HARRY'S THANKSGIVING GREETING

November 23, 2022

WISHING YOU A SAFE, HEALTHY, HAPPY THANKSGIVING FILLED WITH THE JOY OF FRIENDS, FAMILY, FUN AND YUMMY FOOD.

Displaying blog entries 1-3 of 3

November 23, 2022

WISHING YOU A SAFE, HEALTHY, HAPPY THANKSGIVING FILLED WITH THE JOY OF FRIENDS, FAMILY, FUN AND YUMMY FOOD.

November 22, 2022

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

A VERY SAD TIME IN COLORADO SPRINGS…

It’s with a heavy heart that I begin today’s eNewsletter. As I’m sure most all of you know, Colorado Springs, and more specifically the LGBTQ community here, was the target of a horrendous hate crime where five local citizens lost their lives and at least 25 others were injured.

There are just no words to explain how shocked I was to see this unfold. Most especially with it being so close to Thanksgiving Day, an occasion where we all take the time to be grateful for all that we have in our lives.

I work in an industry that has no tolerance for discrimination of any kind and it is my fervent belief that most people are good—and it is our differences that make us interesting. Learning about how others live and believe opens up new worlds for us if we allow it.

As we prepare for Thanksgiving, let us remember those who lost their lives in this tragic event and try to move forward with tolerance and kindness for all.

RESIDENTIAL real estate IS A BIG TOPIC THESE DAYS…

You can’t pick up a newspaper or look online these days without seeing article after article discussing the Residential real estate market. Most are discussing it in “national” terms, and while I have always said that one needs to look at Residential Real Estate in “local” terms, they are overlapping in many areas now.

To begin with, the Seller’s Market of the recent past is essentially gone and while it has been replaced with a Buyer’s Market, there just aren’t a lot of buyers now, and the ones who are looking are in less of a hurry and more discerning in what they want.

There are several reasons for this, beginning with the fact that interest rates have more than doubled since January. And even though rates fell last week, they are still preventing a number of folks, and most especially first-time buyers, from being able to qualify for a loan.

Across the U.S., existing home sales fell for a ninth straight month in October, with sales declining 5.9% from the prior month. In Colorado Springs, the number of home sales has dropped each month since June, while the inventory has reached its highest level in three years.

Home prices here are continuing to rise monthly, year-over-year, but they are now going up by single digit percentages rather than the unsustainable double digits we saw in the last several years.

I’ve been saying for quite a while that what we were seeing in terms of multiple offers on day one and sales considerably over listing price was not something we should anticipate lasting forever. The low interest rates and lack of available homes for sale created a type of market was not healthy for buyers or sellers in many ways.

A home is often the greatest financial asset of most families and the purchase of such deserves the time and consideration that the last several years did not afford. Buying a home should not be as stressful and frenetic as we were seeing, and it was only a matter of time until this changed as it has.

The typical “buying season” for Residential real estate is usually the spring to early summer, since most families like to be in place prior to a new school year for their children and in place for the holiday season. In the last few years, that fell to the wayside and homes were being bought whenever they could be bought.

Now that things are normalizing, home sales at this time of year would typically be slow, and that’s what we are also seeing here in Colorado Springs.

Folks that were waiting to see how much more their homes could appreciate prior to putting them on the market have found that it’s too late. I’ve had clients in recent days lower their asking price after finding few potential buyers for their properties.

Buyers today can afford to be much more discerning when looking at homes, and with more to choose from, they can request contingencies that only six months ago would have been unheard of. Home inspections are also back in the picture.

This is not to say that homes are not selling, because they are. As I’ve said time and again, there will always be those who need to buy and those who need to sell, all for differing reasons. But most homes have been on the market considerably longer than the one day of the recent past, and sales contracts are looking more like they did several years ago.

And for those who are waiting for home values to go down, you may be waiting a long, long time. Nothing that we are seeing today portends that homes will not continue to appreciate, albeit at a slower, more reasonable pace.

Some folks who wished to sell but were unable, are turning their properties into rentals until they can sell them. Others are waiting to see how interest rates will go and staying put for the moment. I don’t have any two clients with the same wants and needs, so their preferences are all across the board.

I’m guessing a number of you who have considered selling to trade up or to move to a new location have a lot of questions in regard to all of the above.

Please give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com so we can discuss your personal situation and figure a way to try and make today’s Residential real estate market work for you.

COLORADO SPRINGS HOME PRICES CONTINUE TO SURPASS MUCH OF THE COUNTRY IN THE THIRD QUARTER OF 2022

The National Association of Realtors, 11.10.22

In the recently published report, single-family, existing-home sales grew in nearly every measured metro area.

The median price nationally rose 8.6% quarter-over-quarter to $398,500.

The median price of single-family homes in Colorado Springs rose 4.8% to $462,200 during the second quarter of the year, per NAR. This price reflects detached, single-family and patio homes but not townhomes or condominiums.

The median price in the Springs ranked 37th highest of the 185 cities surveyed. And once more, the good news is that while our home values are increasing, they remain less than those in the Denver, Boulder and Fort Collins areas, which makes our city more attractive to potential companies and individuals wanting to relocate to Colorado.

To see all 185 metro areas in alphabetical order, please click here. To see them in ranking order, click here. Or click here to see what income levels are required to purchase homes based on either a 5, 10 or 20 percent down-payment.

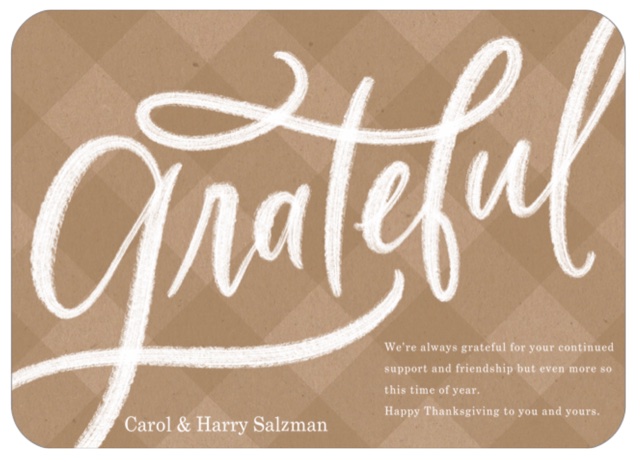

ERA SHIELDS QUARTERLY “STAT PACK” PROVIDES A GOOD RESIDENTIAL real estate OVERVIEW

ERAShields, Quarter Three, 2022

As always, I am pleased to provide you with all the most current local information. This easy-to-understand report, along with graphs, gives you a good idea of the state of local Residential real estate.

Below I’ve reprinted the first page of the report and you can click here to read the report in its entirety.

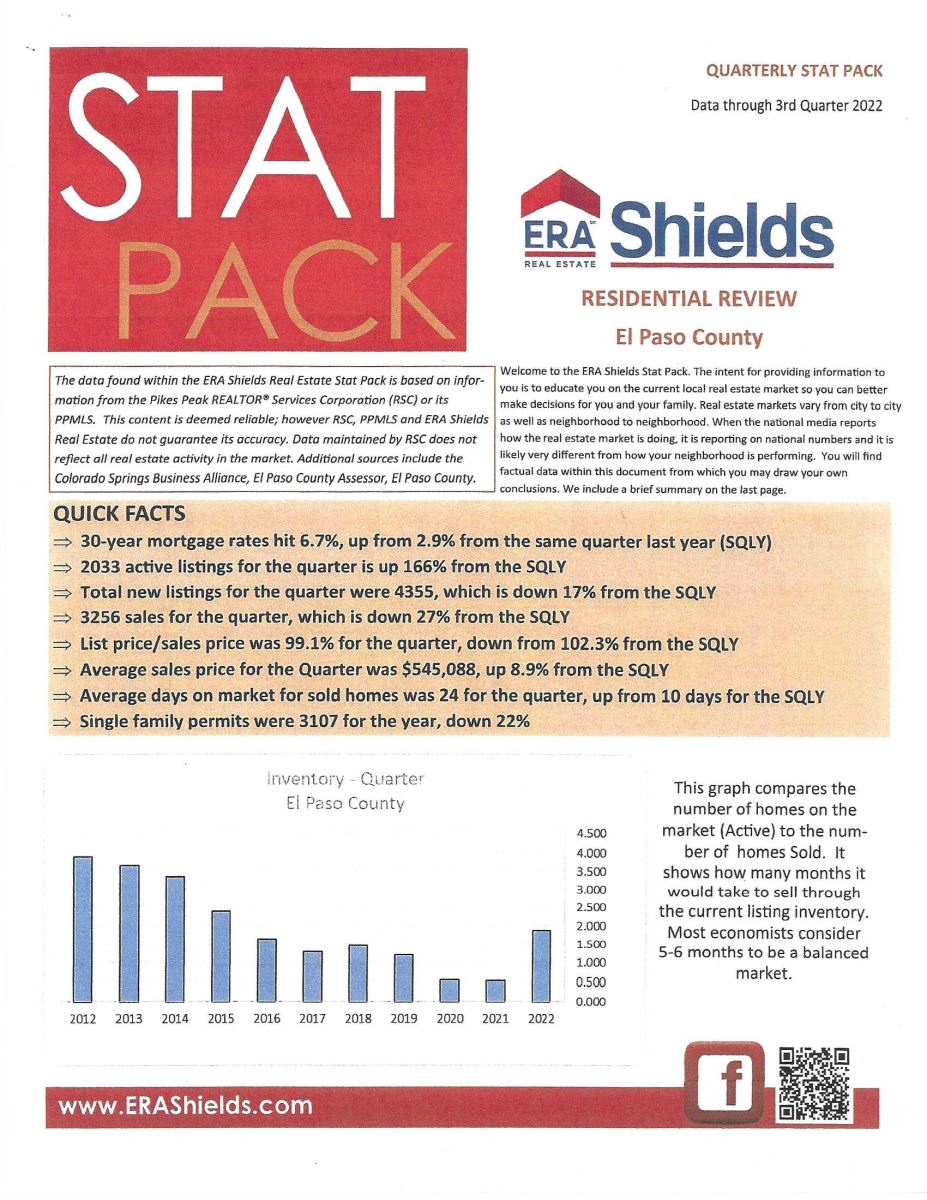

UCCS ECONOMIC FORUM UPDATE

College of Business, UCCS, updated 10.28.22

Here is the most recent economic update from the UCCS Economic Forum. It provides data concerning all aspects of the economy, on both the national and Colorado Springs area levels.

I’ve reproduced the first page of the graphs and you can click here to see the report in its entirety. If you have any questions, please give me a call.

HARRY’S THOUGHT OF THE DAY:

November 7, 2022

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

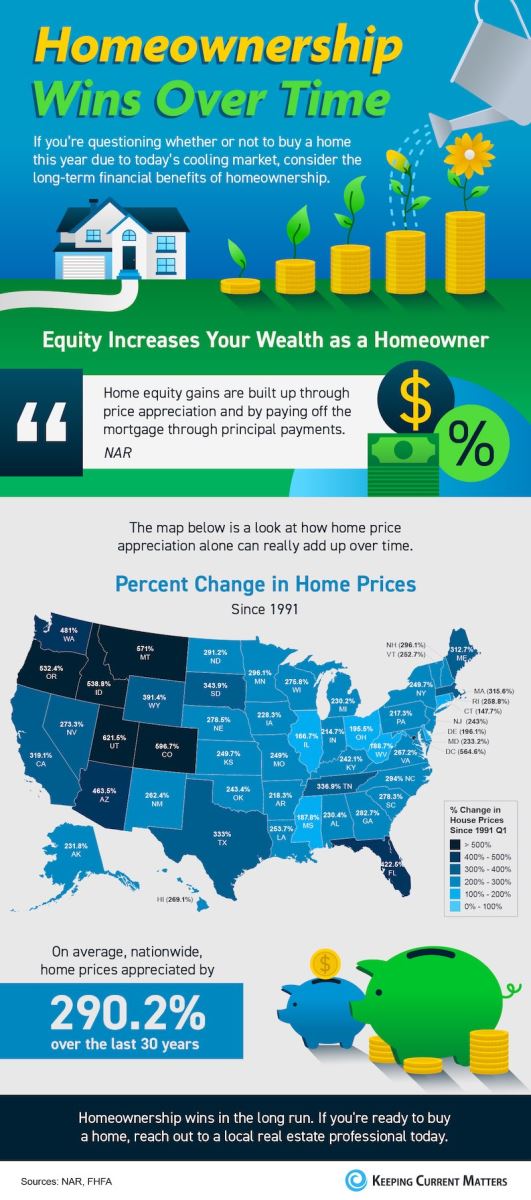

NO MATTER THE CURRENT STATE OF THE MARKET, OVER TIME, HOME OWNERSHIP IS ONE OF THE MOST ESSENTIAL KEYS TO BUILDING PERSONAL WEALTH

Yes, you read that right! A home is often the largest personal asset of many families.

It is certainly up there as the most expensive purchase for most, and it allows the building of equity while providing tax deductible considerations and more.

In times like today when interest rates are at their highest level in more than 15 years and local home prices are still rising, albeit considerably slower than in the recent past, home ownership is still very desirable on so many levels.

Rental rates are higher than ever and climbing steadily. In recent times the lack of available homes for sale created the need for rentals on a large scale and prices went up accordingly. They do not appear to be going down and more investors seem to be looking to scoop up homes for investment purposes and/or companies are building new projects to accommodate those needing or choosing to rent.

I’ve talked to several young professionals who would love to buy a starter home because they are aware that the monthly cost of a home would likely be less than that of their current rental expense. However, saving for a down payment can be tough when your current rental housing output keeps escalating.

It’s most certainly a problem and one not likely solved in the near future.

In Colorado Springs, we face the same higher interest rates and inflation as the rest of the country, but we are in a better position than many other cities in that people want to relocate here and have for some time now.

I just returned from a international relocation conference and had the opportunity to speak with folks like myself who help relocate employees and others to various cities for both employment and personal reasons.

What I learned is that those of us who live in “desirable” cities that provide a good “work/life balance” have a distinct advantage over crime-ridden, overpopulated cities. People are willing to drive further to have their own home in a city where they can enjoy “living”.

Some of this is a result of the recent pandemic where working from home became popular, and some just makes sense, and most especially to those millennials who are looking to put down roots and start raising a family.

In any case, this is all good news for those of us who live in the Colorado Springs area.

Yes, interest rates are high. However, speaking as one who had an 8.5% mortgage on my first home here, I consider 7% “reasonable”. Let’s face it, the very low interest rates of the last several years were not going to stay around forever, and the fast acceleration of home values were not sustainable either.

It’s fair to say home values were needing to “normalize” and now they have. Do I think the home appreciation in Colorado Springs will continue to slow down? Possibly. And I also believe that those values will not rise quick as fast as they did any time too soon. And that’s a good thing. Building home equity, steadily and over time, provides the stability most homeowners need and want. Paying rent to someone else does not do anything but put extra income in the hands of the landlord.

Waiting for interest rates to fall probably isn’t a great idea either. There are several ways to work around the fixed rates of today, such as getting a 5 or 7 year Adjustable-Rate Mortgage (ARM) and refinancing when rates fall, and several other strategies. The best advice for today’s market is to shop around. You will find that rates vary from lender to lender, and I can help direct you to several that often have very competitive rates and terms.

There are two and a half times as many actively listed homes here at present than a year ago. Some of those belong to folks who kept waiting for prices to go up even higher and some are simply those who find that now is the time they want to sell.

That makes today’s market a good one for buyers. There isn’t the frenzy we saw even six months ago where homes were selling “as is” in one day with multiple offers and bidding wars. Buyers have time to make informed decisions, request contingencies and have home inspections. When it comes to such a big financial investment, that is a very good thing as well.

In Residential real estate, there are always those who need to buy and those who need to sell. The economic climate may enter into those decisions, but it is often not the primary reason.

If you are wanting to find out how the present market is going to affect any buying or selling thoughts of yours, please give me a call at 719.593.1000 or email to Harry@HarrySalzman.com .

I look forward to speaking with you soon.

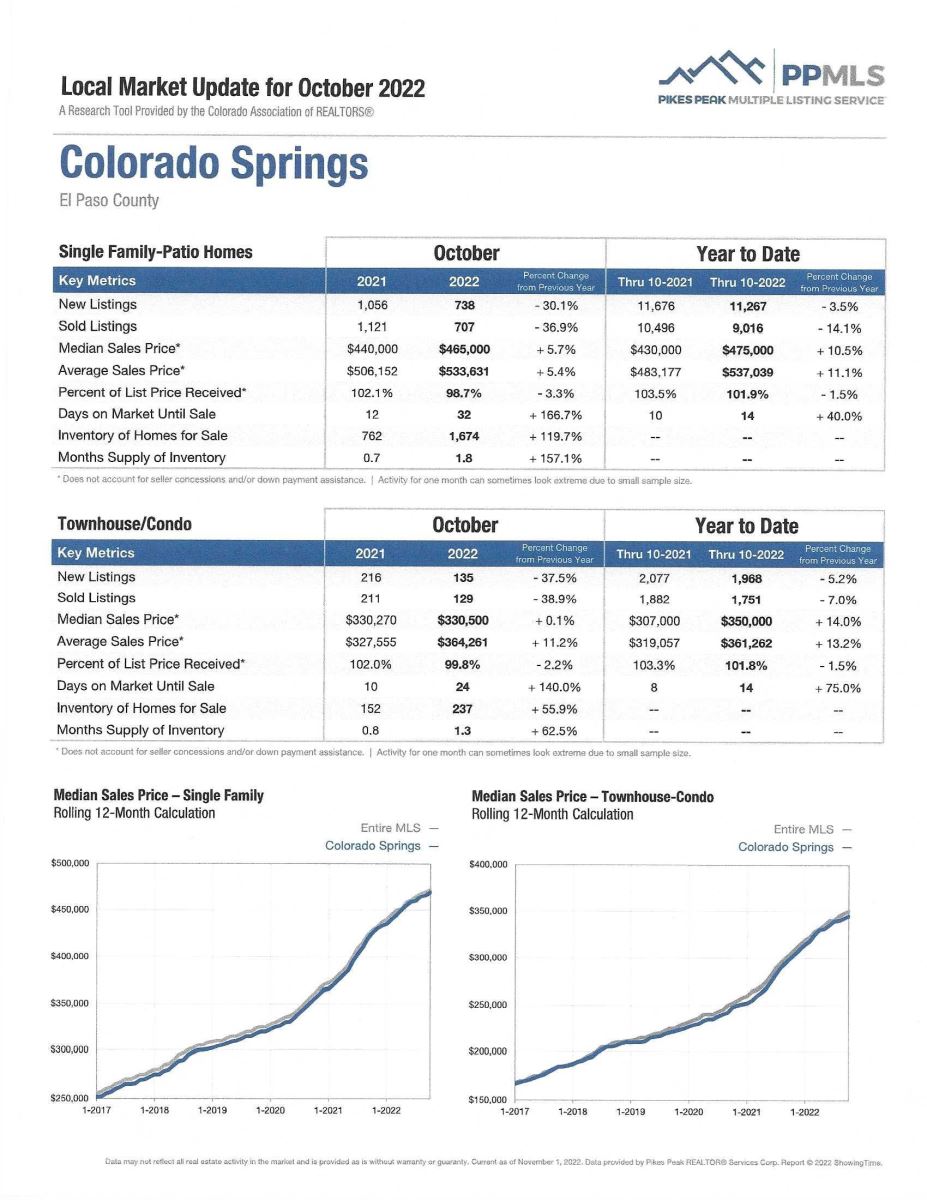

And now for October statistics….

OCTOBER 2022

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the October 2022 PPAR report.

In El Paso County, the average days on the market for single family/patio homes was 31. For condo/townhomes it was 22.

Also in El Paso County, the sales price/list price for single family/patio homes was 98.8% and for condo/townhomes it was 99.8%.

In Teller County, the average days on the market for single family/patio homes was 42 and the sales/list price was 98.0%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing October 2022 to October 2021 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 1,239, Down 22.4%

· Number of Sales were 1,100, Down 33.0%

· Average Sales Price was $532,488, Up 4.4%

· Median Sales Price was $465,000, Up 4.3%

· Total Active Listings are 2,645 Up 152.4%

· Months Supply is 2.4, Down 4.6%

Condo/Townhomes:

· New Listings were 165, Down 33.5%

· Number of Sales were 150, Down 40.0%

· Average Sales Price was $367,514, Up 12.5%

· Median Sales Price was $337,500, Up 3.4%

· Total Active Listings are 264, Up 104.7%

· Months Supply is 1.8, Down 2.6%

Now a look at more statistics…

OCTOBER 2022 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year to Date one-year change:

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

HOMEOWNERSHIP WINS OVER TIME…AN INFOGRAPHIC

Keeping Current Matters 11.4.22

Here’s a graphic representation of what I was talking about earlier. A “key” to a family’s financial health is homeownership.

IF YOU BELIEVE HOMEOWNERSHIP IS OUT OF REACH…MAYBE YOU SHOULD THINK AGAIN

Keeping Current Matters, 11.3.22

A recent “2022 Consumer Insights Report” from Mynd indicates that there’s a portion of millennial and Gen Z buyers who are pursuing homeownership as a way to build their wealth, but it might not be exactly the way previous generations have done it. The study explains how they are breaking into the market:

“…younger generations of Americans are not buying into that dream in the same way that older generations have. A growing number of Americans are choosing to make their first real estate purchase as an investment property.”

Instead of buying a home and moving in, some young buyers are purchasing a home so they can rent it out. This tactic may be gaining popularity, at least in part, because of the affordability challenges brought about by today’s higher mortgage rates. The report mentions how many people in this group are considering this approach. It says:

“Almost half of Millennials and Gen Z (43%) are considering buying an investment property compared to only 9% of Baby Boomers and 27% of Gen X.”

This strategy allows buyers to continue living in their current location like a busy city apartment or a neighborhood they know and love, where they couldn’t afford to buy. But instead of giving up on the idea of owning a home, they buy a home in a more affordable area with the intention of renting it out.

That way they’re getting the best of both worlds. They live where they want, and they still own a home where they can afford it.

Their goal is to generate passive income and diversify their assets. It works like this: in addition to having a rental stream of income, the equity they build in the home they own will also help grow their net worth over time.

If this is something that you or someone you know has considered, please give me a call. I’ve had personal experience in this area and can certainly help provide answers that can help get the ball rolling.

HOME BUYERS ARE MOVING FARTHER AWAY THAN EVER BEFORE

The Wall Street Journal, 11.3.22

As I mentioned earlier, the rise of remote workers and the ballooning cost of housing in major metro areas are leading Americans to move much further away when buying a home.

According to a National Association of Realtors (NAR) survey, buyers who purchased homes in the year ending this past June moved a median of 50 miles from their previous residences. That is the highest recorded distance on record, going back to 2005 and follows five straight years in which the median distance moved was constant at 15 miles.

Some of this is due to employers changing their in-office requirements which gave some remote workers the ability to move farther from their offices.

Smaller communities were especially popular—48% of home purchase were in small towns and rural areas, a record in data going back to 2003 and up from 32% a year earlier, according to the survey.

Suburbs are traditionally the most popular destinations for home buyers, but the share of suburban home purchases dropped to 39% from 51% the prior year. Only 10% of purchases were urban areas, down from 13% the year before.

NAR polled 4,850 people who bought primary homes during the 12-month period.

This survey reflects a 12-month period in which the housing market was upended by the surge in interest rates. The pandemic spurred the biggest housing boom in years as people took advantage of record-low mortgage rates and sought more space to work from home. Home prices rose to record highs. Now that mortgage rates have more than doubled, home purchases have dwindled, and buyers have focused more on affordability.

Colorado Springs, while not considered a “rural” area by any means, is still a great choice for those who do not want the higher prices and congestion of living in a city such as Denver. Folks relocating to southern Colorado are choosing our city and immediate surrounding areas as a place to call home and are willing to commute to do so.

Again…one more reason why I believe our housing market is very stable and should continue that way into the future.

ECONOMIC & WORKFORCE DEVELOPMENT REPORT

Data-Driven Economic Strategies, October 27,2022

As most of you know, Tatiana Bailey, our “local” economist and previous Director of the Southern Colorado Economic Forum at the UCCS College of Business, has started a new non-profit company called Data-Driven Economic Strategies (DDES), along with Rebecca Wilder who worked alongside her at UCCS.

I know many of you enjoy seeing the “data” as it pertains to Colorado Springs in terms of economy, jobs and more. I will continue to publish her reports when I receive them and you can click here to see the first one under the new banner. If you have any questions, please give me a call.

HARRY’S THOUGHT OF THE DAY:

If you haven’t done so already, please vote.

It’s a right that many around the world don’t have and one I never take for granted.

No matter who or what you personally support, if you don’t vote you are missing the opportunity to get your voice heard.

Displaying blog entries 1-3 of 3

Be the first to know what's coming up for sale in the Colorado Springs real estate market with our New Property Listing Alerts!

Just tell us what you're looking for and we'll email a daily update of all homes listed for sale since your last update. You can unsubscribe at any time.

Get NotificationsOur office is located at:

6385 Corporate Drive, Suite 301

Colorado Springs, CO 80919

Office: 719.593.1000

Cell: 719.231.1285

Harry@HarrySalzman.com