HARRY'S BI-WEEKLY UPDATE 10.26.21

October 26, 2021

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

IF A PICTURE IS WORTH 1,000 WORDS…. THE ONE ABOVE COULD MEAN HUNDREDS OF THOUSANDS (OF DOLLARS) TO YOU…

Home sales are picking up again and for many good reasons. Interest rates have remained historically low, but the recent talk of possible increases, along with more available homes for sale, has been good incentive for some of my clients to sit down and discuss whether now is the time for action.

As I’ve said forever, I can’t begin to predict which way rates will go. But I can tell you that these very low ones won’t be around forever. The Fed has been discussing inflation and what can be done to curb it so today’s low interest rates could be a thing of the past sooner than later. And with more and more folks choosing to work from home (WFH), their wants and needs are far different than prior to the pandemic.

Colorado Springs is also seeing quite a resurgence as a place that young professionals want to work and live due to our fabulous work/life balance and new companies are relocating here as well. Downtown has “come back” and then some, with the addition of museums such as the U.S. Olympic and Paralympic Museum and various sports venues, as well as new restaurants, shops, apartments, and other living spaces.

We’re starting to feel like a “big” city, while fortunately retaining many of the things that may us proud and happy to call Colorado Springs our hometown. I won’t talk about traffic since my friends who live elsewhere think we don’t have any, but…if you’ve lived here for any length of time you know what I mean.

Amazon recently opened their largest distribution center in the four surrounding states near our airport and many of those employees (the non-robotic ones!) are looking for homes. So are the ones choosing to relocate here with their companies. Having more homes available for sale has been a blessing for those folks and as new homebuilding continues to ramp up, this has been the choice for many of them as well.

In fact, I’ve helped some relocatees purchase new home construction, often without them seeing a model home in person. Lot and home elevation selections have been completed via video and I’ve been their “eyes” in making certain that the builders follow through with all the particulars. My long-standing relationship with many local builders has made that process easier for my clients and this is a service I provide at no additional cost to the buyer.

I’m starting to find myself as busy as ever, and if there were more existing homes for sale, I’d be even busier. When homes get listed, my clients are ready to pounce, but unfortunately so are a number of other potential buyers.

This leads me to tell you that even though there are more homes for sale at present, we are still seeing multiple offers, many over listing price, and quick turnarounds. Bidding wars apparently are here to stay for a while, so it’s as important as ever to know what you want, need, and can afford PRIOR to the search. Once you find the home you want there is little time to “think it over”.

If you’ve even considered a new home or neighborhood, let’s talk and see how together we can make your present home help you work toward that goal. There’s no better time than now to make all your Residential real estate dreams come true.

And…the best move you can make at present is to call me at 719.593.1000 or email me at Harry@HarrySalzman.com to get the ball rolling.

I look forward to speaking with you.

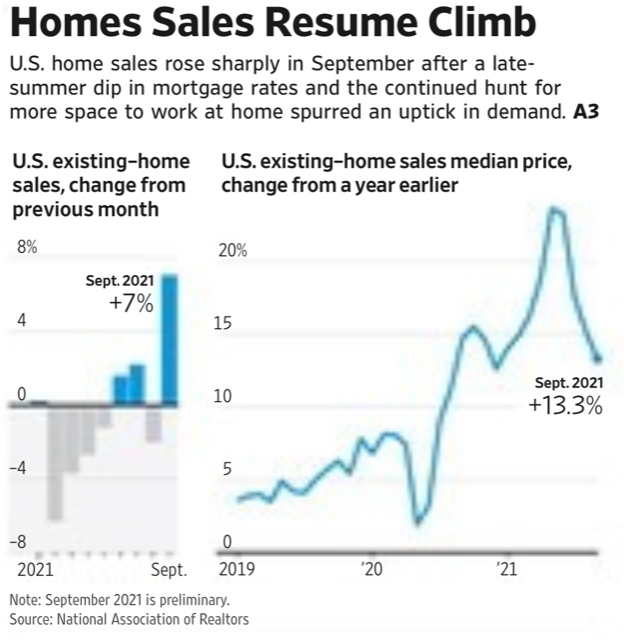

HOME SALES AND PRICES JUMPED IN SEPTEMBER

The Wall Street Journal, 10.22.21

As depicted in the illustration above, U.S. home sales surged last month with their strongest showing since January, ending a months-long stretch when housing market activity slowed from its frenzied pace and high prices put the brakes on a number of buyers.

The dip in mortgage rates and activity at the high end of the market helped existing-home sales rise 7% in September nationally from the prior month to a seasonally adjusted annual rate of 6.29 million, according to the National Association of Realtors (NAR).

While demand from buyers has exceeded supply for more than a year, economists said that last month was still a standout.

“This autumn season looks to be one of the best autumn home-sale seasons in 15 years,” said Lawrence Yun, NAR’s chief economist.

And though prices remain near record highs, the pace of price growth is slowing, which will allow for a more “normal” appreciation.

Again, what all this means is that NOW is the time to get off the fence if you’ve even considered a move. The sooner you begin, the sooner you will be in a new home. Don’t delay, call me today. If there’s a way to get you where you want to be, I’m the guy who can get you there.

SALES TAX COLLECTIONS IN COLORADO SPRINGS JUMP

The Gazette, 10.23.21

Colorado Springs is continuing a robust recovery 1 ½ years after the onset of the COVID-19 pandemic. The city saw another double-digit percentage gain in sales tax collections last month, a good sign for the Pike’s Peak region’s economy.

It’s evident that folks are busy spending on things such as cars, appliances, TVs, apparel and building materials, among other items—and the 2% sales tax levied on such generated nearly $19 million in revenue in September according to a report released last Friday by the Colorado Springs Finance Department.

That’s 22% higher than the same month a year ago and continues the double digit increases that began in March.

According to Tatiana Bailey, director of the University of Colorado at Colorado Springs Economic Forum, “It’s an overall indicator of continued economic growth. We’ve regained all of our jobs in the region. It’s all good news and great news for the mayor’s office and having the tax revenues we need.”

Since Colorado Springs’ sale tax is a critical revenue source and closely watched by city officials and local economists because it funds more than half of the Springs’ annual general fund budget, this is exceptionally good news all around.

Bravo to all of us for helping to boost the local economy.

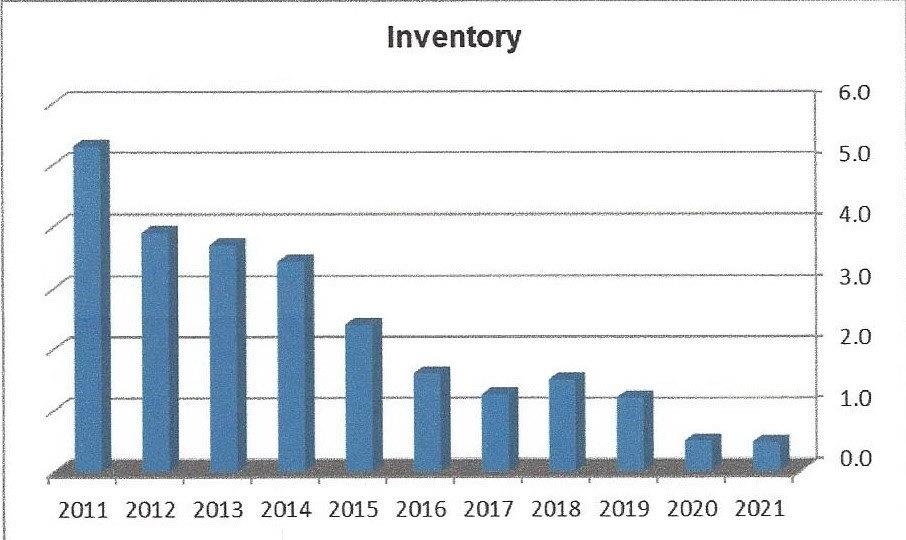

ERA SHIELDS QUARTERLY “STAT PACK”

I want to share with you the quarterly “Residential Review” for El Paso County that is compiled by my company. The data provided is through the Third Quarter, 2021. You can click here to read the report, along with charts, in its entirety.

The graph below compares the number of homes on the market (active) to the number of homes sold. It determines how many months it would take to sell through the current listing inventory. Most economists consider 6.0 months to be a “balanced” market:

And some quick facts you might find interesting:

- New Listings Input for the Quarter were up 472 units from 2020 (9%)

- Sales for the Quarter were down 7% (4490 vs 4854)

- Median Price for the Quarter is up to $445,667 (16%)

- Average Price for the Quarter went up to $500,433 (16%)

- Just 4% of sales in the Quarter were under $300k (in 2020 it was 15%, 2019 it was 37%)

- 50 homes sold for $1 million+ during the Quarter (21 sold during the same period last year)

- Single-Family building permits this year are up 356 units (9%)

- 30-year Fixed-Rate Mortgages are right at 3%

SHOULD YOU RENOVATE OR MOVE…THE BIG QUESTION

Keeping Current Matters, 10.13.21

As I’ve been mentioning a lot, the last 18 months have changed what many buyers are looking for in a home. The American Institute of Architects recently released their AIA Home Design Trends 66667uSurvey, and it reveals the following:

- 70% of respondents want more outdoor living space

- 69% of respondents want a home office (48% wanted multiple offices)

- 46% of respondents want a multi-function room/flexible space

- 42% or respondents want an au pair/in-law suite

- 39% of respondents want an exercise room/yoga space

If you are like any of these respondents and want to add any of the above, you have two options: renovate your current home or buy a home that already has the spaces you desire. The decision you make could be determined by factors such as:

- A possible desire to relocate

- The difference in the cost of a renovation versus a purchase

- Finding an existing home or designing a new home that has exactly what you want (versus trying to restructure the layout of your current house)

In either case you will need access to the funds for either a renovation or the down payment your next home would require. The great news is that the money you need probably already exists in the equity of your current home.

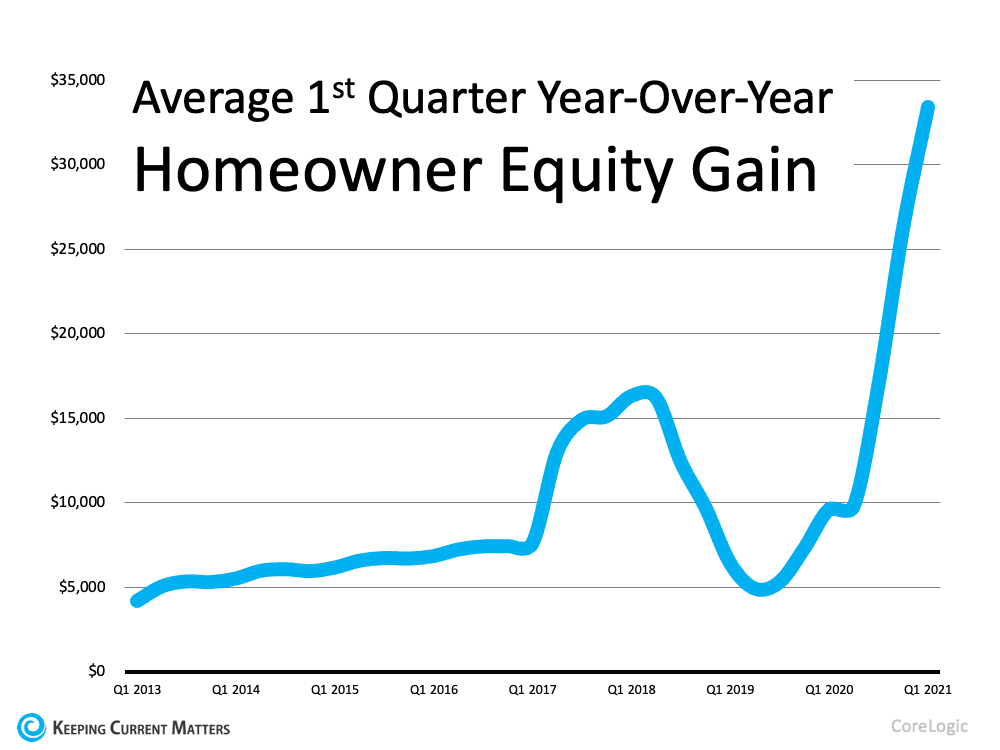

Home equity is skyrocketing due to the record-setting increases in home prices over the past two years. The graph below uses data from CoreLogic to show the average home equity gain in the first quarter of the last nine years:

The money you need to purchase the perfect home or renovate your current house may be right at your fingertips. However, waiting to make your decision may increase the cost of tapping that equity.

If you decide to renovate, you’ll need to refinance or take out an equity loan to access the equity. If you decide to move instead and use your equity as a down payment, you’ll still need to mortgage the remaining difference between your down payment and the cost of your new home.

Mortgage rates are forecast to increase over the next year, so waiting to leverage your equity will probably mean you’ll pay more to do so. According to the latest data from the Federal Housing Finance Agency (FIFA), almost 57% of current mortgage holders have a mortgage rate of 4% or below. If you are one of those homeowners, you can keep your mortgage under 4% by doing it now. If you’re one of the 43% of homeowners with a mortgage rate over 4%, you may be able to do a cash-out refinance or buy a more expensive home without significantly increasing your monthly payment.

First Step: Determine the Amount of Equity in Your Home

If you’re ready to either redesign your current home or find an existing or newly constructed home that has everything you want, the first thing you need to do is determine how much equity you have in your current home. To do that, you’ll need two things:

- The current mortgage balance on your home

- The current value of your home

You can more than likely find the mortgage balance on your monthly mortgage statement. To discover the current market value of your house you can pay several hundred dollars for an appraisal, or you can contact me, and I will be able to give you a professional equity assessment report at no cost to you.

Bottom Line? If you are one of the many who have refocused your thoughts on what you want from your home over the past 18 months, now may be the very best time to either renovate or make a move to the perfect home.

Any Questions? Contact me and I will more than happy to give you answers. And if I don’t have the answers, you can be sure I know how and where to get them for you.

HARRY’S HALLOWEEN JOKES OF THE DAY: