HARRY'S BI-WEEKLY UPDATE 2.20.2024

February 20, 2024

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

TODAY’S RESIDENTIAL real estate MARKET CAN STILL BE SOMEWHAT PUZZLING

As I write this, I am right there with many of you…wondering how the pieces are going to come together during the upcoming spring buying and selling season. I feel that it is going to be a busier time than we’ve seen in the last few years.

I have already had clients preparing their homes for sale and others who are considering their next move as well.

With the drop in mortgage interest rates combined with the increased equity due to higher home values, I’m finding folks getting ready to test the Residential real estate waters sooner than later.

I believe that there will be more homes on the market in the next few months and that will provide better choices and less frenzy than the recent past.

My advice to those of you who have even considered a move? Start your preparation now. Consider your wants, needs and budget requirements and give me a call. A move might be easier on your monthly budget than you think, but you won’t know until we put all the pieces together.

So, if you’ve even been thinking about a move, please give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let’s get together and see how together we can make your Residential real estate dreams come true.

AND ANOTHER WORD FROM ME…

If you’ve got a minute and 47 seconds, I’ve got some additional news for you. Click on the link below to hear my latest podcast:

Be sure to “subscribe” online to hear my “blurbs” when they become available.

COLORADO SPRINGS HOME PRICES ONCE AGAIN ROSE IN QUARTER FOUR…AMONG MOST EXPENSIVE IN THE COUNTRY

The National Association of Realtors, 2.8.24

Median prices of single-family homes across the nation rose for Fourth Quarter 2023 in 86% of the 221 metro areas surveyed quarterly by The National Association of Realtors (NAR), with the median price nationally rising 3.5% to $391,700 from one year ago.

Home prices in Colorado Springs rose about the same—3.6%-- for that same time period and we were ranked number 47 based on Median Sales Prices of the 221 cities surveyed. The Median Sale Price here at the end of Quarter Four 2023 was $459,300. Prices reflect detached, single-family and patio homes but not townhomes or condominiums.

And once more, the good news is that while our home values are increasing, they are still less than those in the Denver, Boulder, Ft. Collins and Greeley areas, which makes our city more attractive to potential companies and others wanting to relocate here.

Qualifying income for local mortgages continues to rise. However, increased home value in your present home can likely give you a larger down payment. That could possibly keep your monthly output lower than you might expect, even in a more expensive new home.

To see all 221 metro areas in alphabetical order, please click here. To see them in ranking order, click here. To see the qualifying income necessary for mortgages, click here.

And if you have any questions, you know where to reach me.

LOWER RATES, MORE LISTINGS: WHAT LIES AHEAD FOR HOUSING THIS YEAR

Keeping Current Matters, 2.2024

As I wrote earlier, this has been a somewhat puzzling year for everyone when it comes to Residential real estate. And that includes the economists who do the yearly forecasts. While it’s normal for experts to re-forecast throughout the year, many of them are already being updated and for the better!

We are finally seeing some relief as mortgage rates have been trending downward in the last few months. You aren’t going to see the 2-3% range of 2020 and 2021—likely ever again. However, we will see rates slowly come down. Many experts are already saying that they expect rates to go into the low sixes and high fives as soon as the end of May.

With prices being driven by supply and demand (good old Econ 101), it’s still going to be a seller’s market for a while.

And, as mortgage rates drop, experts project that many of those hesitant homeowners could be more motivated to move.

According to Selma Hepp, Chief Economist at CoreLogic, “With mortgage rates dropping, demand for homes in early 2024 is likely to be strong and will again put pressure on prices, similar to trends observed in early 2023…Most markets will continue to reach new home price highs over the course of 2024.”

So, once again, with 2024 starting out on a better foot than last year, there’s tremendous opportunity for those who are ready to make a move. Give me a call and let’s see if the time is right for you.

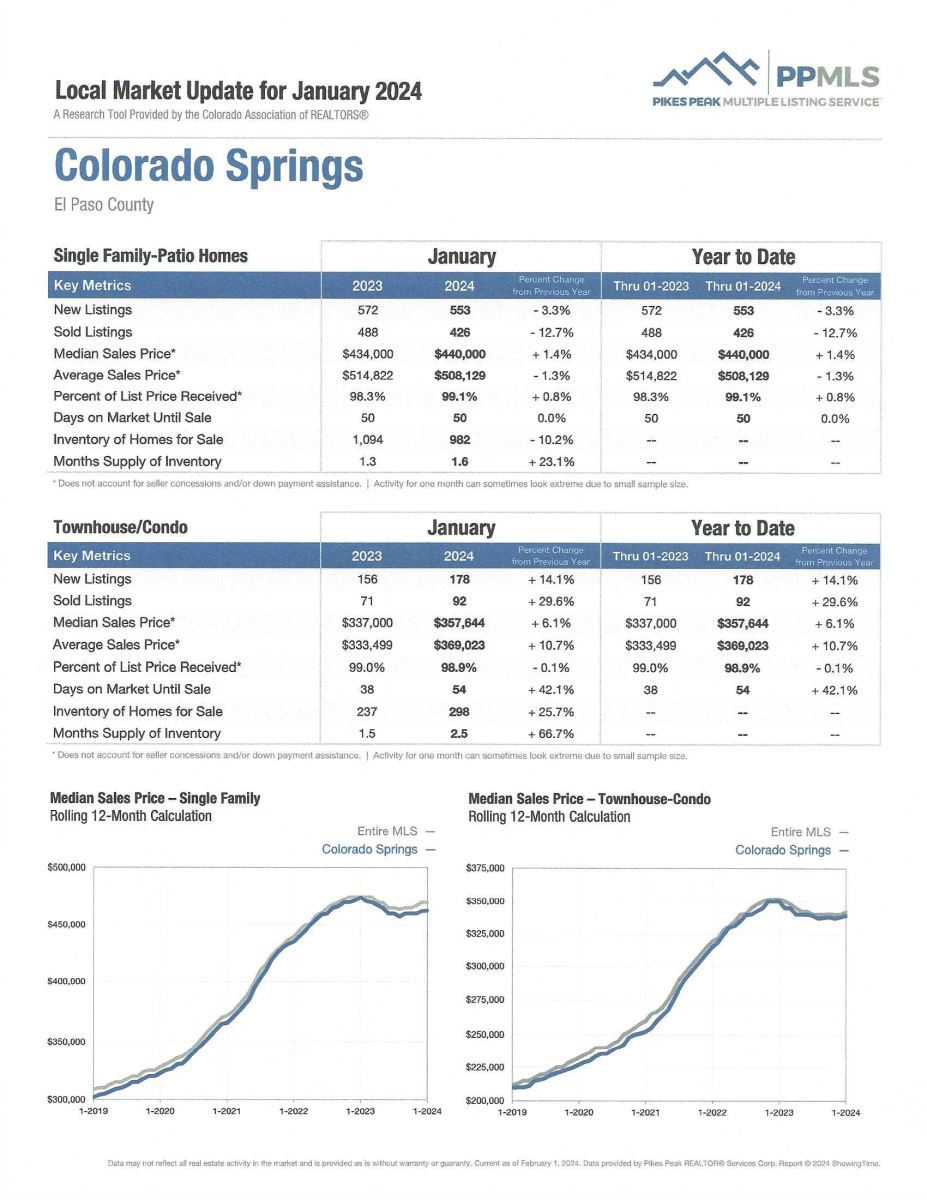

ERA SHIELDS MONTHLY STAT PACK

Data through January 2024, ERA Shields

Here is data from my company’s monthly “Stat Pack” that can better help you understand the local buying and selling reality. I have reproduced the first page, and you can click here to get the report in its entirety.

.jpg)

COLORADO SPRINGS NAMED ONE OF BEST PERFORMING CITIES BY MILKEN INSTITUTE

The Gazette, 2.9.24, The Milken Institute

Colorado Springs was ranked number 15 out of 200 large metro areas nationwide in a report by the Milken Institute released several weeks ago which measures economic vitality.

The Springs had climbed to number 9 among large cities in 2022—it’s highest ranking ever in the report—but slid to number 37 last year before jumping back to number 15 this year.

The Milken Institute’s Best Performing Cities report, first published in 1999, uses 13 indicators to determine its rankings. The indicators examine labor market conditions, high-tech impact and access to economic opportunities.

Some highlights:

The Springs topped Denver-Aurora-Lakewood (#20), Fort Collins (#29), Boulder (#47) and Greeley (#93) in the large-city portion of the report.

In the small cities section were Grand Junction (58) and Pueblo (#119).

This year the report showed three trends:

- Cities’ performance is closely linked to job and wage growth, which is primarily driven by the expansion of high-tech industries.

- While large cities tend to have a stronger presence of high-tech industries, the fastest growth in this sector was observed in top-ranked small cities.

- With the resumption of travel and tourism throughout 2021, the leisure and hospitality industry played a crucial role in driving the highest improvements in this year’s rankings.

To view the information on Colorado Springs’ ranking, copy and paste this link into your browser:

https://public.tableau.com/shared/DX4TDCBN7?:display_count=n&:origin=viz_share_link&:embed=y

HARRY’S FACT OF THE DAY: