HARRY'S BI-WEEKLY UPDATE 5.17.21

May 17, 2021

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

NOT YOUR NORMAL SPRING BUYING SEASON…

If you’ve been reading this eNewsletter for the past year or more you certainly will understand when I say once again that the typical “spring buying season” in Residential real estate is no more. I can’t speak for future years, but for now everything is different.

With folks venturing out more, they are starting to look for the wants and needs they discovered were lacking in their present homes during the last year when they were forced to remain indoors. Bigger and more elaborate kitchens, home offices, outdoor entertaining areas and more have become prevalent in the search for new homes.

Even a big snowstorm hasn’t kept buyers from wanting to see homes because they are hoping others might not be out and that would give them an advantage! I’ve seen so many different scenarios I can’t begin to list them here.

Buyers are trying everything possible to present offers that sellers will notice and hopefully accept. And the stress and disappointments are like nothing I’ve witnessed before.

And that’s where I come in.

A big part of my job is working with my clients to make certain we’ve got as much information as possible right at the beginning of the search. When we’ve figured out a strategy it’s much easier to make the quick decisions that are necessary in today’s market.

Every family situation is different and there’s no easy “no size fits all” in Residential real estate. Home size, location, family size and wants, needs and budget all come into play and have to be considered right from the start.

I like to spend time getting to know my clients so that I can best represent them and make certain they are getting the most for their money. It can get a bit frantic in these bidding wars and I’ve learned that at times, walking away is a “win” when it’s not in a buyer’s best interest to “win the bid, but lose the war” so to speak.

My 48 years in the local Residential real estate arena have taken me through many different cycles and I’ve learned the ins and outs of making sure my clients are protected and happy with the eventual outcome of their home search. It may be YOUR first rodeo, but it’s obviously not mine. I know how to keep the stress levels at an even keel if at all possible and they certainly don’t call me “Mr. Negotiator” for nothing.

If you’ve even considered a move, now is the time to get started. Prices aren’t going down any time soon and mortgage rates essentially have nowhere to go but up, so today is the best time to start. It shouldn’t take long to sell your present home and it will likely go for far more than you might imagine. It WILL take longer to find your next home, so that also needs to be a consideration from the start.

The best move you can make is to call me at 593.1000 or email me at Harry@HarrySalzman.com to get any and all of your Residential real estate questions answered. I look forward to speaking with you.

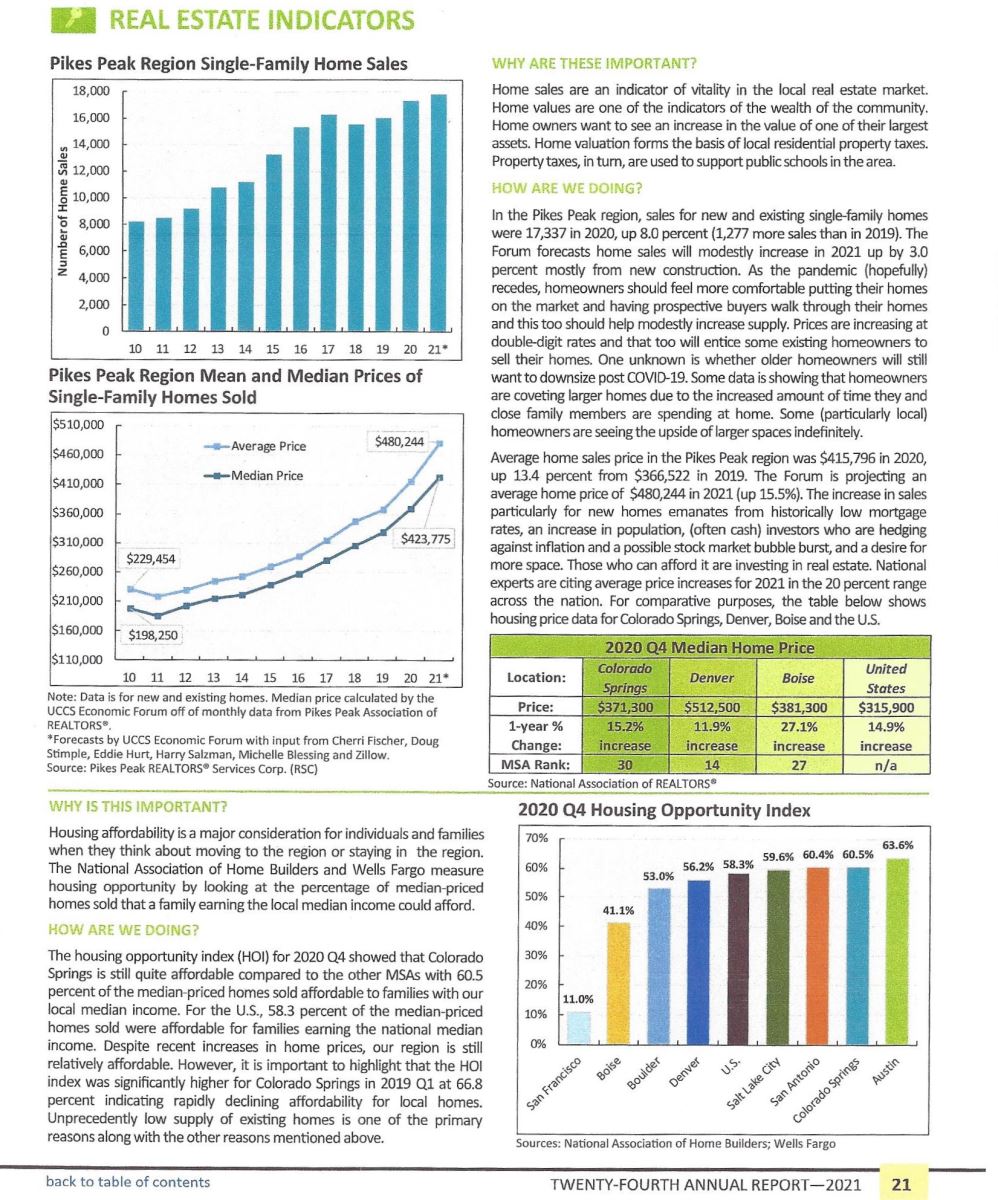

3 GRAPHS THAT SHOW WHY YOU SHOULD SELL YOUR HOUSE NOW

Keeping Current Matters, 5.17.21

As I’m sure you’ve heard more than once from others, and numerous times from me, 2021 is the year of the seller when it comes to Residential real estate.

If you’ve been thinking of moving in order to better suit your changing needs and wants, now is the perfect time to do so. Historically low interest rates are certainly in your favor, and high buyer demand at present presents you with the leverage to negotiate the best contract terms on the sale of your current home.

Here’s what is driving the sellers’ advantage and why there is so much opportunity for homeowners who are ready to move this season.

- Historically Low Inventory

The National Association of Realtors (NAR) explains it this way: “Total housing inventory at the end of March amounted to 1.07 million units, up 3.9% from February’s inventory…Unsold inventory sits at a 2.1-month supply at the current sales pace, marginally up from February’s 2.0-month supply and down from the 3.3-month supply recorded in March 2020.”

Even with the slight rise in number of homes for sale this spring, inventory remains close to an all-time low:

High buyer interest has created a major imbalance between supply and demand, but as the slight uptick in inventory shows, sellers are beginning to reenter the market. Selling your home now enables you to take advantage of buyer demand before more listings come on the market later this year.

- Frequent Bidding Wars

As I’ve been telling you for some time now, bidding wars are becoming the norm as a result of the supply and demand imbalance. NAR reports that the average number of bids received on the most recently closed sales is 4.8 offers. This number has doubled since the first quarter of 2020:

Buyers facing tough competition when searching for a home are more likely to be flexible and generous in their negotiations. This gives the seller the chance to choose the best buyer for their needs and be selective about things like time to closing, contingencies, renovations and more. Working with a seasoned professional like me who is a “certified negotiator” gives you even more leverage in navigating the bidding wars.

- Days on the Market

Today’s sellers aren’t waiting very long to find a buyer for their house either, NAR reports: “Properties typically remained on the market for 18 days in March, down from 20 days in February and from 29 days in March 2020. 83% of the homes sold in March 2021 were on the market for less than a month”:

Lawrence Yun, NAR’s chief economist explains, “The sales for March would have been measurably higher had there been more inventory…Days-on-market are swift, multiple offers are prevalent, and buyer confidence is rising.”

Bottom Line? If you’ve even been thinking about moving, you can see that it’s a great time to sell your present home. Call me and let’s figure out the best way for you to make your current Residential real estate dreams come true.

COLORADO SPRINGS IS NUMBER 30 IN TOP METRO AREA PRICE INCREASE

NAR, 5.11.21, The Wall Street Journal, 5.12.21

Home prices across the country rose just about everywhere during the first quarter of 2021 and this rapid price appreciation shows little sign of fading anytime soon due to the lack of homes for sale and robust demand. Nationwide, the median existing-home sales price rose 16.2% in the first quarter to $319,200—a record high in data going back to 1989.

For 182 of the 182 Metropolitan Statistical Areas (MSAs) tracked by NAR, the median sales price for existing single-family homes was higher in the first quarter compared to a year ago. In 89% of those metro areas, median prices rose by more than 10% from a year earlier. And the average national monthly mortgage payment rose to $1,067 from $995 a year ago.

“Significant price increases throughout the country simply illustrate strong demand and record-low housing supply,” said Lawrence Yun. “The record-high home prices are happening across nearly all markets, big and small, even in those metros that have long been considered off-the-radar in prior years for many home seekers.”

Another factor coming into play is the fact that length of time U.S. homeowners are staying put has been steadily rising, some of which is due to concerns about letting potential buyers into their homes during a pandemic.

A number of buyers are being kept out of the current market, most especially first-time buyers and those with limited budgets who are losing out to all-cash buyers. According to Yun, “The sudden price appreciation is impacting affordability, especially among first-time buyers. With low inventory already impacting the market, added skyrocketing costs have left many families facing the reality of being priced out entirely.”

The following chart shows the median sale price of existing single-family homes in the U.S.:

Colorado Springs was ranked at number 30 this quarter with median sales price increases year-over-year at 14.3%.

To see the entire 182 MSAs in alphabetical order please click here. To see them in order of percentage of median price increase click here.

RECORD HIGH COSTS OF BUILDING MATERIALS CONTINUE TO THREATEN HOUSING AFFORDABILITY

NAHBNow, 5.14.21

It’s not just lumber anymore. The rapidly rising prices for other necessary building materials are causing widespread concerns throughout the housing industry.

While lumber prices, up more than 300% from April 2020, have been dominating the headlines for the past year, the prices for materials like steel, concrete and gypsum products all are climbing at a record pace.

“Steel mill products price volatility is greater than it has been at any time since The Great Recession,” said National Association of Home Builders’ (NAHB) Senior Economist David Logan. “Over the past three months, prices have climbed 22%. Perhaps more concerning than rising prices is that the pace of price changes has quickened each of the past nine months,” he added.

“[Rising materials prices] are significantly driving up prices for single-family homes and apartments,” wrote NAHB Chief Economist Robert Dietz in his bi-weekly newsletter. “Combined with expectations of rising interest rates, these higher prices place additional pressure on housing affordability, which continued to decline in the first quarter,” he added.

If you are considering new construction the earlier you start the better. The lack of available homes for sale is not just an “existing home” thing. Builders cannot keep up with the current demand and with material prices rising daily, prices on those homes are rising quickly as well. Delivery times are much longer than even in the most recent past and interest rates are not guaranteed to stay this low. Please call me sooner than later if this is an option you’re considering and let’s see how we can make it work for you.

THE MOST COMMON REASON ACTIVE BUYERS CAN’T CLOSE THE DEAL

NAHBNow, 5.11.21

A recent post in the Eye on Housing blog showed that 64% of buyers who were actively engaged in the process of finding a home in the first quarter of 2021 have spent upwards of three months searching for a home without success.

The most common reason they have come up empty-handed is not because they can’t find a home at an affordable price (32%) but because they continue to lose out in bidding wars (45%), according to survey results from NAHB’s most recent Housing Trends Report.

This is flipped from a year ago when 40% cited unaffordable prices and only 23% because of offers by other buyers.

When asked what they are most likely to do next if still unable to find a home in the next few months, 50% of active buyers who have searched for three-plus months will continue looking for the “right” home in the same location—about the same percentage as a year earlier. On the other hand, 42% say they will expand their search area, an increase from the 34% willing to take that step a year earlier.

And 25% of active buyers will give up until next year or later, up from 16% a year earlier.

I point all of this out for several reasons. The first is so that your expectations are in line with the Residential real estate landscape of today’s market. And the second is to reiterate the importance of using a seasoned professional like myself in your active search. I can’t promise you will get your first, or sometimes even your second choice, but I can promise that I will do my very best to make the entire process one that adds as little stress as humanly possible.

TIPS FOR BUYERS IN LOW-INVENTORY MARKETS

The Wall Street Journal, 5.4.21

Here are a few excellent tips that I’ve employed in recent times that can help make your offer one that stands out:

- Be Flexible on Timing: Sellers sometimes choose the bidder who is the most flexible on timing. If the sellers want to stay in the house longer for whatever reason, they may choose the buyer who will let them do that, even if it’s not the highest offer.

- Don’t Wait: In a low-inventory market, buyers need to act quickly. That means when a new house comes on the market, drop everything to go see it. You can’t wait for the weekend.

- Get Creative: This means you need someone like me who knows where to look for homes that are about to come on the market as well as finding a way to write a contract that gets a second look.

- Work With a Local Lender: Getting pre-approved and not just pre-qualified is paramount in today’s bidding war environment. And the strength and reputation of a local lender can go a long way in helping to win that war.

- Pay With Cash, if Possible: Cash buyers are far more likely to win a bidding war than those who plan to finance their purchase because a deal can close more quickly and easily without the involvement of a bank.

- Consider Waiving Contingencies: While most real estate agents don’t recommend waiving an appraisal contingency, mortgage contingency or your right to a home inspection, in many markets the practice is now widespread as buyers compete to make their offers the most attractive.

- Consider an Escalation Clause: A number of my clients have been including these clauses, which stipulate that the bidder will top any other offer up to a certain threshold.

HARRY’S THOUGHT OF THE DAY:

.jpg)

.jpg)

.jpg)

.jpg)