HARRY'S BI-WEEKLY UPDATE 9.9.25

September 9, 2025

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

A LOOK BACK SOMETIMES HELPS PUT THE PRESENT INTO PERSPECTIVE

As you might have read in recent days, mortgage rates have fallen to the lowest average in nearly a year with Freddie Mac reporting the following national averages with mortgage rates for the week ending September 4:

- 30-year fixed-rate mortgages: averaged 6.50%, dropping from the prior week’s 6.56% average. A year ago, 30-year rates averaged 6.35%.

- 15-year fixed-rate mortgages: averaged 5.60%, falling from the prior week’s 5.69% average. Last year at this time, 15-year rates averaged 5.47%.

The National Association of Realtors (NAR) is predicting that mortgage rates will remain in the mid-6% range this year and possibly decline to 6% in 2026. A drop in the Fed Fund rate could see a domino effect into the mortgage market but it’s not a one-to-one and won’t necessarily happen overnight according to Jessica Lautz, deputy chief economist at NAR.

In 1972 when I purchased my first home here in Colorado Springs, it cost $25,100 and when it was time for closing, the mortgage interest rate had fall from 9% to 8.5%. Salaries were not what they are today—you were fortunate to earn even $10,000 a year-- and the $239 monthly PITI payment was a lot for me at that time. I had even wondered whether I would qualify.

However, as my home appreciated, I was able to use the equity to purchase my second home and then once more, a third one where I still reside.

I tell you this because purchasing a new home, while obviously more expensive, involves the same steps I had to take back then. Today’s interest rates are lower than my initial rate and of course, salaries are substantially higher than in those days.

Home buying, whether a first home or a fifth one, is a “process” and while I can certainly attest that first-time buyers are finding it more and more difficult, there are many variables to consider and numerous ways to make it happen.

My 53 plus years in the local Residential real estate arena along with my investment banking background, makes me more than qualified to help my clients find the best solution to their housing needs. I can also help direct them to lenders that they might not find on their own who can provide the best mortgage solution tailored to them.

If you’ve even thought about buying a home, either for the first time or to trade up or move to a new neighborhood, now is a great time to start thinking about it.

But you won’t know what’s available for your personal situation until we get together and figure out how to put your wants, needs and budget requirements to the best use to find just the right place for you and your family.

Why not give me a call today at 719.593.1000 or email me at Harry@HarrySalzman.com and together let’s see how your Residential real estate dreams can become reality in the best time frame and for the best financial situation for you?

And….

If you’ve got three minutes and three seconds, I recommend that you watch my newest Residential real estate podcast featuring ME, of course.

Simply click on the link below and you will be directed to my personal YouTube channel:

While you’re at it you might want to subscribe to my channel, so you won’t miss future broadcasts. It won’t cost you anything…well, it could cost you… if you miss some of my informative musings.

And now for statistics…

AUGUST 2025

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the August 2025 PPAR report:

In El Paso County, the average days on the market for single family/patio homes was 40. For condo/townhomes it was 59.

Also in El Paso County, the sales price/list price for single family/patio homes was 98.9 % and for condo/townhomes it was 98.6%.

In Teller County, the average days on the market for single family/patio homes was 57 and the sales/list price was 99.0%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing August 2025 to August 2024 for All Homes in PPAR:

Single Family/Patio Homes:

- New Listings were 1,459, Down 9.1%

- Number of Sales were 1,039, Down 2.3%

- Average Sales Price was $566,443, Up 1.4%

- Median Sales Price was $480,000, Down 2,0%

- Total Active Listings are 4,139, Up 24.7%

- Months Supply is 4.0

Condo/Townhomes:

- New Listings were 250 Up 0.4%

- Number of Sales were 164, Up 4.5%

- Average Sales Price was $346,232, Down 5.1%

- Median Sales Price was $328,500, Down 5.4%

- Total Active Listings are 684, Up 14.6%

- Months Supply is 4.2

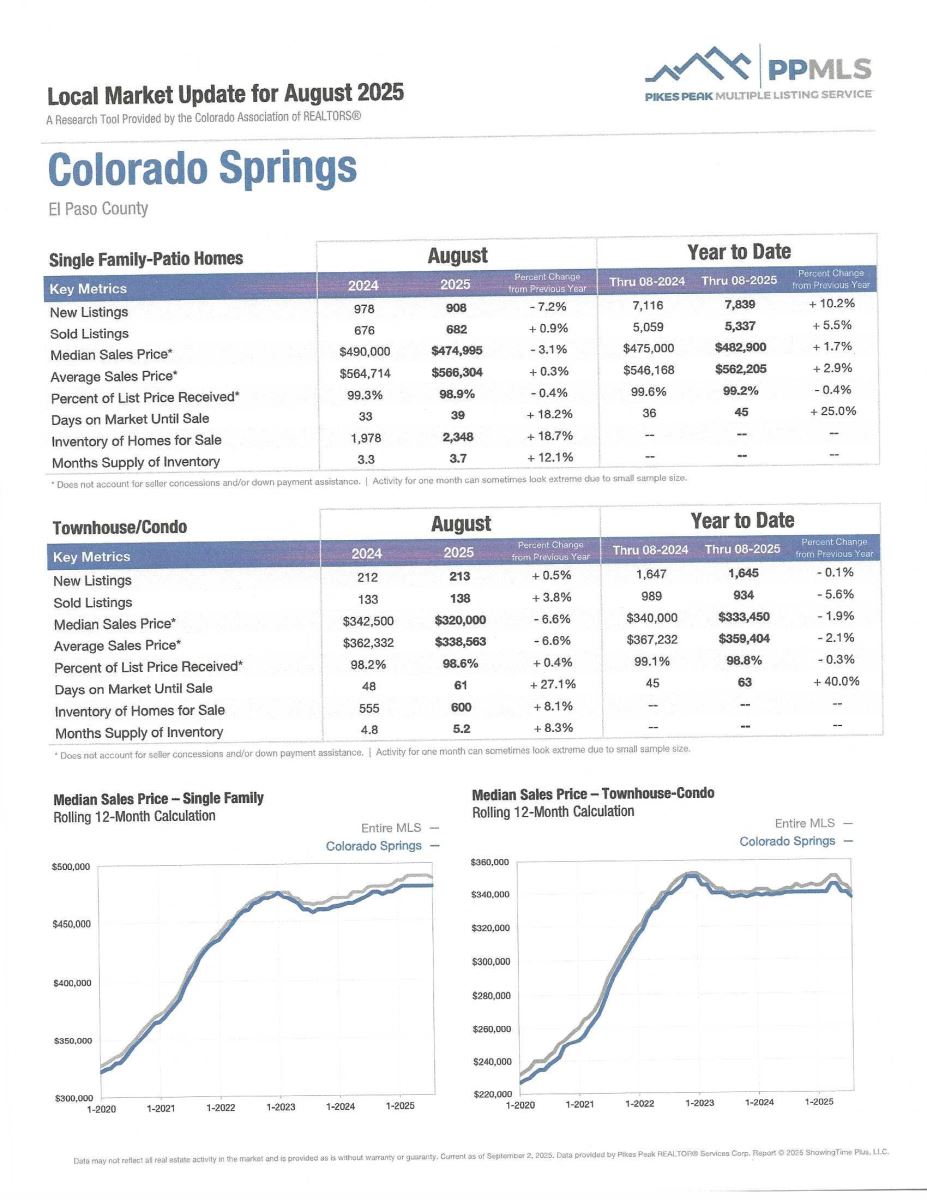

AUGUST 2025 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year-to-Date one-year change:

- Sold Listings for All Properties were Up 0.9%

- Median Sales Price for All Properties was Down 3.2%

- Active Listings on All Properties were Up 15.9%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

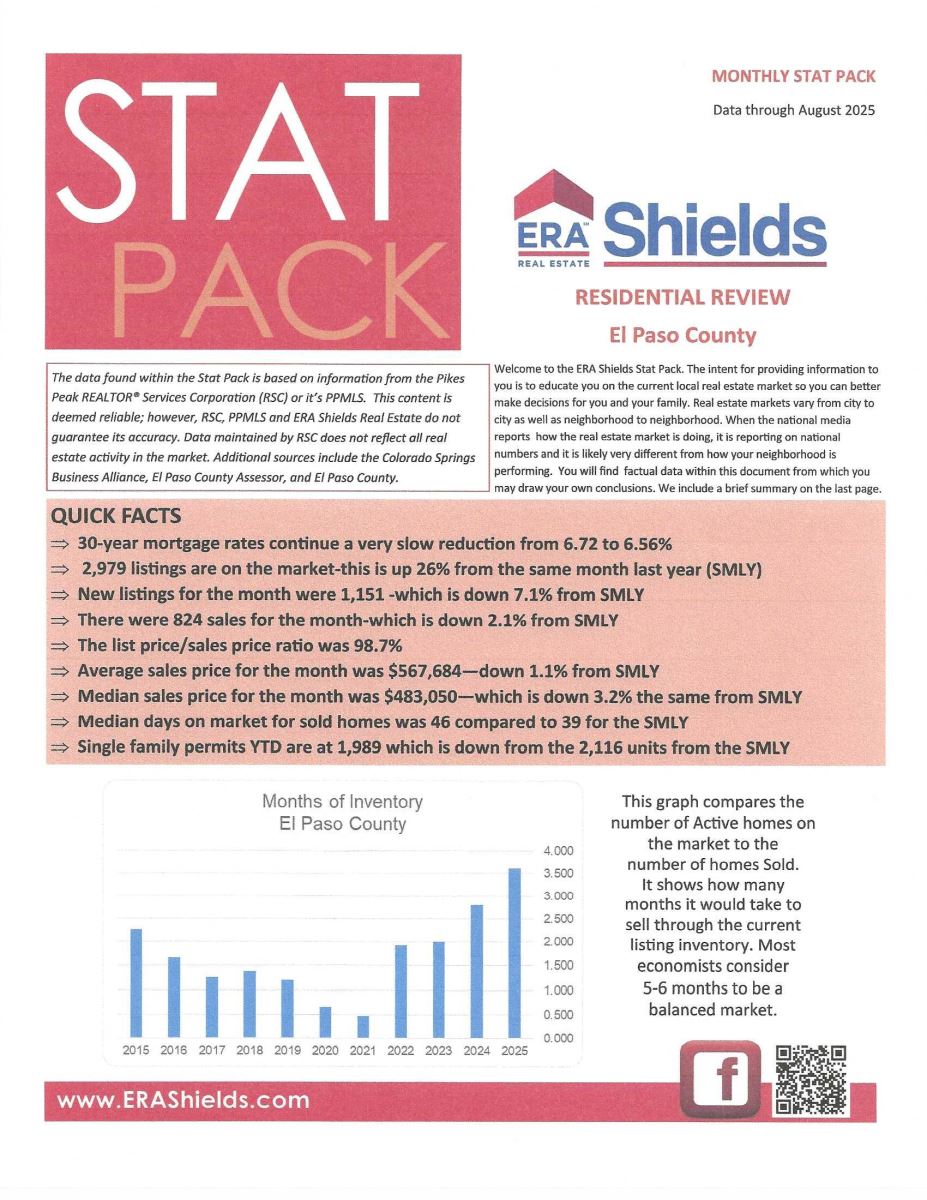

ERA SHIELDS STAT PACK

Data through 8.2025, ERA Shields

Here is data from my company’s “Stat Pack” that can better help you understand the local buying and selling reality. There are various statistics--some monthly, some quarterly and some annual. I have reproduced the first page, and you can click here to get the report in its entirety.

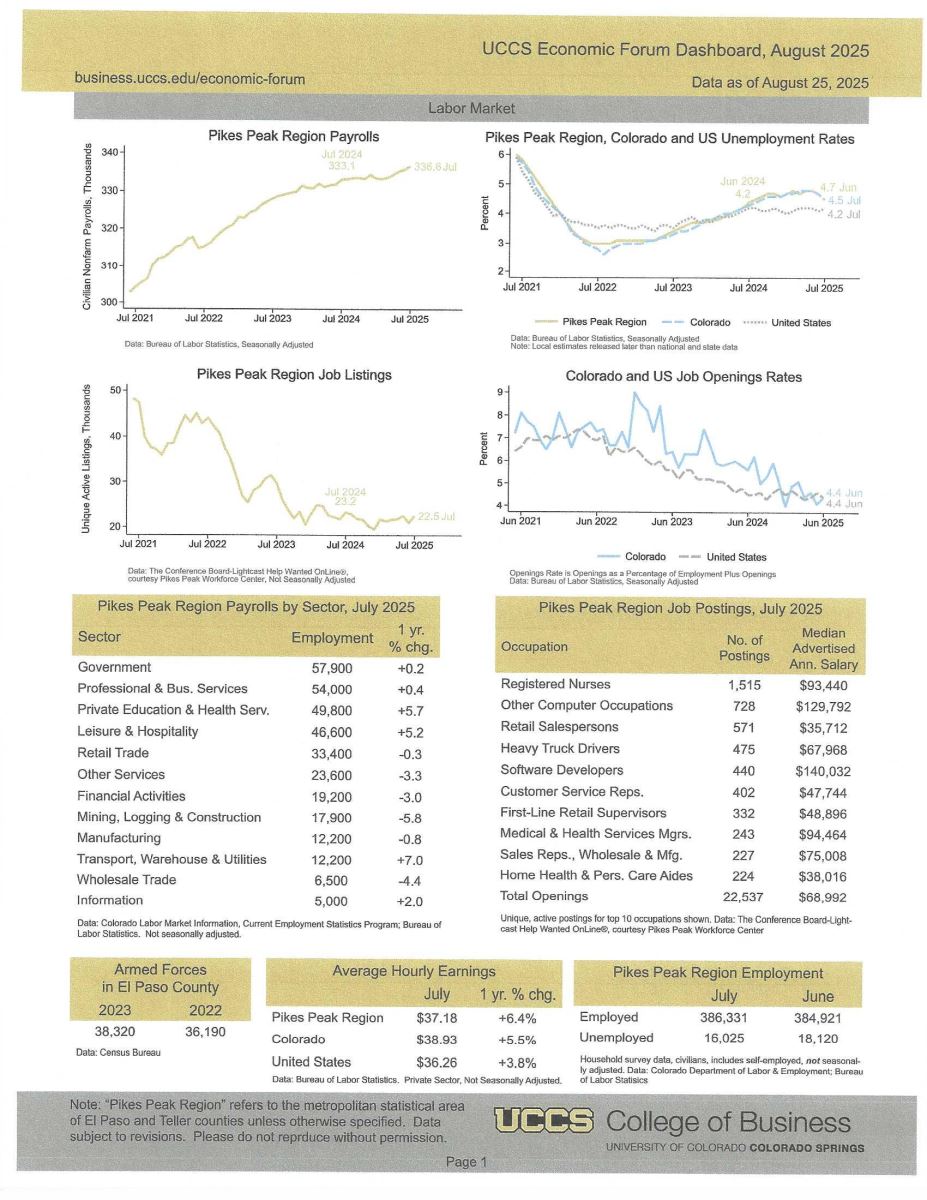

ECONOMIC & WORKFORCE DEVELOPMENT REPORT

Data-Driven Economic Strategies, August 2025

As always, I like to share the useful data I receive from our “local economist”, Tatiana Bailey. You will see in these charts what’s happening locally in terms of the economy as well as the most recent Workforce Progress Report.

This information is especially invaluable to business owners; however, I know you all will all find it worthwhile reading.

Below is a reproduction of the first page of graphics. To access the full report, please click here. And if you have any questions, give me a call.

.jpg)

UCCS ECONOMIC FORUM MONTHLY DASHBOARD

Updated August 2025, UCCS College of Business/Economic Forum

Here is the monthly report from the UCCS College of Business Economic Forum. It is created by professor Dr. Bill Craighead, who is the Forum Director. He also publishes an on-line “Weekly Economic Snapshot” you might enjoy.

I know several of you who like statistics and use this information in your daily business life, and I will share it with you when I receive it each month.

I’ve reproduced the first page of the charts below. To access the report in its entirety, please click here.