March 5, 2024

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

STILL A LOT OF QUESTIONS, BUT THE ANSWER? NOW IS A GOOD A TIME TO BUY AND SELL

Interest rates are still fluctuating but I’m finding that folks are beginning to realize that a “normal” of somewhere in the 6% range is here to stay…at least for the foreseeable future. In fact, while mortgage rates are currently higher than they have been in recent years, they are not abnormally high on a historical basis. Look at this chart and you will see what I mean:

.png)

Yes, present conditions are still short of ideal, but “if you wait for ideal conditions, you may end up living in limbo instead of a new house” to quote an article I recently read in The Wall Street Journal.

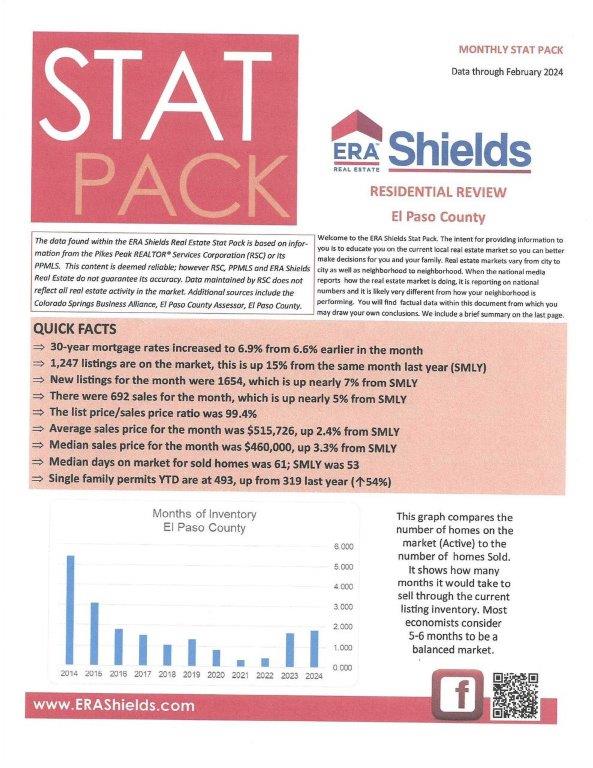

What does that mean? If you look at the local statistics from February, you will see that things are starting to look up in Residential real estate even before the traditional spring buying and selling season.

Home prices continue to rise, and we are seeing more listings each month. It appears that those who were waiting to see if prices would go down before they bought are realizing that each month they wait they are losing potential equity because prices are NOT going down.

And let’s not forget that that as mortgage rates fall, prices will continue to rise even faster, which means that there will be little improvement in affordability—another reason not to wait.

In fact, prices are continuing to rise. Some of that has to do with the recent lack of available homes for sale but almost all 2024 forecasts from national and local economists indicate that home prices are going to continue to rise, just not at as quick as in the most recent past.

According to the Home Price Expectation Survey by Fannie Mae, which includes projections from over one hundred economists, real estate experts and investment and market strategists, home prices are expected to see small but steady increases every year through 2028.

And it’s still a seller’s market now due to the low supply of available homes and that’s not likely to change real soon.

I’ve always said that no matter the state of the market there are always those who need or want to sell and those who need or want to buy. That’s been the case for the more than 51 years I have worked in local Residential real estate, and I would guess it will continue to be so.

Millions of millennials are starting families and looking to buy homes. Unemployment remains low amid strong economic growth. Locally, several companies are expanding, and others are relocating here. With them are employees who will be looking for homes to buy.

If you’ve been wanting to buy or sell but have waited for whatever the reason, now is a good time to consider your options. You may be surprised to find that what you thought impossible might just be possible today. The most important thing is to be mindful of what you want, need, and can afford.

And that’s where I come in. The current market is not for the timid or inexperienced. It takes a lot of advanced planning and knowledge of how to navigate these waters. It’s crucial to take into consideration your individual wants, needs and budget requirements to come up with a viable plan.

My 51 plus years in Residential real estate, coupled with my Investment Banking background, give me an edge that my clients have found to be crucial in helping them and their families realize their personal real estate visions.

If Residential real estate is among your hopes and dreams for 2024, please give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let me help make them come true.

And, if you’ve got one minute and 46 seconds, take a look at my newest podcast. Simply click on the link below and you will be directed to my personal YouTube channel.

To watch, click here:

https://youtu.be/MBq1QkjgpqE?si=9WzhioEnVlSUYeLV

While you’re at it you might want to subscribe to my channel, so you won’t miss future broadcasts. It won’t cost you anything…well, it could cost you… if you miss some of my informative musings!

And now for statistics…

FEBRUARY 2024

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

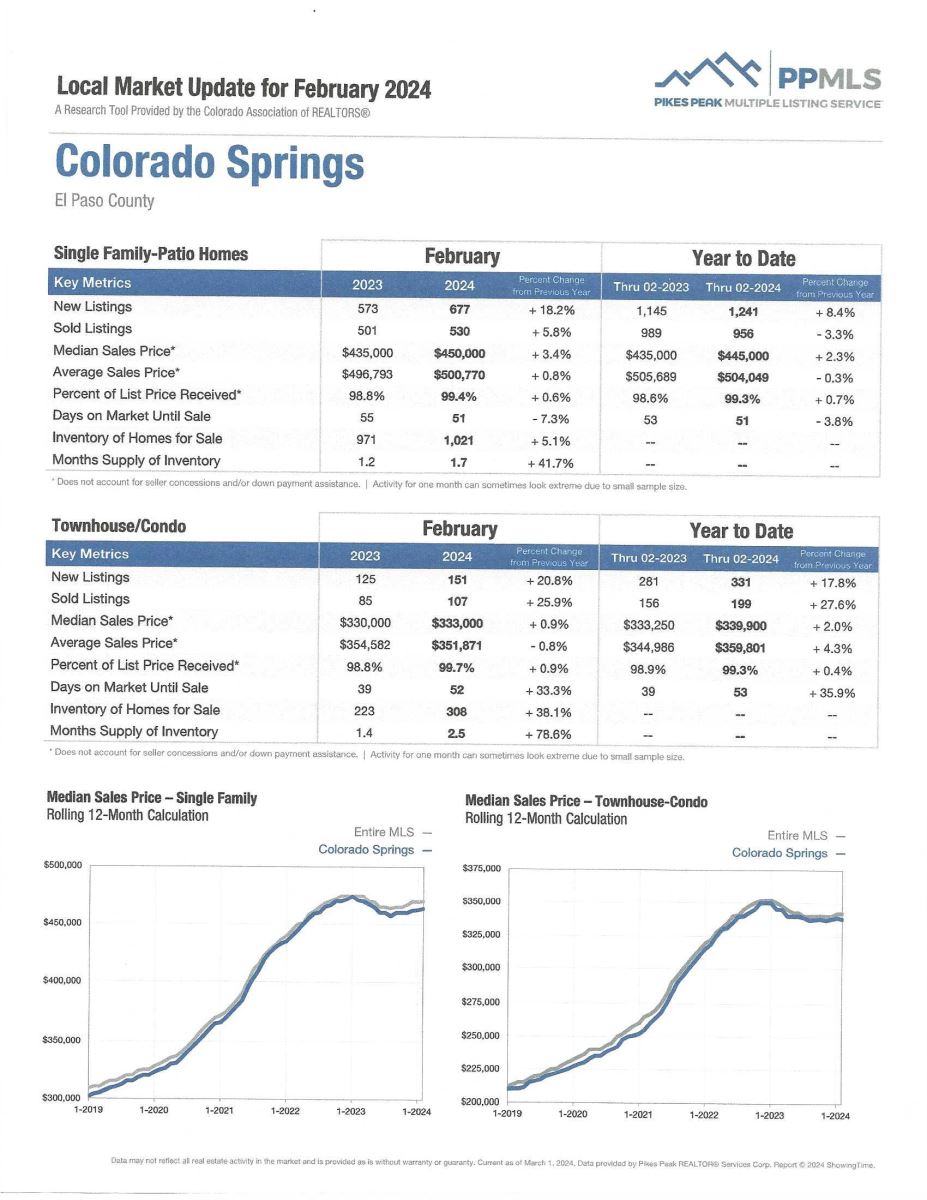

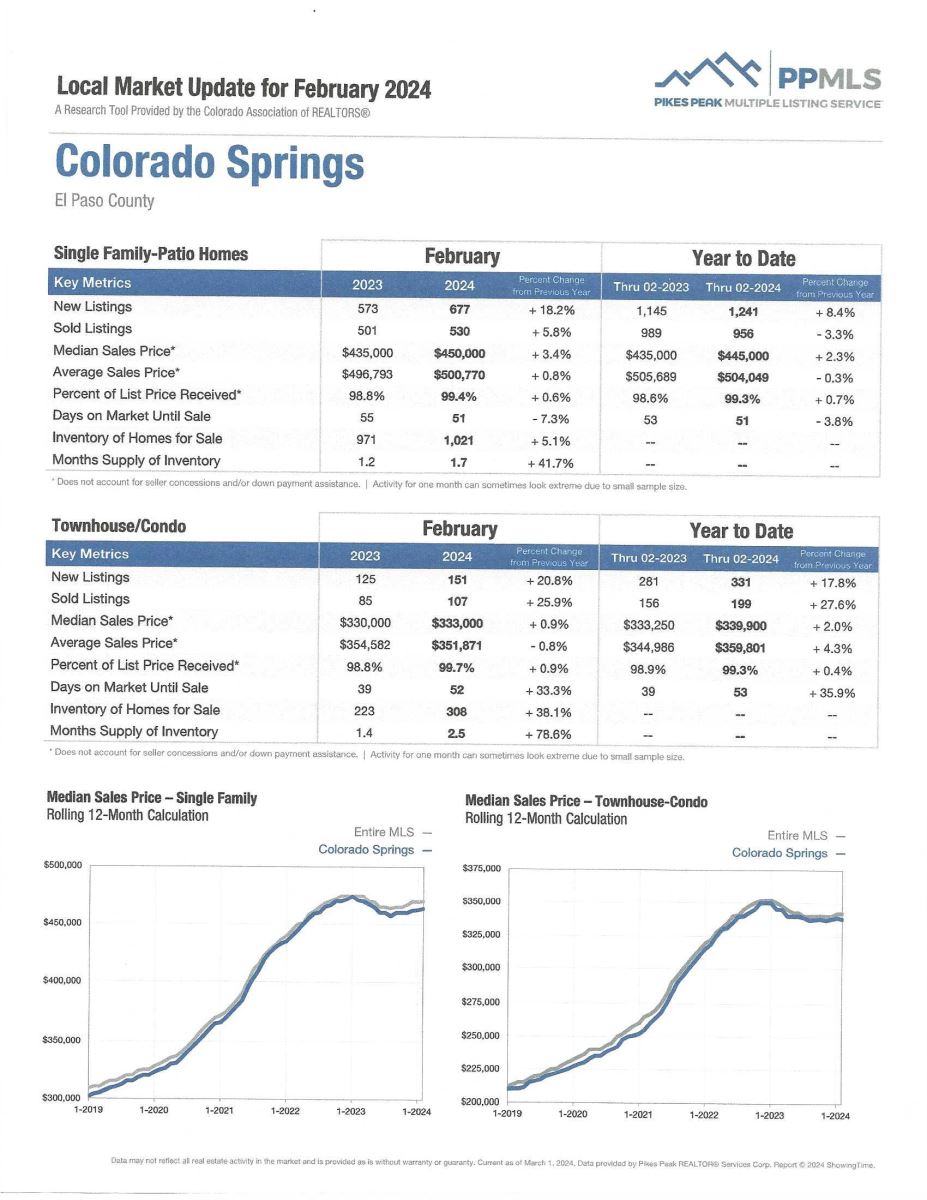

Here are some highlights from the February 2024 PPAR report:

In El Paso County, the average days on the market for single family/patio homes was 52. For condo/townhomes it was also 52.

Also in El Paso County, the sales price/list price for single family/patio homes was 99.4% and for condo/townhomes it was 99.7%.

In Teller County, the average days on the market for single family/patio homes was 67 and the sales/list price was 97.3%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing February 2024 to February 2023 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 1,142, Up 17.0%

· Number of Sales were 792, Up 1.8%

· Average Sales Price was $511,272, Up 2.2%

· Median Sales Price was $455,950, Up 3.6%

· Total Active Listings are 1,830, Up 26.8%

· Months Supply is 2.3, Up 14.9%

Condo/Townhomes:

· New Listings were 187, Up 15.4%

· Number of Sales were 131, Up 26.0%

· Average Sales Price was $365,720, Up 1.8%

· Median Sales Price was $335,000, Down 0.4%

· Total Active Listings are 351, Up 56.0%

· Months Supply is 2.7, Up 2.2%

Now a look at more statistics…

FEBRUARY 2024 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year-to-Date one-year change:

- Sold Listings for All Properties were Up 7.0%

- Median Sales Price for All Properties was Up 3.8%

- Active Listings on All Properties were Up 9.9%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering in order to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

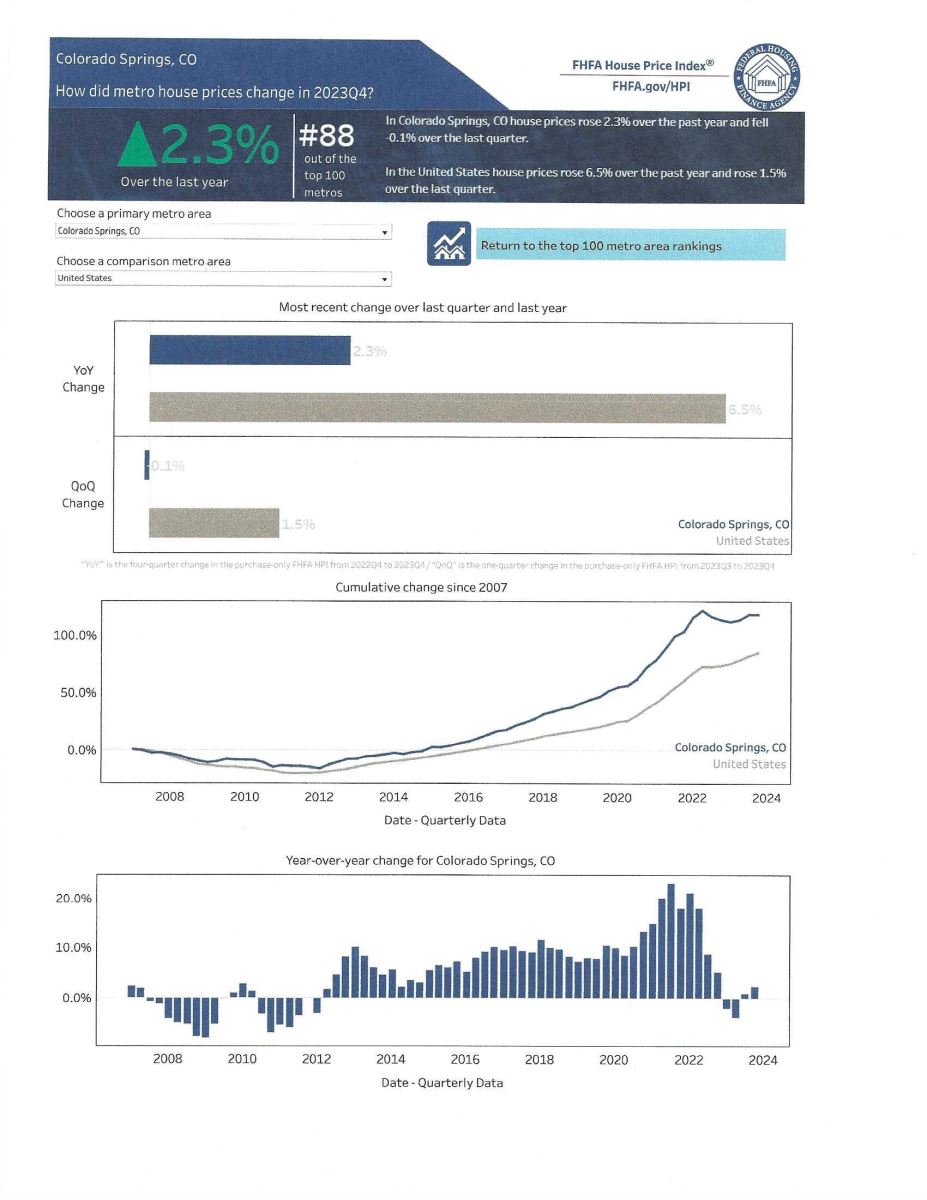

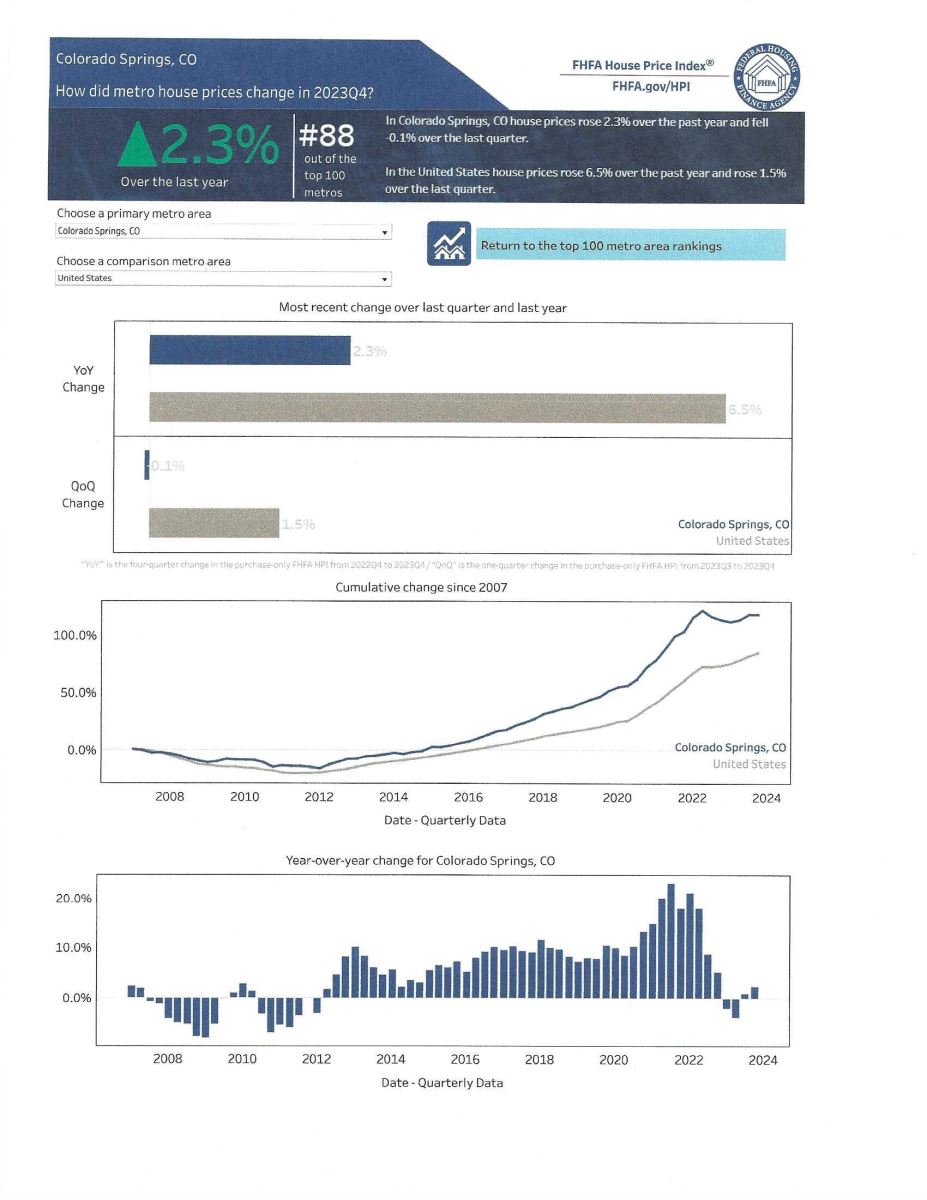

COLORADO SPRINGS RANKS #88 IN THE Q4 2023 FHFA HOUSE PRICE INDEX

Federal Housing Finance Agency, 2.27.24

The Federal Housing Finance Agency (FHFA) House Price Index (HPI) is a comprehensive collection of publicly available house price indexes that measure changes in single-family home values based on data that extend back to the mid-1970’s from all 50 states and over 400 American cities.

The information is obtained by reviewing repeat mortgage transactions on single-family properties whose mortgages have been purchased or securitized by Fannie Mae or Freddie Mac since January 1975.

The FHFA HPI serves as a timely, accurate indicator of house price trends at various geographic levels.

I’ve shared the local statistics from this report each quarter for many years.

The recently published FHFA House Price Index for Q 4 2023 lists Colorado Springs as #88 out of the top 100 in house price changes during that quarter, up a couple of spots from #95 in the third quarter 2023.

While we are still in the top 100, we remain far below a year ago. Our lack of available homes for sale has kept us from ranking considerably higher and I am hopeful that things are beginning to turn around in that area.

The charts below illustrate the Colorado Springs changes both year-over-year and quarter-over-quarter. If you have any questions, you know where to find me.

13 FEATURES NEW-HOME BUYERS SAY ARE ESSENTIAL AND DESIRABLE

National Association of Realtors (NAR) 3.1.24

New research is showing that house hunters are willing to accept a smaller property if it has some key amenities.

They appear willing to sacrifice property size to afford homeownership, and the newly constructed house has dropped to its lowest level in 13 years—2,479 square feet, according to new research from the National Association of Home Builders (NAHB). In fact, 26% of builders say they plan to build even smaller in 2024, research shows.

But while buyers may accept a smaller home, they want it to be more personalized and want it to feel like it was made just for them and to be significantly different from their neighbors.

According to the NAHB survey called “What Home Buyers Really Want”, nearly 40% of home buyers say they’re willing to buy a home with a smaller lot while 35% say they’d buy a smaller house. Respondents who would opt for a smaller home say they’d be most willing to shrink spaces like the home office (53%) and the dining room (52%). But they’re not willing to sacrifice the size of the kitchen or closets.

Buyers are prioritizing other key features around the home. Eighty percent or more of home buyers in NAHB’s survey rate the following property amenities as “essential” or “desirable”:

- Laundry Room

- Patio

- Energy Star Windows

- Exterior Lighting

- Ceiling Fan

- Garage Storage

- Front Porch

- Hardwood Flooring

- Full Bath on the Main Level

- Energy Star Appliances

- Walk-in Pantry

- Landscaping

- Table Space in the Kitchen

Technology features are also gaining in popularity. Over the last decade, the following home features have posted the most significant growth among home buyers, according to NAHB:

- Security Cameras

- Wired Home Security System

- Programmable Thermostat

- Multi-zone HVAC System

- Energy Management System

- Video Doorbell

Other home features showing significant growth over the past 10 years include:

- Quartz or Engineered Stone for Kitchen Countertops.

- Lighting Control System

- Outdoor Fireplace

- Outdoor Kitchen

- Built-in Seating in the Kitchen

- Exposed Beams

Also, with the growth of multigenerational living, more home buyers appear to prefer two primary bedroom suites rather than one.

Surveyed home builders say they are prioritizing many of these features that buyers want.

If a new home purchase is something you are considering, I can help you here as well. I have good working relationships with several local homebuilders and can assist you with site selection, elevation, and more. I can also help direct you to mortgage lenders that are geared to your individual situation. And did I mention that all of that is at no cost to you?

If new home construction is something you want to consider, just give me a call and let’s see what we can find for you.

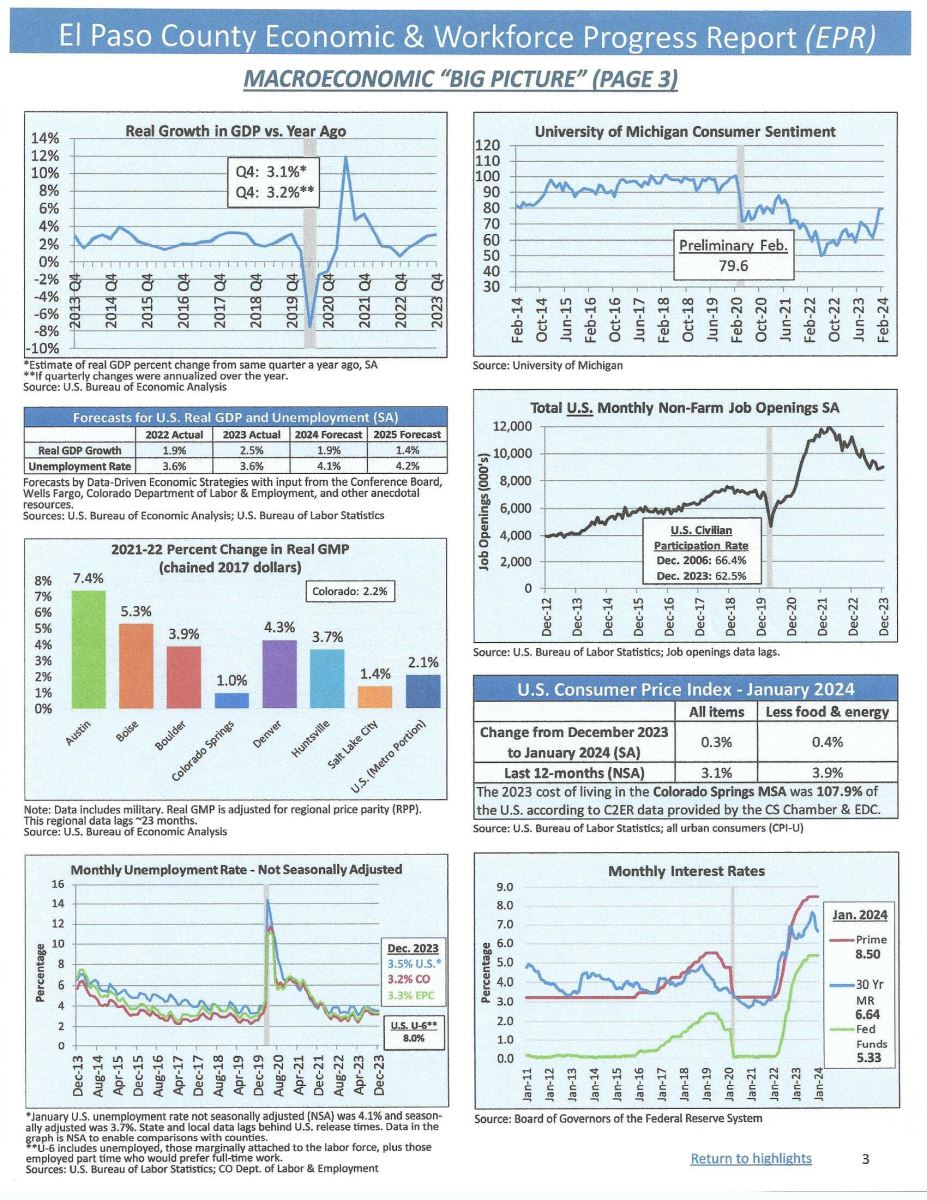

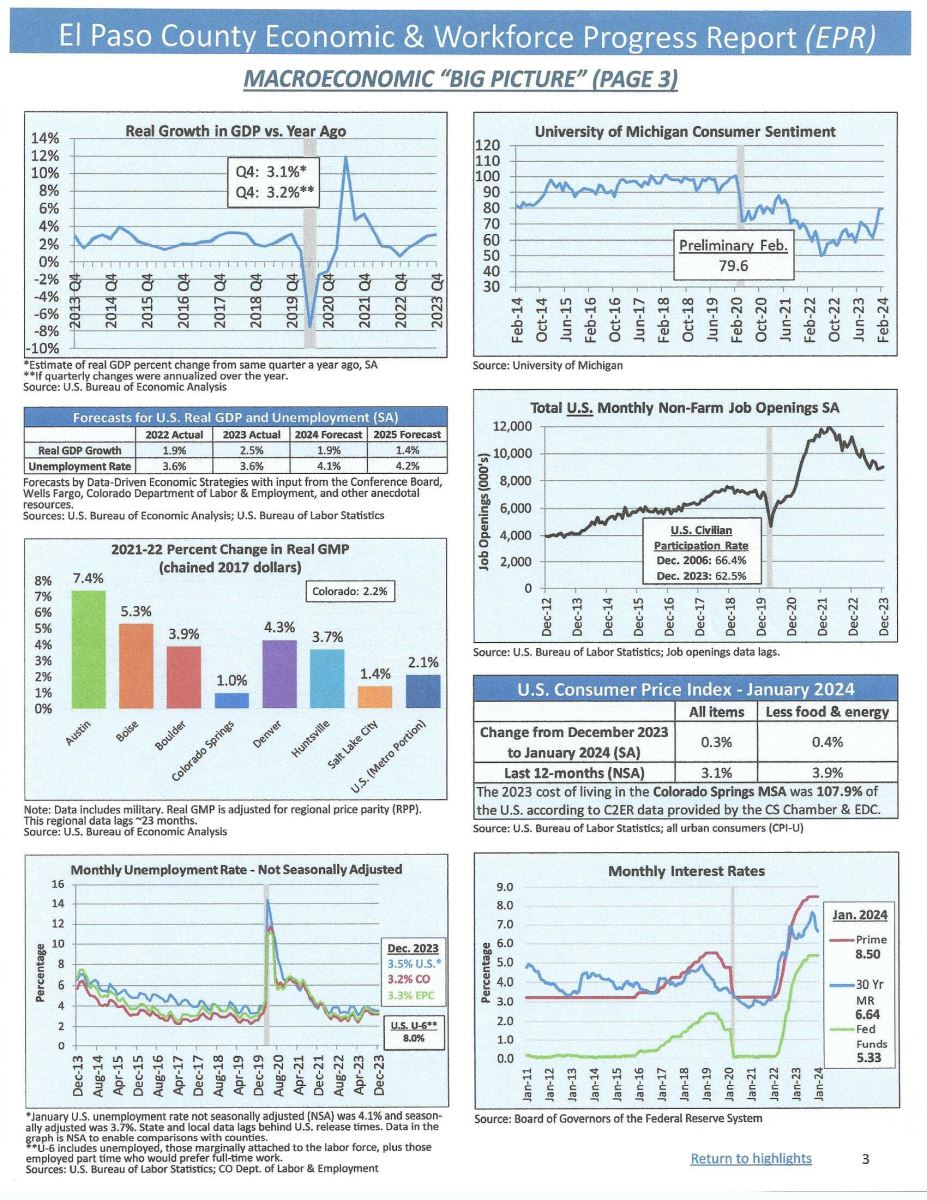

ECONOMIC & WORKFORCE DEVELOPMENT REPORT

Data-Driven Economic Strategies, February 2024

As always, I like to share the useful economic data I receive from our “local economist”, Tatiana Bailey. You will see in these charts what’s happening locally in terms of the economy as well as the most recent Workforce Progress Report.

This information is especially invaluable to business owners; however, I know you all will all find it worthwhile reading.

I’ve reproduced the first page of the graphics below. To access the report in its entirety, please click here. If you have any questions, give me a call.

UCCS ECONOMIC FORUM MONTHLY DASHBOARD ANDS 2024 CITY COMPARISON REPORT

Updated February 2024, UCCS College of Business/Economic Forum

Here is the monthly report from the UCCS College of Business Economic Forum. It is created by professor Dr. Bill Craighead, who is the Forum Director. He also publishes an on-line “Weekly Economic Snapshot”.

I know several of you who enjoy statistics and use this information in your daily business life, and I will share it as always.

To read the monthly updated report, please click here.

The UCCS Economic Forum also published a “2024 City Comparison Report” which compares Colorado Springs with Boise, Raleigh, Salt Lake City, San Antonio, Pueblo, and Denver in various capacities. I know you will find this quite interesting.

To view the 2024 City Comparison Report, please click here.

.png)