June 4, 2025

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

LET’S TALK A BIT ABOUT INTEREST RATES

I seem to get more and more questions about interest rates and what I think is happening or going to happen.

To be quite honest, I have no idea.

But, when asked about the 3% interest rates of a few years ago I DO have a response. We’re not going to see those again in a very very long time, if ever.

Those rates were never meant to last. They were a short-term response to a very specific moment in time and as the market started finding it’s footing again, it was time for a reset.

In 2020 and 2021, 3% mortgage rates gave buyers a serious boost of more affordability, more buying power and more opportunity. But those were the result of emergency economic policies put in place during the height of a global pandemic.

Now that the economy is in a different place we’re seeing mortgage rates normalizing in the high 6% to low 7% range.

While currently most experts project a slight easing in the months ahead, most industry leaders agree with me—rates are not going back to 3%.

As I’ve been saying for some time now, waiting for 3% interest rates to return is futile. And while you’re waiting, home values keep appreciating so that makes it harder to buy later than it might be today.

As you will see in the statistics below, home values are continuing to hold their own and even increase. Some months more than others, but they are NOT going down and aren’t likely to do so. This is especially true in a desirable area like Colorado Springs which is attracting new folks more and more due to our great work/life balance.

If you’ve been putting off your home search while waiting for interest rates to fall, you will be waiting a very long time.

There are a number of options available when it comes to interest rates these days and a realtor like me with a background in investment banking can help you find just the right financing for your individual needs and budget if at all possible.

And, if the rates do go down at some later date, you can always refinance as your home will likely have appreciated in value.

With the spring buying and selling season in full swing, NOW is the best time to start your search if you’ve even considered a move in the last year or more. You could be surprised to find that the possible increased equity in your present home will provide you with a greater down payment, which in turn will result in less of a monthly output than you might expect.

But you won’t know anything unless you get together with me and we figure out how to put your wants, needs and budget requirements to the best use to find just the right place for you and your family.

My 53 years in the local Residential real estate arena, makes me more than qualified to help my clients find the best solution to their housing needs so why not give me a call today at 719.593.1000 or email me at Harry@HarrySalzman.com and together let’s see how your Residential real estate dreams can become reality in the best time frame for you.

And now for statistics…

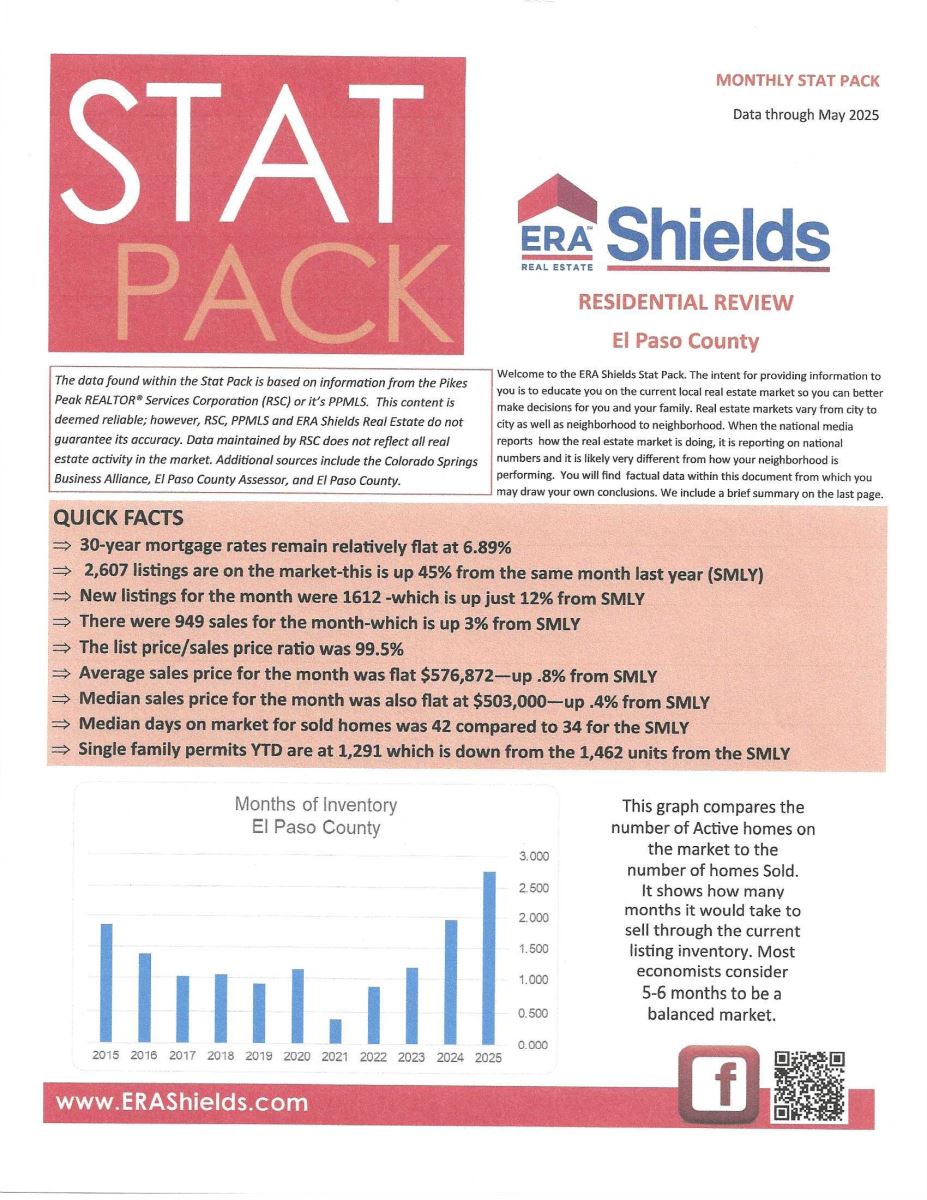

MAY 2025

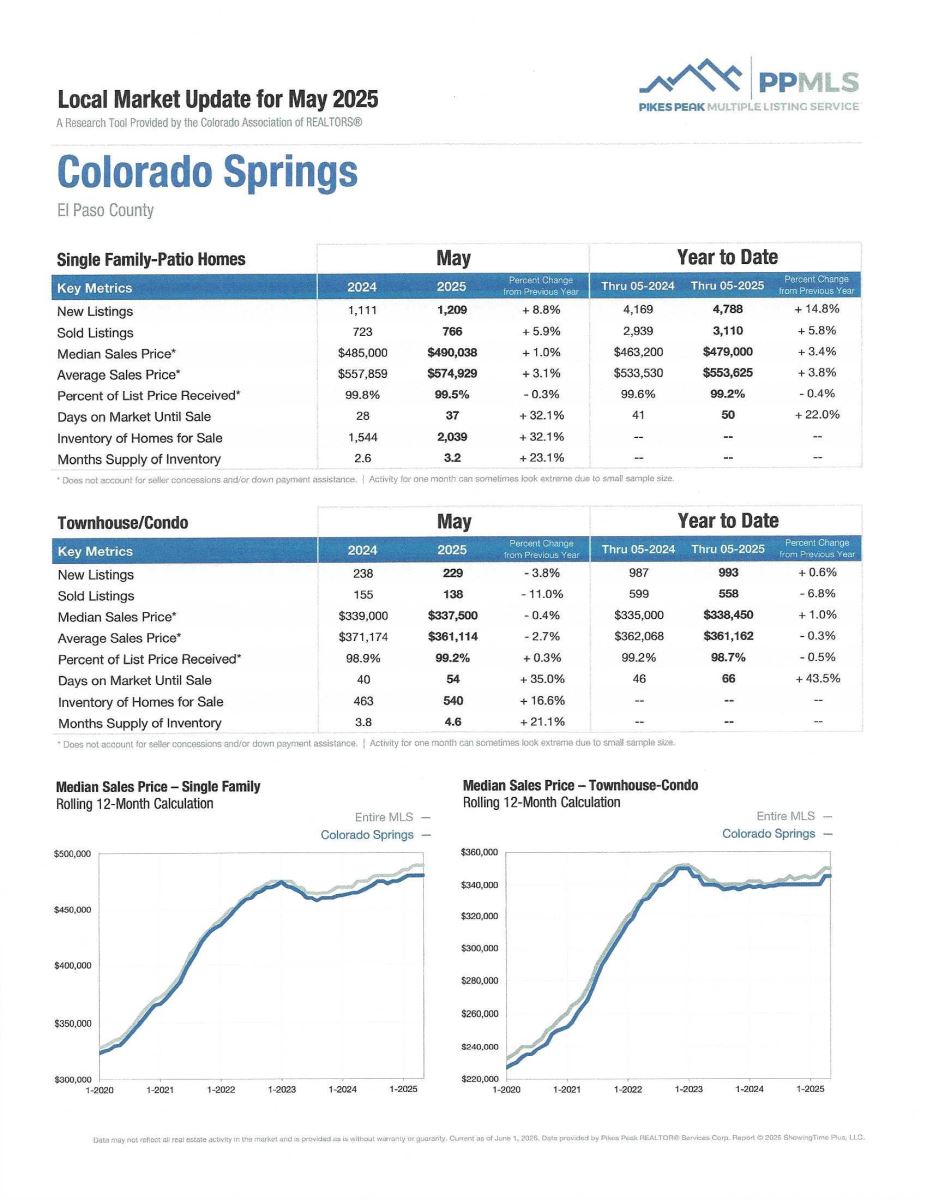

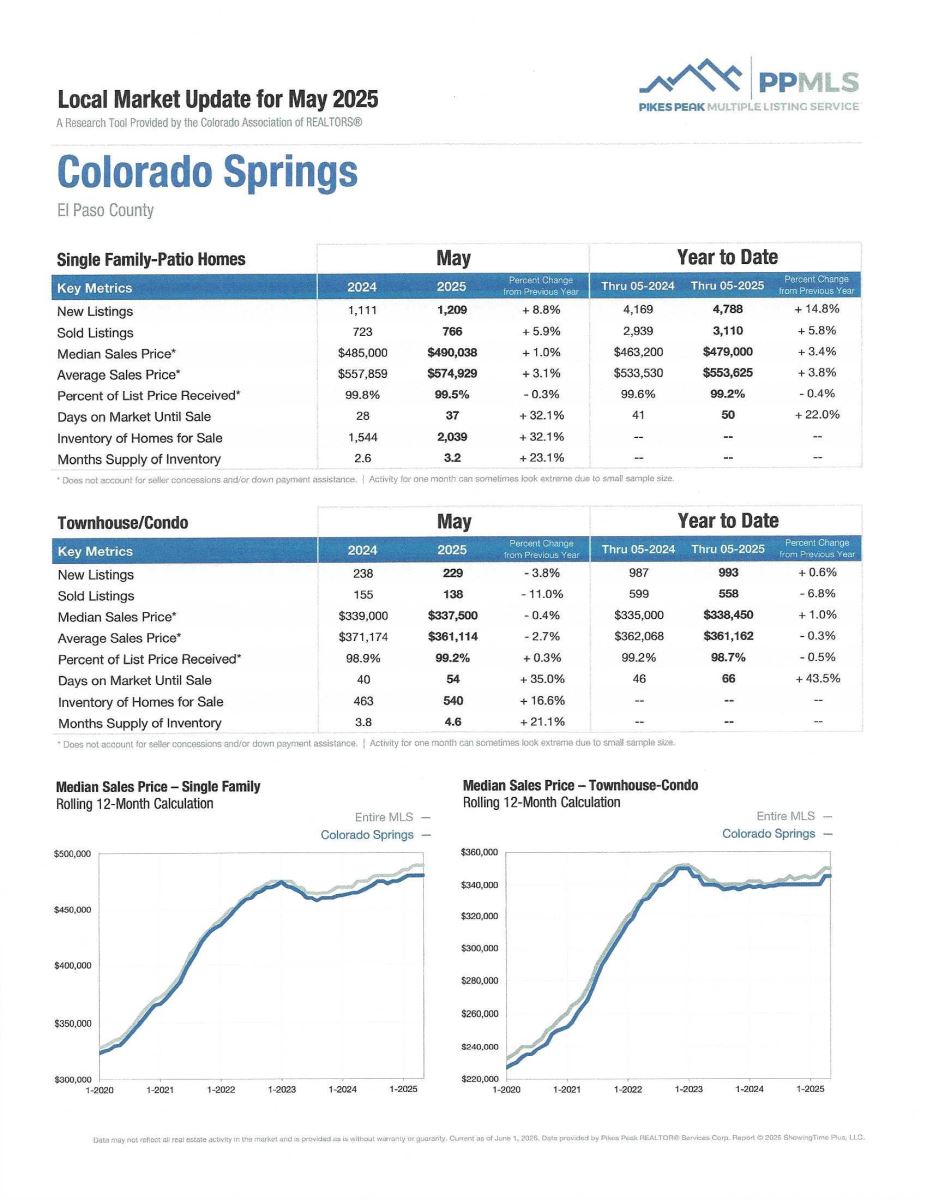

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the May 2025 PPAR report:

In El Paso County, the average days on the market for single family/patio homes was 38. For condo/townhomes it was 54.

Also in El Paso County, the sales price/list price for single family/patio homes was 99.5% and for condo/townhomes it was 99.2%.

In Teller County, the average days on the market for single family/patio homes was 65 and the sales/list price was 98.3%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing May 2025 to May 2024 for All Homes in PPAR:

Single Family/Patio Homes:

- New Listings were 2,048, Up 10.8%

- Number of Sales were 1,166, Up 2.1%

- Average Sales Price was $566,304, Up 1.7%

- Median Sales Price was $490,000, Down 1.8%

- Total Active Listings are 3,671, Up 38.8%

- Months Supply is 3.1

Condo/Townhomes:

- New Listings were 272, Down 9.9%

- Number of Sales were 166, Down 9.3%

- Average Sales Price was $364,586, Down 1.7%

- Median Sales Price was $341,000, Up 0.3%

- Total Active Listings are 629, Up 27.8%

- Months Supply is 3.8

MAY 2025 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year-to-Date one-year change:

- Sold Listings for All Properties were Up 0.3%

- Median Sales Price for All Properties was Up 1.0%

- Active Listings on All Properties were Up 27.7%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering in order to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

WHY SOME HOMES ARE SELLING FASTER THAN OTHERS

KeepingCurrentMatters, 5.7.25

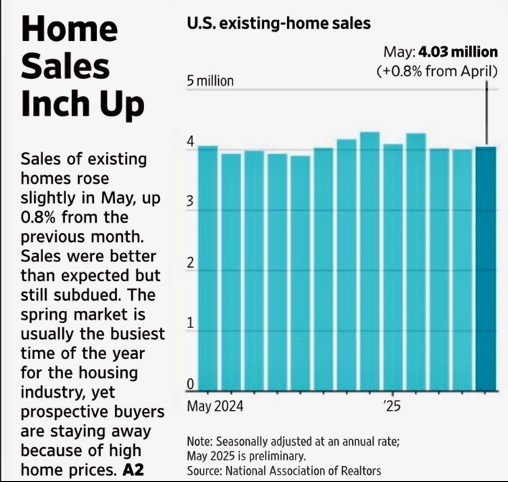

As you already know, in most markets, including ours, things have slowed down a bit and while you may remember how quickly homes sold a few years ago, that’s not what you should expect today.

And now that inventory has grown, according to Realtor.com, homes are taking a bit longer to sell in today’s market.

However, we are only looking at around a 10 day differential compared to the last few years and Realtor.com puts it this way:

“In April, the typical home spent 50 days on the market…This marks the 13th straight month of homes taking longer to sell on a year-over-year basis. Still, homes are moving more quickly than they did before the pandemic…”

By this comparison, if your home takes a bit longer to sell this year, it’s not really a concern.

It comes down to having the right strategy and of course, a broker like myself on your side.

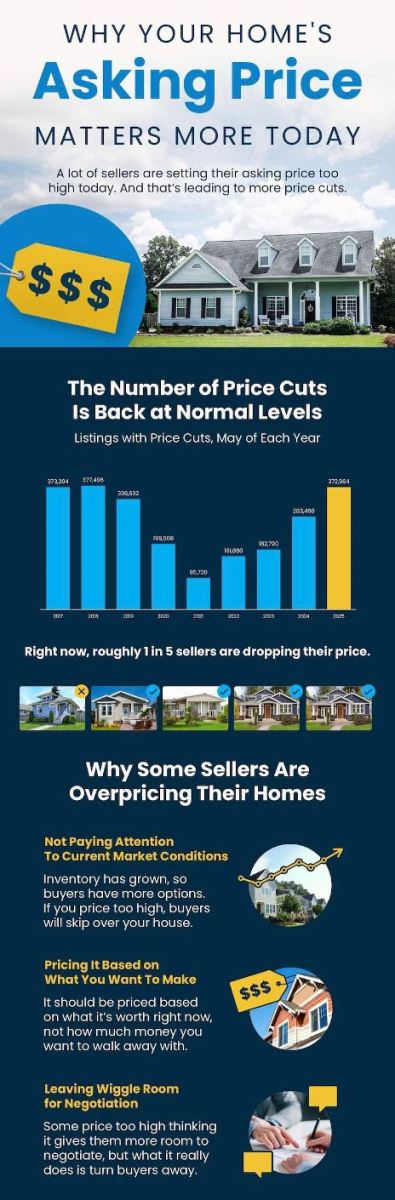

- Price it Right. One of the biggest reasons homes sit on the market is overpricing. Most sellers want to list higher thinking they can lower it later—but the backfires by turning buyers away.

- Focus on the First Impression. A messy yard or a home that needs paint? It’s going to turn off buyers since they decide within seconds whether they like a house.

- Strong Marketing and High Quality Listing Photos. If your listing doesn’t look professional, you could have trouble drawing in buyers who think you’re trying to cut corners.

- The Location of the Home. You know how I always talk about taking location into consideration in all things real estate? Well, it applies here too in that some neighborhoods just tend to sell faster than others.

But here is the bottom line—you want the most money in your pocket in the shortest amount of time with the least amount of stress.

When you hire me, it’s my job to make certain that all of these bases and more are totally covered before we even list your home on MLS. I know how to properly price and stage your home to help you get the best possible price in the shortest time possible.

Give me a call when you are ready, or even thinking of being ready, and let’s discuss how to get your home ready for market.

HOME PROJECTS THAT ADD THE MOST VALUE

KeepingCurrentMatters, 5.30.25

Some Highlights:

- Whether you’re planning to move soon or not, you want to be strategic about which home projects you take on since not all of them will be worth it.

- Before you decide what upgrades to tackle, talk to me so I can let you know what’s in demand in our area and where you are likely to best recoup the costs.

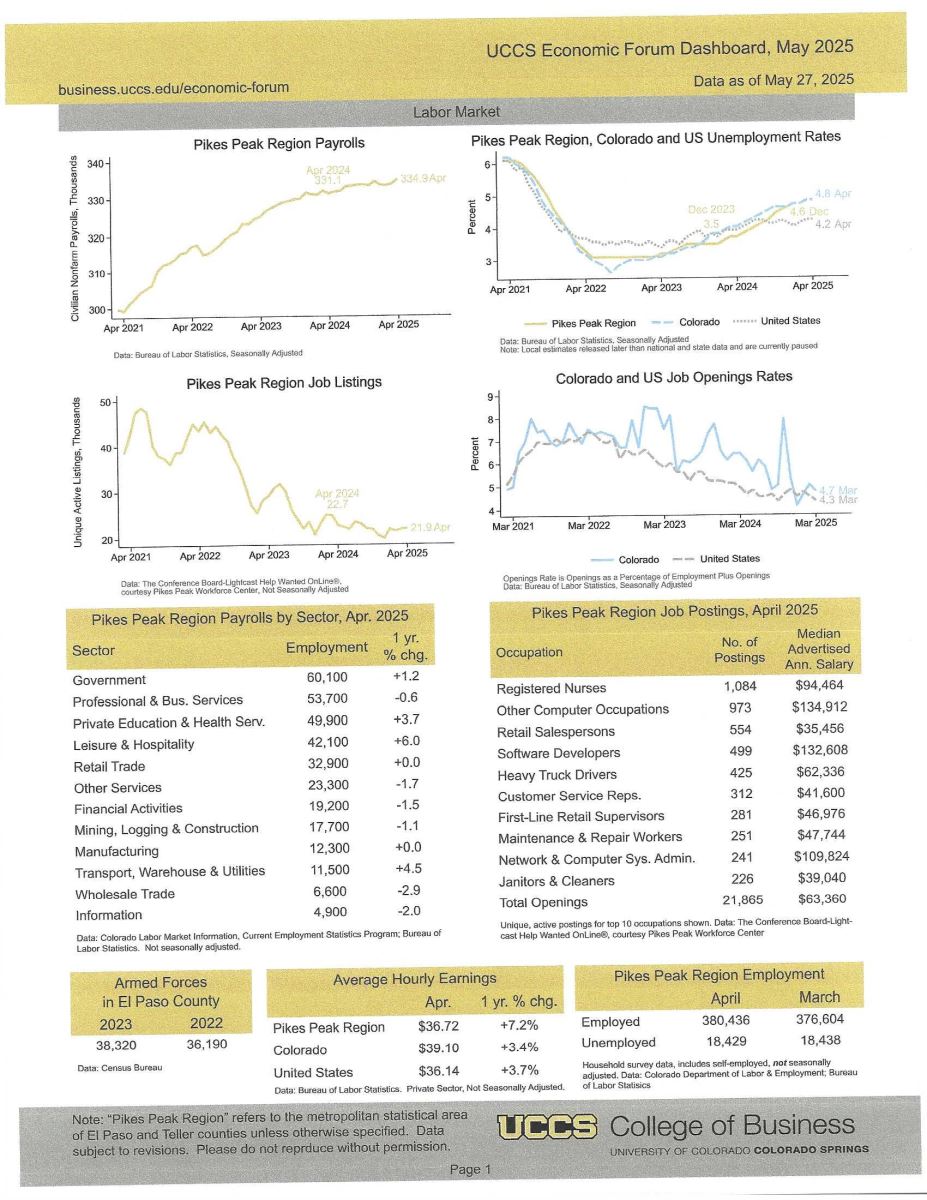

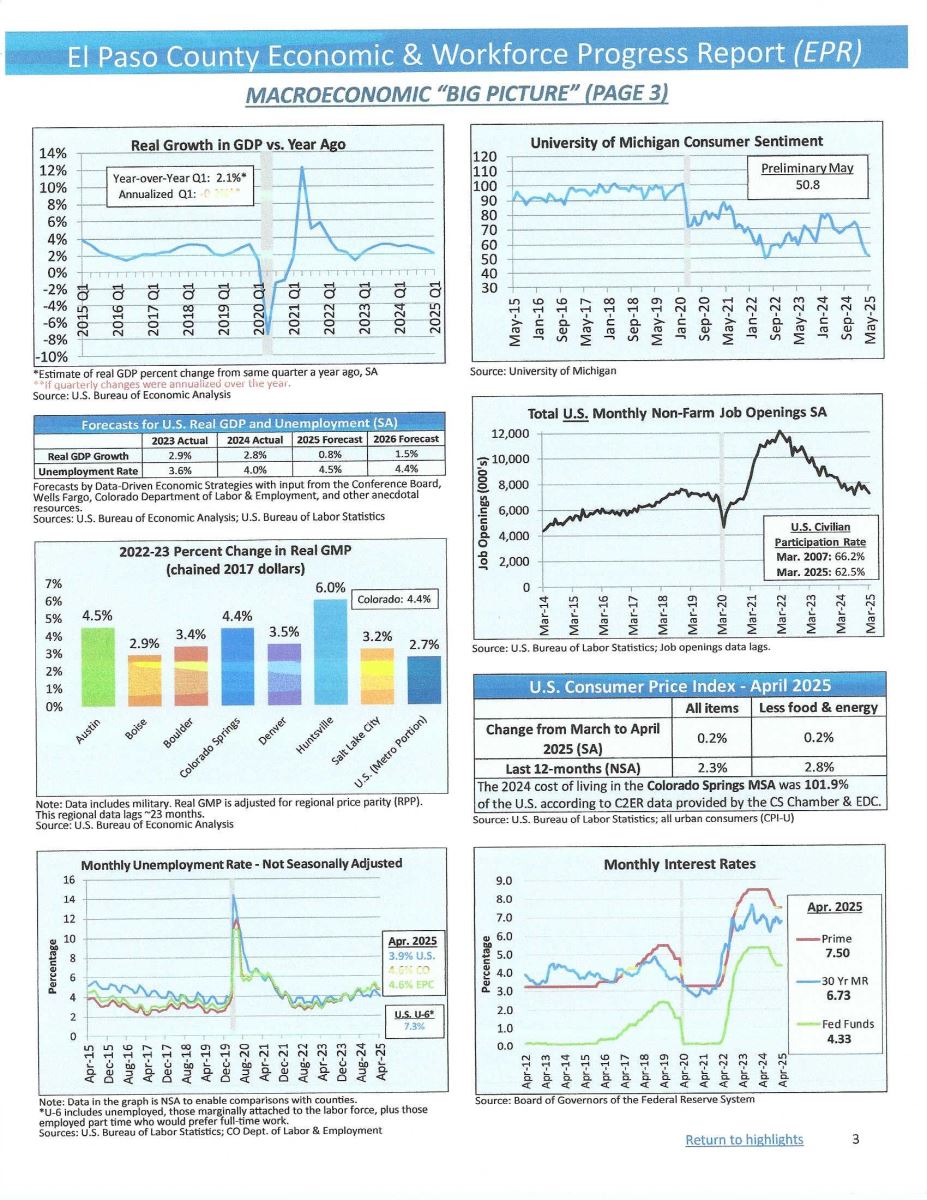

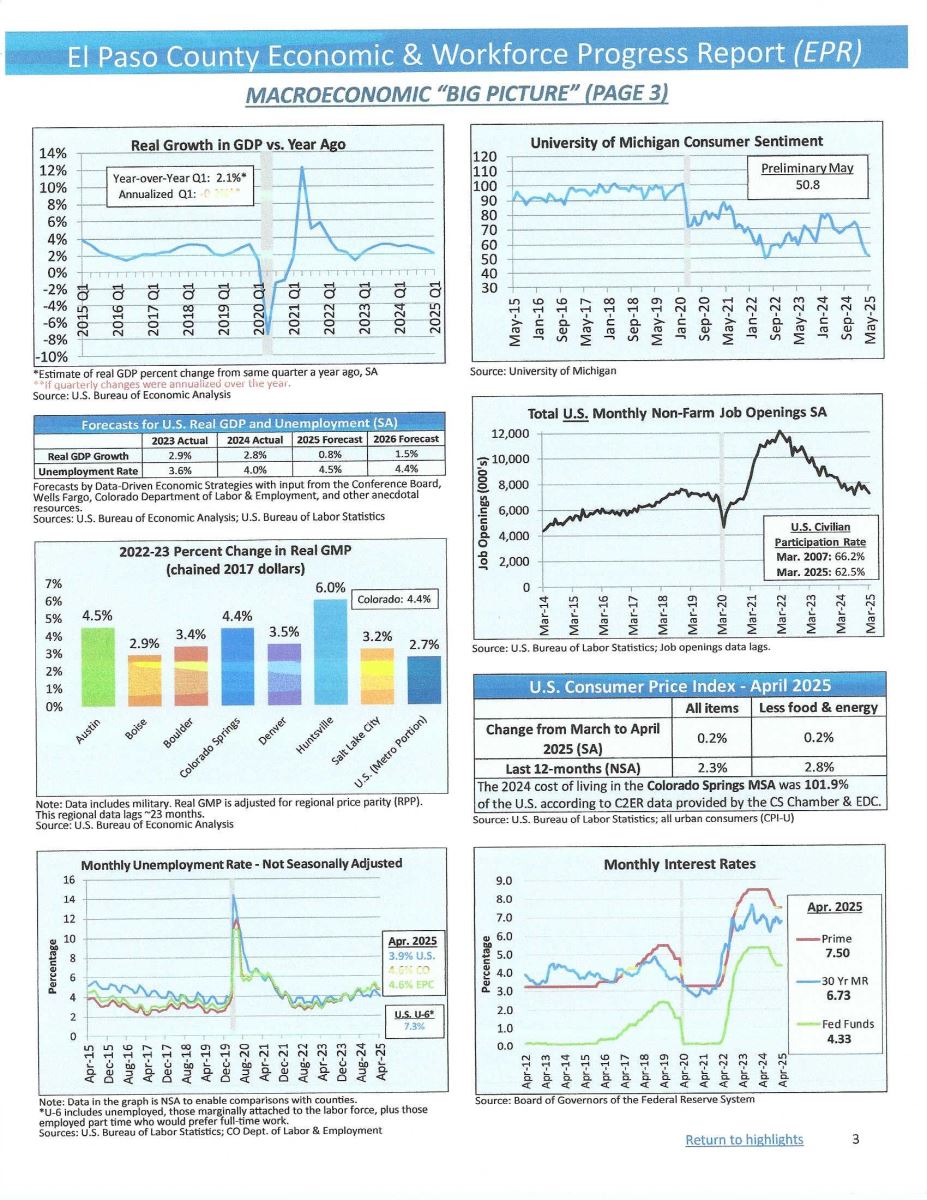

ECONOMIC & WORKFORCE DEVELOPMENT REPORT

Data-Driven Economic Strategies, May 2025

As always, I like to share the useful data I receive from our “local economist”, Tatiana Bailey. You will see in these charts what’s happening locally in terms of the economy as well as the most recent Workforce Progress Report.

This information is especially invaluable to business owners; however, I know you all will all find it worthwhile reading.

Below is a reproduction of the first page of graphics. To access the full report, please click here. And if you have any questions, give me a call.

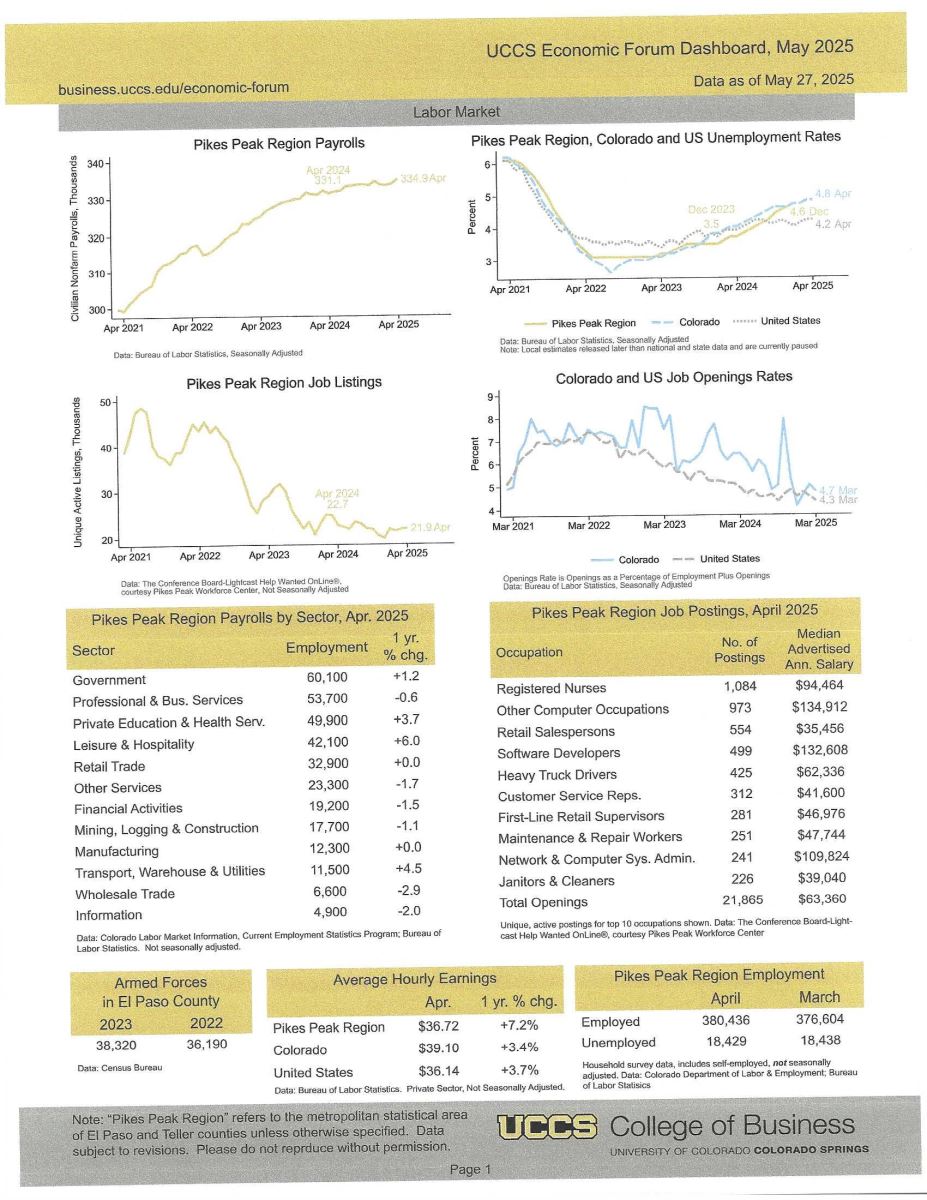

UCCS ECONOMIC FORUM MONTHLY DASHBOARD

Updated May 2025, UCCS College of Business/Economic Forum

Here is the monthly report from the UCCS College of Business Economic Forum. It is created by professor Dr. Bill Craighead, who is the Forum Director. He also publishes an on-line “Weekly Economic Snapshot” you might enjoy.

I know several of you who like statistics and use this information in your daily business life, and I will share it with you when I receive it each month.

I’ve reproduced the first page of the charts below. To access the report in its entirety, please click here.