HARRY'S BI-WEEKLY UPDATE 8.25.20

August 25, 2020

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Unique Brand of Personal Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

LOCAL HOMEOWNERS HAVE A LOT TO REJOICE ABOUT…

These are certainly trying times for us all and I’m finding that we have to do our hardest to find some joy in the midst of uncertainty. One of the things that has brought me some joy is knowing that my lifelong philosophy of touting homeownership to one and all has continued to prove me right over the long haul.

I truly believe and practice what I preach and as I’ve told you time and again, while homeownership may be the biggest financial investment in most people’s lives, it continues, over time, to provide returns far better than the stock and bond market.

There have been a number of recent articles talking about how the residential real estate market has definitely been the shining light in the country’s economic recovery. Increasing home sales and prices have been a rare bright spot for the U.S. economy and are continuing to be so. This brings a smile to my face since I have personally seen how this affects my friends and clients who I’ve been blessed to work with in their real estate transactions over the last 47 plus years.

One thing is for certain…folks are realizing that being quarantined has made them acutely aware of what they actually like or dislike about their current living situation and also what they might need and want in case they are quarantined once again or...to just enjoy in general. People are looking for home office space, bigger kitchens, larger great rooms and greater outdoor gathering spots. Some are already working on renovations and others are out looking for new locations.

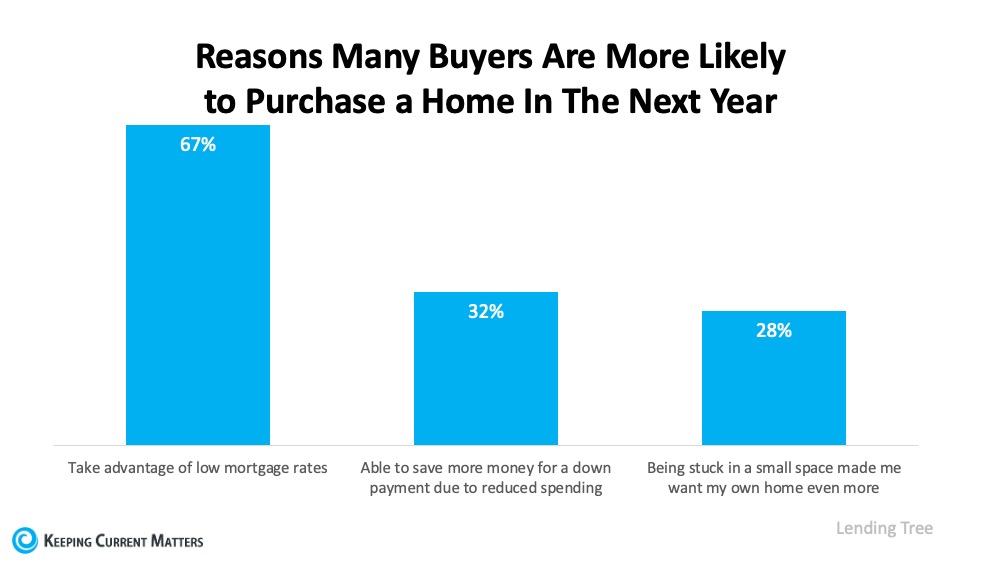

Renters are finding that monthly costs are climbing and will likely continue to do so. Those folks who are able are now looking to buy, especially since interest rates are presently at unheard of lows. Others are looking to buy for investment purposes since rental demand continues to be high.

The only problem at the moment is the lack of existing homes for sale all over the country, but most especially locally. We are starting to see some listing activity and that’s a good thing. I’ve always contended that no matter what’s going on in other aspects of life, there will always be those that need to sell and those that need to buy. My job has been to help balance the priorities of my clients to get them the best of what they want, need and can afford.

If you’ve been thinking of making a change—to a different home or location—or simply want to buy for investment purposes—NOW is the time to at least discuss whether this is feasible. Just give me a call at 593.1000 or email me at Harry@HarrySalzman.com and let’s see how we can make all of your residential real estate dreams come true.

HOMES ARE MORE AFFORDABLE RIGHT NOW THAN THEY HAVE BEEN IN YEARS

Keeping Current Matters, 8.13.20

As home prices are appreciating, it’s normal to think a home will cost more as the trend continues. However, the way the housing market is positioned today, low mortgage rates are actually making homes more affordable, even as prices rise. Here’s why:

- “While home prices have risen for 97 consecutive months, July’s record-low mortgage rates have made purchasing the average-priced home the most affordable it’s been since 2016”, according to Mortgage Monitor Report.

This is fabulous news for first time buyers and those who where unable to purchase last year or earlier in the spring due to the slowdown from the pandemic. By waiting a little longer, they can now afford 10% more home than they could have a year ago while keeping their monthly mortgage payment unchanged.

With rates hitting all-time lows eight times this year already, it’s now less expensive to borrow money, making homes more affordable over the lifetime of a loan. Mark Fleming, chief economist at First American shares what low mortgage rates mean for affordability:

“In July, house-buying power got a big boost as the 30-year fixed mortgage rate made history by moving below three percent. That drop in the mortgage rate from 3.23 percent in May to 2.98 percent in July increased house-buying power by nearly $15,000.

Bottom Line? If you’re even thinking of making a move, now is a great time to take advantage of the affordability that comes with historically low interest rates. Call me sooner than later to see if we can help you get more home for the the same monthly payment you now have.

METRO HOME PRICES GROW IN 96% OF METRO AREAS IN SECOND QUARTER 2020

National Association of Realtors, 8.12.20

In the recent quarterly report by the National Association of Realtors, the overwhelming majority of the nation’s metro areas witnessed increased home prices in the second quarter of 2020.

The median single-family home price in 174 of the 181 metropolitan statistical areas showed sales price gains. The national median sales price gain year-over-year for the second quarter was 4.2%, however, it is still a slower pace of appreciation compared to the pre-pandemic rate of 7.7% in the first quarter.

“Home prices have held up well, largely due to the combination of very strong demand for housing and a limited supply of homes for sale,” said Lawrence Yun, NAR chief economist. “Historically low inventory continues to reinforce and even increase prices in some areas.”

Yun says that the record-low mortgage rates will undoubtedly continue to attract new buyers, but that more homes are needed. “Unless an increasing number of new homes are constructed, some buyers could miss out on the opportunity to purchase a home or have the opportunity delayed,” he said. “In the meantime, prices show no sign of decreasing.”

“Although housing prices have consistently moved higher, when the favorable mortgage rates are factored in, an overall home purchase was more affordable in 2020’s second quarter compared to one year ago,”. Yun added.

Colorado Springs is #27 out of 181 metro statistical areas, with a second quarter year-over-year sales price increase of 8.3%. That is almost DOUBLE the U.S. average increase of 4.2% so you can see that local homeowners have lots to be happy about.

You might want to see the entire list of 181 metropolitan statistical areas in alphabetical order by clicking here. When you get a look at the real numbers, both nationally and locally, it will be a real welcome to MY “real life world of residential real estate “and you will see why I’m smiling a lot these days. And you will smile too!

DIY RADON TESTS CAN BE PURCHASED AT THE HEALTH DEPARTMENT

For those wanting to test home for Radon, do-it-yourself kits real estate Radon Kit can be purchased at the Health Department at 1675 Garden of the Gods Road in the second-floor lab. The price is $45. It is my understanding that they can also be ordered on-line at Home Depot.

Just an FYI for those who have inquired or those who may be interested.

HARRY’S JOKE OF THE DAY

.jpeg)

.jpg)

.jpg)