HARRY'S HOLIDAY GREETING

December 21, 2020

HARRY’S HOLIDAY GREETING

Harry Salzman

Displaying blog entries 131-140 of 498

December 21, 2020

HARRY’S HOLIDAY GREETING

December 9, 2020

*** HARRY’S SPECIAL EDITION ***

Good Morning and Welcome to My World…

Since this is most certainly a year of “firsts”, when I was asked to be the featured guest on The Global TV Talk Show—a live streamed event and most certainly a “first” for me—I said, “why not?”. This was especially true when I was told I would be giving my expert advice on Residential real estate relocation, and more specifically, on the status of home sales and the growth of Colorado Springs in general.

These are two areas I could talk about for hours and I have—as many of you can attest—so I figured it might be fun.

The host of The Global TV Talk Show which is based in San Diego, California is Ed Cohen, a very long-time friend and associate who I know from my many years of participation in the national relocation Directors Council (RDC) and the international Worldwide Employee relocation Council (Worldwide ERC).

The 53-minute live-steamed event was recorded for their YouTube channel, and includes a brand-new video provided to me by the Colorado Springs Chamber and EDC.

Yeah, I know, you’re saying, “53 minutes of listening to Harry Salzman?” and I get it, BUT I promise it won’t be a waste of time and you just might learn something to boot.

So…without further ado…here is the link:

I hope you enjoy watching it as much as I did participating in it. It may be a “first” for me, but I’m thinking it might not be the last. It’s said, “You can’t teach old dogs new tricks”, but if I’m any example…there’s hope for all.

All feedback and questions are welcome and as always, I can be reached at 593.1000 or emailed at Harry@HarrySalzman.com.

Happy Wednesday to all.

December 8, 2020

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Personal Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

*** Be sure to look in your inbox tomorrow for a “Special Edition” I think you’ll enjoy. I was interviewed by the Global TV Talk Show, based in San Diego, CA for my expert advice in relocation, and more specifically, about the status of residential home sales in Colorado Springs and I wanted to share the video first with you, my clients and friends. Also included is a brand-new video from the Colorado Springs Chamber. I believe you’ll find it worthwhile and interesting to watch. ***

IT SEEMS LIKE 2020 JUST KEEPS GOING ON AND ON AND ON WHEN RECENT YEARS HAVE GONE BY IN A HEARTBEAT.

The housing market, on the other hand, is moving faster and faster in a positive direction and continues to be the bright spot in the U.S. economy.

Homes sales across the U.S. have skyrocketed to a 14-year high, and there’s no apparent end in sight. Folks are taking a look at their present living conditions in a way they might never have prior to the pandemic. Working from home (WFH) coupled with more home schooling and most definitely more home cooking and entertainment is driving new wants and needs that many never considered before. When you add the historically low interest rates into the mix…it’s keeping both buyers and sellers quite busy.

Another consequence of the pandemic is that buyers are wanting to relocate to cities such as Colorado Springs because of the proximity to outdoor activities and more of a suburban type of environment. Getting out of busy cities is becoming a priority, especially for those who now WFH and can do so most anywhere. And let’s face it, those of us who presently live here know exactly why companies and their employees want to move here. After all, we aren’t called “America The Beautiful City” for nothing.

These factors are what’s driven the Colorado Springs area to a 25-year low in availability of existing homes for sale. As of yesterday, there was a total of 749 homes for sale in all categories—single-family, patio homes, townhomes and condos.

Available homes are selling at a premium—most over listing price—and bidding wars continue to be the norm. It’s definitely a seller’s market and will continue that way until there is greater inventory.

This is also the reason that home price appreciation continues its unrealistic surge and that in itself is causing concern for some first-time buyers who, despite the low interest rates, can’t qualify or afford to buy at present.

Most interesting is that this is traditionally a slower time of year for home sales and that is certainly not the case this year. As you will see, single-family/patio home sales for November were up 24.7% over the same time last year and condo/townhomes were up 37.6%.

If you’ve even considered a move, now is a good time to check out the possibilities. While it might take a while to find your next home, you might consider the possibility of leasing back your present one while you complete the process of buying the next one. This is not always a possibility, but it’s one you can certainly request when we list your home.

Something for present homeowners to remember is that the equity in your present home is potentially greater than you might think, and with interest rates so low, it’s possible you can get into another home for not much more in monthly payment costs.

New home construction is a more viable option than in past years and new homes sales across the U.S. are 41.5% higher than a year ago, most likely due to the low number of available homes for sale most everywhere in the country.

I’ve helped a number of clients in their new home purchases recently. My good relationships with a number of local builders has given my clients an advantage. I can help with site and home selection and even direct folks to the best lender for their individual situation. And did I mention this comes at no additional cost to the buyers? Just one of the many things I provide as part of my special brand of customer service.

I have been in the local residential real estate arena for more than 47 years, and with my investment banking background to boot, can help you make all your residential real estate dreams come true.

It all starts with a call to me at 593.1000 or an email to Harry@HarrySalzman.com and we can get the ball rolling. The sooner you begin, the sooner you’ll be living in the home that can provide you with the comfort and security you want, need and deserve.

And now for statistics…still “off the chart” but lack of listings is troubling…

As I just mentioned, you will see that home prices are continuing their upward trend due in part to low interest rates, low inventory and a pent-up demand created by the pandemic.

NOVEMBER 2020

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the November 2020 PPAR report. Remember that the new format of this report no longer provides monthly statistics for each individual neighborhood. However, if you are interested in what’s happening in your neighborhood, I can provide you with this information through other means.

In El Paso County, the average days on the market for single family/patio homes was 18. For condo/townhomes it was 16.

Also in El Paso County, the sales price/list price for single family/patio homes was 101.1% and for condo/townhomes was also 101.1%.

Please click here to view the detailed 10 -page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing November 2020 to November 2019 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 1,102, Down 1.9%

· Number of Sales were 1,482, Up 24.7%

· Average Sales Price was $429,163, Up 17.5%

· Median Sales Price was $380,000, Up 16.9%

· Total Active Listings are 675, Down 59.5%

· Months Supply is .05, Down 2.4%

Condo/Townhomes:

· New Listings were 166, Up 10.7%

· Number of Sales were 238, Up 37.6%

· Average Sales Price was $275,411, Up 10.9%

· Median Sales Price was $263,100, Up 14.4%

· Total Active Listings are 77, Down 49.3%

· Months Supply is 0.43, Down 1.3%

And a look at more statistics…

November 2020 LOCAL MARKET UPDATE AND MONTHLY INDICATORS ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for residential real estate.

It is broken down by geographical areas and you can look to see how your neighborhood is doing in terms of sales, prices, and more.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year to Date one-year change:

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical area of your choice from the 14-page Local Market Update. I recommend that you check out your own area or one that you are considering, to get a good idea of the local pulse. As an example, here is a detailed report on El Paso county:

REALTOR.COM HOUSING FORECAST: SELLERS TO MAINTAIN THE MARKET ADVANTAGE

Rismedia.com 12.2.20

In its recently released 2021 Housing Forecast realtor.com predicted that inventory will make a slow and steady comeback, providing buyers with much-needed relief. That said, they also predicted that increasing interest rates and prices will continue to pose a challenge on affordability throughout the year.

The Forecast Breakdown:

Mortgage Rates: Up to 3.4 percent by year-end

Existing-Home Median Price Appreciation: + 5.7 percent

Single-Family Home Housing Starts: +7.0 percent

Homeownership Rate: 65.9 percent

Key Housing Trends, according to realtor.com:

-Millennials continue to drive the market while Gen-Z become market players

-Affordability becomes a growing obstacle

-Inventory starts slow road to recovery

-Suburbs to shine if remote work stays around

A couple of elements could impact these forecast trends, however. According to the report, if COVID-19 continues to bring lockdowns and quarantines, that could “put a dent in housing inventory and sales, slowing the market and putting increased pressure on buyers.” But if a vaccine is rolled out quickly, homes sales, prices and inventory could be stronger than predicted.

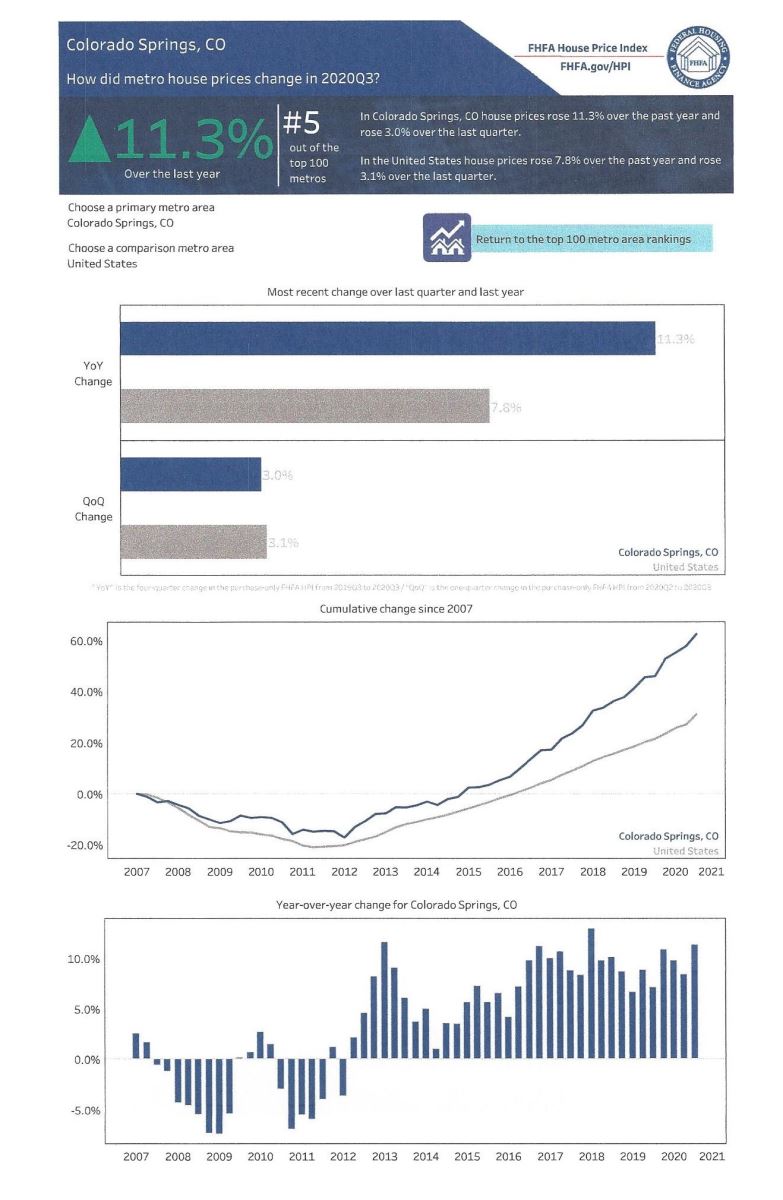

U.S. HOME PRICES UP 7.8% OVER LAST YEAR: COLORADO SPRINGS UP 11.3%

The Federal Housing Finance Agency recently published their House Price Index for Quarter 3 and needless to say…it was great news for homeowners.

“House prices recorded their strongest gain in the history of the FHFA HPI purchase-only series in the third quarter of 2020,” said Dr. Lynn Fisher, Deputy Director of the Division of Research and Statistics at FHFA. “Relative to a year ago, prices were up 7.8 percent during the quarter—the fastest year-over-year rate of appreciation since 2006. Monthly data indicate that prices continued to accelerate during the quarter, reaching 9.1 percent in September, as demand continues to outpace the supply of homes available for sale.”

Colorado Springs was #5 out of the top 100 metro areas:

If you wish to see the full list of 100 metro areas to see their rate of appreciation, both year-over-year and quarter-over-quarter, please click here.

MAXIMUM LOAN AMOUNTS RAISED FOR 2021

The maximum loan amounts for 2021 were raised 7 ½ %-- from $510,400 to $548,250 for conventional loans. Any loan amount over that will be considered a Jumbo loan.

FHA loans will top out at $356,362 in 2021.

If you have any questions, please give me a call.

November 19, 2020

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Personal Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

CONGRATULATIONS TO ALL HOMEOWNERS IN THE COLORADO SPRINGS AREA…BUT REMEMBER…EVERYTHING COMES WITH A PRICE

A recent report from the National Association of Realtors (NAR) concerning Home Buyers by Metropolitan Statistical Area (MSA) shows that Colorado Springs is the number one city with the highest concentration of buyers.

Good News? Well, in some ways, yes. And in others, maybe not so much.

It’s certainly great for all current homeowners because obviously, greater demand is creating higher home appreciation. However, a little slower appreciation would be more realistic, as I’ve been saying for quite some time now.

For first-time homebuyers and those looking to relocate here for professional or personal reasons, it’s not quite as welcome news.

Like the rest of the country, the Colorado Springs area has been faced with a shortage of available homes for sale, and in our case, we have the lowest number of existing homes for sale ever. This shortage is one of the factors in the unrealistically high home appreciation which will likely continue until there are more homes for sale.

Our once comparatively “quiet” city is growing by leaps and bounds and there’s no end in sight. Companies are realizing the “work-life balance” is importance for today’s employees and their families, and this pandemic has driven that fact home even harder.

If you are able to work from home (WFH), wouldn’t you rather be in Colorado Springs than in some crowded city? A rhetorical question to be sure, however, one that obviously many folks across the nation are asking themselves.

The current pandemic has also forced folks into rethinking home “need and want “priorities and many are looking to add larger kitchens, quiet office space, home schooling and outdoor recreational and dining areas.

Our downtown is thriving with the opening of the U S. Olympic and Paralympic Museum, numerous new apartment complexes, the new sports complex currently under construction, and more. Hopefully it won’t be too long before we can put some of the restrictions due to COVID-19 behind us and restaurants and stores will be thriving again as well.

Southwest Airlines has just added Colorado Springs as one of their destination cities and that promises to bring even more vacation travelers to our locale, as well as increasing traffic to and from COS.

Mayor John Suthers, along with the City Council and Chamber/EDC and others have worked so hard to see these dreams become realities and a big shout out goes to all concerned. There was a time in the not-so-distant past when none of these things seemed possible, and certainly not in the time frame in which they have.

If you’ve even thought about selling to trade up or move to a new neighborhood, NOW is the time. It will likely take a bit longer to find what you want, and you may want to consider new construction as a viable option as well. This is something a number of my clients have looked at in recent times and I’ve helped them find just the right solution for their individual situation.

This is all part of my special brand of customer service and help with new home construction options comes at no additional cost to you. In fact, it could save you money in the long run since I can not only help in site and home selection, but also in finding the right lender for you.

Homes are not likely to get any cheaper, interest rates are still historically low and the equity in your present home is likely more than you might imagine—so don’t delay. Give me a call at 593.1000 or email me at Harry@HarrySalzman.com and together we can make all your residential real estate dreams come true.

METRO HOME PRICES INCREASE IN ALL AREAS IN THIRD QUARTER 2020

Realtor Mag, 11.12.20

Just like we are seeing in the local statistics, home prices all across the country are seeing greater gains due to the limited number of homes for sale, record low interest rates and high buyer demand. The majority of major metro markets posted double-digit price gains in the third quarter and single-family existing home prices increased in all 181 metro areas tracked in NAR’s latest quarterly report.

According to Lawrence Yun, NAR’s chief economist, “Favorable mortgage rates continue to bring fresh buyers to the market. However, the affordability situation will not improve even with low interest rates because housing prices are increasing much too fast.”

He added that, “In light of the pandemic, prices jumped in a number of metros that contain larger properties and open space—where families could find extra rooms, including areas for an at-home office”.

Colorado Springs ranked 28th with a 13.6% increase, in comparison with the U.S. as a whole at 12.%.

Click here to see the entire list of 181 MSAs in numerical order or to view them in alphabetical order, click here. If you have any questions, please give me a call.

FOUR REASONS WHY THE ELECTION WON’T DAMPEN THE housing market

Keeping Current Matters, 11.2.20

Interestingly enough, I read this article the day before the election and here we are two weeks out and we still don’t have the final results. However, the thoughts concerning the housing market aren’t likely to change—the housing market has been and will continue to be—the driving force in the U.S. economy.

Here are four reasons why:

Ali Wolf, chief economist for Meyers Research, also notes: “History suggests that the slowdown is largely concentrated in the month of November. In fact, the year after a presidential election is the best of the four-year cycle. This suggests that demand for new housing is not lost because of election uncertainty, rather it gets pushed out to the following year as long as the economy stays on track.”

Bottom Line: There’s no question that this has been one of the most contentious presidential elections in our nation’s history and will have a major impact on many sectors of the economy. However, as Matthew Speakman, an economist at Zillow explained several weeks ago:

“While the path of the overall economy is likely to be most directly dictated by coronavirus-related and political developments in the coming months, recent trends suggest that the housing market—which has basically withstood every pandemic-related challenge to this point—will continue its strong momentum in the months to come.”

So…once more with feeling…if you’re in the market…give me a call sooner than later.

METRO AREA WEALTH GAINS FROM HOMEOWNERSHIP AS OF 2020 Q2

National Association of Realtors, 10.30.20

Homeownership is the key to building wealth. Among all families, the ownership of a primary residence typically accounts for 90% of total wealth, based on the 2019 Survey of Consumer Finance data. Among those in the bottom 20% of the income percentile, the median value of holdings for a primary residence accounts for 99% of total family assets, but only 42% for families in the top 10% of the income bracket.

Housing wealth accumulation takes take and is built up by paying off mortgage debt and by home price appreciation. And while home prices can fall, they tend to recover and go up over the longer term. As of September 2020, the median sales price of existing home sales in the U.S. was $311,800, a 35% gain since July 2006, when prices peaked at $230,000.

Nationally, a person who bought a typical home 30 years ago would have typically gained about $283,000 as of the second quarter of 2020. Of the total wealth gain, 67% is from the price appreciation of 3.7% annually. Over a 10-year period, the wealth accumulation is $144,490, of which $114,233 or 80% are from the price appreciation.

Once again…homeowners accrue housing wealth or equity over time from the principal payments to reduce the mortgage debt and from the appreciation of home prices:

Housing Wealth Gains = Principal Payments + Price Appreciation Gains

Here is a look at Wealth Gains from Homeownership in Colorado Springs:

Note: The calculations show the housing wealth gains accumulated for a typical home purchased 5, 10 and 15 years ago and sold at the median sales price as of 2020 Q2. The calculations assume a 30-year fixed mortgage plus points and fees and 10% down payment.

These calculations are illustrative of the wealth gains from homeownership in Colorado Springs. The actual home equity gains accrued over time will vary by property and will depend on home improvements undertaken over time. These home improvement costs are not taken into account in the calculations.

.jpg)

As you can see, these charts illustrate what I’ve been telling you time and again for many, many years. Homeownership over time far outshines gains from traditional stocks and bonds while providing you shelter and comfort along the way.

If you have any questions, please give me a holler.

November 5, 2020

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Personal Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

THE ONE CONSTANT IN THIS NOT-SO-NORMAL ECONOMY AND WORLD? HOMEOWNERSHIP.

I was waiting to write this AFTER the Presidential election but since the results aren’t final at this time I didn’t want to prolong giving you great news regarding the state of residential real estate.

With “home” taking on so many new meanings and functions, the housing market is playing a leading role in the present economic turnaround. Many folks are buying or selling much sooner than they anticipated as they search for more functionality and personal comfort in their homes.

High buyer demand and low inventory are causing homes to appreciate at a faster-than-normal pace. According to the National Association of Realtors (NAR), the real estate industry provided $3.7 billion dollars of economic impact to the country last year. This is significant in terms of the national economy as well as to the bottom line of current homeowners.

U.S. home prices between July and August 2020 showed a largest increase since the Federal Housing Finance Agency (FHFA) started the House Price Index in 1991.

As most of you know, homeownership is something I advocate for anyone who is in a position to do so. And this is not just because I work in the industry. I have invested in real estate since I purchased my first home in 1972 (even at an 8.5% mortgage loan rate!) and it has proven time and again to be a great investment. The personal economic gains over the long haul have consistently outperformed stocks and bonds and the equity gains have allowed me to purchase other homes while keeping my bottom line in check.

COVID-19 has contributed greatly to the lack of inventory in the Colorado Springs area for a number of reasons. As mentioned earlier, folks who are working from home (WFH) and homeschooling their kids are finding new wants and needs for their housing situations. And, WFH is also affording a number of those who live in crowded cities the opportunity to move to a more favorable environment such as ours.

According to a new survey from online freelance company Upwork, as many as 23 million Americans plan to relocate to a new city due to WFH.

I’ve had more relocation calls in the last few months than I had all last year from those wanting to move here, and let’s face it…why not move to “America the Beautiful City” if that’s an option? We get it. However, that is another factor contributing the 25-year low availability of existing homes for sale here.

As you will see, our median home prices are still on the rise, and I’m afraid that will continue until we have more listings. Yes, rising median home prices are great, but this kind of rate is not sustainable, nor is it practical. It is particularly hard on first time homebuyers who do not have equity to use and have trouble qualifying for the higher loan amounts.

Something for present homeowners to remember is that the equity in your present home is potentially greater than you might think, and with interest rates so low, it’s possible you can get into another home for not much more in monthly payment costs.

Also worth considering when you sell your present home is the possibility of leasing it back from the buyer so that you have time to complete the process of finding a new home or getting ready for a move. That’s not always an option, but it’s certainly one we can request when listing your home.

New home construction is a more viable option than in past years and I’ve helped a number of clients in their new home purchases recently. My good relationships with a number of local builders has given my clients an advantage. I can help with site and home selection and even direct folks to the best lender for their individual situation. And did I mention this comes at no additional cost to the client? Just one of the many things I provide as part of my special brand of customer service.

So, if you are thinking of making a move…don’t delay. It won’t be as easy as in the past to find what you want, need and can afford, but having me on your side will significantly help. I have been in the local residential real estate arena for more than 47 years, and with my investment banking background to boot, can help you make all your residential real estate dreams come true.

It all starts with a call to me at 593.1000 or an email to Harry@HarrySalzman.com and we can get the ball rolling. The sooner you begin, the sooner you’ll be living in the home that can provide you with the comfort and security you want, need and deserve.

And now for statistics…still “off the chart” but lack of listings is troubling…

You will see that home prices are continuing their upward trend due in part to low interest rates, low inventory and a pent-up demand created by the pandemic.

OCTOBER 2020

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the October 2020 PPAR report. Remember that the new format of this report no longer provides monthly statistics for each individual neighborhood. However, if you are interested in what’s happening in your neighborhood, I can provide you with this information through other means.

In El Paso County, the average days on the market for single family/patio homes was 21. For condo/townhomes it was 11.

The sales price/list price for single family/patio homes was 100.8% and for condo/townhomes was 100.6%.

Please click here to view the detailed 9-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing October 2020 to October 2019 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 1,559, Down 6.3%

· Number of Sales were 1,732, Up 19.6%

· Average Sales Price was $432,477, Up 16.2%

· Median Sales Price was $383,447, Up 14.5%

· Total Active Listings are 881, Down 54.6%

· Months Supply is .05, Down 62.0%

Condo/Townhomes:

· New Listings were 230, Up 19.8%

· Number of Sales were 260, Up 24.4%

· Average Sales Price was $276,160 Up 7.5%

· Median Sales Price was $262,000, Up 13.9%

· Total Active Listings are 101, Down 46.3%

· Months Supply is 0.4, Down 56.8%

And a look at more statistics…

October 2020 LOCAL MARKET UPDATE AND MONTHLY INDICATORS ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for residential real estate.

It is broken down by geographical areas and you can look to see how your neighborhood is doing in terms of sales, prices, and more.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year to Date one-year change:

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical area of your choice from the 18-page Local Market Update. I recommend that you check out your own area or one that you are considering, to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

HOT housing market NOT LIKELY TO COOL IN WINTER

Realtor.com , 11.3.20

Winter is normally a slow season in real estate, but economists predict it isn’t likely to be that way this year. Lawrence Yun, economist for NAR, says “It will be one of the best winter sales years ever”.

As previously mentioned, low inventories, combined with high demand due to record-low interest rates is sending buyers to the market quickly.

“We currently see buyers sticking around in the housing market much later than we usually do this fall,” says Danielle Hale, realtor.com’s chief economist. “If that trend continues, we will see more buyers in the market this winter, too. So this winter is likely to be a good time to sell.”

Here is a snapshot of the national picture of existing home sales in September 2020. As you can see, prices continue to rise, and inventory continues to drop. Sales are higher and inventory is lower locally, but you get the idea. It’s a busy, busy housing market most everywhere.

I can’t emphasize enough that if you are even thinking of making a move, NOW is the time for us to start the process. There are options available for most all situations and with my experience and expertise, I’m the one that can help you navigate through the home buying and selling wars.

Give me a holler sooner than later and together we will find the right situation for all of your family’s wants, needs and budget requirements.

UCCS ECONOMIC FORUM DASHBOARD

UCCS Economic Forum, College of Business, updated 10.29.20

As always, I like to share the info I receive from the UCCS Economic Forum as soon as it’s available. You can click here to see the U.S. “Big Picture” as well as the local economic news.

If you have any questions, please give me a call.

October 20, 2020

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Unique Brand of Personal Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

AND SO IT CONTINUES….

Having been in the Colorado Springs residential real estate arena for more then 47 years I often think I’ve seen it all…but then something happens and I realize there’s still more to see. What I’ve been seeing and thinking about lately is how much has changed in the last several years--in the world generally, but also in my professional world.

Home prices are going through the roof—literally. And mortgage interest rates are going into the cellar—also literally. We’ve seen enormous home appreciation over the past several years and until there are more available listings, this is going to continue. In the U.S., the average home appreciation from August 2019 to August 2020 was 5.9%. Our local appreciation was almost twice that.

Mortgage interest rates keep spiraling downward—and this is affording many folks the ability to get 15-year mortgages rather than the more traditional 30-year ones, resulting an even greater savings in interest and faster home equity. When I first started selling real estate, a 12% mortgage was the norm and I’ve even seen ones at 9% and higher! Today, mortgage rates are under 3%—something I could never have imagined back then.

And interestingly enough, if you think about what really matters—monthly housing out-of-pocket costs—things haven’t changed that much. I often need to remind my clients that with prices increasing and mortgage rates declining, out-of-pocket monthly cost can often be less than it was with lower homes values and higher interest rates.

This current pandemic has caused so many of us to reconsider what we want and need in our living spaces. WFH (working from home) is the new normal for many and not likely to change in the near future. Home schooling and virtual learning can be an option due to COVID-19. Folks are avoiding their normal workout places and ordering exercise equipment for the home, and outside entertainment areas have become a necessity. These factors have created the need for separate spaces so the entire family can proceed with life in the new normal in the best way possible.

Some are taking this time to deal with renovation of their present homes while others are looking for new homes or new neighborhoods. Unfortunately, this pandemic hit at a time when available housing is at a record all-time low locally. When homes come on the market, they are tending to sell in record time and often over list price. Bidding wars are prevalent, and disappointment is all too common. Buying and/or selling a home should be an exciting adventure and I try to make it as stress-less as possible for my clients. Therefore, it’s quite distressing for me to see my clients disappointed due to not getting their first or second choice or having to deal with buyers who have not-so-scrupulous lenders, and more. I often wonder if some of the “new” real estate professionals could possibly imagine a day when there were so many homes for sale that buyers got a relative bargain at times. Those days are long gone, but they sure made things easier for all.

New home construction has become a choice for many of my buyers due to some of the above reasons and also because a lot of the new homes have the “spaces” that folks are now realizing they want and need. Inventory is better than it was previously since home construction was able to continue while other industries were shut down. However, the availability and price of lumber and other materials has contributed to new construction price increases as well.

I’ve been working with a number of clients, both local and ones who are relocating here, in dealing with home builders and have helped them in site selection, home features and have also directed them to lenders who can work with their individual situations. This is a service I provide AT NO ADDITIONAL COST to my clients and one that has saved them substantial dollars as well. If new construction is an option, please give me a call and let’s discuss the possibilities for you and your family.

Actually, no matter whether it’s new construction or existing home sales, I’m your guy. With all my years of experience, along with my investment banking background, I’m your “ace in the hole” when it comes to residential real estate.

So, if you’ve been thinking about making a move, or even purchasing for investment purposes, NOW is the time to at least see what you can do to make your real estate dreams a reality. Just give me a call at 593.1000 or email me at Harry@HarrySalzman.com and let’s get the ball rolling.

real estate INVESTING 101

YPN Realtor, The Lounge, 10.8.20

As many of you know, I put my money where my mouth is. I have been investing in residential real estate since I started in this business and it has proven time and again to be not only a sound, but also lucrative business. In fact, just last month I sold the very first home I purchased for investment back in 1977. I purchased it for $20,800, sold it for $289,500, and collected rent on that home for all the years in between. You do the math—even after essentially gutting and redoing it prior to sale, I still made a substantial profit.

Being a landlord can be quite rewarding, but it’s not for everyone. At first I acted as my own property manager, but now I employ one to take care of my investment properties. Either way can work—it all depends on how much time and energy you want to put into it.

Here are a few tips that can help you become the owner and property manager of a successful rental property:

These are just a few things to consider and I’d be happy to discuss my own personal experiences in owning rental properties with you if you are interested. Again, let me remind you that it’s important to discuss all options with your tax and/or investment advisors first. I can help you find an investment property, but I can’t advise whether it’s advisable or even feasible for you to do so from a tax standpoint.

MORTGAGE RATES SET RECORD LOW FOR 10TH TIME

Freddie Mac Survey, 10.16.20

Mortgage rates fell slightly the week of October 15th, setting a new record low for the 10th time this year, according to Freddie Mac. The 30-year, fixed-rate mortgage averaged 2.81%, the lowest rate since Freddie Mac began tracking such data in 1971. The previous low of 2.86% was set in mid-September.

“Low mortgage rates have become a regular occurrence in the current environment,” says Sam Khater, Freddie Mac’s chief economist. “As we hit yet another record low, many people are benefiting, as refinance activity remains strong. However, it’s important to remember that not all people are able to take advantage of low rates, given the effects of the pandemic.”

However, home buyers who are ready to enter the market are rushing to take advantage of these lower borrowing costs. “With mortgage rates to remain near 3% for the next couple of years, homebuying activity is expected to stay strong for several more years,” Nadia Evangelou, a research economist for NAR wrote on NAR’s Economists’ Outlook blog.

AND, ACCORDING TO LAWRENCE YUN, NAR chief economist:

“Home prices have mostly outpaced broader consumer price inflation over the past decade. From 2010 to mid-2020, the median home price (nationally) rose 61% to reach $295,300. The key reason: steadily shrinking supply coupled with steadily rising demand. Americans saw inflation of 18% and a wage hike of 30% over the same 10-year period. Yet, incredibly, the percentage of income devoted to a mortgage principle and interest payment to buy a median priced home is essentially unchanged, reflecting the awesome power of low mortgage rates…”

“More amazingly, in the midst of a pandemic and high unemployment, home prices are setting new highs, with multiple offers common on many properties. The rate of home sales, after plunging during the spring shutdown (nationally) is poised to surpass 2019 levels in the final months of the year.”

Yun’s comments reflect what I’ve been telling you for some time. NOW is the time to buy and sell. No matter the higher cost of the homes, it’s the monthly payments that count…and they are likely much lower than you might imagine. Give me a call sooner than later and let’s discuss.

October 5, 2020

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Personal Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

OWNING A HOME IS MONEY IN THE BANK…

Actually, and realistically, homeownership today is FAR BETTER than money in the bank when you consider what banks are actually paying for your money and what your home appreciation continues to be.

This was brought home (no pun intended) to me this past week when I was virtually attending the UCCS Economic Forum. Listening to keynote speaker Dave Nelsen, Futurist and President of Dialog Consulting Group, I was even more acutely aware (if that’s possible) of why owning residential real estate is so vital to personal economic stability and wealth.

Mr. Nelsen gave us a glimpse into the not too distant future, one in which things are going to be radically different than we have been used to in terms of work, transportation, living arrangements and so much more. These past six months of living with the pandemic have already begun to alter the way so many of us do our jobs, educate our children, and spend our leisure time (more on that further on, as well as the link to listen to the keynote yourself).

In some ways, that’s probably a good thing since virtual living and working, automation and robotic devices, artificial intelligence, self-driving automobiles and other similar concepts are banging on our doors. We need to be prepared to let them in whether we want to or not.

The one constant in most all of this is residential real estate. As we’ve recently witnessed, our homes have provided not only shelter, but also classrooms, workout places, employment spaces, food preparation and serving areas, movie theaters and more.

As I’ve told you in recent eNewsletters, folks are looking at their homes in new ways and discovering what they like and don’t like about how and where they have been living. Some are renovating, and others are making lists of their wants and needs and are hoping to realize them as quickly as possible. Yet others still are wanting to move to places like Colorado Springs not only for the obvious reasons, but also to get away from big cities now that working from home (WFH) and virtual meetings have become a new reality and they are now able to live wherever suits them best. Quite honestly, if you ask me, I’d certainly pick the Colorado Springs area over anywhere else as well.

According to the National Association of Realtors Pending Price Index, contract signings in August rose 8.8% over July and were 24.2% higher than a year ago. The housing market has made a strong comeback since the COVID-19 outbreak first hit and remains a key factor in the national economic recovery.

And that presents the current problem of our severe lack of existing homes for sale. As soon as we get a home listed it oftentimes has a line of buyers ready to pounce, and the listing price is often just a starting point in the negotiations. It’s crazy. But it’s reality.

With interest rates below 3%, rising rental prices and escalating home appreciation, folks are realizing that now is the time to buy—especially with a new list of wants and needs.

These are just some of the reasons that homebuilding in Colorado Springs has reached a 15-year high. New home construction is affording folks the opportunity to create the spaces they need for all facets of their “new” housing reality. With the supply of existing homes at an all-time low locally, new homes are fast becoming a viable choice for a number of my clients.

Fortunately for them, and for you, I have good working relationships with a number of local builders and can help with site and model selection as well as assist in helping direct you to the best lender for your individual situation. And did I mention? This comes at no additional cost to you. Just one of the many services you get with a seasoned professional like me.

In fact, I recently had clients who were relocating here from Hawaii and did not have time to visit beforehand. I sent them information on new homes being built that met their specified wants, needs and budget and they had me personally select their site location and oversee the homebuilding process. The first time they saw the home in person was when they moved here this past week!

My 47 plus years in local residential real estate, along with my investment banking background and personal brand of customer service, makes me the best choice to help you find exactly what you and your family want, need and can afford. In this highly competitive arena, it pays well to have me on your side. I’ve been through all kinds of market situations and can help you navigate the home market as smoothly and stress free as possible.

If you’ve even been wondering what’s out there that can satisfy your individual family situation when it comes to residential real estate…NOW is the time to find out. Just give me a call at 593.1000 or email me at Harry@HarrySalzman.com and let’s see how together we can help you realize your ideal homeownership situation. I look forward to helping you and your family members in this endeavor.

And now for statistics…once again “off the chart”…

You will see that home prices are continuing their upward trend due in part to low interest rates, low inventory and a pent-up demand created by the pandemic. With so many folks looking to buy, I would expect to see these numbers, along with the number of sales, to continue to increase over the next few months.

A good thing to remember when considering a move is that the equity in your present home is potentially greater than you might think, and with interest rates so low, it’s possible you can get into another home for not much more in monthly payment costs.

SEPTEMBER 2020

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the September 2020 PPAR report. Remember that the format of this report no longer provides monthly statistics for each individual neighborhood. However, if you are interested in what’s happening in your neighborhood, I can provide you with this information through other means.

In El Paso County, the average days on the market for single family/patio homes was 21. For condo/townhomes it was 15.

The sales price/list price for single family/patio homes was 100.8% and for condo/townhomes was 100.9%.

Please click here to view the detailed 8-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing September 2020 to September 2019 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 1,665, Up 17.2%

· Number of Sales were 1,804, Up 29.4%

· Average Sales Price was $431,293, Up 17.1%

· Median Sales Price was $385,000, Up 18.3%

· Total Active Listings are 996, Down 52.3%

· Months Supply is .06, Down 63.2%

Condo/Townhomes:

· New Listings were 255, Up 19.7%

· Number of Sales were 261, Up 29.2%

· Average Sales Price was $295,276, Up 9.2%

· Median Sales Price was $277,000, Up 14.9%

· Total Active Listings are 134, Down 35.9%

· Months Supply is 0.5, Down 50.4%

And a look at more statistics…

September 2020 LOCAL MARKET UPDATE AND MONTHLY INDICATORS ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

It is broken down by geographical areas and you can look to see how your neighborhood is doing in terms of sales, prices, and more.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year to Date one-year change:

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical area of your choice from the 18-page Local Market Update. I recommend that you check out your own area or one that you are considering, to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

THE COST OF A HOME IS FAR MORE IMPORTANT THAN THE PRICE

Keeping Current Matters, 9.22.20

Housing inventory is at an all-time low, with 39% fewer homes for sale today nationally (and 50.9% fewer locally) than a year ago. Buyer demand continues to set records, along with home prices which have increased 5.5% nationally and 17.7% locally over the same time last year.

The home value appreciation is great news if you’re planning to sell your home, but as a first-time or repeat buyer, this may seem troubling. However, potential buyers should realize that the price of a house is not as important as the monthly cost.

Let’s break it down.

Two weeks ago, Freddie Mac announced the average interest rate for a 30-year fixed-rate mortgage was 2.87%. At the same time last year, the rate was 3.73%. Using this as an example, let’s talk about how that difference impacts the true cost of a home.

Assume you purchased a home last year and took out a $250,000 mortgage. Using the national average price increase of only 5.5% over the past year, to buy the same home would necessitate taking out a mortgage of $263,750.

The table below calculates the difference in your monthly payment:

That’s a savings of $61 monthly, or $732 annually, and $21,960 over the life of the loan.

Bottom Line? Even though home values have appreciated, NOW is a great time to buy because of the historically low interest rates.

UCCS ECONOMIC FORUM UPDATE

UCCS Economic Forum, College of Business, updated 9.11.20

I just received the updated statistics from the UCCS Economic Forum and wanted to share them with you, as always. Please click here for the look at both the national and local updates on the economy in terms of employment, local demographics, real estate and more.

As I mentioned earlier, the virtual UCCS Economic Forum held last Thursday was very informative. The theme of the meeting was “Our Resilient Future” featured futurist Dave Nelsen as the keynote speaker.

Aikta Marcoulier, Executive Director, Pikes Peak SBDA, presented a Pikes Peak Region Small Business Resiliency and Report to the Community.

Dr. Tatiana Bailey, Director, UCCS Economic Forum, presented Economic Conditions and Outlook for the Pikes Peak Region.

You can access the presentation in its entirety by going to the UCCS Economic Forum’s website: www.uccseconomicforum.com

There is excellent information here for all-- not only about the state of the economy and city today, but also scenarios that can help prepare both our businesses and our lives for the future. If you have any questions, please give me a call.

HARRY’S THOUGHTS OF THE DAY:

September 22, 2020

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Unique Brand of Personal Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

THE TIME TO INVEST IN A NEW HOME IS NOW…

It doesn’t matter if you want to sell and trade up, move to a new neighborhood, help a family member purchase a home or buy for investment purposes…. there’s no better time than the present.

Interest rates are still historically low and home values locally are simply off the chart, so the equity in your present home is likely greater than you might imagine. The securities markets are in a constant state of flux, but home values are continuing to rise.

Realtors all over are asking each other, “Have you ever seen a market like this?’ And the answer is, “NO. NEVER”. The pandemic has not stopped the consistent home price growth we’ve witnessed in recent years and is a very bright light in the recovery of the economy.

Folks are looking at their living conditions in a different light in terms of what they need in order to work from home, tutor their kids from home, eat more meals at home and in general, simply spend more time at home.

These are all reasons why you might want to give me a call so we can discuss your personal wants, needs and budget requirements if you’ve at all wondered whether you might either want to trade up or buy another home for a family member or for investment purposes.

The price of lumber is continuing to escalate according to the National Association of Homebuilders, which means that new construction costs will rise along with them and further increase the value of existing homes. The price of lots is also on the rise which will again affect the price of existing homes.

If new construction is something you’ve considered, NOW is the time to make your move. I can help you in that area at no additional cost to you. I know the ins and outs of site selection, home features and so much more. On top of that, I can also help direct you to the best mortgage financing for your individual needs.

Rental prices are higher than ever and don’t look to decrease any time soon. That makes buying for investment purposes a great choice for those who might have considered this option in the past. Of course, it’s always smart to talk to your tax advisor before becoming a landlord, but I can tell you from personal experience that I’ve found my investment properties have provided a more lucrative rate of return than those from stocks and bonds.

Do you have a student in college? So many are learning remotely from their dorm room or apartments these days. Why not purchase a home and let your student live there while renting out rooms to others? The increased equity by the time your student graduates could possibly pay for a major part of their tuition. It certainly is worth discovering if this is a possibility that could work for you.

No matter what the reason, there’s no better time than NOW to call me at 593.1000 or email me at Harry@HarrySalzman.com and discuss all the possibilities. I look forward to talking to you soon.

FIRST-TIME BUYERS RUSH TO LOCK IN LOW MORTGAGE RATES

Realtor Magazine, 9.18.20

A new wave of first-time home buyers are being drawn in by the record low interest rates according to Freddie Mac. “In August, activity among first-time buyers rose 19% from July to the highest monthly level ever for Freddie Mac,” said Sam Khater, chief economist for Freddie Mac. He added that the rebound “has come at a critical time for the economy.”

Mortgage rates have dropped more than 80 basis points since the beginning of 2020, the National Association of Realtors reported. And, the qualifying income to buy a starter home has dropped by 10% to nearly $43,000. Further, the monthly mortgage payment dropped by $100.

This is prompting homebuying activity to move higher than pre-pandemic levels according to NAR. If this doesn’t get you thinking, it should at least cause you to give me a call to discuss how this might affect you or one of your family members.

The following chart demonstrates just how amazing this is:

Any questions? Just give me a call.

10 LANDLORD RESPONSIBILITIES YOU MAY HAVE OVERLOOKED

RisMedia’s Housecall, 3.2.2015

I’ve posted some of this previously, but it’s always good to remind my clients who are landlords of their responsibilities. Reading this every year is a good reminder for all-- even those who hire property managers for their rental properties.

Some of the duties of a landlord are clear, such as collecting rent and finding new tenants for a vacant property. Our may be less clear and the more you know, the more success you’ll have with your real estate investments.

Being a landlord involves a steep learning curve when starting out, and the laws aren’t always simple. Taking the time to learn about your responsibilities as a landlord can mean the difference between earning a nice profit and losing money—or worse. Protect yourself by learning the laws that apply to you and surrounding yourself with a team of professionals.

September 8, 2020

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Personal Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

MISSING THAT CRUISE OR OTHER TRAVEL IN 2020? CONSIDER ‘TRAVELING’ TO A NEW HOME INSTEAD…

One of the things I’ve missed this year is traveling to new places and returning to places I so enjoy visiting, both for business and pleasure. This is the refrain I also hear from so many of my clients. I’ve always enjoyed hearing about their recent adventures and plans for upcoming trips.

Instead, this year I’ve been hearing about what those same folks realize they either like or dislike about their present living conditions and what they want to do about changing them. Places such as Home Depot and Lowe’s are full of those who have lots of time on their hands and want to make their homes more comfortable and enjoyable. And HGTV and the like have had no shortage of viewers during this pandemic year.

What I’ve heard from clients, and have also learned from my own personal experience this year, is that working from home or home-schooling is creating needs most of us never knew we had.

Now that homes have gone from the place we returned to after work, school, the gym, or travel to the place where families do all of those things, there’s a growing list of “wants and needs” for homeowners.

Personal spaces, larger entertainment areas, home gyms, bigger and more efficient kitchens, outdoor entertaining facilities…these are on the wish lists of many I talk to. Some are looking for new neighborhoods, others for larger homes, and some are preparing to move closer to family or retiring in warmer climates.

The one common denominator is time. And the question I am often asked is…“How soon can I get moved and settled in a new place?”

Well…I wish I had an easy answer for that one. One of the biggest issues in the Colorado Springs area continues to be a lack of available homes for sale. In fact, last month we had a more than 50% decrease in the number of active listings in all local existing properties. As soon as one goes on the market there are often multiple offers over listing price and bidding wars—sometimes within hours of its listing. That makes it tough for everyone. It is most definitely continuing to be a seller’s market in residential real estate and will continue to be so until we have more homes for sale.

There are a number of companies relocating here and most of those being relocated with them are looking for places to live. With rental rates so high and mortgage interest rates so low, it makes great sense for them to buy. I, unfortunately, have to tell them to “get in line”.

This is one of the many reasons that new home construction is on the upswing, both here and across the country. Folks want to move to get the things they want and need in a new home and with interest rates under 3%—now is the perfect time.

If you are one of those who have been even considering selling to trade up or move to a new neighborhood, either across the city or across the country, simply give me a call and let’s see how together we can make your wants, needs and budget requirements work to make that happen.

After all, if you can’t be cruising or traveling much these days, you might as well take advantage of contacting me—your Colorado Springs “Ambassador” of all things concerning residential real estate. My 47 plus years of “world class service” coupled with my investment banking background, make me your surest bet for finding a home—be it for yourself, a family member or even for investment purposes.

Give me a call today at 593.1000 or email me at Harry@HarrySalzman.com and let’s get started.

And now for statistics…still “off the chart”…

You will see that home prices are continuing their upward trend due in part to low interest rates, low inventory and a pent-up demand created by the pandemic. With so many folks looking to buy, I would expect to see these numbers, along with the number of sales, to continue to increase over the next few months.

A good thing to remember when considering a move is that the equity in your present home is potentially greater than you might think, and with interest rates so low, it’s possible you can get into another home for not much more in monthly payment costs.

AUGUST 2020

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the August 2020 PPAR report. Remember that the new format of this report no longer provides monthly statistics for each individual neighborhood. However, if you are interested in what’s happening in your neighborhood, I can provide you with this information through other means.

In El Paso County, the average days on the market for single family/patio homes was 19. For condo/townhomes it was 15.

The sales price/list price for single family/patio homes was 100.6% and for condo/townhomes was 100.8%.

Please click here to view the detailed 9-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing August 2020 to August 2019 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 1,689, Down 8.3%

· Number of Sales were 1,771, Up 14.9%

· Average Sales Price was $435,922, Up 17.3%

· Median Sales Price was $380,000, Up 15.2%

· Total Active Listings are 1,077, Down 50.9%

· Months Supply is .06, Down 57.3%

Condo/Townhomes:

· New Listings were 264, Up 5.6%

· Number of Sales were 246, Up 18.8%

· Average Sales Price was $273,104, Up 3.9%

· Median Sales Price was $265,000, Up 9.5%

· Total Active Listings are 119, Down 36.4%

· Months Supply is 0.5, Down 46.5%

And a look at more statistics…

August 2020 LOCAL MARKET UPDATE AND MONTHLY INDICATORS ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

It is broken down by geographical areas and you can look to see how your neighborhood is doing in terms of sales, prices, and more.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year to Date one-year change:

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical area of your choice from the 18-page Local Market Update. I recommend that you check out your own area or one that you are considering, to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:.jpg)

NEW HOME CONSTRUCTION SHOOTS UP 22.6% IN JULY

HousingWire, 8.18.20, NAHB, 8.2020

In a sign that the housing market continues to lead the economy during the pandemic, sales of newly built, single-family homes rose in July to its highest pace since 2006. According to a report from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development, new home construction starts for single-family housing climbed to a seasonally adjusted annual rate nationally of 1.496, a 22.6% jump from the month prior.

These housing starts not only jumped monthly, but also showed a 23.4% growth from the previous July.

“Single-family new home sales in recent months have outpaced their usual relationship to starts,” said Fannie Mae chief economist, Doug Duncan. “Homebuilders have supported sales by drawing down existing inventories in light of continued buyer demand.”

The National Association of Home Builders confirmed that their builder confidence survey has been indicating this for months. “Consumers are being driven by low interest rates, a growing focus on the importance of housing and a shift in buyers seeking homes in lower density areas,” said NAHB Chairman Chuck Fowke.

“New home sales are benefitting from the suburban shift, as prospective buyers seek out affordable markets in order to obtain more residential space. Moreover, sales are increasingly coming from homes that have not started construction, with that count up 34% year-over-year,” said NAHB chief economist Robert Dietz.

If new home construction is in your future, I’m your guy for that, too. I have excellent working relationships with a number of local builders and can help with the ins and outs of new construction purchasing, including site selection and financing. And all of it comes at no additional cost to you, so why not have the “upper hand” in dealing with new construction by giving me a call today?

COLORADO SPRINGS RANKS #16 OUT OF THE TOP 100 METRO AREAS IN HOUSING PRICE INCREASE ACCORDING TO FHFA HOUSE PRICE INDEX 2020 Q2 REPORT

FHFA House Price Index, FHFA.gov/HPI

According to the recent 2020 Q2 Housing Price Index report from the Federal Housing Finance Agency (FHFA), Colorado Springs’ housing market is doing just as well as I’ve been reporting. We are #16 out of the top 100 metro markets surveyed, with a 7.9% increase year-over-year and a 1.2% increase quarter-over-quarter in 2020.

Considering we weren’t even able to show homes for months, and then only on a limited basis, I’d say we are definitely doing great.

In case you’re wondering, “the FHFA is the nation’s only public, freely available index that measures changes in single-family house prices based on data covering all 50 states and over 400 American cities. Extending back to the mid-70’s, the Home Price Indexes are built on tens of millions home sales and other insights about house price fluctuations at national, census division, state, metro area, county, ZIP code and census tract levels.”

And…if you wish to see the report showing all of the top 100 cities as well as the local Colorado Springs area data, please click here.

UCCS ECONOMIC FORUM UPDATE & ECONOMIC FORUM VIRTUAL EVENT INFORMATION

UCCS Economic Forum, College of Business, updated 8.31.20

I just received the updated statistics from the UCCS Economic Forum and wanted to share them with you, as always. Please click here for the look at both the national and local updates on the economy in terms of employment, local demographics, real estate and more.

As a charter member and sponsor of the UCCS Economic Forum, I’m also excited to tell you about the upcoming UCCS Economic Forum Virtual Event on Thursday, October 1 from 1:00-4:00 pm. Due to the pandemic, this year’s meeting will be FREE to all who sign up to watch the presentation. Below are the details and you can go to the website to register and get more information.

The theme of the meeting is “Our Resilient Future” and will feature Dave Nelsen, Futurist and President of Dialog Consulting Group as the keynote speaker.

Aikta Marcoulier, Executive Director, Pikes Peak SBDA will present a Pikes Peak Region Small Business Resiliency and Report to the Community.

Dr. Tatiana Bailey, Director, UCCS Economic Forum will present Economic Conditions and Outlook for the Pikes Peak Region.

Mark your calendars. The information presented will be certain to help you in making future economic decisions and as always, will be quite entertaining and more than worth your time.

You can REGISTER for FREE at:

www.Pikespeaksbdc.org/economicforum

If you have any questions, please give me a call.

HARRY’S THOUGHT OF THE DAY:

Displaying blog entries 131-140 of 498

Be the first to know what's coming up for sale in the Colorado Springs real estate market with our New Property Listing Alerts!

Just tell us what you're looking for and we'll email a daily update of all homes listed for sale since your last update. You can unsubscribe at any time.

Get NotificationsOur office is located at:

6385 Corporate Drive, Suite 301

Colorado Springs, CO 80919

Office: 719.593.1000

Cell: 719.231.1285

Harry@HarrySalzman.com