HARRY'S BLACK FRIDAY SPECIAL

November 24, 2021

HARRY’S BLACK FRIDAY SPECIAL

Displaying blog entries 1-4 of 4

November 24, 2021

HARRY’S BLACK FRIDAY SPECIAL

November 22, 2021

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

SOME DAYS THERE SEEMS TO BE MORE QUESTIONS THAN ANSWERS…

You know, after 48+ years in local Residential real estate, along with my Investment Banking background, I’ve become somewhat of an expert in these arenas. Some days I wish I had a crystal ball because oftentimes there is no definitive answer to a lot of the questions I’m asked.

It’s easy for me to understand why Zillow ended its iBuying department. Buying and selling Residential real estate is not for the timid…or for those with limited experience.

Are prices going to continue to climb? Are interest rates going to go up as well? Is it a good time to purchase a home for investment purposes? Am I better off looking at new construction because of the lack of existing homes for sale? Is this the best time to sell my present home and trade up?

Those are just a few of the questions I field daily. If I knew all the answers to those inquiries, it sure would make life easier for not only me, but for my clients as well.

However, I do have some answers that have remained true for as long as I’ve been working in Residential real estate.

All answers need to first be based on LOCAL statistics. When you see on national news that home prices are going up or down—always remember they are talking about the U.S.A. in general. As I’ve been saying for quite some time now, Colorado Springs as a city is seeing spectacular growth. When the housing crisis enfolded in 2007-8, we were not hit nearly as hard as the rest of the country and thus were able to recover at a faster pace.

During the recent pandemic as folks were leaving big cities or starting to work from home (WFH), Colorado Springs was the choice of many.

As more and more companies are moving here and relocating employees with them, those folks are needing places to live as well.

When you add that to our excellent work/life balance…well, I think you get the picture.

While looking at the local picture is important, the primary place to look is at your individual situation.

When I’m asked, “Is now good time to buy or sell?”, I always answer the same way. “If it’s right for YOU, then it’s a good time to buy or sell.” There’s no standard formula for buying and selling a home and that’s why I spend time with each client to determine what is best for their situation.

It’s important to find out what someone is looking for and determine why they want to buy, sell, or invest in a home as everyone has different wants, needs and budgets. Those type of questions need to be addressed upfront and we can proceed from there.

Yes, it’s not easy out there in Residential real estate territory these days, but when you’ve got me on your team, you’ll win in the end. It may take longer than usual to find exactly what you want, but if there’s any way possible, I will work to make it happen for you and your family.

And the best move you can make at present is to call me at 593.1000 or email me at Harry@HarrySalzman.com to get any and all of your Residential real estate questions answered. If I don’t have the answer, I sure do know where to get it, and that’s as important as “knowing it all”.

I look forward to speaking with you.

COLORADO SPRINGS HOME PRICES JUMP HIGHER IN THIRD QUARTER 2021…AMONG MOST EXPENSIVE IN THE COUNTRY

The National Association of Realtors, 11.10.21

Median prices of single-family homes across the nation rose double-digits for Quarter Three 2021 in 99% of the 183 metro areas surveyed quarterly by The National Association of Realtors (NAR), with the median price nationally rising 16.0% to $363.700.

Colorado Springs surpassed that, with the median price of single-family homes jumping 18.6% to $441,200 during the third quarter of the year. Prices reflect detached, single-family and patio homes but not townhomes or condominiums.

The median price in the Springs ranked 29th highest of the cities surveyed. And once more, the good news is that while our home values are increasing, they are still less than those in the Denver and Boulder areas, which makes our city more attractive to potential companies and others wanting to relocate here.

Qualifying income for local mortgages continues to rise, however, increased home value in your present home can likely give you a larger down payment. That could possibly keep your monthly output lower than you might expect, even in a more expensive new home.

To see all 183 metro areas in alphabetical order, please click here. To see them in ranking order, click here. To see the qualifying income necessary for mortgages, click here.

And if you have any questions, you know where to reach me.

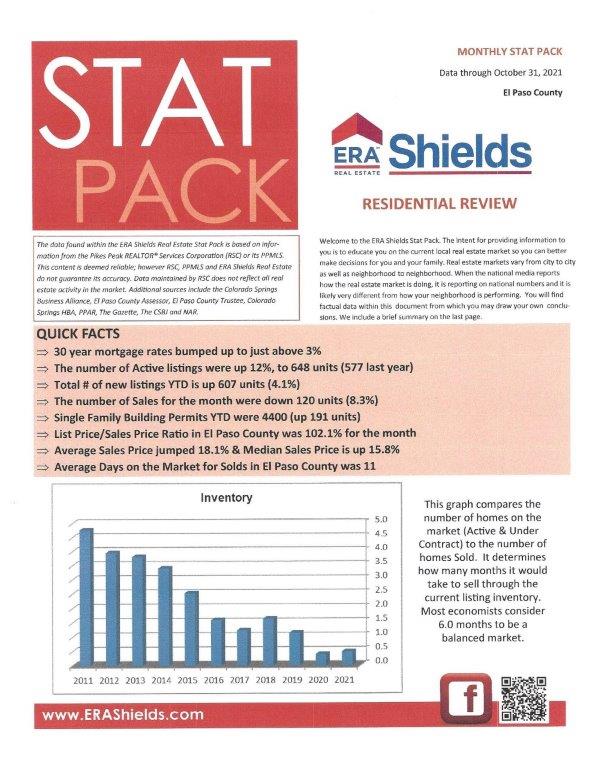

ERA SHIELDS “STAT PACK” PROVIDES A GOOD RESIDENTIAL real estate OVERVIEW

ERAShields, 10.31.21

As always, I am pleased to provide you with the most current local information. This easy-to-understand report, along with graphs, gives you a good idea of the state of local Residential real estate.

Below I’ve reprinted the first page of the report and you can click here to read the report in its entirety.

HOMES SELLING IN ONE WEEK, FORCING BUYERS TO TAKE RISKS

The Wall Street Journal, 11.12.21

This recent article wasn’t news to me, as I’ve been encountering similar situations for over a year now, but it’s interesting to see that buyers all over the country are also having difficulty in purchasing existing homes for sale in this seller’s market.

According to a survey by the National Association of Realtors, “Homes sales between July 2020 and June 2021 sat on the market for a median period of one week before going under contract.” That is down from three weeks a year earlier and marks a record low in data going back to 1989.

This rapid turnover helps explain how the number of homes sold rose to multiyear highs during the Covid-19 pandemic, even as the inventory of homes for sale remained so low.

The pandemic sparked the biggest housing boom in more than a decade…for many of the reasons I mentioned before.

Supply is still constrained, and buyers are having to pounce quickly once they find what they are looking for. As I’ve told you in previous articles, many buyers have waived their rights to terminate a contract because of a low appraisal or unfavorable inspection. In fact, several my buyers have bought homes without ever seeing them in person.

This has been especially true of new construction where there are only so many lots released at a time and buyers must get in line to purchase. I’ve gone to those sites for my clients and selected lots and home elevations, and we have communicated through Zoom calls so the clients can make a quick decision based on my input. This is a service I provide at no additional cost to the buyer and can make a difference, especially when time is of the essence.

One of my recent clients did not get their first choice due to not committing to the lot immediately. They were able to get their second choice, but the homebuilder required a commitment on the phone with a signed contract emailed immediately thereafter.

Fortunately, I have good working relationships with most local builders but even that doesn’t always get me to the front of the line. Lately it’s been via a lottery type of situation and buyers only have x amount of time to commit.

Whether it’s new construction or purchasing an existing home, the most important thing is knowing your wants, needs and budget before even starting to look.

After you make those decisions, the next best one is to call me and get the ball rolling. It’s going to take longer than you might expect and the sooner we start, the sooner you can be living in the home of your dreams.

HARRY’S JOKE OF THE DAY:

Even though it’s a “corny” joke, there’s a double meaning in here.

As we approach the Thanksgiving holiday, I always start by giving thanks for my family and you, my clients and friends.

Have a safe and happy Thanksgiving.

November 4, 2021

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

I HAD INTENDED TO INCLUDE THIS WITH MY “JOKES OF THE DAY” BUT…

…unfortunately this crazy Residential real estate market is in no way a joke. Every time I think we have reached our “new normal” it keeps changing.

I was hoping that when we started to have a few more existing homes for sale that most of those bidding wars and winning bids over list price would settle down a bit. But I was wrong. Let me give you a recent example.

Last Thursday I listed a home for $540,000. When the showings began that day, I received a call from a broker who wanted to make an offer, sight unseen, for their buyer. I let that broker know that the seller was not going to accept any offer immediately. He said that was fine and that his buyer would put in a purchase price increase clause that would allow his bid to go $3,000 higher than the highest bid--to a high of $605,000.

As the day progressed and showings began, we received a number of offers. And then the bidding war began. Since the first offer had indicated they were willing to bid $3,000 over the highest bid, that offer was accepted on that same day one! Selling price? $598,000.

Yes, you read that right. The home sold for $58,000 more than the asking price in one day—that’s 10% OVER the listing price. And the best news for my seller was that the buyer was putting down more than 50% cash, thus negating the need for an appraisal which possibly could have come in at under the selling price!

And the moral of this story?

If you’ve even considered the possibility of selling to trade up or move to a new neighborhood, NOW is the time for more reasons than the above.

Mortgage interest rates which have been staying at historical lows are projected to rise. I can’t tell you when that might happen, but most economists are saying the rates can’t stay this low.

Home prices are continuing to rise which means two things if you are looking to move. First of all, your present home is more than likely worth more than you might imagine, thus providing you extra equity to put into your next one.

Therefore, even though your next home will also likely cost more, the size of your down payment could possibly help keep your monthly output close or not too much more than what it is currently.

The downside at the moment is still the shortage of existing homes for sale. So you really do need to know where you intend to move prior to listing your present home. It’s possible to request to lease your home back from the buyer for a certain period of time, but that is not always an option.

I wish I could tell you that new home construction is the answer and in a number of cases it is, but I’ve lately seen the implementation of “lotteries” in order to deal with only so many available lots and oh, so many potential buyers.

Homebuilders are working as fast as they can to rectify this, but at the moment it’s a bit hard to navigate through those “wars” as well. And if new home construction is what you are seeking, I can help you there as well, without any additional cost to you.

The one bright side in all of this?

Me, of course.

With my 48+ years in the local Residential real estate arena, coupled with my Investment Banking background, I’ve experienced a lot and can help make the buying and selling process a bit less painful, if possible. I used to say I could make it fairly “stressless”, but unfortunately that’s not the case at present. I continue, however, to do my best to make purchasing what is often your most valuable investment as pleasant an experience as I am able.

So, if you’re ready…I’m willing and able to help you make your Residential real estate dreams come true.

The very best move you can make right now is to call me at 719.593.1000 or email me at Harry@HarrySalzman.com to get any and all of your questions answered.

I look forward to speaking with you.

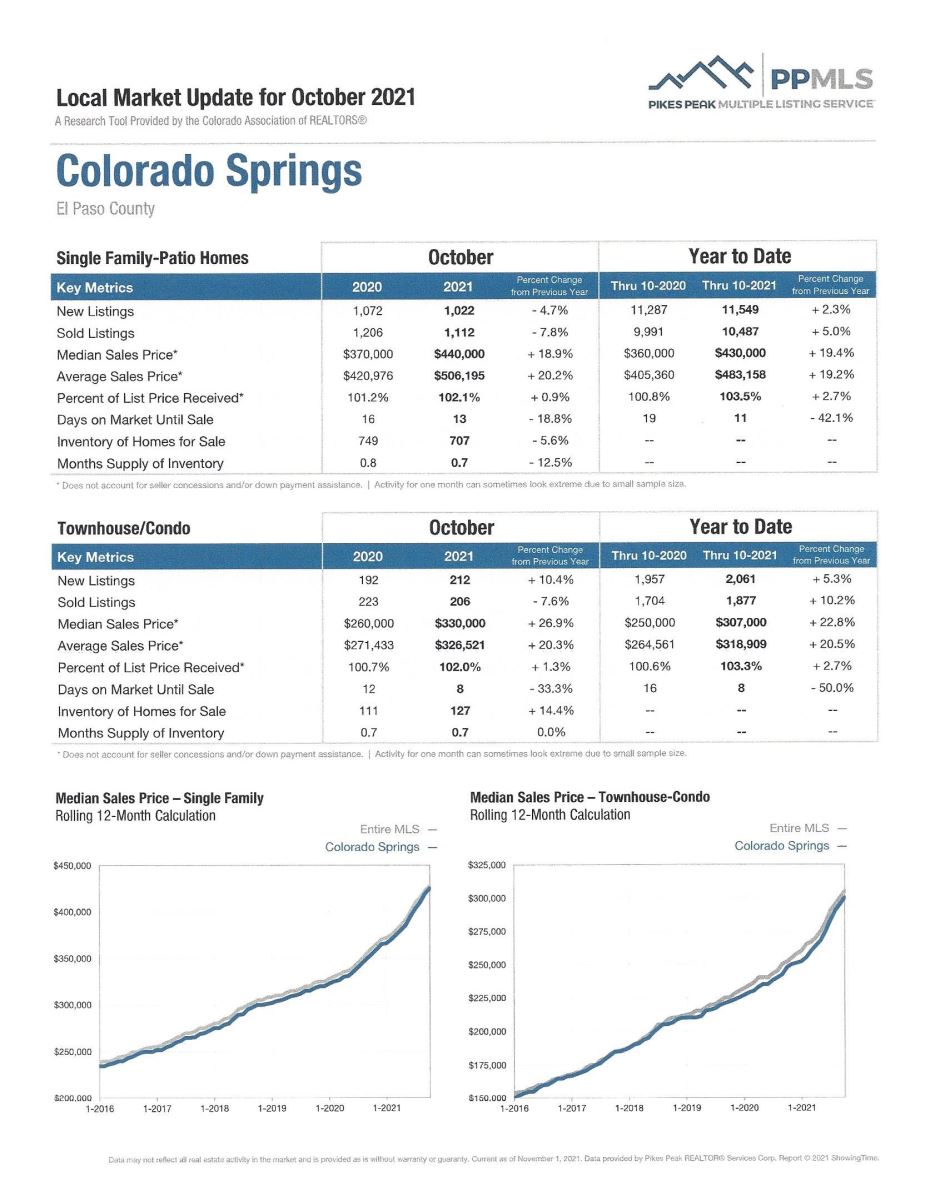

OCTOBER 2021

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the October 2021 PPAR report. The format of this report no longer provides monthly statistics for each individual neighborhood. However, if you are interested in what’s happening in your neighborhood, I can provide you with this information through other means.

In El Paso County, the average days on the market for single family/patio homes was a low 11. For condo/townhomes it was 8.

Also in El Paso County, the sales price/list price for single family/patio homes was 102.0% and for condo/townhomes it was 101.9%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing October 2021 to October 2020 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 1,596, Up 2.4%

· Number of Sales were 1,641, Down 5.3%

· Average Sales Price was $510,180, Up 18.0%

· Median Sales Price was $446,000, Up 16.3%

· Total Active Listings are 1,048, Up 19.0%

· Months Supply is 0.6, Down 3.6%

Condo/Townhomes:

· New Listings were 248, Up 7.8%

· Number of Sales were 250, Down 3.8%

· Average Sales Price was $326,622, Up 18.3%

· Median Sales Price was $326,272, Up 24.5%

· Total Active Listings are 129, Up 27.7%

· Months Supply is 0.5, Down 7.2%

Now a look at more statistics…

OCTOBER 2021 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year to Date one-year change:

You can click here to read the 15-page Monthly Indicators or click here to get specific information on the geographical area of your choice from the 18-page Local Market Update. I recommend that you check out your own area or one that you are considering, to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area in general:

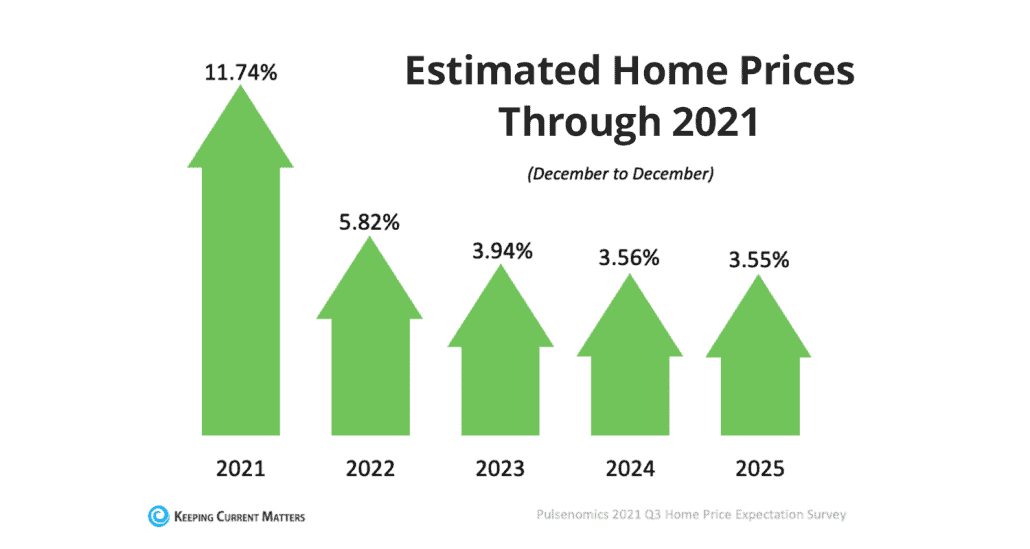

NATIONAL housing market PREDICTIONS FOR 2021 & 2022

Keeping Current Matters, 10.26.21

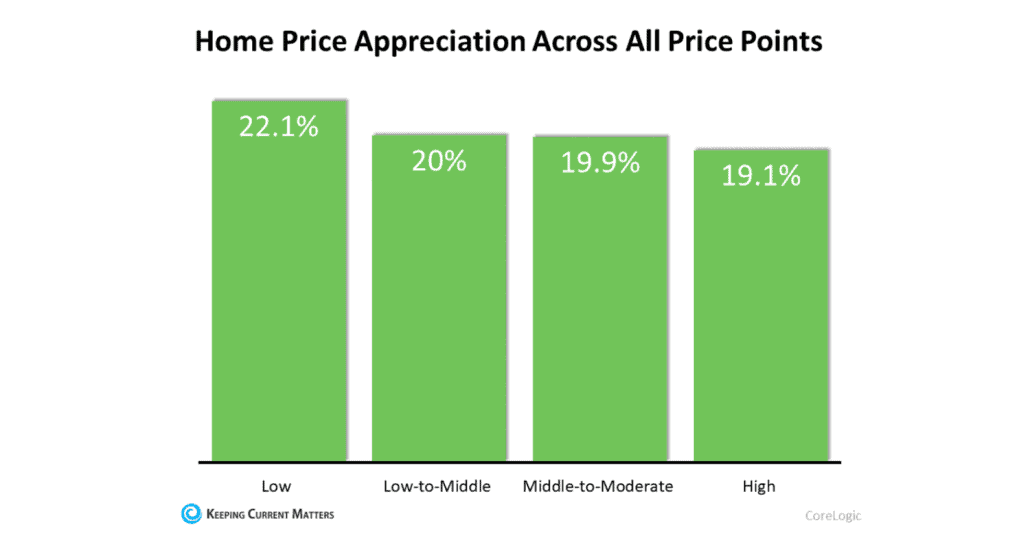

Despite all the ups and downs this past year, one thing we know for sure is that the real estate market in 2021 not only met expert predictions, it surpassed them and broke records along the way.

That, of course, brings up the future. Will the 2022 housing market continue to follow that same trajectory, or are we facing a possible downturn?

The following is a deep dive into what leading real estate experts are projecting for the final quarter of 2021 and what to expect in 2022 so you, as a potential buyer and/or seller have the knowledge and confidence you need to be successful.

As always, please remember that these predictions are generalized on the national level, and when I write about trends it is more localized. For example, when you read about unemployment further down, remember that Colorado Springs was not hit nearly as hard as a lot of the country, and we have rebounded at a faster pace. Our home prices have risen at a pace higher than much of the USA and due to the desirability of working and living here, we will undoubtedly continue to outpace a good portion of the country in the coming year and more.

housing market FORCAST:

IS THE housing market GOING TO CRASH BEFORE 2021 ENDS?

The answer, according to top real estate experts, is a big NO. While memories of the housing crash of 2008 still linger on the minds of many buyers and sellers, today’s market conditions resemble nothing close to what caused it.

Home price appreciation may be high but again, it’s a result of supply and demand. The foreclosure situation should be balanced out by the large amount of equity homeowners currently have which means they can choose to sell rather than foreclose.

Plus, while affordability may be decreasing, historically speaking it’s still high compared to most other years.

WHAT DOES THIS MEAN FOR BUYERS AND SELLERS FOR THE REST OF 2021?

There is still a lot of motivation for both buyers and sellers in today’s market and that’s not expected to change in the next couple of months.

With both inventory and mortgage rates remaining low, both sides of the real estate transaction stand to benefit from making a move before the end of the year.

real estate is still strong and waiting until next year could mean losing out on a less competitive market and better affordability—the two big factors positively impacting buyers and sellers today.

2022 housing market PREDICTIONS

Here’s what industry experts are saying about what they anticipate for the 2022 housing market:

HOME PRICES

It is important to remember again that the 2021 market was anything but normal, and that escalating home values were a direct result of the record-low inventory. Experts predict that the inventory situation should improve in the coming year, stabilizing price appreciation across the nation.

But will home prices depreciate in 2022? More than 100 industry experts don’t think so. Instead, they are projecting a more modest appreciation of 5.82% nationally in the next 12 months compared to the 11.74% rise seen nationally on average in 2021.

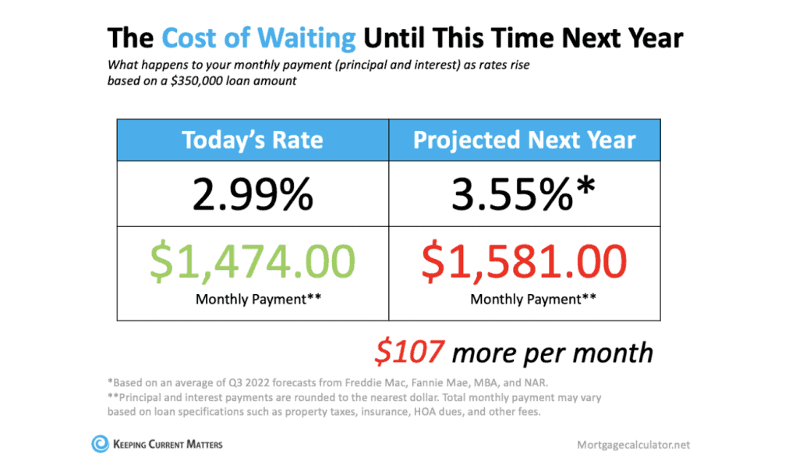

MORTGAGE RATES

In case I haven’t mentioned it enough, the past year saw the lowest mortgage rates in the history of real estate. So, if you are waiting for those rates to come back down or go down more, you may be waiting a very long time.

While homes right now may be less affordable than they were a year ago, they’re still extremely affordable.

If you look at the 30-year mortgage rate chronicled by Freddie Mac, you can see the average rates by decade:

While experts don’t project that mortgage rates will rise a huge amount, any increase would mean an increase in monthly mortgage payments. A couple of decimal points may not seem like a lot to most, but it could make or break a buyer’s budget.

If you play the waiting game, a rise in mortgage rates coupled with the continued home price appreciation means just one thing—paying more for the same house you could buy now.

HOUSING INVENTORY

Inventory has been the biggest player in the anything but ordinary real estate market of the past two years.

With the bidding wars and such going on you might be wondering if housing inventory will increase in 2022. The good news is that there are many factors that lead industry experts to anticipate a rise in homes for sale.

Here’s why:

BOTTOM LINE

If I’ve taught you anything in these eNewsletters it should be that while the future can be projected, it can’t be predicted.

While industry experts don’t expect the 2022 housing market to be as crazy as 2020 or 2021, it’s important to keep reading my eNewsletters to get current information on our local residential real estate status.

Better yet, give me a call and we can discuss your individual situation and how to best take advantage of making your wants, needs and budgetary requirements get you into the home of your dreams.

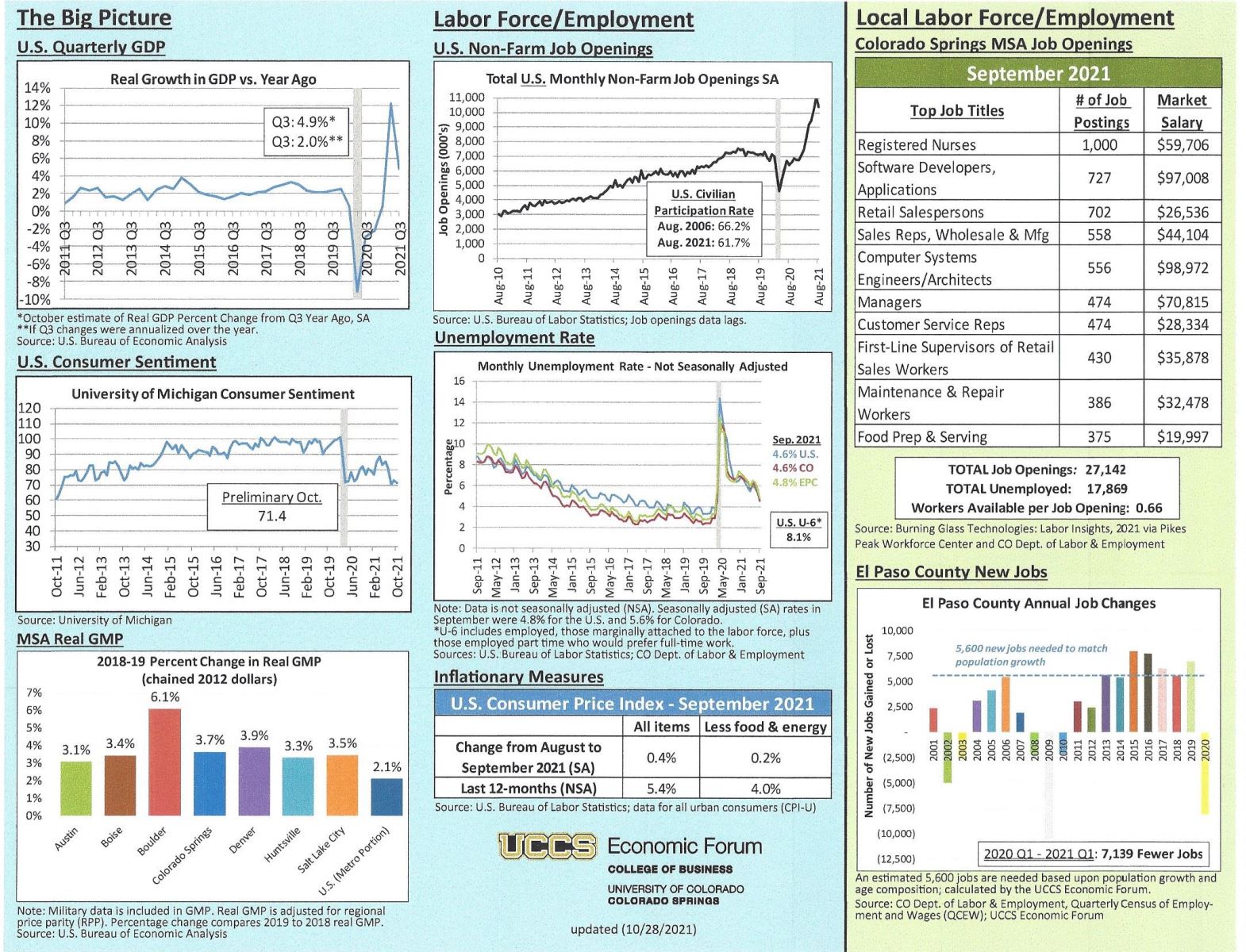

UCCS ECONOMIC FORUM UPDATE

College of Business, UCCS, updated 10.28.21

As always, I’ve included the most recent economic update from the UCCS Economic Forum. It provides data concerning all aspects of the economy, on both the National and Colorado Springs levels.

I’ve reproduced just one of the charts below. You can click here to read the entire report and if you have any questions, please give me a call.

Displaying blog entries 1-4 of 4

Be the first to know what's coming up for sale in the Colorado Springs real estate market with our New Property Listing Alerts!

Just tell us what you're looking for and we'll email a daily update of all homes listed for sale since your last update. You can unsubscribe at any time.

Get NotificationsOur office is located at:

6385 Corporate Drive, Suite 301

Colorado Springs, CO 80919

Office: 719.593.1000

Cell: 719.231.1285

Harry@HarrySalzman.com