HARRY'S BI-WEEKLY UPDATE 3.24.22

March 24, 2022

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

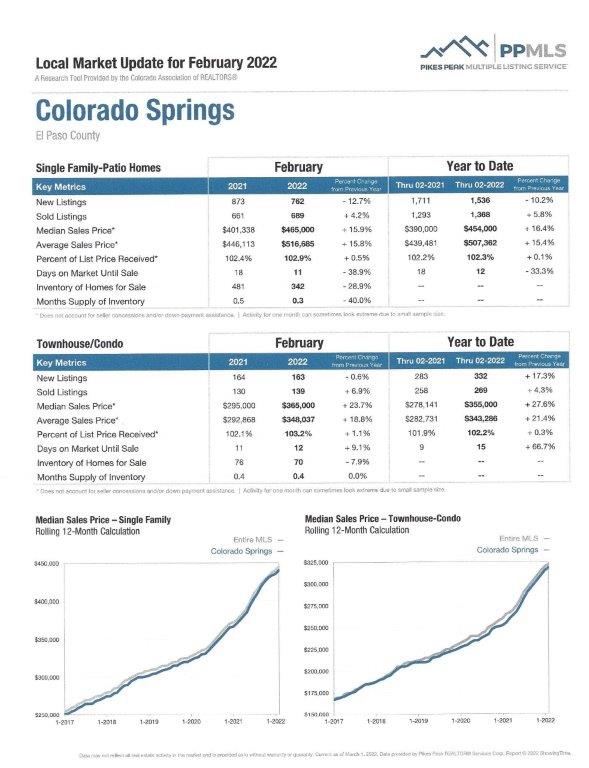

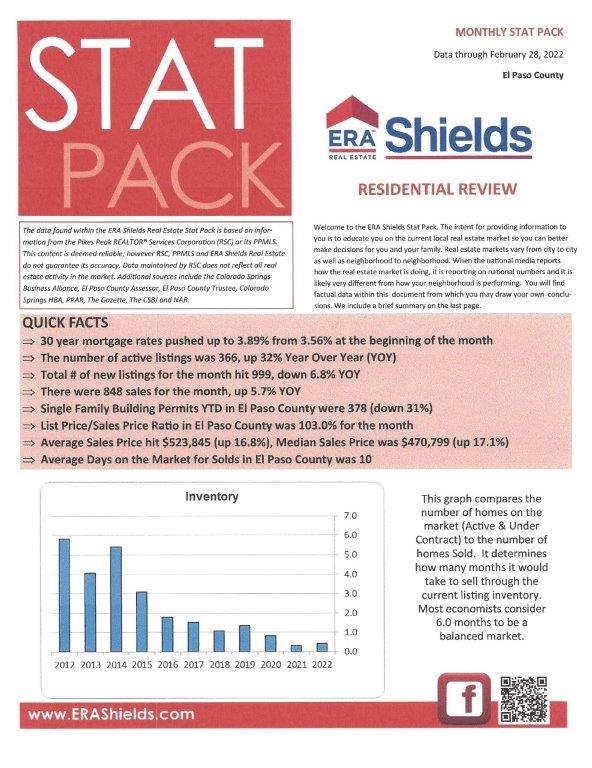

RESIDENTIAL real estate SALES AND PRICES CONTINUE THEIR STATUS QUO…

Good news for many, but not so good for others.

As you will see in the following story, the average American homeowner gained more than $55,000 in equity over 2021. While that is a mind-boggling figure for those of us who have been in the business for many, many years and great news for current homeowners, it’s concerning for first-time buyers and those who want to sell and trade up.

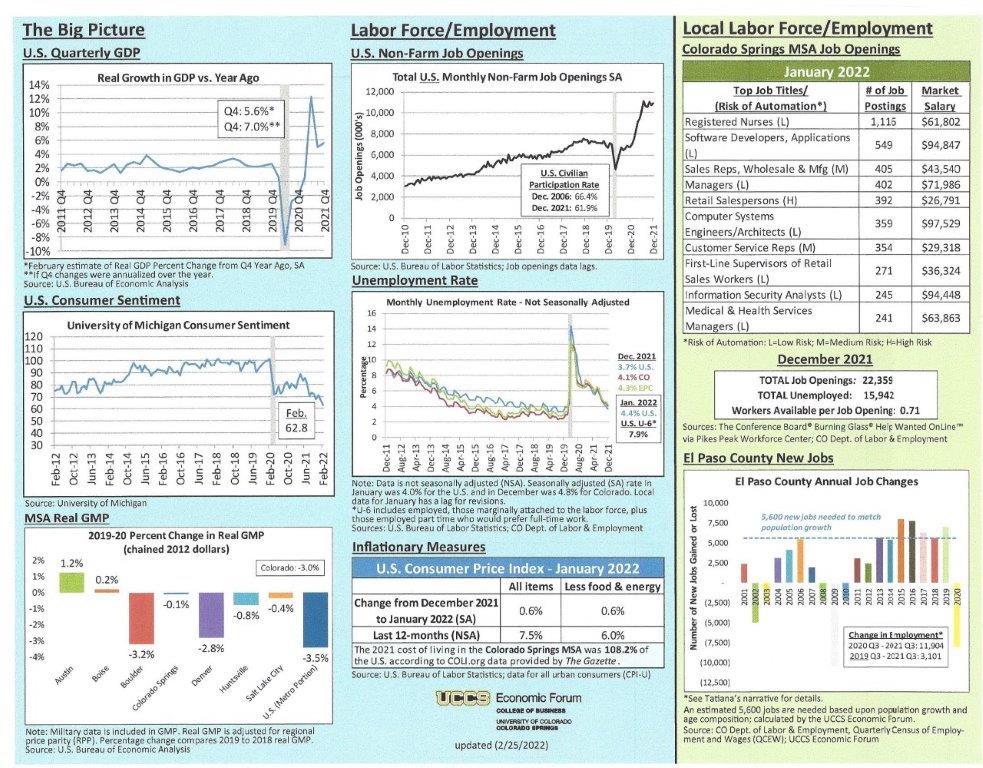

I’ve been writing about the low number of existing homes for sale over the last couple of years and not much has changed. It’s still Econ 101—Supply and Demand. When there are fewer homes for sale, the “Seller’s Market” means higher list prices with bidding wars and sales way over list price. That in turn helps raise the equity in all homes since scarcity of anything means it will cost more to buy.

A good example is a home I sold this past week. It was listed at $479,000 and went on MLS Friday morning. After the first showing we had an excellent offer and by the end of the day, there were more. More than half of the offers had escalation clauses which meant the buyer was willing to go $1000 or more over the highest bid up to a set amount, which in one case was $550,000!

Yes…you read that right...one of the offers was up to $71,000 over the list price of the home!

That’s what I mean about crazy times in the Residential real estate market. With interest rates on the rise, folks who have been taking a wait and see attitude are now jumping in before rates and home prices get any higher. That’s making for an even more competitive market, and buyers are having to come up with inventive ways to get the seller to even consider their offer. I recently read in The Wall Street Journal about how home buyers are getting very creative in their offers. One example referred to an offer made by a potential buyer to the seller for a 50% discount for a year at his Washington, D.C. restaurant. Yes, creative incentives are the norm these days and the more creative the better.

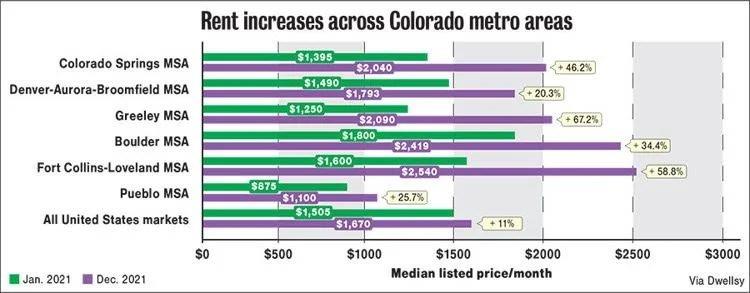

With rental rates at an all-time high, home ownership is on the mind of many renters. However, first-time buyers are having a tough time qualifying for these higher priced homes. I’ve had several parents who have used the equity in their present home to help their children with down payments on first homes.

It’s also a great time to buy an investment property if that’s something you have considered. It’s not for everyone, but if it’s something you’ve considered, talk to your tax and investment advisors and then give me a call.

Today’s market makes it more important than ever to work with a seasoned, knowledgeable real estate broker like me. I’ve worked in the local Residential Real Estate arena for almost 50 years and have seen just about every cycle imaginable. I know how to write an offer that gets attention and coupled with my expertise in negotiation, I can make the whole process smoother. Another important factor is my relationship with other brokers, since most that have dealt with me in the past know when I present an offer it’s very likely to close.

And for my sellers, I provide the ability to review offers and point out the pros and cons of each. This could mean taking a little less but knowing that it’s an offer that will close.

After all, offers are only offers until they close. So, turning away good offers for one that might offer a little more cash could hurt in the long run if it’s not a viable offer that can make it to the closing table.

For those of you who have waited, wait no longer. NOW is the time to make your move. While there are not a lot of existing homes from which to choose, we can usually find one that can work for you. New home construction is also an option and that’s an area where I can assist you as well, for no additional cost to you.

But don’t delay. If you’ve even considered a move, either to sell and trade up or move to a new neighborhood, the best move you can make now is to call me at 719.593.1000 or email me at Harry@HarrySalzman.com and let’s figure out how we can make your Residential real estate dreams come true.

THE AVERAGE AMERICAN HOMEOWNER GAINED MORE THAN $55K IN EQUITY LAST YEAR

KeepingCurrentMatters, 3.21.22

As I just mentioned, home values are on the rise due to low supply and high demand. Bidding wars are driving up prices and will continue to do so until there are more existing homes for sale.

According to Dr. Frank Nothaft, chief economist at CoreLogic, “Home prices rose 18% during 2021 in the CoreLogic Home Price Index, the largest in its 45-year history, generating a big increase in home equity wealth”.

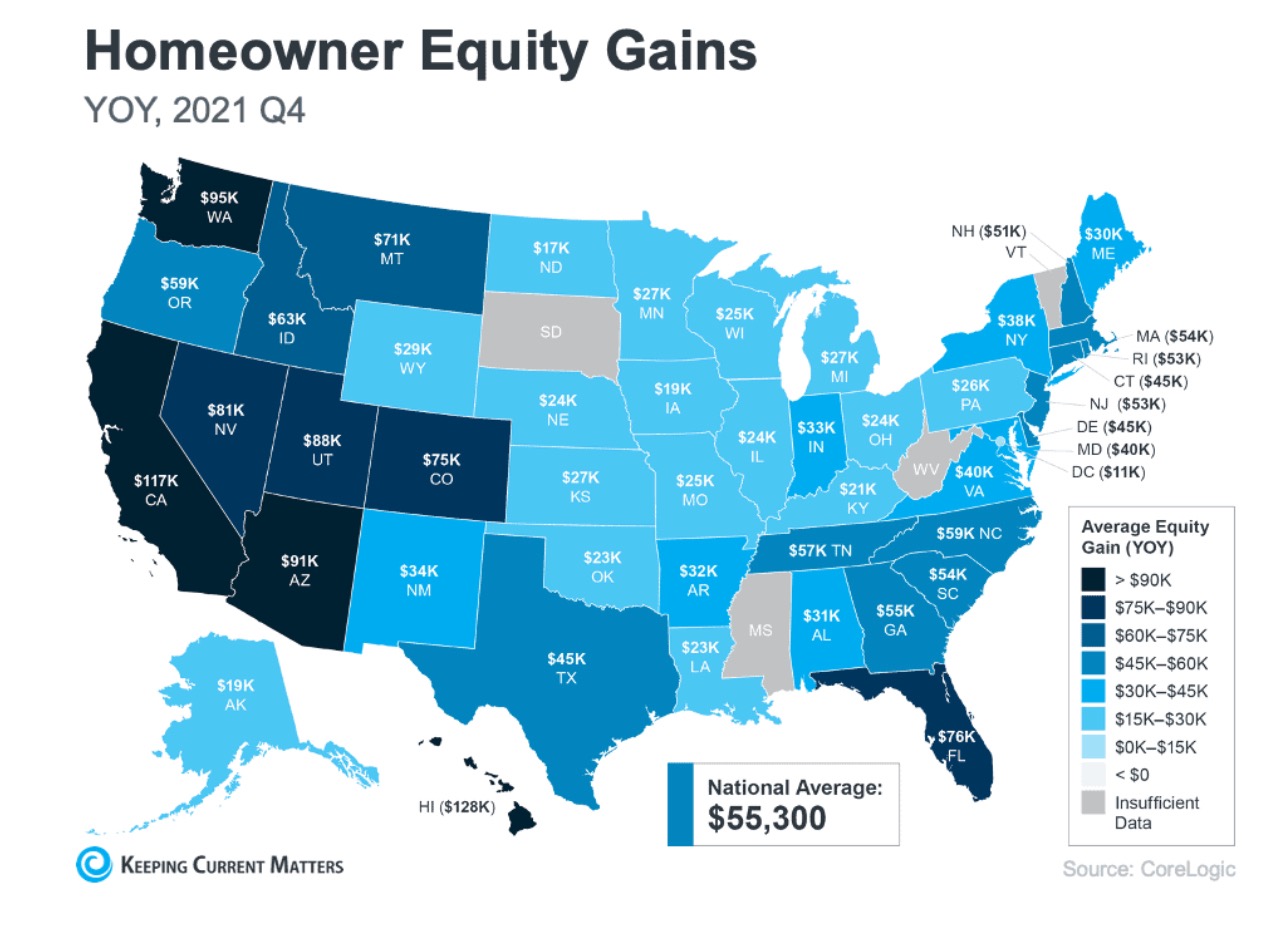

In the latest Home Equity Insights from Corelogic, it showed that the average homeowner’s equity has grown by $55,300 over the last 12 months. As I’ve mentioned before, our local average price increases have been considerably over the U.S. average for some time now.

Below is a graphic showing what’s happening across the United States. It measures gains year-over-year for the 4thQuarter 2021.

What does this mean to you? Well, if you are considering selling to trade up or move elsewhere, the equity in your present home will likely mean a larger down payment on your next home. If you’ve worried about rising home prices, your current equity can likely go a long way to helping even things out.

If you want to know how much equity you have in your present home, give me a call and I can help you with that. I believe you might be surprised what you can easily afford and keep your monthly output close to what you are currently paying.

WHAT YOU NEED TO KNOW IF YOU’RE THINKING ABOUT BUILDING A HOME

KeepingCurrentMatters, 3.23.22

With options for existing homes nothing like they once were, you might be considering new construction as an option. Homebuilders today are doing all they can to keep up with the demand, but they are currently facing obstacles outside of their control.

Supply chain issues are a big hurdle. According to a recent article from HousingWire, “nearly everything needed in the homebuilding process is facing some sort of delay and subsequent price increase.”

And it’s not just lumber. Roofing materials, windows, garage doors, siding, and gypsum (which is used in drywall) are also affected.

When supplies are low, charges inevitably go up and a lack of availability is causing delays, meaning builders are struggling to stay on schedule.

Another challenge is the skilled labor shortage. It’s nothing new since it’s been an issue for more than a decade now, but the good news is that a February jobs report shows employment in the construction industry is showing gains.

How does this impact you?

When you weigh your options in trying to decide between buying an existing home or building a new one, factor the potential delay in the new home construction into your decision. It doesn’t mean you shouldn’t consider new home construction, but it does mean you should consider your timeline and if you are willing to wait while your home is being constructed.

And once again, if new construction is in your plans, I’m your guy. I can help with site and elevation selection as well as help in getting you the best mortgage to fit your needs. This all comes as part of my special brand of customer service and at no additional cost to you. So, if new home construction is in your plans, I’m only a phone call away.

WHAT ARE THE BENEFITS OF BUYING AND OWNING A RENTAL PROPERTY?

American Family Insurance, 3.8.22

Investment properties can be an appealing source of income, even to those who have never considered it before. The benefits of investing in rental property can help you advance towards your long-term financial goals.

Buying an investment property is not a lot different from purchasing a single-family home for private use. The process is very much the same, from making an offer to closing the deal. real estate professionals such as me, work with investor buyers just as we do buyers for homes of their own.

Selecting the property is somewhat the same, as you will want to look at the property through a similar lens—seeking the perfect blend of affordability, financial opportunity, and potential resale value.

Fixer-uppers have great potential here in that rental properties that require a bit of an up-front investment are worth your consideration.

As I’ve mentioned in the past, I’ve also had investors purchase newly constructed homes with the idea that there would be little, if any, required maintenance for many years and they could attract long term renters at a better monthly rental fee.

There are a number of benefits of investing in rental properties which include:

- Generating a monthly passive income stream

- Making the right purchase can increase your resale price

- Rental unit furniture, appliances and other items may qualify for a tax deduction

- Write off of your landlord insurance

- Through 2025, there is a special income tax deduction that affords business owners a deduction up to 20% of net rental income or 2.5 percent of the purchase price of the property and/or other expenses likes salaries for rental property employees. Please check with your tax attorney or CPA for details.

- Renters pay down your principal

Now, the potential problems with owning a rental property:

- Troublesome tenants

- Lack of liquidity

- Maintenance Costs

- Insuring your investment

There are lots of things to take into account when considering becoming a landlord. As I’ve said time and again, this is something you need to discuss with your tax and investment advisors.

The bottom line is that over the long haul, the appreciation of single-family homes has been greater than the growth of public stocks on the NYSE. This is certainly something worth considering in your long-term financial goals.

I’ve been a landlord for many, many years and would be happy to share the upside as well as the downside with you. Just give me a call and we can discuss.

PRICING YOUR HOME RIGHT IS CRITICAL

KeepingCurrentMatters,

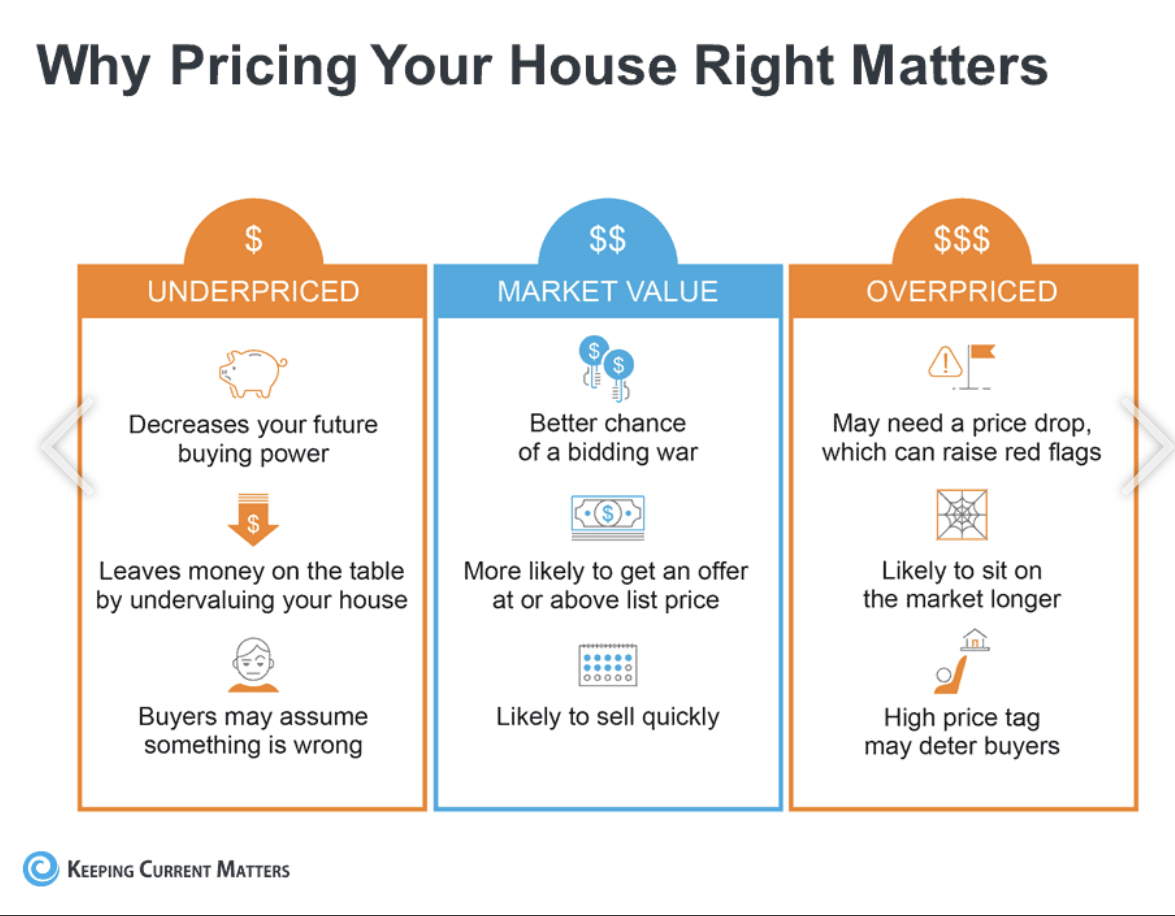

The price you set for your house sends a message to potential buyers. Price it too low and it might raise questions about the condition of the home. Price it too high and you might deter potential buyers.

Even in a Seller’s Market, it’s crucial to send the right message to potential buyers. You need top aim directly for the center…not too low and not too high:

Don’t try to figure this out by yourself. When you’re ready to list your home, give me a call. I can help you determine the correct listing price, based on actual facts and comparables. That way you will be able to get the very best price possible for your present home.