HARRY'S BI-WEEKLY UPDATE 7.27.22

July 27, 2022

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

LOTS OF QUESTIONS…STILL THE SAME ANSWERS…

I’ve recently been asked many questions in regard to the local Residential real estate market.

- Is it a good time to buy?

- Is it a good time to sell?

- What about the rising interest rates?

- Are home prices going to continue to rise?

- How will this affect my personal situation?

- And that’s only a few of them

Those of you regular readers know my answer already since I’ve never wavered in reply. It’s always a good time to buy and sell if that is what you need or want to do and it’s a matter of finding the best way for your personal situation.

There are always folks who need to buy and those who need to sell, both for various reasons, and my job is to make the process as easy as possible to meet the needs, wants and budgets of my clients and potential clients.

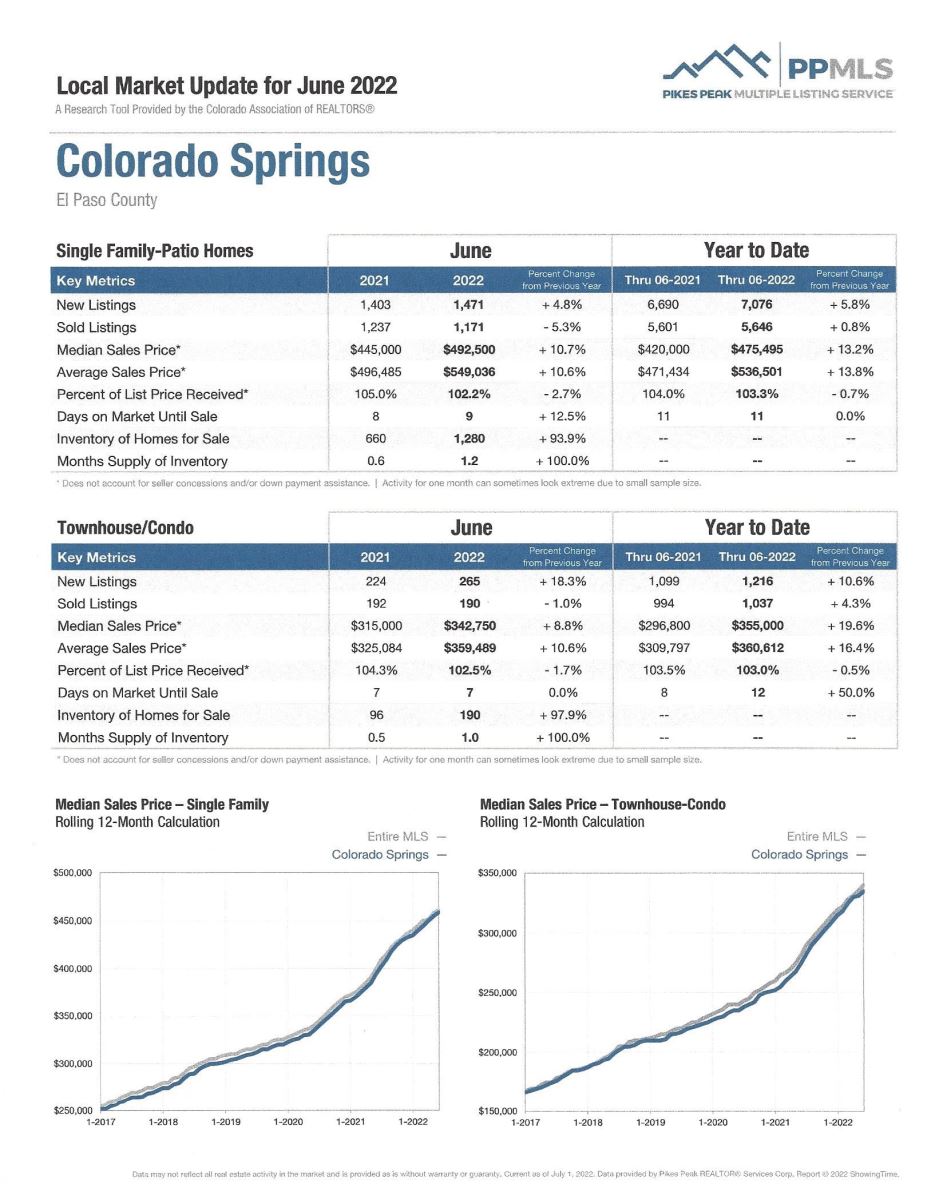

I’ve been saying for quite some time that price appreciation this year locally will fall to around 10%, which is certainly a good return, but will allow the market to normalize somewhat. The recent fast pace of price appreciation has made it difficult for first-time buyers especially, and has driven up demand as folks have been worried that if they don’t sell and trade up soon they could be priced out of the market.

High demand and low inventory across the country, and most especially here in the Colorado Springs area led to selling prices over asking price and created bidding wars which favor all-cash buyers who have been willing to forego inspections and contingencies. Again, a detriment to first-time buyers, and for those who need to apply for a mortgage.

However, if you are ready to sell and trade up or move to a new location or even are looking to buy for investment purposes, there is no better time than the present. Your current equity will likely give you an excellent down payment and even with the higher interest rates you could possibly keep your monthly output close to what you currently pay.

And I can tell you this much—if you’ve waited for prices to come down, you’re going to wait a very long time and it is doubtful that you will see that happen. You hopefully will see prices rising more realistically in the next few years as more homes become available for sale.

If you have waited for interest rates to go back down, well, good luck with that as well. Writing as someone who had an interest rate of 8.5% on my first home in 1972, and have seen them as high as 20%, I still consider today’s rates to be excellent. Why? Because the annual appreciation of about 10% now equals about 4% above a 30-year fixed-rate mortgage of 6% today.

While I was starting to write this column yesterday, news from The Wall Street Journal flashed across my screen. I couldn’t wait to share it with you since it answers many of the questions I’ve been asked. So, without further ado:

AND IT’S GREAT NEWS FOR THE COLORADO SPRINGS housing market…

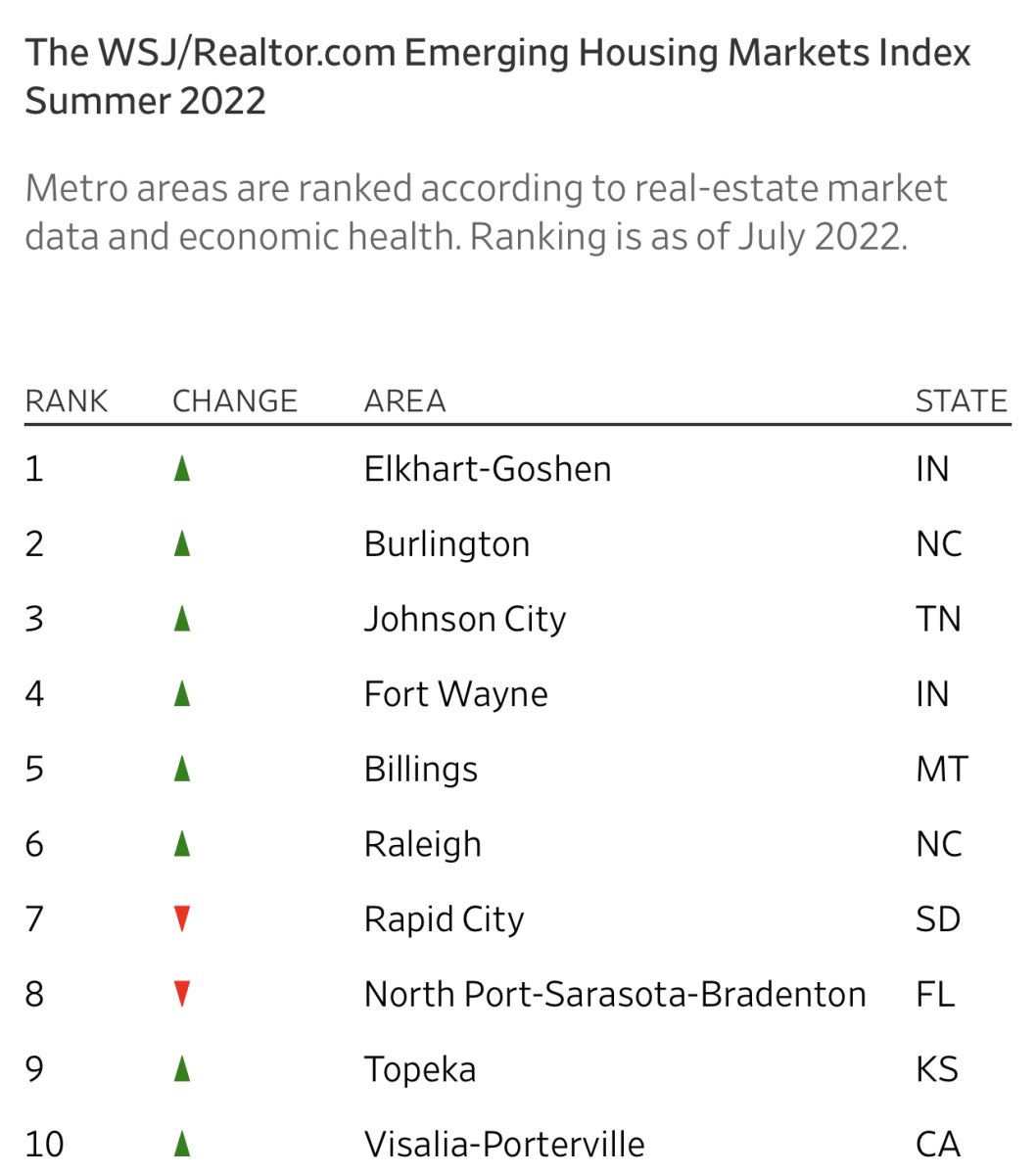

The Wall Street Journal, 7.26.22

The article is titled: “Low-Cost Cities with Strong Economies Remain Attractive as housing market Slows” and it goes on to add that “Remote workers help push small, affordable areas to the top of the latest WSJ/Realtor.com index”.

As remote and new hybrid work schedules are becoming more common, employees are willing to relocate for cheaper housing or a better quality of life. Work/life balance is becoming very important and that has helped push smaller, affordable markets to the top of the second quarter “Emerging Housing Markets Index” published by The Wall Street Journal/Realtor.com.

The index identifies the top metro areas for home buyers seeking a strong housing market, flourishing economy, and appealing lifestyle. The methodology explored two main areas: real estate markets (50%) and Economic health (50%).

Those two areas comprise eight key indicators:

- real estate Supply (16.6%)

- real estate Demand (16.6%)

- Median Home Listing Price (16.6%)

- Unemployment (6.25%)

- Wages (6.25%)

- Regional Price Parities (6.25%)

- Amenities (6.25%)

- Commute (6.25%)

- Foreign-Born Residents (6.25%)

- Small Businesses (6.25%)

- Property Taxes (6.25%)

Overall, existing-home sales have dropped for five consecutive months. After two years of fast-rising home appreciation and low interest rates, declining affordability and economic uncertainty is beginning to push some buyers out of the market. Some sellers are lowering their list prices and price growth is expected to continue to slow in the coming months.

This comes as the U.S. median home price hit a record high of $416,000 in June according to the National Association of Realtors, up 13.4% on the year and the highest since records began in 1999. As you know, our local median single family home price for that same period was $495,000, up 14.6% year-over-year and our average sales price was $551,304, up 12.6% year-over-year.

While we have seen an uptick in available homes for sale in the past several months, we are still seeing some multiple offers. Maybe not 15, as I had on one home and probably closer to 2 or 3, but the good news is that we are still seeing competitive offers on a number of listings.

With so many folks wanting to relocate here and only so many homes for sale, our housing market is geared to remain healthy even while other areas might not far so well.

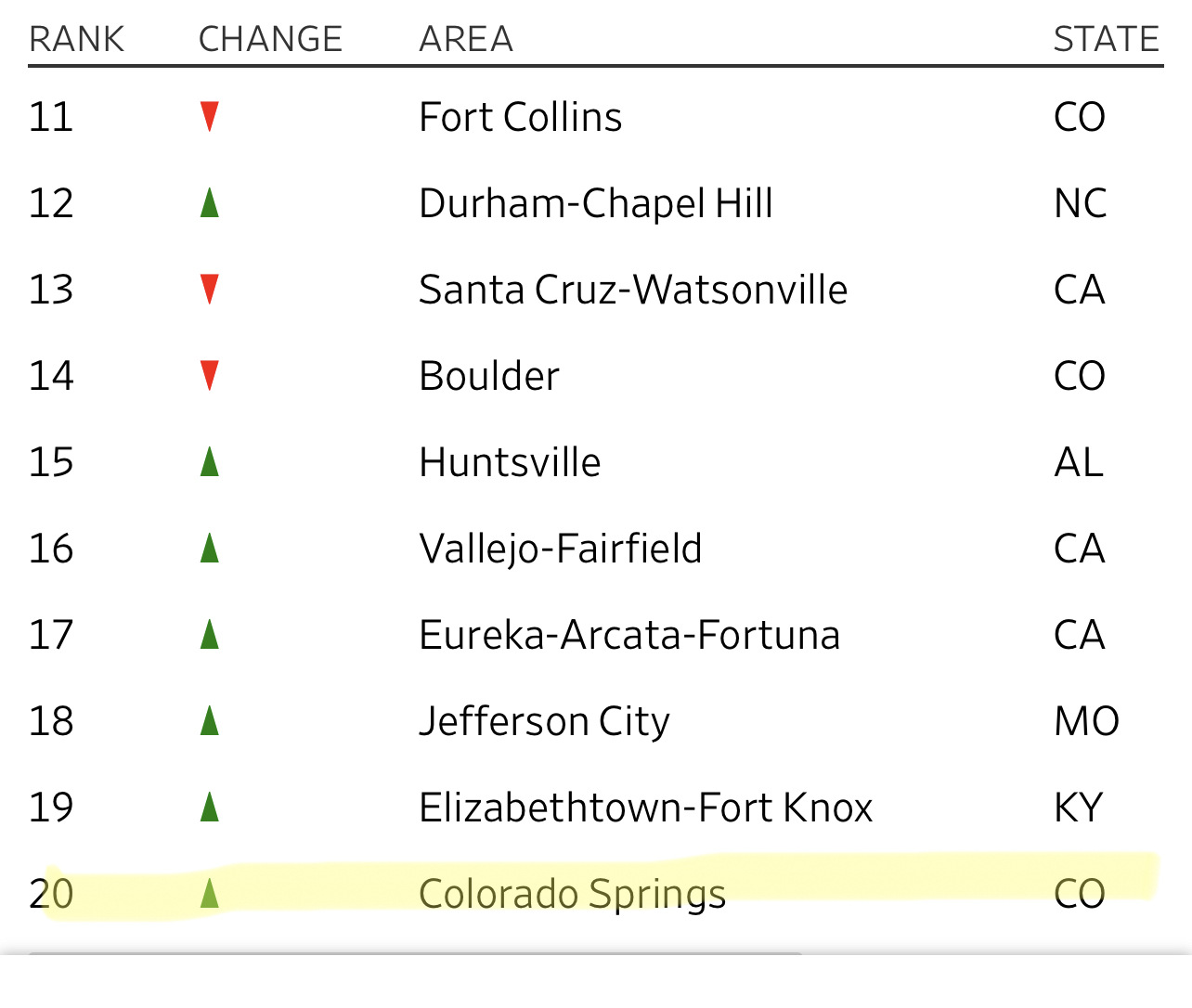

So let me cut to the chase---out of the 300 metro areas surveyed, Colorado Springs ranked number 20. Yes, once again, our city is considered one of the cities that continue to remain attractive even as the housing market is slowing nationwide.

As you will see, Denver is not among the top 20—it is ranked number 66. Fort Collins came in at 11 and Boulder at number 14, so that is great for Colorado in general and for us in the Colorado Springs area, just another reason to be happy we live in a city that is so desirable.

I know, I know… I would have liked to have kept it a secret, too, but…in terms of inevitable growth, it is a big “wow” that our economy, small business friendliness, unemployment and housing demand is so fabulous.

And once again, I want to give a big shout out to all of our hard-working city and county employees, our Chamber and EDC, and folks such as Mayor John Suthers, Doug Price of Visit Colorado Springs, Chancellor Venkat Reddy at UCCS and so many more who have worked tirelessly to get the Colorado Springs as healthy as it is today and have brought in new businesses, and with them, new residents. Colorado Springs is no longer that little tourist town south of Denver and our future is looking very bright. Bravo to all.

Here are the top 20 markets as identified in the Index:

There you have it.

Yes, it could take a bit longer to buy or sell today and you may pay a higher interest rate, but there are a lot of options, and you have your ace in the hole—me. With my 50 years in the local real estate arena, along with my Investment Banking background, I’ve seen it all and understand what it takes to work in all types of situations.

So, here I am, ready, willing, and able to answer all your questions personally. Simply give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and we can go from there. If I can’t give you the answer to every question you might have, fortunately with all my experience and local connections, I know where to get any answer, and that’s as important as knowing it all!

RENT VS. BUYING? AN INFOGRAPHIC

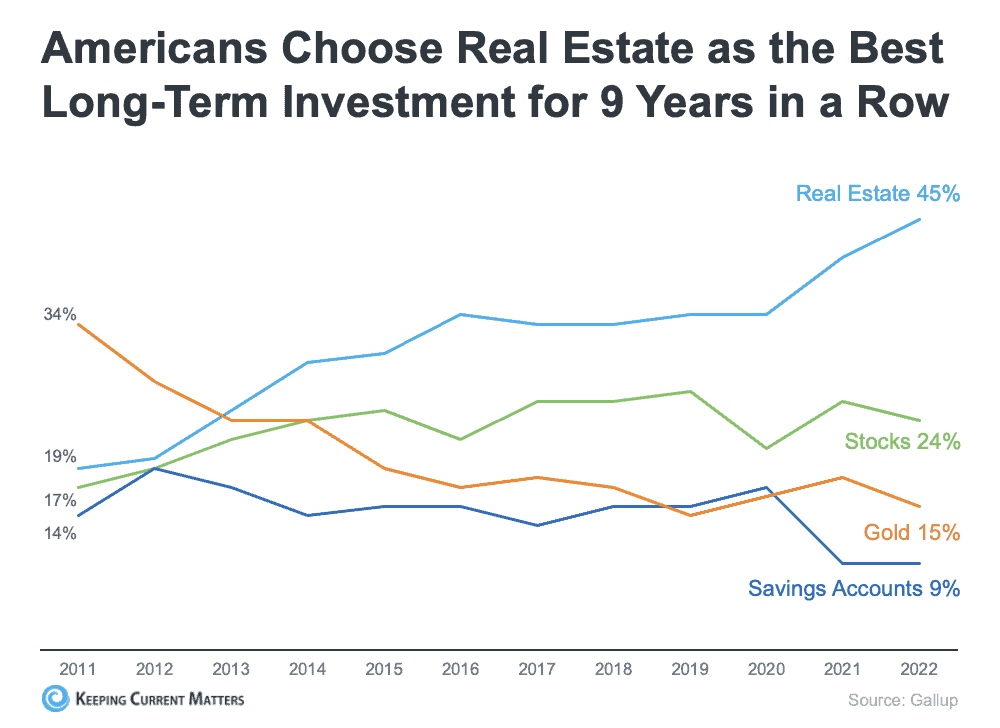

KeepingCurrentMatters, 7.15.22