HARRY'S BI-WEEKLY UPDATE 5.9.2022

May 9, 2022

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Personal Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

IN RESIDENTIAL real estate, THE WORD OF THE YEAR IS “UP” …

…and it’s “up” in so many, many ways.

Let’s begin with prices. In April, the Colorado Springs area average sales price for a single family/patio home was $561,907 which is up 16.6% year-over-year. That’s $60,000 more than the same time last year! For condo/townhomes the average sales price was $387,761, up 19.6% year-over-year.

The next “up” is mortgage interest rates. At an average of 5.27% as of last week for a 30-year fixed-rate loan, they are now the highest they have been in nearly 13 years. From January to April, rates rose at their fastest three-month pace since 1994. And like housing prices, interest rates show no sign of slowing down their upward trend. Some experts are predicting rates to go as high as 6% this year.

Everything to do with Residential real estate is moving fast and will continue as the traditional spring buying season gets fully underway.

As I’ve been telling you, one of the reasons for the continued high escalation of prices is the shortage of available homes for sale. With so few on the market over the past year, bidding wars and sales considerably over the listing price have become the norm. When there are more homes for sale, price appreciation should begin to normalize, making it more affordable and hopefully less fiercely competitive for potential buyers.

In the recent past, higher interest rates might have meant slower sales, but at present we are not seeing that happen. It could prevent some first-time buyers from qualifying, but in general there are so many folks wanting to buy homes that the interest rate, while considerably higher than what it was, is still low compared to years past and will not deter them from the search for a new home. According to Ralph McLaughlin, real-estate economist for The Wall Street Journal, “We’ve never seen a time where mortgage rates have risen as quickly as they have and the market hasn’t cooled off”.

We are beginning to see more listings and I’m guessing that homeowners who were on the fence these last few years are realizing that the time to sell and trade up or move to a new neighborhood is NOW. Home prices aren’t going to get any lower and mortgage rates likely aren’t going back down anytime soon.

Another reason for the uptick in listings is that a year ago potential sellers were still concerned with having buyers in their homes, or themselves looking at new homes, due to the COVID pandemic. Today this is not as much of a concern and sellers who were waiting are now entering the market.

It is still a Seller’s Market even with more listings and will continue that way until listings are considerably higher than at present. If you’re holding back from buying a house because of the rise in rates, consider that inflation is up even more!

We haven’t seen inflation this high since the early 1980’s and if it continues, owning a home is an excellent cushion against rising inflation. Houses, like most physical assets, retain their value during high inflation and have done better than most such assets.

In any case, there are a lot of things to consider if you are wanting to make a move. To begin with, you will need to decide upfront exactly what your needs, wants and budget considerations are because when you find a home there is no time to delay in making your best offer. And when I say best offer, I mean that. Today’s market finds very creative offers that buyers are hoping will set them apart from the rest. There is essentially no room for renegotiation and contingencies on the buying side.

U.S. home prices are predicted to rise another 10% this year (and Colorado Springs area homes will likely rise conservatively 10 to 12%), so there’s no time like the present to start your search.

It is more important than ever to have a professional, seasoned, well-respected real estate broker such as me on your side because experience and negotiation expertise such as mine is more crucial than ever before. Sellers are wanting their brokers to work with brokers on the other side who they know can bring an offer to closing.

With the stock market in a slump, I’ve seen an uptick in those seeking homes for investment purposes. Over the long haul, real estate has surpassed stock and bond returns and today even more so. That, unfortunately, is adding to the housing shortage and hurting first-time buyers even more.

I truly believe that, while it may take considerably longer than in the past, there is most definitely a home for everyone. It may not be exactly what you want, but especially for first-time buyers, homeownership is a far better option than renting if possible. Homes can be updated and renovated, and when the time is right, can likely be sold for a profit or used as a rental property when it’s time to move on or trade up.

There’s a lot to discuss if a move is a consideration and I’ve got the experience to guide you when you’re ready.

So, if Residential real estate is among your hopes and dreams for 2022, please give me a call at 593.1000 or email me at Harry@HarrySalzman.com and let me help make them come true.

And now for statistics…

APRIL 2022

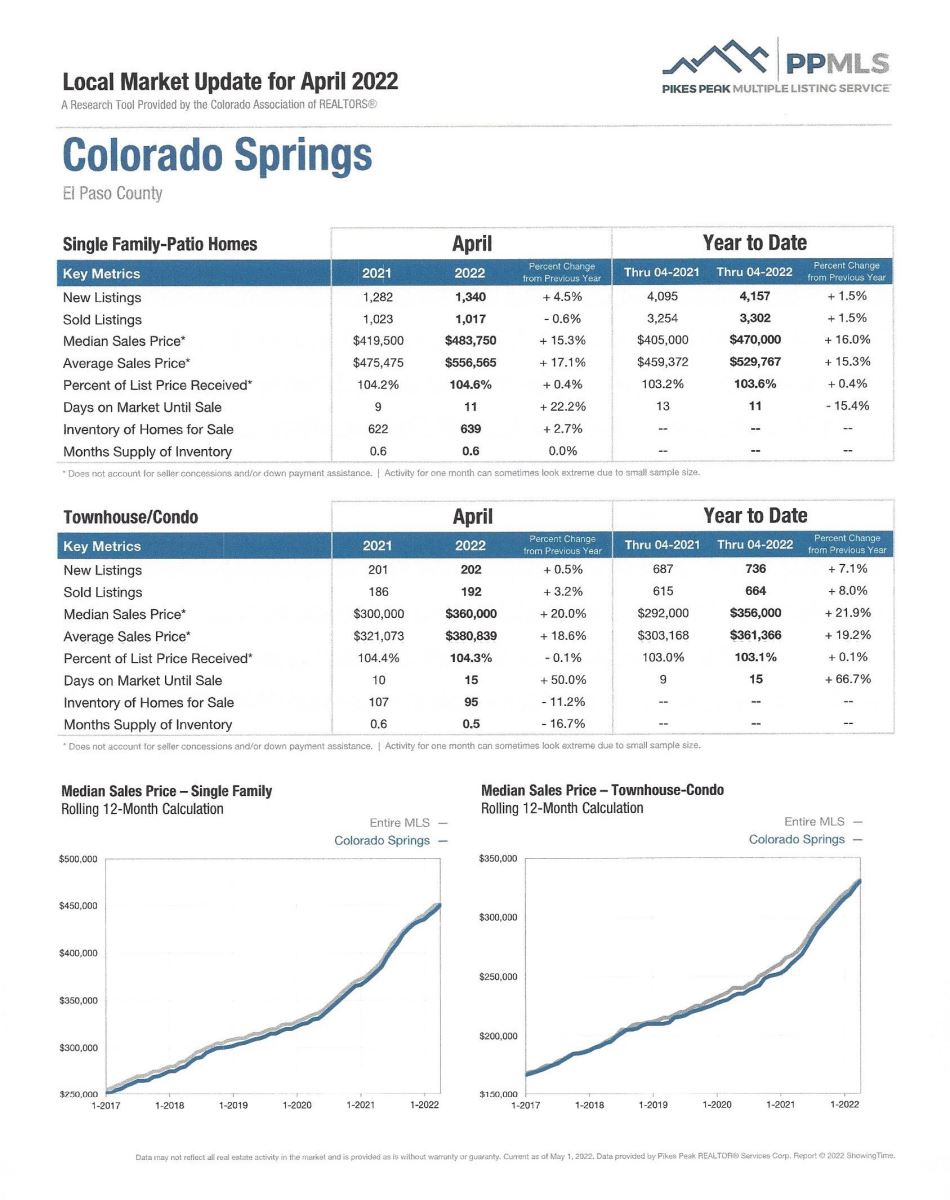

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the April 2022 PPAR report:

In El Paso County, the average days on the market for single family/patio homes was a very low 10. For condo/townhomes it was 14.

Also in El Paso County, the sales price/list price for single family/patio homes was 104.2% and for condo/townhomes it was 104.1%.

In Teller County, the average days on the market for single family/patio homes was 17 and the sales/list price was 104.1%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing April 2022 to April 2021 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 2,223, Up 18.3%

· Number of Sales were 1,489, same as 1 year ago

· Average Sales Price was $561,907, Up 16.6%

· Median Sales Price was $484,450, Up 14.0%

· Total Active Listings are 969, Up 74.0%

· Months Supply is 0.7, no change

Condo/Townhomes:

· New Listings were 248, Up 14.3%

· Number of Sales were 227, Up 2.7%

· Average Sales Price was $387,761, Up 19.6%

· Median Sales Price was $365,000, Up 19.7%

· Total Active Listings are 79, Up 5.3%

· Months Supply is 0.3, Up 2.0%

Now a look at more statistics…

APRIL 2022 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year-to-Date one-year change:

- Sold Listings for All Properties were Up 0.4%

- Median Sales Price for All Properties was Up 15.0%

- Active Listings on All Properties were Up 6.5%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

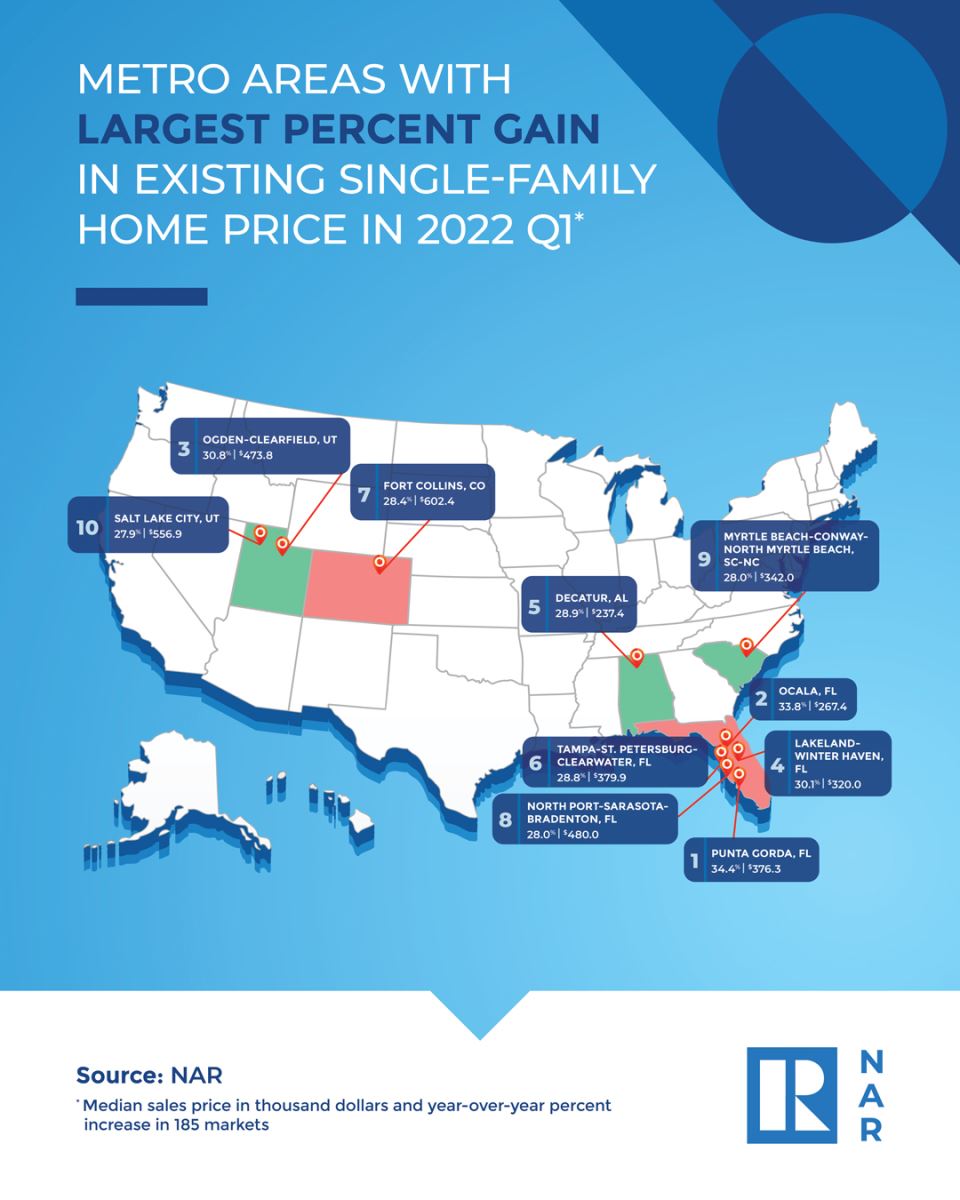

COLORADO SPRINGS HOME PRICES TO SURPASS MUCH OF THE COUNTRY IN THE FIRST QUARTER OF 2022

The National Association of Realtors, 5.3.22

In the recently published report, 70% of the 185 Metropolitan Statistical Areas (MSAs) surveyed quarterly by the National Association of Realtors (NAR) reached double-digit median home price appreciation in the first quarter of 2022, surpassing the 66% of the previous quarter.

The median price nationally rose 15.7% quarter-over-quarter to $368,200.

Colorado Springs surpassed that, with the median price of single-family homes jumping 17.4% to $455,000 during the first quarter of the year. This price reflects detached, single-family and patio homes but not townhomes or condominiums.

The median price in the Springs ranked 32nd highest of the cities surveyed. And once more, the good news is that while our home values are increasing, they are still less than those in the Denver, Boulder and Fort Collins areas, which makes our city more attractive to potential companies and individuals wanting to relocate to Colorado.

This graphic depicts areas with the largest percent gain:

To see all 185 metro areas in alphabetical order, please click here. To see them in ranking order, click here. Or you can click here to see what income levels are required to purchase homes based on either a 5, 10 or 20 percent down-payment.

And if you have any questions, you know where to reach me.

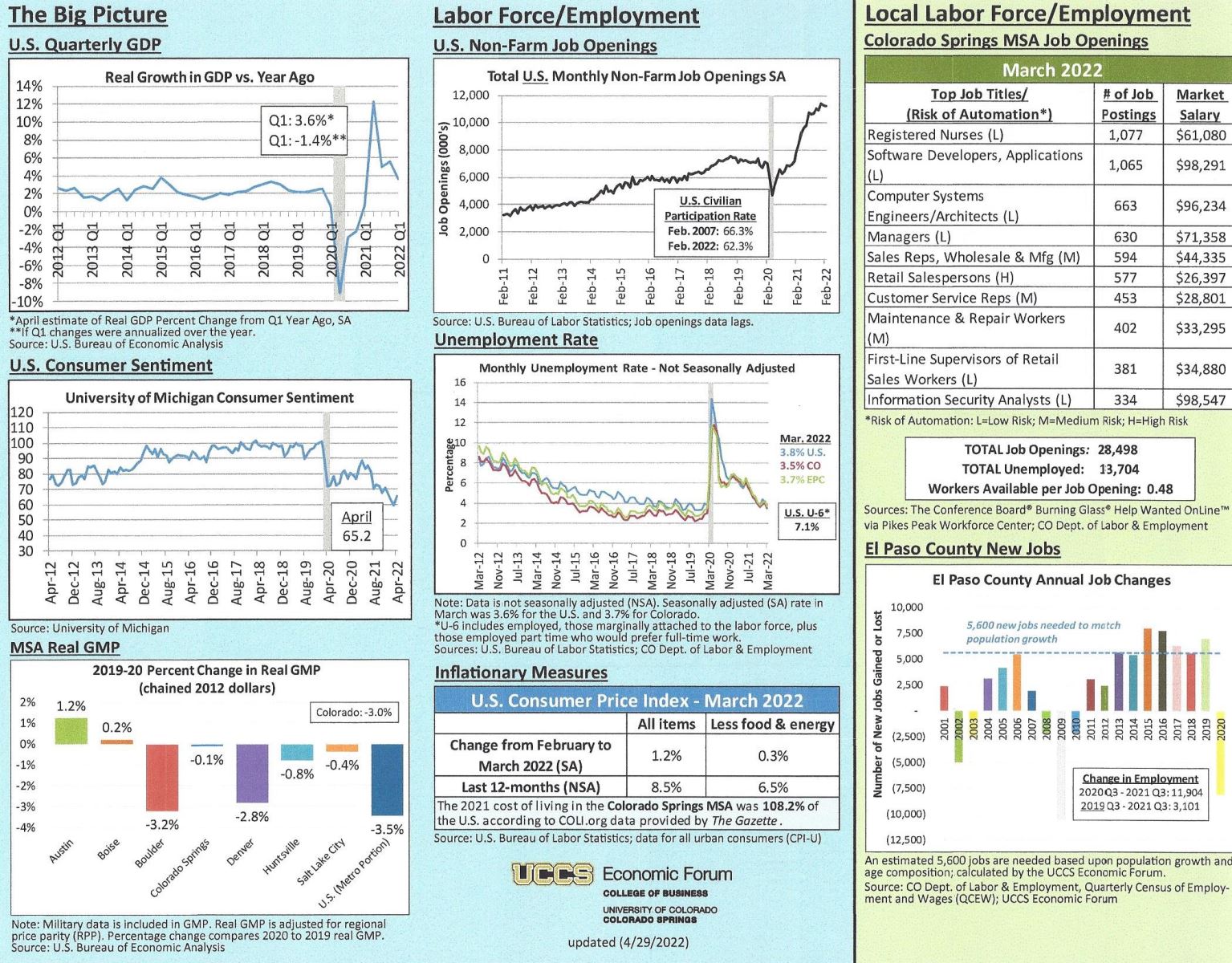

UCCS ECONOMIC FORUM UPDATE

College of Business, UCCS, updated 4.29.22

Here is the most recent economic update from the UCCS Economic Forum. It provides data concerning all aspects of the economy, on both the national and Colorado Springs area levels.

I’ve reproduced the first page of the graphs and you can click here to see the report in its entirety.

For those of you who like to plan ahead, the always informative UCCS Economic Forum Event this year will be held at the ENT Center for the Arts on Thursday, September 1, 2022, from 1:30-4:30, with a networking and happy hour to follow. Full agenda and registration will be available next month.