HARRY'S BI-WEEKLY UPDATE 5.25.22

May 25, 2022

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

.jpg)

COLORADO SPRINGS NAMED NO.2 IN BEST PLACES TO LIVE REPORT

U.S. News & World Report, May 16, 2022

In last week’s annual rankings of the “Best Places to Live” by U.S. News & World Report, Colorado Springs rose to the number two ranking from last 6th place a year ago. We have placed in the top six of 152 cities for five consecutive years and have surpassed Boulder (#4), Fort Collins (#54), and Denver (#55) this year.

This report is intended to help folks make the best decision when choosing where to settle down among the top 152 metro areas, based on answers from voters across the country who were asked to list what they believe to be the most important factor when choosing where to live.

The criteria and percentage used included:

- Job Market Index—20%. The two factors used here were the unemployment rate and the average salary.

- Value Index—25%. This index, also called the Housing Affordability Index, measures how comfortably the average resident of each metro area can afford to live within their means. To do this, the median annual household income was compared with the housing cost in each area.

- Quality of Live Index—32.5%. This index measures how satisfied residents are with their daily lives in each ranked metro area. Multiple aspects of life were evaluated using a weighted average based on a survey of what importance people across the U.S. placed on each aspect. These are:

- Crime Rates (25%)

- Quality and Availability of Health Care (10%)

- Quality of Education (20%)

- Well-Being (20%)

- Commuter Index (17%)

- Air Quality Index (8%)

- Desirability Index—17.5%. This measures whether people want to live in a given metro area.

- Net Migration—5%. This measures whether people are moving to or away from each metro area. While the Desirability Index measures whether a metro area is appealing, Net Migration represents whether a metro area is actually attracting new residents.

Those of us who live here, whether for a lifetime, newly arrived, or a 50-year resident such as me, we all are aware of the exceptional benefits of calling Colorado Springs our home. And I know some of us wish that we could have kept it “our” secret for many, many years. However, times change and so do how people wish to work and live.

Once folks discovered that work-life balance was an important element for them, it was going to be tough to convince them that simply “visiting” here would suffice.

This is one of the reasons for the lack of available homes that cities such as ours are facing. So many businesses are wanting to relocate here, and they bring with them employees who need homes.

Employees who can now work from anywhere are choosing to live in cities such as ours for all of the above reasons as well.

I wish to point out that Colorado Springs did not earn this important accolade on its own or simply by chance.

All of us who live here owe a debt of gratitude to Mayor John Suthers for his foresight and genuine devotion to his hometown. We also need to thank our City Council, Chamber/EDC, County Commissioners, Doug Price and the Visit COS team, as well as educators such as UCCS Chancellor Venkat Reddy who work tirelessly to not only improve the city but to help spread the word about Colorado Springs both near and far. Their hard work has brought great returns and I’ve no doubt their work will continue to do so for years to come.

If you’d like to read the U.S. World & News Report story in it’s entirety and see all the cities surveyed, please go to:

https://realestate.usnews.com/places/rankings/best-places-to-live?int=top_nav_Best_Places_to_Live

AND NOW FOR MY REGULARLY SCHEDULED COLUMN…

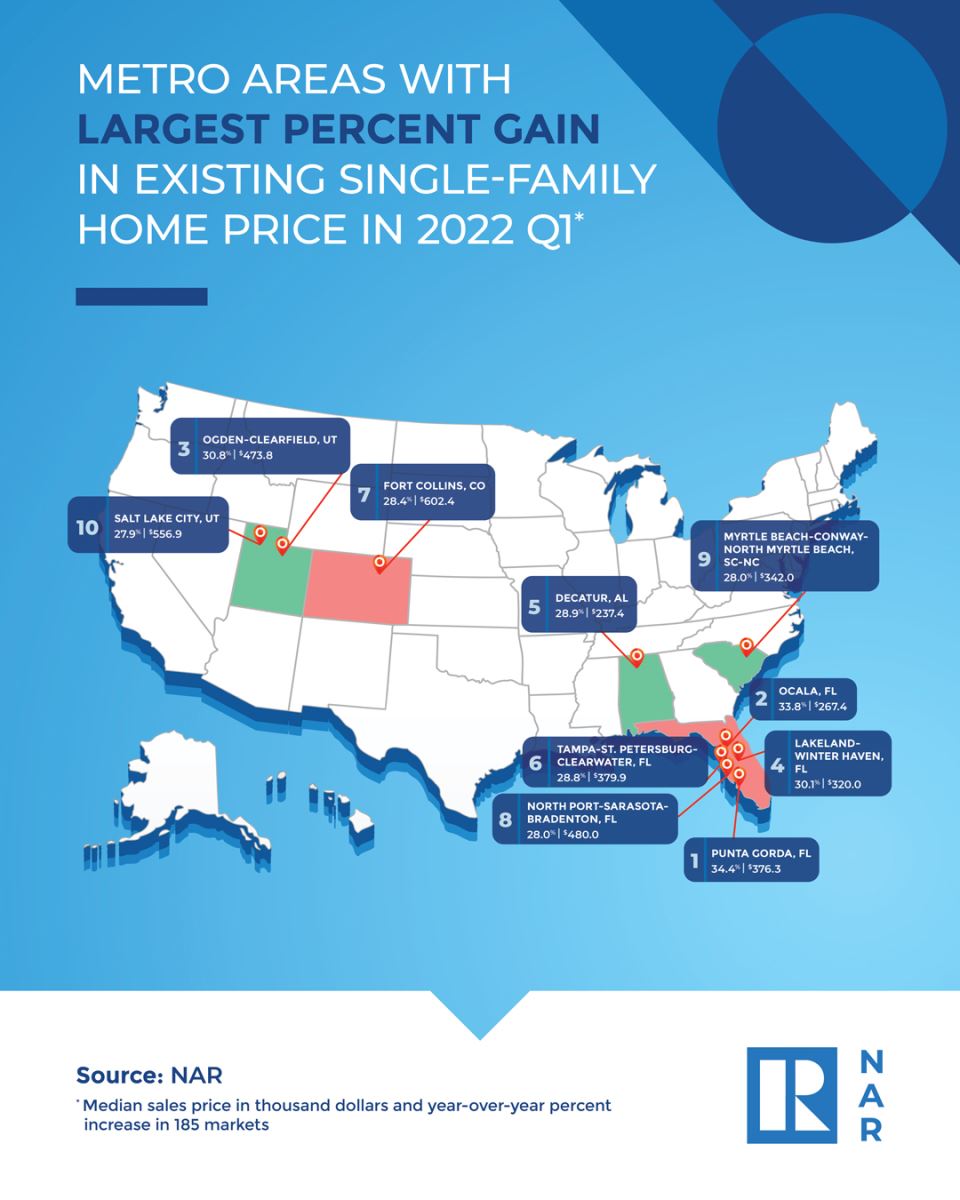

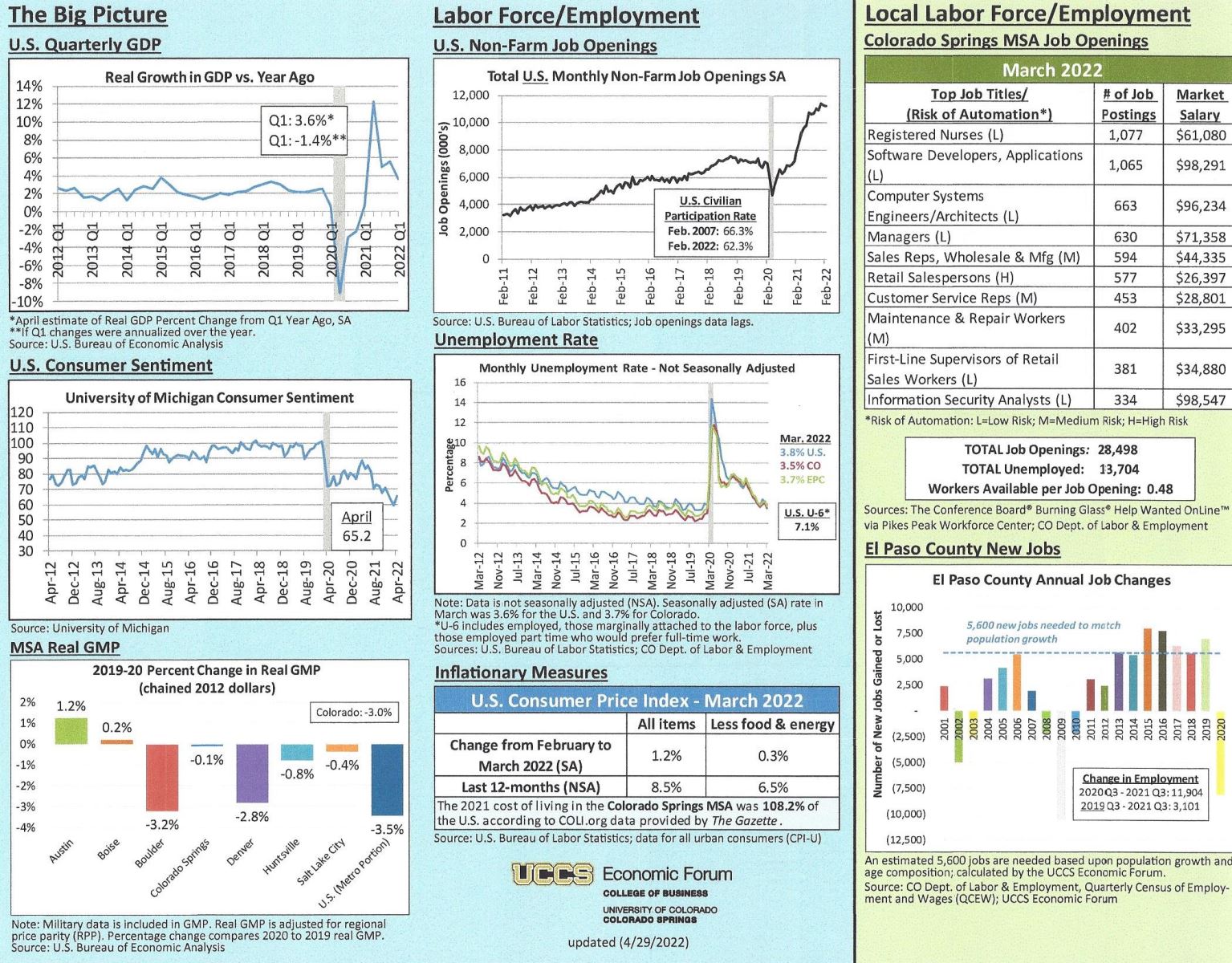

With the Residential real estate market changing at record pace, it’s oftentimes a challenge to stay dialed in. Rising interest rates, coupled with lack of available homes for sale and high price appreciation, only brings more and more questions concerning the impact on home affordability.

I’d like to give you some examples of what’s happening in the Colorado Springs market.

The local average price of a home is currently around $557,000. At 4.5%, the principal and interest payment on a 30-year fixed-rate mortgage with 20% down would have been $2258. With a 0.5% increase in interest rate, at 5%, the payment would have been $2392. And with a rate of 5.5% that monthly payment is $2530 today.

Now let’s consider it from the standpoint of how much home a buyer can qualify for. Based on $100,000 gross income, the interest rate of 4.5% and a 30% debt-to-income ratio, you might qualify to buy a place for $415,000 and at 5.5% interest rate you would only qualify to buy a place for $370,000. That’s a pretty big difference.

This, of course, is of greatest concern for first-time buyers. With rental rates increasing so quickly, many who have been renting are finding it would be not only less expensive to own but would provide them with an asset that will increase over time by building equity for them rather than for their landlords.

I attended a meeting for Pikes Peak Area Realtors Monday evening and one of the speakers was from the National Association of Realtors (NAR). She was talking about the rising interest rates and comparing it to other times when the country was heading to, or already in, a recession. One of the things she told us is exactly what I’ve been telling you for some time—the price of homes is not likely to go down even in a recession—and the shortage of available homes is here for the foreseeable future.

I have been advocating for acting NOW over the last three or four years and many of you have done so. Others have chosen to wait for various reasons. What I can tell you is this. Even I did not expect rates to rise this quickly. I knew they were headed up, but this is the fastest they have done so in many, many years. Will they continue to rise? Will they come down a bit? I don’t think anyone of us has the answer.

What I do know is that the right time for buying and selling a home is when it is the right time for YOU. If you’ve waited for prices to come down, you’re going to wait a very long time and it is doubtful that you will see it. You hopefully will see prices rising more realistically in the next few years as more homes become available.

If you have waited for interest rates to go back down, well, good luck with that as well. Writing as someone who had an interest rate of 12% on my first home, I still consider today’s rates to be excellent.

I can tell you this for certain. If you are ready to sell and trade up or move to a new location or even are looking to buy for investment purposes, there is no better time than the present. Your current equity will likely give you an excellent down payment and even with higher interest rates you could possibly keep your monthly output close to what you currently pay.

But you won’t know anything unless you ask. And lucky for you, you’ve got me. With my 50 plus years in the local Residential real estate arena, coupled with my Investment Banking background and expertise in negotiation, I’ve been there, seen it all, done it all, and am still here doing it for clients, past clients, and friends, family and co-workers of clients.

Give me a call today at 719.593.1000 or email me at Harry@HarrySalzman.com and let’s see how together we can make your Residential real estate dreams come true.

12 TIPS FOR THOSE LOOKING TO NAVIGATE THE WILD real estate MARKET

5280, May 2022

- Be Ready To Pay Well Over Asking Price. Today, asking price is the “starting” point and offers most always go up from there. Bidding wars and all-cash offers far over asking price are becoming the norm. It’s important to make your first offer your BEST offer if you want to be taken seriously by the seller.

- Get Your Finances In Order and Then Find a Lender.

Getting pre-approved for a loan is essential, especially in today’s market. It’s important to know what you can afford and if you can qualify for what you need.

First-time buyers need even more time to make certain they have everything in order so should start the pre-approval process as early as possible.

If your credit score is in the mid 600’s or lower, try to pay down some debt. Your credit utilization ratio, which measures how much credit you’re using compared to your credit limit is a key component banks use to determine your loan amount.

If you don’t have five to 20 percent of the purchase price to use as a down payment, keep calm and ask your potential lender about first-time homebuyer assistance programs such as SmartStep Plus from the Colorado Housing and Finance Authority.

If you get approved for a U.S. Federal Housing Administration (FHA) loan your lender will inform you that waving inspection—which often sweetens a deal in this tight market—isn’t an option.

- Budget for Interest Rates to Go Up This Year. Interest rates are rising faster than in a very long time, so you need to consider the effect if the interest rate is higher when you purchase your home.

- Determine What You Can Live Without. Available and affordable are two rarities in this market, which means you are most certainly going to have to compromise on your list of must-haves. Figuring out what not settling looks like can be a challenge. A house may not have everything you want, and most do not, but if it has “good bones” you will be able to renovate to your liking down the road.

- Beware the Risks of Waiving Contingencies. Contracts are meant to protect buyers—and sellers—but in today’s market, where bidding wars are common and homes go under contract in a matter of days (if not hours), buyers are waiving their rights in order to not lose houses to less fussy buyers. Forgoing financing contingencies, home-inspection contingencies or appraisal contingencies could cost you in the end.

- Understand the Difference Between FHA and Conventional Loans. There are significant differences between these two loan types and it’s important to know them. The minimum down payment, minimum credit score, maximum debt-to-income ratio and mortgage insurance requirements are different and it’s important to understand which can work best for you.

- Assess the Value of New Versus “Vintage”. There are many things to consider if you are comparing “new” homes to “vintage” homes and it’s important to understand the pros and cons of each.

- Be Prepared. With floods and fires becoming more common in suburban areas, it’s important to know how to safeguard your home and minimize risk if disaster comes knocking. It’s crucial to re-evaluate your home insurance coverage, stay up to date on new mandates for fire codes, inventory your possessions and their values and document the items room by room. Keeping vital records off-site can give you peace of mind in an emergency and making a plan for things with sentimental value will assure that family heirlooms get to the rightful people.

- Consider a Condo or Townhome if You’re a First-Time Home Buyer. It’s more important to get your foot in the door for your first home purchase than to get everything you want all at once. After you own a home, you can gain equity and move on. It’s somewhat like a savings account that will help you save for the next move.

- Find a Champion in Your Agent. According to the Colorado Association of Realtors, this past January there were roughly 22,000 real estate agents working in the state, a little more than 5,000 active listings statewide, and a market flush with buyers and cash. With all this competition, you will definitely want someone like me in your corner who won’t ignore your 3 a.m. text message full of new listings. The most important things to consider when looking for an agent is whether they are 1) full time and 2) a seasoned professional. If the answer is no, run as fast as you can toward someone like me who has many, many years of experience in all types of markets and who knows how to negotiate the best deal for you.

- Consider Buying With Friends and Family. It’s not always easy to purchase a home, especially a first home, alone these days. Purchasing with friends and/or family can be an option and one that is worth considering.

- Be Creative, but Realistic When Using Digital Resources. Online sites such as Zillow can be helpful in giving you an idea of market prices, but they cannot replace the one-on-one assistance of a professional, licensed real estate broker.

So there you go. Some helpful suggestions that can start you on your way. And when you are ready to move ahead full steam…you know where to find me.

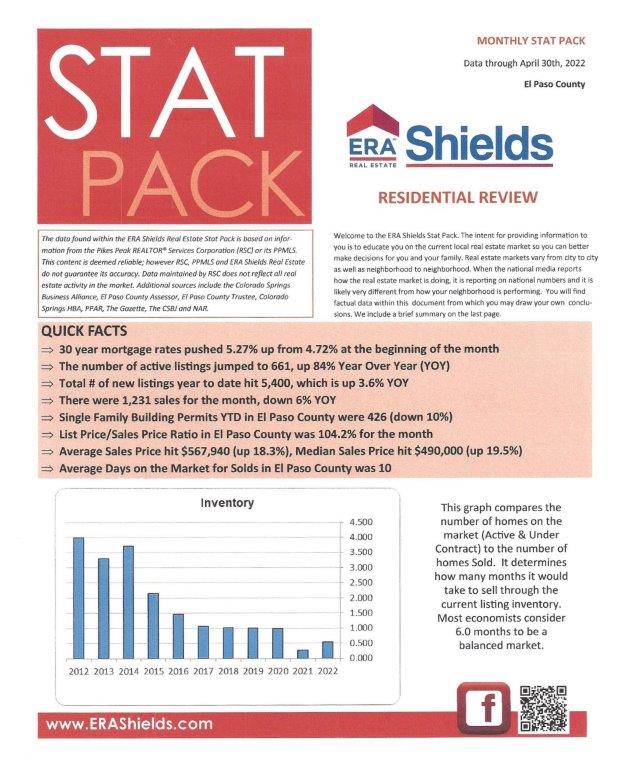

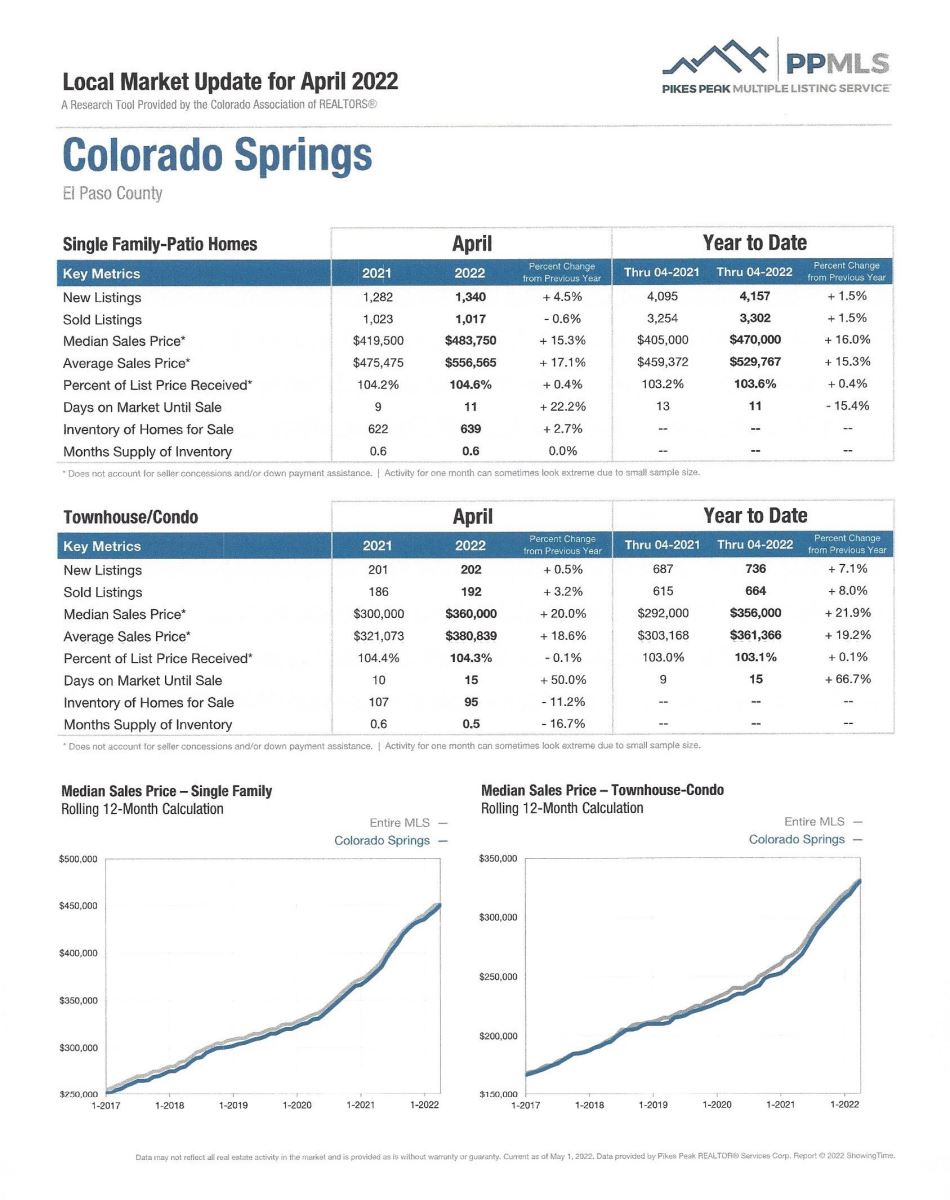

ERA SHIELDS “STAT PACK” PROVIDES A GOOD RESIDENTIAL real estate OVERVIEW

ERAShields, 4.30.22

As always, I am pleased to provide you with the most current local information. This easy-to-understand report, along with graphs, gives you a good idea of the state of local Residential real estate.

Below I’ve reprinted the first page of the report and you can click here to read the report in its entirety.