HARRY'S BI-WEEKLY UPDATE 2.8.22

February 8, 2022

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Personal Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

AND SO IT GOES…

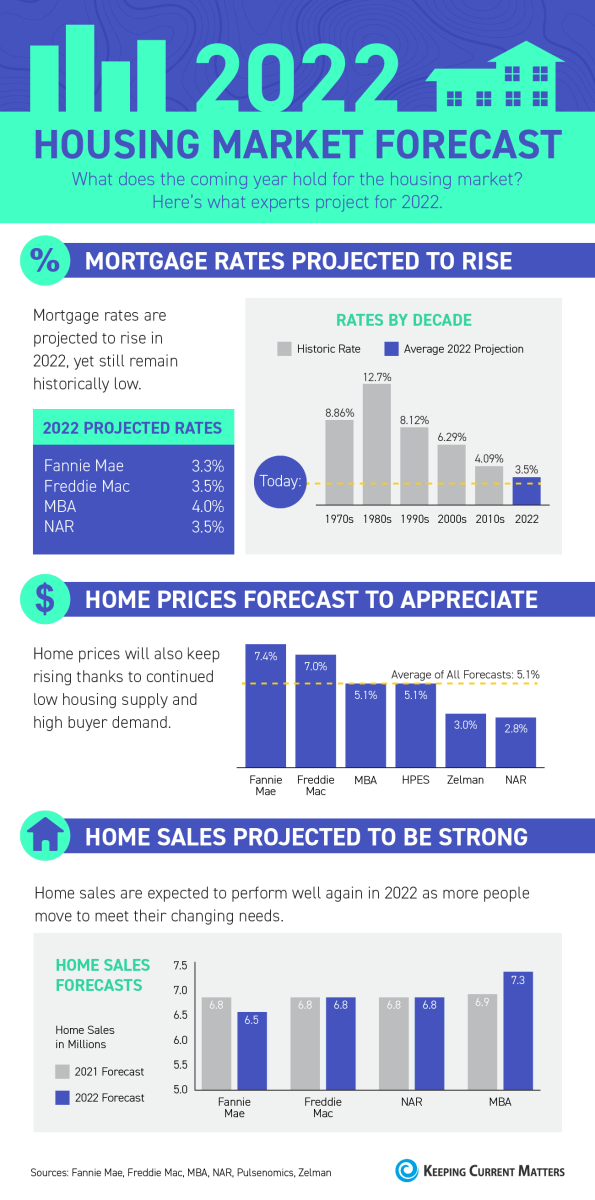

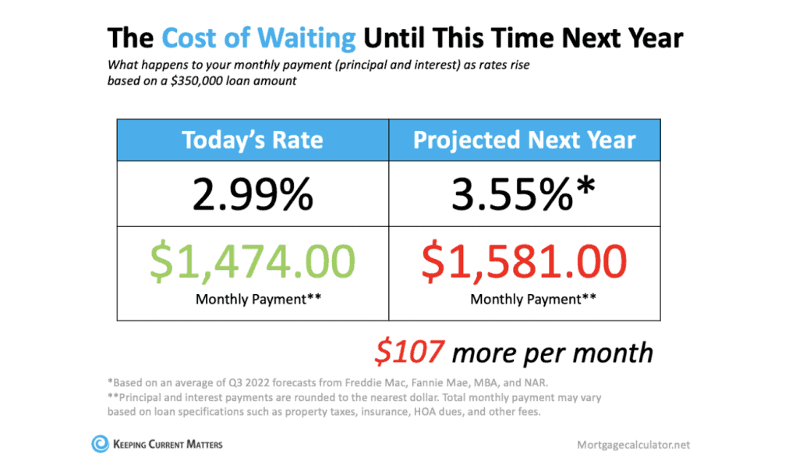

As we wave goodbye to January 2022, with it we begin our goodbye to the historically low interest rates of recent times. While today’s rates are certainly much lower than the 12-15% APRs of the 1980’s, they are inching up and each increase has the possibility of increasing the monthly output for mortgage loans.

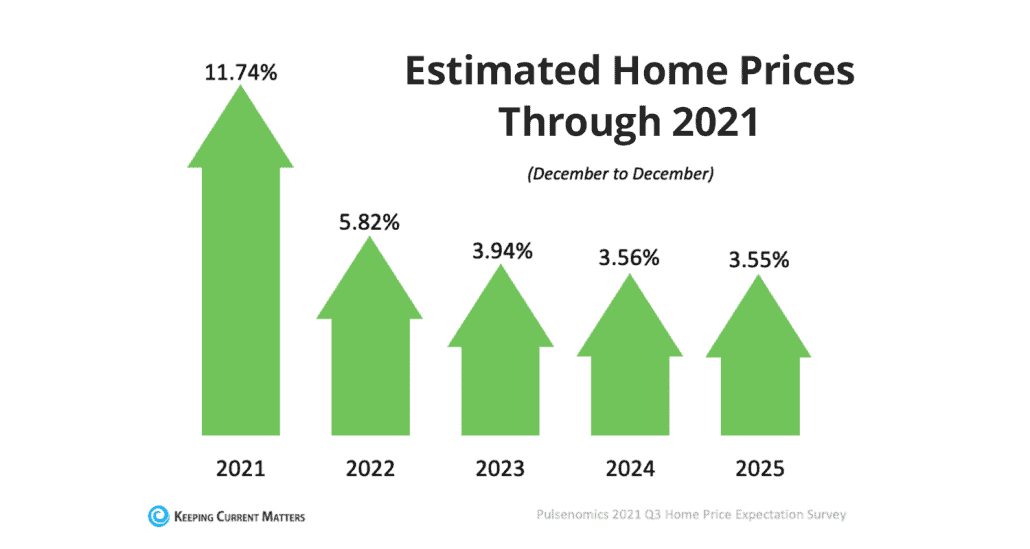

The good news is that while home appreciation is still high, it is finally starting to normalize a bit, and should be right around the 12-14% increase I have predicted for 2022.

Let’s talk for a minute how this can affect you. For those looking to sell, either to trade up or move to a new neighborhood or another state to be closer to family, the equity in your present home is likely higher than you might think. This is going to give you a greater down payment, so despite the rising mortgage rates and the higher price you will pay for your next home, it’s possible you can keep your monthly payment close to what you currently pay.

I’ve been getting calls from folks who are worried they have missed out on the recent boom, but I have assured them, and can assure you, that the time to buy or sell a home is when YOU are ready. Is the present time good for buying and selling? You bet it is. But, if it’s not right for YOU, then it’s not a good time.

If you’ve been thinking of a move, the best thing you can do is meet with a seasoned real estate professional like me to discuss all the issues involved so that when you decide it’s right, then you can pounce.

Today’s market is unlike any I’ve seen in my almost 50 years in the local Residential real estate arena, and it takes a lot of planning, perseverance, and professional help to guide you in the right direction. Those “Three P’s”, along with my superb negotiation skills, make all the difference to a successful and hopefully less stressful moving experience.

As I mentioned in the last eNewsletter, Colorado Springs has a record low number of existing homes for sale, thus continuing the Seller’s Market that we’ve been experiencing for quite some time now. There are a number of reasons for this, among them the new wants and needs made evident from the pandemic and work-from-home status of many. The low interest rates have given renters an impetus to move to homeownership, and Colorado Springs is seeing new businesses relocating here and with them come employees looking for a place to live. When you add them up, bingo—not a lot of homes left for sale.

New home construction is ramping up as fast as possible but shortages of materials such as lumber, concrete, aluminum, and more are not only holding up building, but adding to the cost of these homes as well.

I even have investor clients who have gone the new construction route as it has provided them with the opportunity for longer term renters and less home repairs than that of older homes.

If new construction is something you have considered, I’m your guy for that as well. I have l long time working relationships with a number of local builders and I can help you with site and home selection as well as assist you in securing the best mortgage for your individual situation. Did I mention this comes at no additional cost to you? It’s certainly an offer you won’t want to pass on if new construction is in your future.

As most of you know, I’ve been a relocation specialist for many, many years and while I have a number of clients who move for career purposes, I’ve recently had some moving to be closer to family or to a warmer climate as they retire. I have a network of realtors that I’ve known for years who I can refer to you if moving out of state is in your future. That helps take off some pressure when you get ready to make that move.

The gist of this column is…. I know how things can get a bit overwhelming in the current residential real estate market and that’s why you have me. I’ve seen it all and can help you navigate the current buying and selling wars. That’s my commitment to each and every client. Your goals are mine and I take that personally. It’s one of the reasons I’m still here enjoying the challenge, and why I am so fortunate to find myself working with children and grandchildren of past and present clients.

If Residential real estate is among your hopes and dreams for 2022, please give me a call at 593.1000 or email me at Harry@HarrySalzman.com and let me help make them come true.

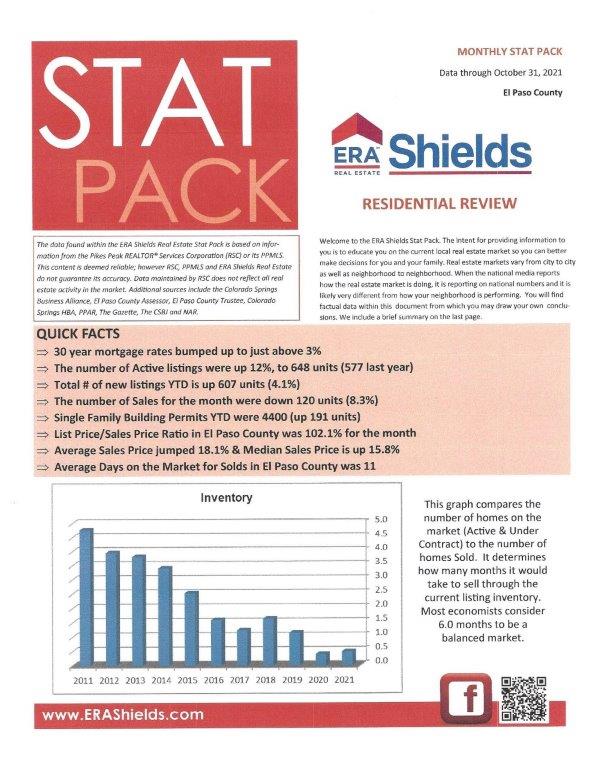

And now for statistics…

JANUARY 2022

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

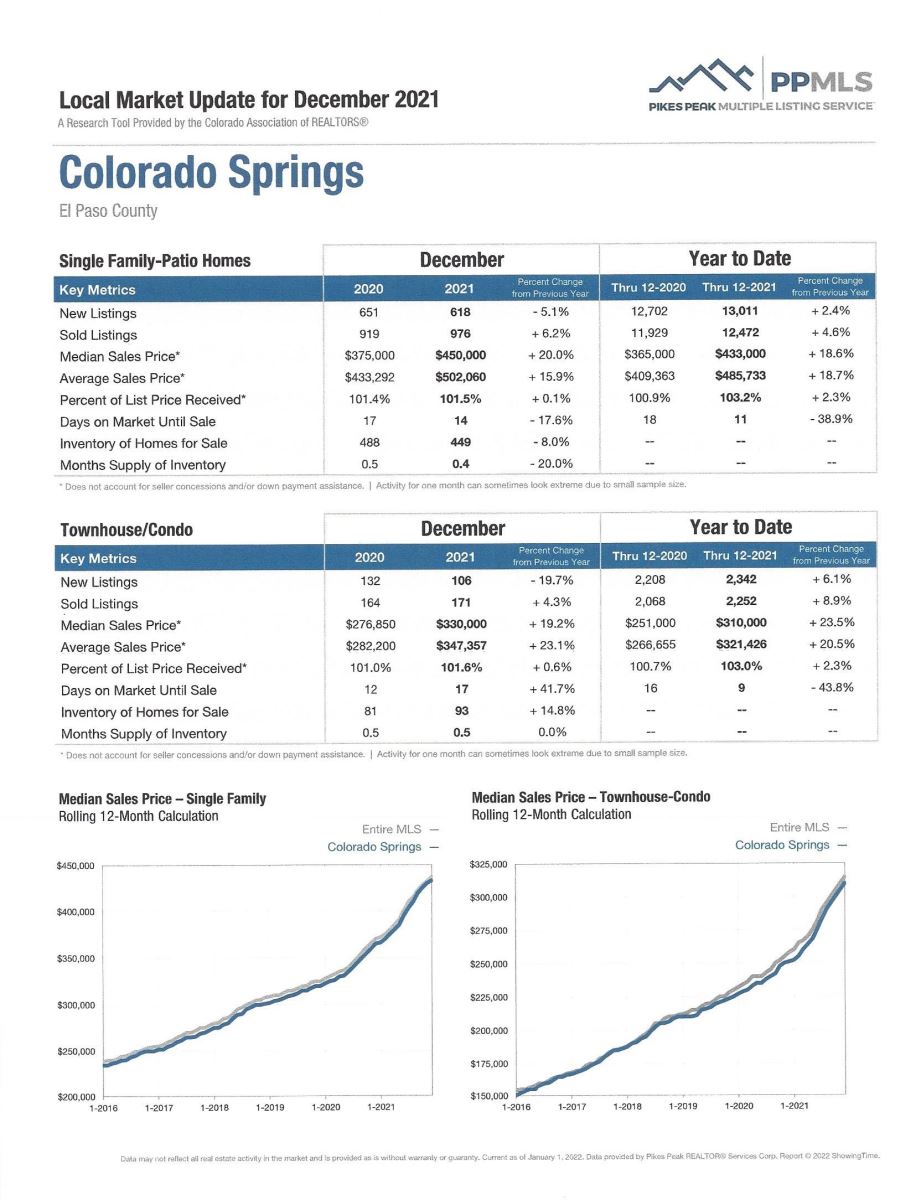

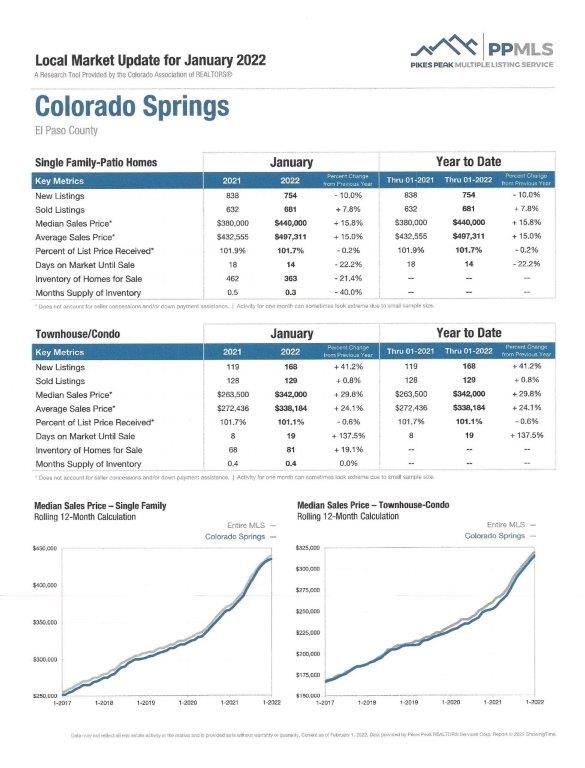

Here are some highlights from the January 2022 PPAR report. Remember that the new format of this report no longer provides monthly statistics for each individual neighborhood. However, if you are interested in what’s happening in your neighborhood, I can provide you with this information through other means.

In El Paso County, the average days on the market for single family/patio homes was a low 14. For condo/townhomes it was 17.

Also in El Paso County, the sales price/list price for single family/patio homes was 101.6% and for condo/townhomes it was also 101.1%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing January 2022 to January 2021 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 1,180, Up 6.1%

· Number of Sales were 1,058 Up 9.0%

· Average Sales Price was $494,954, Up 14.2%

· Median Sales Price was $445,000, Up 15.6%

· Total Active Listings are 549, Up 19.3%

· Months Supply is 0.5, Up 2.2%

Condo/Townhomes:

· New Listings were 205, Up 28.1%

· Number of Sales were 158, Up 1.9%

· Average Sales Price was $342,524, Up 19.9%

· Median Sales Price was $345,000, Up 23.5%

· Total Active Listings are 79, Up 23.4%

· Months Supply is 0.5, Down 12.1%

Now a look at more statistics…

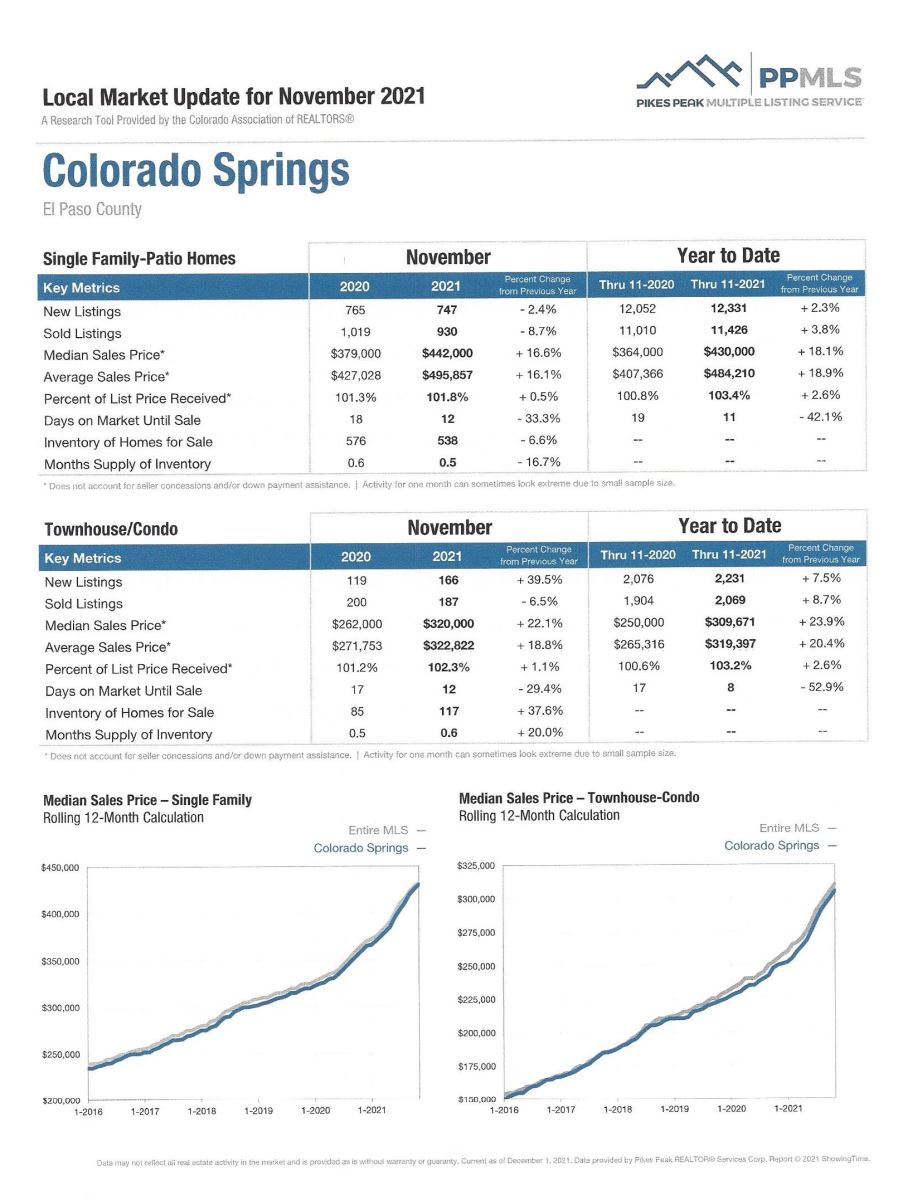

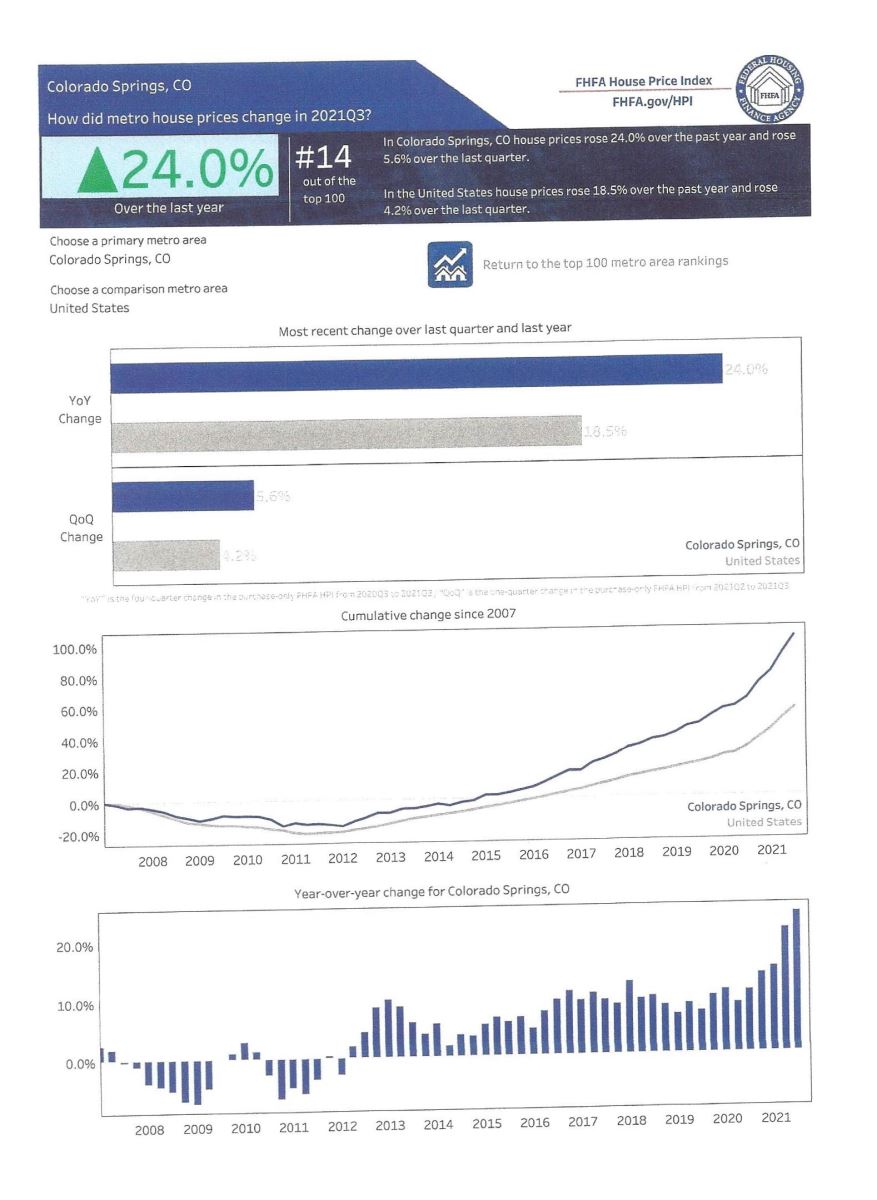

JANUARY 2022 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year to Date one-year change:

- Sold Listings for All Properties were Up 4.9%

- Median Sales Price for All Properties was Up 17.6%

- Active Listings on All Properties were Down 12.7%

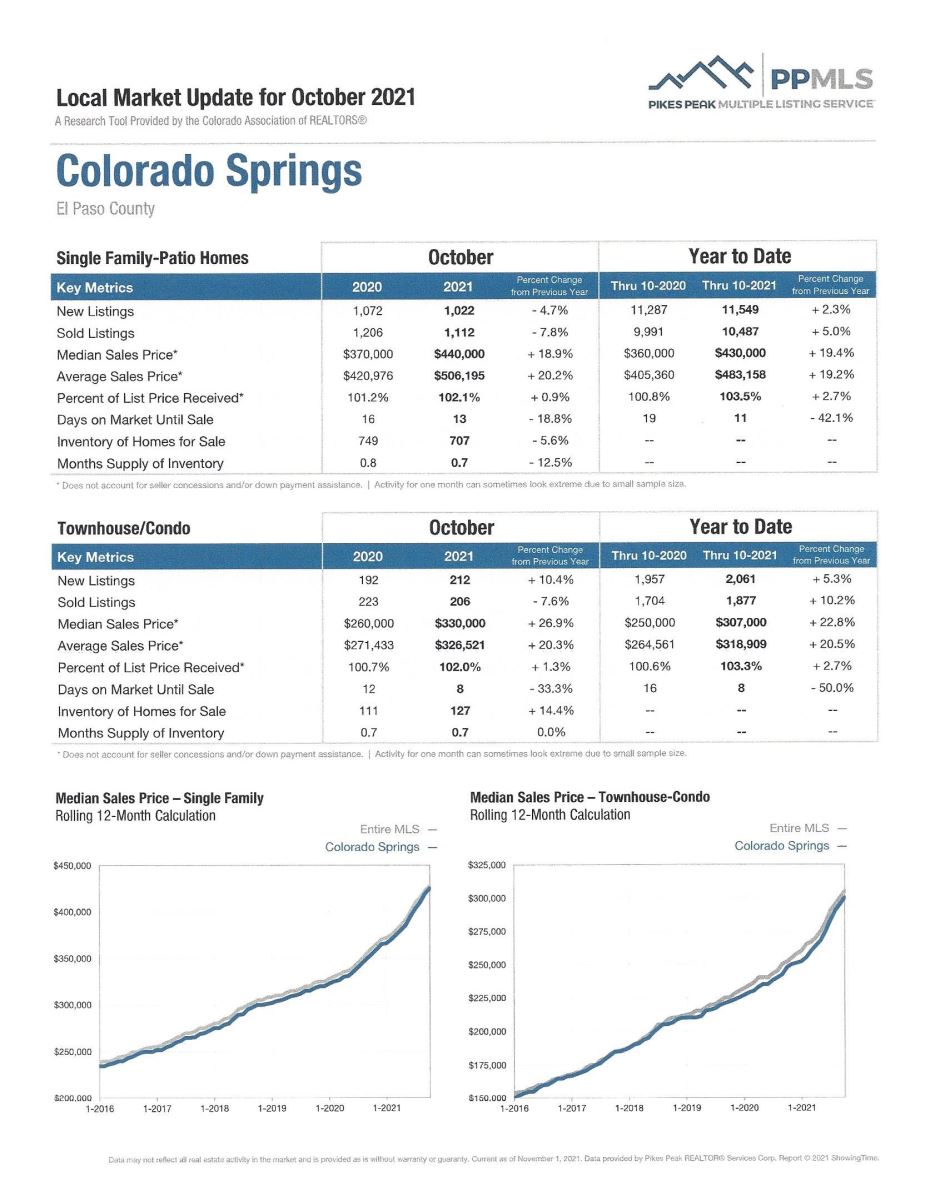

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering in order to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

CONGRATS TO ME…

As we went to press, I received notification from ERA real estate that I have again qualified for “Circle of Achievement” recognition, a top honor at our national company. Just another notch in my almost 50-year-old belt of real estate accolades, but I never take any of them for granted.

I don’t work for the rewards…I work for YOU, but I will admit that it is nice to be recognized from time to time.

When you see the banner below you will know what it stands for:

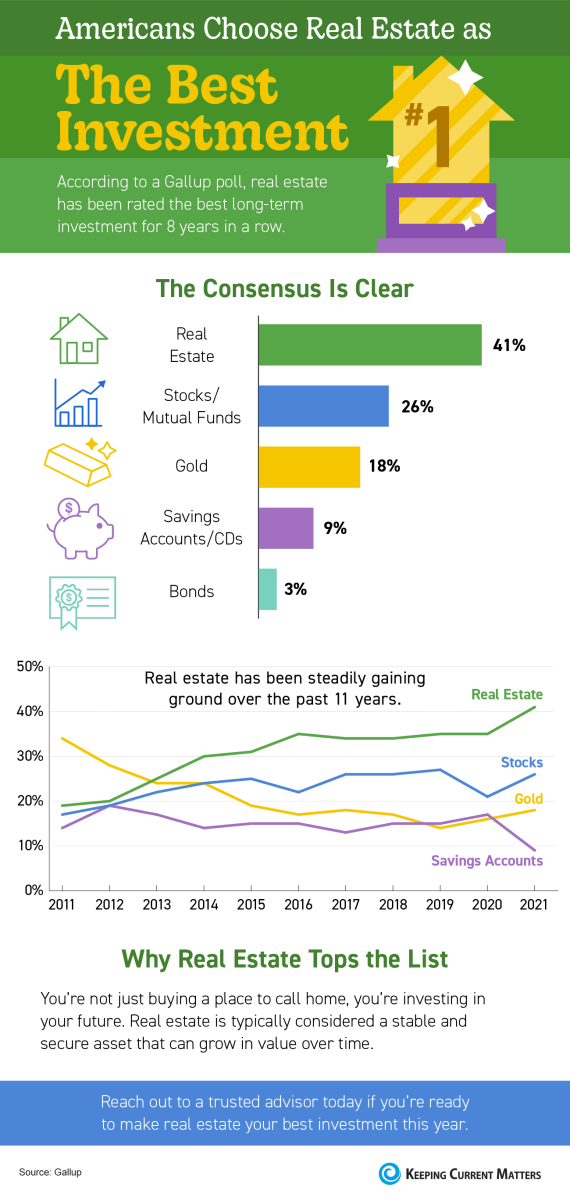

WHY NOW IS A ONCE-IN-A-LIFETIME OPPORTUNITY FOR SELLERS

KeepingCurrentMatters, 1.27.22

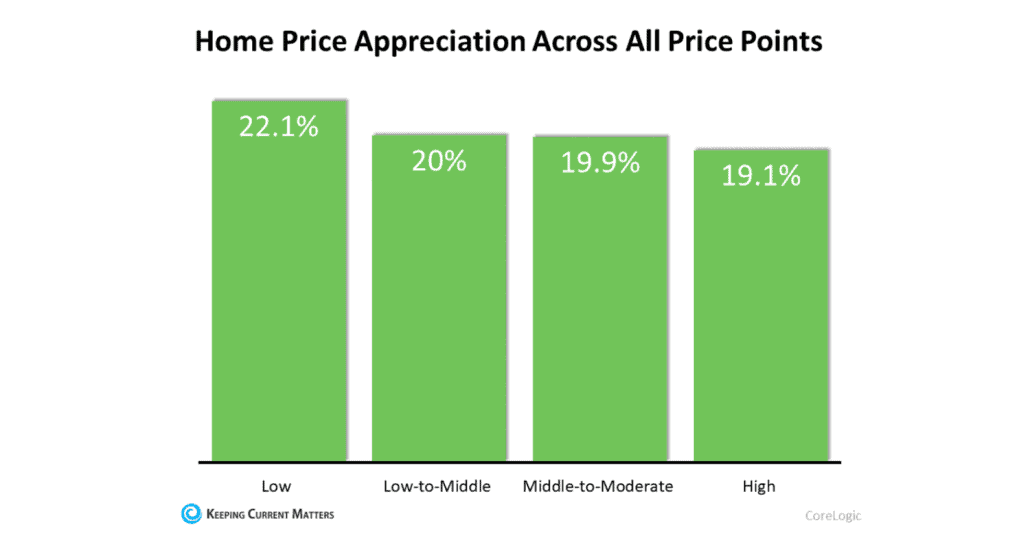

If you’ve considered selling your home this year, you truly have a once-in-a-lifetime opportunity. Whenever you chose to sell anything, you always hope for strong demand coupled with a limited supply to get your maximum leverage when negotiating the sale.

Home sellers are in the position at this very moment and here’s why:

Demand Is Very Strong

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), 6.18 million homes were sold in 2021. This was the largest number of home sales in 15 years. Lawrence Yun, chief economist for NAR explains:

“Sales for the entire year finished strong, reaching the highest annual level since 2006…With mortgage rates expected to rise in 2022, it’s likely that a portion of December buyers were intent on avoiding the inevitable rate increases.”

Demand isn’t expected to weaken this year, either. As a matter of fact, the Mortgage Finance Forecast, published several weeks ago by the Mortgage Bankers Association (MBA) calls for existing-home sales to reach 6.4 million homes this year.

Supply Is Very Limited

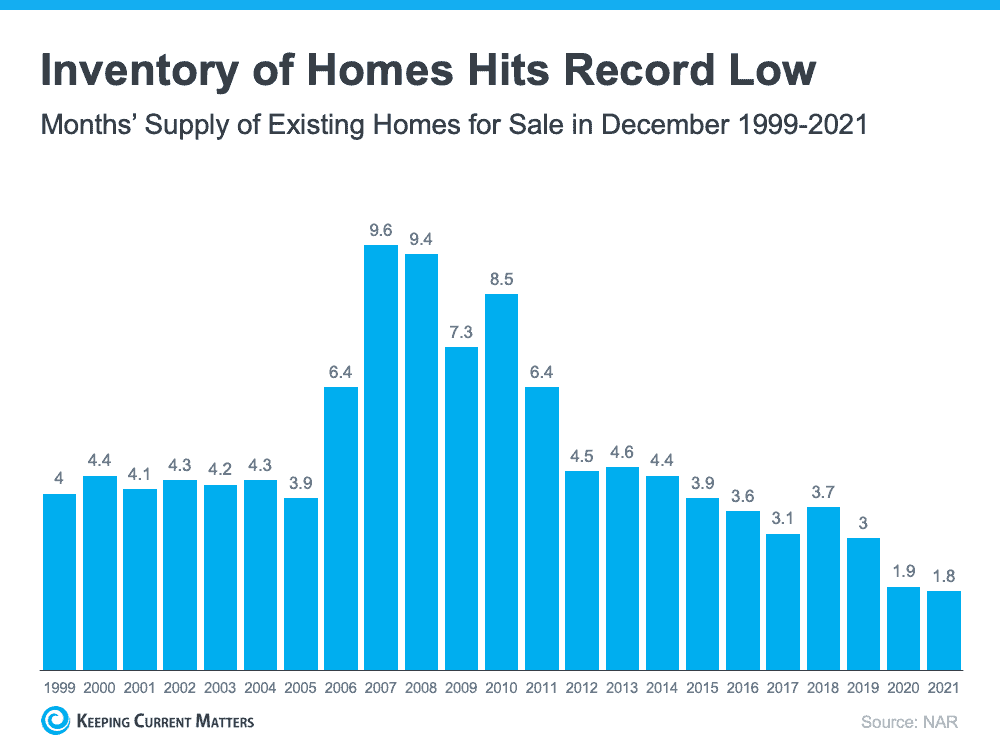

In the same report from NAR, it reveals that that months’ supply of inventory just hit the lowest number of the century. It states:

“Total housing inventory at the end of December amounted to 910,000 units, down 18% from November and down 14.2% from one year ago (1.06 million). Unsold inventory sits at a 1.8-month supply at the present sales pace, down from 2.1 months in November and from 1.9 months in December 2020.”

In reality, inventory normally decreases every December due to seasonal trends. However, the following graph emphasizes how this past December was lower than any other December going all the way back to 1999.

Right Now, Sellers Have Maximum Leverage

As I said before, when considering any type of sale, when there’s a strong demand and a limited supply, the seller has the maximum leverage in the negotiation.

For homeowners who are thinking about selling, there may never be a better time than right now. With demand this high and inventory this low, you’ll have leverage in all aspects of the sale of your house.

Today’s buyers are aware they need to be flexible negotiators who make very competitive first offers, so here are a few areas that could tip in your favor when your house goes on the market:

- Competitive sales price

- Flexible closing date

- Potential for a leaseback to all allow you more time to find a home

- Minimal offer contingencies

Bottom Line

If you’re even thinking of selling your home, contact me sooner than later and let’s discuss how you can maximize the potential available in today’s market.

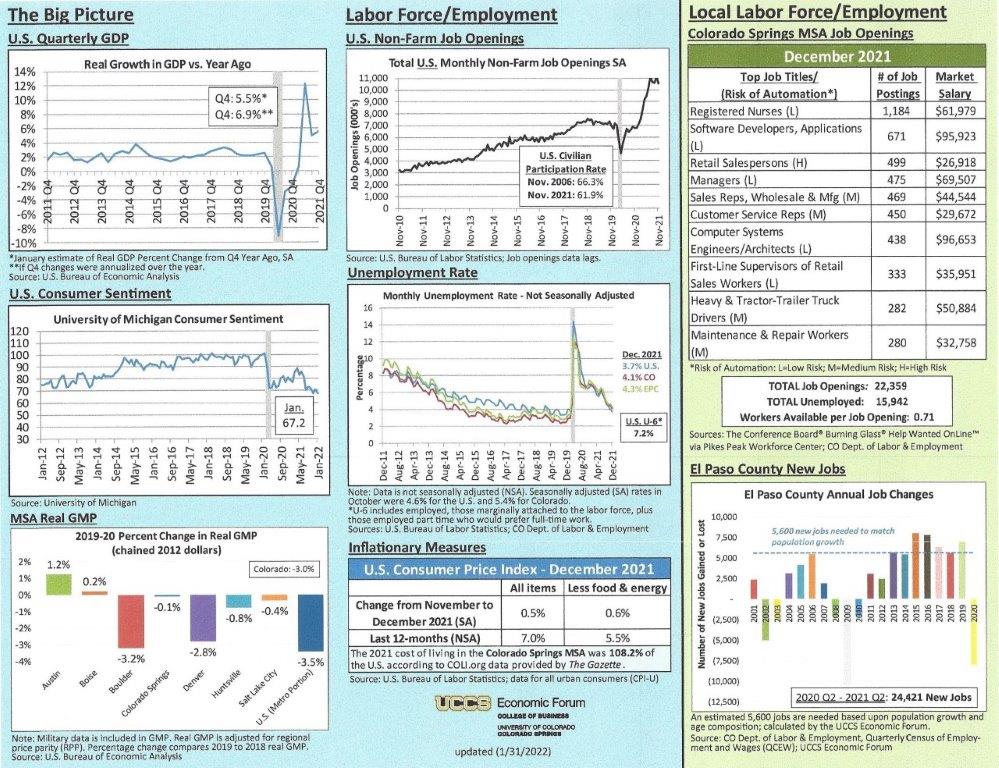

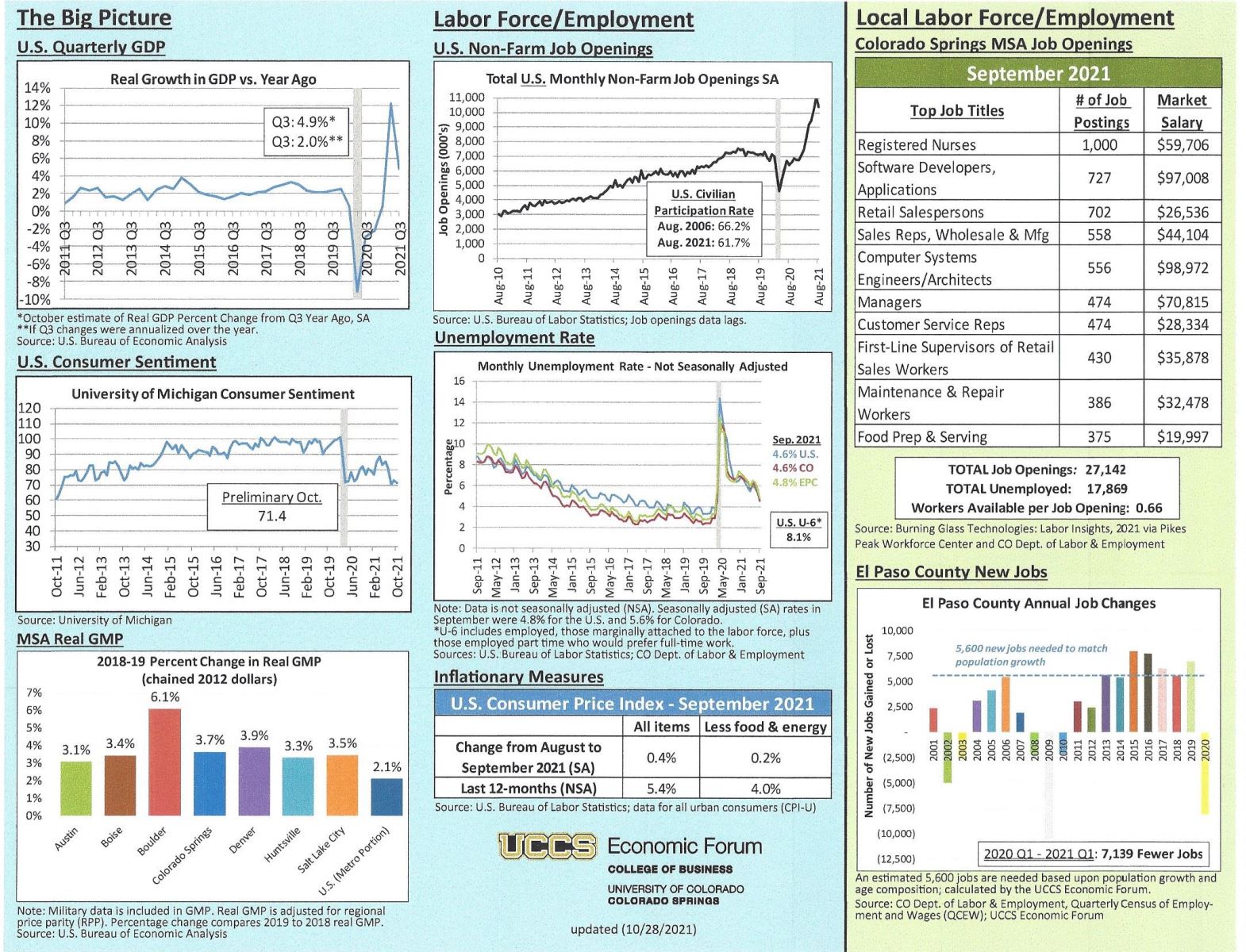

UCCS ECONOMIC FORUM UPDATE

College of Business, UCCS, updated 1.31.22

Here is the most recent economic update from the UCCS Economic Forum. It provides data concerning all aspects of the economy, on both the national and Colorado Springs area levels.

I’ve reproduced the first page of the graphs and you can click here to see the report in its entirety.

If you have any questions, please give me a call.