HARRY'S BI-WEEKLY UPDATE 1.25.22

January 25, 2022

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

LOW INTEREST RATES ARE ON THE RISE AND SO IS HOME APPRECIATION. THE TIME TO JUMP IN IS NOW…BUT TIME IS NOT ON YOUR SIDE FOR MUCH LONGER.

I rarely begin my eNewsletter on a less than positive note, but I hope this headline got your attention.

I’ve been saying for a while now that while home appreciation is continuing its upward trend, the low mortgage interest rates of yesterday are soon to be history. And recently, the Federal Reserve has indicated that they intend to raise their rates for banks four times this year to help curb inflation. Mortgage interest rates are sure to follow, and in fact have been rising for the last month. It’s doubtful we will see the historically low rates again in our lifetime, if ever.

Today’s rates are still a bargain compared to rates of even five or six years ago, so if you have even considered a buying a home, there’s not any time to waste. Here are some of my thoughts to consider if you are thinking of getting into the market:

- As of Sunday, there were 308 home listings for existing homes in Colorado Springs and another 111 in the other areas of El Paso County. That’s a total of 419 single family detached homes for sale—a less than two-week supply!

- Interest rates are slowly rising—the 30-year fixed-rate ones are currently the highest they’ve been in two years--and will continue to rise until inflation is curbed.

- Rental rates are higher than ever and will continue to rise with demand. It’s proven to be cheaper to be a homeowner than a renter if possible and sometimes that means modifying your expectations in order to purchase a home now. Home appreciation like that we have been experiencing will likely provide the equity you will need when you are ready to upgrade or trade up.

- I believe that we will continue to experience home appreciation in Colorado Springs of between 12-14% in 2022 and this presents a great opportunity for investors to consider buying rental properties. If you’ve looked at the volatility of the stock market in recent days you can understand the prudence of this. The huge drop this past week, although with a quick recovery of sorts yesterday, illustrates this point.

- Costs of new construction materials such as lumber, cement, copper, aluminum, cotton and more continue to rise and with them the price of new homes. Locking in a home now, if that is the direction you wish to go, is essential. Some builders are not even quoting exact prices, but the sooner you begin the search the sooner you will at least be on the list for a new home.

- Single family/patio homes in Colorado Springs and El Paso County sold for 103.2% of their listing price for all of 2021. In Teller County that number was 101.3% of list price. Your present home will likely sell quickly and for more than you might expect.

- Colorado Springs is going to continue to be a favored place for companies and individuals when it comes to relocation. I see no end to this trend and expect it to continue more than ever due to the work-from-home situations that allow folks to work from wherever they choose. Many are choosing and will continue to choose Colorado Springs.

Let’s discuss interest rates. Yes, they are going up. However, they are still low and when you consider the appreciation, you will make back the difference faster than any ever. A home represents one of the biggest investments most families ever make, and today’s home appreciation will likely provide a far better return than day trading or short-term investments.

A home is a long-term investment which will provide you and your family personal enjoyment. Or it can be a rental home for investment purposes which will provide not only monthly income but an appreciation considerably better than the stock market. In fact, a number of my investment buying clients are supplementing their retirement income with the income from their rentals, while that home is gaining appreciation year after year.

Read further in this eNewsletter to see more highlights of what’s happening now and is predicted to happen in Residential real estate as 2022 progresses.

And, if you’re ready or even thinking of being ready, pick up the phone and give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let’s discuss any and all possibilities for making your Residential real estate dreams come true.

AMERICANS CHOOSE real estate AS THE BEST INVESTMENT

Keeping Current Matters, 1.21.22

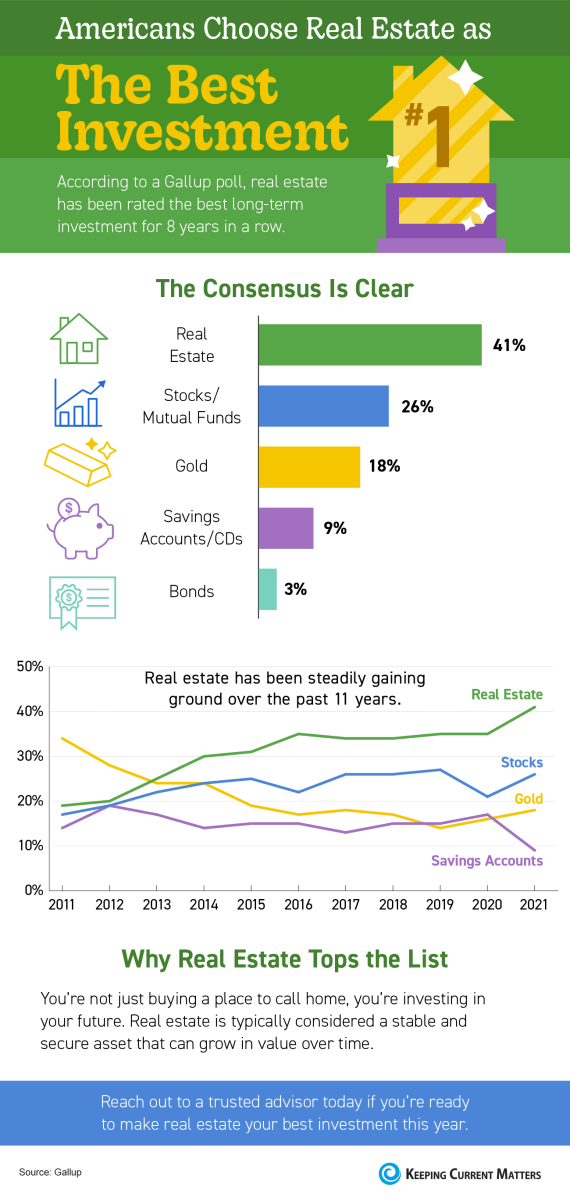

As I mentioned earlier, more and more Americans are choosing real estate as “The Best Investment”. This infographic illustrates it well:

Some highlights:

- According to a Gallup poll, real estate has been rated the best long-term investment for eight years in a row.

- real estate tops the list because you’re not just buying a place to call home—you’re investing in your future. Real estate is typically considered a stable and secure asset that can grow in value over time.

- If you’re ready to invest in your family’s future, give me a call sooner than later and let’s get started!

WHAT 2022 MEANS FOR HOMEBUYERS

Associated Press, 1.23.22

(Excerpted from an interview with Lawrence Yun, Chief Economist for the National Association of Realtors (NAR):

How do you see the housing market’s trajectory shaping up this year?

Mortgage rates will definitely be higher, which means that people who were barely able to qualify last year will not be able to do so this year. Combine that with some increase in supply. Builders have the profit motive. Lumber prices and other materials costs are rising, but they’re simply tacking on those additional costs to consumers, who are willing to buy. Price growth (nationally) will be something around 5% in 2022, which will be a very normal rate of increase.

Fair to say homeowners who are selling will still have an edge on buyers nationally?

We’re in a housing shortage of roughly 3 or 4 million. And given that homebuilders can probably at the maximum put up maybe 2 million homes, more likely 1.7 or 1.8 million homes (a year), this housing shortage will persist this year and probably linger on somewhat next year. Hence, the market in 2022 will still favor sellers.

How high do you see mortgage rates going this year?

My best guess at the moment is about 3.7%. It could be a little lower or a little higher, but it’s going to certainly be higher than the 3% people enjoyed last year.

To what degree will higher rates dampen home sales?

Rising home prices have hindered affordability, but now rising interest rates are another thing that will begin to shave off some of the demand potential from first-time buyers. My official forecast for home sales this year is they will come down about 2% from last year.

Has the pandemic led to any enduring changes to the way Americans buy and sell homes?

The pandemic will come to an end. Hopefully, the sooner the better. But the work-from-home situation, that development is here to stay. That will be the key factor driving the housing market preference and demand.

What’s the biggest worry you have about the housing market now?

The concern is really first-time buyers. If we don’t increase supply sufficiently, we will have a situation where the country becomes more divided. Homeowners are feeling very wealthy. Renters are feeling very frustrated, beginning to see accelerating rents. So, we need to ensure that housing supply continues to increase.

ERA SHIELDS “2021 ANNUAL REVIEW OF COLORADO SPRINGS RESIDENTIAL real estate AND 2022 FORECAST

I want to share with you the “2021 Annual Review and 2022 Forecast” compiled by my company.

Some interesting facts taken from the report:

“Fun Facts from 2021 (El Paso County):

- Most expensive sale—an amazing home near The Broadmoor sold for $8,000,000

- Largest home sold—The $8,000,000 home was also the largest at 16,594 square feet

- Cheapest home sold—A single-wide in Ramah on a foundation sold for $52,000

- Smallest home sold—In old-town Fountain, a 400 square foot home

“Quick Hits from 2021 (El Paso County)

- Number of units sold was an all-time high at 14,803 (up 1%)

- Average sales prices for the year were $487,876 (up 18%)

- Median sales price was $431,250 (up 18%)

- Inventory levels for the year averaged just 2 weeks

- New home permits hit 2862 for Colorado Springs (down 3%)

- 391 homes sold for $1,000,000 or more (just 38 in 2015)

- 73 homes sold for under $200,000 (3,736 in 2015)

- Mortgage rates hit an all-time low of 2.65% in January, and peaked in April at 3.18%

You can click here to read the 12-page report, along with charts, in its entirety. If you have any questions, please give me a holler.