HARRY'S BI-WEEKLY UPDATE 2.22.22

February 22, 2022 2.22.22 (in case you missed it!)

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

QUESTIONS ASKED AND ANSWERED…

Today’s unprecedented Residential real estate market has brought with it many new questions. In most cases they can be given old answers.

My clients have been wondering how the home prices and mortgage rates are going to affect them. They also wonder if this is a good time to sell and move up or purchase for investment purposes.

As I’ve said time and again, the only right time to buy and sell is when it’s right for you. Period. Prices change all the time, as do mortgage rates. It’s important to realize that when it’s the right time for you, we can find a way to work with your needs, wants and budget.

Just because median home prices are continuing to rise and mortgage rates are at their highest level in three years, it doesn’t mean you have to stay where you are if that’s not your desire. Your current home is likely worth a lot more then you might imagine, and that equity will go a long way to keeping your monthly output lower than you might guess. It’s simply a matter of sitting down with me and figuring it all out.

If you or a family member are currently renting, you already know that rents are at an all time high. Most often these days it’s a lot less expensive to buy than to rent if possible, and the result will be equity building for you rather than for your landlord. I tell folks they need to start somewhere and then move on from there.

As you might imagine, investment properties are another question. And the answer again is, if it’s right for you, then it can be a great idea. However, there are a number of considerations such as whether you want to be a landlord or want to pay a property manager to handle things for you. It’s also important to check with your tax and investment counselors to make certain that purchasing an investment property fits into your long-term financial planning.

If the answer is yes, then I’m most definitely your guy, as I own investment properties and have for most of my almost 50 years in the local Residential real estate arena. I can give you the pros and cons from my personal experience and that type of information is invaluable.

One of the most asked questions these days is, “Are we facing a housing bubble?”. And the answer to that is no. Every housing economist has said that this current market is very different than it was during the housing crash 15 years ago.

To begin with, in 2010 the U.S. Congress enacted the “Dodd-Frank Wall Street Reform and Consumer Protection Act”,a United States federal law that overhauled financial regulation in the aftermath of the Great Recession. It made changes affecting all federal financial regulatory agencies and almost every part of the nation’s financial services industry.

This Act created agencies to ensure that consumers were protected against abuses related to credit cards, mortgages, and other financial products. The types of mortgage loans that helped contribute to the housing crash 15 years ago are no longer around and the definition of credit worthiness has changed substantially as well.

I have excerpted some thoughts and graphs from an article I read last week in Keeping Current Matters to illustrate this. The article was written to address the fact that many recently surveyed consumers do believe that there’s a housing bubble beginning to form. It’s a bit lengthy but a great answer to the question I’m so often asked these days.

Here are four key reasons that explain why today is nothing like the last time:

Houses Are Not Unaffordable Like They Were During the Housing Boom.

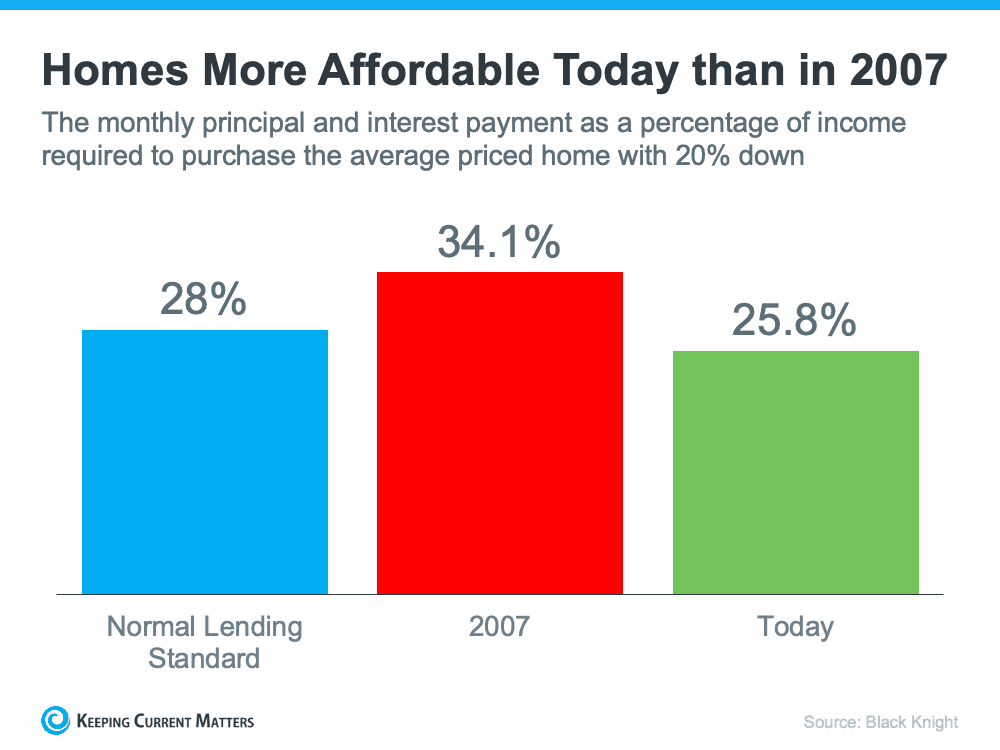

There are three components to the affordability formula: the price of the home, wages earned by the purchaser, and the mortgage rate available at the time. Conventional lending standards say a purchaser should not spend more than 28% of their gross income on their mortgage payment.

Fifteen years ago, prices were high, wages were low and mortgage rates were over 6%. Today, prices are still high. Wages, however, have increased and the mortgage rate, even after the recent spike, is still well below 6%. That means the average purchaser today pays less of their monthly income toward their mortgage payment than they did back then.

According to the latest Affordability Report by ATTOM Data, Chief Product Officer Todd Teta addressed that exact point:

“The average wage earner can still afford the typical home across the U.S., but the financial comfort zone continues shrinking as home prices keep soaring and mortgage rates tick upward.”

Affordability is not as strong as it was last year, but it’s much better than it was during the boom. Here’s a chart showing that difference:

Mortgage Standards Were Much More Relaxed During the Boom.

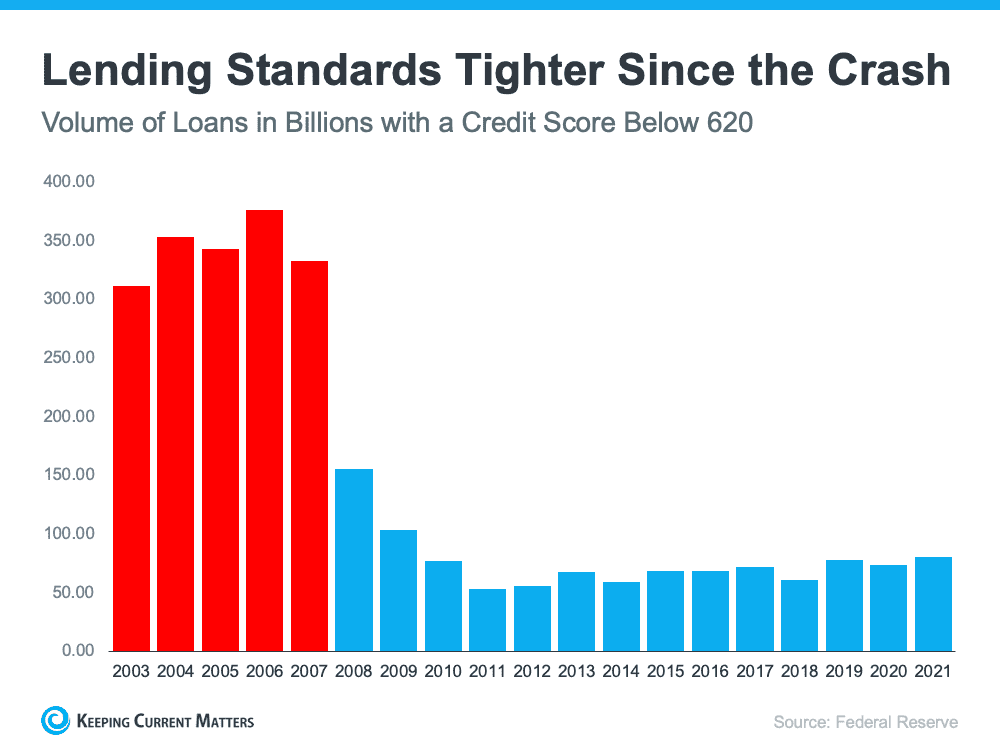

During the housing bubble it was much easier to get a mortgage than it is today. For example, let’s review the number of mortgages granted to purchasers with credit scores under 620. According to credit.org, a credit score between 550-619 is considered poor. In defining scores below 620 they explain:

“Credit agencies consider consumers with credit delinquencies, account rejections, and little credit history as subprime borrowers due to their high credit risk.”

Buyers can still qualify for a mortgage with a credit score that low, but they’re considered riskier borrowers. Here’s a graph showing the mortgage volume issued to purchasers with a less than 620 credit score during the housing boom and the subsequent volume in the 14 years since:

Mortgage standards are nothing like they were last time. Purchasers that acquired a mortgage over the last ten years are much more qualified. (Thank you, Congress, for the Dodd Frank Act)

Here’s a look at what that means going forward.

The Foreclosure Situation Is Different Now.

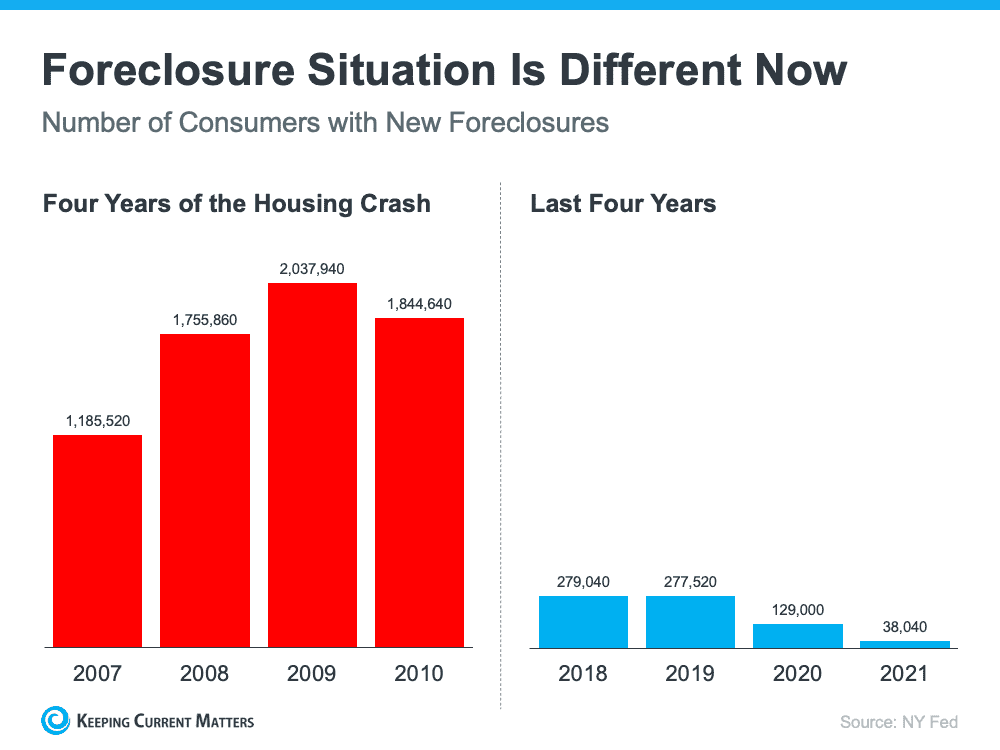

The most obvious difference is the number of homeowners that were facing foreclosure after the housing bubble burst. The Federal Reserve issues a report showing the number of consumers with a new foreclosure notice. Here are the numbers during the crash compared to today:

There’s no doubt the 2020 and 2021 numbers are impacted by the forbearance program created to help homeowners facing uncertainty during the pandemic. However, there are fewer than 800,000 homeowners left in the program today, and most will be able to work out a repayment plan with their lenders.

Rick Sharga, executive vice president of RealtyTrac, explains:

“The fact that foreclosure starts declined despite hundreds of thousands of borrowers exiting the CARES Act mortgage forbearance program over the last few months is very encouraging. It suggests that the ‘forbearance equals foreclosure’ narrative was incorrect.”

Why so few foreclosures today? Well, quite simply, homeowners are equity rich, not tapped out.

In the run-up to the housing bubble some homeowners were using their homes as a personal ATM machine. Many withdrew their equity as it built up. When home values began to fall, some found themselves in a negative equity situation. Some of those households decided to walk away from their homes, and that led to a rash of distressed property listings (foreclosures and short sales) which sold at huge discounts, thus lowering the value of other homes in the area.

Today’s homeowners have learned their lessons. Prices have risen considerably in the last few years, leading to over 40% of homes in the country having more than 50% equity. But owners have not been tapping into it like last time, as evidenced by the fact that national tappable equity has increased to a record $9.9 trillion. With the average home equity now at $300,000, what happened last time won’t happen today.

The latest Home Equity Insights report from Corelogic explains:

“Not only have equity gains helped homeowners more seamlessly transition out of forbearance and avoid a distressed sale, but they’ve also enabled many to continue building their wealth.”

There will be nowhere near the same number of foreclosures as we saw during the crash.

What does this mean for the housing market?

We Don’t Have a Surplus of Homes on the Market—We Have a Shortage

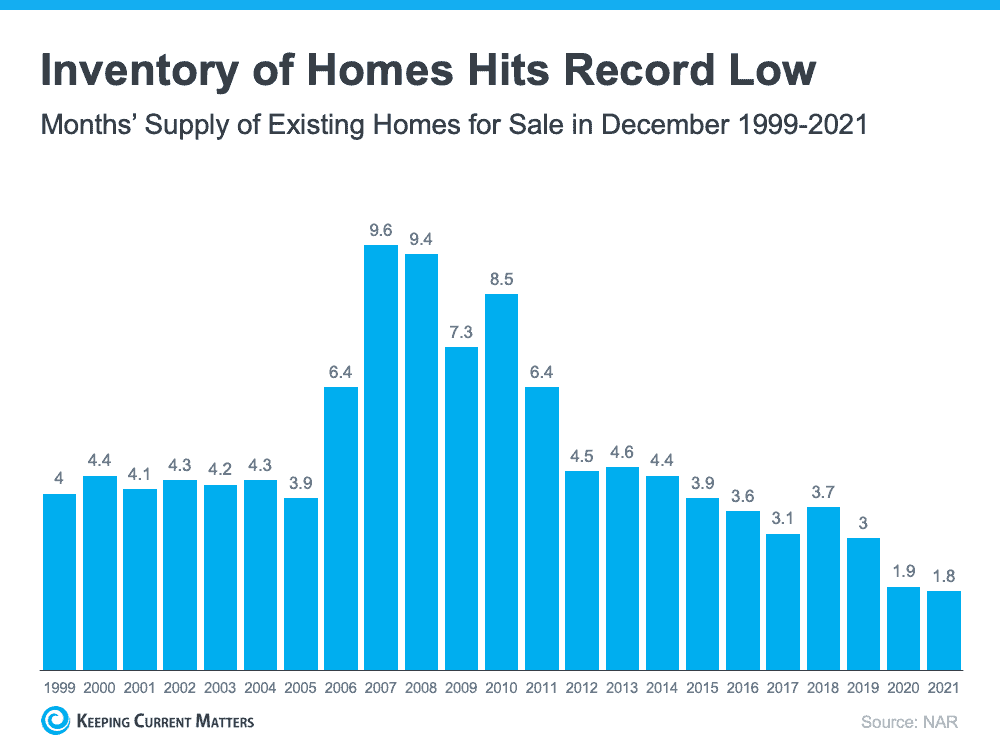

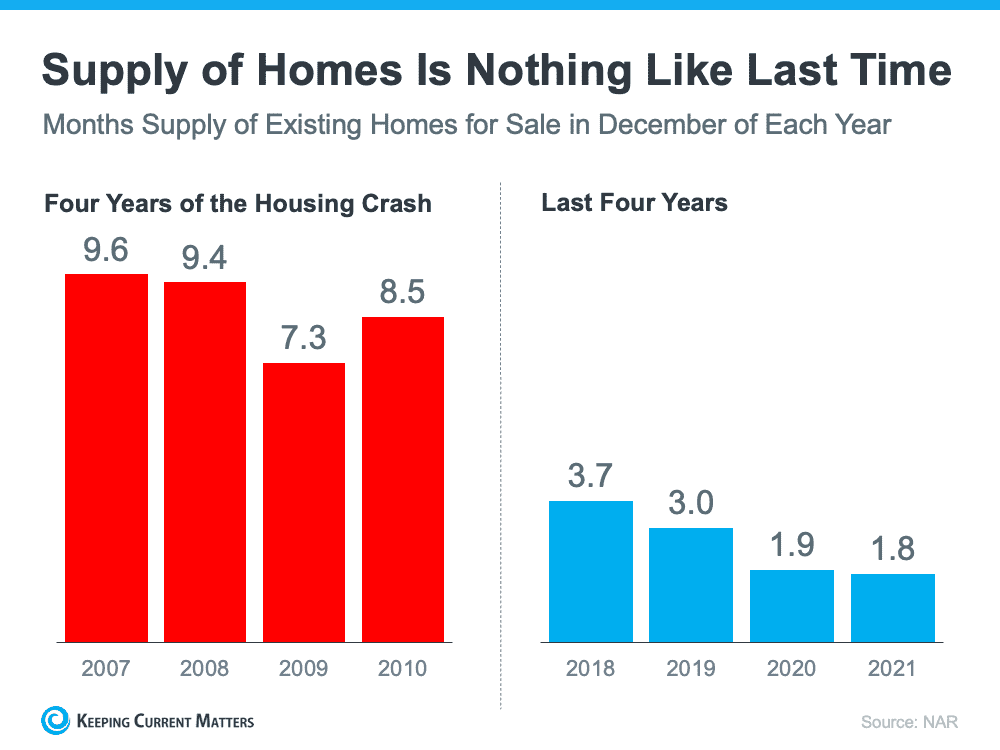

The supply of inventory needed to sustain a normal real estate market is approximately six months. Anything more is an overabundance and will cause prices to depreciate. Anything less is a shortage and will lead to continued price appreciation.

As you will see in the following graph, there were too many homes for sale from 2007 to 2010 (many of which were short sales and foreclosures) and that caused prices to tumble. Today there is a shortage of inventory, which is causing the acceleration in home values to continue, and most especially here in Colorado Springs.

Inventory is nothing like last time. Prices are rising because there’s a healthy demand for homeownership at the same time there’s a shortage of homes for sale.

A long answer to an often-asked question, but I think after reading this you might understand better why I say it’s always a good time to buy and sell if it’s the right time for YOU.

Yes, there are not a lot of homes for sale at present, but there’s always a home somewhere for someone, even in new construction, and I can assist in helping make the whole process less of a burden than it has become in this market.

Consider that U.S. homes sales jumped 6.7% in January despite the record-low inventory, as buyers rushed to purchase homes as the mortgage rates began to rise. The housing market remains extremely competitive and potential first-time buyers are now reluctant to wait as their leases are coming due.

Folks don’t want to see the affordability factor go away and potential sellers are starting to consider all their options.

If you even considered a move or have a family member, coworker or friend considering the same, please give me a call sooner than later. My almost 50-year experience in the Colorado Springs housing market coupled with my investment banking background and expertise in negotiation gives me a heads up on most. I can be reached at 719.593.1000 or by email at Harry@HarrySalzman.com.

I look forward to talking with you soon.

COLORADO SPRINGS HOME PRICES CONTINUED TO SOAR IN 2021 AND CONTINUED TO SURPASS MUCH OF THE COUNTRY

The National Association of Realtors, 2.10.22

In the recently published report, 67% of the 183 Metropolitan Statistical Areas (MSAs) surveyed quarterly by the National Association of Realtors (NAR) reached double-digit median home price appreciation in the fourth quarter of 2021. This is less than the 78% of the third quarter but still a significant figure.

The median price nationally rose 14.6% quarter-over-quarter to $361,700.

Colorado Springs surpassed that, with the median price of single-family homes jumping 19.2% to $442,700 during the final quarter of the year. This price reflects detached, single-family and patio homes but not townhomes or condominiums.

The median price in the Springs ranked 31st highest of the cities surveyed. And once more, the good news is that while our home values are increasing, they are still less than those in the Denver and Boulder areas, which makes our city more attractive to potential companies wanting to relocate.

To see all 183 metro areas in alphabetical order, please click here. To see them in ranking order, click here.

You can also click here to see, in alphabetical order, the change in median sales price of existing single-family homes over the past three years or click here to see what income levels are required to purchase homes based on either a 5, 10 or 20 percent down-payment.

And if you have any questions, you know where to reach me.

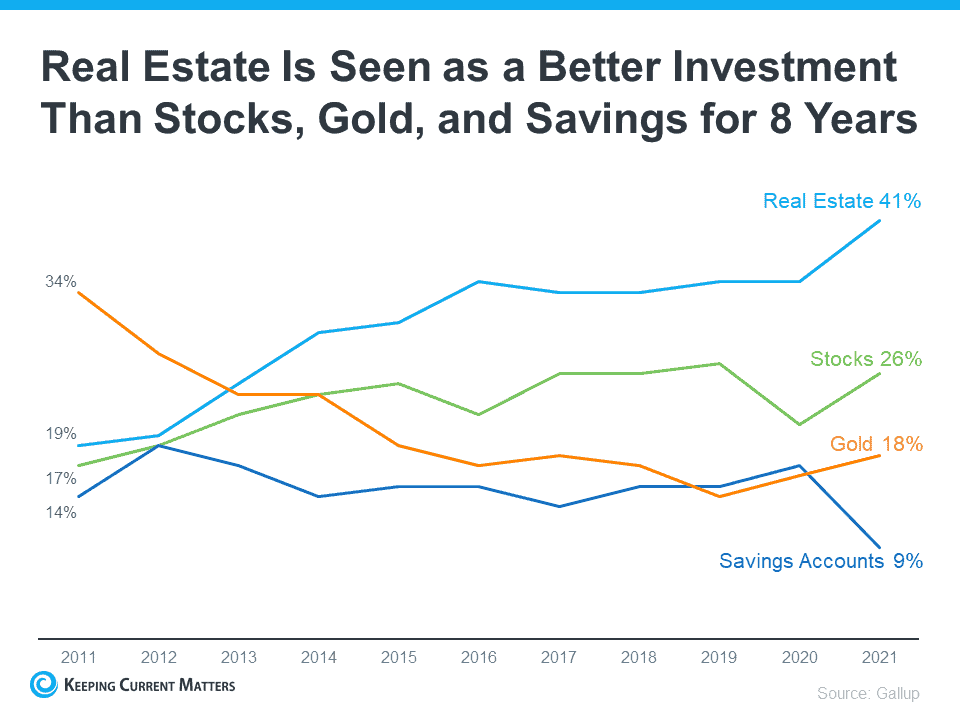

real estate IS VOTED “BEST INVESTMENT” EIGHT YEARS IN A ROW

Keeping Current Matters, 2.21.22

In a just released annual Gallup poll, Americans chose real estate as the best long-term investment. This is nothing new, since it has topped the list for the past eight years, consistently gaining traction as the best long-term investment.

It’s also not the first time you’ve read this in one of my eNewsletters, as I have been saying this myself for way more than eight years. And, as I mentioned earlier, I put my money where my mouth is, and residential real estate plays a major part in my own investment portfolio.

If you’ve even considered buying a home this year for yourself or for investment purposes, this poll should reassure you. Even when inflation is rising like it is today, Americans agree that as an investment, real estate truly shines.

Why Is real estate a Great Investment During Times of High Inflation?

With inflation at its highest level since the1980’s, it is more important than ever to understand the financial benefits of homeownership.

Rising inflation means that prices are increasing in all areas, including goods, services, housing costs and more.

However, when you purchase a home, you lock in your monthly principle and interest payments, effectively shielding yourself from increasing housing payments. Property taxes will rise, and you may incur other expenses, but a fixed-rate mortgage allows the biggest portion of monthly housing expenses to remain the same.

For renters, there is no protection against increases in housing costs, especially with rising rental prices.

History Shows During Inflationary Periods, Home Prices Rise as Well

As a homeowner, your house is an asset that typically increases in value over time, even during inflation. That’s because, as prices rise, the value of your home does as well. Therefore, buying a home is a great hedge during periods of inflation.

According to Natalie Campisi, Advisor Staff for Forbes, “Tangible assets like real estate get more valuable over time, which makes buying a home a good way to spend your money during inflationary times”.

Bottom Line?

Once more, with feeling…if you’ve even thought about buying a home for personal or investment reasons, there’s no time like NOW. Let’s get together and see how we can help increase your personal assets while better hedging against inflation.

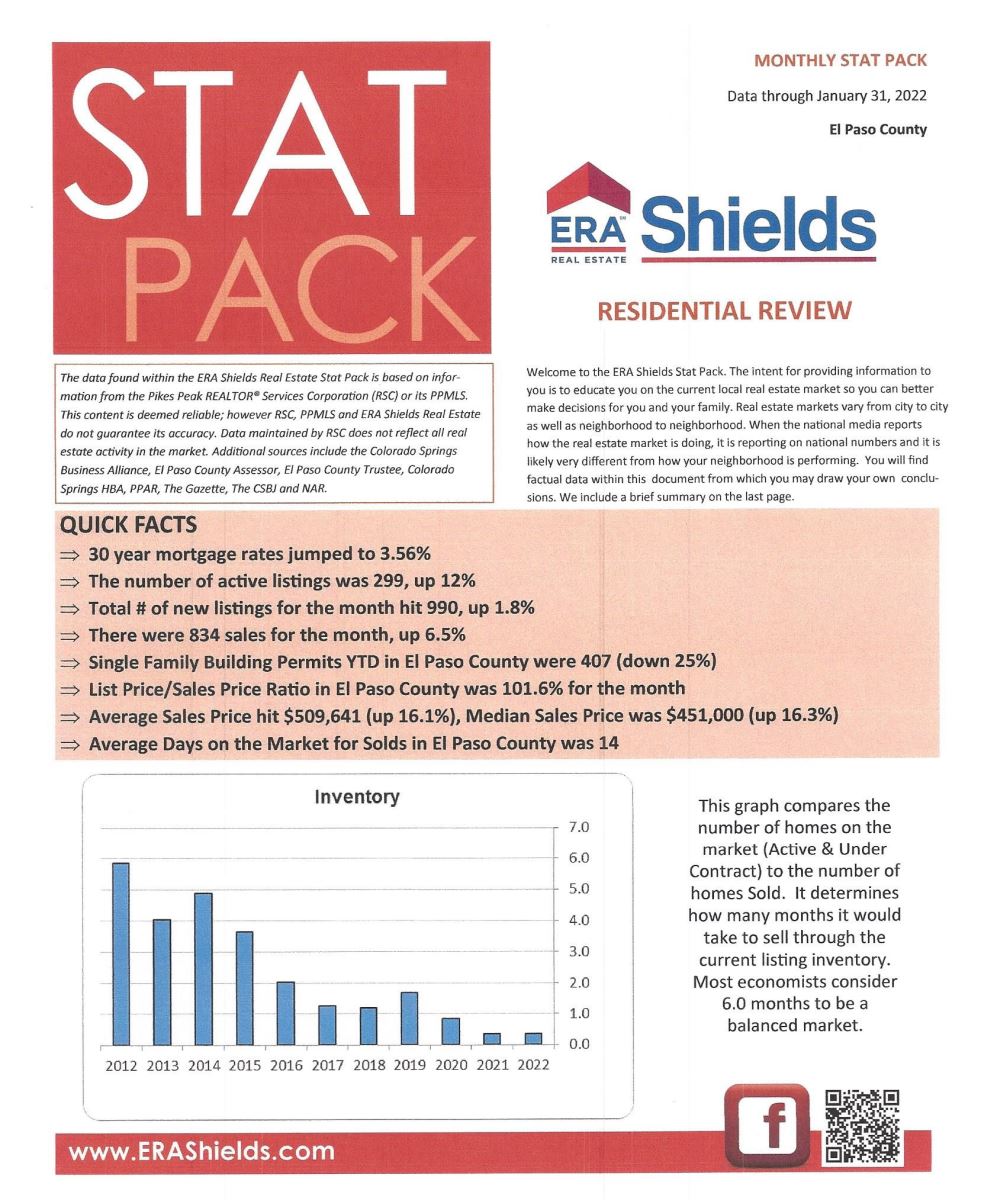

ERA SHIELDS “STAT PACK” PROVIDES A GOOD RESIDENTIAL real estate OVERVIEW

ERAShields, 1.31.22

As always, I am pleased to provide you with the most current local information. This easy-to-understand report, along with graphs, gives you a good idea of the state of local Residential real estate.

Below I’ve reprinted the first page of the report and you can click here to read the report in its entirety.