HARRY'S BI-WEEKLY UPDATE 11.4.21

November 4, 2021

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

I HAD INTENDED TO INCLUDE THIS WITH MY “JOKES OF THE DAY” BUT…

…unfortunately this crazy Residential real estate market is in no way a joke. Every time I think we have reached our “new normal” it keeps changing.

I was hoping that when we started to have a few more existing homes for sale that most of those bidding wars and winning bids over list price would settle down a bit. But I was wrong. Let me give you a recent example.

Last Thursday I listed a home for $540,000. When the showings began that day, I received a call from a broker who wanted to make an offer, sight unseen, for their buyer. I let that broker know that the seller was not going to accept any offer immediately. He said that was fine and that his buyer would put in a purchase price increase clause that would allow his bid to go $3,000 higher than the highest bid--to a high of $605,000.

As the day progressed and showings began, we received a number of offers. And then the bidding war began. Since the first offer had indicated they were willing to bid $3,000 over the highest bid, that offer was accepted on that same day one! Selling price? $598,000.

Yes, you read that right. The home sold for $58,000 more than the asking price in one day—that’s 10% OVER the listing price. And the best news for my seller was that the buyer was putting down more than 50% cash, thus negating the need for an appraisal which possibly could have come in at under the selling price!

And the moral of this story?

If you’ve even considered the possibility of selling to trade up or move to a new neighborhood, NOW is the time for more reasons than the above.

Mortgage interest rates which have been staying at historical lows are projected to rise. I can’t tell you when that might happen, but most economists are saying the rates can’t stay this low.

Home prices are continuing to rise which means two things if you are looking to move. First of all, your present home is more than likely worth more than you might imagine, thus providing you extra equity to put into your next one.

Therefore, even though your next home will also likely cost more, the size of your down payment could possibly help keep your monthly output close or not too much more than what it is currently.

The downside at the moment is still the shortage of existing homes for sale. So you really do need to know where you intend to move prior to listing your present home. It’s possible to request to lease your home back from the buyer for a certain period of time, but that is not always an option.

I wish I could tell you that new home construction is the answer and in a number of cases it is, but I’ve lately seen the implementation of “lotteries” in order to deal with only so many available lots and oh, so many potential buyers.

Homebuilders are working as fast as they can to rectify this, but at the moment it’s a bit hard to navigate through those “wars” as well. And if new home construction is what you are seeking, I can help you there as well, without any additional cost to you.

The one bright side in all of this?

Me, of course.

With my 48+ years in the local Residential real estate arena, coupled with my Investment Banking background, I’ve experienced a lot and can help make the buying and selling process a bit less painful, if possible. I used to say I could make it fairly “stressless”, but unfortunately that’s not the case at present. I continue, however, to do my best to make purchasing what is often your most valuable investment as pleasant an experience as I am able.

So, if you’re ready…I’m willing and able to help you make your Residential real estate dreams come true.

The very best move you can make right now is to call me at 719.593.1000 or email me at Harry@HarrySalzman.com to get any and all of your questions answered.

I look forward to speaking with you.

OCTOBER 2021

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

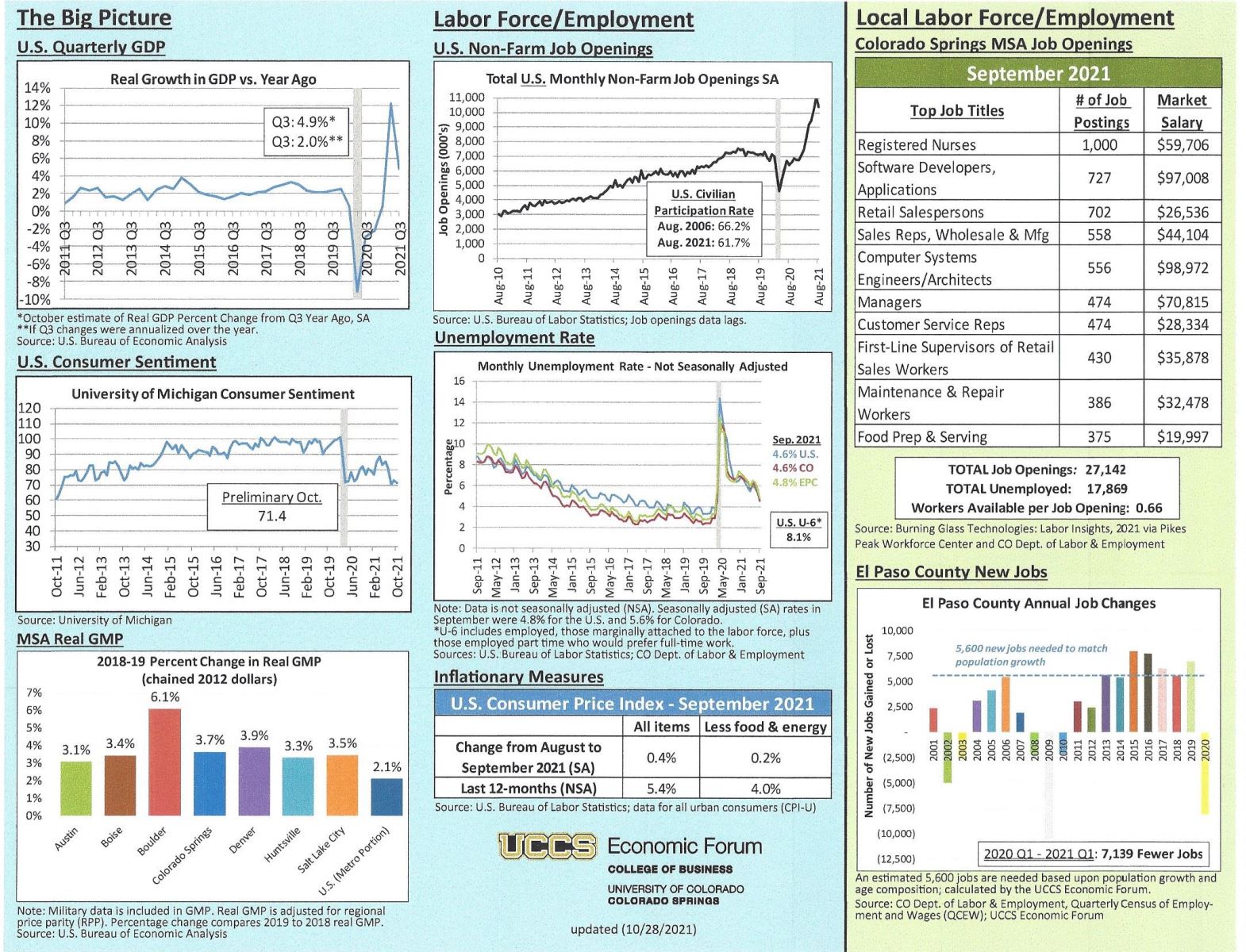

Here are some highlights from the October 2021 PPAR report. The format of this report no longer provides monthly statistics for each individual neighborhood. However, if you are interested in what’s happening in your neighborhood, I can provide you with this information through other means.

In El Paso County, the average days on the market for single family/patio homes was a low 11. For condo/townhomes it was 8.

Also in El Paso County, the sales price/list price for single family/patio homes was 102.0% and for condo/townhomes it was 101.9%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing October 2021 to October 2020 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 1,596, Up 2.4%

· Number of Sales were 1,641, Down 5.3%

· Average Sales Price was $510,180, Up 18.0%

· Median Sales Price was $446,000, Up 16.3%

· Total Active Listings are 1,048, Up 19.0%

· Months Supply is 0.6, Down 3.6%

Condo/Townhomes:

· New Listings were 248, Up 7.8%

· Number of Sales were 250, Down 3.8%

· Average Sales Price was $326,622, Up 18.3%

· Median Sales Price was $326,272, Up 24.5%

· Total Active Listings are 129, Up 27.7%

· Months Supply is 0.5, Down 7.2%

Now a look at more statistics…

OCTOBER 2021 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year to Date one-year change:

- Sold Listings for All Properties were Down 7.0%

- Median Sales Price for All Properties was Up 16.8%

- Active Listings on All Properties were Down 9.1%

You can click here to read the 15-page Monthly Indicators or click here to get specific information on the geographical area of your choice from the 18-page Local Market Update. I recommend that you check out your own area or one that you are considering, to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area in general:

NATIONAL housing market PREDICTIONS FOR 2021 & 2022

Keeping Current Matters, 10.26.21

Despite all the ups and downs this past year, one thing we know for sure is that the real estate market in 2021 not only met expert predictions, it surpassed them and broke records along the way.

That, of course, brings up the future. Will the 2022 housing market continue to follow that same trajectory, or are we facing a possible downturn?

The following is a deep dive into what leading real estate experts are projecting for the final quarter of 2021 and what to expect in 2022 so you, as a potential buyer and/or seller have the knowledge and confidence you need to be successful.

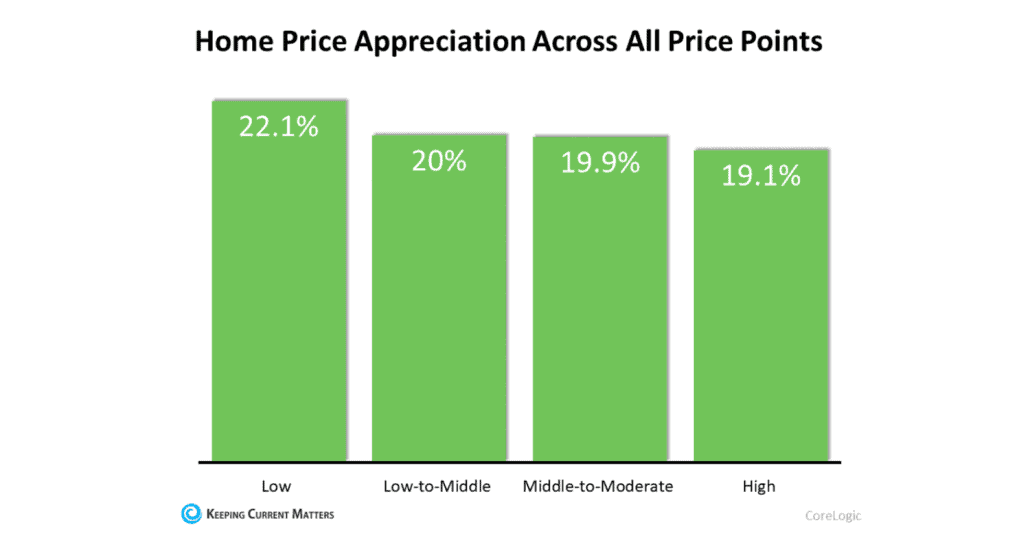

As always, please remember that these predictions are generalized on the national level, and when I write about trends it is more localized. For example, when you read about unemployment further down, remember that Colorado Springs was not hit nearly as hard as a lot of the country, and we have rebounded at a faster pace. Our home prices have risen at a pace higher than much of the USA and due to the desirability of working and living here, we will undoubtedly continue to outpace a good portion of the country in the coming year and more.

housing market FORCAST:

- Interest rates are rising but projected to stay low. This is good news because affordability reached one of the highest levels in 30 years due to the low rates. And as I mentioned earlier, although prices continue to rise, homes are still affordable to purchase, although slightly less so than earlier this year.

- Home sales are slowing but still strong. While the last two years have been some of the craziest I’ve seen during my 48+ years in the business and home sales are slightly slowing, that definitely doesn’t mean the market is slow. It’s simply returning to a more balanced one than we have been witnessing these last few years.

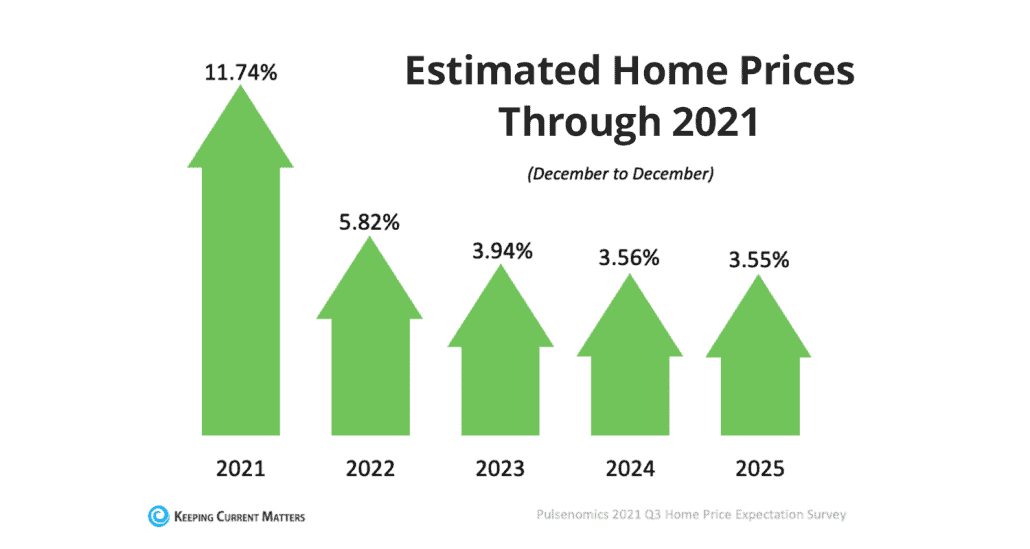

- Home prices are appreciating slower too. The constant battle between high buyer demand and low inventory this year led to a surge in home values that left a number of folks scared we were headed for another housing bubble. And while this year’s price escalation has been a bit excessive, it was just a result of Econ 101—high buyer demand coupled with extremely low supply. As inventory starts to rise, experts anticipate price appreciate will slow.

- Foreclosures will happen—but won’t lead to price declines. The massive wave of unemployment caused by the pandemic led many homeowners across the country to enter mortgage forbearance. While unemployment is slowly but surely declining ahead of expectations, it will be awhile for much of the country to reach the pre-COVID levels. This will cause foreclosures to rise. Experts don’t anticipate this will lead to anything resembling the foreclosure crisis of 2008 and they don’t expect it to lead to the major home value depreciation that followed. (remember that I’m reporting “national” news and that Colorado unemployment rate is again quite low).

IS THE housing market GOING TO CRASH BEFORE 2021 ENDS?

The answer, according to top real estate experts, is a big NO. While memories of the housing crash of 2008 still linger on the minds of many buyers and sellers, today’s market conditions resemble nothing close to what caused it.

Home price appreciation may be high but again, it’s a result of supply and demand. The foreclosure situation should be balanced out by the large amount of equity homeowners currently have which means they can choose to sell rather than foreclose.

Plus, while affordability may be decreasing, historically speaking it’s still high compared to most other years.

WHAT DOES THIS MEAN FOR BUYERS AND SELLERS FOR THE REST OF 2021?

There is still a lot of motivation for both buyers and sellers in today’s market and that’s not expected to change in the next couple of months.

With both inventory and mortgage rates remaining low, both sides of the real estate transaction stand to benefit from making a move before the end of the year.

real estate is still strong and waiting until next year could mean losing out on a less competitive market and better affordability—the two big factors positively impacting buyers and sellers today.

2022 housing market PREDICTIONS

Here’s what industry experts are saying about what they anticipate for the 2022 housing market:

HOME PRICES

It is important to remember again that the 2021 market was anything but normal, and that escalating home values were a direct result of the record-low inventory. Experts predict that the inventory situation should improve in the coming year, stabilizing price appreciation across the nation.

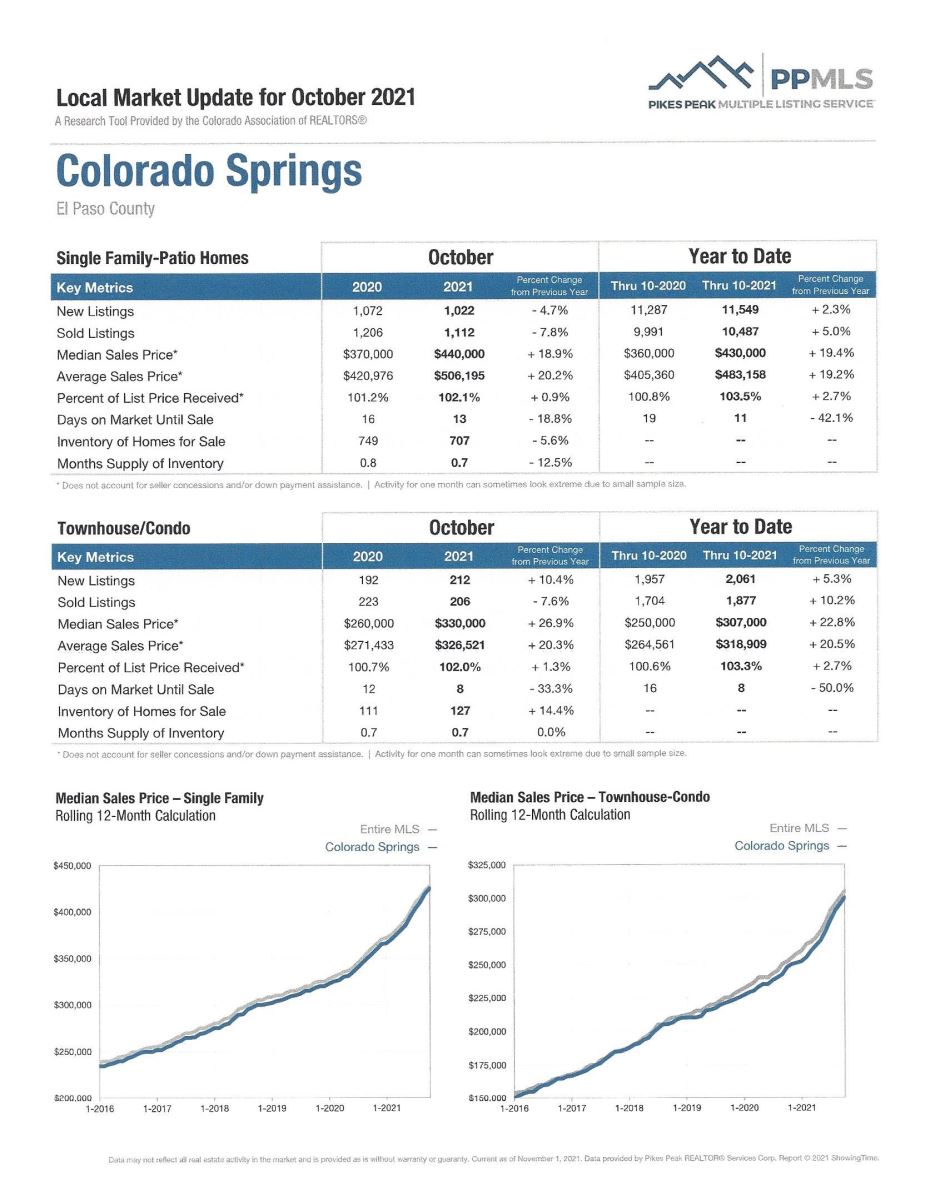

But will home prices depreciate in 2022? More than 100 industry experts don’t think so. Instead, they are projecting a more modest appreciation of 5.82% nationally in the next 12 months compared to the 11.74% rise seen nationally on average in 2021.

MORTGAGE RATES

In case I haven’t mentioned it enough, the past year saw the lowest mortgage rates in the history of real estate. So, if you are waiting for those rates to come back down or go down more, you may be waiting a very long time.

While homes right now may be less affordable than they were a year ago, they’re still extremely affordable.

If you look at the 30-year mortgage rate chronicled by Freddie Mac, you can see the average rates by decade:

- 1970’s: 8.86%

- 1980’s: 12.7%

- 1990’s: 8.12%

- 2000’s: 6.29%

- 2010’s: 4.09%

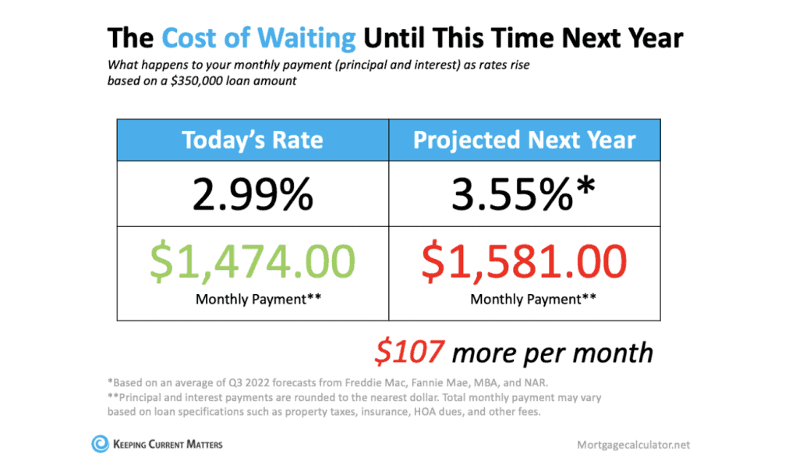

While experts don’t project that mortgage rates will rise a huge amount, any increase would mean an increase in monthly mortgage payments. A couple of decimal points may not seem like a lot to most, but it could make or break a buyer’s budget.

If you play the waiting game, a rise in mortgage rates coupled with the continued home price appreciation means just one thing—paying more for the same house you could buy now.

HOUSING INVENTORY

Inventory has been the biggest player in the anything but ordinary real estate market of the past two years.

With the bidding wars and such going on you might be wondering if housing inventory will increase in 2022. The good news is that there are many factors that lead industry experts to anticipate a rise in homes for sale.

Here’s why:

- Homeowners may be more confident putting their homes on the market as COVID numbers continue to drop and more people become vaccinated.

- Many of the obstacles halting or slowing new construction start to fade and those homes come on the market, adding new inventory and meeting the needs of population growth.

- As forbearance comes to a close, experts predict a wave of new homes coming on the market. However, they don’t anticipate the majority of those to be foreclosures. Instead, because of built-up equity, homeowners in this position will have the opportunity to sell instead.

BOTTOM LINE

If I’ve taught you anything in these eNewsletters it should be that while the future can be projected, it can’t be predicted.

While industry experts don’t expect the 2022 housing market to be as crazy as 2020 or 2021, it’s important to keep reading my eNewsletters to get current information on our local residential real estate status.

Better yet, give me a call and we can discuss your individual situation and how to best take advantage of making your wants, needs and budgetary requirements get you into the home of your dreams.

UCCS ECONOMIC FORUM UPDATE

College of Business, UCCS, updated 10.28.21

As always, I’ve included the most recent economic update from the UCCS Economic Forum. It provides data concerning all aspects of the economy, on both the National and Colorado Springs levels.

I’ve reproduced just one of the charts below. You can click here to read the entire report and if you have any questions, please give me a call.