HARRY'S BI-WEEKLY UPDATE 1.9.2023

January 9, 2023

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

HAPPY NEW YEAR….AND WELCOME TO 2023

Just as I began my January 2022 eNewsletter by saying “As we bid adieu to another unprecedented year, here’s wishing you a very Happy, Healthy New Year”, I again wish you the same. The “unprecedented” year I referred to in 2021, continued in 2022, but for quite different reasons.

Many of those reasons this past year had to do with the unprecedented doubling of the mortgage interest rates. I have never seen anything quite like that and hope we don’t experience a rise in rates that fast again. Was it just two years ago that my “2020” vision predicted that interest rates appeared likely to remain low for the foreseeable future”? Who knew how short that “future” would be?

And then last year at this time I had predicted that the Federal Reserve would raise rates as soon as April and sure enough they did. What I didn’t expect was the rates to almost double from 3 ½ % in June to 7% in December. As you are aware, this slowed down the then prevalent Seller’s market fast and along with it the quick sales with bidding wars and offers over list price.

This hurt first-time buyers as well as those who could not qualify for the higher rates more than ever. And at the same time, the rental market was flooded with those folks. Fortunately for them, rental rates did not keep up their rapid increase, but it did provide those looking for investment properties a better market from which to choose.

My predictions for 2023 include the expectation that things will slow down in terms of time. It will take a bit longer to sell, and pricing adjustments will be necessary, but home values will still rise by 3% to 5%. Nothing is “black and white” anymore and anything is negotiable.

I also believe:

- Seasonal fluctuations such as “spring buying” will return, rather than the recent steady year-round demand we’ve seen, and year-end sales will slow down.

- Interest rates above 5 percent will become the norm. I expect by the end of 2023 that rates will level off at about 5 ½ percent to 5 ¾ percent.

- Assumable loans might become more popular and Buyers assuming a VA or FHA loan are going to be a big trend for the next decade. That process can take longer but can save the Buyer a lot of money in the end.

- The market will be more balanced. Although inventory will remain low, interest rates and inflation will put the ball back in the Buyer’s court when it comes to closing cost help, inspections, repair negotiations and offers below initial asking price.

- Homes will continue to appreciate as they have in the past, although not as rapidly. As I’ve said time and again, you can’t only look at the last quarter or even the last couple of years. real estate is a long-term investment. When you look at the value of home ownership compared to other investments, it’s still going to be extremely positive.

- For most, your home will likely continue to be your largest and fastest growing investment.

I have always said that no one can every expect to buy at the lowest price point, nor sell at the highest. It just isn’t possible and most anyone who thinks they can will likely lose in the long run.

Yes, prices are holding steady, but those who are waiting for them to drop lower before they buy will likely be in for a very long wait.

Lawrence Yun, Chief Economist of the National Association of REALTORS (NAR), expects home prices to hold steady throughout most of 2023 because of the low inventory in most areas. Colorado Springs is most definitely one of those areas as you will see in the statistics below.

Yun still does not foresee a housing market crash like that in 2008 because conditions are fundamentally different. He expects the national median home price to increase by about 1 percent while home sales will decline about 7 percent, but he also predicts that the market will rebound strongly in 2024.

“The market will see a 10 percent increase in sales and a 5 percent increase in the national median home price next year”, he said.

Tatiana Bailey, Executive Director of Data Driven Economic Strategies, and our “local” economist, has said that the high credit card usage, paired with the lower money in savings accounts show that folks are doing whatever they can to offset inflation.

“So, we better get inflation down”, she said, “but if you’re making it more difficult for people to borrow money, then is the medicine really helping? My personal view is that the Federal Reserve had to raise interest rates, but I think they should have done it more slowly.”

I could not agree with her more, but what’s done is done and now we have to hope that the Federal Reserve will start lowering rates, a quarter percent by each calendar quarter, in order to get mortgage interest rates, among others, more affordable for most.

We have had to play with the cards dealt by the Fed for the last six months or so and while it’s been challenging for both Buyers and Sellers, I do believe things will begin to improve just in time for the “spring buying season”.

Markets such as Colorado Springs that were so popular when the pandemic hit and working from home became a “thing”, are seeing folks continuing to relocate there. IT company Zivaro and manufacturer Entegris, which makes products for the semiconductor industry, have announced expansions into Colorado Springs and will create up to 1,000 new, well-paying jobs in our community in about mid-2024.

Along with these companies and others will be relocated employees looking for housing and this will help drive up our local sales and prices. It will also put additional pressure on local folks who are looking to move or trade up and that will be true until there are more available homes for sale and more newly constructed ones as well.

According to the 2023 forecast of Knock Buyer-Seller Index, there is a great divide between the best markets for Buyers vs. Sellers. The pandemic markets have become the 2023 top Buyers’ markets, moving at a faster pace than the rest of the nation on average.

Colorado Springs is Number Two in the top five Buyers’ metros for 2023, just behind the Phoenix-Mesa-Chandler, AZ markets.

And, according to the Index, “although these markets will see median home price growth moderate and even decline from their pandemic peaks in 2023, prices are forecast to end the year 38% above pre-pandemic levels, 3% higher than the national average change.”

For Colorado Springs, the Index said:

- November 2022 median home price: $425,000

- Forecasted 2023 home price change: +1.2%

- Forecasted 2023 home sales change: -18.3%

- Forecasted 2023 month’s supply: 4.2 months

- Forecasted sales-to-list-price ratio: 97%

The Index went on to say:

“Colorado Springs was viewed as an affordable alternative to high-priced West Coast metros and even neighboring Denver, where the median home price is 38% higher. Located at the foot of Pikes Peak, Colorado Springs is known for its great weather, with over 300 days of sunshine a year, walkable neighborhoods, easy access to the outdoors, and a vibrant downtown.”

I could not have said it much better. In fact, those are just some of the many reasons that I have mentioned to those I have helped relocate here over the last 50 plus years.

And, while it may be more difficult today, it’s still possible for you to find what you need, want, and can afford in a home.

That’s where I come into the picture. The current market is not for the timid or inexperienced. It takes a lot of advanced planning.

My almost 51 years in the local residential real estate arena, coupled with my investment banking background, give me an edge that my clients have found to be crucial in helping them and their families realize their personal real estate visions.

A new year brings with it a lot of new hopes and dreams. If Residential real estate is among your hopes and dreams for 2023, please give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let me help make them come true.

And now for statistics…

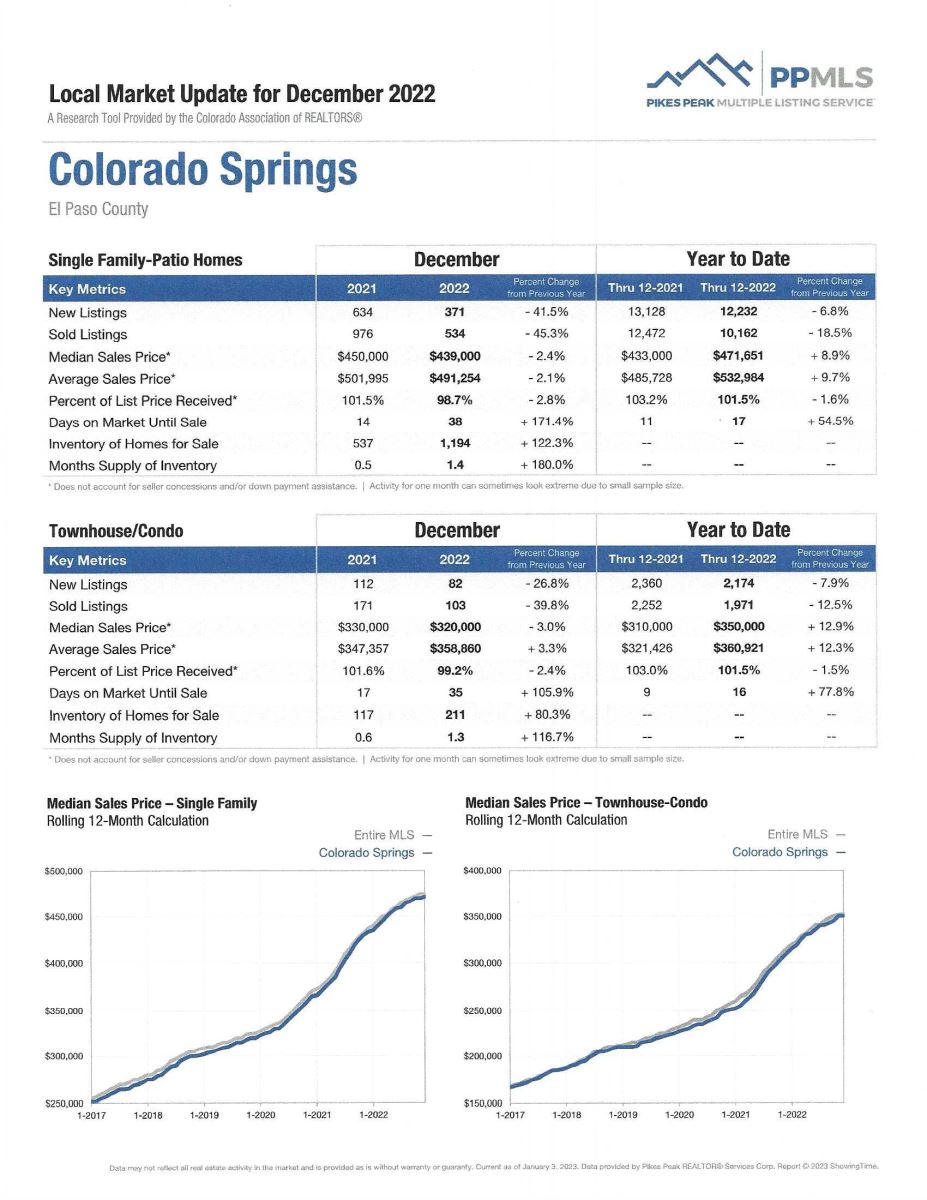

DECEMBER 2022

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the December 2022 PPAR report.

In El Paso County, the average days on the market for single family/patio homes was a 40. For condo/townhomes it was 34.

Also in El Paso County, the sales price/list price for single family/patio homes was 98.8% and for condo/townhomes it was also 99.2%.

In Teller County, the average days on the market for single family/patio homes was 56 and the sales/list price was 97.7%.

Since these are year-end statistics, I am providing you with both the regularly posted year-over-year monthly stats as well as the cumulative year-to-date comparison of 2022 to 2021.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing December 2022 to December 2021 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 659, Down 33.8%

· Number of Sales were 851, Down 41.0%

· Average Sales Price was $490,910, Down 3.0%

· Median Sales Price was $441,000, Down 2.0%

· Total Active Listings are 1,909, Up 189.7%

· Months Supply is 2.2, Down 4.6%

Condo/Townhomes:

· New Listings were 116, Down 17.1%

· Number of Sales were 125, Down 42.9%

· Average Sales Price was $368,781, Up 4.8%

· Median Sales Price was $320,000, Down 4.5%

· Total Active Listings are 244, Up 174.2%

· Months Supply is 2.0, Down 4.1%

The Cumulative YTD Summary: (comparing Jan-Dec 2022 to Jan-Dec 2021)

Single Family/Patio Homes:

- New Listings were 19,180, Down 2.4%

- Sales were 15,259, Down 16.0%

- Average Sales Price was $535,404, Up 8.9%

- Volume was $8,169,729,636, Down 8.5%

Condo/Townhomes:

- New Listings were 2,595, Down 7.2%

- Sales were 2,305, Down 14.2%

- Average Sales Price was $368,323, Up 12.5%

- Volume was $848,984,515, Down 3.5%

And FYI…

While the average sales price for single family/patio homes was down 3% in comparing December 2022 to December 2021, when looking at the cumulative year-to-date summary for January to December 2022, the average sales price for single family/patio homes was UP 8.9%.

Now a look at more statistics…

DECEMBER 2022 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year to Date one-year change:

- Sold Listings for All Properties were Down 41.6%

- Median Sales Price for All Properties was Down 1.7%

- Active Listings on All Properties were Up 111.5%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering in order to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

INFOGRAPHIC: TIPS TO REACH YOUR HOME BUYING GOALS IN 2023

Keeping Current Matters, 1.6.2023