HARRY'S BI-WEEKLY UPDATE 10.6.23

October 6, 2023

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

YES, MORTGAGE LOAN RATES ARE UP AGAIN…BUT THEN SO ARE HOME VALUES

We are hearing a lot about the rising mortgage interest rates these days, especially since the average 30-year fixed-rate hit 7.49% this week, a new 23 year high according to Freddie Mac.

But what you’re not hearing as much about nationally is that home values are also on the rise. And locally, they have been again for several months.

Why mention that? Well, it should be obvious. Yes, if you’re buying a new home your mortgage interest rate WILL likely be higher than whatever your current rate may be, BUT…with home values increasing monthly, your investment will begin earning dividends right away.

If you are wanting to buy and have decided to wait for interest rates to go down, there’s no telling when that will happen, or when it does, how low the rates will fall. They are not likely to ever go back to the historic lows of several years ago but should drop a bit by the second quarter of next year according to experts.

Home appreciation isn’t going to stop and depending on the number of available homes for sale it’s likely to keep rising faster. It’s a Seller’s Market and until there are more homes on the market it will continue that way.

Folks were thinking that when mortgage rates first started rising home values would go down as they did during the housing bust of 2008. Didn’t happen. Economists kept saying it would not happen and it didn’t. But it did prevent some from buying homes at that time as they worried about a repeat of the late 2000’s.

At the end of last year, I made my annual forecast for our local economist, Tatiana Bailey, and I told her I believed home values would increase by 2-3% this year. So far, I am basically on target as you will see in the statistics below. And I’m hopeful we could even end the year a bit stronger.

Something else you might consider if you are looking to buy at present. Mortgage interest rates are negotiable! There was a big article in today’s Wall Street Journal talking about just that and I’ve seen that in recent times with my buyers.

Mortgage lenders want to lend! When they don’t make loans, they are not making money. It’s that simple. As I always tell you…it’s Econ 101…Supply and Demand. Therefore, they are will to entertain negotiations on the rate.

You can find in today’s 30-year fixed-rate arena rates anywhere from 7.5%-8% depending on the lender.

And rates WILL go down in the next few years and as they do, mortgage loans can be refinanced at those lower rates. In fact, some buyers have that specifically put in their loan package, depending on the lender.

That’s why it’s so important to have a professional like me on your team. I’ve been called “Mr. Negotiator” for many years and it’s to my clients’ advantage. My Investment Banking background makes it a natural for me to deal with lenders for my clients.

Yes, things are somewhat in a flux in Residential real estate, but if you’ve even considered buying or selling during the past year and held back for whatever reason, give me a call and let’s see how we can make that happen.

And, if you’ve got a minute and 20 seconds, I’ve got some more news for you. Simply click on the link below and you will be directed to my personal YouTube channel.

To watch, click here:

In fact, while you’re at it, you might want to subscribe to my channel, so you won’t miss my future broadcasts. It won’t cost you anything…well, it could cost you… if you miss some of my informative musings!

So, as always, if Residential real estate is among your current hopes and dreams, please give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let me help make them come true.

And now for statistics…

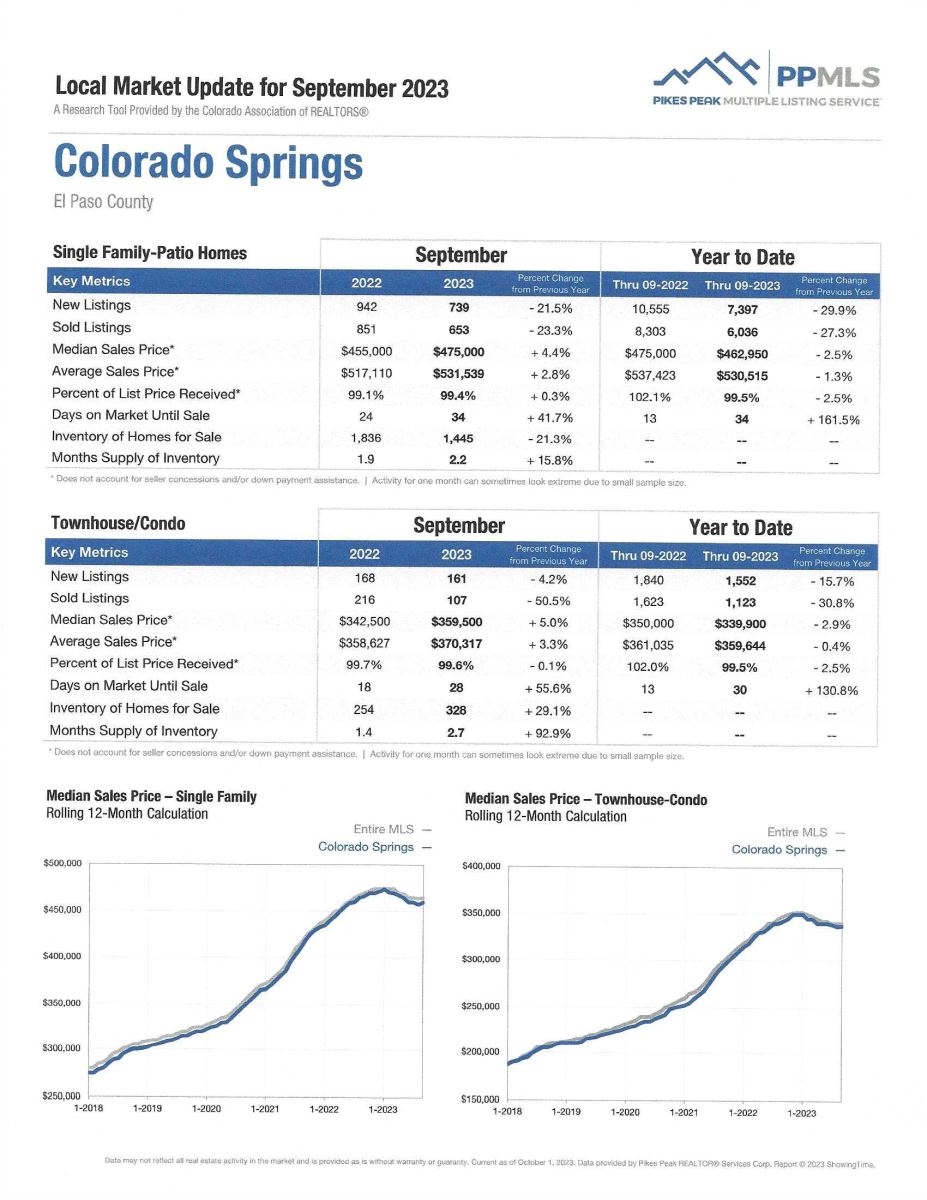

SEPTEMBER 2023

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the September 2023 PPAR report.

In El Paso County, the average days on the market for single family/patio homes was 36. For condo/townhomes it was 28.

Also in El Paso County, the sales price/list price for single family/patio homes was 99.2% and for condo/townhomes it was 99.6%.

In Teller County, the average days on the market for single family/patio homes was 43 and the sales/list price was 121.5%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing September 2023 to September 2022 for All Homes in PPAR:

Single Family/Patio Homes:

- New Listings were 1,243, Down 17.0%

- Number of Sales were 1,008, Down 22.1%

- Average Sales Price was $540,882 Up 3.4%

- Median Sales Price was $475,000, Up 3.3%

- Total Active Listings are 2,484, Down 7.7%

- Months Supply is 2.5, Up 0.3

Condo/Townhomes:

- New Listings were 186, Down 9.3%

- Number of Sales were 131, Down 47.2%

- Average Sales Price was $369,467, Up 1.7%

- Median Sales Price was $350,000, Up 1.4%

- Total Active Listings are 366, Up 55.7%

- Months Supply is 2.8, Down 1.2

SEPTEMBER 2023 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year-to-Date one-year change:

- Sold Listings for All Properties were Down 26.8%

- Median Sales Price for All Properties was Up 4.5%

- Active Listings on All Properties were Down 11.9%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering in order to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

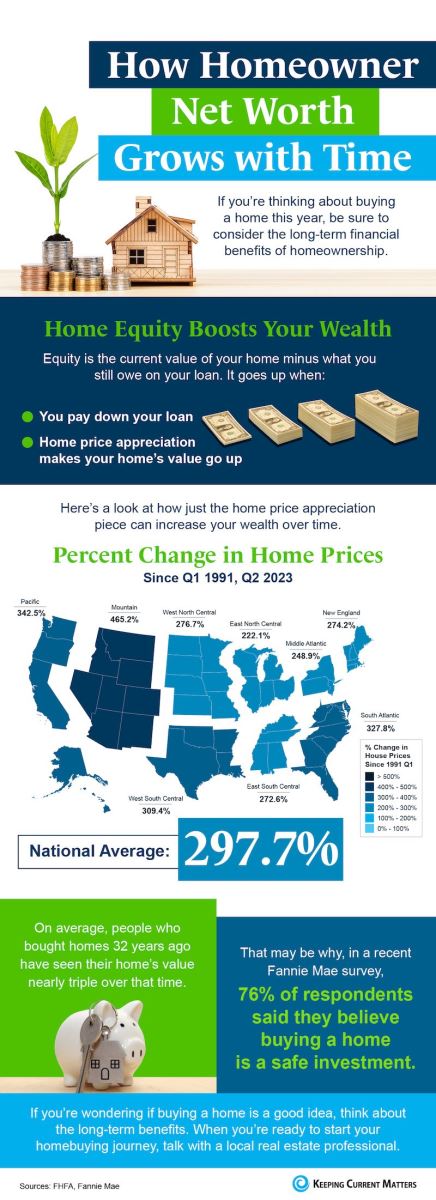

HOW HOMEOWNER NET WORTH GROWS WITH TIME…AN INFOGRAPHIC

Keeping Current Matters, 9.6.23

This helps demonstrate what I’ve said throughout my entire Residential real estate Career…owning a home is an important part of increasing one’s net worth!

A couple of highlights:

- If you are thinking of buying a home, most especially in this current market, be sure to consider the long-term financial advantages of homeownership, like home equity.

- On average, people who bought homes 32 years ago have seen their home’s value nearly triple over that time.

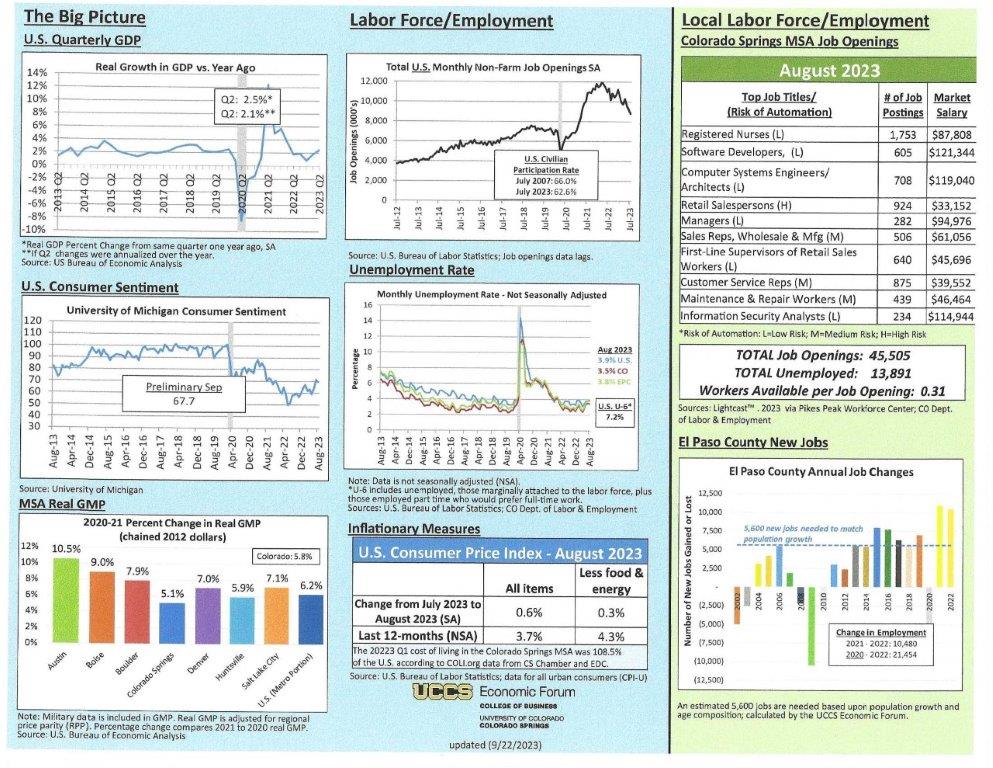

ECONOMIC & WORKFORCE DEVELOPMENT REPORT

Data-Driven Economic Strategies, September 2023

As always, I like to share the useful economic data I receive from our “local economist”, Tatiana Bailey. You will see in these charts what’s happening locally in terms of the economy as well as the most recent Workforce Progress Report.

This information is especially invaluable to business owners; however, I think you all will all find it worthwhile reading.

To access the report, please click here and if you have any questions, please give me a holler.

UCCS ECONOMIC FORUM MONTHLY DASHBOARD

Updated September 22, 2023, UCCS College of Business/Economic Forum

I’ve always shared the monthly report from the UCCS College of Business Economic Forum when available and I know several of you who enjoy statics use this information in your daily business life.

Now that there is a new director, Dr. Bill Craighead, I should be publishing it monthly once again.

Here is a reproduction of the first page, and to read the report in its entirety, please click here.