HARRY'S BI-WEEKLY UPDATE 8.24.23

August 24, 2023

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

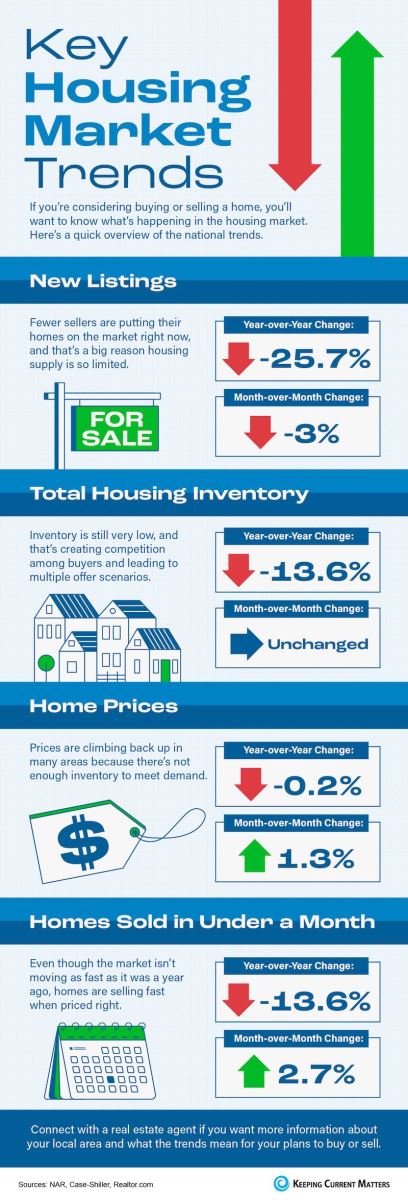

YES, MORTGAGE RATES MAY BE RISING, BUT HOMES PRICES ARE TOO…

It’s somewhat of a mixed bag of stories about Residential real estate of late.

Yes, mortgage rates have hit their highest point in 20 years, however, compared to the not so terribly distant past, they aren’t so high.

And what does this mean to you as a potential buyer or seller?

While August was a very slow month nationally and I’m guessing here as well, you would not know it from my recent sales activity. I’ve had a very busy quarter and the inquiries keep on coming.

As I’ve said time and again, all Residential real estate must be looked at on a LOCAL level, and as you are probably aware, Colorado Springs is on a roll in attracting new employers and with them relocated employees who are looking for homes.

Plus, the relatively higher income and education levels of our folks here makes it easier for them to realize that waiting for lower interest rates or lower home prices is not necessarily the smartest move.

While interest rates are considerably higher than they were, with home prices continuing to rise, today’s buyers will be able to refinance when rates go down over the next few years.

With fewer homes for sale at present, listing your home today will afford it greater visibility than when there was a surplus of homes for sale.

It can be a bit complicated, but that’s not a problem for you, because you have me. My long-time experience in the local market, coupled with my Investment Banking background, makes me an asset to you when you are looking to buy or sell, even in this unusual market.

If you’ve even been thinking about a move, please give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let’s get together and see how together we take your wants, needs and budget requirements to make your Residential real estate dreams come true.

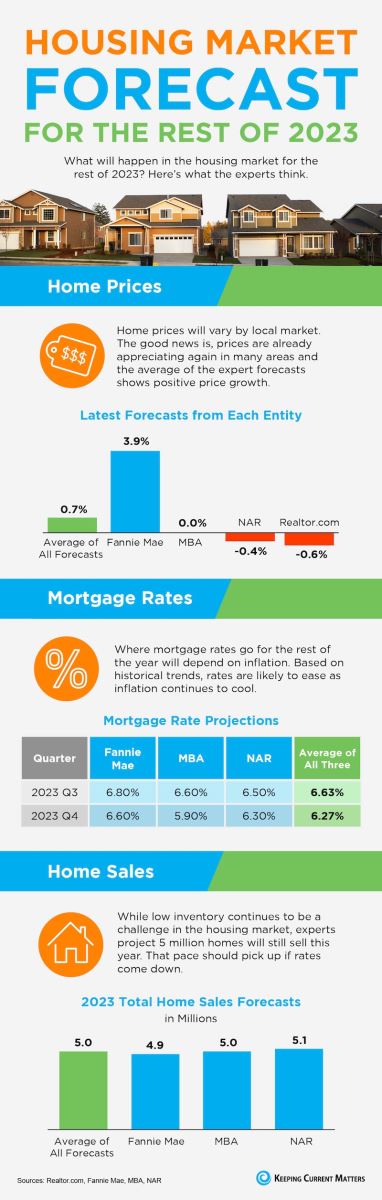

HOME PRICES ARE RISING AGAIN

Keeping Current Matters, 8.11.23

Some Highlights:

- Looking at monthly home price data from six expert sources shows the worst home price declines are behind us, and they’re rising again nationally.

- If you’ve waited to move on to a new home because you were worried about home prices crashing, this rebound is good news.

- Call me sooner than later so we can discuss whether this is a good time for you to realize your Residential real estate dreams.

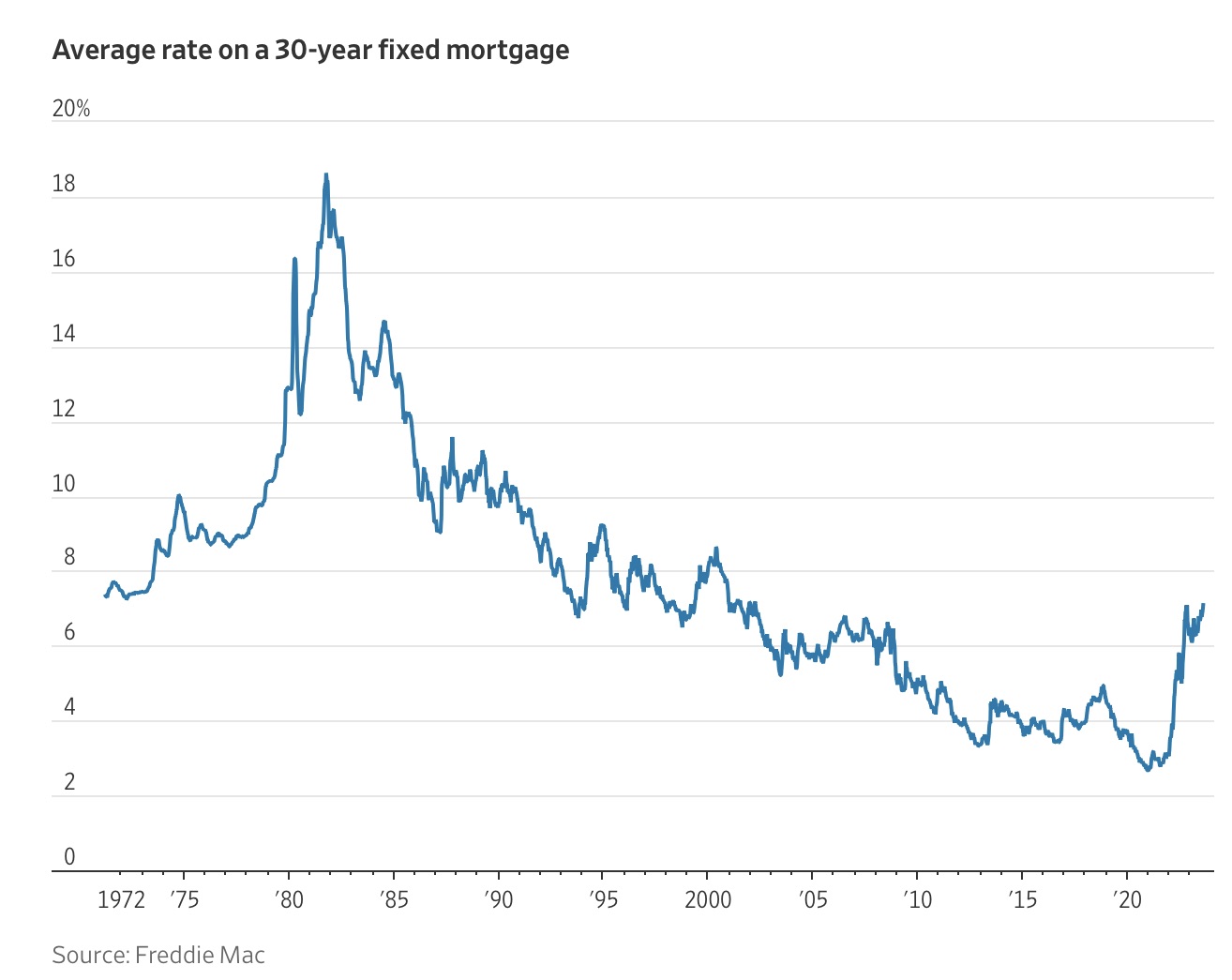

MORTGAGE RATES HIT HIGHEST LEVEL IN MORE THAN 20 YEARS

The Wall Street Journal, 7.19.23

While last week was the first time since last fall that the mortgage interest rate has risen above 7%, it is far below rates that I can still remember and in fact. One of the first homes I purchased was financed with a loan of 8.5%.

Here is a look at the average rate on a 30-year fixed mortgage since 1972:

This news can be disconcerting for some, but as I mentioned earlier, with home prices also starting to rise once again, there are ways to make this market work for you.

It all begins with a call to me, so if you’ve even wondered how this can work give me a holler.

AND THE MAIN REASON MORTGAGE RATES ARE SO HIGH?

Keeping Current Matters, 6.7.23

Since mortgage rates are the biggest concern of most homebuyers at the moment, I thought I’d try to answer some questions I’ve been asked:

- Why are Mortgage Rates so high?

- When will Rates go back down?

Why Are Mortgage Rates So High?

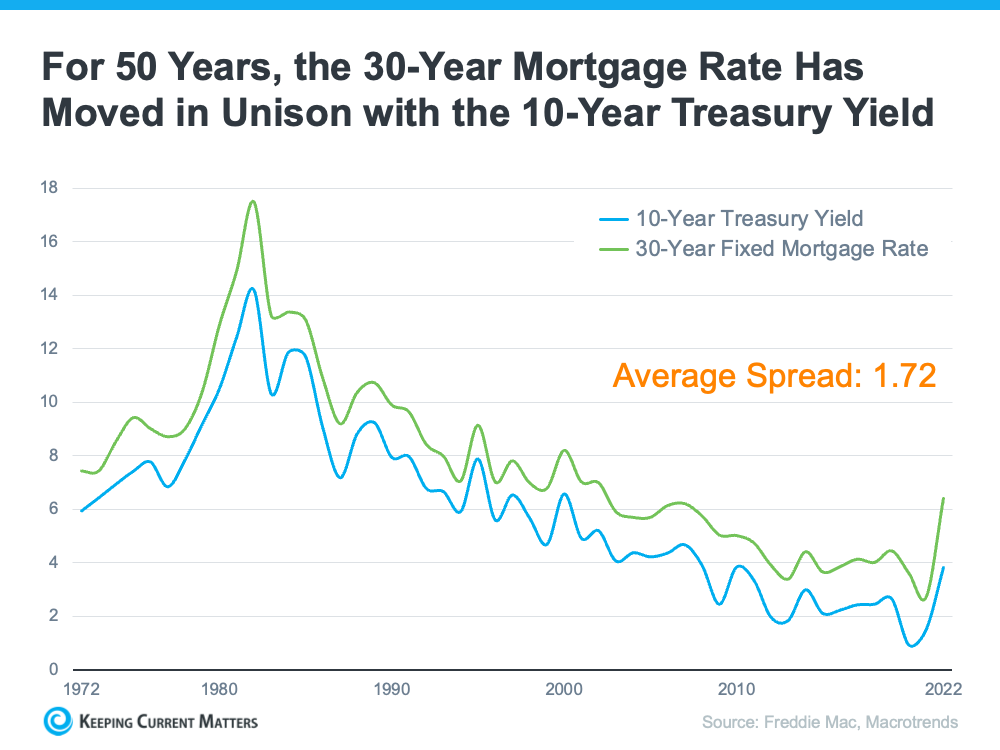

The 30-year fixed-rate mortgage is largely influenced by the supply and demand for mortgage-backed securities (MBS). And according to Investopedia:

“Mortgage-back securities (MBS) are investment products similar to bonds. Each MBS consists of a bundle of home loans and other real estate debt bought from the banks that issue them…The investor who buys a mortgage-backed security is essentially lending money to home buyers.”

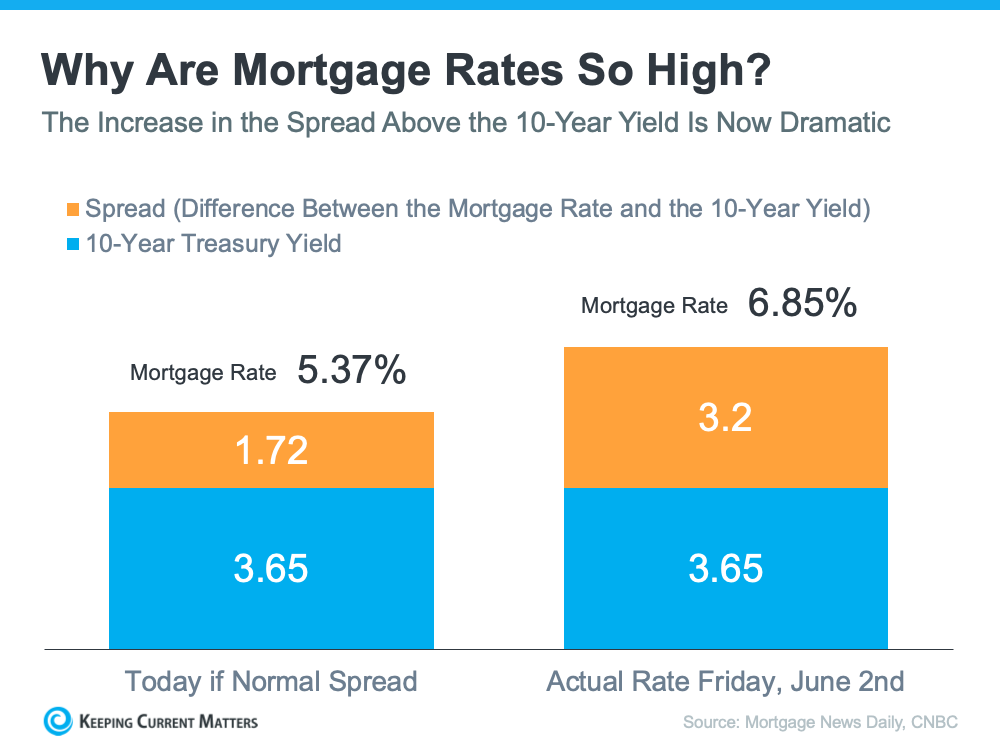

Demand for MBS helps determine the spread between the 10-Year Treasury Yield and the 30-year fixed mortgage rate. Historically, the average spread between the two is 1.72 (see chart below):

In early June of this year the mortgage rate was 6.85%. That means the spread was 3.2% which is almost 1.5% over the norm. If the spread was at its historical average, mortgage rates would have been 5.367% (3.65% 10-Year Treasury Yield + 1.72% spread).

This large spread is unusual. As George Ratiu, Chief Economist at Keeping Current Matters explains:

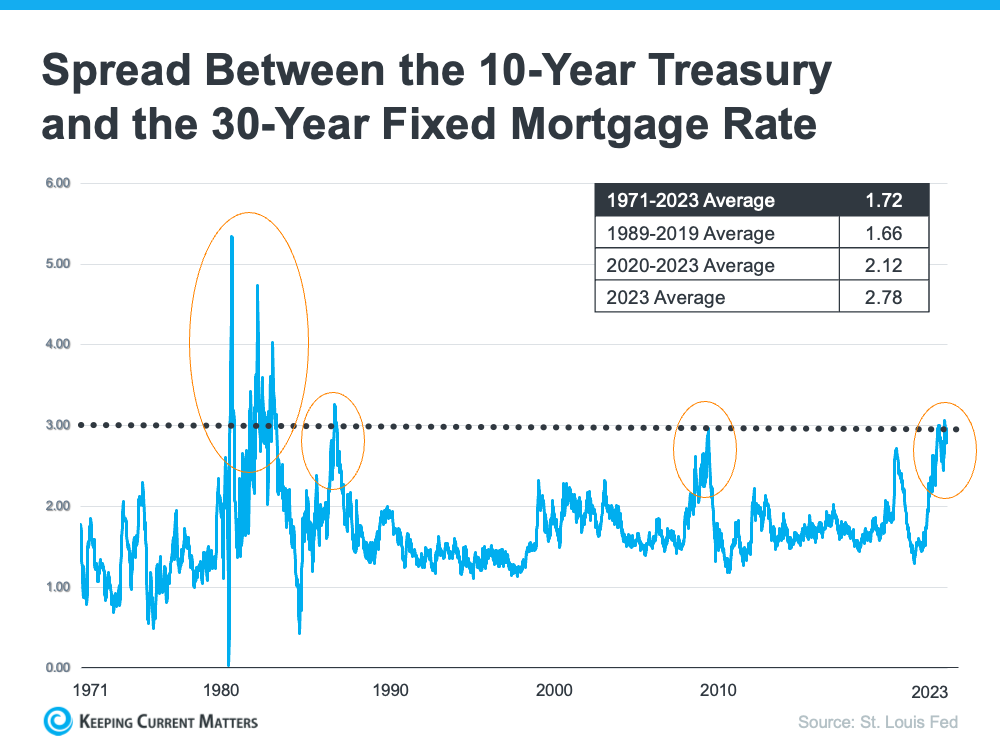

“The only times the spread approached or exceeded 300 basis points were during periods of high inflation or economic volatility, like those seen in the early 1980’s or the Great Financial Crisis of 2008-09.”

The graph below uses historical data to help illustrate this point by showing the few times the spread has increased to 300 basis points or more:

The graph shows how the spread has come down after each peak. The good news is that means there’s room for mortgage rates to improve today.

So, what’s causing the larger spread and making mortgage rates so high today?

The demand for MBS is heavily influenced by the risks associated with investing in them. Today, that risk is impacted by broader market conditions like inflation and a fear of a potential recession, the Fed’s interest rate hikes to try to bring down inflation, headlines that create unnecessarily negative narratives about home prices, and more.

Simply put—when there’s less risk, demand for MBS is high, so mortgage rates will be lower. On the other hand, if there’s more risk with MBS, demand for MBS will be low, and we’ll see higher mortgage rates as a result. Currently, demand for MBS is low, so mortgage rates are high.

When Will Mortgage Rates Go Back Down?

Odeta Kushi, Deputy Chief Economist at First American, answers that question in a recent blog:

“It’s reasonable to assume that the spread and, therefore mortgage rates will retreat in the second half of the year if the Fed takes its foot off the monetary tightening pedal and provides investors with more certainty. However, it’s unlikely that the spread will return to its historical average of 170 basis points, as some risks are here to stay.”

Bottom Line

The spread will shrink when the fear investors feel is eased. That’ll mean we should see mortgage rates moderate as the year goes on. However, when it comes to forecasting mortgage rates, no one can know for sure exactly what will happen.

And all of that said…I’m sure I lost some of you a few paragraphs back. To me, with my Investment Banking background, it’s second nature, but I do understand that it’s tough to put it in layman’s terms. If you have any questions, you know where to find me.

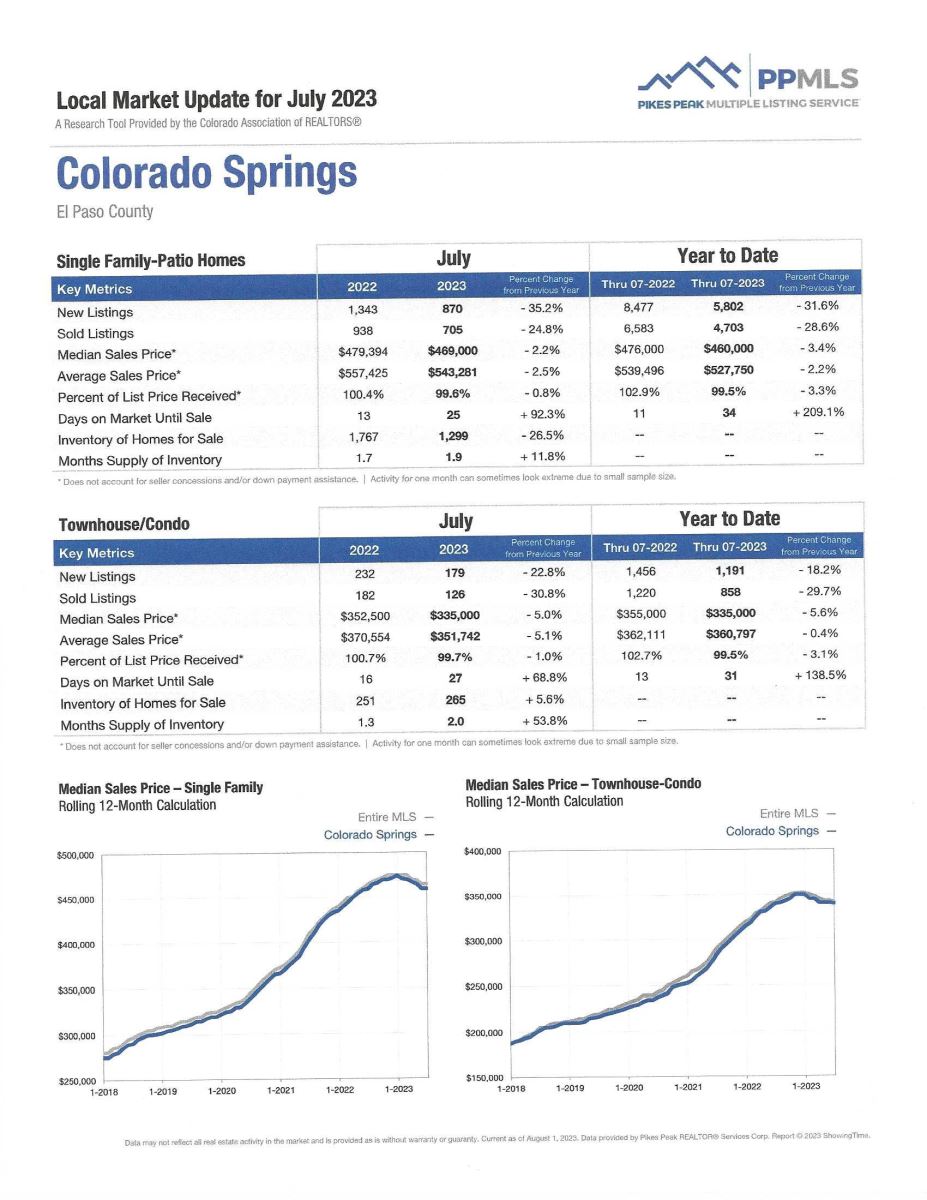

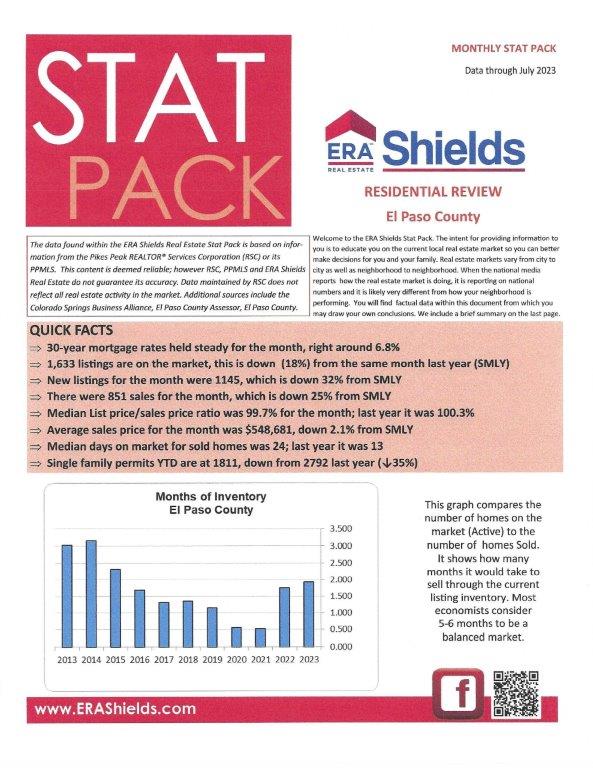

ERA SHIELDS MONTHLY STAT PACK

Data through July 2023, ERA Shields

Here is data from my company’s monthly “Stat Pack” that can better help you understand the local buying and selling reality. I have reproduced the first page and you can click here to get the report in its entirety.

SAVE THE DATE FOR THE 27TH ANNUAL UCCS ECONOMIC FORUM…

This is an always worthwhile event and registration is FREE. You can scan the above QR code for registration and more information.