HARRY'S BI-WEEKLY UPDATE 7.29.25

July 29, 2025

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

MORE OF THE SAME….AND SOME PREDICTIONS…

Not often the case, but recently Colorado Springs is mimicking what’s happening all over the U.S.A. in terms of Residential real estate.

We currently have more inventory than we’ve had in ages, but homes just aren’t selling very fast. In fact, quite the opposite. However, the good news is that homes keep appreciating, although at a more normalized pace than in the last several years.

I was listening to a podcast by Lawrence Yun, chief economist at the National Association of Realtors (NAR) and he was talking about a survey of 88 million homeowners that was done by NAR.

The results showed that 35.2% of those homeowners have no mortgage—either they paid cash for their home or paid off the mortgage on that home. That left 52.8% of those who did have mortgages.

A record of “high net worth” of those who owned homes was also indicated in the survey. Therefore, as homeowners you should be proud that you are among the “high net worth” folks.

This was no surprise to me as a family’s home is most often their greatest asset and over time, most home values have increased faster than stocks and bonds. This is even more true today as homes keep continuing to appreciate.

And speaking of appreciation, there are a number of folks who have been waiting for home prices to decrease, along with lower mortgage rates, before jumping into the market.

Well, I’ve got some news for you…it just isn’t in the cards for those two things to happen anytime soon, if ever again.

Homes might be dipping a bit in some markets, but not here in Colorado Springs and those waiting for bigger dips need to face the facts. While home price growth is slowing down, that doesn’t mean we’re headed for a crash. As the National Association of Homebuilders (NAHB) explained:

“House price growth slowed…partly due to a decline in demand and an increase in supply. Persistent high mortgage rates and increased inventory combined to ease upward pressure on home prices. These factors signaled a cooling market, following rapid gains seen in previous years."

However, experts say that even with the slowdown, prices will still rise this year nationally as well as here in Colorado Springs.

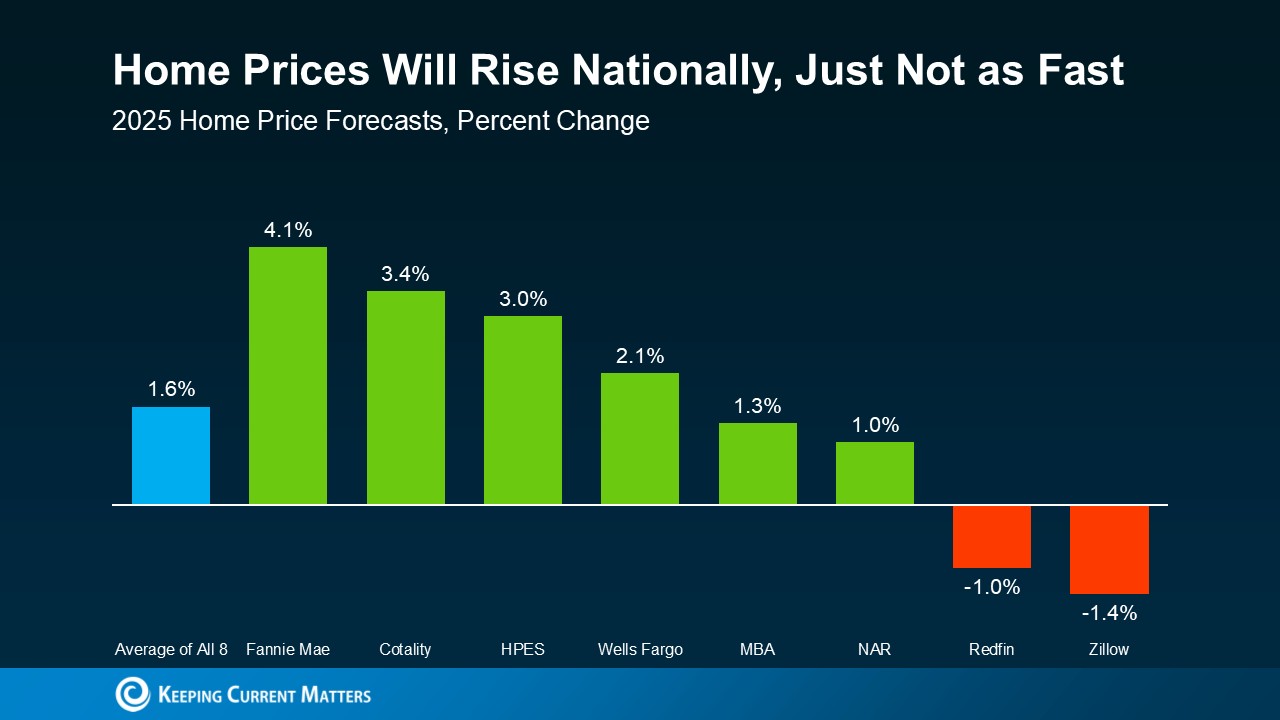

The average of 8 leading forecasters shows prices are expected to go up 1.5%-2% nationally in 2025. See below:

That means, if you’re waiting for a major drop, most experts agree that’s just not in the cards.

Plus, those small changes are not so important when you consider how much home prices have climbed over the past few years. Data from the Federal Housing Finance Agency (FHFA) shows prices are up 55% nationally compared to just five years ago.

If you can read between the lines, and as I’ve said all along, the best time to buy a home is NOW—no matter when “now” is. Homes will continue to appreciate and the sooner you buy, the sooner you will start earning appreciation.

Now about mortgage rates.

Once again, there are some who are waiting for rates to come down before looking to buy. According to Yahoo Finance:

“If you’re looking for a substantial interest rate drop in 2025, you’ll likely be left waiting. The latest news from the Federal Reserve and other key economic data point toward steady mortgage rates on par with what we see today.”

To put it bluntly, don’t try to time the market or wait for a drop that may not be coming.

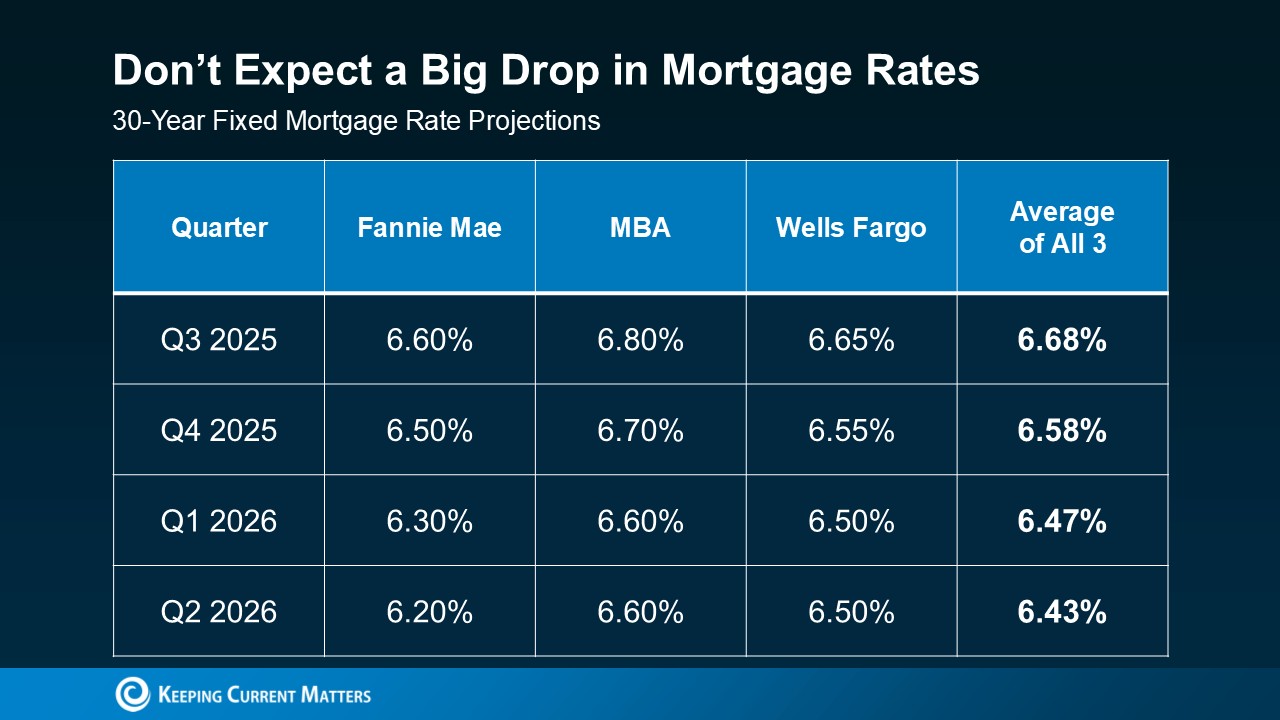

Most experts say rates will remain in the 6’s and current projections have them settling in the mid-6% range by the end of this year. See below:

Once again, those of you that have been “on hold” are watching homes continue to appreciate while waiting for interest rates to fall and realizing that waiting is costing you, most especially in the home appreciation that’s happening to a home you might want to purchase while you wait.

If you’ve been wanting to explore how you can sell to trade up or move to a new neighborhood, I can help you determine if now is the right time to do so and if it is, can help you navigate the Residential real estate waters.

I can almost always find a way to help my clients get what they want, need and can afford no matter the state of the current market.

With more properties on the market at present, as a buyer you can use that to your advantage. If you want to make a move, your best bet is to focus on your personal situation—not what the headlines say.

If you’ve even considered a move in the last year or more the time to start is NOW. You might be surprised to find that the possible increased equity in your present home could provide you with a greater down payment, which in turn will result in less of a monthly output than you might expect.

But you won’t know anything unless you get together with me and we figure out how to put your wants, needs and budget requirements to the best use to find just the right place for you and your family.

I am a leading authority in the Residential real estate industry and keep my clients and visitors well-informed, thus enhancing their ability to make timely and effective real estate decisions.

Give me a call today at 719.593.1000 or email me at Harry@HarrySalzman.com and together let’s see how your Residential real estate dreams can become reality in the best time frame for you.

HOME SALES HIT NINE-MONTH LOW

Reuters, 7.24.25, The Wall Street Journal, 7.24.25

The key spring buying and selling season turned out to be a dud this year as mortgage rates weighed on activity.

While home prices rose to a record high in June, a housing market recovery in 2025 is looking less and less possible.

The usually busiest time of year for Residential real estate saw sales at a nine-year low. Home appreciation and high interest rates have made home purchases unaffordable for many.

High prices have contributed the most to the sluggish market. However, with more homes coming on the market, the previous seller’s market is now turning into a buyer’s market.

This is great news for those looking to move. The days of bidding wars and buying homes sight unseen are gone and there is a lot more room for negotiation these days.

So once again, if you’ve been thinking of making a move, it’s most definitely worth finding out how to make it happen. There are a lot more homes to choose from and my expertise in negotiation can greatly help in this buyer’s market.

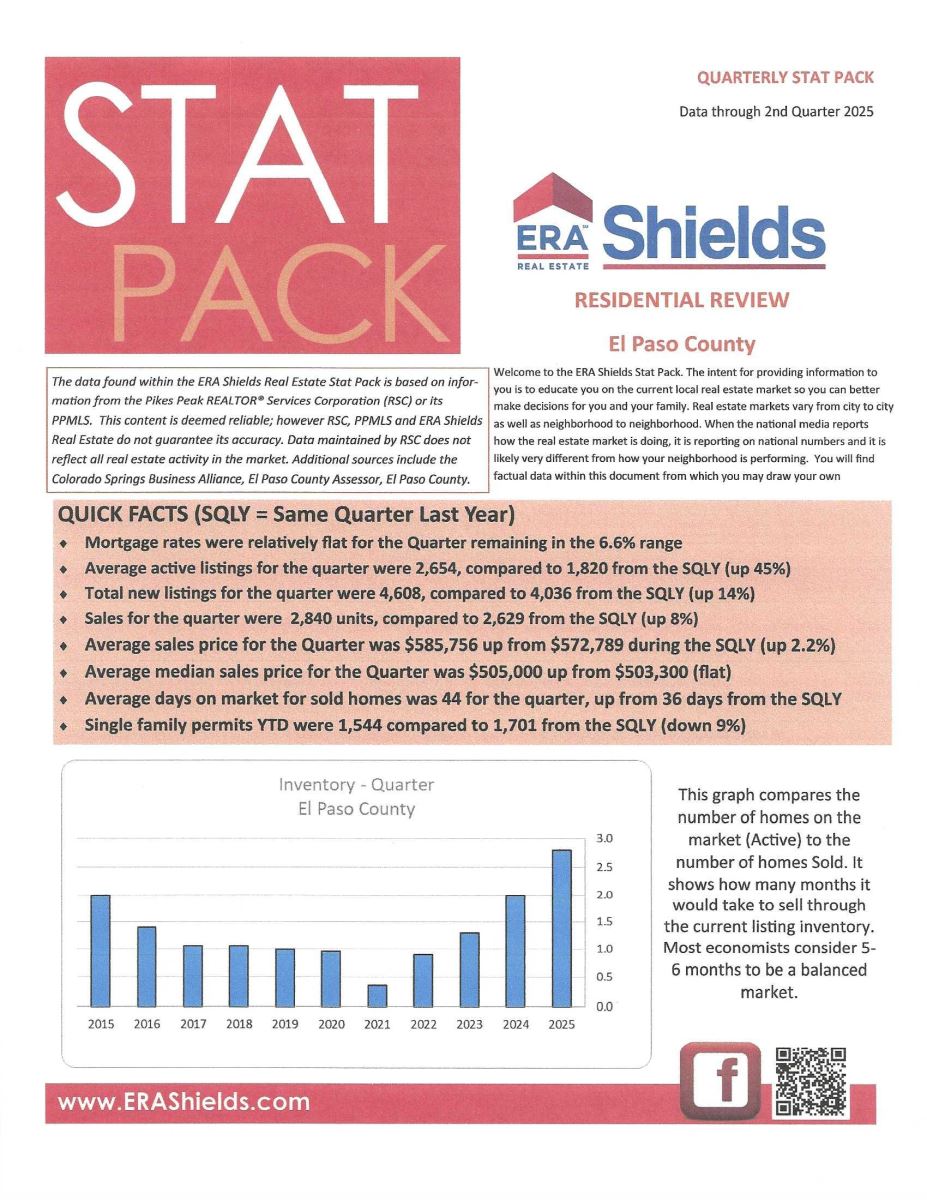

ERA SHIELDS QUARTERLY STAT PACK

Data through Quarter 2, 2025, ERA Shields

Here is data from my company’s quarterly “Stat Pack” that can better help you understand the local buying and selling reality. I have reproduced the first page, and you can click here to get the report in its entirety.