HARRY'S BI-WEEKLY UPDATE 7.7.20

July 7, 2020

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Personal Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

SAY HELLO TO THE real estate FAIRY…SHE’S BEEN MAKING A LOT OF RESIDENTIAL REAL ESTATE DREAMS COME TRUE

Do you believe in magic? Well, I’m ambivalent on that one, but it’s hard to ignore the real statistics, and magic or not…residential real estate in the Colorado Springs area is approaching “magical” numbers.

With our recent local average sales price going over $400,000 for the first time, it’s happy days for local homeowners and even for those still looking to own in our town. The mortgage rates keep hitting all time low numbers, so while our home values are escalating, the monthly payments are staying reasonable.

Now is the time to sell and trade up or buy for the first time or for investment purposes. It’s somewhat of a perfect storm. Higher housing prices plus historically low interest rates equal monthly payments that are affordable. Plus, if you are looking for investment properties, the time is right because rental rates are getting higher all the time and those that cannot afford to own are looking for places to rent.

I’ve been busier than ever meeting with clients who are wanting to sell and trade up, especially since the forced quarantine has made many people realize what they truly want and need in their homes. Bigger kitchens, great rooms and practical yards are just some of the requirements I’ve been hearing about.

And, folks from bigger cities are finding that Colorado Springs has it all, as those of us who live here already know, and are wanting to relocate yesterday.

The problem is our lack of existing homes for sale—just as it has been in the past year or more. It is still most definitely a seller’s market and bidding wars and homes going for considerably more than asking price are now the norm.

What does that mean to you? For starters, if you’ve even been thinking of selling to trade up, now is the time. You will likely get more for your present home than you might imagine and while the new home may be costing you more, the historically low interest rates will help to keep that monthly payment in a more affordable range.

If you have been wanting to begin the process of making your residential dreams come true, all it takes is a phone call to me at 593.1000 or an email to Harry@HarrySalzman.com and I can put my extensive knowledge, experience and special brand of customer service to work for you, your family members and co-workers.

I look forward to talking with you and seeing you soon.

And now for statistics…

You will see that, while home sales prices did not increase as much as in the recent past, they still managed to do quite well for a time when it was still almost impossible to visit available homes. With the number of folks ready to buy, I would expect to see these numbers, along with the number of sales, to increase over the next few months.

As might be expected, there were fewer new listings again last month, but considerably more than in in the recent past. Now that we can visit homes to photograph them and talk with owners, you will undoubtedly see more homes for sale before too long.

JUNE 2020

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the June 2020 PPAR report. Remember that the new format of this report no longer provides monthly statistics for each individual neighborhood. However, if you are interested in what’s happening in your neighborhood, I can provide you with this information through other means.

In El Paso County, the average days on the market for single family/patio homes was 15. For condo/townhomes it was 19.

The sales price/list price for single family/patio homes was 100.8% and for condo/townhomes was 100.5%.

Please click here to view the detailed 9-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing June 2020 to June 2019 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 2,020, Down 1.6%

· Number of Sales were 1,684, Up 2.0%

· Average Sales Price was $401,980 Up 7.5%

· Median Sales Price was $360,000 Up 8.8%

· Total Active Listings are 1,479, Down 30.3%

· Months Supply is .09, Down 15.2%

Condo/Townhomes:

· New Listings were 226, Down 10.0%

· Number of Sales were 239, Up 24.5%

· Average Sales Price was $259,285, Up 4.2%

· Median Sales Price was $241,400 Up 0.6%

· Total Active Listings are 134. Down 19.8%

· Months Supply is 0,6, Down 0.8%

And a look at more statistics…

JUNE 2020 LOCAL MARKET UPDATE AND MONTHLY INDICATORS ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

It is broken down by geographical areas and you can look to see how your neighborhood is doing in terms of sales, prices, and more.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year to Date one-year change:

- Sold Listings for All Properties were Up 1.5%

- Median Sales Price for All Properties was Up 9.4%

- Active Listings on All Properties were Down 38.2%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical area of your choice from the 18-page Local Market Update. I recommend that you check out your own area or one that you are considering, to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

.jpeg)

THREE REASONS HOMEBUYERS ARE READY TO PURCHASE THIS YEAR

Keeping Current Matter, 6.16.20

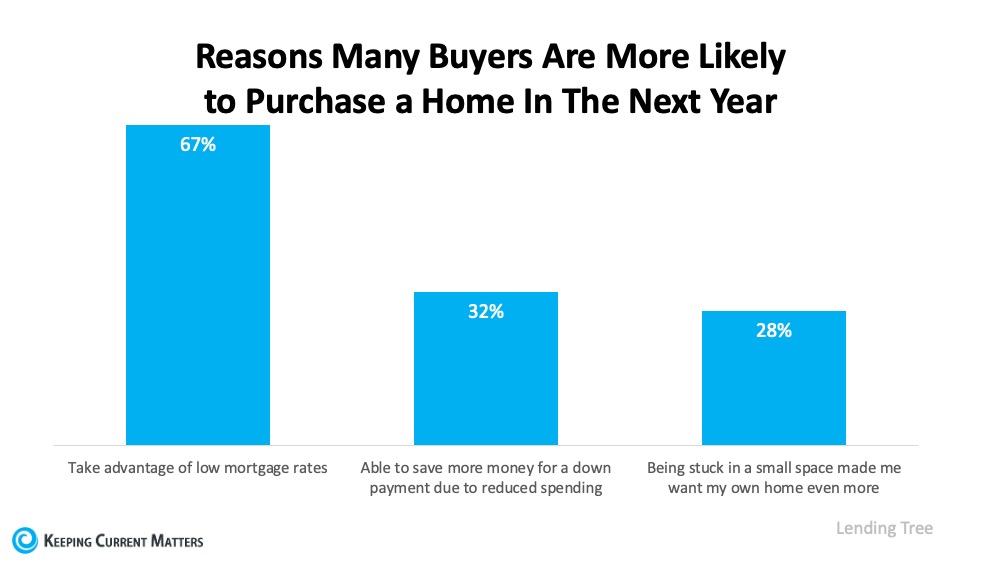

A recent survey by Lending Tree tapped into the behavior of over 1,000 perspective home buyers. The results showed that 53% of all homebuyers are more likely to buy a home in the next year. The survey went on to explore why this is so.

Here is the breakdown of why these factors are key in motivating buyers to actively engage in the home search and the corresponding wins for sellers as well:

- Low Mortgage Rates. The biggest reason potential homebuyers indicated they’re eager to purchase this year is due to current mortgage rates which are at all time lows. Today’s rates are making it more affordable than ever to buy a home, which is a huge incentive for purchasers. In fact, 67% of respondents in the survey want to take advantage of low mortgage rates. This is no surprise when comparing historic mortgage rates by decade:

- Reduced Spending. Some people have also been able to save a little extra money over the past few months while under quarantine. One of the advantages of sheltering in place is that many have been able to work remotely and minimize extra spending on things like commuting expenses, social events, and more. For those in that category they may have a bit more saved up for down payments and closing costs, making purchasing a home more feasible today.

- Re-Evaluating Their Space. Spending more time at home has given potential buyers a chance to really evaluate their living space, whether renting or as a current homeowner. With time to assemble a “wish list” of what they really need and want in their next home, from more square footage to a more spacious neighborhood, they’re ready to make it happen.

What does this mean for buyers and sellers? With these three factors in play, the demand for housing will keep growing this year, especially over the summer as more communities continue their phased approach to reopening. Buyers can take advantage of additional savings and low interest rates. And if you’re thinking of selling, know that your home may be in high demand as buyer interest grows and the number of homes for sale continues to dwindle. This may be your moment to list your house and make a move into a new home as well.

Bottom Line? If you’re ready to buy or sell—or maybe both—call me sooner than later to help put your plan in motion. With low mortgage rates leading the way, it’s a great time to take advantage of your position in today’s market.

HOME SELLERS ARE THE MISSING LINK IN THE HOUSING RECOVERY

Realtor Mag, 7.1.20

Housing inventory, or rather, the lack of it, continues to be buyers’ biggest hurdle. In June the number of homes for sale plummeted nationwide, as well as here locally, prompting realtor.com to call home sellers the “missing link” to an otherwise strong summer housing market.

“Our June data reinforces that buyers are out in force and serious about finding a home,” say Danielle Hale, realtor.com’s chief economist. “Although the new listings trend has improved, inventory continues to decline, indicating that what is coming onto the market is selling.”

Again…if you are looking to sell…NOW is the time. Call me today and let’s see how we can make your present home work toward making your future real estate dreams come true.

UCCS ECONOMIC FORUM UPDATE

UCCS Economic Forum, College of Business, updated 6.26.20

I just received the updated statistics from the UCCS Economic Forum and wanted to share them with you, as always. Please click here for the look at both the national and local updates on the economy in terms of employment, local demographics, real estate and more.

As always, if you have any questions, please give me a call.

HARRY’S THOUGHT OF THE DAY: