Harry's Bi-Weekly Update 4.14.14

April 14, 2014

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Personal Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

HAPPY HOLIDAYS TO ALL WHO CELEBRATE

I’d like to take a moment to reflect on the significance of the two religious holidays that are happening this week. Both remind us of the importance of FREEDOM, one of the basic principles upon which our great country was founded.

It is my hope that everyone can appreciate the value of freedom and start working together and not against each other. Appreciation of our differences simply requires more understanding of what makes each of us unique. As this holiday season approaches...I wish you all peace and the freedom to be who you are and to have the freedom to practice whatever it is that makes you--you.

IS A HOUSING BUBBLE HERE ONCE AGAIN?

DSNews 4.1.14

When year over year price increases continue on a double-digit course despite recent slowdowns, the question of a housing “bubble” comes again to the forefront and it’s a question I’ve recently been asked by clients.

According to Jed Kolko, Trulia chief economist, the answer is both yes and no! Kolko estimates that national home prices are still around 5 percent undervalued when examining long-term fundamentals like historical prices, incomes and rents. While ongoing improvements in prices have brought the market close to a tipping point, he notes that it’s still a far cry from the 39 percent overvaluation in the first quarter of 2006.

“Even though recent double-digit price gains look unsustainable, current national price levels are not cause for alarm,” Kolko said in a blog post. “Sharp price gains, like we’ve had in 2012 and 2013 are not the sign of a bubble unless price levels look high relative to fundamentals.”

He further added that “the slowdown in price gains make it less likely that we’re headed for another bubble.”

WHAT A GOOD real estate BROKER BRINGS TO THE TABLE

You want to sell your home and wonder why you need a reputable real estate Agent to help with this transaction? I’m here to tell you how and why this can make a difference between heartbreak and success.

When we need advice in a legal, medical, accounting or whatever situation, we go to the best lawyer, doctor, accountant, etc. that we can find. Their professional help can save us time and money. Oftentimes, we seek a second opinion and then make informed decisions based on the professional knowledge we received.

Well, your personal real estate situation is no different. You need to seek the same level of professionalism in your Realtor that you would in any other professional.

Even forgetting the fact that there are so many “i’s” to dot and “t’s” to cross in negotiating your way through the real estate wars today, a reputable Real Estate Agent can make certain that you’ve done all you can to get your home in the best shape prior to listing.

One of the most important things to consider is pricing. We all want to get the most money possible for our homes and oftentimes what we think our home is worth is not necessarily what the market will realistically sustain.

Fixing up your home to put its best foot forward is important to do prior to listing. The better your home shows, the better competitive advantage and the quicker it will sell.

Let me share with you three recent success stories from the past three weeks. All three home Sellers and their properties are in different price ranges and had different Buyer profiles but each Seller took the time to listen to my advice and went under contract in record time.

The listing prices of the three homes were $224,900, $400,000 and $659,900 and all three coincidentally were in the northwest area of Colorado Springs.

- Each of the three Sellers considered my thoughts as to who they might be looking for as Buyers of their respective homes.

- Each Seller hired the appropriate “fix up” contractor for their price range. Not all “fix up” contractors are best for all price ranges so knowing who to hire is important.

- All three homes had interior and exterior issues and I was able to help each Seller determine how much they needed to spend in order to receive a quick and reasonable sale.

- Each Seller took my suggestion for the listing price. I provided each with market value analysis and comparables which they looked at and analyzed to come up with a price.

One home was on the market 10 days, one for 4 days and one was on the market for less than 24 hours!

That, my friends, is why it’s important to list your home with a reputable real estate Agent. The type of customer service I provide to each and every one of you is based on more than 40 years in the local Real Estate arena, along with my Investment Banking background. I do the homework for you and try to make the process as stress-free as possible.

While I’m talking about Selling a home here, as you know, I put the same detail and work into helping Buyers and Investors find what they want, too. If you are in the market for any real estate transaction, call me today at 598.3200 or email me at Harry@HarrySalzman.com and let me show you how I can put my considerable knowledge to work for you.

COST OF LIVING IN COLORADO SPRINGS REMAINS BELOW NATIONAL AVERAGE

The Gazette

The cost of living in Colorado Springs just keeps getting better. According to a survey from the Council for Community and Economic Research, last year it was 3.9 percent below the national average, which was slightly better than in 2012 when we were 3.7 percent below.

The index for 2013 didn’t change much because half of the six components were lower and the other three were higher from a year earlier when compared with the national average. Components measuring grocery items, transportation and miscellaneous goods and services were lower, while those measuring housing, utilities and health care were higher.

While the index does not measure inflation, it compares prices in more than 300 metro areas for 57 goods and services used or purchased by households where middle managers live. It’s purpose is to help managers compare living costs when considering a move to another city.

A MILLION REASONS…OR POSSIBLY JUST A FEW HUNDRED THOUSAND…TO BUY LOCALLY

The Gazette

A report by Trulia, Inc. of the nation’s 100 largest metro areas ranked Colorado Springs seventh in terms of offering the most house for a $1 million price tag.

You could fit four million-dollar homes from New York inside a million dollar property in Colorado Springs! In the New York/New Jersey area a million dollars will get you just 1,489 square feet—the smallest in this survey.

While this is great news for Buyers interested in properties of this size and price range, what it means to the rest of us is that no matter what the price—homes in Colorado Springs are a relative bargain based on size in compared to many other metro areas.

DODD-FRANK REGULATIONS POSING A “SERIOUS CHALLENGE”

DSnews 4.9.14

Bankers are worried about lending and that fear is affecting who can qualify for mortgage loans based on the latest version of the Dodd-Frank mortgage regulations.

According to the results of the latest annual real estate Lending Survey by the American Bankers Association, loan officers are clearly showing signs of caution. More than 80 percent of bankers surveyed believe that tightened Dodd-Frank rules will restrict credit, thereby narrowing the pool of candidates able to secure mortgages.

Regulation Z, which was implemented in January, prohibits lenders from making a higher-priced mortgage loan without regard to the consumer’s ability to repay. This change led lenders to alter who they saw as viable mortgage loan candidates as they figure out how to do business within the confines of tighter controls.

Robert Davis, EVP of the American Bankers Association said, “The new mortgage rules are a serious challenge, especially in the near term, for mortgage lending. The problem will last at least as long as bankers calibrate their compliance systems, and perhaps much longer.”

There are some Mortgage Winners and Losers because of this new regulation:

Mortgage Winners:

- Homeowners with solid income, lots of home equity, and excellent credit. If you want to borrow much less than your home is worth and have great credit and plenty of income to pay your monthly bills, you’ll easily meet the new standards.

- First-time homebuyers. Most FHA and many low downpayment loans will meet the new safe loan standards. Those with marginal credit or other impairments that raise questions about their ability to repay a mortgage will likely face the same hurdles they faced before the rule.

- Homeowners whose lenders don’t treat them right. If your servicer loses your payment, doesn’t answer when you write to ask questions, or forces you to buy expensive insurance you don’t need, things are looking up. The new mortgage rules set standards for posting payments and answering your questions promptly, and stop mortgage lenders from forcing you to buy insurance you don’t need.

- Homeowners who don’t like to shop around. In the past, lenders paid loan officers a bonus for pushing customers into higher-interest loans. Now, lenders can’t do that anymore. Plus, lenders who charge you more than 1.5% above the going interest rate will lose protection from lawsuits.

When you’re shopping, ask if you’re getting a “qualified mortgage”—that’s the official name for a loan that meets the new guidelines. You’ll know that your loan is amongst the safest for you and within 1.5% of the rate most people with good credit are paying.

Added protections and tighter lending policies are presenting potential hardships for some people. The new rule could restrict lending by at least 10% and higher in some regions, which can create difficulties in our economic recovery says Jeff Kibbey, primary legal counsel for Century Mortgage Company.

The future of homeownership depends on greater access to credit. “Over the past 8 years, homeownership in the U.S. has decreased while many in the growing population have turned to renting instead of buying a home,” said NAR’s chief economist, Lawrence Yun. “We need to ensure that good, creditworthy renters can someday have the appropriate access to credit so they can build equity through homeownership.”

Mortgage Losers:

- Minorities and modest-income Americans. Credit continues to be so tight that responsible Buyers are having trouble attaining homeownership, Yun said. Homeownership among African-Americans has fallen to just above 43%, down from just under 50% in 2004 and African-American net worth has been cut in half due to higher unemployment and the foreclosure crisis.

- Owners and buyers of higher-priced homes in high-cost areas. If you’re Buying or Selling a higher-cost home, finding a mortgage can by costly if the home’s value is more than the FHA or Fannie Mae and Freddie Mac loan limits of $271,050 (FHA) to $414,000 (Fannie/Freddie) in lower-cost areas and $625,500 (for both) in the highest-cost areas.

If your mortgage is for more than the limits, you (or your home’s Buyers) will need a jumbo loan, which usually means a FICO mortgage credit score of 720 or better and putting as much as 20% down or buying private mortgage insurance.

More people than ever could be in this situation: Buyers in more than 300 counties face FHA loan-limit reductions greater than 10% and in some markets, the biggest FHA loan size will be cut in half, Yun said.

- Middle-Income Americans who fall outside the new guidelines. First-time homebuyers trying to purchase a $350,000 house aren’t going to have a lot of loan options if they can’t get an FHA or Fannie/Freddie guaranteed loan,predicts Bankrate.com senior financial analyst Greg McBride.

Those with bigger bank accounts, say a homebuyer purchasing a $900,000 home, won’t have the same difficulties. That richer borrower is an appealing customer for related financial products so a bank is more likely to give him a loan that falls outside the new guidelines to land him as a customer.

- Single homebuyers. Dual-income households tend to have higher credit scores because they have a second paycheck to fall back on in a financial crisis. Restrictive mortgage lending standards favor higher credit scores.

- Mortgage borrowers with fluctuating income who have had a bad year, or two, including business owners, commissioned salespeople, or executives who didn’t get that big bonus. There’s a new emphasis on ability to repay and that starts with proving you have steady income.

- Mortgage borrowers with lots of debt. If your car payments, student loans, or other installment debt take up more then 43% of your income, and can’t qualify for an FHA or GSE loan, you won’t meet the new lending standards, so you may have a hard time finding a mortgage.

What does all this mean to you? Well, it’s not getting any easier to obtain a mortgage, however; having me in your corner with my connections to qualified mortgage lenders, it’s easier to find out exactly what it’s going to take to make that homeownership dream a reality. No matter which category you fall into, give me a call and let’s see how we can help you navigate through the mortgage lending wars and obtain a qualified mortgage.

ON A GOOD NOTE…LOWER MORTGAGE RATES HELP SPRING BUYING

DSNews 4.11.14

With the prime Buying season in full swing, a bit of good news for consumers is that mortgage rates fell a bit last week, according to reports from Freddie Mac and Bankrate.com.

In its weekly Primary Mortgage Market Survey, Freddie Mac reported the 30-year fixed-rate mortgage (FRM) averaging a rate of 4.34% for the week ending April 10, a decline from 4.41% the previous week.

The 15-year FRM last week averaged 3.38%, down nearly a tenth of a percentage point from early April.

So while home prices are continuing their upward trend which may cause a bit of “sticker shock” to Buyers, this decline in mortgage interest rates helps ease the shock a bit. As always, though, if you are looking to Sell and Trade Up or Buy for first time or Investment purposes, NOW is a very good time. Prices are not coming down, inventories are not growing and mortgages are certain to go up, so don’t sit on the fence if you are wanting to get what you are looking for in the real estate market.

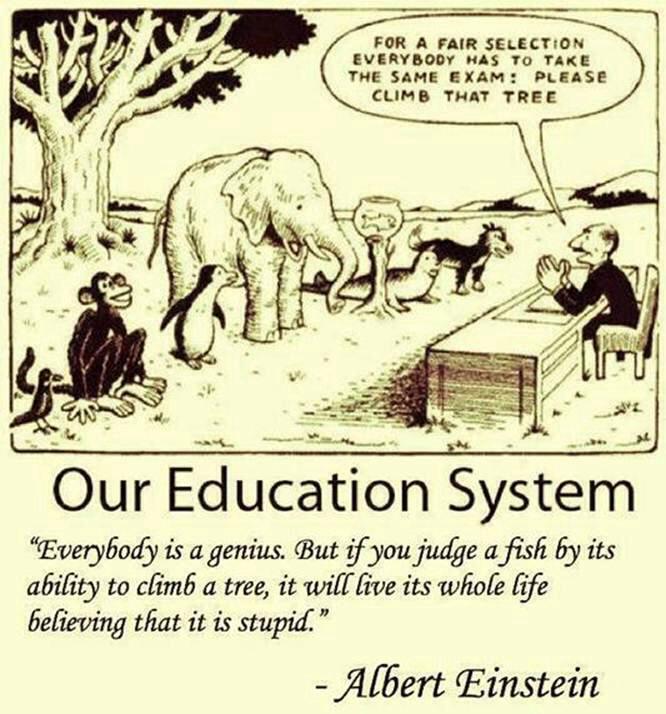

HARRY’S PHILOSOPHY OF THE DAY