HARRY'S BI-WEEKLY UPDATE 7.26.21

July 26, 2021

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

TO ALL WORKERS WHO HAVE JUMPED BACK INTO THE FREY AND ARE HELPING TO TRY AND GET OUR ECONOMY BACK ON TRACK…YOU ARE IN OUR DEBT

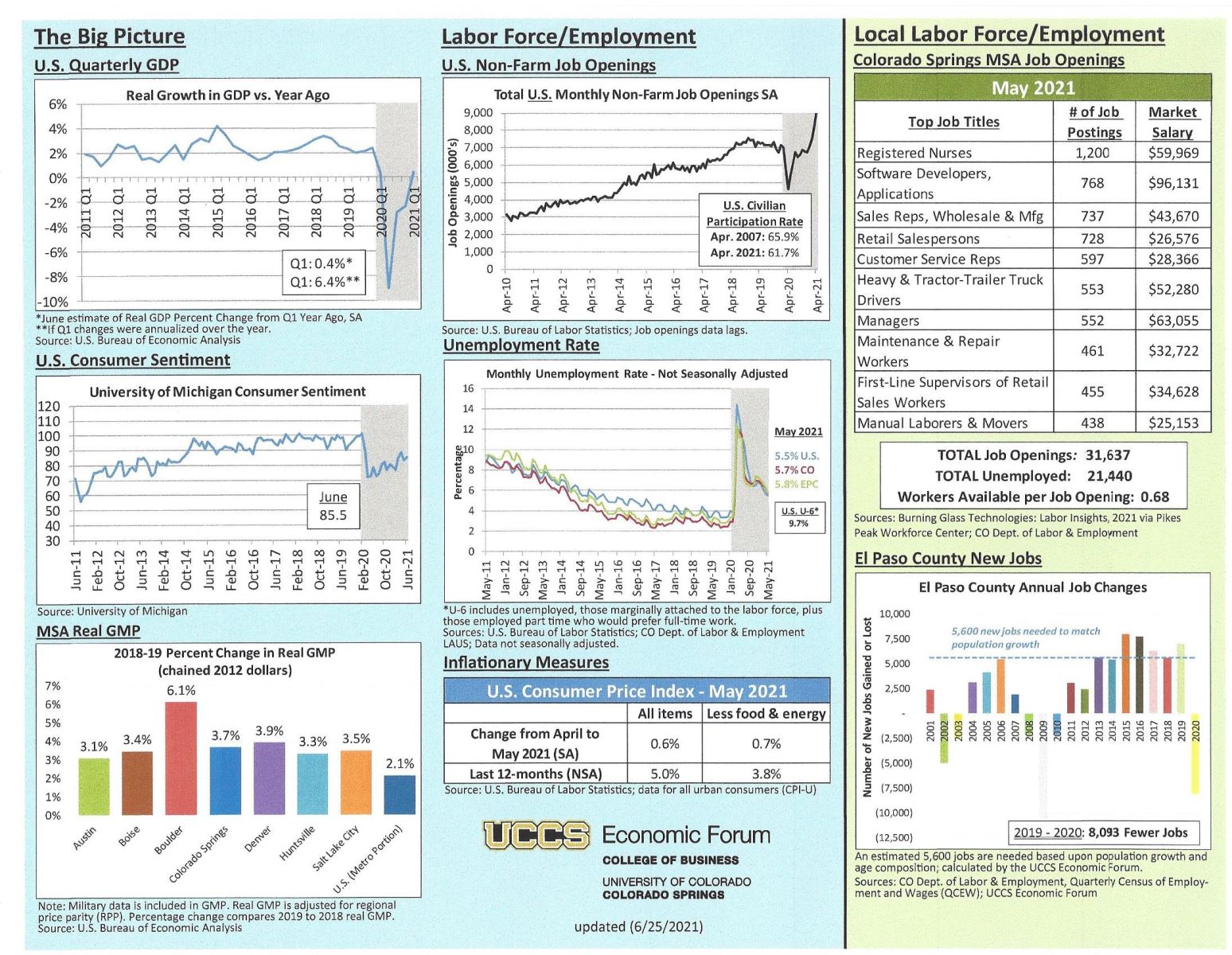

We are a country of so much fortitude and resilience and yet as I sit here thinking about recent days, I wonder what is going on with our labor force in general. I work with so many folks who are either in the process of renovating their homes, as Carol and I are, and with many others who are looking to buy either an existing home or new construction. What I’ve seen lately is exorbitant time delays, the rising and lack of materials and so much more that is threatening to really ramp up inflation.

It literally takes a village to renovate or build a home, and when a segment of that village stalls, everything gets backed up and can cause major concern for those needing a house now, not six months or a year from now.

The supply chain has been precarious in recent months, with suppliers running out of everything from light switches to paint. I was truly amazed to hear that due to the chemical fires in Texas some of the tints needed to create paint colors were not available. Who knew? And some furniture that needs foam padding was hurt by those same chemical fires. This is causing major delays and will continue to drive up the costs of these items, and of renovations and new construction as well.

But what really is starting to hurt as much if not more than those type of problems is the lack of available labor to help all of our businesses, restaurants, hotels and the like get back on track for the onslaught of folks who are ready to finally get out and live life as normally as possible again.

There is not a restaurant I’ve been in recently whose owner or manager hasn’t shared with me the difficulty of staying open regular hours while still providing excellent customer service. Some are limiting the number of seatings while others are choosing to change hours or close an extra day each week.

This is the same in every local or national shopping store I’ve visited. You see signs posted most everywhere offering excellent wages and benefits—and even a sign-up bonus for some. I don’t recall ever seeing this many cries for help, and it’s troubling when you consider how many are still collecting unemployment simply because they “can”.

I’m not here to judge anyone for their decisions, but I am here to say a big “Thank You” to all of the workers, young and old, who have gone back to work to help continue making our city and our country whole again.

It’s not simply the “essential” workers such as doctors, nurses, fire, police and others who deserve our thanks.

All workers are “essential” in my book, and I want to send a big shout out to all those toiling away in restaurants, shopping stores, manual labor, and so much more. You are the ones who make a difference every day in the lives of so many and you do so anonymously and with grace.

I want to make sure you know your labor is not in vain by any means, and I for one, am very grateful.

COLORADO SPRINGS IS RATED # 6 AMONG BEST PLACES TO LIVE AND IS AN EMERGING housing market

USNews&World Report,7.21.21, The Wall Street Journal, 7.21.21

In the most recent annual analysis from U.S. News & World Report, Colorado Spring came in number 6 out of 150 major U.S. cities surveyed.

According to the report, in order to make the top of the list, a place had to have good value, be a desirable place to live, have a strong job market and a high quality of life.

Three other Colorado cities also made the list with Boulder at number 1, Denver at number 14 and Fort Collins at number 17.

In similar news, The Wall Street Journal reported about their joint study with Realtor.com where metro areas were ranked according to real-estate market data and economic health. In that study only two Colorado cities were ranked in the top 50—Colorado Springs at number 16, and Boulder at number 46.

This study showed that the housing boom and appeal of remote workers has driven buyers away from big cities to more affordable areas with appealing lifestyle amenities. Areas with higher property taxes have fallen in the rankings over the past couple of years.

While home prices in all markets have risen steadily in the past several years, homes in these emerging markets are considerably more affordable and folks are finding they can get more for their money in relocating there.

And home buyers remain unfazed by longer commutes these days as well. If they are able to purchase a home in an area they love and at a better price than in a bigger city, they are willing to make the commute, especially if they are afforded the opportunity of working from home at least part time.

Recently, I have had a number of relocation inquiries and it’s been difficult for these families to find a home as quickly as they might need one. The low availability of existing homes for sales, coupled with the long wait for newly constructed homes is creating difficulty not only for the one being located but for the company who needs them here now as well.

This again goes back to the significant lack of labor. Besides the shortage of material, there is a lack of those who can move the material from point “a” to point “b” and those needed to help in construction, electrical work, plumbing work and so much more.

That is precisely why I thank and commend those who are doing their share rather than doing nothing.

MEDIAN U.S. HOME PRICES HIT A NEW HIGH IN JUNE

The Wall Street Journal, 7.22.21

According to the National Association of Realtors, June sales of existing homes rose 22.9% from a year earlier. The median home price in the country rose to $363,300 in June, up 23.4% from a year earlier.

The housing market boom is easing slightly as rising prices are prompting more homeowners to list their homes for sale. Lawrence Yun, chief economist for NAR, said that homes sold in June received an average of four offers, down from five the previous month.

But the number of homes for sale remains far lower than normal, and robust demand due to the continued ultra-low mortgage interest rates is expected to continue pushing home prices higher.

At the moment, demand is trumping everything, and higher inventory isn’t going to take the brakes off price increases any time soon.

If you’ve even considered a move, now is the time to get started. Prices aren’t going down any time soon and mortgage rates essentially have nowhere to go but up, so today is the best time to start. It shouldn’t take long to sell your present home and it will likely go for far more than you might imagine. It WILL take longer to find your next home, so that also needs to be a consideration from the start.

The best move you can make is to call me at 593.1000 or email me at Harry@HarrySalzman.com to get any and all of your Residential real estate questions answered. I look forward to speaking with you.

U.S. HOUSING STARTS ARE RISING, HOWEVER BUILDING PERMITS ARE TUMBLING

Reuters, 7.21.21

Homebuilding across the county increased more than expected in June but permits for future homes fell to an 8-month low, likely due to the uncertainty caused by expensive building materials as well as shortages of labor and land.

A report from the Commerce Department last week suggested a severe shortage of houses, which has boosted prices and sparked bidding wars across the country. With demand driven by low mortgage rates and a desire for more spacious accommodations during the pandemic, this could persist for a while.

Though lumber prices are coming down from record highs, builders are paying more for steel, concrete and lighting and lots more and are grappling with shortages of appliances like refrigerators.

There have been reports of multi month delays in the delivery of windows, heating units, and appliances which have delayed the delivery of homes and forced builders to cap activity. Many builders continue to point to a shortage of available workers as a separate challenge.

MORTGAGE RATES NOSE-DIVE AS REFINANCE FEE IS ENDED

Yahoo.com, 7.25.21

It’s difficult to believe but mortgage rates this week dropped back to within shouting distance of their recent record lows.

When 30-year fixed rates spiked during the spring, there were predictions that the economy’s recovery from the pandemic could push rates as high as 4% this year. But at the moment, they are deep beneath 3% once again and offering hefty savings to both homebuyers and refinancing homeowners.

The government’s announcement that the end is coming for a widely loathed fee has contributed to rate drops, though another reason is that the recovery is looking like less of a sure bet.

Recent drops in rates have been tied, in part, to the economic uncertainty created by rising COVID infections.

“Concerns about the Delta variant, and the overall trajectory of the pandemic, are undoubtedly affecting economic growth,” say Sam Khater, Freddie Mac’s chief economist. “Declining rates provide yet another opportunity for homeowners to save money on their monthly mortgage payment through a refinance.”

The average rate on 15-year fixed-rate mortgages also dipped, falling from 2.22% to 2.12%. A year ago, 15-year fixed loans had an average rate of 2.545.

Fifteen-year mortgages are a popular choice among refinancing homeowners, with the Mortgage Bankers Association estimating that 15-year fixed-rate loans account for approximately 20% of all refis in the U.S.

The Federal Housing Finance Agency is scrapping is 0.5% fee on refinances which is making refi loans cheaper. That surcharge has cost the typical borrower an extra $1400, according to mortgage bankers.

FHFA oversees both Freddie Mac and Fannie Mae, two government sponsored enterprises that buy most mortgage loans from lenders. The agency introduced the fee last year because it said that Freddie and Fannie needed the revenue because they were facing billions in losses related to the pandemic.

Since lenders passed the additional cost on to consumers, the fee “artificially increased the average mortgage rate,” says Zillow economist Matthew Speakman. Banks are now lowering their rates ahead of the surcharge’s official end on August 1.

If you’re a homeowner who has been putting off on refinancing, it’s probably time to stop procrastinating.

These low rates, like most things in life, aren’t a guarantee and they most certainly be around forever.

WHAT DO EXPERTS SEE ON THE HORIZON FOR THE SECOND HALF OF THE YEAR?

KeepingCurrentMatters, 6.30.21

- Mortgage Rates Will Likely Increase, but Remain Low

- Home Appreciation Will Continue, but Price Growth Will Likely Slow

- Inventory Remains a Challenge, but There’s Reason to Be Optimistic

Bottom Line? Looking at the forecast for prices, interest rates, inventory and home sales, experts remain optimistic about what’s on the horizon for the second half of 2021.

I strongly predict that the Colorado Springs home price forecast will be much higher than that of the national forecast for 2021 shown above.

Contact me sooner than later so can discuss how to navigate the market together in the coming months.