HARRY'S BI-WEEKLY UPDATE 12.6.21

December 6, 2021

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

JUST LIKE CHESS…BUYING AND SELLING A HOME TODAY REQUIRES SOME STRATEGIC MOVES

While it’s always been important to have a strategy for your individual situation when you want to buy, sell, or purchase for investment, today’s Residential real estate market requires strategic moves that even a master chess player might find interesting.

This is normally a “quiet” time in the housing market with the holiday season already underway. However, nothing in the past couple of years has been “normal” and with home prices continuing their upward climb, and mortgage rates likely due to increase soon, folks who might have waited in the past are on the move or getting ready to do so.

There continues to be a shortage of existing homes for sale even though there are more than a year ago. New home construction is booming, but prices keep escalating due to lumber increases once again, as well as a shortage of materials. Demand is so high that builders are “taking names” and the fortunate buyers-to -be have no more than half an hour to make a decision in some cases.

Needless to say, stress levels are high for both buyers and sellers and that is not likely to change any time soon.

As you will see later in this eNewsletter, Colorado Springs has gone from # 20 to #14 in the top 100 of the Federal Housing Finance Agency’s third quarter report of “Metro House Price” changes.

That just tells us what we already know—Colorado Springs and its fabulous work/life balance options is no longer our “little” hometown. We are growing steadily, and the end is nowhere in sight. Good for the city’s economy, good for all the new and exciting times to come, but not so good for finding a home at a low price point. And that hits first time buyers even harder than most.

The good news for current homeowners is that your present home is more than likely worth a lot more than you might imagine. Therefore, your equity will help considerably with the down payment on a new place. So even though you will be paying more for the next home, at today’s still low interest rates it’s possible that your monthly output will not increase by much.

The bright side in all of this?

Me, of course.

With my 48+ years in the local Residential real estate arena, coupled with my Investment Banking background, I’ve mastered the “strategic moves” necessary to wade through the current “battleground” per se.

I’ve experienced more than most and can help make the buying and selling process a bit less painful, if possible. I used to say I could make it fairly “stressless”, but unfortunately that’s no longer a given. I continue, however, to do my best to make purchasing what is often your most valuable investment as pleasant an experience as I am able.

They say the “early bird gets the worm” and those who are starting now rather than waiting for the traditional “spring buying season” will have a head start in making their Residential real estate dreams come true.

To get the ball rolling early, just give me a call and together we can devise the best plan for your individual family situation.

I can be reached at 719.593.1000 or by email at Harry@HarrySalzman.com and I look forward to putting my special brand of customer service to work for YOU.

NOVEMBER 2021

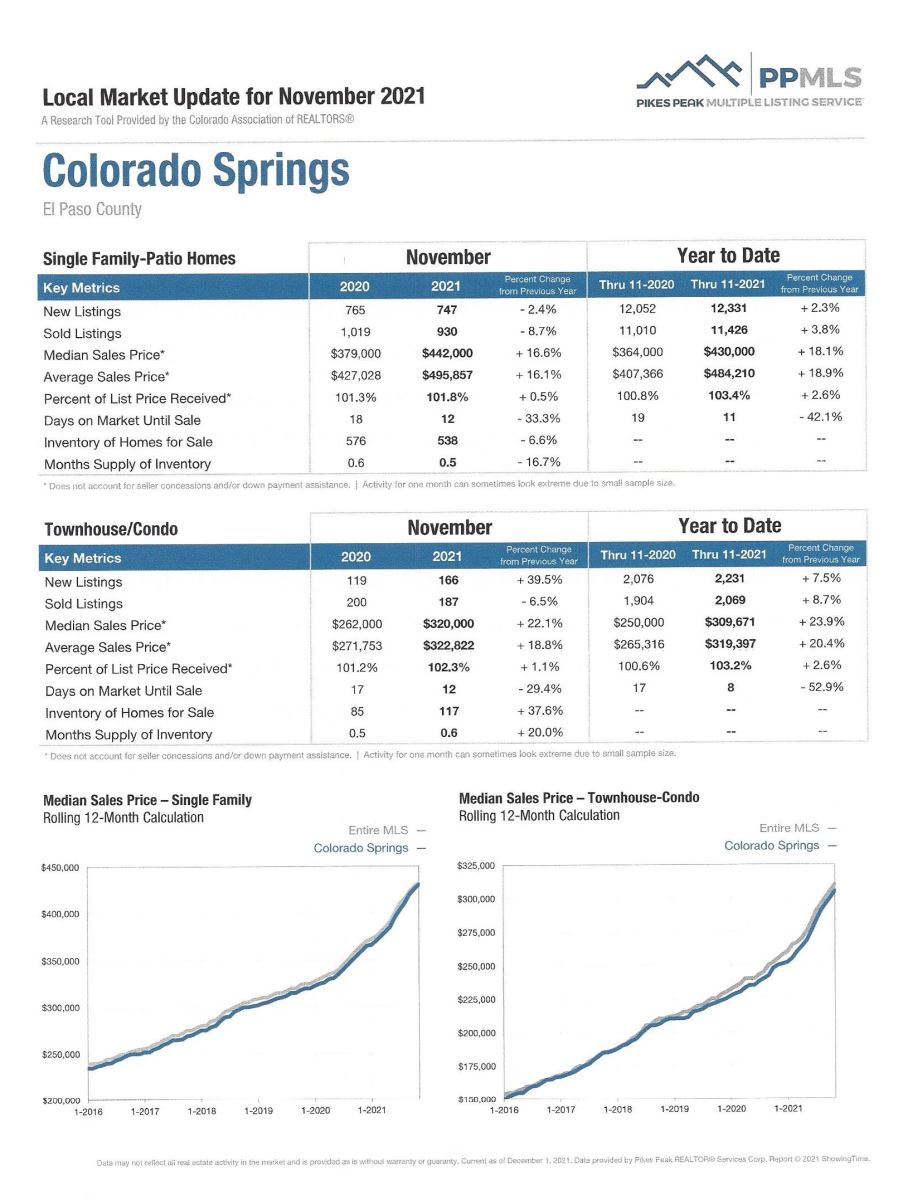

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the November 2021 PPAR report. The format of this report no longer provides monthly statistics for each individual neighborhood. However, if you are interested in what’s happening in your neighborhood, I can provide you with this information through other means.

In El Paso County, the average days on the market for single family/patio homes was 11. For condo/townhomes it was 13.

Also in El Paso County, the sales price/list price for single family/patio homes was 101.8% and for condo/townhomes it was 102.2%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing November 2021 to November 2020 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 1,201, Up 9.0%

· Number of Sales were 1,466, Down 1.1%

· Average Sales Price was $507,507, Up 18.3%

· Median Sales Price was $450,000, Up 18.4%

· Total Active Listings are 855, Up 26.7%

· Months Supply is 0.6, Down 24.7%

Condo/Townhomes:

· New Listings were 198, Up 19.3%

· Number of Sales were 229, Down 3.8%

· Average Sales Price was $336,208, Up 22.1%

· Median Sales Price was $325,000, Up 23.5%

· Total Active Listings are 115, Up 49.4%

· Months Supply is 0.5, Down 13.1%

Now a look at more statistics…

NOVEMBER 2021 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year to Date one-year change:

- Sold Listings for All Properties were Down 9.3%

- Median Sales Price for All Properties was Up 17.6%

- Active Listings on All Properties were Down 3.4%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical area of your choice from the 18-page Local Market Update. I recommend that you check out your own area or one that you are considering, to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area in general:

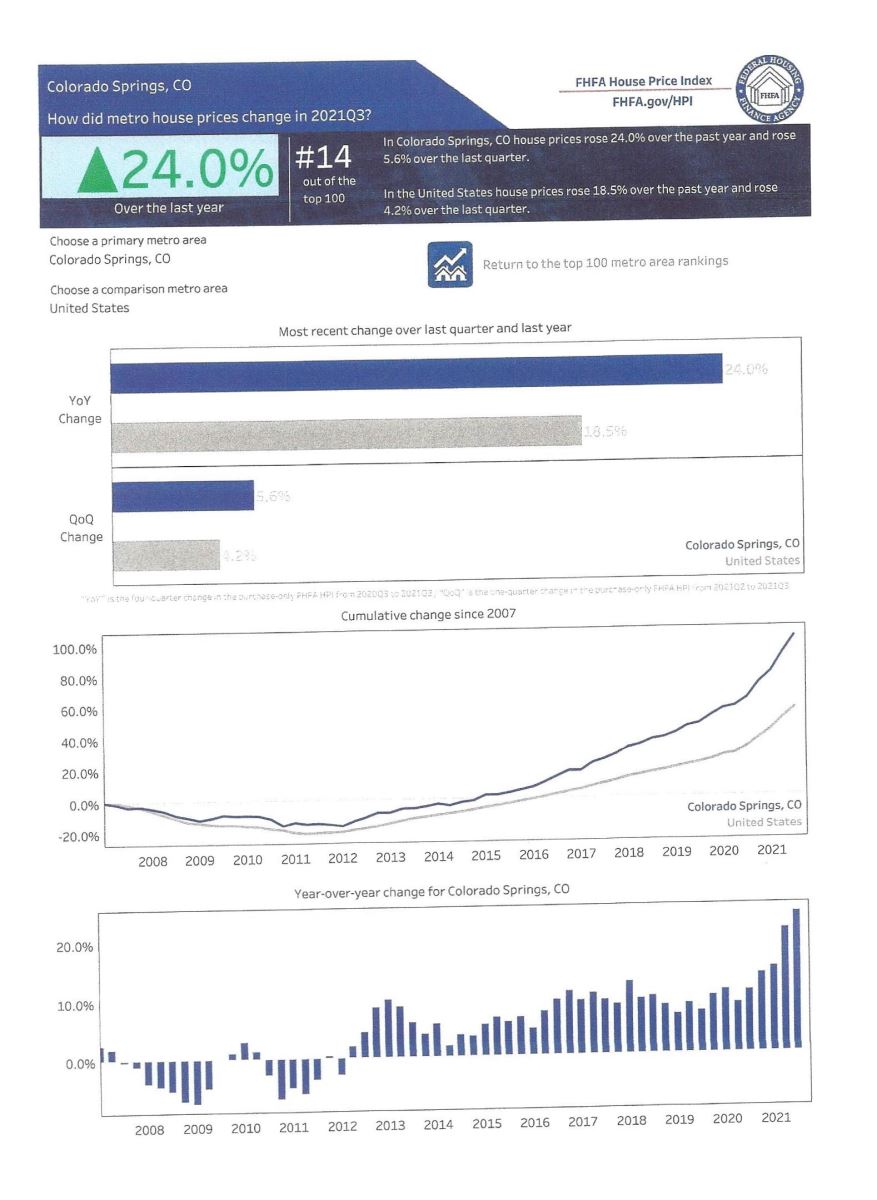

COLORADO SPRINGS RANKS EVEN HIGHER IN THE Q3 FHFA HOUSE PRICE INDEX

FHFA, 11.30.21

The recently published FHFA House Price Index for third quarter 2021 lists Colorado Springs as #14 out of the top 100 in house price changes during that quarter. We moved up from #20 in the Q2 report and I would expect us to keep moving up in the future.

House prices in all 50 states and the District of Columbia rose between the second and third quarter. Of the nine census divisions, the Mountain region, home of Colorado Springs, recorded the strongest four-quarter appreciation.

Here is a copy of the Colorado Springs changes:

If you are interested in seeing the entire list of 100 cities in ranking order, please click here. And, if you have any questions, you know who to call.

LOAN LIMIT INCREASES FOR 2022

The new conforming/jumbo cut-off on mortgage loans is $647,200. This was a surprise since most lenders expected it to be $625,000, so good news for buyers.

VA loan cutoffs will be at $647,200 as well.

FHA loans in El Paso and Teller counties will be $460,000, while Pueblo will be $420,680.

UCCS ECONOMIC FORUM UPDATE

College of Business, UCCS, updated 11.29.21

As always, I’ve included the most recent economic update from the UCCS Economic Forum. It provides data concerning all aspects of the economy, on both the National and Colorado Springs levels.

You can click here to read the entire report and if you have any questions, please give me a call.

IS THIS A GOOD TIME TO BUY OR SELL A HOUSE?

UBS, 11.2.21, Keeping current matters, 11.18.21

These are questions I’m asked a lot. My answer is always the same—if you are wanting to move and the numbers can work for you, it’s always a good time to buy and or sell. In most cases, the decision to purchase a home is one of the most emotional, difficult and financially impactful investments one can make.

And while I strongly believe each client’s specific needs, wants and budget contribute to the overall answer, it’s still important to consider timing when possible.

The information from several articles I recently read can help answer these questions as well.

Is this a good time to buy a house?

Here are five questions that UBS asks clients to consider:

- Is the house being purchased for shelter, a long-term investment, or for a fix and flip?

- What is the anticipated time horizon for living in the house?

- What are the individual’s near-term, medium-term, and long-term liquidity needs?

- Will purchasing the house significantly change one’s lifestyle?

- Should the house suffer a significant decline in value—say 20%--will that change one’s lifestyle?

While there are no right or wrong answers to those questions, answering them tends to remove a substantial emotional component of the purchase decision. For example, someone who is buying a house for shelter purposes, anticipates owning it for an extended period of time and has the liquidity profile to own the home and maintain their lifestyle, can be less focused on what is the “exact right time to buy”.

On the other hand, someone who is considering a fix and flip, is more liquidity constrained and risks a lifestyle impairment should they not be able to sell the house in a timely manner, might want to reconsider the purchase option.

In addition, it’s also crucial that a house be factored into one’s overall asset and liability profile. It is very important to include a primary residence in all of your long-term financial planning scenarios.

In short, again, there is no simple answer about the “right” time to buy a house. Working closely with your financial advisors and a seasoned professional like myself will help you get the answers for your personal situation.

Is this a good time to sell a house?

Putting your home on the market now will get you one step ahead of your neighbors who might be waiting for the traditional “spring buying season”. If you want to stand out from the crowd, this holiday season is the best time to make sure your house is available for buyers.

The number of existing homes for sale is still historically low and putting your home on the market now will give you the best chance to be in front of buyers competing for these homes.

As mortgage rates begin to increase next year, more folks will be entering the selling market before the current frenzy ends. By selling now, your home will get the most exposure and you will be ahead of the game.

Even though it’s the holiday season, don’t think there aren’t a number of potential buyers who are out looking every day. Today’s buyers are still dealing with a limited number of homes for sale and are competing with each other for their dream home. When that happens, if your house is one of the few on the market, you may find your home in a bidding war and possibly going for over the asking price.

Creative offers are coming in for most homes these days and chances are you might get one that will waive contingencies and will pay the difference, if any, over the home appraisal. Making your move to list your home today will get you in ahead of those who are waiting until after the holidays.

These are just some of the things to consider when wondering about a good time to buy or sell. And once again, the best answer I can give you is that if, after all considerations, the time is right for YOU, then most ANY time can be the right time.