HARRY'S BI-WEEKLY UPDATE 3.28.24

March 28, 2024

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

I’VE BEEN IN ARIZONA FOR SPRING BASEBALL…HOWEVER…

I still wanted to touch base (pun intended) before next week’s eNewsletter. Yes, the weather was great, the ball games were fun, and I ate too much good food.

But as those of you who know me are aware…I’m never far from my thoughts on Residential real estate. In fact, I worked with a couple of my clients from afar and even managed to sell a home for one of them.

Which gets me to you, my clients and friends. Spring buying and selling season is starting up and we should see more available homes for sale when the statistics for March come out next week.

While activity has been relatively slow over the winter months due in part to the lack of available homes and high interest rates, I expect things to start picking up in the next month.

If you’ve been waiting for prices to come down you might be waiting a long time. Folks still want to own if it’s at all possible and are finding creative ways to do so. As I’ve mentioned in previous eNewsletters, just because the interest rates are higher than they have been in previous years, there are still ways to work with financial institutions and others to negotiate rates or get buydowns.

That’s where I come in.

My almost 52 years in the local Residential real estate arena give me a heads up on most. And when you add in my Investment Banking background, you will find I’m able to help in areas that other brokers can’t.

It’s truly especially important in todays’ market to have a seasoned, knowledgeable professional in your corner. So, what are you waiting for?

If you’ve even been thinking about selling to trade up or move to a new neighborhood, let’s get together and see how we can make your wants, needs and budget requirements work for you.

Just give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let’s get started before the spring season is underway.

PS: I’ll have more to say about the recent court rulings on real estate sales and commissions in next week’s eNewsletter. Like most, I’m still trying to digest all the rulings and what they will mean to you and me.

JUST ANOTHER REASON TO BE A HOMEOWNER…

Bloomberg, 3.6.24

According to new research from the Federal Reserve Bank of St. Louis, the wealth of the typical American senior climbed by about $91,000 during the pandemic years as home and stock values soared.

That was the median increase in net worth between 2019 and 2022 for households headed by someone 65 or older, according to data from the Fed’s Survey of Consumer Finances. Households headed by someone 40 to 64 years old saw median gains of $57,800.

U.S. ECONOMIC, HOUSING AND MORTGAGE MARKET OUTLOOK—MARCH 2024

FreddieMac, 3.20.24

I just received this report from Freddie Mac and wanted to share some quick highlights with you:

- While the U.S. economy remains robust, inflation pressure continues, which could keep mortgage rates higher for longer.

- Homeowners’ insurance costs are growing but are a small fraction compared to the mortgatge principal and interest payments.

- Residential investment remained positive but slowed down from the 6.7% quarter-over-quarter increase in Q3 to 2.98% in Q4 2023.

- Home prices continue to exhibit strength. The FHFA Purchase-Only Home Price Index for December 2023 rose 0.1% month-over-month compared to 0.4% in November 2023 and was up 6.6% year-over-year. Despite the deceleration in December, house prices continue to outpace overall consumer prices.

- Mortgage rates resumed their upward trajectory in February and averaged 6.8% for the month, as measured by Freddie Mac’s Primary Mortgage Market Survey. This increase was mainly due to the stronger than expected inflation measures with markets pushing out the expectation of the Fed pivot to the second half of the year.

- The stability in rates brought back some activity into the housing market in January, with increases in existing and new home sales. However, tight inventory is still a key barrier to home sale volumes.

- The U.S. economic outlook remains broadly positive.

- Freddie Mac expects the Federal Reserve to not cut rates until the summer at the earliest and potential upside surprises on inflation could push rate cuts out even further.

- They forecast mortgage rates to stay above 6.5% through this quarter and next.

- Assuming a scenario where inflation moves closer to target prompting the Federal Reserve to cut the federal funds rate, a modest recovery in home sales as mortgage rates drift down in the latter half of the year is expected.

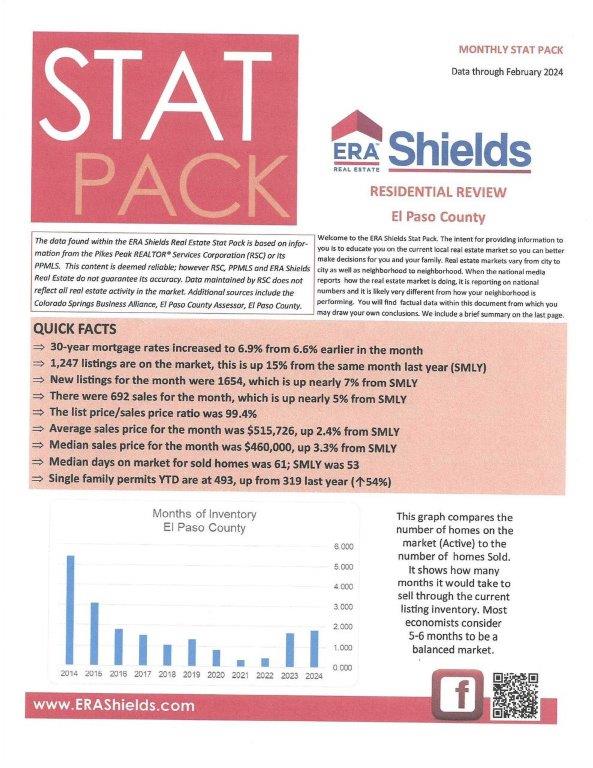

ERA SHIELDS MONTHLY STAT PACK

Data through February 2024, ERA Shields

Here is data from my company’s monthly “Stat Pack” that can better help you understand the local buying and selling reality. I have reproduced the first page, and you can click here to get the report in its entirety.