HARRY'S BI-WEEKLY UPDATE 8.26.25

August 26, 2025

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

MORTAGE RATES ARE SLOWING COMING DOWN AND LOCAL LISTINGS ARE UP...BUT SALES ARE STILL SLOW

Mortgage rates hit their lowest mark of 2025 with the long-term rate falling to 6.58% last week, and it is providing a bit of a boost to homebuyers. That was the fourth week in a row that rates have come down, and here’s hoping that continues for the near future. The current rate is now at its lowest level since October 2024, when it averaged 6.54%. Whether or not this is going to get the ball rolling on our basically stagnant Residential real estate market is yet to be seen.

Home sales surprisingly rose nationally and here in July while prices eased a bit.

There are more properties on the market, so it appears that even though the spring buying and selling season was somewhat of a bust, it appears that folks might now be ready to make their move (literally).

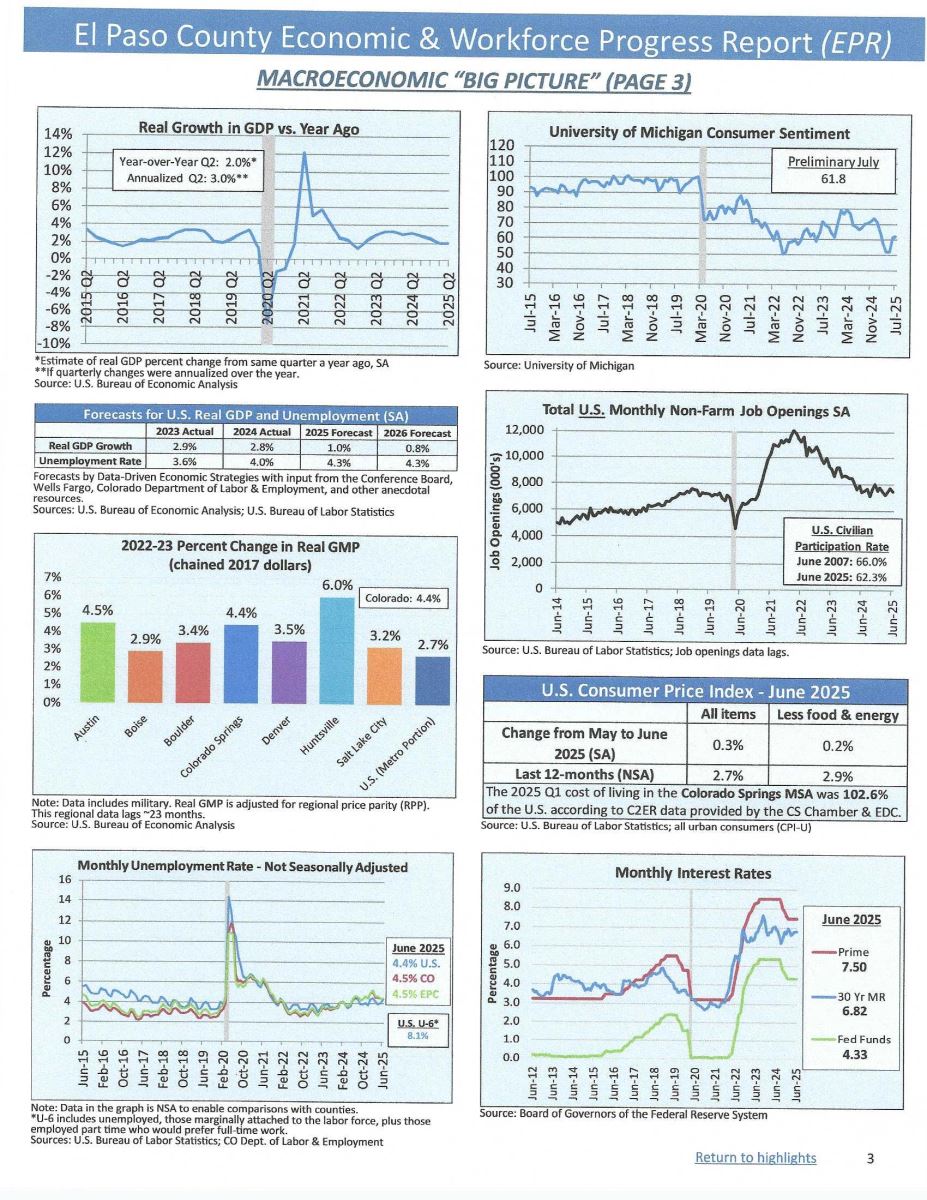

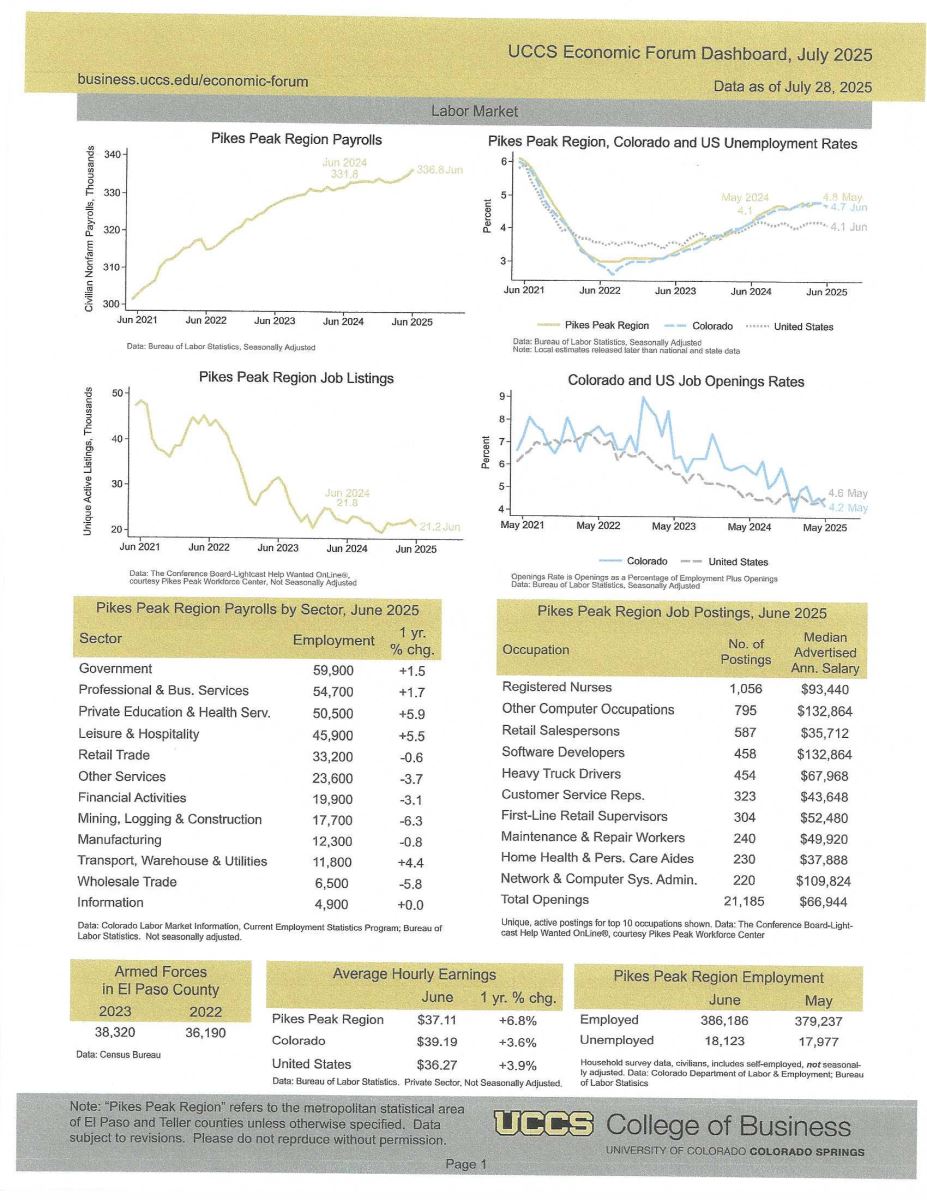

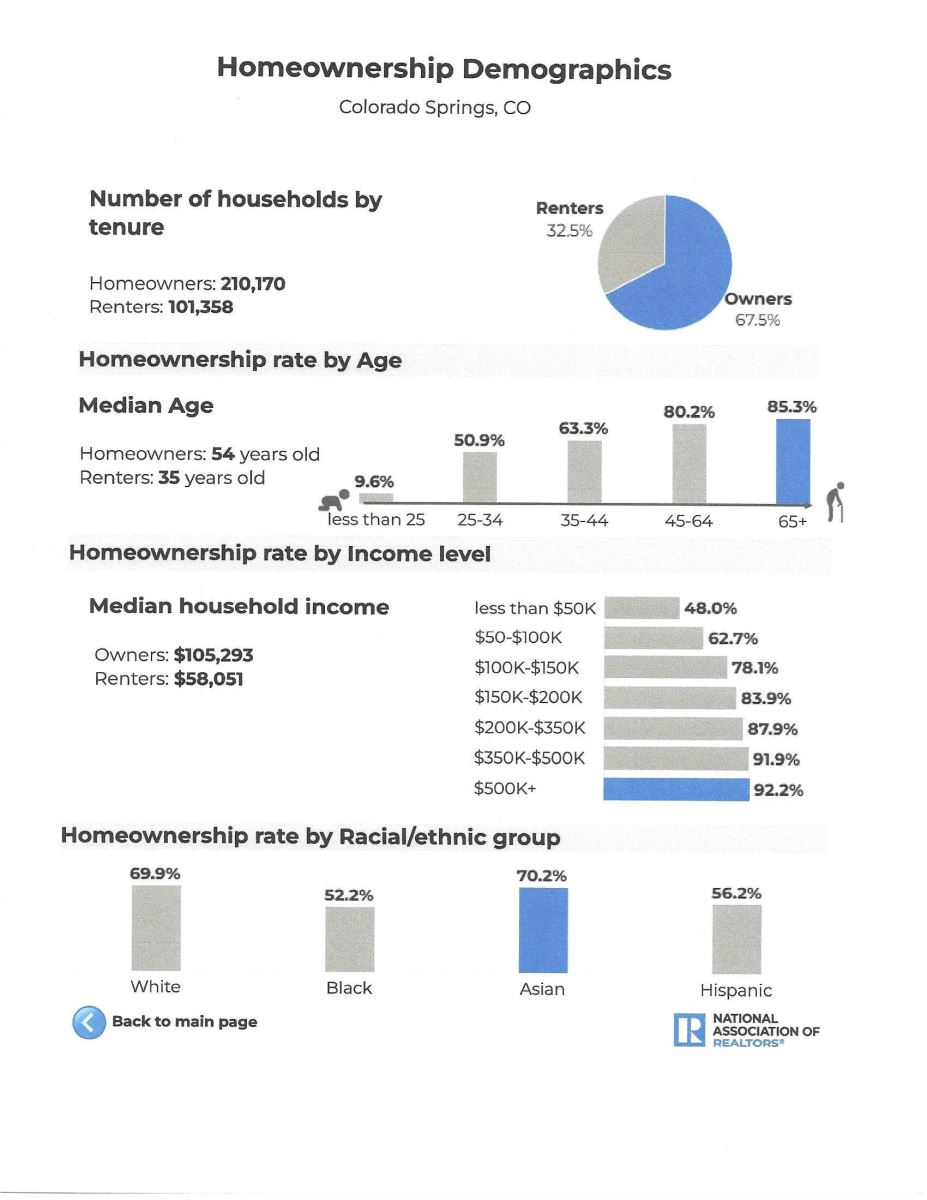

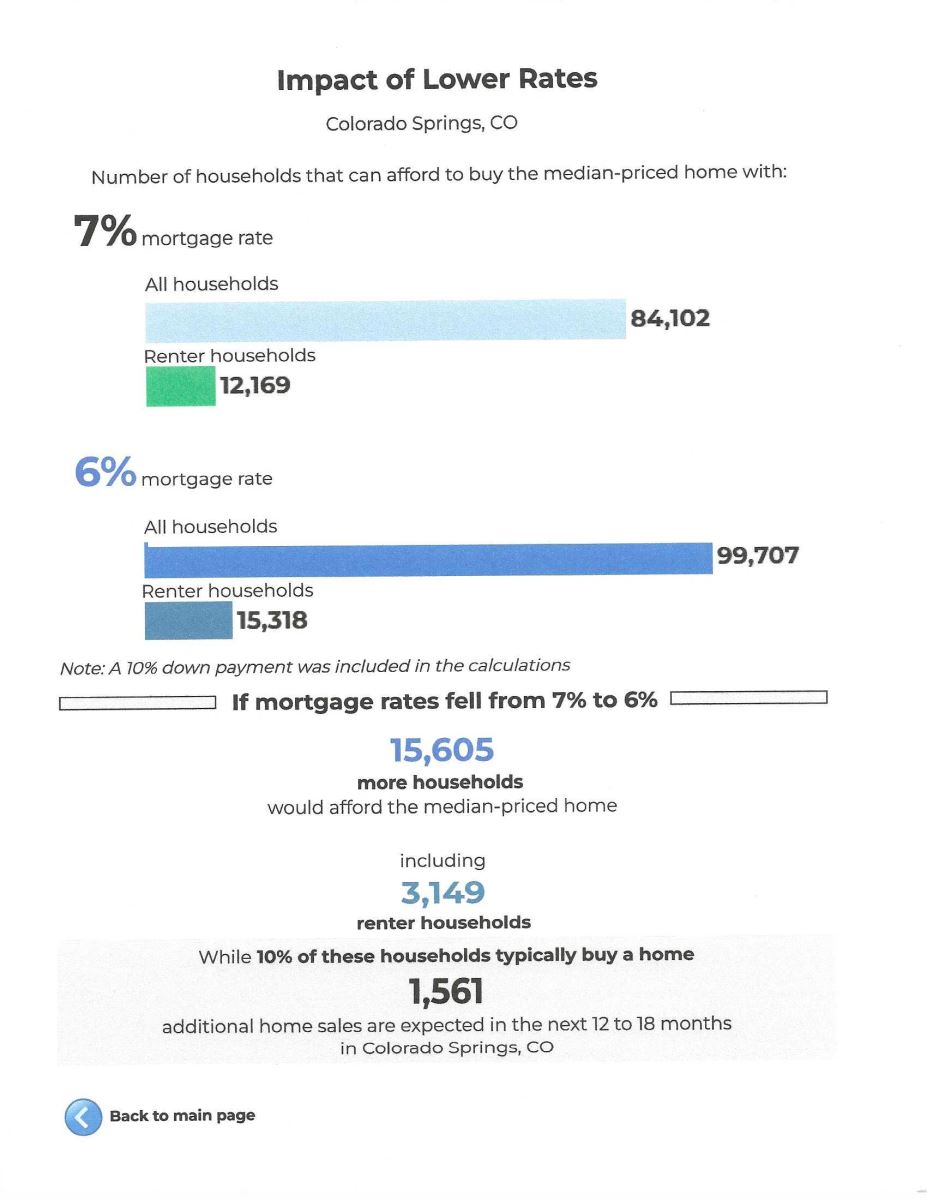

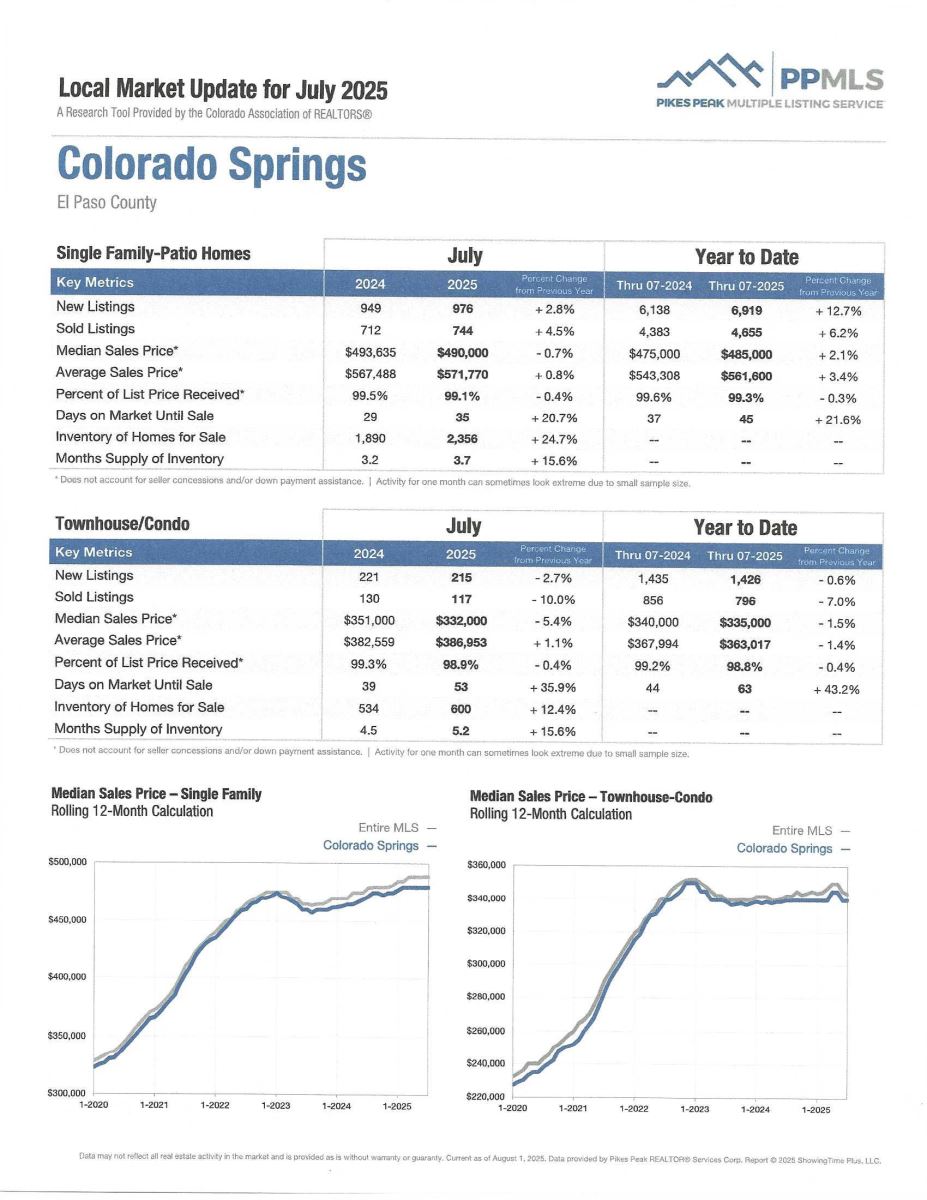

This week the National Association of Realtors (NAR) came out with a “dashboard” --statistics in graph form-- for various cities. I found them to quite interesting and have reproduced several pages below for you to get an idea and you can click here to see all of the graphs concerning Colorado Springs.

I think you will find all of the charts informative and if you have any questions, please give me a call.

With more properties on the market at present, as a buyer you can use that to your advantage. If you want to make a move, your best bet is to focus on your personal situation—not what the you hear on the news or from well-minding friends or relatives.

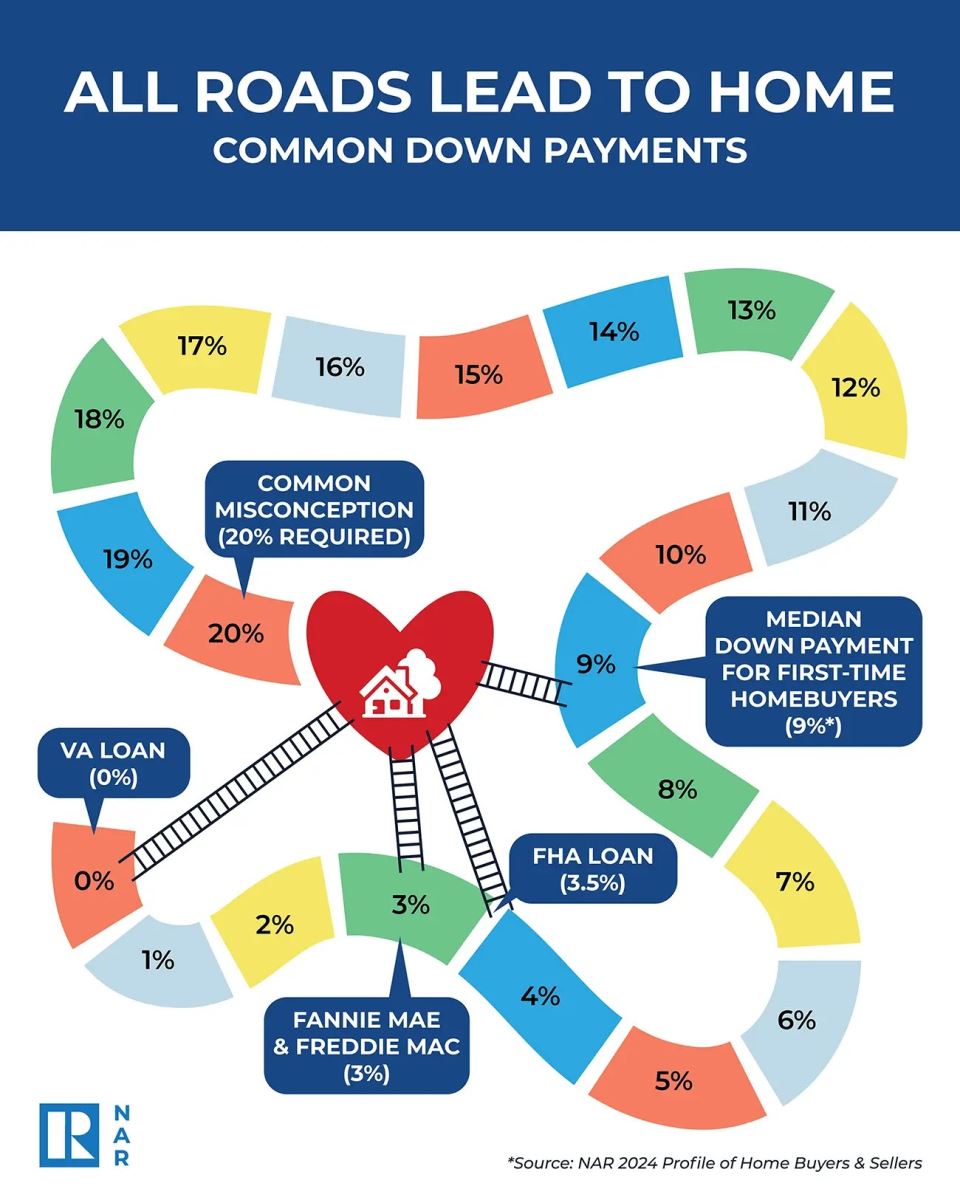

If you’ve even considered a move in the last year or more NOW is the time to begin. You might be surprised to find that the possible increased equity in your present home could provide you with a greater down payment, which in turn will result in less of a monthly output than you might expect.

But you won’t know anything unless you get together with me and we figure out how to put your wants, needs and budget requirements to the best use to find just the right place for you and your family.

I am a leading authority in the Residential real estate industry and keep my clients and visitors well-informed, thus enhancing their ability to make timely and effective real estate decisions.

Give me a call today at 719.593.1000 or email me at Harry@HarrySalzman.com and together let’s see how your Residential real estate dreams can become reality in the best time frame for you.

COLORADO SPRINGS IS RANKED #49 OUT OF 228 MEASURED METRO AREAS IN THE RECENTLY PUBLISHED NAR SURVEY

The National Association of Realtors, 8.12.25

In the recently published quarterly report from the National Association of Realtors (NAR), single-family, existing-home prices grew in 75% of measured metro areas. This is down from 83% the previous quarter.

Compared to a year ago, the national median single-family existing-home price climbed 1.7% to $429,400.

Also compared to a year ago, the median price of single-family homes in Colorado Springs rose 0.2% to $480,600 per NAR. This price reflects detached, single-family and patio homes but not townhomes or condominiums. Considering that 24% of the measured markets experienced declining home prices, at least our median price improved just a bit and is higher than the national average.

The median home price increase in the Springs ranked 49th highest of the 228 cities surveyed.

To see all 228 metro areas in alphabetical order, please click here. To see them in ranking order, click here. Or click here to see what income levels are required to purchase homes based on either a 5, 10 or 20 percent down-payment.

If you have any questions, please give me a call.

WHAT MORTGAGE RATE WILL GET MORE BUYERS MOVING? PLUS, A HOUSING FORECAST…

NAR Magazine, 8.13.25

NAR’s latest forecast indicates that about 5.5 million more households would be able to a afford median priced home if the 30-year mortgage rate dropped to 6%. This number includes 1.6 million renters. If rates were to hit that number, it’s likely that 10% -- or 550,000 – of those additional households would buy a home over the next 12 to 18 months, according to new data from NAR.

NAR forecasters are saying that rates could dip to the sweet spot of 6% by 2026 and that could drive home sales up 14% in 2026.

So, should you wait if you are wanting to buy? That depends. Buyers who are holding out for lower interest rates may be missing out.

Following years of declines, housing inventories are finally rising across the country as well as here in Colorado Springs, giving buyers a greater choice than they have had in many years.

As a result, home shoppers may find they have more bargaining power and some real estate brokers are even seeing price drops as seller competition heats up.

And with home values continuing to appreciate, it could cost you to wait if the price of the home you want costs more later.

According to Lawrence Yun, chief economist for NAR, current homeowners remain the biggest beneficiaries of the housing market, enjoying record-high real estate net worth.

“Through real estate, more Americans are gaining financial security,” Yun said. “Real estate net worth is on solid ground, based on the low delinquency rate and even lower foreclosure rate conditions.”

The Housing Forecast: 2025 and 2026

Since mortgage rates remain stagnant, NAR downgraded its housing forecast for the remainder of 2025—but upgraded its forecast for 2026 on the expectation that rates will continue to come down. Yun presented the following outlook for the housing market:

Existing-home sales:

- 2025: +3%

- 2026: +14%

New home sales:

- 2025: +5%

- 2026: +5%

Median home prices:

- 2025: +1%

- 2026: +4%

Mortgage rates:

- 2025: 6.7%

- 2026: 6%

Jobs:

- 2025: +1.6 million

- 2026: +2 million

Keep in mind this is a national forecast and traditionally Colorado Springs has exceeded the national average in terms of prices and sales.

As for first time buyers, they made up only 24% of the market last year—a record low, compared to the historical norm of about 40%. However, they, too, are slowly returning, currently accounting for 30% of home purchases in May, according to Jessica Lautz, NAR’s deputy chief economist. She attributed this to more stable mortgage rates (hovering around the mid to high 6% range since January) and increased housing inventory.

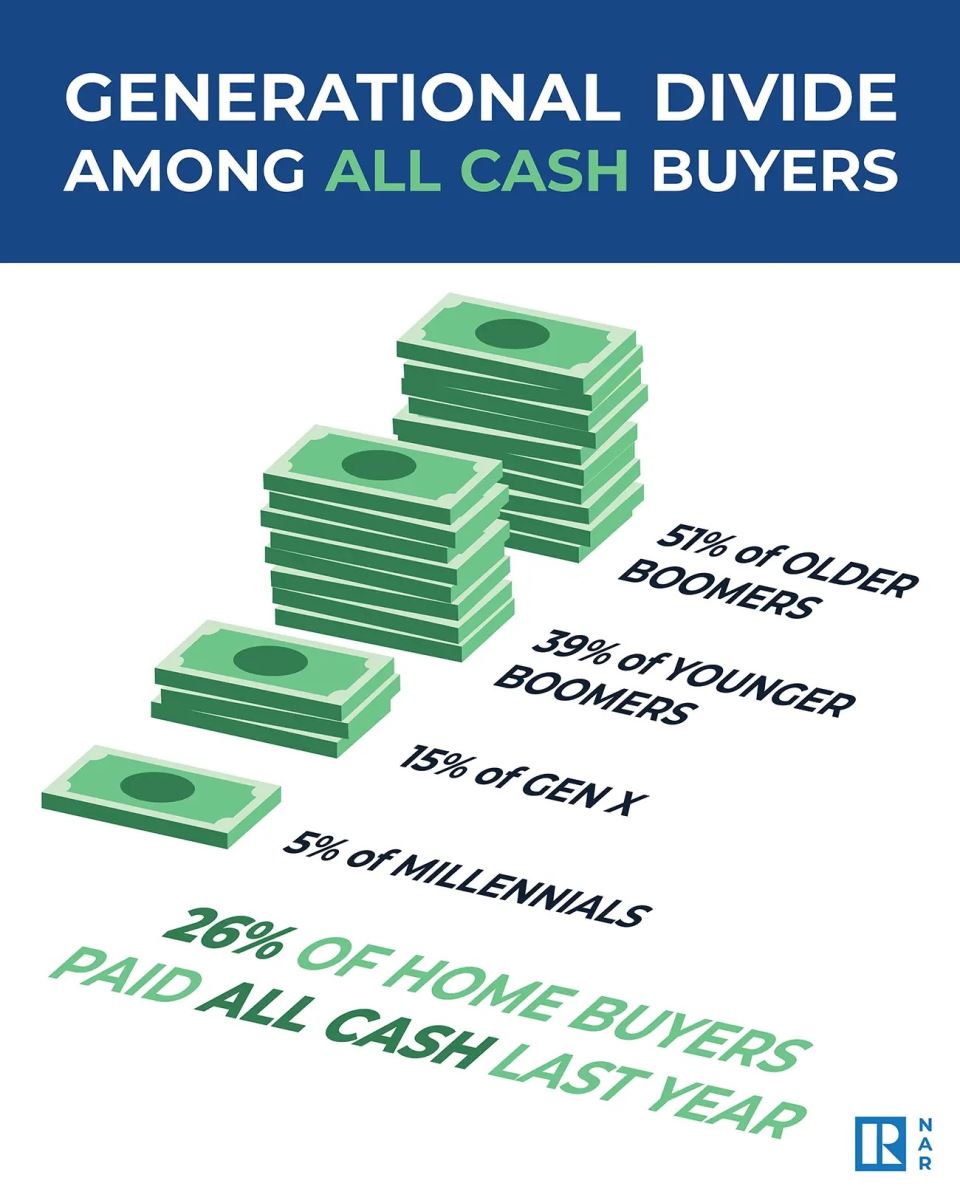

All-cash buyers stay strong: they now make up over 25% of the housing market, with one-third of repeat buyers—primarily baby boomers—buying homes without a mortgage. Many are using equity from prior home sales, Lautz reported.

Interestingly, Lautz noted that one in 10 first-time buyers are also paying all-cash for a home purchase, drawing from personal savings, inheritance, financial gifts from their parents and investments, like stocks and 401(k)s.

This is depicted below:

.jpg)