HARRY'S BI-WEEKLY UPDATE 5.9.25

May 9, 2025

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

YES, YOU SAW AND READ THAT RIGHT….

…the news in the Colorado Springs Residential real estate market is so good I thought I’d put my podcast front and center so you can click on the link below and see and hear it for yourself.

It’s a short 2 minutes and 26 seconds but full of very positive news for you.

As you will see, a number of folks are starting to make their move (literally) and we have had a lot more listings and sales in the last month and things are looking good for May as well.

To watch, click here:

While you’re at it you might want to subscribe to my YouTube channel, so you won’t miss future broadcasts. It won’t cost you anything…well, it could cost you… if you miss some of my informative musings!

With the springs buying and selling season obviously in full swing, NOW is the best time to start your search if you’ve even considered a move in the last year or more. You could be surprised to find that the possible increased equity in your present home will provide you with a greater down payment, which in turn will result in less of a monthly output than you might expect.

But you won’t know anything unless you get together with me and we figure out how to put your wants, needs and budget requirements to the best use to find just the right place for you and your family.

My 53 years in the local Residential real estate arena, coupled with my background in Investment Banking makes me more than qualified to help my clients find the best solution to their housing needs. I can also steer them in the direction of the most appropriate financing options for their individual situation.

Give me a call today at 719.593.1000 or email me at Harry@HarrySalzman.com and together let’s see how your Residential real estate dreams can become reality in the best time frame for you.

And now for statistics…

MARCH 2025

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the March 2025 PPAR report:

In El Paso County, the average days on the market for single family/patio homes was 44. For condo/townhomes it was 58.

Also in El Paso County, the sales price/list price for single family/patio homes was 99.5% and for condo/townhomes it was 99.1%.

In Teller County, the average days on the market for single family/patio homes was 87 and the sales/list price was 97.7%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing March 2025 to March 2024 for All Homes in PPAR:

Single Family/Patio Homes:

- New Listings were 1,923, Up 15.4%

- Number of Sales were 1,106, Up 15.3%

- Average Sales Price was $570,072 Up 0.9%

- Median Sales Price was $490,000, Up 0.0%

- Total Active Listings are 3,117, Up 45.7%

- Months Supply is 2.8

Condo/Townhomes:

- New Listings were 285, Up 2.2%

- Number of Sales were 153, Up 6.3%

- Average Sales Price was $351,813, Down 3.7%

- Median Sales Price was $350,000, Up 3.6 %

- Total Active Listings are 596, Up 43.3%

- Months Supply is 3.9

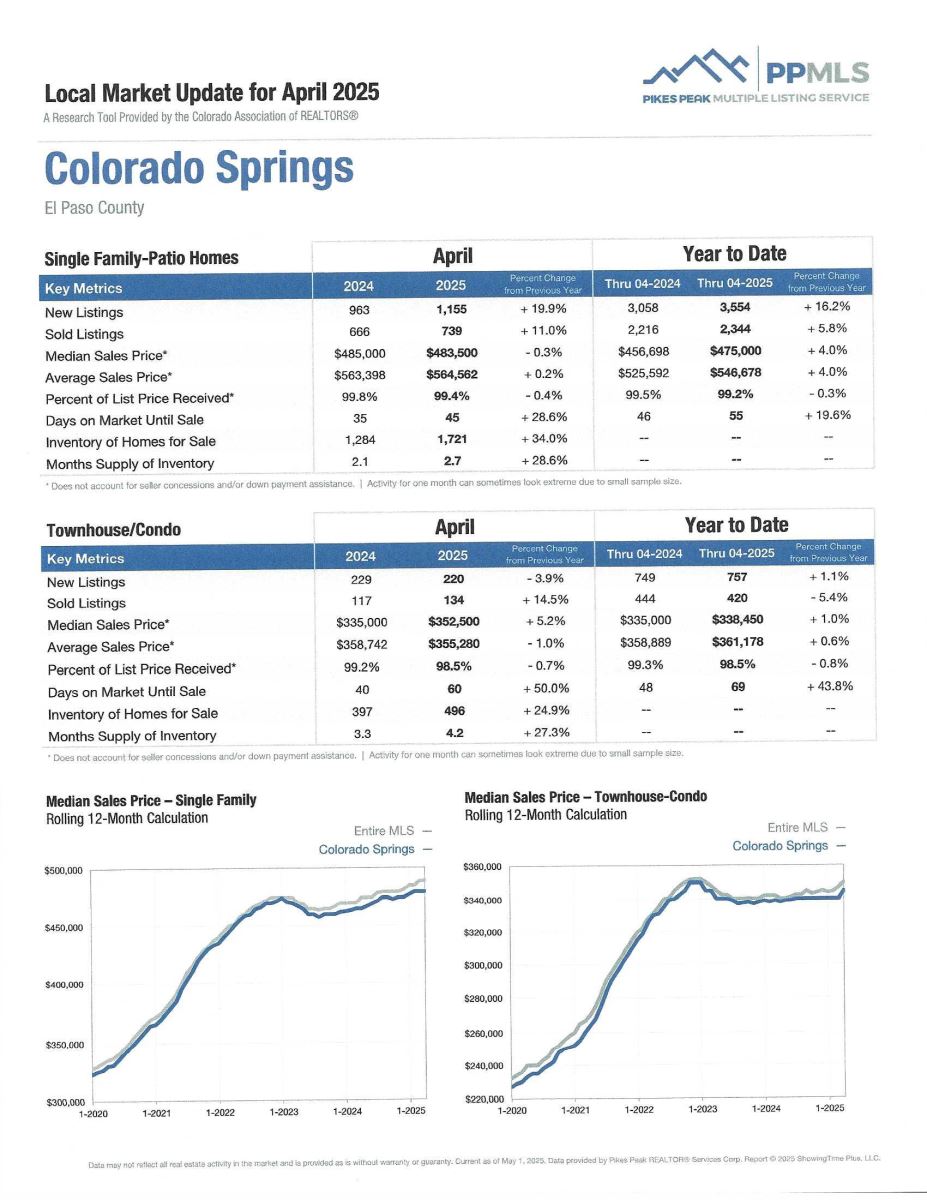

MARCH 2025 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year-to-Date one-year change:

- Sold Listings for All Properties were Up 11.9%

- Median Sales Price for All Properties was Down 0.1%

- Active Listings on All Properties were Up 30.8%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering in order to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

IS IT FINALLY A BUYER’S MARKET???

Globe Newswire, 5.3.25

Increased inventory, fewer bidding wars and slightly lower mortgage interest rates are making the homebuying process easier than it has been in the recent past.

A recent first-quarter 2025 survey from Bright MLS revealed that signs point to a potentially more overall favorable year for homebuyers.

“While it’s not officially a buyer’s market yet, the pendulum is clearly swinging away from the intensely competitive conditions of recent years,” said Lisa Sturtevant, chief economist at Bright MLS.

“Buyers are seeing more options and facing fewer obstacles compared to this time last year”, she added.

With increased listings, nationally and here in Colorado Springs, there are more options for buyers than even six months ago and sellers who have waited longer than usual to sell their home are finding things are beginning to move at a faster pace.

That being said, once again, if you have even thought about a move, the time to do so is now before the competition starts to really ramp up once again.

HOME PRICES DECLINE IN THE SOUTH, BUT RISE ELSEWHERE

The Wall Street Journal, 5.6.25

Once again, home prices are dictated by Econ 101…the law of supply and demand. In areas where there are lots of homes for sale, mostly in the southern part of the U.S., home prices have been declining.

On the other hand, in areas with high demand and lower inventory, such as Colorado Springs, home prices are either holding steady or rising.

This article pointed out the fact that areas such as ours where there are new companies relocating and others expanding, there are folks who will need housing and that is creating a shortage of inventory.

Folks who are holding on to their present homes longer due to interest rates or whatever reason are also contributing to the housing shortage and increased values.

However, once again, it is starting to become more of a buyer’s market as sellers who are ready to sell and move on are often offering some concessions in order to get a sale.

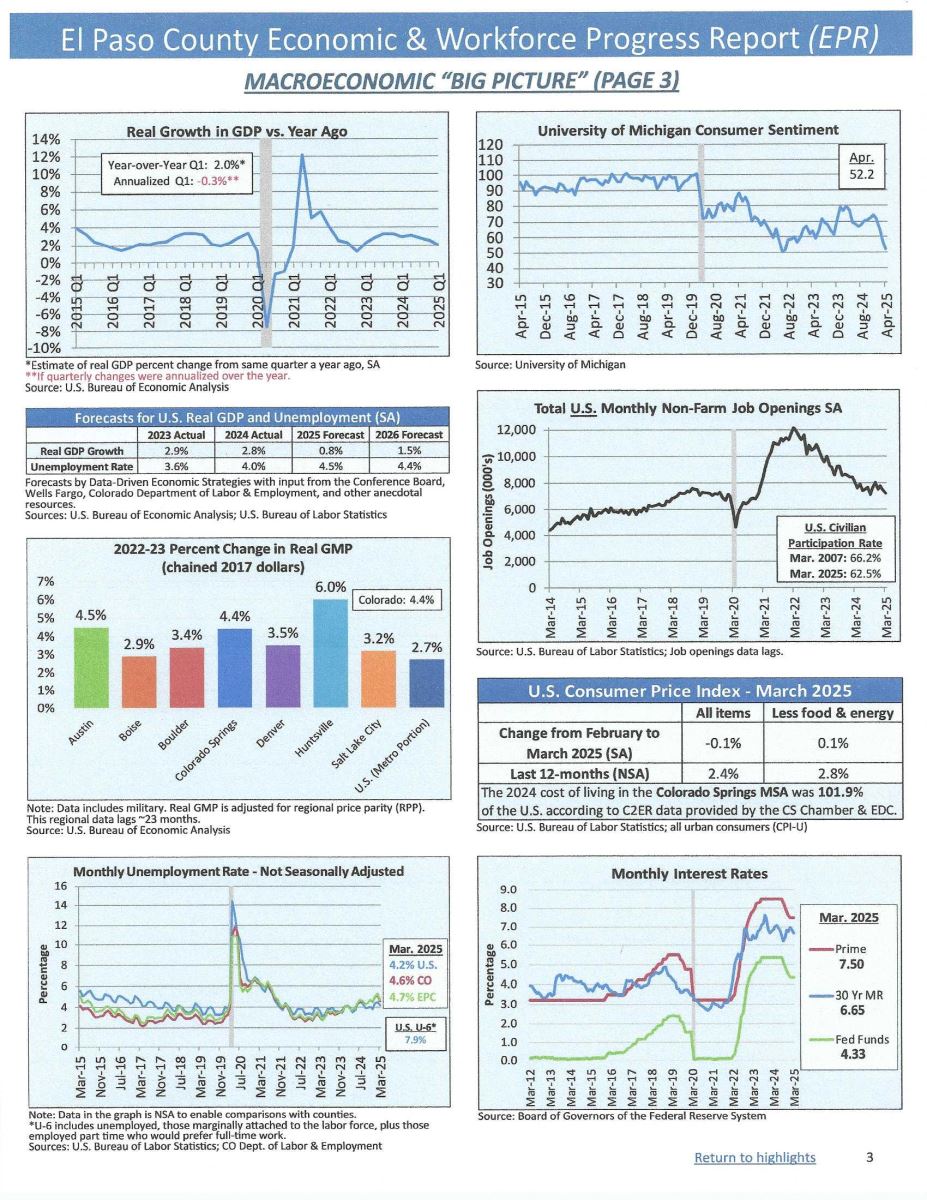

ECONOMIC & WORKFORCE DEVELOPMENT REPORT

Data-Driven Economic Strategies, March 2025

As always, I like to share the useful data I receive from our “local economist”, Tatiana Bailey. You will see in these charts what’s happening locally in terms of the economy as well as the most recent Workforce Progress Report.

This information is especially invaluable to business owners; however, I know you all will all find it worthwhile reading.

Below is a reproduction of the first page of graphics. To access the full report, please click here. And if you have any questions, give me a call.

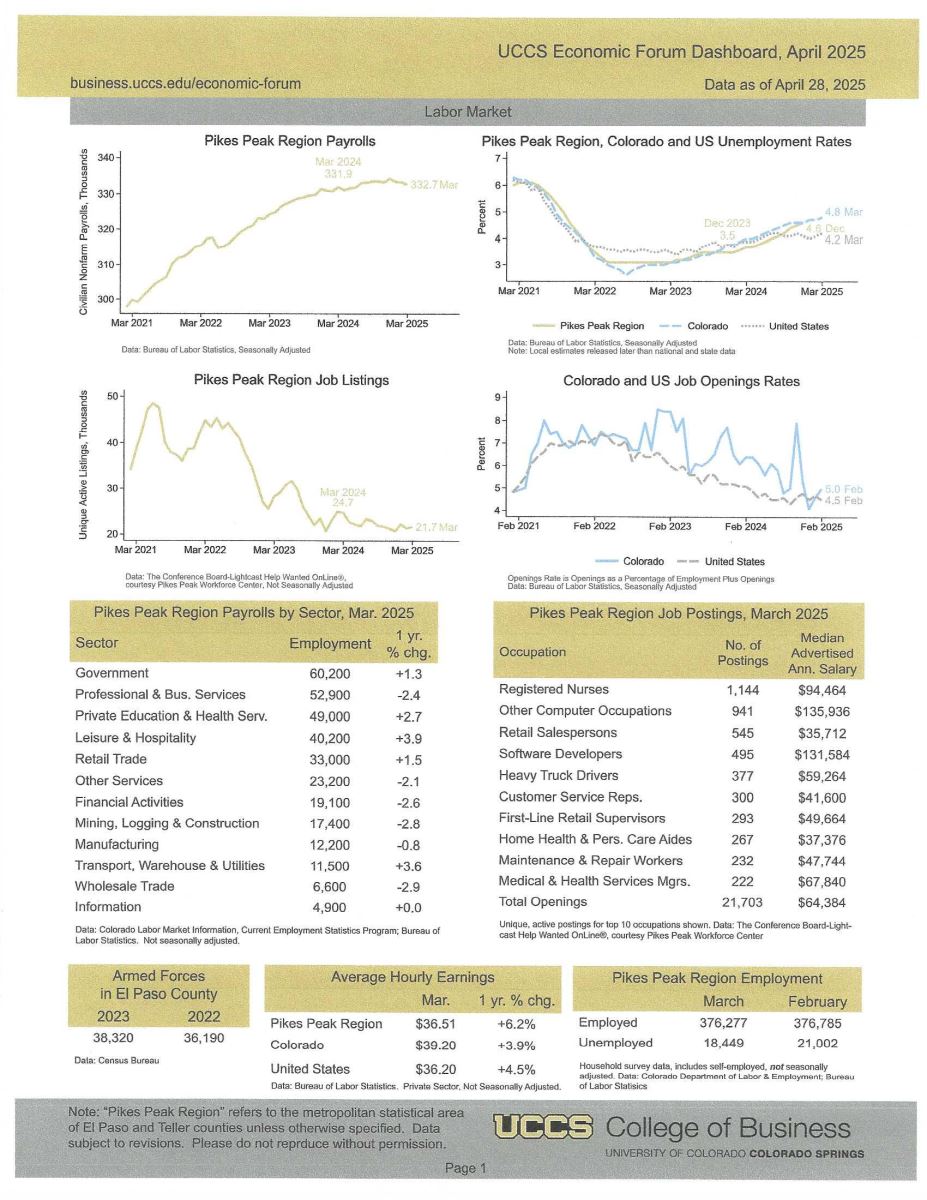

UCCS ECONOMIC FORUM MONTHLY DASHBOARD

Updated March 2025, UCCS College of Business/Economic Forum

Here is the monthly report from the UCCS College of Business Economic Forum. It is created by professor Dr. Bill Craighead, who is the Forum Director. He also publishes an on-line “Weekly Economic Snapshot” you might enjoy.

I know several of you who like statistics and use this information in your daily business life, and I will share it with you when I receive it each month.

I’ve reproduced the first page of the charts below. To access the report in its entirety, please click here.