HARRY'S THANKSGIVING GREETING 2025

November 24,2025

HARRY’S THANKSGIVING GREETING

Wishing you and yours a happy, safe, and plentiful Thanksgiving holiday…

Displaying blog entries 1-2 of 2

November 24,2025

HARRY’S THANKSGIVING GREETING

Wishing you and yours a happy, safe, and plentiful Thanksgiving holiday…

November 7, 2025

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

NOT A LOT OF MOVEMENT IN THE MORTAGE RATES BUT IF YOU’VE BEEN WAITING TO MAKE A MOVE…NOW IS A GOOD TIME

Yes, you read that right.

Traditionally, this time of year is considered one of the slowest for Residential real estate. However, there hasn’t been anything “traditional” about buying and selling in recent times and I’m seeing more movement in the market than in the recent past.

Folks are getting tired of waiting for the “right” time and realizing that the longer they wait for mortgage rates to fall, the more home prices are going to go up, thus depriving them of “home equity” that could have been theirs had they bought when they were first considering a move.

As you will see in the statistics below, listings on single family homes are up 15.4% over this time one year ago. That means more people are tired of waiting and are now ready to sell to trade up or move to another neighborhood.

What is also means is that if you are ready to do the same, there are more homes available and that provides you with a better selection as well as more buying power since it’s no longer a “sellers’ market”.

Another thing to consider is financing that can help keep your interest rate down. We are again seeing more buyers opting for a 5-year Adjustable-Rate Mortgage, figuring that rates will go down during those five years which will allow them to refinance at the better rate for a traditional mortgage of 15 or 30 years.

Also, you might find that your present home has more equity than you might imagine, thus providing more dollars for a down payment on the new home and keeping your payment lower.

In a nutshell…NOW is a great time to sit down with me and together we can see what’s available for your personal situation and figure out how to put your wants, needs and budget requirements to the best use to find just the right place for you and your family.

Why not give me a call today at 719.593.1000 or email me at Harry@HarrySalzman.com and let’s see how your Residential real estate dreams can become reality in the best time frame and for the best financial situation for you.

And now for statistics…

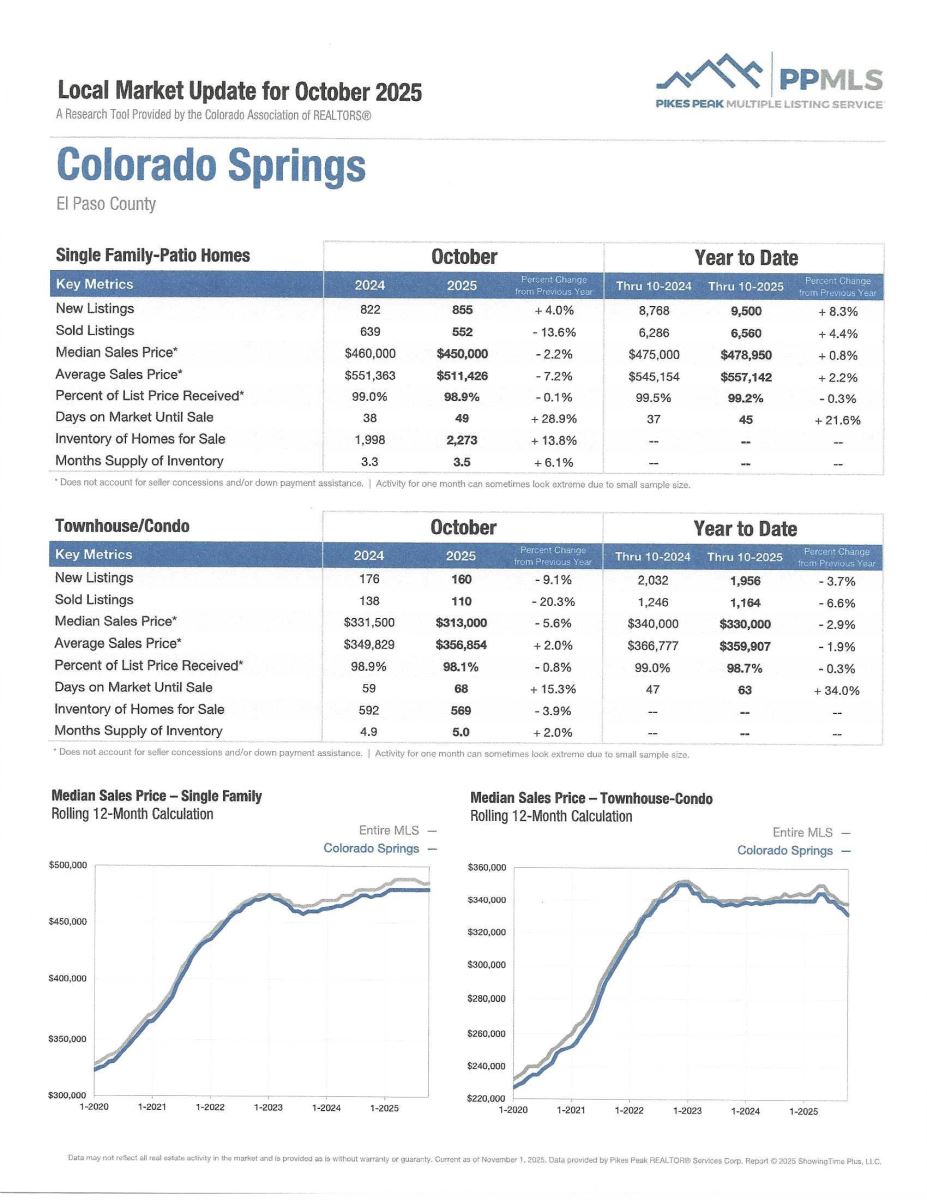

OCTOBER 2025

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the October 2025 PPAR report:

In El Paso County, the average days on the market for single family/patio homes was 52. For condo/townhomes it was 66.

Also in El Paso County, the sales price/list price for single family/patio homes was 99% and for condo/townhomes it was 98.2%.

In Teller County, the average days on the market for single family/patio homes was 62 and the sales/list price was 98.1%.

Please click here to view the detailed 12-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing October 2025 to October 2024 for All Homes in PPAR:

Single Family/Patio Homes:

Condo/Townhomes:

OCTOBER 2025 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year-to-Date one-year change:

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

2025 NATIONAL ASSOCIATION OF REALTORS (NAR) PROFILE OF HOME BUYERS AND SELLERS

NAR, 11.4.25

NAR publishes a yearly profile of home buyers and sellers and I thought you might like to see a few highlights from this year’s report.

The real estate Market:

From the middle of 2024 through the middle of 2025 the market continued to show extremely limited inventory, and what was available was often at unaffordable price points for some potential home buyers. During the time data was collected for this survey, the 30-year fixed-rate averaged 6.69%. As a result of decreased housing affordability and limited housing inventory, potential first-time buyers retreated further from the housing market. Homeowners continued to watch their equity grow and the market remained divided between an all-time high of all-cash buyers and an all-time low of first-time buyers.

First-Time Home Buyers:

First-time home buyers in the last year shrank to an historic low of just 21% of all buyers. Prior to 2008, the share of first-time buyers has a historical norm of 40%. At the same time, the share of first-time buyers is at its lowest level, and the age of first-time buyers is now 40. In the 1980’s the typical first-time buyer was in their late 20’s. Among the elite first-time buyers who can enter the market, they are most likely to use personal savings (59%) or financial assets (26%) for their down payment. In reports from past years, a gift or loan from a friend or relative was more common among first-time buyers than financial assets.

Repeat Home Buyers:

Repeat buyers can enter the housing market with large down payments (median of 23%). Thirty percent paid cash and did not finance their home. Repeat buyers have continued to earn housing equity as home prices increase. Home sellers have owned their home for an all-time high of 11 years before selling and make a housing trade.

For repeat buyers, this was the same down payment as in 2024, but it is the highest down payment seen since 2003. This year, down payments also grew for first-time buyers. The typical down payment for first-time buyers was 10%, which matches the highest share recorded since 1989.

Repeat buyers also have the highest median age, at 62, seen in the report’s history. As half of repeat buyers are over the age of 62, they are driven by the desire to purchase a home to be closer to friends and family (at 19%). While this is the top reason to purchase a home, neighborhood preferences have also changed. Among all buyers, the quality of the neighborhood (59%) and convenience to friends and family (47%) are the top neighborhood factors. Convenience to the home buyer’s job has continued to decline incrementally and is now at 31%, down from 52% in 2014. The decline in convenience to one’s job is notable, as return-to-work orders have become more common among employers between 2024 and 2025.

Household Composition:

Among all home buyers, 61% are married couples, 21% are single women and 9% are single men. Among the first-time buyers, 25% are single women and 10% are single men, as the share of married couples remained flat at 50%. The share of home buyers with children under the age of 18 fell to an all-time low of just 24%. A reduction of home buyers with children is likely being shaped by a reduction in birth rates and a rise in older repeat buyers. Additionally, a steady share of buyers cite childcare expenses as a barrier to saving for a down payment.

Buyers’ Use of a real estate Agent or Broker:

Eighty-eight percent of home buyers purchased their home through a real estate agent or broker. Home buyers primarily sought help finding the right home to purchase (50%) and negotiating the terms of the sale (13%). Home buyers also wanted help with price negotiations (12%) and help with paperwork (7%).

Length of Search for a Home:

The number weeks a buyer searched for a home remained steady at 10 weeks compared to last year. Due to limited inventory, it is not surprising that buyers continue to report the most difficult task in the home-buying process is finding the right home to purchase. However, overall, 92% of home buyers are satisfied with the buying process.

Sellers’ Use of a real estate Agent:

Ninety-one percent of sellers sold with the assistance of a real estate agent, up from 90% last year and only 5% were for sale by owner (FSBO) sales, an all-time low. Sellers placed a high priority on the following three tasks: helping market the home to potential buyers, pricing the home competitively, and selling the home within a specific timeframe.

I’m expecting next year’s survey to differ now that interest rates are lower and there are more available homes on the market. However, I found this survey to be interesting and thought you would as well.

If you have any questions, as always, please give me a call.

COLORADO SPRINGS IS RANKED #50 OUT OF 230 MEASURED METRO AREAS IN THE RECENTLY PUBLISHED NAR SURVEY

The National Association of Realtors, 11.6.25

In the recently published quarterly report from the National Association of Realtors (NAR), single-family, existing-home prices grew in 77% of measured metro areas. This is up from 73% the previous quarter.

Compared to a year ago, the national median single-family existing-home price climbed 1.7% to $426,800, the same annual growth as the first quarter of the year.

Also compared to a year ago, the median price of single-family homes in Colorado Springs again rose 0.2% to $474,100 per NAR. This price reflects detached, single-family and patio homes but not townhomes or condominiums. Considering that 23% of the measured markets experienced declining home prices, at least our median price improved a bit and is higher than the national average.

The median home price increase in the Springs ranked 50th highest of the 230 cities surveyed.

To see all 230 metro areas in alphabetical order, please click here. To see them in ranking order, click here. Or click here to see what income levels are required to purchase homes based on either a 5, 10 or 20 percent down-payment.

If you have any questions, please give me a call.

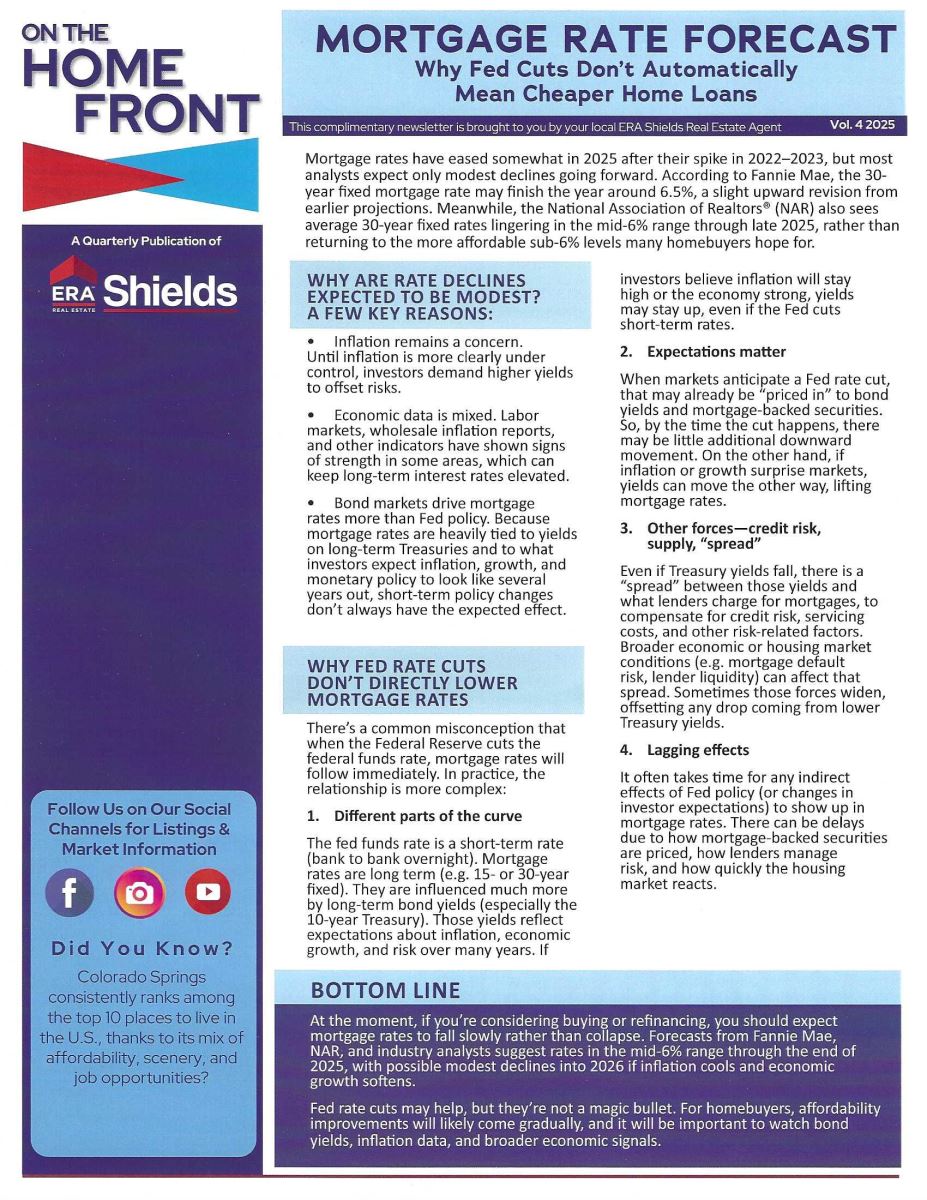

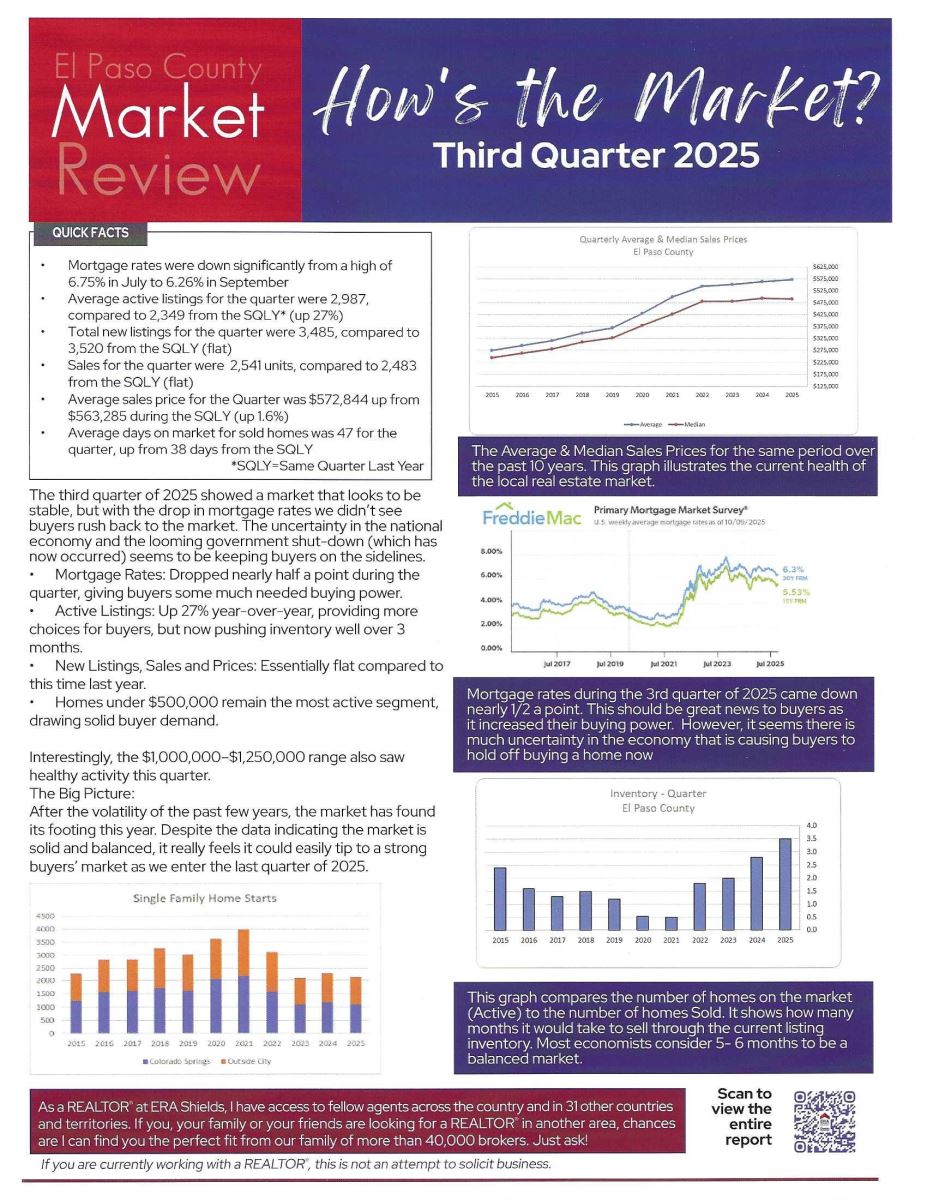

ERA SHIELDS “ON THE HOME FRONT”

VOLUME 4, 2025

Here is a copy of my company’s newsletter. Any questions? Give me a call.

Displaying blog entries 1-2 of 2

Be the first to know what's coming up for sale in the Colorado Springs real estate market with our New Property Listing Alerts!

Just tell us what you're looking for and we'll email a daily update of all homes listed for sale since your last update. You can unsubscribe at any time.

Get NotificationsOur office is located at:

6385 Corporate Drive, Suite 301

Colorado Springs, CO 80919

Office: 719.593.1000

Cell: 719.231.1285

Harry@HarrySalzman.com