HARRY'S BI-WEEKLY UPDATE 8.22.2022

August 22, 2022

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

LOTS OF POTENTIAL CAPTIONS FOR THE ABOVE PICTURE…

- Home equity is increasing monthly

- Home prices are high

- Mortgage rates are rising

- Housing affordability is the worst since 1989

- Rental prices for homes are getting higher

Any and all of these would be the right caption when you think of housing these days.

There is continued good news for homeowners since they are consistently building equity, although at a somewhat more “normalized” rate than in the recent past.

For first-time buyers and those looking to move, there are both pluses and minuses in today’s Residential real estate market.

Yes, the high prices, coupled with the rising interest rates, are hurting first-time buyers the most because mortgage loan qualification is harder for most of them. Many of them are turning to family members for help with the down payment in order to qualify because rental prices are also higher than ever before.

The good news for those wanting to sell and trade up is that there are now more available homes for sale, thus helping ease the “frenzy” we’ve seen the last couple of years. There are fewer bidding wars, and buyers are finding a little more “wiggle room” in their negotiations.

While the prices and interest rates are still increasing, the tax deductions and gains in personal net worth are making a move worthwhile at present. Home prices, while not rising as quickly, are still providing better returns than the stock and bond markets, and, as in the past, over the long haul should continue to do so.

As you will read further on, economists, while predicting a recession, do not expect anything like the housing crisis in 2008, and in fact, expect home values to keep increasing.

I’ve been in the local Residential real estate arena for a little over 50 years now, and I’ve seen just about every cycle imaginable. I know the “ins and outs” of getting my clients what they are looking for based on their individual wants, needs and budget.

My background in Investment Banking, as well as my expertise in negotiation, make me well suited to handle most anything that most real estate agents haven’t even considered.

When you work with me, your goals become mine, and I work tirelessly to see that together we can find the right answers for you and your family.

After all, that’s what is most important about homeownership…the ability to have a place to call your own where you and your family members can “nest”, work, play and at the same time build equity for your financial future.

When you’re ready, I’m your guy. Simply give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and I’m here to answer all your Residential real estate questions.

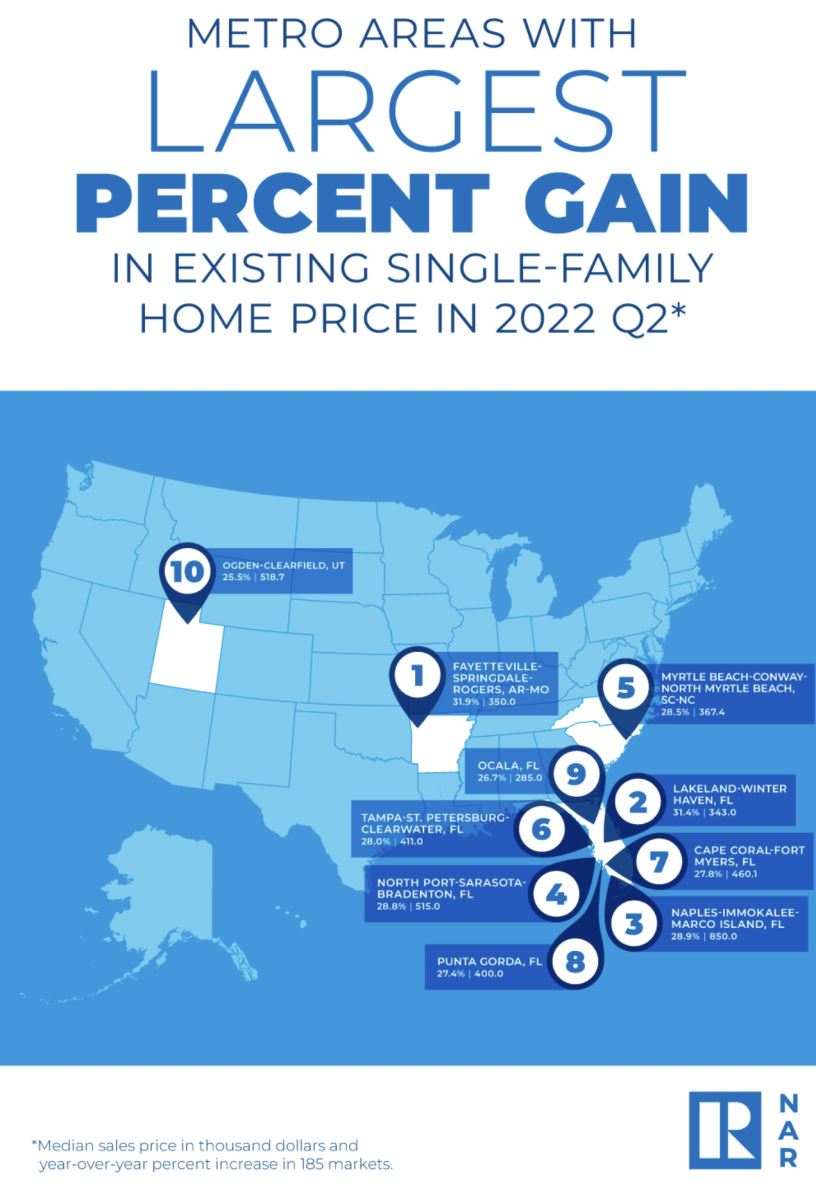

COLORADO SPRINGS HOME PRICES CONTINUE TO SURPASS MUCH OF THE COUNTRY IN THE SECOND QUARTER OF 2022

The National Association of Realtors, 8.11.22

In the recently published report, 80% of the 185 Metropolitan Statistical Areas (MSAs) surveyed quarterly by the National Association of Realtors (NAR) reached double-digit median home price appreciation in the second quarter of 2022, surpassing the 70% of the previous quarter.

The median price nationally rose 14.2% quarter-over-quarter to $413,500, surpassing $400,000 for the first time.

The median price of single-family homes in Colorado Springs rose 9.5% to $480,900 during the second quarter of the year, per NAR. This price reflects detached, single-family and patio homes but not townhomes or condominiums.

The median price in the Springs ranked 36th highest of the 185 cities surveyed. And once more, the good news is that while our home values are increasing, they remain less than those in the Denver, Boulder and Fort Collins areas, which makes our city more attractive to potential companies and individuals wanting to relocate to Colorado.

This graphic depicts areas with the largest percent gain:

To see all 185 metro areas in alphabetical order, please click here. To see them in ranking order, click here. Or click here to see what income levels are required to purchase homes based on either a 5, 10 or 20 percent down-payment.

WHILE THE U.S. IS INCHING CLOSER TO RECESSION, IT’S NOT THE SAME-OLD, SAME-OLD, AND ESPECIALLY IN THE RESIDENTIAL housing market

RealtorMag, Summer 2022

Yesterday I was reading an article by Lawrence Yun, Chief Economist and S.V.P. of Research for NAR, and wanted to share some of his findings with you.

According to Yun, “The U.S. gross domestic product contracted in the first quarter by 1.5%. The stock market has been tumbling. Inflation is stubbornly high. The Federal Reserve plans to continue raising interest rates. Pending home sales have fallen for six straight months and are now trending slightly below 2019 levels. The economy, in short, is on the verge of a recession”.

However, he adds that it will not be a straightforward recession. Despite hiring freezes at tech firms and recent job cuts among mortgage lenders as business dries up, the bigger problem for the economy is not a lack of jobs but a shortage of workers.

He said, “Statistically, there are two job openings for each unemployed person. That’s why wages are up an average of 5.5% from a year ago, to nearly $32 per hour nationwide. However, inflation is gobbling up the increase with an 8% rise in the cost of living.”

The sizeable average household accumulation of housing wealth--$75,100 in the last two years and $155,400 over the past five years will go a long way to easing some of the pain.

Yes, interest rates are higher, but we are still showing a year-over-year median price increase in local single family and patio homes of 7.2% in July and an average increase of 11.2%. For townhomes and condos, it was a median price increase of 11.9% and an average increase of 15.2%.

More importantly, “Colorado’s economy continues to shine even with the uncertainty at the national level and in the national economy,” according to Jena Griswold, Colorado Secretary of State. We have new companies moving here and others expanding. With them come lots of relocated employees and new jobs for current residents. These folks need housing and will continue to need it for the foreseeable future.

So, even factoring in the higher interest rates, with tax deductions and appreciation it still makes sense to be a homeowner rather than a renter if possible.

If you have any questions, please give me a call.

AND FOR THOSE STILL WONDERING…

KeepingCurrentMatters.com, 8.12.22

RENTAL CRISIS IS ATTRACTING MORE INVESTORS

Bloomberg.com, 8.10.22

With rental costs soaring across the U.S. and here in Colorado Springs as well, folks in many of those cities and in all income brackets are struggling to find new homes or to pay for the ones they already have.

The home affordability crisis has been snowballing with the fast appreciation in values and now with the rising interest rates. Some potential home buyers have backed out of sales due to eligibility requirements and other factors, thus putting more and more people in the market for rental properties.

Like the bidding wars and other frenzy we’ve seen in the residential real estate market during the past couple of years, supply v. demand is also ruling the rental market due to tight supplies. This is giving landlords the leverage to hike rents at all price points. Coupled with the end of the federal eviction moratorium, this has forced folks to make tough choices.

More renters than usual are staying put in their homes, sending apartment occupancy rates near the highest level in more than two decades and that cuts down on the number of apartments available for rent.

For those interested in purchasing investment properties, now is a great time to investigate it further. Being a landlord is not for everyone, but if it is something you have considered, it’s worth talking to your tax accountant or investment advisors and then to me. I’ll be happy to provide you with information based on my many years of owning these types of properties. I can give you the pros and cons, and if you and your advisors believe this is right for you, then I can help you find the property that fits for your situation.

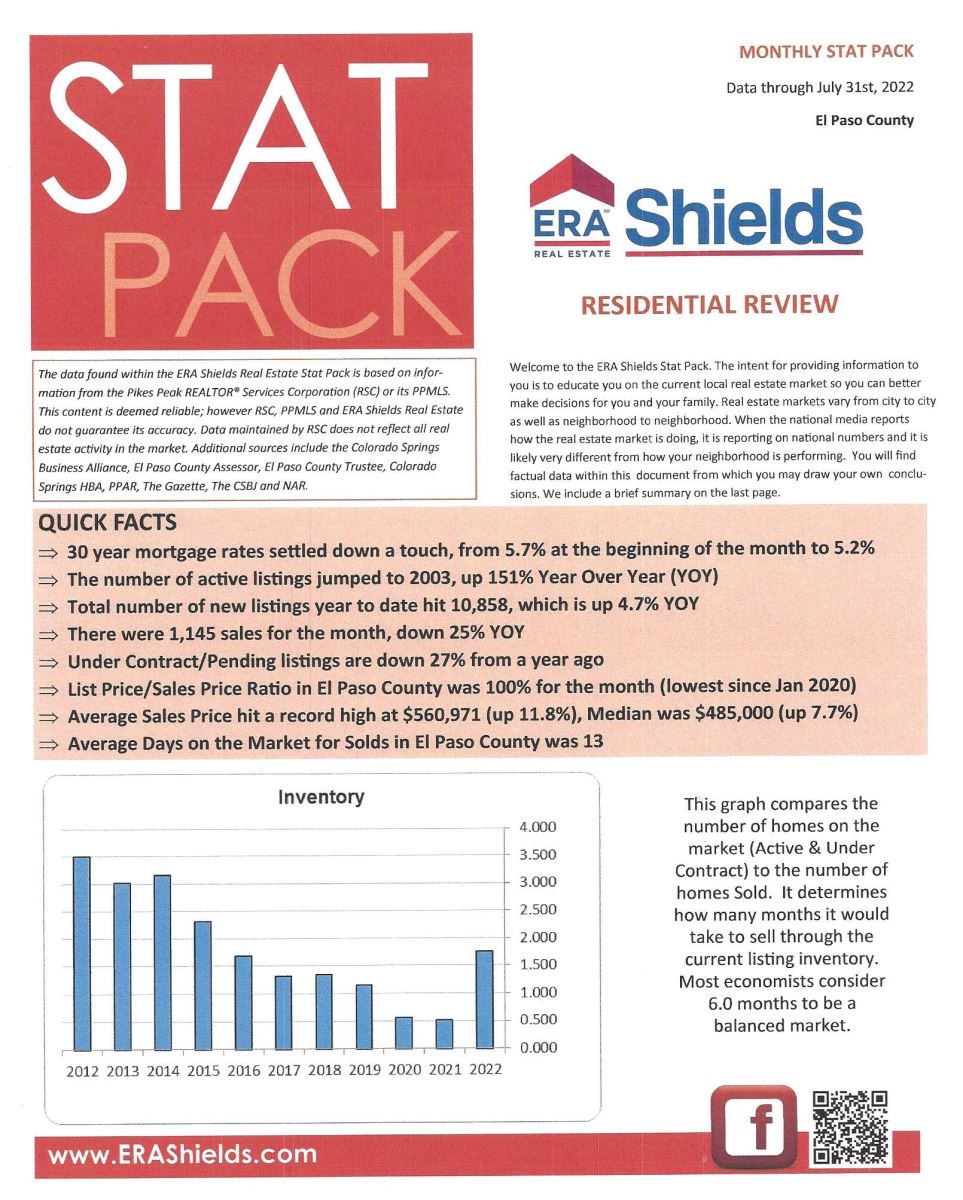

ERA SHIELDS “STAT PACK” PROVIDES A GOOD RESIDENTIAL real estate OVERVIEW

ERAShields, 7.31.22

As always, I am pleased to provide you with the most current local information. This easy-to-understand report, along with graphs, gives you a good idea of the state of local Residential real estate.

Below I’ve reprinted the first page of the report and you can click here to read the report in its entirety.