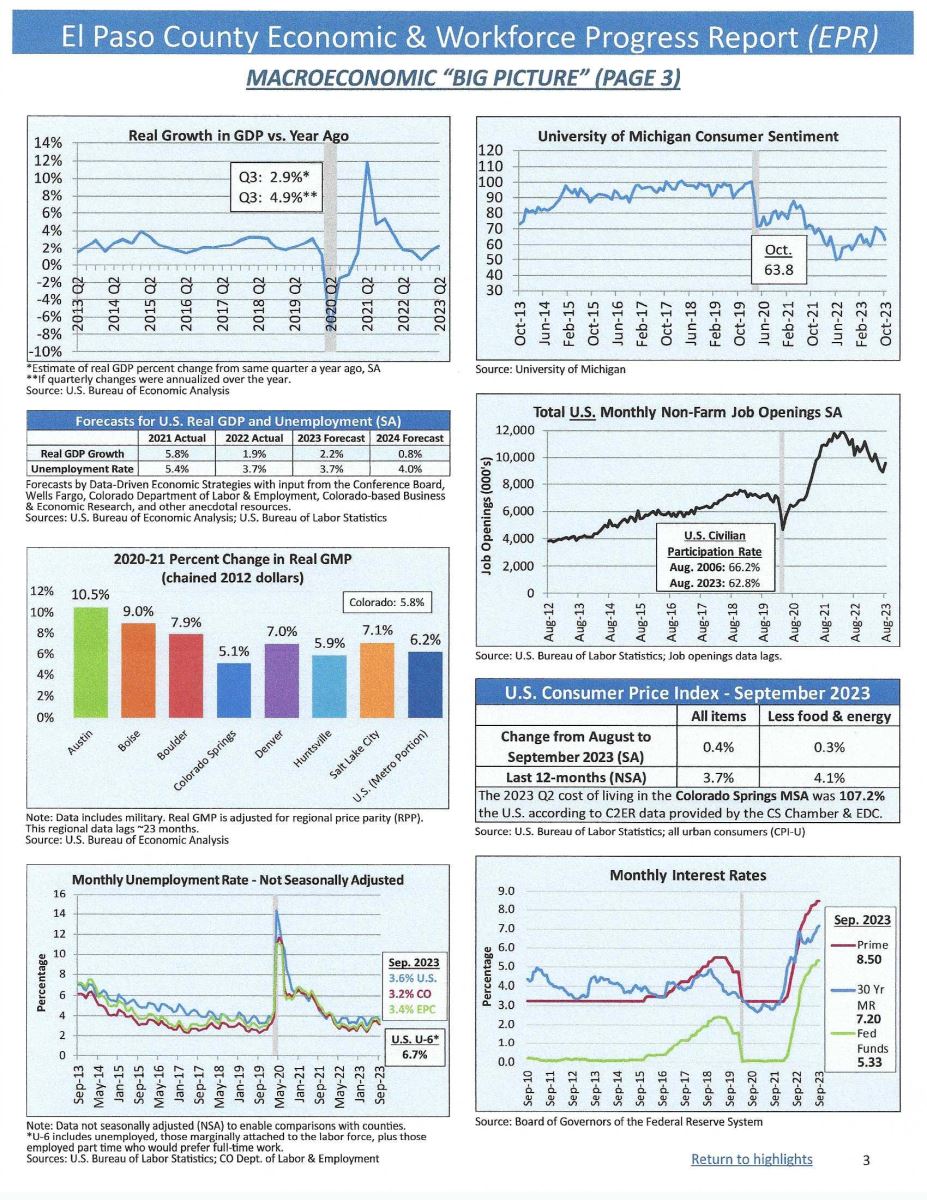

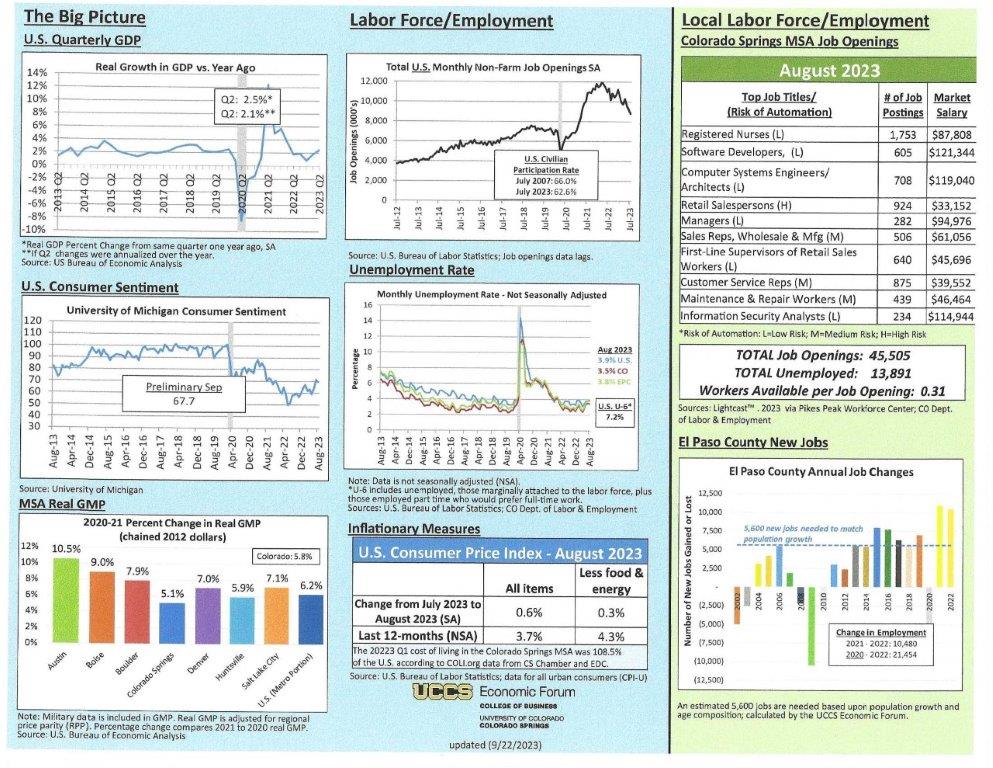

ECONOMIC & WORKFORCE DEVELOPMENT REPORT

Data-Driven Economic Strategies, November 2023

As always, I like to share the useful economic data I receive from our “local economist”, Tatiana Bailey. You will see in these charts what’s happening locally in terms of the economy as well as the most recent Workforce Progress Report.

This information is especially invaluable to business owners; however, I think you all will all find it worthwhile reading.

Below is a reproduction of the first page of statistics that I know you will find interesting and

to access the report in its entirety, click here. If you have any questions, please give me a holler.

.jpg)

UCCS ECONOMIC FORUM MONTHLY DASHBOARD

Updated November 28, 2023, UCCS College of Business/Economic Forum

Here is the monthly report (with a new look!) from the UCCS College of Business Economic Forum. I know several of you who enjoy statistics and use this information in your daily business life and I will share it as always.

Below I have reproduced a copy of the first page and to read the entire report, please click here.

.jpeg)

I just same across this…it has hung on the file cabinet in my office for the last 40 plus years and seemed appropriate for this time of year:

November 28, 2023

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

A HOME IS A GIFT TO YOURSELF AND YOUR FAMILY THAT JUST KEEPS ON GIVING

I hope everyone had a great Thanksgiving holiday. With all the turmoil in today’s world, I’m thankful every day that I live in the United States of America and most especially here in Colorado Springs. I hope and pray that 2024 will bring more peace to us all, no matter where we live or how we believe.

And I’m very thankful for YOU, my clients, friends, and clients to be. What I do, and have done for 51 years now, is help find “safe harbors” for people. After all, isn’t that what homebuying is all about? Finding the right place for a family to grow and prosper in a safe, happy and creative environment?

It gives me great pleasure when I can help find just the “right” fit for an individual family’s wants, needs and budget requirements. I work hard to make that happen and when I see how it all comes together…well, sometimes it’s like “magic”.

I certainly don’t claim to be a magician, and oftentimes my title of “real estate Therapist” comes into play here, but when I see how my hard work comes to fruition it truly makes me happy because I know from all my years in this business that finding the “right” home can make such a difference to a family.

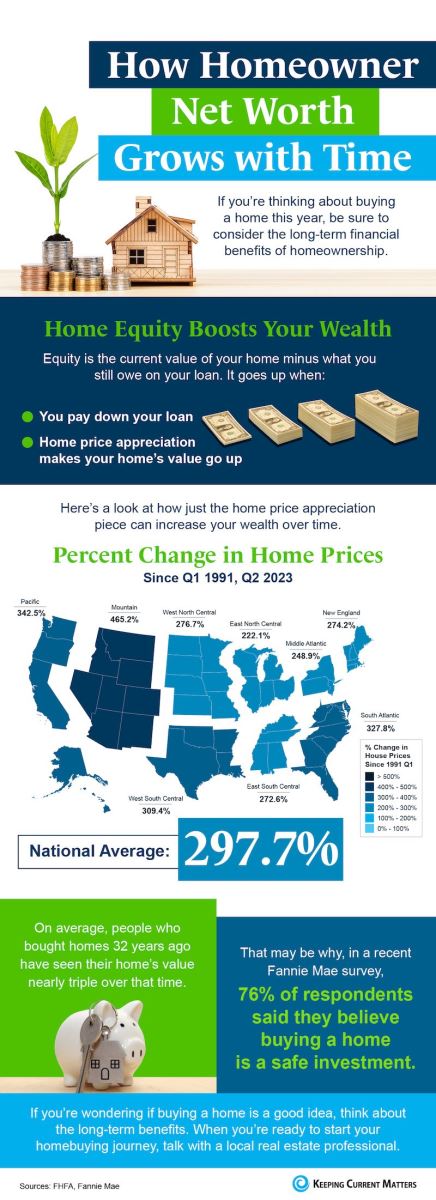

And that’s not even taking into consideration that a home is often a family’s most valuable asset. With each passing year that asset is likely increasing in value, thus bringing even more financial stability and home equity.

So, with the holiday season upon us, I thought I’d remind you that your home is a gift you bought that keeps on giving and likely will do so for many, many years to come.

And when you are ready to put that equity to work either in another home or in an investment property, I’ll be here to help you along the way.

By now you know how to reach me…either by calling 719.593.1000 or by email at Harry@HarrySalzman.com. I’ll be available whenever you, your family, your co-workers or friends need me.

AND NOW ANOTHER WORD FROM ME…

If you’ve got a minute and 37 seconds, I’ve got some additional news for you. Click on the link below to hear my latest podcast:

Be sure to “subscribe” online to hear my “blurbs” when they are first available.

THE THANKSGIVING HOLIDAY MAY BE OVER, BUT HOMEOWNERS ARE THANKFUL EVERY DAY….an Infographic

Keeping Current Matters.11.24.23

COLORADO SPRINGS HOME PRICES CONTINUE TO RISE IN THIRD QUARTER 2023

The National Association of Realtors, 11.9.23

In the recently published report from the National Association of Realtors (NAR), single-family, existing-home prices grew in 82% of measured metro areas. This is up 58% from the previous quarter.

According to Lawrence Yun, chief economist for NAR, “Homeowners have accumulated sizable wealth, with a typical homeowner gaining more than $100,000 in overall net worth since 2009 and before the height of the pandemic.”

“However,” he added, “the persistent lack of available homes on the market will make the dream of homeownership increasingly difficult for younger adults unless housing supply is significantly boosted.”

The median price nationally rose 2.2% quarter-over-quarter to $406,900.

The median price of single-family homes in Colorado Springs rose 0.9% to $466,300 during the third quarter of the year, per NAR. This price reflects detached, single-family and patio homes but not townhomes or condominiums.

The median price in the Springs ranked 46th highest of the 221 cities surveyed.

To see all 221 metro areas in alphabetical order, please click here. To see them in ranking order, click here. Or click here to see what income levels are required to purchase homes based on either a 5, 10 or 20 percent down-payment.

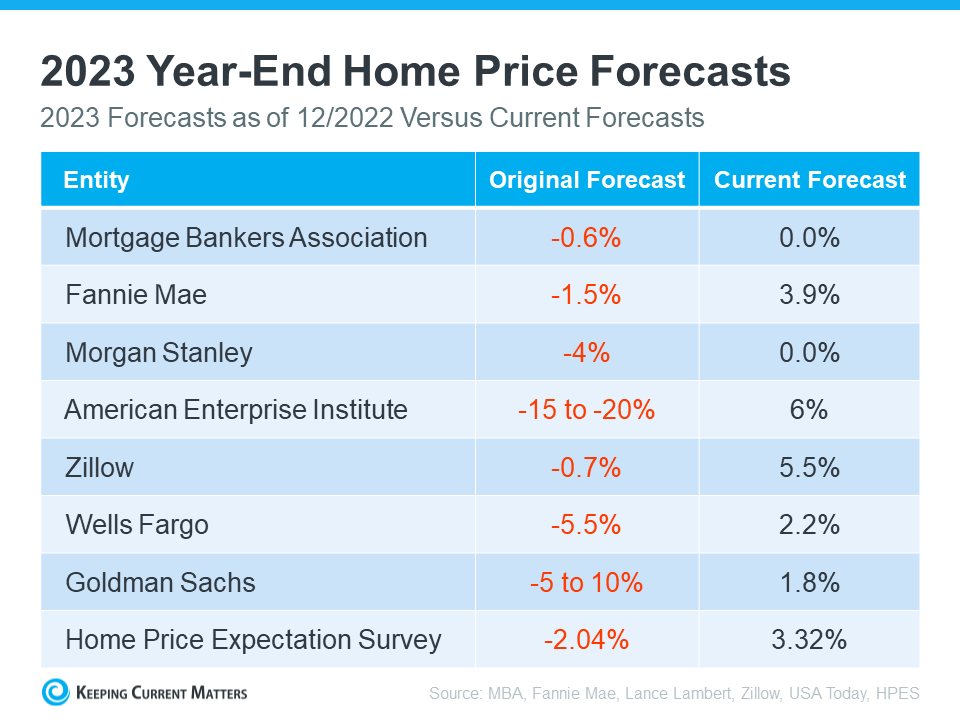

2024 HOUSING FORECASTS SHOW NO SIGN OF “SLOWDOWN” EITHER IN SALES OR HOME VALUES…an Infographic

Keeping Current Matters, 11.17.24

Bottom Line:

SHARE OF U.S. HOMES BOUGHT WITH CASH HITS 9-YEAR HIGH

The Gazette, 11.19.23

Homeowners who want to bypass the highest mortgage rates in two decades are increasingly forgoing financing and paying all cash.

Homes purchased entirely with cash, which means there was no reference to a mortgage on the deed, accounted for 34% of all sales in September, up from 29.5% a year ago and the highest share in nearly a decade, according to a Redfin analysis of home sales in 40 of the nation’s most populous meto areas.

With homes sales at a 13-year low in October nationwide, and even though the all-cash share of all sales increased, the number of all-cash transactions in September fell 11% from a year earlier Redfin found. In contrast, homes sales overall fell 23% in the same period.

“Were it not for those cash buyers, I think the housing market would be in an even worse position than now”, said Daryl Fairweather, Redfin’s chief economist.

Even homebuyers who use financing are electing to make bigger down payments in order to reduce the size of their mortgage.

The typical U.S. homebuyer put down 16.1% of the purchase price in September, the highest percentage in nearly a year and a half, according to Redfin.

I am seeing the same things with recent clients. Homes ARE selling, but more and more I find clients putting larger down payments or paying all-cash for their purchases. I expect this to change a bit once rates start to fall, but for now this seems to be the norm.

November 21, 2023

HARRY’S THANKSGIVING GREETING

Wishing you and yours a happy, safe, and plentiful Thanksgiving holiday…

November 7, 2023

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

MORTGAGE RATES FALLING A BIT, BUT STILL HIGH AND NATIONAL ASSOCIATION OF REALTORS MAKES THE NEWS…LOTS TO DISCUSS HERE

Let’s begin with the recent news about the lawsuit where the National Association of Realtors (NAR) was found liable last week for charging the same commissions as they have for years even though home prices are considerably higher than they were years ago. This will obviously be appealed so it’s not known how this will eventually play out.

Here’s my take on it. Yes, Realtors are still making the same commission as they have for years, but it actually takes a lot more work today on the part of Realtors to go from square one to the closing table.

So let me just speak for myself here.

To begin with, my job is to help facilitate an experience as stress free as possible for the buyer or seller. In the market frenzy of recent years, it was more stressful than I can ever remember as buyers were forced to make an offer on a home without seeing it in person in many cases. It required quick action on my part to get the offer written in such a way as to make it stand out from the many others that inevitably came in. And for my sellers, it took a lot of time to go through multiple offers and bidding wars to determine what offer was in their best interest.

It was very difficult, not only for me, but for my clients as well. I like to take the stress away from them whenever possible because buying or selling a home is a huge decision, but luckily for them, one of my specialties is negotiation. But with so many offers coming in so fast, it was stressful for everyone during that time.

But now let’s talk about today. Yes, the frenzy is gone and there is more time to make decisions, but there are not many homes for sale. My buyers depend on me to find them a home that fits their needs, wants and budget requirements and in today’s market that is not an easy thing to do.

Finding a lender who is the best fit for my client is also something I assist with if asked and I can find the best rates from reputable lenders because this is something I have done for clients my entire career. My investment banking experience, and from having owned my own mortgage

company at one time, come in real handy here as I know the ins and outs of this sometimes difficult aspect of home buying.

Once we find a home, there are all the offer negotiations, inspections, and more.

So, not to sound defensive, but…. we Realtors more than earn our commission.

If you don’t believe that’s true, simply ask someone how things went when they tried “For Sale by Owner”. The answer most always is, “Never again!”

And now on to the mortgage rates of today…

Yes, mortgage rates are much higher than they were even a year ago. With them hovering around 8% many potential buyers are waiting to see what will happen.

My advice? Don’t wait too long. Rates aren’t going down much anytime soon but home prices are also not going down since appreciation is continuing to go up. Yes, you read that right.

At the end of last year, I made my annual forecast for our local economist, Tatiana Bailey, and I told her I believed home values would increase by 2-3% this year. That was higher than national economists predicted for annual home appreciation, but…at present our local appreciation is even higher than I predicted, as you will see in the statistics below.

And those high interest rates? Well, mortgage interest rates are negotiable!

Mortgage lenders want to lend. When they don’t make loans, they are not making money. It’s that simple. As I always tell you…it’s Econ 101…Supply and Demand. Therefore, they are willing to entertain negotiations on the rate.

Some lenders are even making “Refinance for Free” propositions to potential borrowers. A recent Wall Street Journal article explained that “usually, lenders who offer buy-now-refinance later mortgages will give some borrowers a certificate or another type of IOU that gives them access to a credit that can be used to pay for some of the costs associated with a future refinance”, according to Jacob Channel, senior economist at Lending Tree.

Other lenders may roll the future closing costs into the loan amount or waive lender fees. Each offer is different, but the point is…once again…mortgage rates and terms are negotiable!

And rates WILL go down in the next few years and home appreciation WILL continue, especially in desirable locations such as Colorado Springs.

If you’ve considered a move, now is a great time to find out how to put all of this to work for you and your family. Having a seasoned, knowledgeable professional like me on your side will only make it easier.

And, if you’ve got two minutes and 17 seconds, I will further explain why it makes sense to buy now and refinance later if you are even considering a move.

Simply click on the link below and you will be directed to my personal YouTube channel.

To watch, click here:

In fact, while you’re at it, you might want to subscribe to my channel, so you won’t miss future broadcasts. It won’t cost you anything…well, it could cost you… if you miss some of my informative musings!

So, as always, if Residential real estate is among your current hopes and dreams, please give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let me help make them come true.

And now for statistics…

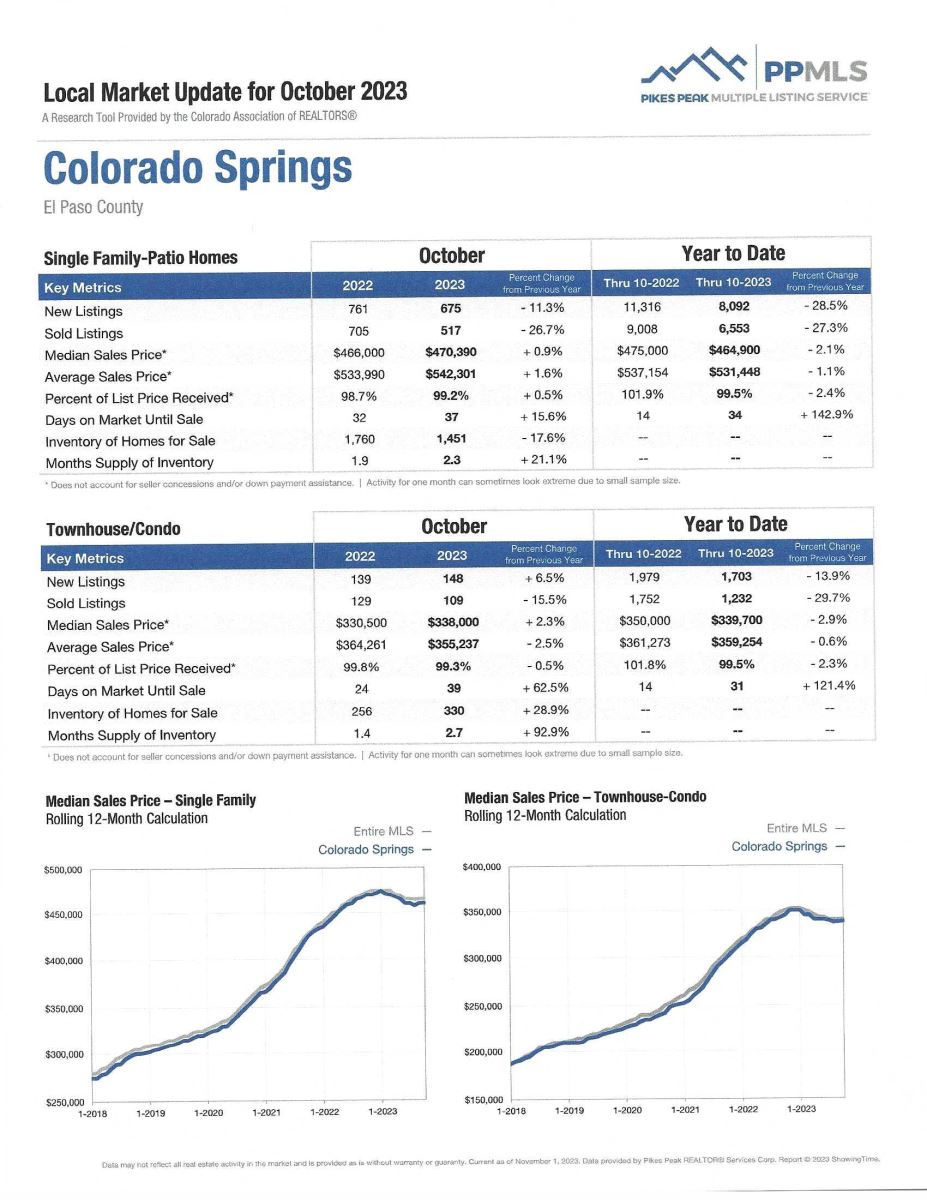

OCTOBER 2023

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the October 2023 PPAR report.

In El Paso County, the average days on the market for single family/patio homes was 43. For condo/townhomes it was 38.

Also in El Paso County, the sales price/list price for single family/patio homes was 99.3% and for condo/townhomes it was 99.4%.

In Teller County, the average days on the market for single family/patio homes was 37 and the sales/list price was 97.7%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing October 2023 to October 2022 for All Homes in PPAR:

Single Family/Patio Homes:

Condo/Townhomes:

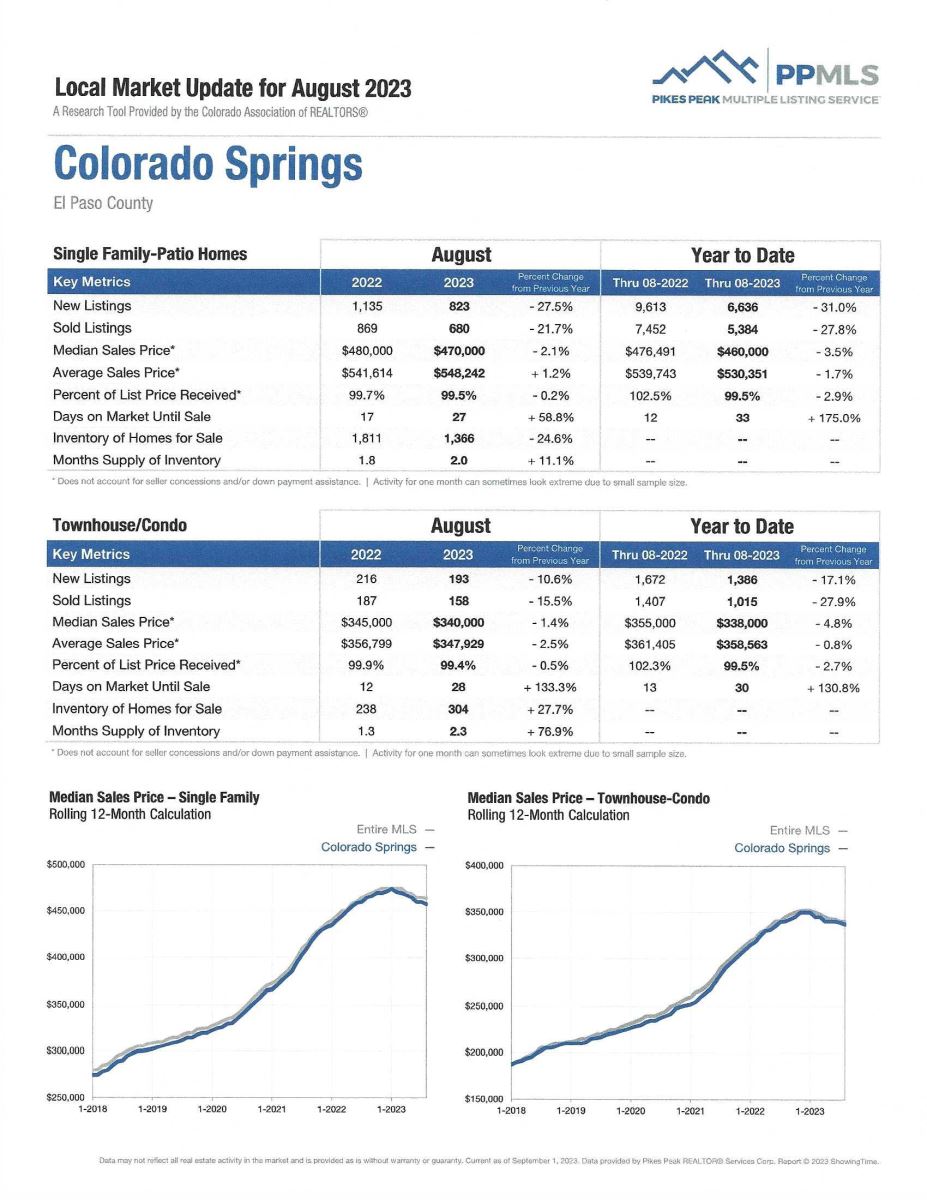

OCTOBER 2023 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year-to-Date one-year change:

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering in order to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

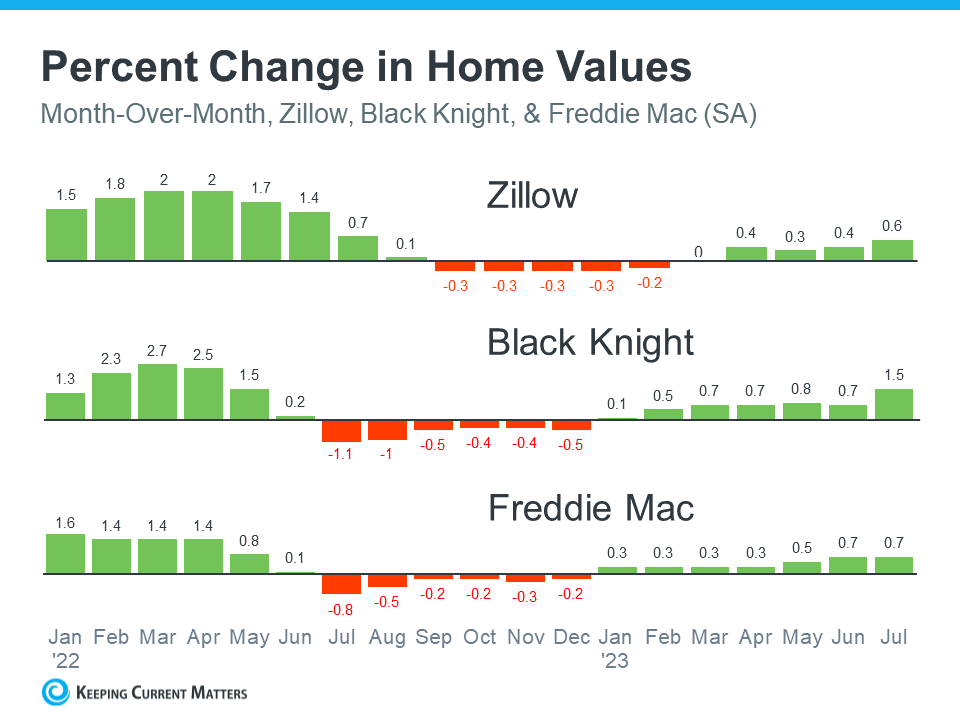

3 GRAPHS THAT PROVE HOME PRICES AREN’T FALLING

KeepingCurrentMatters, October 20,2023

You can see from the above statistics that our local home prices are rising, not falling, but for those who believe media reports that home prices will fall, here is some concrete evidence that home values are not going to fall like they did during the crash of 2008.

Data shows that home prices are NOT falling. Take a look at this graph showing three trusted sources and you’ll see that prices bounced back quickly after experiencing only minor, if any, declines last year:

Home prices follow a predictable seasonal trend, and that trend is what’s starting to happen once again this year.

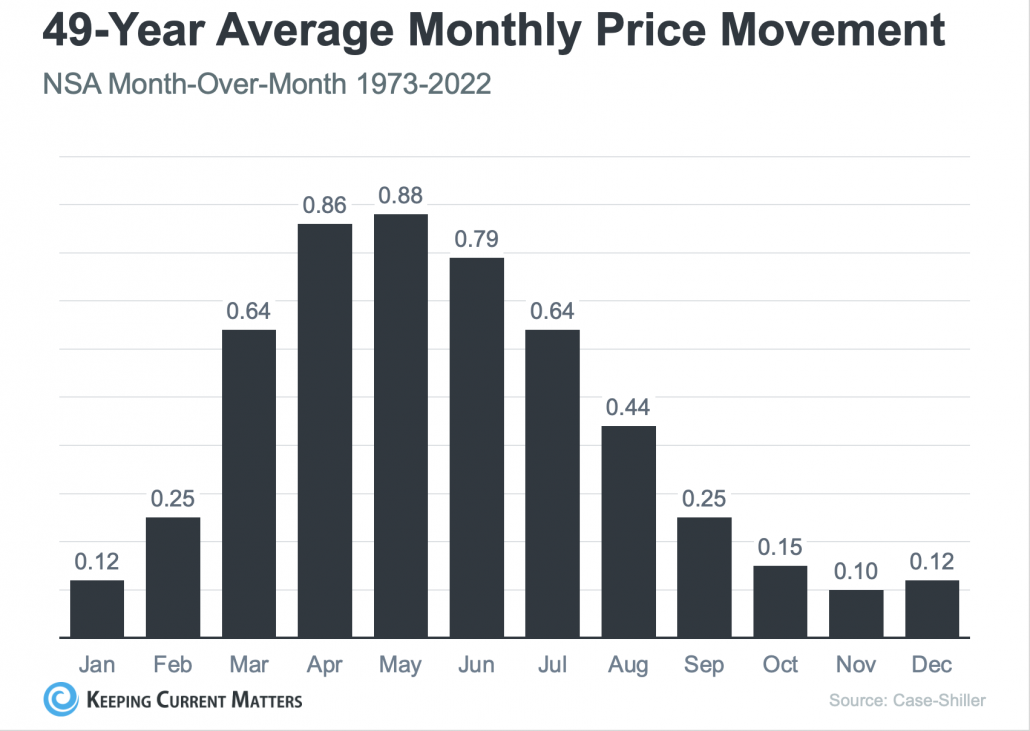

Just like the changing of the seasons, the housing market has its own cycles. To get a clear picture of what’s “normal” for the market, let’s look back in time for a minute.

Check out the graph below—it’s based on Case-Shiller data from 1973 to 2022 (unadjusted for seasonality). It will help you understand how home prices usually change throughout the year.

At the beginning of the year home prices grow, but not as much as they do in the spring and summer markets. That’s because the market is less active in January and February since fewer people move at that time of year.

As the market transitions into the peak homebuying spring season, activity ramps up and home prices go up a lot more in response. Then as fall and winter approach, activity eases again. Price growth slows, but still typically appreciates and that is what we are seeing now, both nationally and here in Colorado Springs. It’s a deceleration of appreciation, not depreciation.

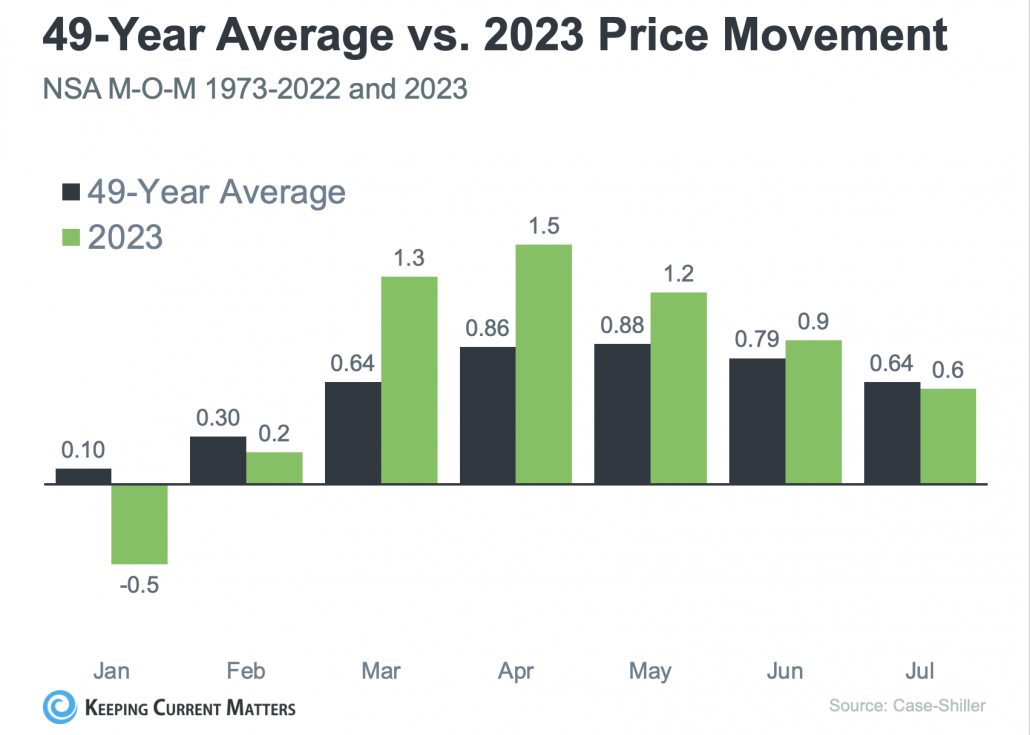

Look at this next graph. It takes the graph from above on the long-term trend and adds in the latest numbers available for this year. That way it’s even easier to see. The black bars represent the average home price movement over 49 years, while the green bars show what’s happening this year:

Prices are still going up, just a bit slower. Sometimes the media gets it wrong, thinking slower growth means prices are dropping.

But that’s not true—it’s just that appreciation is happening at a more typical pace.

These again are more examples of the fact that homes are NOT going to lose value and if you are looking to buy, the sooner you do, the sooner your home can start earning equity for you.

ECONOMIC & WORKFORCE DEVELOPMENT REPORT

Data-Driven Economic Strategies, October 2023

As always, I like to share the useful economic data I receive from our “local economist”, Tatiana Bailey. You will see in these charts what’s happening locally in terms of the economy as well as the most recent Workforce Progress Report.

This information is especially invaluable to business owners; however, I think you all will all find it worthwhile reading.

Below is a reproduction of the first page of statistics that I know you will find interesting and to access the report in its entirety, click here. If you have any questions, please give me a holler.

UCCS ECONOMIC FORUM MONTHLY DASHBOARD

Updated October 24, 2023, UCCS College of Business/Economic Forum

Here is the monthly report from the UCCS College of Business Economic Forum. I know several of you who enjoy statistics and use this information in your daily business life and I will share it as always.

To read the report, please click here.

October 26, 2023

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

.png)

STILL LOTS OF QUESTIONS…BUT I’VE GOT SOME ANSWERS…

When you’ve been in the Residential real estate business as I have for 51 plus years, you’ve seen just about every type of “cycle” imaginable. I’ve seen interest rates as high as 21% and as low as 2%. I’ve seen a home price in Colorado Springs as low as $18,000 in 1972 and the average price as it is was in September at $553,959.

So, when it comes to “surprises”, there is very little that surprises me in Residential real estate.

Why do I mention this? It should be obvious. The importance of doing business with a seasoned, knowledgeable professional like myself cannot be overemphasized, and most especially in today’s ever-changing market.

When you’ve seen it all you know how to respond in a timely and pragmatic way. My investment banking background also gives me a special heads up on the competition and is an important plus to my clients as I also know how to help them navigate the mortgage market and find the right fit for their individual situation.

Am I bragging? Maybe. But I’ve earned the right.

Forty percent of the Residential real estate agents in the National Association of Realtors (NAR) have been in sales for ten years or less. They have not witnessed many cycles and have enjoyed working when the historically low interest rates caused the buying frenzy of recent years. Those were the “easy” years.

The going gets tough when you have to deal with interest rates that have escalated as quickly as they have in the last year and buyers and sellers need help with figuring out how to make this market work for their individual wants, needs and budget requirements.

Let’s face it. The historically low interest rates of a few years ago are gone and I seriously doubt we will see them again for a very long time, if ever. So now it’s time to move on and address what’s happening today.

Rates are high…and are likely to stay that way for a while and buyer traffic is less than normal due to those high rates.

But as I’ve continually said, rates don’t tell the whole story. The BIG story is that home appreciation is on the rise, and it will continue to do so.

Yes, some of that is due to the lack of available homes for sale. But, while economists had forecasted either a flat or negative appreciation this year, those forecasts have changed. And, here in Colorado Springs we have already surpassed my MY forecast of 2-3%.

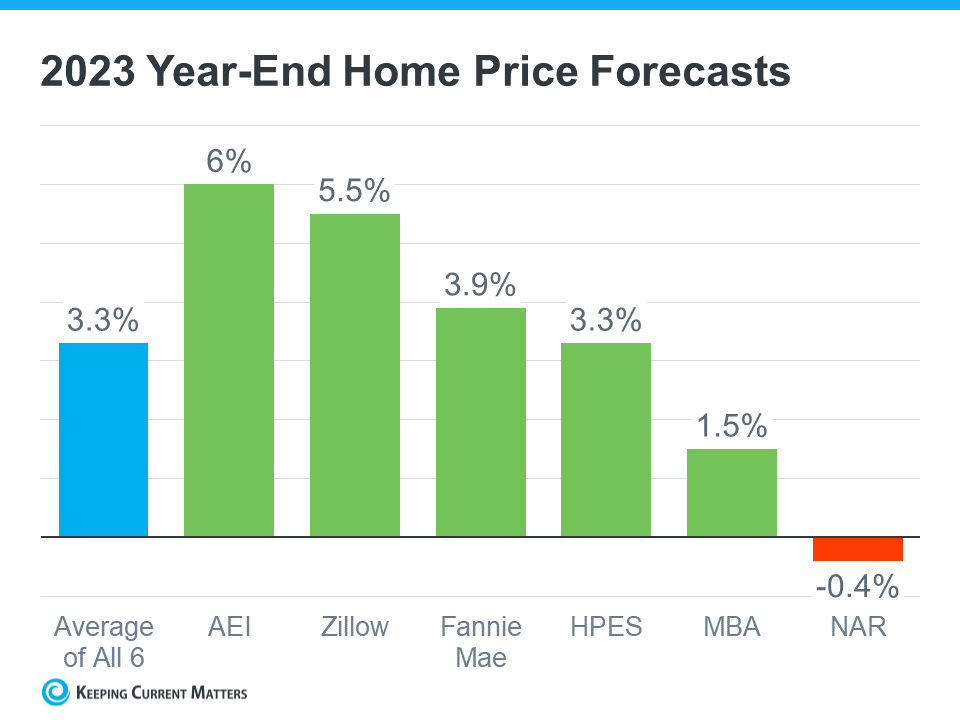

Here is a copy of the most recently revised national year-end home price forecasts:

So, if you’ve thought about making a move, waiting for rates to come down while home values are appreciating might not be in your best interest. (no pun intended).

I’ve recently been working with clients who want to sell to trade up or move to a new location and while it’s not as easy as it was just a year ago, it’s still doable, depending on inventory. Where there’s a will…my clients have me. And I can always find a way if it’s at all possible and in their best interest. And if it’s not…I will tell them that as well.

After all, I’m not in business for a quick sale. I’m here for the long haul and to cultivate relationships and will always put the best interest of my clients first. That’s why I’m still in business and have had the pleasure of working with not only my long-time clients but also their kids and even a grandchild or two at times.

If you’ve even been thinking about a move, please give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let’s get together and see how together make your Residential real estate dreams come true.

AND ANOTHER WORD FROM ME…

If you’ve got a minute and 37 seconds, I’ve got some additional news for you. Click on the link below to hear my latest podcast:

Be sure to “subscribe” online to hear my “blurbs” when they are first available.

WHO ARE WE? A LOOK AT EL PASO COUNTY AND COLORADO SPRINGS BY THE NUMBERS

The Gazette, 10.1.23

Below is an article that was in the Sunday Gazette several weeks ago and I thought if you hadn’t seen it you might be interested in the statistics. So…here you go…

HOME PRICE GROWTH IS RETURNING TO NORMAL…an Infographic

Keeping Current Matters, 10.20.23

.jpg)

THREE THINGS HOME BUYERS CAN ASK FOR NOW

The Wall Street Journal, 10.9.23

Home buyers are facing steep costs and few options as mortgage rates push 8% and new listings are scarce. However, the good news is that they have more leverage than they realize.

With lenders having to compete for business now that higher rates have scared off many potential buyers, some may be willing to reduce some fees. Besides shopping around for the best rate, there are also a handful of extras that buyers can ask for to reduce their closing costs and monthly payments.

Sellers are also more receptive to certain requests than they were during the height of the pandemic-fueled housing frenzy since they don’t want to risk losing the deal. In August of this year, nearly 16% of pending home sales nationally fell through as buyers got cold feet, compared with about 11.7% in August 2021, according to Redfin.

A you might guess, a buyer’s power to negotiate largely depends on how much competition there is for the house. Here are three things to consider asking for from the seller:

These are three things that could help make a difference in what you ultimately pay for a new home. Please call me with any questions or to see how any, or all, of these options could apply to you.

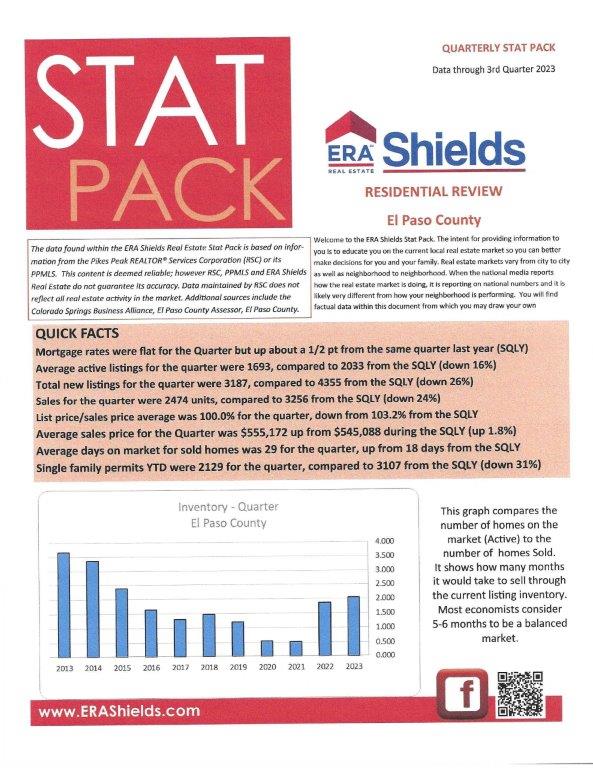

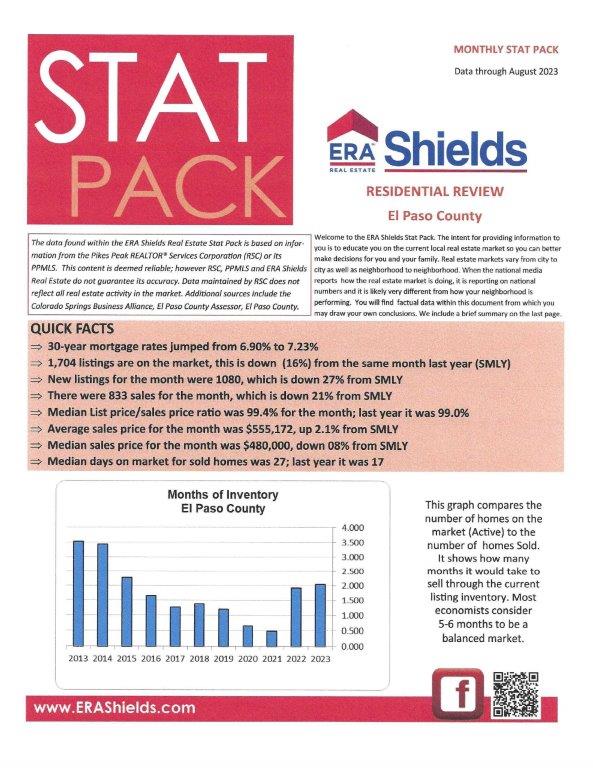

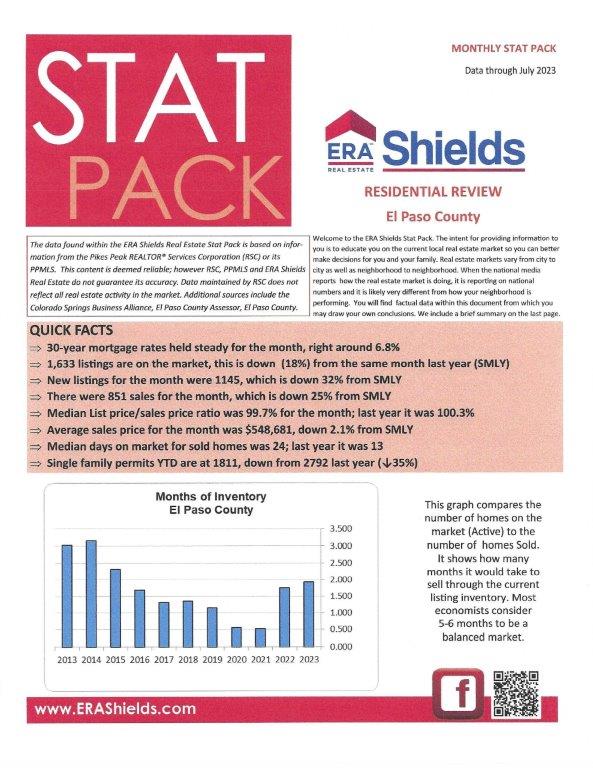

ERA SHIELDS QUARTERLY STAT PACK

Data through September 2023, ERA Shields

Here is data from my company’s quarterly “Stat Pack” that can better help you understand the local buying and selling reality. I have reproduced the first page, and you can click here to get the report in its entirety.

October 6, 2023

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

YES, MORTGAGE LOAN RATES ARE UP AGAIN…BUT THEN SO ARE HOME VALUES

We are hearing a lot about the rising mortgage interest rates these days, especially since the average 30-year fixed-rate hit 7.49% this week, a new 23 year high according to Freddie Mac.

But what you’re not hearing as much about nationally is that home values are also on the rise. And locally, they have been again for several months.

Why mention that? Well, it should be obvious. Yes, if you’re buying a new home your mortgage interest rate WILL likely be higher than whatever your current rate may be, BUT…with home values increasing monthly, your investment will begin earning dividends right away.

If you are wanting to buy and have decided to wait for interest rates to go down, there’s no telling when that will happen, or when it does, how low the rates will fall. They are not likely to ever go back to the historic lows of several years ago but should drop a bit by the second quarter of next year according to experts.

Home appreciation isn’t going to stop and depending on the number of available homes for sale it’s likely to keep rising faster. It’s a Seller’s Market and until there are more homes on the market it will continue that way.

Folks were thinking that when mortgage rates first started rising home values would go down as they did during the housing bust of 2008. Didn’t happen. Economists kept saying it would not happen and it didn’t. But it did prevent some from buying homes at that time as they worried about a repeat of the late 2000’s.

At the end of last year, I made my annual forecast for our local economist, Tatiana Bailey, and I told her I believed home values would increase by 2-3% this year. So far, I am basically on target as you will see in the statistics below. And I’m hopeful we could even end the year a bit stronger.

Something else you might consider if you are looking to buy at present. Mortgage interest rates are negotiable! There was a big article in today’s Wall Street Journal talking about just that and I’ve seen that in recent times with my buyers.

Mortgage lenders want to lend! When they don’t make loans, they are not making money. It’s that simple. As I always tell you…it’s Econ 101…Supply and Demand. Therefore, they are will to entertain negotiations on the rate.

You can find in today’s 30-year fixed-rate arena rates anywhere from 7.5%-8% depending on the lender.

And rates WILL go down in the next few years and as they do, mortgage loans can be refinanced at those lower rates. In fact, some buyers have that specifically put in their loan package, depending on the lender.

That’s why it’s so important to have a professional like me on your team. I’ve been called “Mr. Negotiator” for many years and it’s to my clients’ advantage. My Investment Banking background makes it a natural for me to deal with lenders for my clients.

Yes, things are somewhat in a flux in Residential real estate, but if you’ve even considered buying or selling during the past year and held back for whatever reason, give me a call and let’s see how we can make that happen.

And, if you’ve got a minute and 20 seconds, I’ve got some more news for you. Simply click on the link below and you will be directed to my personal YouTube channel.

To watch, click here:

In fact, while you’re at it, you might want to subscribe to my channel, so you won’t miss my future broadcasts. It won’t cost you anything…well, it could cost you… if you miss some of my informative musings!

So, as always, if Residential real estate is among your current hopes and dreams, please give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let me help make them come true.

And now for statistics…

SEPTEMBER 2023

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the September 2023 PPAR report.

In El Paso County, the average days on the market for single family/patio homes was 36. For condo/townhomes it was 28.

Also in El Paso County, the sales price/list price for single family/patio homes was 99.2% and for condo/townhomes it was 99.6%.

In Teller County, the average days on the market for single family/patio homes was 43 and the sales/list price was 121.5%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing September 2023 to September 2022 for All Homes in PPAR:

Single Family/Patio Homes:

Condo/Townhomes:

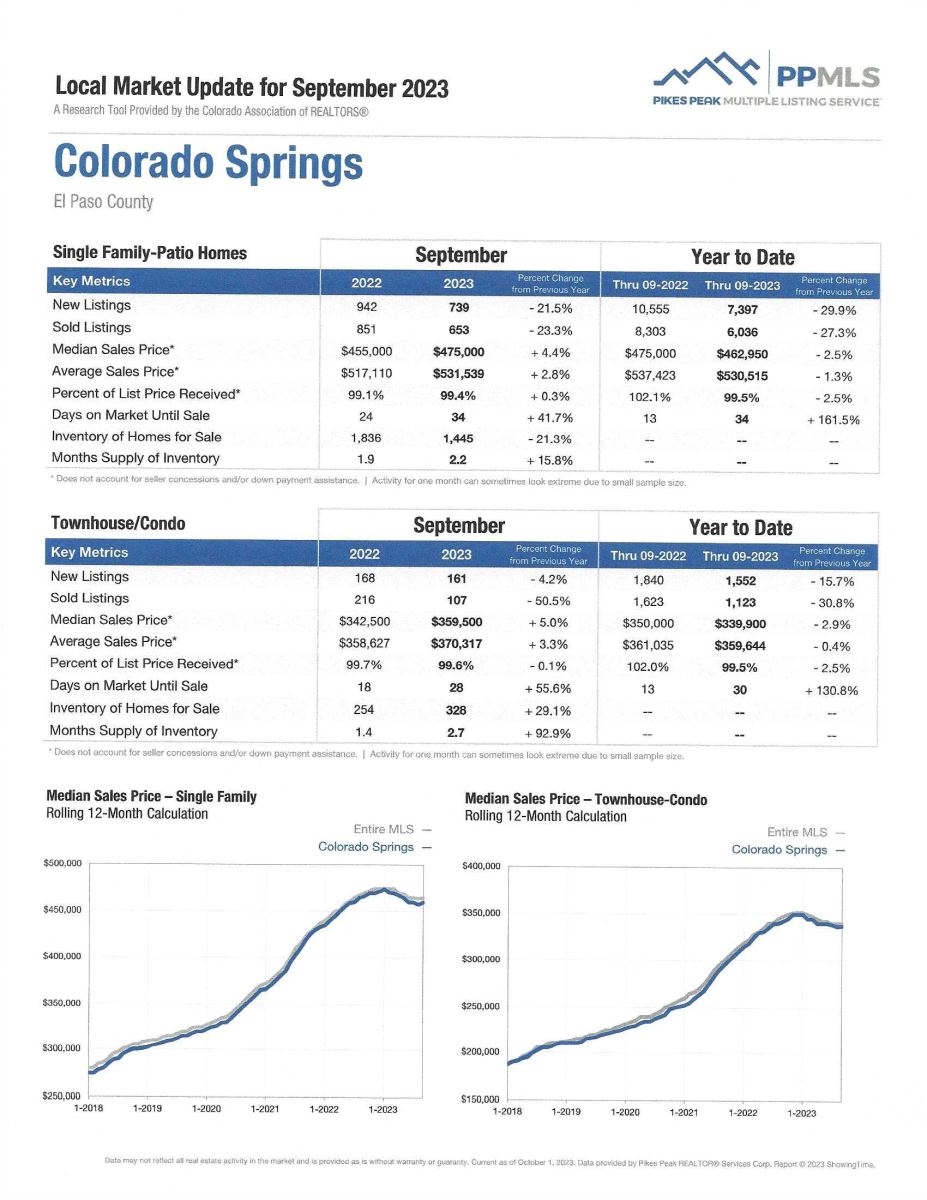

SEPTEMBER 2023 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year-to-Date one-year change:

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering in order to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

HOW HOMEOWNER NET WORTH GROWS WITH TIME…AN INFOGRAPHIC

Keeping Current Matters, 9.6.23

This helps demonstrate what I’ve said throughout my entire Residential real estate Career…owning a home is an important part of increasing one’s net worth!

A couple of highlights:

ECONOMIC & WORKFORCE DEVELOPMENT REPORT

Data-Driven Economic Strategies, September 2023

As always, I like to share the useful economic data I receive from our “local economist”, Tatiana Bailey. You will see in these charts what’s happening locally in terms of the economy as well as the most recent Workforce Progress Report.

This information is especially invaluable to business owners; however, I think you all will all find it worthwhile reading.

To access the report, please click here and if you have any questions, please give me a holler.

UCCS ECONOMIC FORUM MONTHLY DASHBOARD

Updated September 22, 2023, UCCS College of Business/Economic Forum

I’ve always shared the monthly report from the UCCS College of Business Economic Forum when available and I know several of you who enjoy statics use this information in your daily business life.

Now that there is a new director, Dr. Bill Craighead, I should be publishing it monthly once again.

Here is a reproduction of the first page, and to read the report in its entirety, please click here.

September 26, 2023

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

YES, INTEREST RATES ARE STILL HIGH…

…and are likely to stay that way for a while. However, buyer traffic is stronger than normal and it’s also likely to stay that way.

Let’s face it. The historically low interest rates of a few years ago are gone and I seriously doubt we will see them again for a very long time, if ever. So now it’s time to move on and address what’s happening today.

The Fed did not raise rates last week, but they did indicate that could happen this last quarter of 2023. In any case, mortgage rates are still high in comparison to the recent past but are average or even low compared to when I started in Residential real estate back in 1972.

Mortgage rates, which rose last month to a two-decade high above 7%, are one of the main ways that the Fed’s efforts to curb inflation and cool the economy have affected consumers.

But the rates don’t tell the whole story. The BIG story is that home appreciation is on the rise, and it will continue to do so. After declining nationally on a year-over-year basis for five consecutive months—the longest run of declines in 11 years—U.S. home prices rose again in July.

There are still not enough available homes for sale and that shortage is dictating not only prices, but also interest rates. When lenders have a lot of new clients, they can afford to lower their rates. And when there are more homes for sale, prices can be more negotiable. But for the present, that’s not happening, and we end up with higher rates and higher home appreciation.

It’s simple Econ 101. Supply and Demand. And having started my career as an Investment Banker, that’s right up my alley.

That doesn’t make it easier for clients who are looking to buy but where there’s a will…they have me.

My long-time experience in the local market makes me an asset to you when you are looking to buy or sell, even in this unusual market.

If you’ve even been thinking about a move, please give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let’s get together and see how together we take your wants, needs and budget requirements to make your Residential real estate dreams come true.

And…to all my Jewish clients and friends…I’d like to wish you a very happy, healthy, and peaceful New Year

JUST TO ILLUSTRATE THAT PLENTY OF BUYERS ARE STILL ACTIVE TODAY…HERE’S AN INFOGRAPHIC

KeepingCurrentMatters, 9.15.23

Bottom Line:

If you have been holding off selling your home because you believe there are no buyers out there, it’s time to think again.

Data shows that buyers are still active even with the higher interest rates. As I’ve consistently said--there are always those who need or want to sell and those who need or want to buy. This has been true in all my 51 plus years in Residential real estate and is true with my active clients right now.

So don’t delay your plan to sell for fear of no buyers. The opposite is true and buyer traffic is still strong today.

ERA SHIELDS MONTHLY STAT PACK

Data through August 2023, ERA Shields

Here is data from my company’s monthly “Stat Pack” that can better help you understand the local buying and selling reality. I have reproduced the first page and you can click here to get the report in its entirety.

HARRY’S JOKE OF THE DAY:

This came across the tv screen when I was watching the Denver news in Summit County. Not a joke…but something I thought was pretty funny indeed and possibly something to ponder:

September 7, 2023

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

LOTS OF GOOD NEWS TO SHARE…

I’ve had questions about where the Residential real estate market is headed here in Colorado Springs since a number of folks have been concerned about the high interest rates.

Well, I’m here to tell you that despite the highest mortgage rates since 2001, the housing market is in great shape, both here and nationally.

In fact, just this week the 2023 home price forecasts from seven organizations were revised. As you can see in the chart below which provides the original 2023 forecasts that were released in late 2022 for what would happen to home prices by the end of this year, the most recently released forecasts are much more in line with what I predicted for the same period.

In all instances, the original forecasts called for home prices to fall. But when you look at the right column, you can see all the experts have updated their projections for the year-end to show they expect prices to either be flat or have positive growth. That’s a significant change from the original negative numbers.

Most important to note: DO NOT BELIEVE EVERYTHING YOU READ OR HEAR ABOUT RESIDENTIAL real estate. We are approaching the time of year when the market typically slows so if you read that homes are NOT selling as quickly, well—that’s normal. Last year the media said that home prices would fall significantly and that did not happen.

It’s also so important to localize everything—especially Residential real estate. We have a thriving city that will continue to thrive with all the new companies relocating here. If there were more available homes for sale, we would see far greater sales no matter the high mortgage rate.

And speaking of the mortgage rate, that is not a problem either. Rates WILL go down in the next few years and as they do, mortgage loans can be refinanced at those lower rates. In fact, some buyers have that specifically put in their loan package, depending on the lender.

The most important thing to remember is that there are always folks who need to buy and those who need to sell. If you are even considering your options, the time to talk about it is NOW.

So, yes, things are looking up in Residential real estate and if you’ve even considered buying or selling during the past year and held back for whatever reason, give me a call and let’s see how we can make that happen.

And, if you’ve got a minute and a half, I’ve got some more news for you. Simply click on the link below and you will be directed to my personal YouTube channel.

To watch, click here:

In fact, while you’re at it, you might want to subscribe to my channel, so you won’t miss my future broadcasts. It won’t cost you anything…well, it could cost you… if you miss some of my informative musings!

So, as always, if Residential real estate is among your current hopes and dreams, please give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let me help make them come true.

And now for statistics…

AUGUST 2023

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the August 2023 PPAR report.

In El Paso County, the average days on the market for single family/patio homes was 27. For condo/townhomes it was also 27.

Also in El Paso County, the sales price/list price for single family/patio homes was 99.4% and for condo/townhomes it was 99.5%.

In Teller County, the average days on the market for single family/patio homes was 47 and the sales/list price was 103.9%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing August 2023 to August 2022 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 1,407 Down 21.9%

· Number of Sales were 1067, Down 21.9%

· Average Sales Price was $553,959, Up 4.4.0%

· Median Sales Price was $480,000, Down 0.1%

· Total Active Listings are 2,420, Down 8.3%

· Months Supply is 2.3, Up 0.4

Condo/Townhomes:

· New Listings were 230, Down 9.1%

· Number of Sales were 189, Down 12.1%

· Average Sales Price was $361,131, Down 0.1%

· Median Sales Price was $347,500, Down 0.7%

· Total Active Listings are 352, Up 53.7%

· Months Supply is 1.9, Down 4.4

AUGUST 2023 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year-to-Date one-year change:

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering in order to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

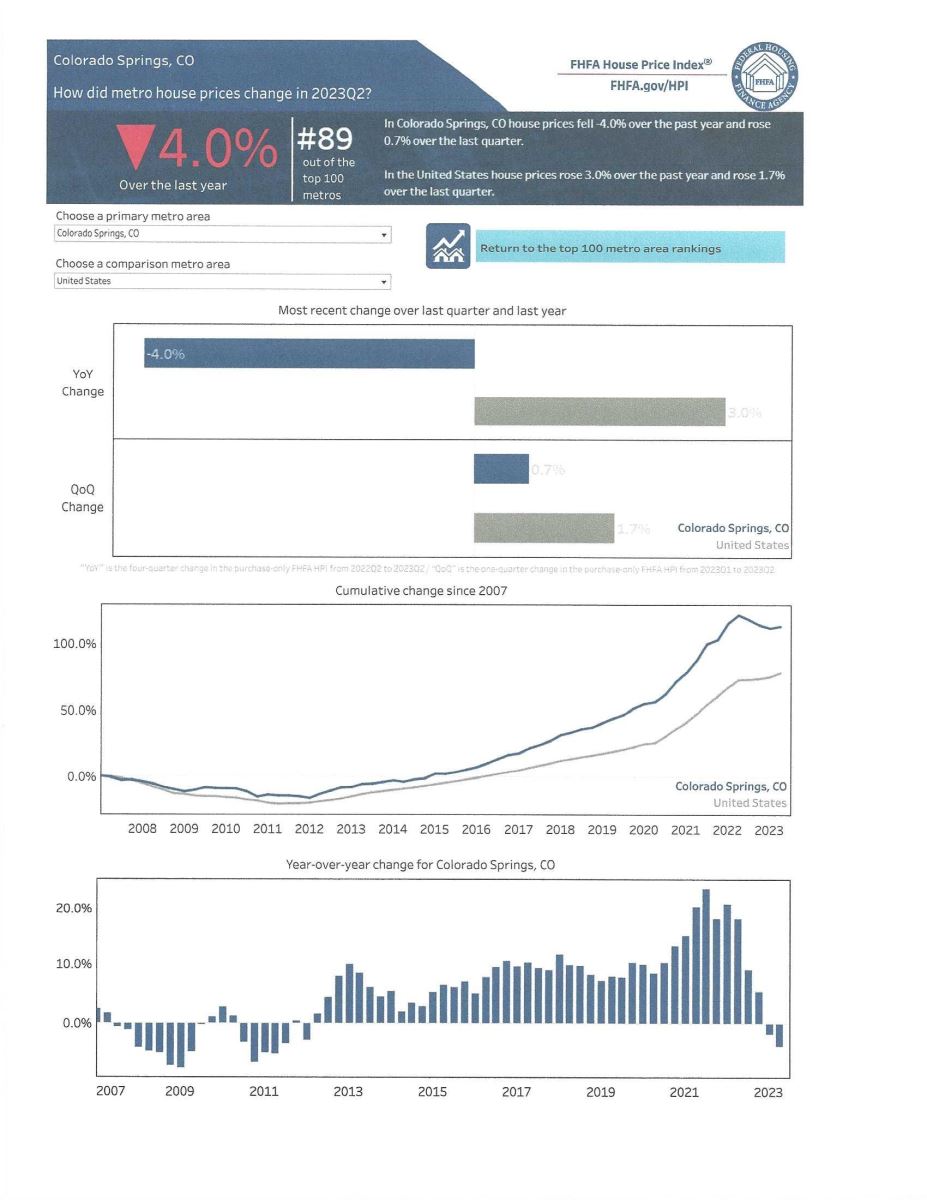

COLORADO SPRINGS RANKS #89 IN THE Q2 FHFA HOUSE PRICE INDEX

Federal Housing Finance Agency, 5.30.23

The recently published FHFA House Price Index for first quarter 2023 lists Colorado Springs as #89 out of the top 100 in house price changes during that quarter.

While we are still in the top 100, we fell 58 places from last year. Our lack of available homes for sale has kept us from ranking considerably higher and I am hopeful that things are beginning to turn around in that area.

It should be noted that we are still ranked higher than Denver! A definite plus and assuredly not lost on companies looking to relocate to Colorado.

Here is a copy of the Colorado Springs changes:

Here is the list of 100 measured cities in ranking order:

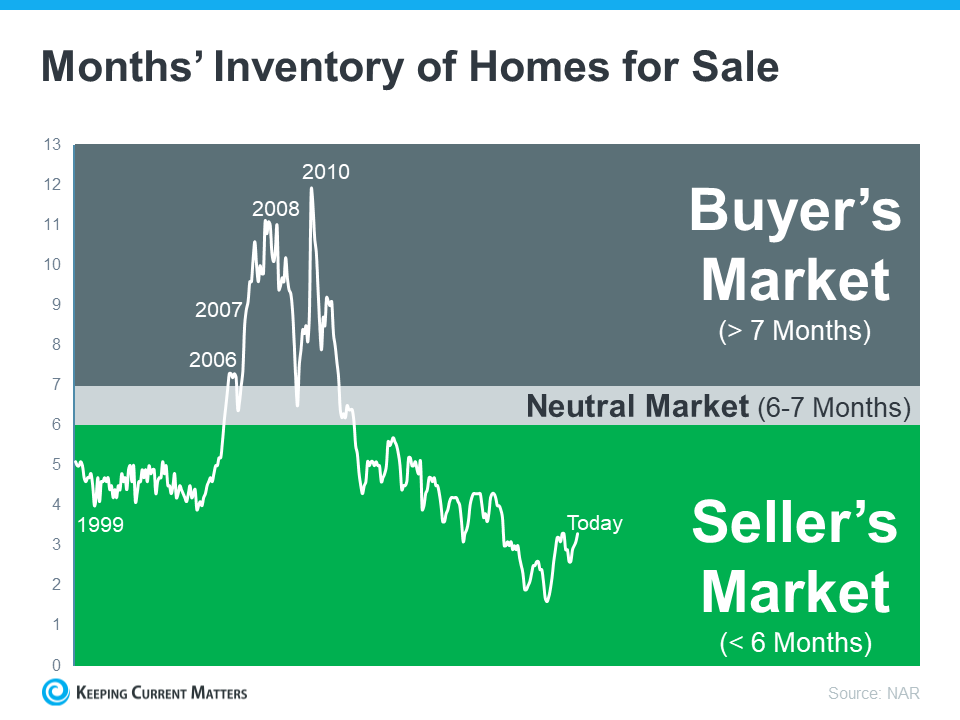

WHY IT’S STILL A SELLER’S MARKET TODAY

Keeping Current Matters, 9.4.23

Even with activity in the housing market slowing from the frenzy of recent years, it’s still a seller’s market due to the historical lack of available homes for sale.

What exactly does that mean and more importantly, what does that mean for you if you want to sell your home today?

The most recent Existing Home Sales Report from the National Association of Realtors (NAR) shows housing supply is still astonishingly low. Housing inventory is measured by the number of available homes on the market. It’s also measured by months’ supply, meaning the number of months it would take to sell all those available homes based on current demand. In a balanced market, there’s usually about a six-month supply. Today, we have only about 3 months’ supply of homes at the current pace. (see graph below):

As the visual shows, given the current inventory of homes for sale nationally, it’s still as seller’s market.

We are nowhere near what’s considered a balanced market today. In fact, the current months’ supply is half of what’s typical of a normal market. That means there just aren’t enough homes to go around based on today’s buyer demand.

According to Lawrence Yun, NAR’s Chief Economist: “There are simply not enough homes for sale. The market can easily absorb a doubling of inventory.”

Attention Sellers:

These conditions give you a real edge. Right now, there are buyers who are ready, willing and able to purchase a home. And due to the shortage of homes for sale, the ones that do hit the market are like magnets for those buyers.

Bottom Line:

If you are wanting to sell and trade up or move to a new neighborhood, today’s market sets you up with a big advantage when you sell your home. Due to the low supply your home will be in the spotlight for motivated buyers who are craving more options.

If this is something you have considered, please give me a call and let’s discuss all your options.

ECONOMIC & WORKFORCE DEVELOPMENT REPORT

Data-Driven Economic Strategies, August 2023

As always, I like to share the useful economic data I receive from our “local economist”, Tatiana Bailey. You will see in these charts what’s happening locally in terms of the economy as well as the most recent Workforce Progress Report.

This information is especially invaluable to business owners; however, I think you all will all find it worthwhile reading.

To access the report, please click here and if you have any questions, please give me a holler.

August 24, 2023

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

YES, MORTGAGE RATES MAY BE RISING, BUT HOMES PRICES ARE TOO…

It’s somewhat of a mixed bag of stories about Residential real estate of late.

Yes, mortgage rates have hit their highest point in 20 years, however, compared to the not so terribly distant past, they aren’t so high.

And what does this mean to you as a potential buyer or seller?

While August was a very slow month nationally and I’m guessing here as well, you would not know it from my recent sales activity. I’ve had a very busy quarter and the inquiries keep on coming.

As I’ve said time and again, all Residential real estate must be looked at on a LOCAL level, and as you are probably aware, Colorado Springs is on a roll in attracting new employers and with them relocated employees who are looking for homes.

Plus, the relatively higher income and education levels of our folks here makes it easier for them to realize that waiting for lower interest rates or lower home prices is not necessarily the smartest move.

While interest rates are considerably higher than they were, with home prices continuing to rise, today’s buyers will be able to refinance when rates go down over the next few years.

With fewer homes for sale at present, listing your home today will afford it greater visibility than when there was a surplus of homes for sale.

It can be a bit complicated, but that’s not a problem for you, because you have me. My long-time experience in the local market, coupled with my Investment Banking background, makes me an asset to you when you are looking to buy or sell, even in this unusual market.

If you’ve even been thinking about a move, please give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let’s get together and see how together we take your wants, needs and budget requirements to make your Residential real estate dreams come true.

HOME PRICES ARE RISING AGAIN

Keeping Current Matters, 8.11.23

Some Highlights:

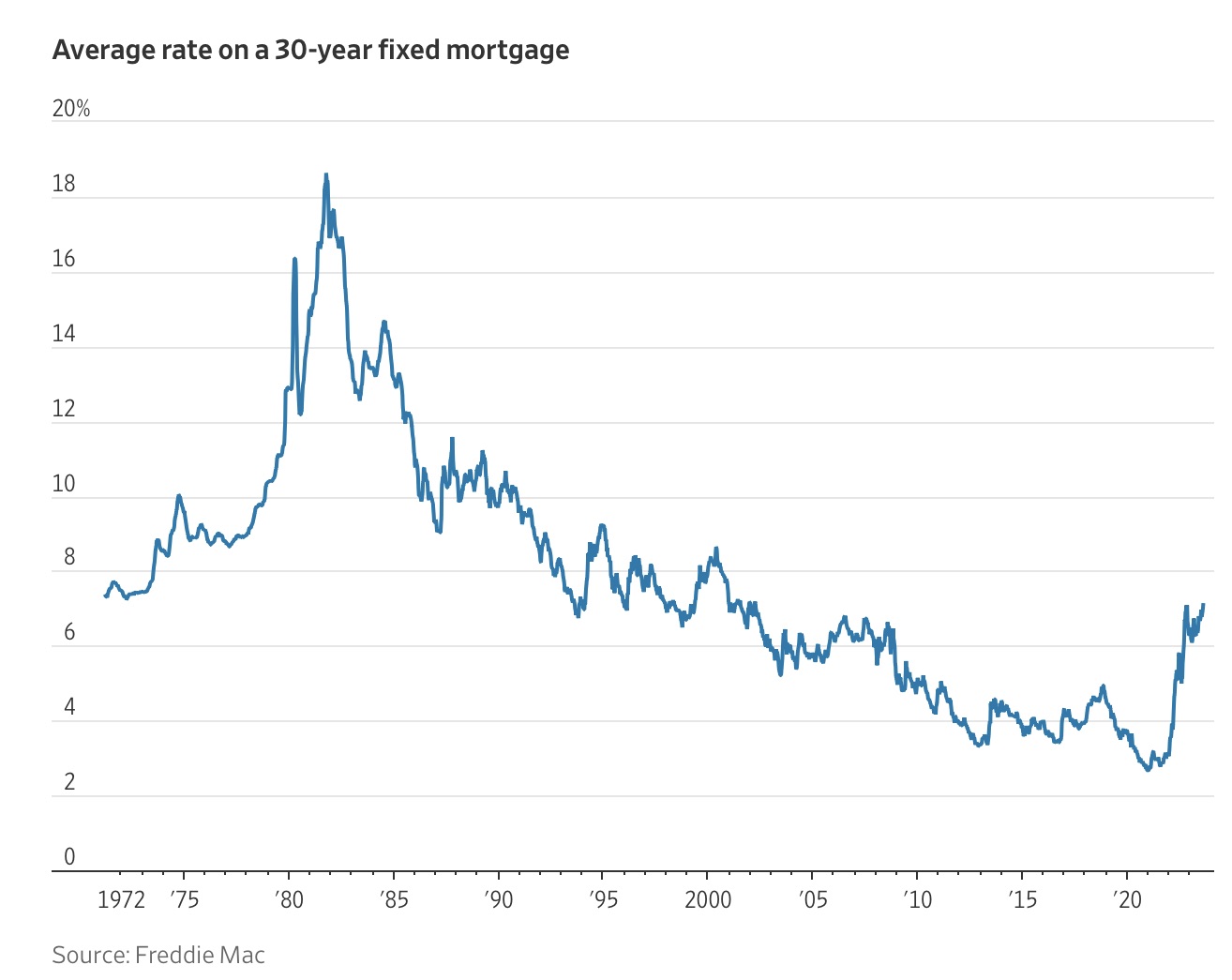

MORTGAGE RATES HIT HIGHEST LEVEL IN MORE THAN 20 YEARS

The Wall Street Journal, 7.19.23

While last week was the first time since last fall that the mortgage interest rate has risen above 7%, it is far below rates that I can still remember and in fact. One of the first homes I purchased was financed with a loan of 8.5%.

Here is a look at the average rate on a 30-year fixed mortgage since 1972:

This news can be disconcerting for some, but as I mentioned earlier, with home prices also starting to rise once again, there are ways to make this market work for you.

It all begins with a call to me, so if you’ve even wondered how this can work give me a holler.

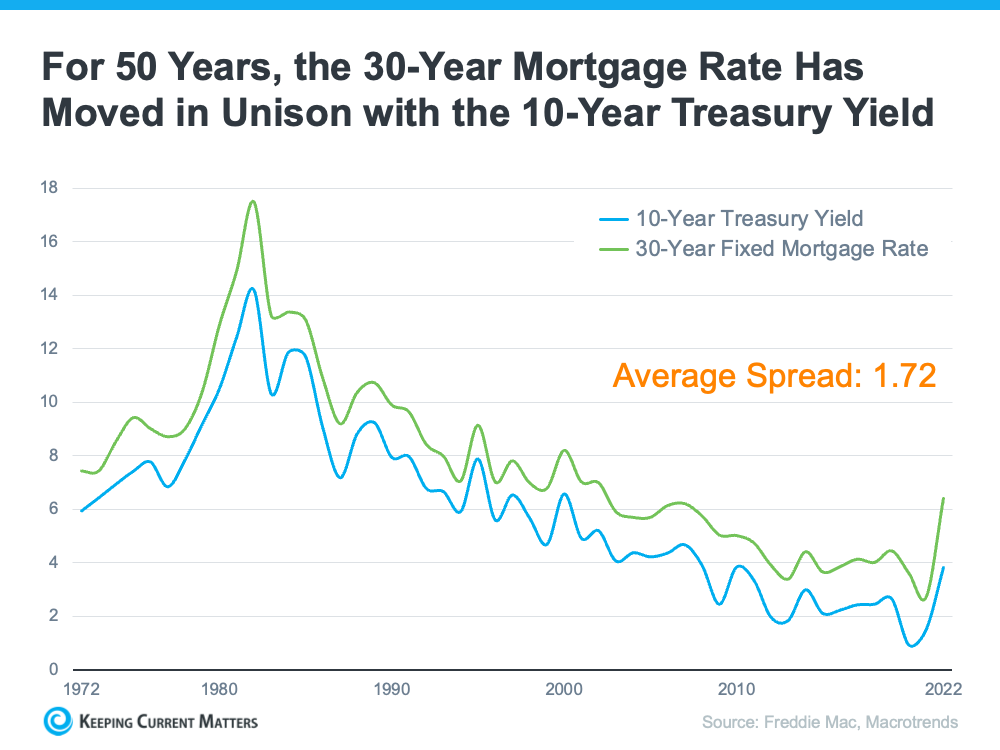

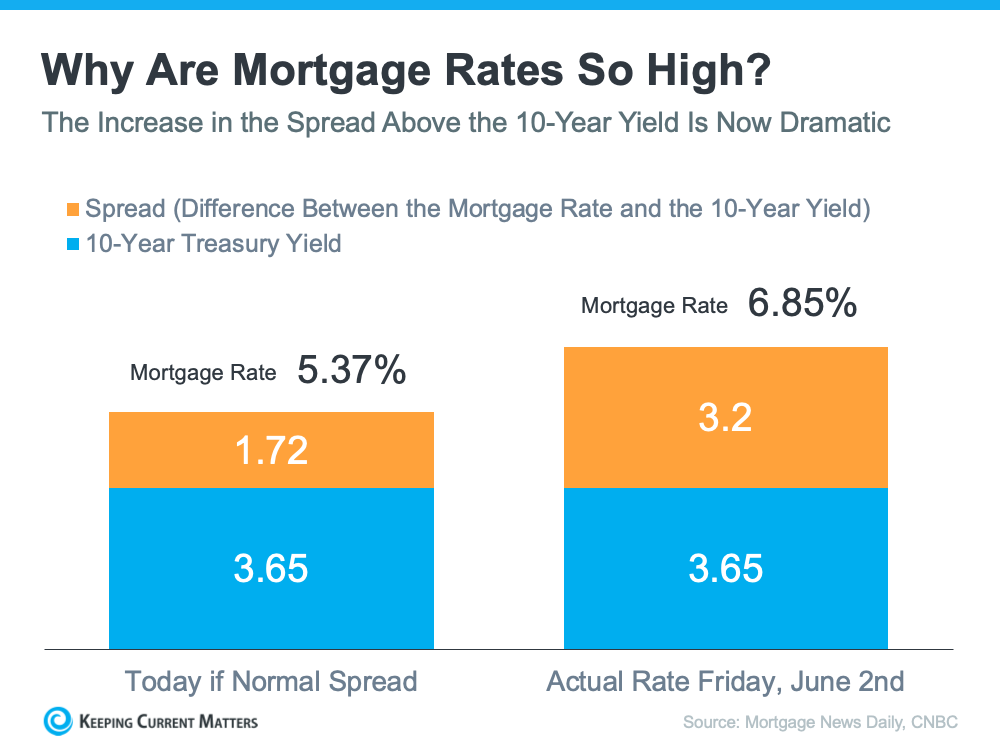

AND THE MAIN REASON MORTGAGE RATES ARE SO HIGH?

Keeping Current Matters, 6.7.23

Since mortgage rates are the biggest concern of most homebuyers at the moment, I thought I’d try to answer some questions I’ve been asked:

Why Are Mortgage Rates So High?

The 30-year fixed-rate mortgage is largely influenced by the supply and demand for mortgage-backed securities (MBS). And according to Investopedia:

“Mortgage-back securities (MBS) are investment products similar to bonds. Each MBS consists of a bundle of home loans and other real estate debt bought from the banks that issue them…The investor who buys a mortgage-backed security is essentially lending money to home buyers.”

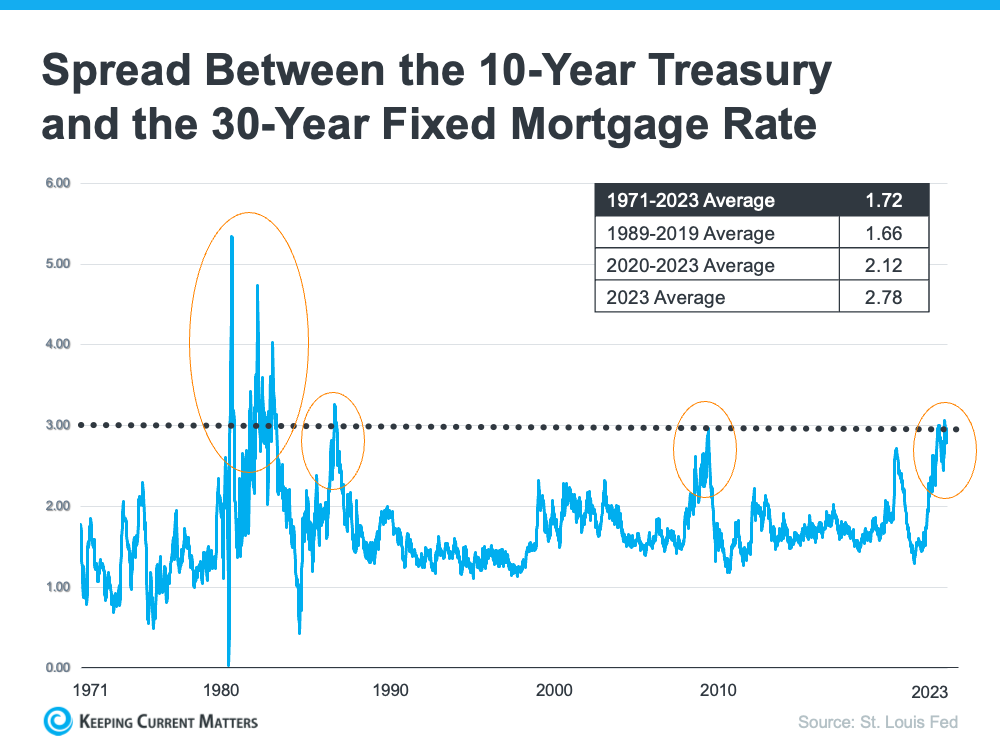

Demand for MBS helps determine the spread between the 10-Year Treasury Yield and the 30-year fixed mortgage rate. Historically, the average spread between the two is 1.72 (see chart below):

In early June of this year the mortgage rate was 6.85%. That means the spread was 3.2% which is almost 1.5% over the norm. If the spread was at its historical average, mortgage rates would have been 5.367% (3.65% 10-Year Treasury Yield + 1.72% spread).

This large spread is unusual. As George Ratiu, Chief Economist at Keeping Current Matters explains:

“The only times the spread approached or exceeded 300 basis points were during periods of high inflation or economic volatility, like those seen in the early 1980’s or the Great Financial Crisis of 2008-09.”

The graph below uses historical data to help illustrate this point by showing the few times the spread has increased to 300 basis points or more:

The graph shows how the spread has come down after each peak. The good news is that means there’s room for mortgage rates to improve today.

So, what’s causing the larger spread and making mortgage rates so high today?

The demand for MBS is heavily influenced by the risks associated with investing in them. Today, that risk is impacted by broader market conditions like inflation and a fear of a potential recession, the Fed’s interest rate hikes to try to bring down inflation, headlines that create unnecessarily negative narratives about home prices, and more.

Simply put—when there’s less risk, demand for MBS is high, so mortgage rates will be lower. On the other hand, if there’s more risk with MBS, demand for MBS will be low, and we’ll see higher mortgage rates as a result. Currently, demand for MBS is low, so mortgage rates are high.

When Will Mortgage Rates Go Back Down?

Odeta Kushi, Deputy Chief Economist at First American, answers that question in a recent blog:

“It’s reasonable to assume that the spread and, therefore mortgage rates will retreat in the second half of the year if the Fed takes its foot off the monetary tightening pedal and provides investors with more certainty. However, it’s unlikely that the spread will return to its historical average of 170 basis points, as some risks are here to stay.”

Bottom Line

The spread will shrink when the fear investors feel is eased. That’ll mean we should see mortgage rates moderate as the year goes on. However, when it comes to forecasting mortgage rates, no one can know for sure exactly what will happen.

And all of that said…I’m sure I lost some of you a few paragraphs back. To me, with my Investment Banking background, it’s second nature, but I do understand that it’s tough to put it in layman’s terms. If you have any questions, you know where to find me.

ERA SHIELDS MONTHLY STAT PACK

Data through July 2023, ERA Shields

Here is data from my company’s monthly “Stat Pack” that can better help you understand the local buying and selling reality. I have reproduced the first page and you can click here to get the report in its entirety.

SAVE THE DATE FOR THE 27TH ANNUAL UCCS ECONOMIC FORUM…

This is an always worthwhile event and registration is FREE. You can scan the above QR code for registration and more information.

Displaying blog entries 51-60 of 496

Be the first to know what's coming up for sale in the Colorado Springs real estate market with our New Property Listing Alerts!

Just tell us what you're looking for and we'll email a daily update of all homes listed for sale since your last update. You can unsubscribe at any time.

Get NotificationsOur office is located at:

6385 Corporate Drive, Suite 301

Colorado Springs, CO 80919

Office: 719.593.1000

Cell: 719.231.1285

Harry@HarrySalzman.com