HARRY'S BI-WEEKLY UPDATE 3.6.2025

March 6, 2025

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

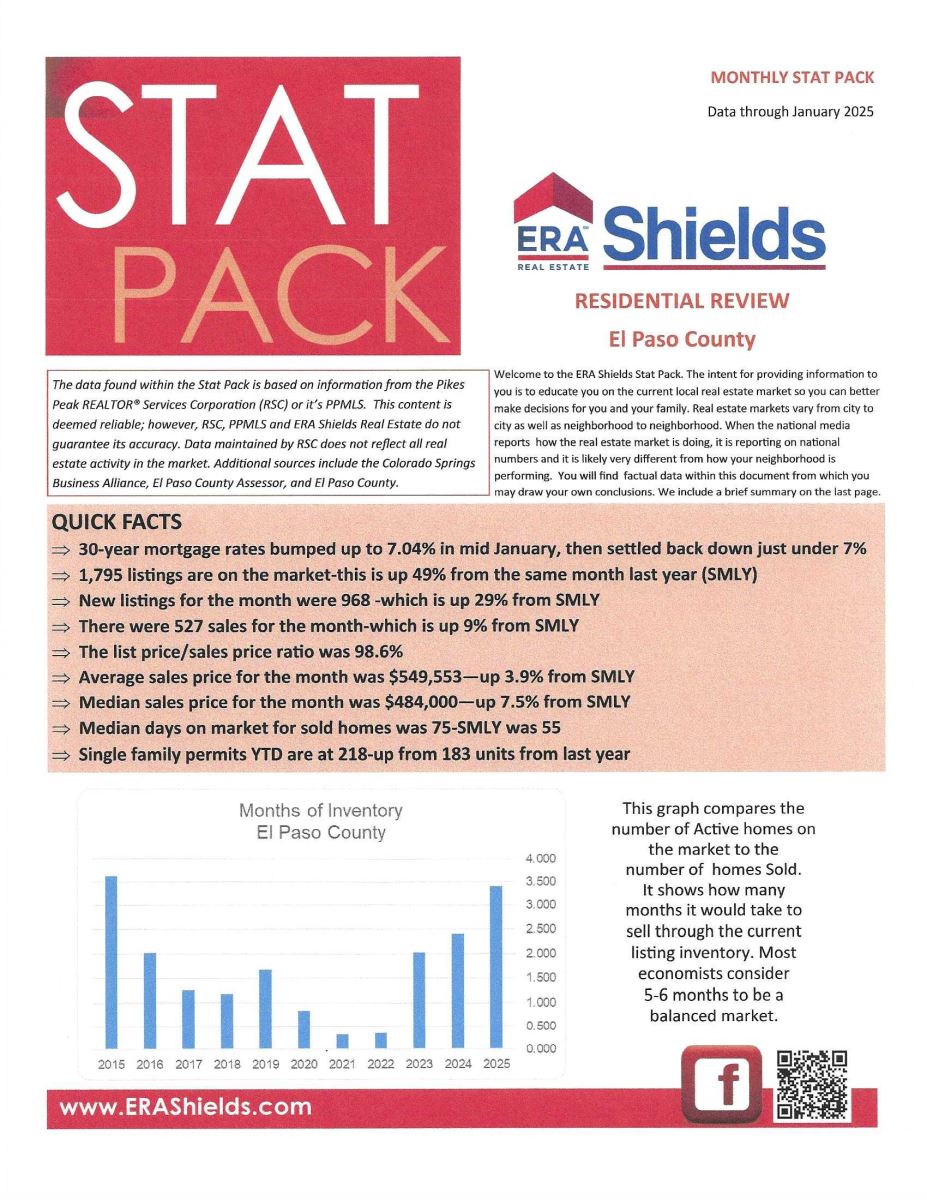

As an eternal optimist, I wish I could give you a better report for the local and national Residential real estate markets, but between the high interest rates, low inventory and not so great weather, the last few months have been awfully slow but I’m thinking it’s going to be a busier spring buying and selling season than last year.

The one thing I would like to leave with you is this. Home values are continuing to rise, although at a much slower pace than several years ago. But…. the point here is that they ARE continuing to rise.

What does that mean?

For many families, their home is their greatest financial asset, and it is continuing to earn equity for them. Over the 52 years I’ve been in Residential real estate, I’ve seen most every cycle imaginable, and I can tell you this: Long term, home values almost always continue to work in the best interest of their owners.

Over the long haul, real estate has proven to be a more predicable asset than stock or bonds and I do not see that changing.

With the tariffs recently placed on Canada, who produces a great deal of the lumber we use in the United States in homebuilding, the cost will inevitably show up in the price of newly built homes. That makes existing homes a greater commodity for those looking to buy.

And yes, there are always those looking to buy and those looking to sell. Their reasons may vary, but I’ve yet to see a time when that is not true. Some years find a much slower pace due to market conditions that include interest rates, but over the long run a home is most always a great investment in the financial future of most families.

I can’t predict where the interest rates will land this year, and at the moment they are at the lowest level in the past two months, but I don’t see them falling below 6.25% by 4th quarter of 2025 so that appears to become more the norm.

According to Danielle Hale, an economist at realtor.com, “Eighty-three percent of homeowners with an outstanding mortgage currently have a sub-6% rate and 55% have a mortgage rate under 4%.” She added that “many existing homeowners are still feeling locked in, timid to trade-up costs by taking on a new mortgage at a much higher rate.”

However, Hale does believe that will lessen over the next few months, with realtor.com predicting that 75% of outstanding mortgages likely will have a sub-6% rate by the end of 2025. “Life happens and people will need to move due to job changes or family changes…this lock-in effect will gradually fade,” she said.

My advice?

With the spring buying and selling season almost upon us, if you’re even thinking about making a move, now’s the time to talk about all things Residential real estate. With listings on the rise, and interest rates slowly dropping, the time to get a hold of me “as soon as possible” so you’ll be ahead of the traditional “busy” season.

You can reach me at 719.593.1000 or by email at Harry@HarrySalzman.com and I’ve got the answers to your questions.

And now for statistics…

FEBRUARY 2025

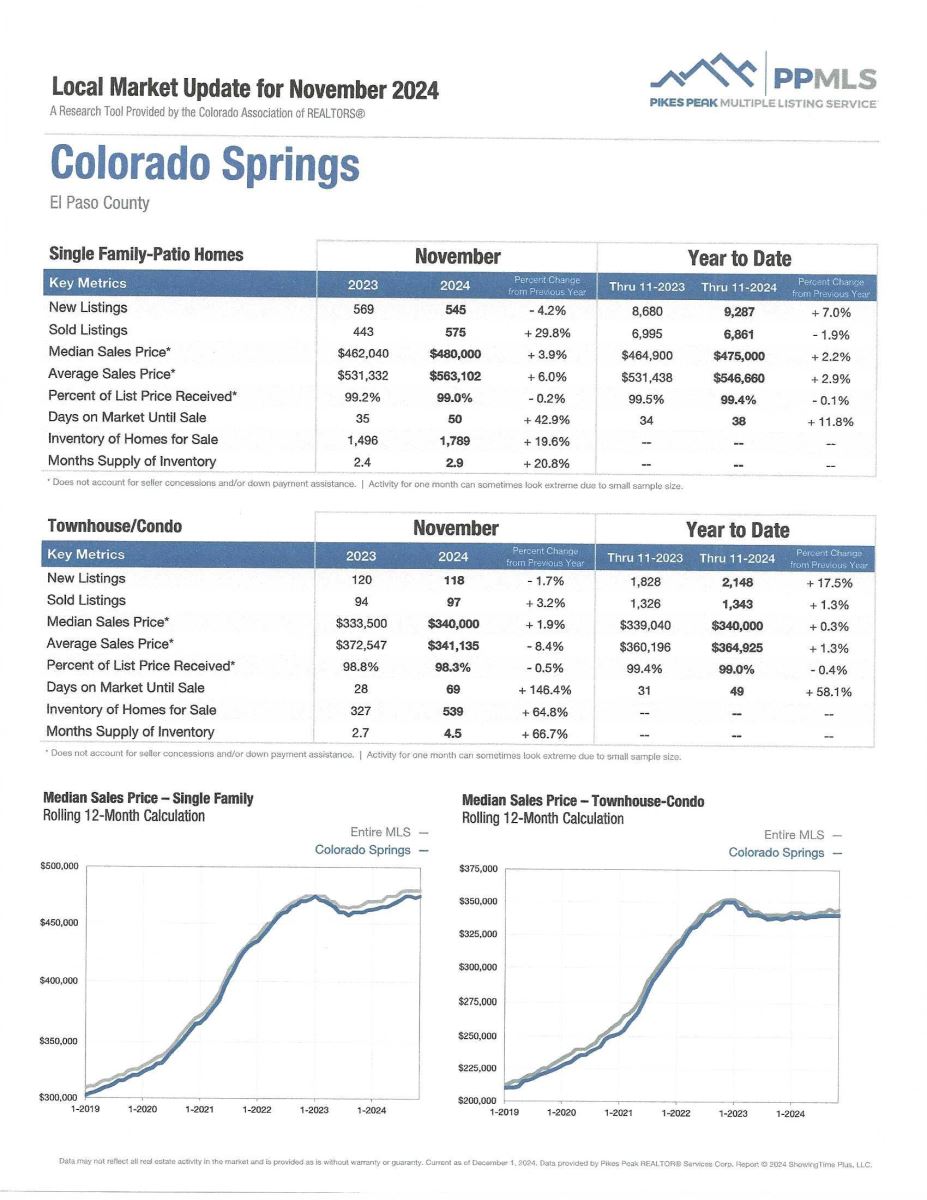

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

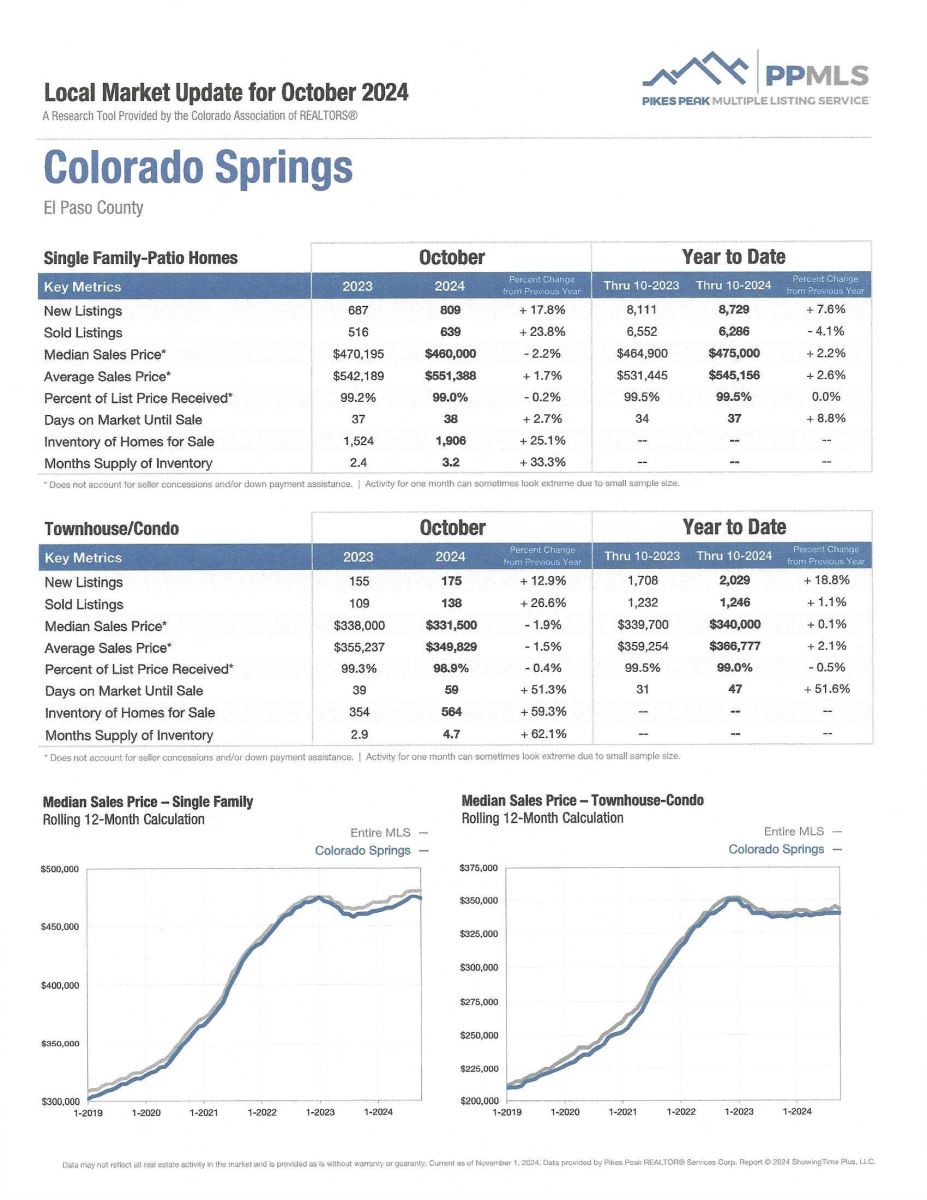

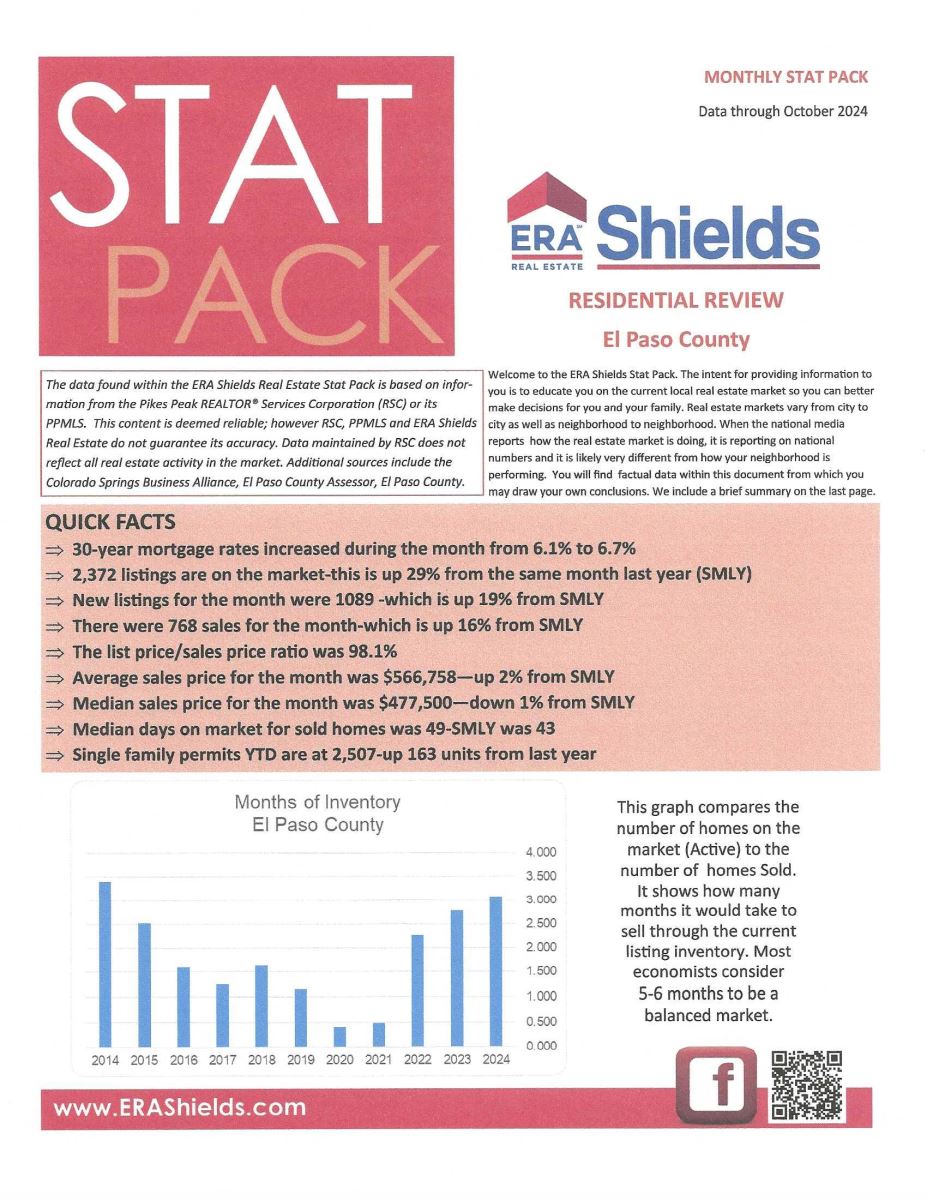

Here are some highlights from the February 2025 PPAR report. You might note that while homes are selling at close to asking price as in the past several months, the days on the market are longer.

In El Paso County, the average days on the market for single family/patio homes was 59. For condo/townhomes it was 74.

Also in El Paso County, the sales price/list price for single family/patio homes was 99.0% and for condo/townhomes it was 98.0%.

In Teller County, the average days on the market for single family/patio homes was 88 and the sales/list price was 98.4%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing February 2025 to February 2024 for All Homes in PPAR:

Single Family/Patio Homes:

- New Listings were 1,181, Up 3.4%

- Number of Sales were 730, Down 7.8%

- Average Sales Price was $544,170, Up 6.4%

- Median Sales Price was $473,500, Up 3.8%

- Total Active Listings are 2,425, Up 32.5%

- Months Supply is 3.3

Condo/Townhomes:

- New Listings were 191, Up 2.1%

- Number of Sales were 98, Down 25.2%

- Average Sales Price was $343,873, Down 6.0%

- Median Sales Price was $325,000, Down 3.0 %

- Total Active Listings are 494, Up 40.7%

- Months Supply is 5.0

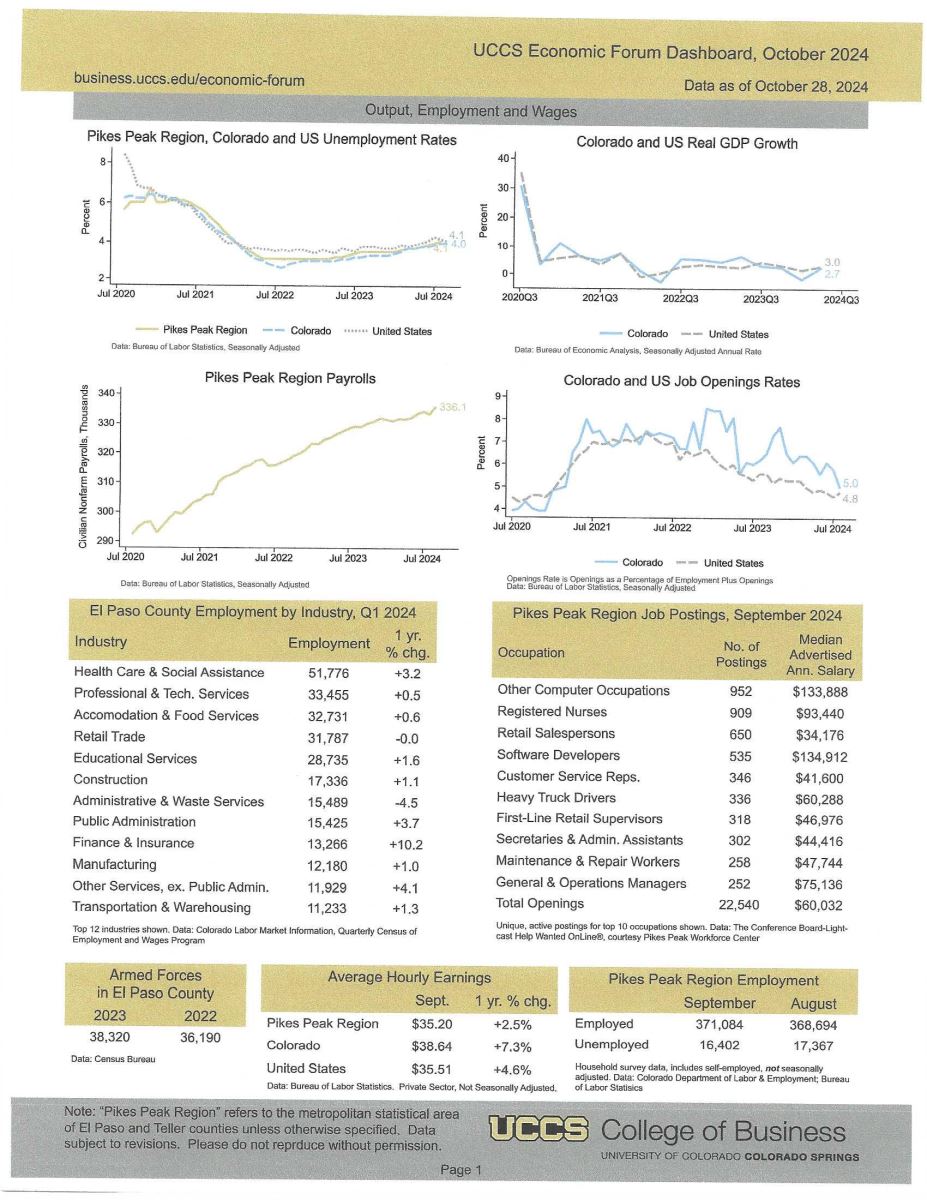

FEBRUARY 2025 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year-to-Date one-year change:

- Sold Listings for All Properties were Down 9.0%

- Median Sales Price for All Properties was Up 3.0%

- Active Listings on All Properties were Up 26.2%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering in order to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

.jpg)

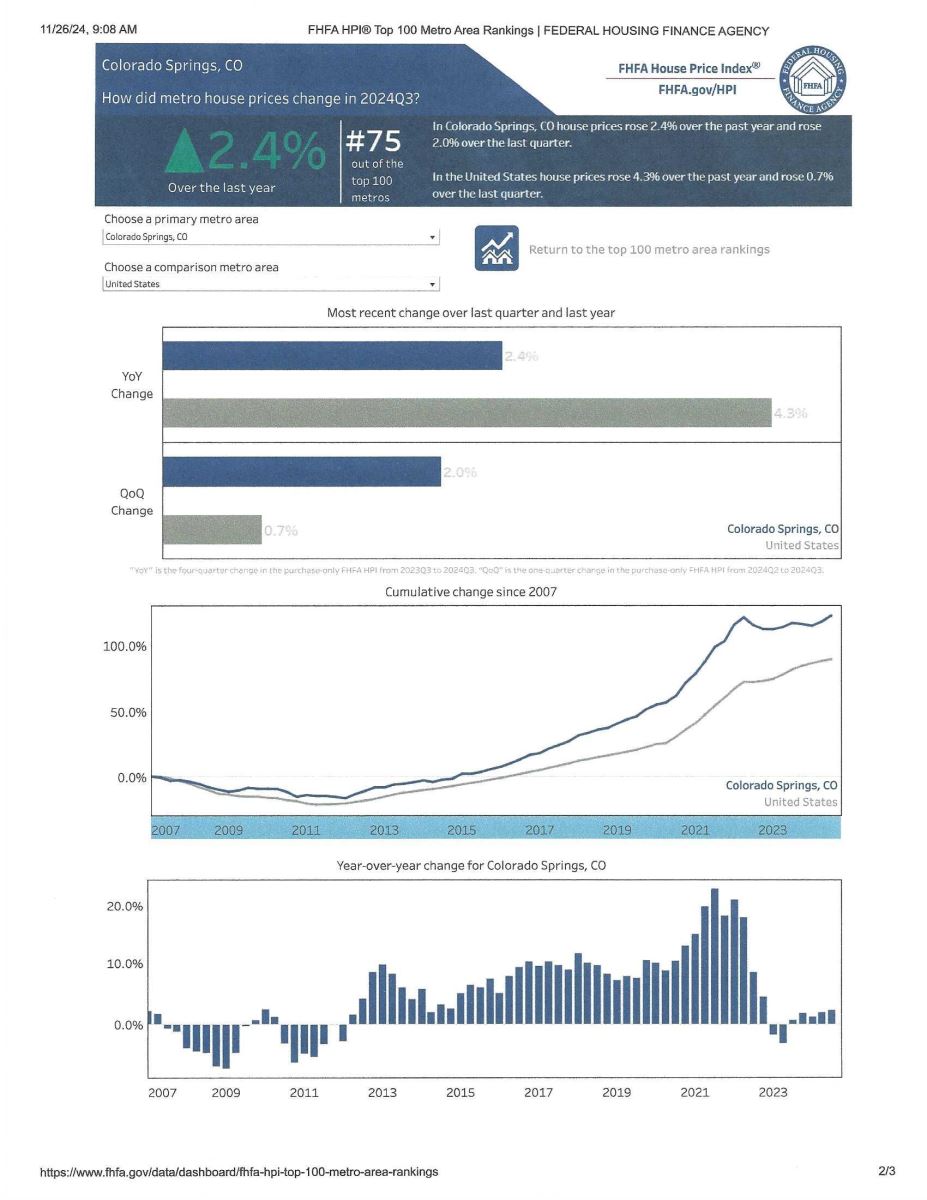

COLORADO SPRINGS HOME PRICES CONTINUE TO RISE, ALTHOUGH AT A SLOWER PACE, IN LAST QUARTER 2025

The National Association of Realtors, 1.2025

Home prices finished strong in 2024, data from the National Association of Realtors (NAR) shows. But in the last five years alone, median home prices have jumped 50%.

As I mentioned at the start of this eNewsletter, property owners are getting richer as home prices prove resilient against lower home sales. Nearly 90% of measured metro areas registered home price increases in the final quarter of 2024, according to the latest housing data from NAR.

Fourteen percent of the 226 metros tracked posted double-digit price gains, up from 7% in the third quarter.

Compared to a year ago, the national median single-family existing-home price climbed 4.8% to $410,100.

The median price of single-family homes in Colorado Springs rose 1.0% to $464,100 during the last quarter of the year, per NAR. This price reflects detached, single-family and patio homes but not townhomes or condominiums.

The median price in the Springs ranked 48th highest of the 226 cities surveyed. With more inventory and lower interest rates we would undoubtedly rank even higher.

According to NAR economist Lawrence Yun, “record high home prices and the accompanying housing wealth are definitely good news for property owners, however renters who are looking to transition into homeownership face significant hurdles.

The high home prices are making it difficult for real estate newcomers to save up for a down payment. Still, FOMO (fear of missing out) may be setting in for those would-be homeowners as wealth accumulation for homeowners far outpaces that of renters as we discussed earlier.

To see all 226 metro areas in alphabetical order, please click here. To see them in ranking order, click here. Or click here to see what income levels are required to purchase homes based on either a 5, 10 or 20 percent down-payment.

If you have any questions, please give me a call.

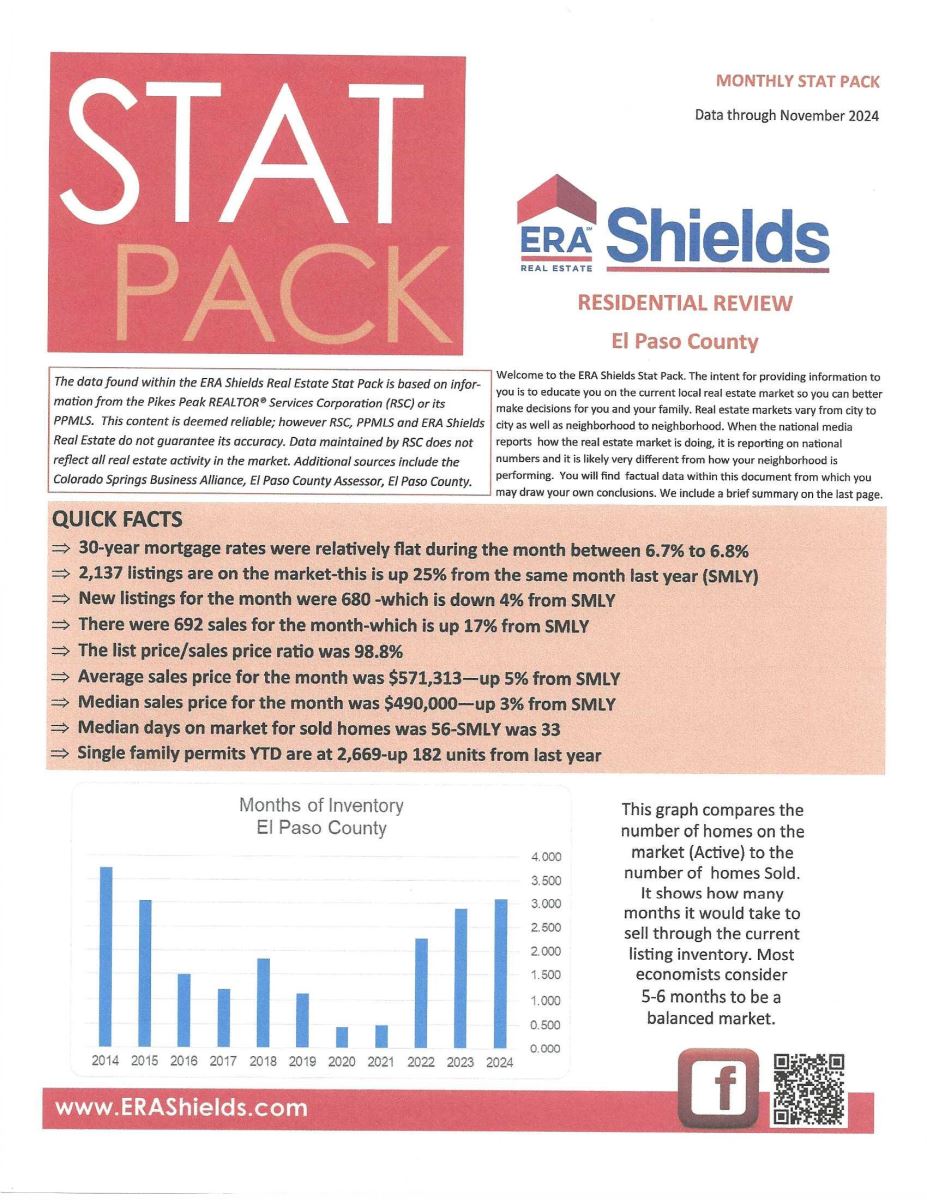

HOME BUYERS ARE FINALLY GETTING THE UPPER HAND AGAIN

The Wall Street Journal, 2.23.25

Home buyers are having the most leverage over sellers in years.

The bidding wars of the past half-decade are fading in most parts of the country and instead, today’s buyers say they are finding sellers willing to lower prices or throw in extras to sweeten the deal. Nationally, the average home is now changing hands for 2% less than the price on the listing, according to real estate brokerage Redfin.

Behind this shift in power balance is the growing supply of homes in some markets. Nationally, new listings increased in January by almost 5% compared to last year which by one measure, is more for-sale homes than at any point in six years.

And, Colorado Springs had a 32.5% increase in active listings year over year in February.

At the same time, though, demand is easing because many would-be buyers are deciding not to purchase at today’s prices, which are up sharply from a few years ago.

A dearth of buyers has slowed down the housing market. Nationally, existing home sales fell 4.9% in January from the prior month to a seasonally adjusted annual rate of 4.08 million, the National Association of Realtors (NAR) said last week. Last year, home sales fell to the lowest level since 1995 for the second straight year.

And prices continue to rise as you can see from the local statistics.

With mortgage rates at 6.75% as of today, this adds a considerable amount to the monthly payment compared to just a few years ago. And the costs of insurance, property tax and homeowners association fees have been rising briskly as well.

Sellers have been sitting in a fantasy thinking their homes will sell as fast as they did several years ago.

And that’s where buyers can find wiggle room for greater negotiation.

It’s still a slow dance so to speak, but with someone like me in your corner, if you’re ready to buy, I’m ready to help you find a way to do it that’s best for your individual situation.

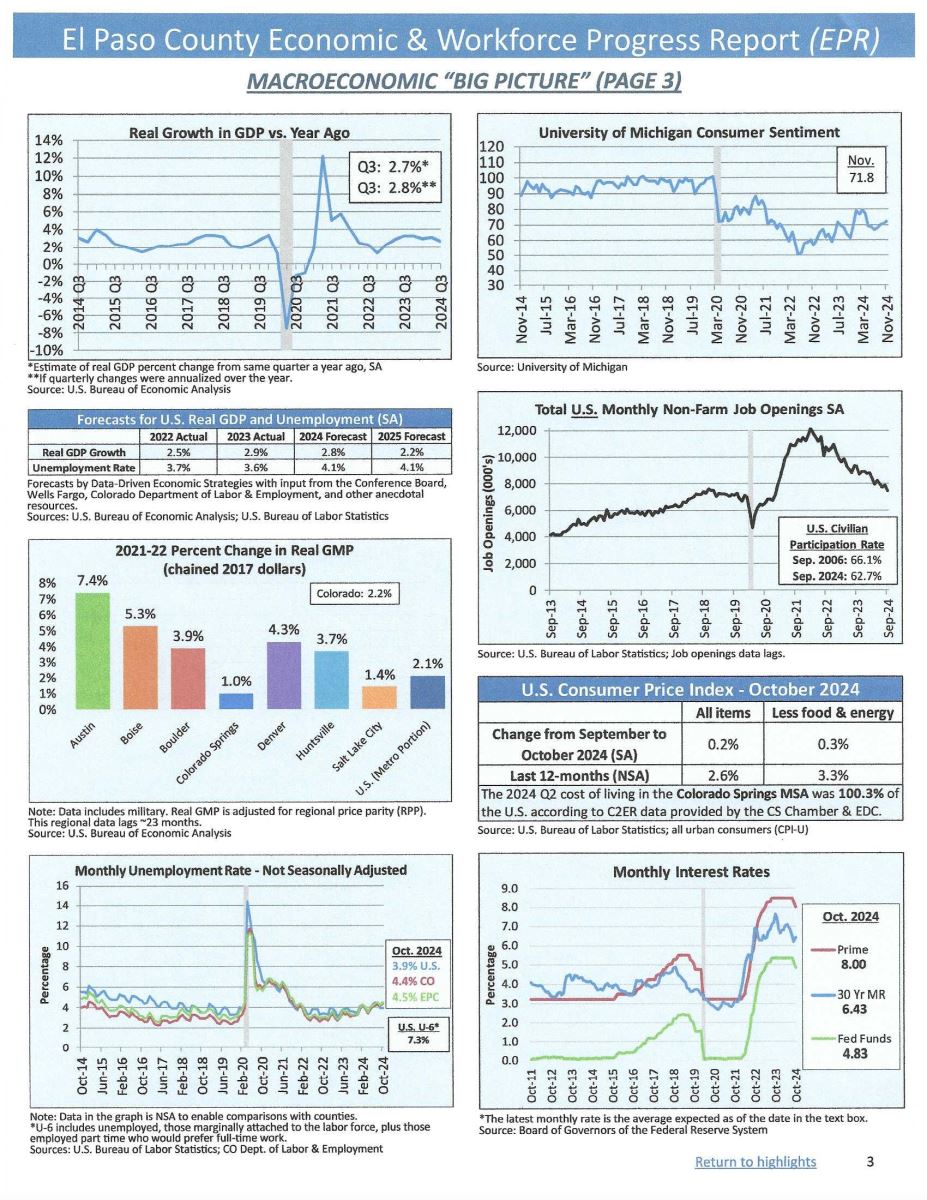

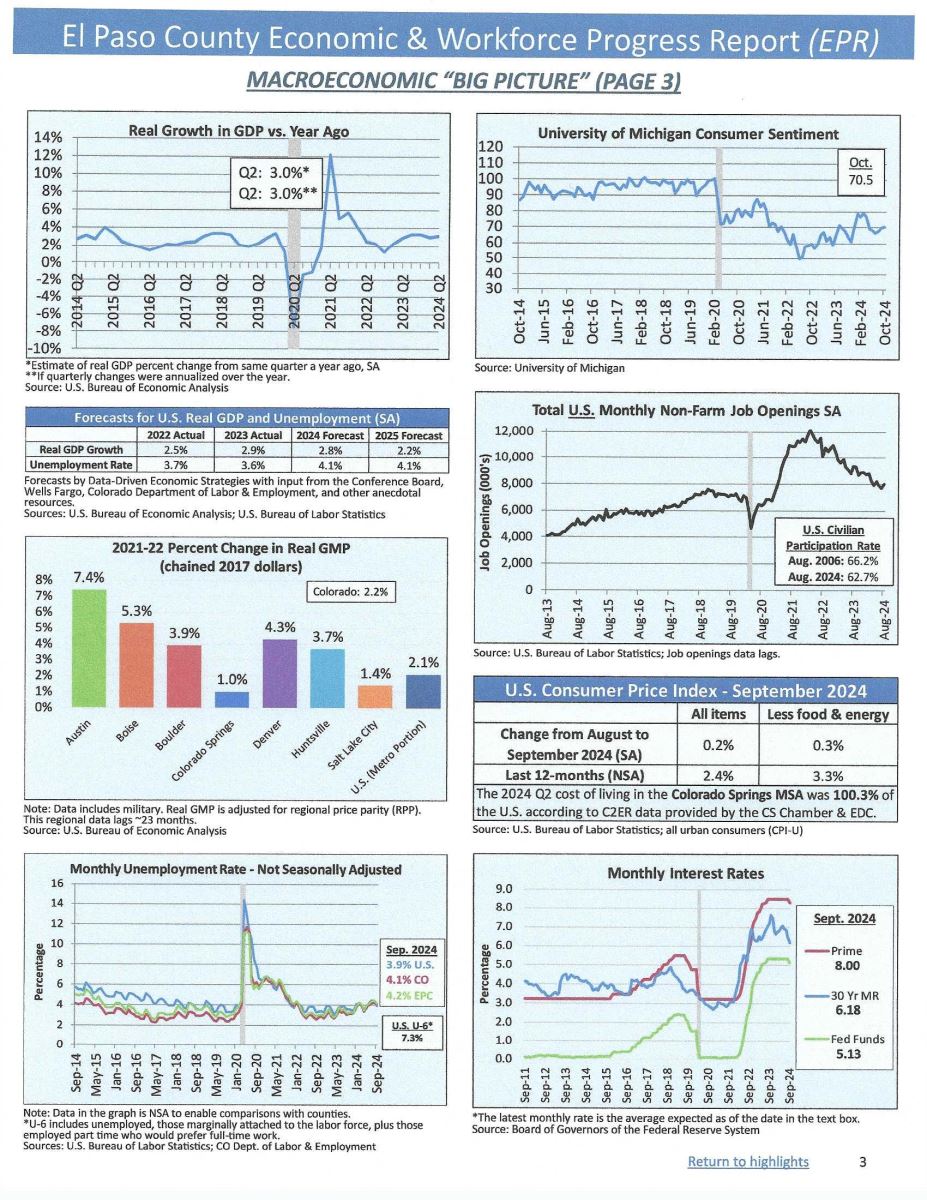

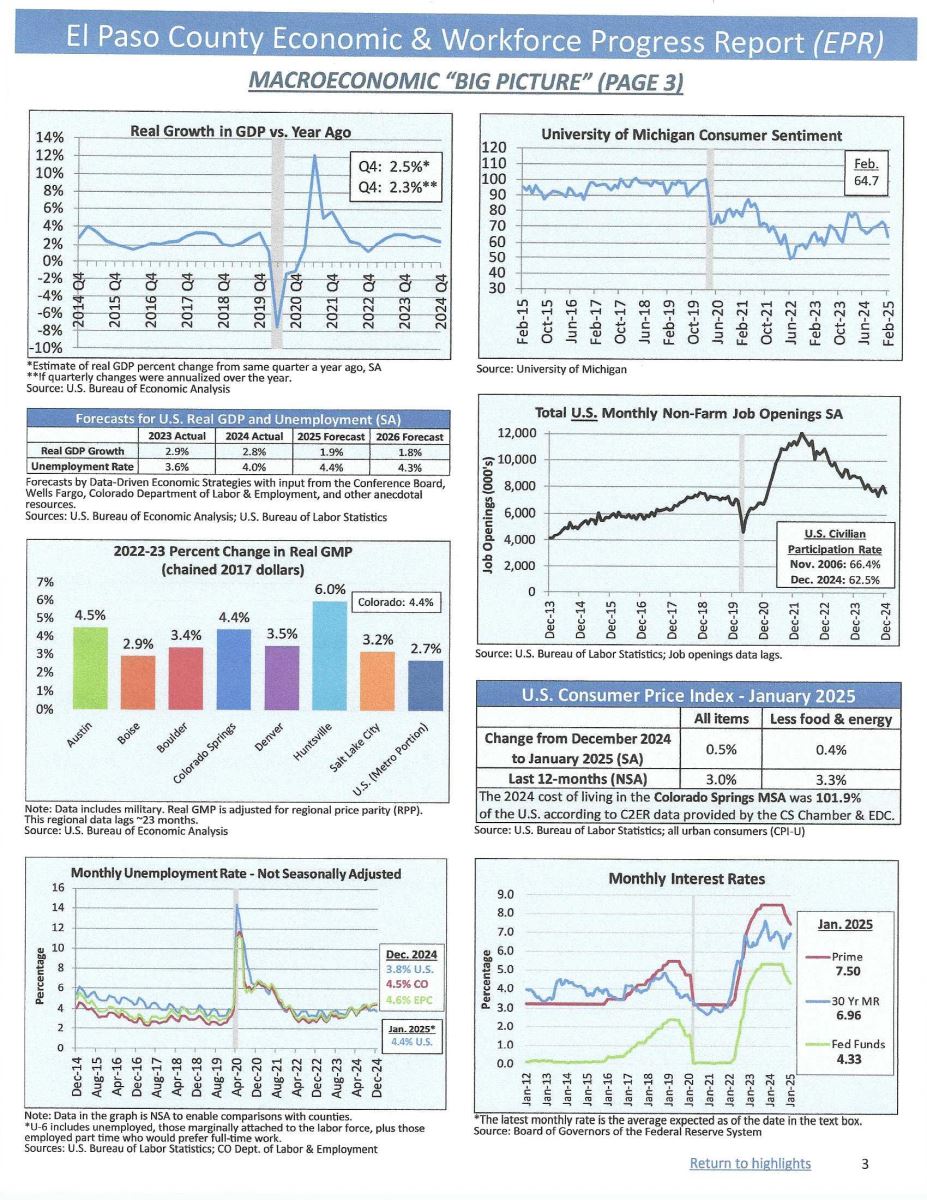

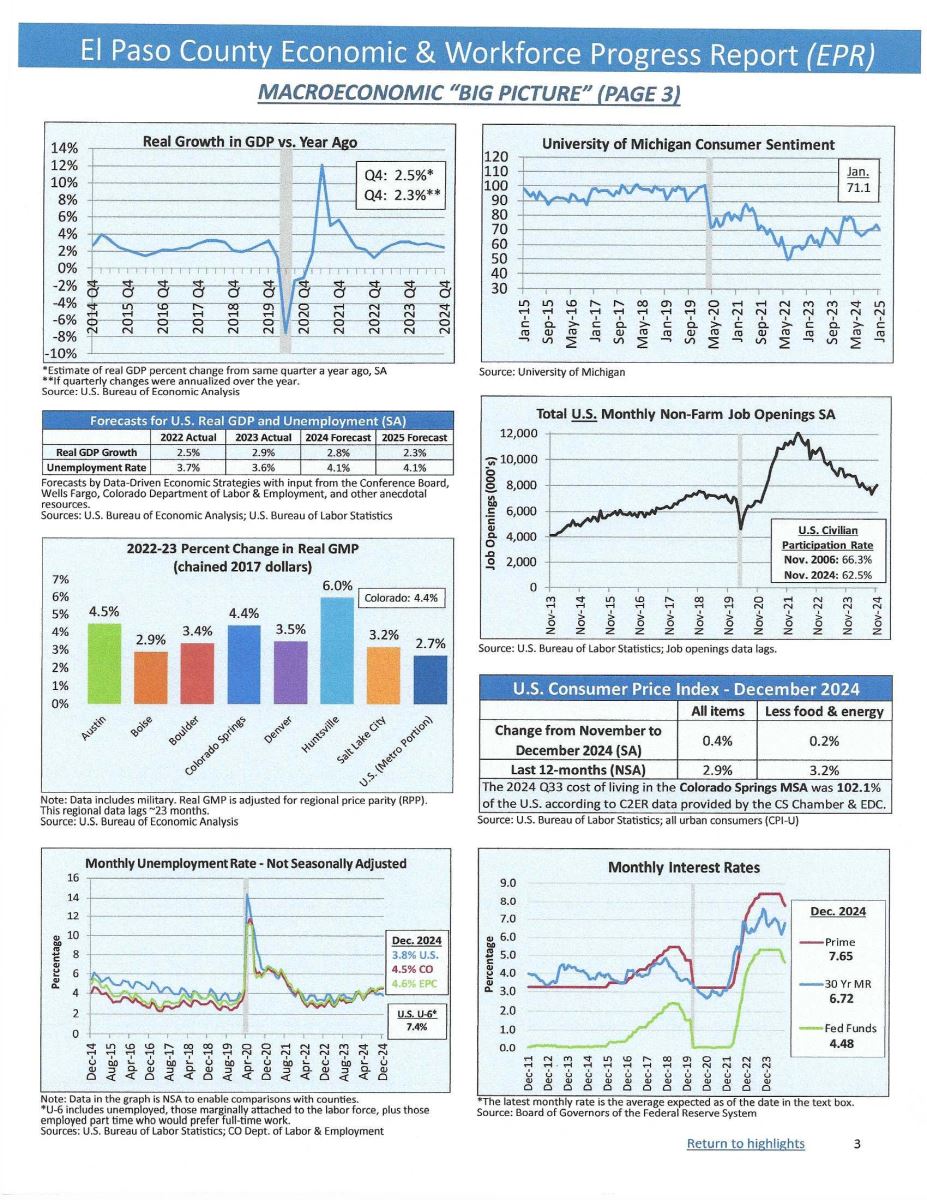

ECONOMIC & WORKFORCE DEVELOPMENT REPORT

Data-Driven Economic Strategies, February 2025

As always, I like to share the useful data I receive from our “local economist”, Tatiana Bailey. You will see in these charts what’s happening locally in terms of the economy as well as the most recent Workforce Progress Report.

This information is especially invaluable to business owners; however, I know you all will all find it worthwhile reading.

Below is a reproduction of the first page of graphics. To access the full report, please click here. And if you have any questions, give me a call.

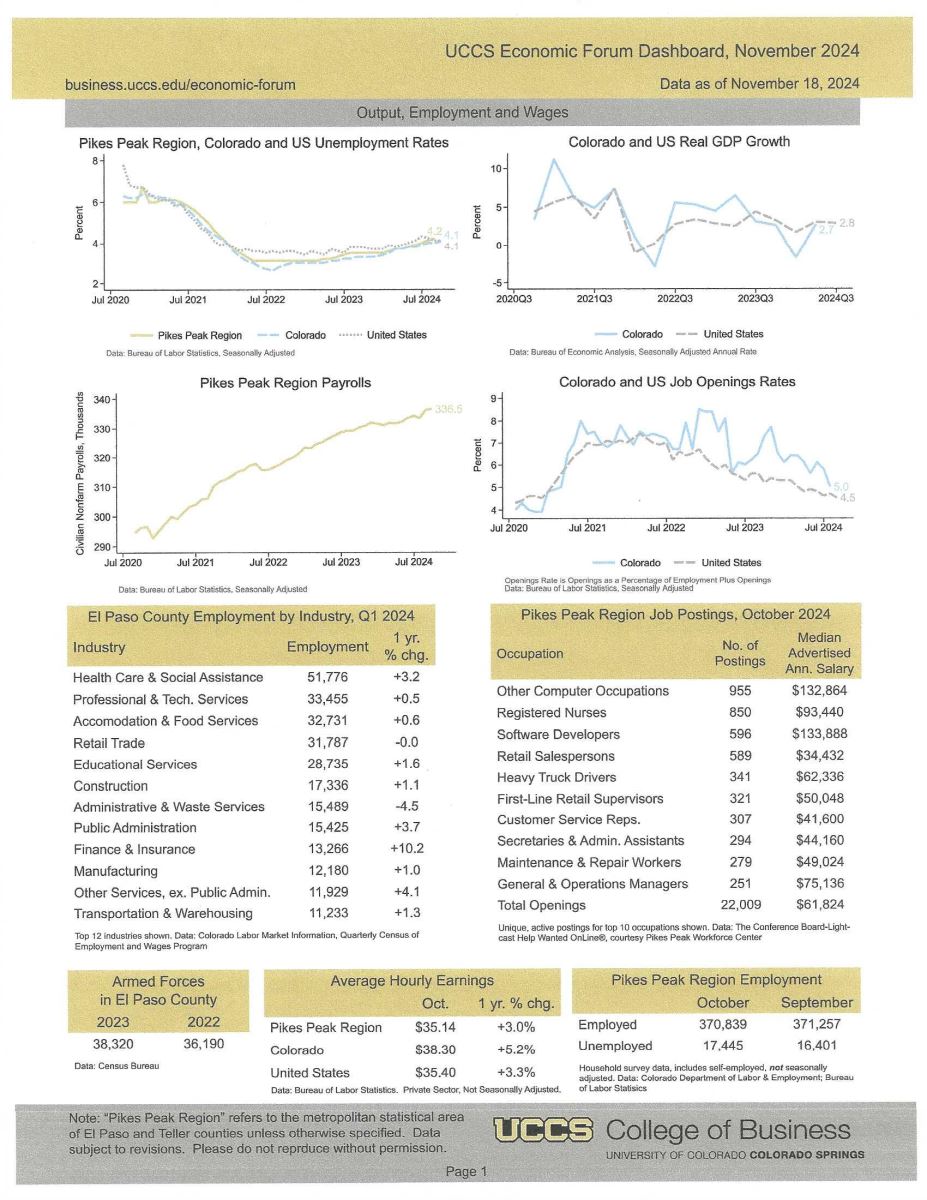

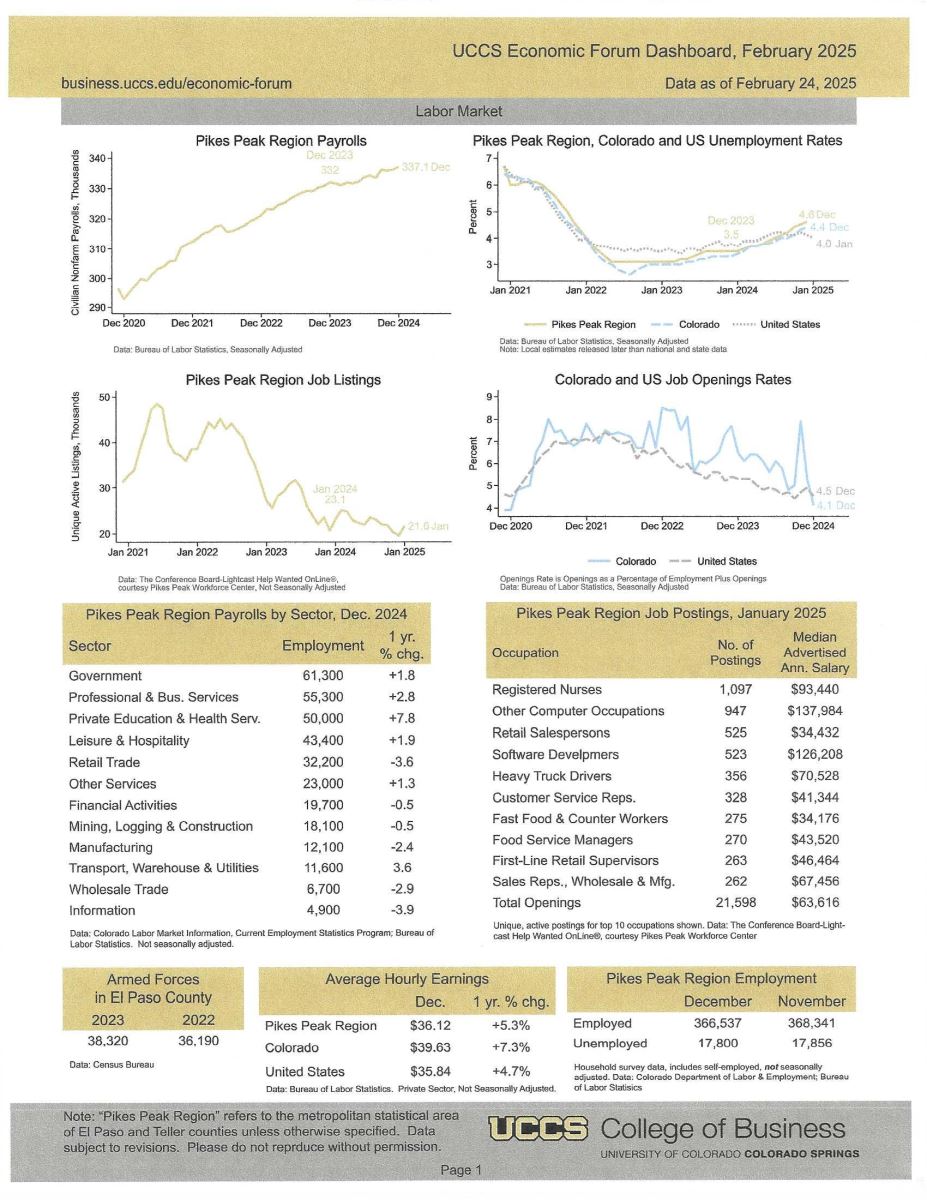

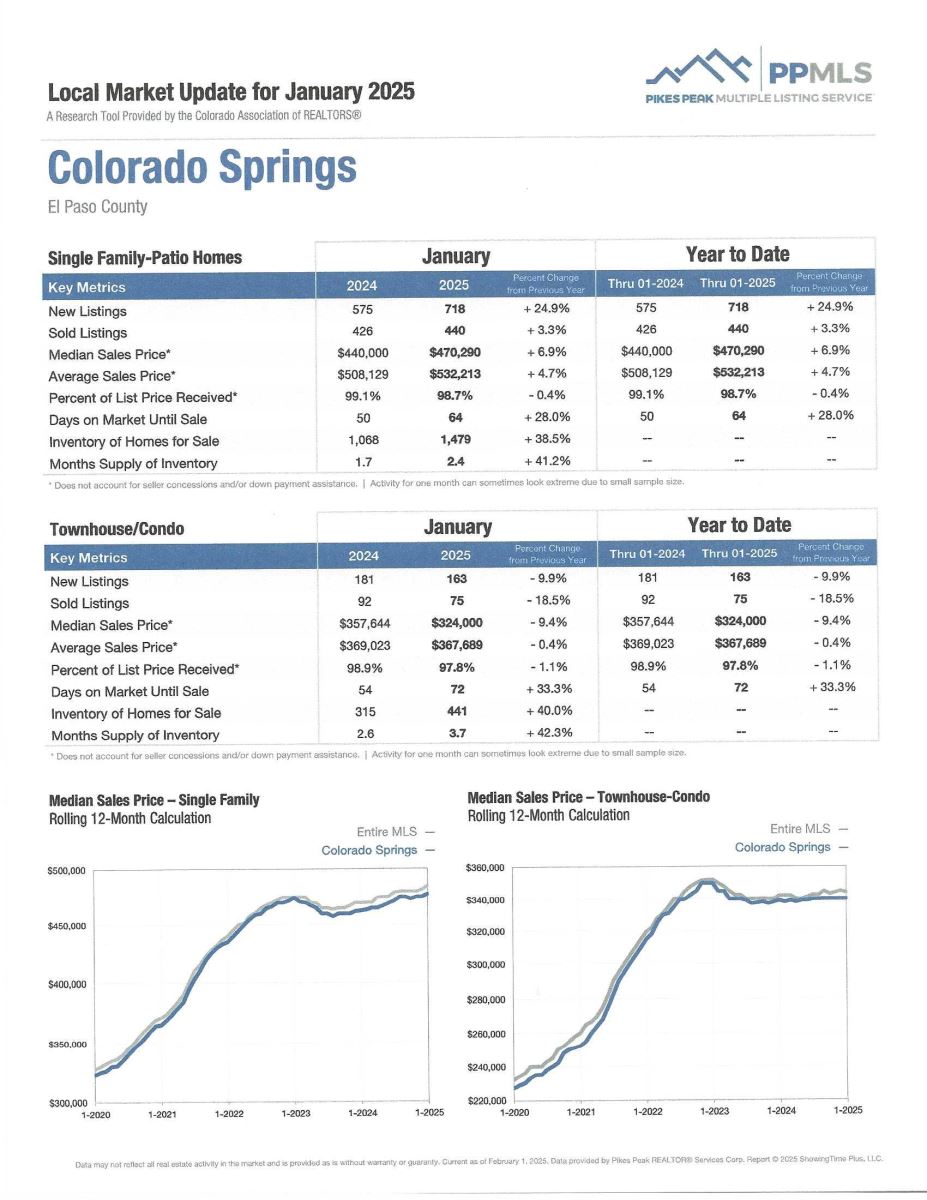

UCCS ECONOMIC FORUM MONTHLY DASHBOARD

Updated February 2025, UCCS College of Business/Economic Forum

Here is the monthly report from the UCCS College of Business Economic Forum. It is created by professor Dr. Bill Craighead, who is the Forum Director. He also publishes an on-line “Weekly Economic Snapshot” you might enjoy.

I know several of you who like statistics and use this information in your daily business life, and I will share it with you when I receive it each month.

I’ve reproduced the first page of the charts below. To access the report in its entirety, please click here.

.png)

.jpg)

.jpg)

.jpg)

.jpg)