HARRY'S BI-WEEKLY UPDATE 4.18.24

April 18, 2024

HARRY’S BI-WEEKLY UPDATE

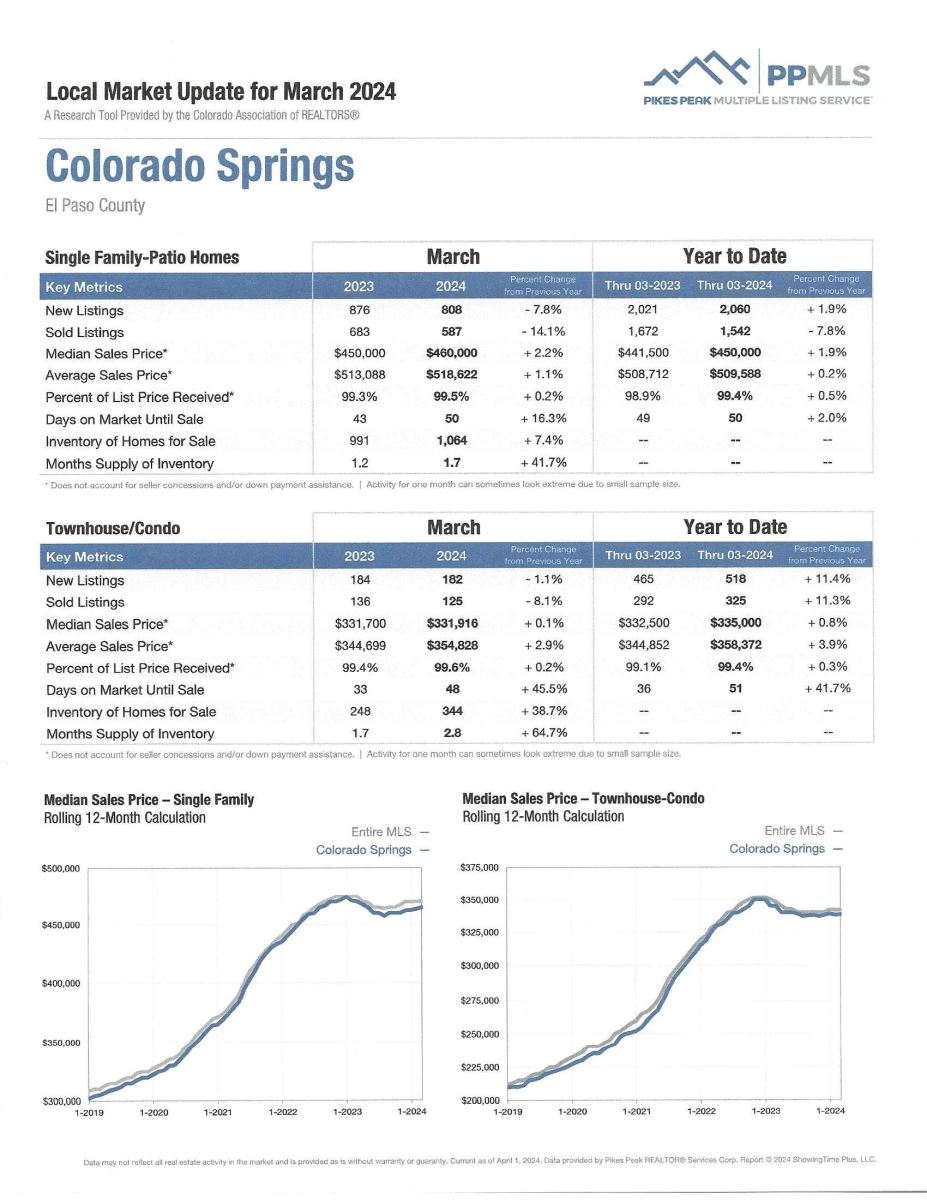

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

RATES ARE STILL HIGH, AVAILABLE HOMES ARE STILL SCARCE, BUT…

…it couldn’t be a better time to buy or sell.

Yes, you read that right. In my 52 years of selling Residential real estate in the local market, I’ve witnessed just about every type of “market cycle” and there is one thing I can tell you for certain—it’s always a good time to buy or sell.

And, more importantly, there are always those who want or need to buy or sell at most every moment for various personal reasons.

This much I know. While interest rates are high, there is no guarantee that they will drop significantly, and they could go higher. Even if they do drop, they are not likely to ever fall to the historic lows we saw several years ago. And when they do drop, you can always refinance at the lower rate. In fact, some lenders are even writing that option into their loan documents.

Another way to get around the higher mortgage rates is to get a “buy down” from a builder or seller. This will essentially lower your rate.

So, if the higher rates are a problem, there are ways around them, and I’m your guy when it comes to finding those ways. My long-time experience, coupled with my Investment Banking background, gives my clients a distinct advantage in so many areas.

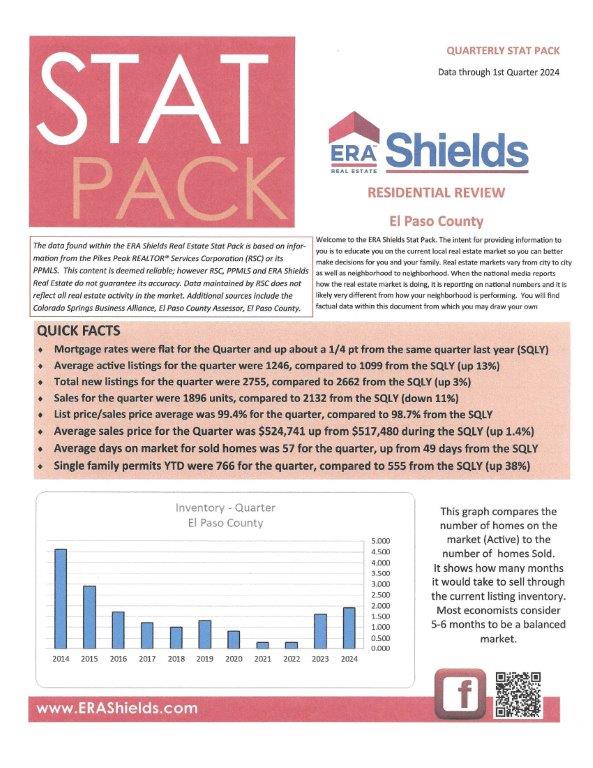

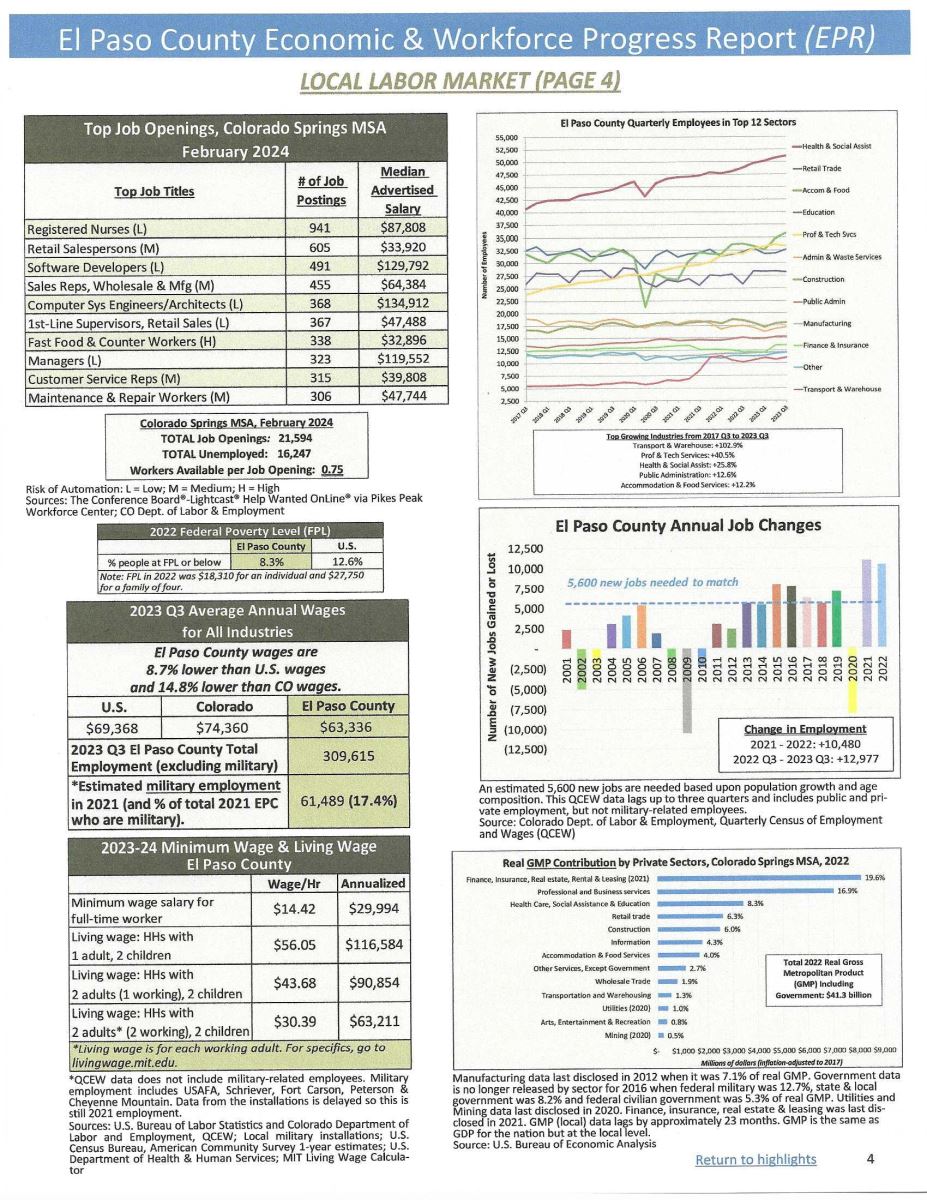

Home appreciation is another factor to consider. As you have seen from the statistics I publish monthly, home values are not depreciating. In fact, while they are not rising as quickly as in the recent past, they are “normalizing”, and it is very unlikely you will see home depreciation in the Colorado Springs area, especially with so many companies expanding or wanting to relocate here.

Home appreciation begins when you buy your home, no matter what your interest rate may be. That means you are growing what is often your most valuable asset and that can be a considerable amount over time.

If you have been waiting for rates to drop, either to buy for the first time or to sell and trade up, there is no better time than the present to find out how your wants, needs and budget considerations can work to get you the home of your dreams.

Just give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let’s discuss how together we can make that dream come true.

And, if you’ve got one minute and 39 seconds, take a look at my newest podcast. Simply click on the link below and you will be directed to my personal YouTube channel.

To watch, click here:

While you’re at it you might want to subscribe to my channel, so you won’t miss future broadcasts. It won’t cost you anything…well, it could cost you… if you miss some of my informative musings!

HOUSEHOLDS MAY FINALLY BE ADJUSTING TO HIGHER MORTGAGE RATES

Fannie Mae, March 2024

A recent Fannie Mae Home Purchase Sentiment Index showed that the percentage of respondents who said it is a good time to buy a home increased from 19% to 21% while those that said it is a bad time to buy decreased from 81% to 79%. As a result, the net share of those who say it is a good time to buy increased 4 percentage points month over month.

In the same survey, the percentage of respondents who say it is a good time to sell a home increased from 65% to 66%, while the percentage of those who said it is a bad time to sell decreased from 35% to 34%. As a result, the net share of those who say it is a good time to sell increased 2 percentage points month over month.

This monthly Fannie Mae survey was launched in 2010 and polls the adult general population in the U.S. to assess their attitudes toward owning and renting a home, purchase and rental prices, household finances and overall confidence in the economy.

The March 2024 survey, while indicating that folks are still worried about the economy in general, still shows that households may finally be adjusting to higher mortgage rates and ready to again consider buying and selling.

So, once more, if you’ve been considering a move, get a leg up on the potential competition by starting now.

7 TYPES OF TAX-DEDUCTIBLE HOME IMPROVEMENTS

National Association of Realtors (NAR) 4.9.24

Many homeowners say they’re planning major renovations this year and some of these projects may be eligible for a tax deduction which could help alleviate some of the high costs of homeownership.

Here are a few types of tax-deductible home improvements.

- Energy-Efficient Upgrades

- Clean Energy Upgrades

- Historic Home Upgrades

- Medically Necessary Upgrades

- Home Office Repairs and Improvements

- Rental Property Repairs

- Capital Improvements

As always, be sure to discuss this with your personal tax advisor to find out if they apply to your individual situation.

THE PERKS OF DOWNSIZING WHEN YOU RETIRE…AN INFOGRAPHIC

KeepingCurrentMatters, 4.12.24

Some Highlights:

- If you’re about to retire, or just did, downsizing can be a good way to try to cut down on some of your expenses.

- Smaller homes typically have lower energy and maintenance costs. Plus, you may have enough equity built up to fuel your move.

- If you’re thinking about moving to a smaller home, call me to help go over your goals and look at all your options in the local market.

WHAT BUYERS, SELLERS WANT MOST FROM real estate AGENTS

NAR, 4.4.24

As most of you are aware, there has been a lot of news concerning real estate brokers, fees, and more. Most of us in the industry are still digesting all the upcoming potential rules and regulation changes and I will keep you informed as I gather the information.

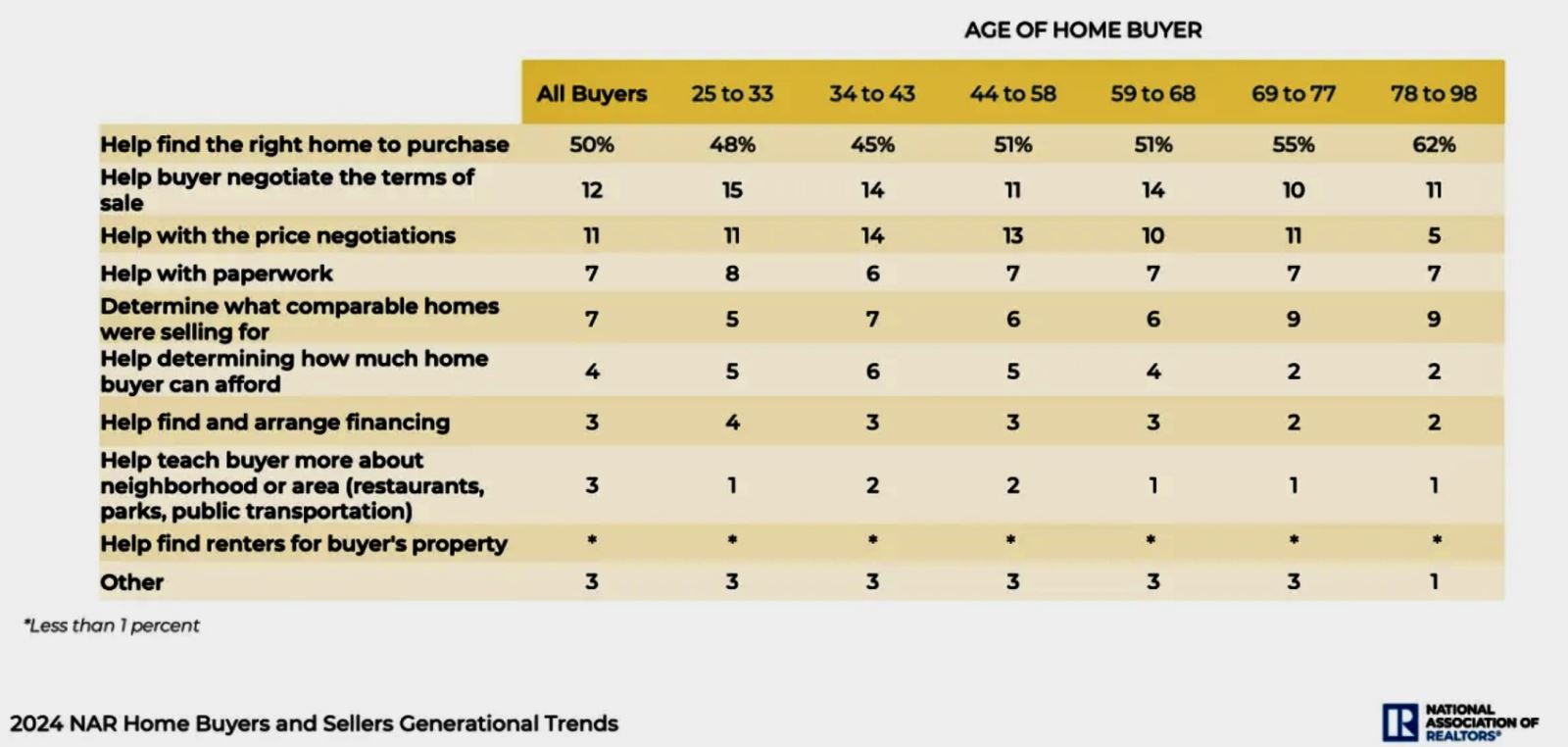

A recent article published by the National Association of Realtors (NAR) stated that the majority of home buyers and sellers—nearly 90% of them—rely on real estate agents or brokers, but a new study from NAR indicated that what they need could differ depending on age and experience in the market.

For example, home buyers don’t just want help with finding a home, but also with negotiating and with learning about the real estate process, according to NAR’s 2024 Home Buyers and Sellers Generational Trends Report.

The study reported that “While the internet is being utilized throughout the home search, agents remain the most-used information source in the home search, followed by mobile or tablet search devices”.

“Sellers, as well, turned to professionals to price their homes to potential buyers, sell within a specific time frame, and find ways to fix up their homes to sell them for more,” the study reported.

Buyers want a “Guide and a Coach”.

Younger home buyers are more likely to say that one of the most difficult steps in the homebuying process—behind finding a property and saving for a down payment—is understanding the real estate process and the steps they need to take, the study found.

Older adults, ages 44 and up, tend to feel more confident heading into the purchase process, generally having had previous experience buying a home. Nearly a quarter of older adults cited “no difficult steps” in the homebuying process, the survey says. But they still report struggling with finding the right property and with completing the paperwork in a transaction.

WHAT BUYERS WANT MOST FROM real estate AGENTS

As buyers reflected on their experience, they reported that the most commonly cited benefits provided by real estate agents and brokers during the home purchase process were:

- Helping buyer understand the process: 61%

- Negotiating better sales contract terms: 46%

- Providing better list of service providers (i.e. home inspectors): 46%

- Improving buyer’s knowledge of search areas: 45%

- Negotiating a better price: 33%

- Shortening a buyer’s home search: 23%

- Expanding buyer’s search area: 21%

When choosing an agent, buyers said their top criteria were the agent’s experience (21%), honesty and trustworthiness (19%), reputation (15%), and whether the agent was a friend or family member (12%). An agent’s reputation tended to be slightly more important to older generations than to younger generations, the study showed.

Home buyers also said they valued constant communication from their real estate agent, identifying their top likes as agents who personally call them to inform them of activities (73%), those who send them property information and communicating via text message (71%) and those who send them postings as soon as a property is listed or when the price changes or the listing is under contract (70%).

And now to Sellers…

What Home Seller Want: Make Their Home Stand Out

More than one-third of home sellers—across all age groups—relied on a referral from a friend, neighbor or relative to find their real estate agent, the survey found. Only 5% relied on internet searches to find one.

Sellers reported their top criteria for choosing their real estate agent was the agent’s reputation, their honesty and trustworthiness, and whether the agent was a friend or family member.

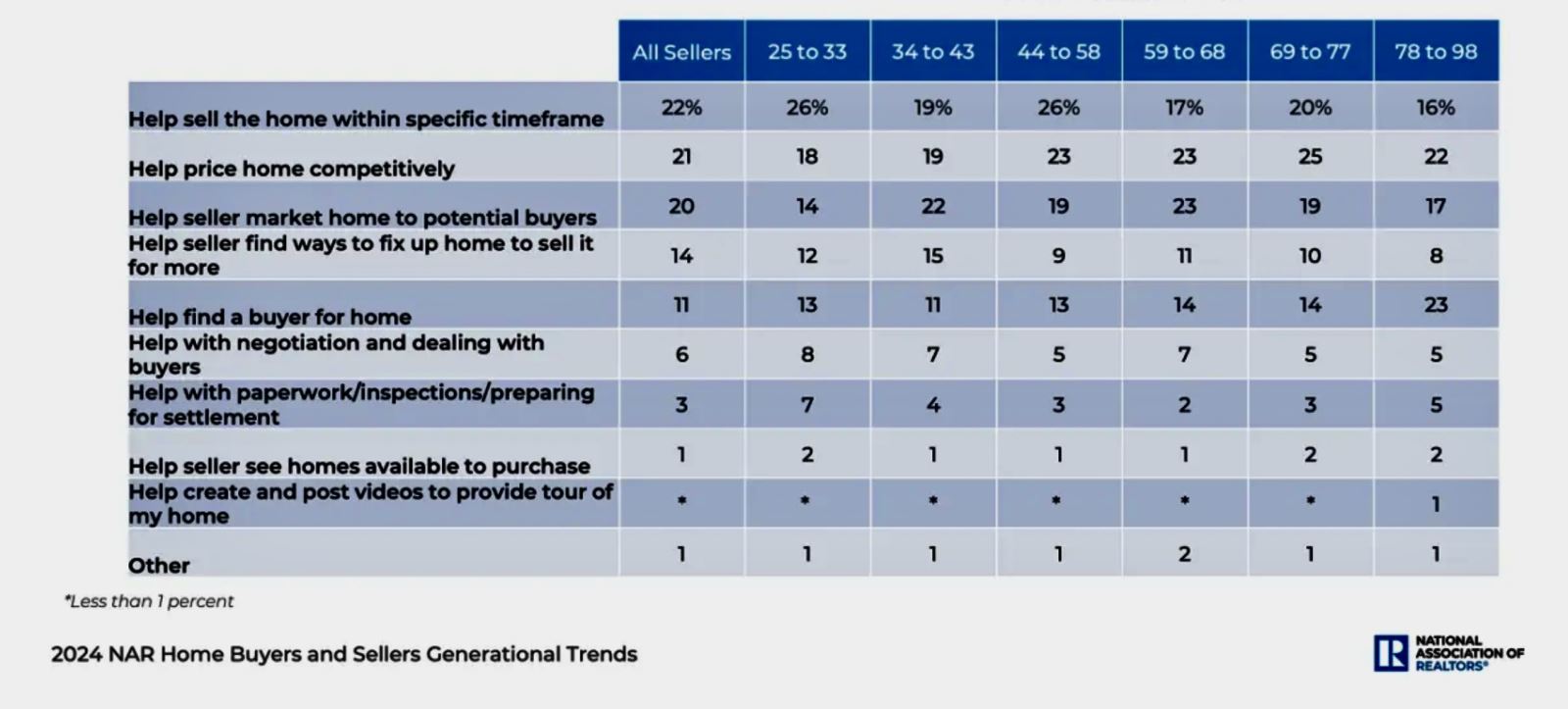

WHAT SELLERS MOST WANT FROM real estate AGENTS, BY LEVEL OF SERVICE PROVIDED BY THE AGENT

I found this study to be very informative and I hope you did as well. It makes me even more proud of my 52 years in this industry, to still be working with not only past clients, but also with children and even grandchildren of past clients. I truly value your loyalty and work hard every day to continue to earn your trust.

As I’ve said time and again, I’m not only in this only for a sale. I’m also here to help my clients and their families find the place that will bring them the most personal happiness, and in the process, help earn them the added dividend of home appreciation.

HARRY’S JOKE OF THE DAY: (HMMM…)