HARRY'S BI-WEEKLY UPDATE 11.7.23

November 7, 2023

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

MORTGAGE RATES FALLING A BIT, BUT STILL HIGH AND NATIONAL ASSOCIATION OF REALTORS MAKES THE NEWS…LOTS TO DISCUSS HERE

Let’s begin with the recent news about the lawsuit where the National Association of Realtors (NAR) was found liable last week for charging the same commissions as they have for years even though home prices are considerably higher than they were years ago. This will obviously be appealed so it’s not known how this will eventually play out.

Here’s my take on it. Yes, Realtors are still making the same commission as they have for years, but it actually takes a lot more work today on the part of Realtors to go from square one to the closing table.

So let me just speak for myself here.

To begin with, my job is to help facilitate an experience as stress free as possible for the buyer or seller. In the market frenzy of recent years, it was more stressful than I can ever remember as buyers were forced to make an offer on a home without seeing it in person in many cases. It required quick action on my part to get the offer written in such a way as to make it stand out from the many others that inevitably came in. And for my sellers, it took a lot of time to go through multiple offers and bidding wars to determine what offer was in their best interest.

It was very difficult, not only for me, but for my clients as well. I like to take the stress away from them whenever possible because buying or selling a home is a huge decision, but luckily for them, one of my specialties is negotiation. But with so many offers coming in so fast, it was stressful for everyone during that time.

But now let’s talk about today. Yes, the frenzy is gone and there is more time to make decisions, but there are not many homes for sale. My buyers depend on me to find them a home that fits their needs, wants and budget requirements and in today’s market that is not an easy thing to do.

Finding a lender who is the best fit for my client is also something I assist with if asked and I can find the best rates from reputable lenders because this is something I have done for clients my entire career. My investment banking experience, and from having owned my own mortgage

company at one time, come in real handy here as I know the ins and outs of this sometimes difficult aspect of home buying.

Once we find a home, there are all the offer negotiations, inspections, and more.

So, not to sound defensive, but…. we Realtors more than earn our commission.

If you don’t believe that’s true, simply ask someone how things went when they tried “For Sale by Owner”. The answer most always is, “Never again!”

And now on to the mortgage rates of today…

Yes, mortgage rates are much higher than they were even a year ago. With them hovering around 8% many potential buyers are waiting to see what will happen.

My advice? Don’t wait too long. Rates aren’t going down much anytime soon but home prices are also not going down since appreciation is continuing to go up. Yes, you read that right.

At the end of last year, I made my annual forecast for our local economist, Tatiana Bailey, and I told her I believed home values would increase by 2-3% this year. That was higher than national economists predicted for annual home appreciation, but…at present our local appreciation is even higher than I predicted, as you will see in the statistics below.

And those high interest rates? Well, mortgage interest rates are negotiable!

Mortgage lenders want to lend. When they don’t make loans, they are not making money. It’s that simple. As I always tell you…it’s Econ 101…Supply and Demand. Therefore, they are willing to entertain negotiations on the rate.

Some lenders are even making “Refinance for Free” propositions to potential borrowers. A recent Wall Street Journal article explained that “usually, lenders who offer buy-now-refinance later mortgages will give some borrowers a certificate or another type of IOU that gives them access to a credit that can be used to pay for some of the costs associated with a future refinance”, according to Jacob Channel, senior economist at Lending Tree.

Other lenders may roll the future closing costs into the loan amount or waive lender fees. Each offer is different, but the point is…once again…mortgage rates and terms are negotiable!

And rates WILL go down in the next few years and home appreciation WILL continue, especially in desirable locations such as Colorado Springs.

If you’ve considered a move, now is a great time to find out how to put all of this to work for you and your family. Having a seasoned, knowledgeable professional like me on your side will only make it easier.

And, if you’ve got two minutes and 17 seconds, I will further explain why it makes sense to buy now and refinance later if you are even considering a move.

Simply click on the link below and you will be directed to my personal YouTube channel.

To watch, click here:

In fact, while you’re at it, you might want to subscribe to my channel, so you won’t miss future broadcasts. It won’t cost you anything…well, it could cost you… if you miss some of my informative musings!

So, as always, if Residential real estate is among your current hopes and dreams, please give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let me help make them come true.

And now for statistics…

OCTOBER 2023

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the October 2023 PPAR report.

In El Paso County, the average days on the market for single family/patio homes was 43. For condo/townhomes it was 38.

Also in El Paso County, the sales price/list price for single family/patio homes was 99.3% and for condo/townhomes it was 99.4%.

In Teller County, the average days on the market for single family/patio homes was 37 and the sales/list price was 97.7%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing October 2023 to October 2022 for All Homes in PPAR:

Single Family/Patio Homes:

- New Listings were 1,185, Down 4.4%

- Number of Sales were 851, Down 22.6%

- Average Sales Price was $556,964, Up 4.6%

- Median Sales Price was $485,000, Up 4.3%

- Total Active Listings are 2,505, Down 5.3%

- Months Supply is 2.9, Up 0.2

Condo/Townhomes:

- New Listings were 185, Up 12.1%

- Number of Sales were 128, Down 14.7%

- Average Sales Price was $373,190, Up 1.5%

- Median Sales Price was $350,000, Up 3.7%

- Total Active Listings are 378, Up 43.2%

- Months Supply is 3.0, Down 2.9

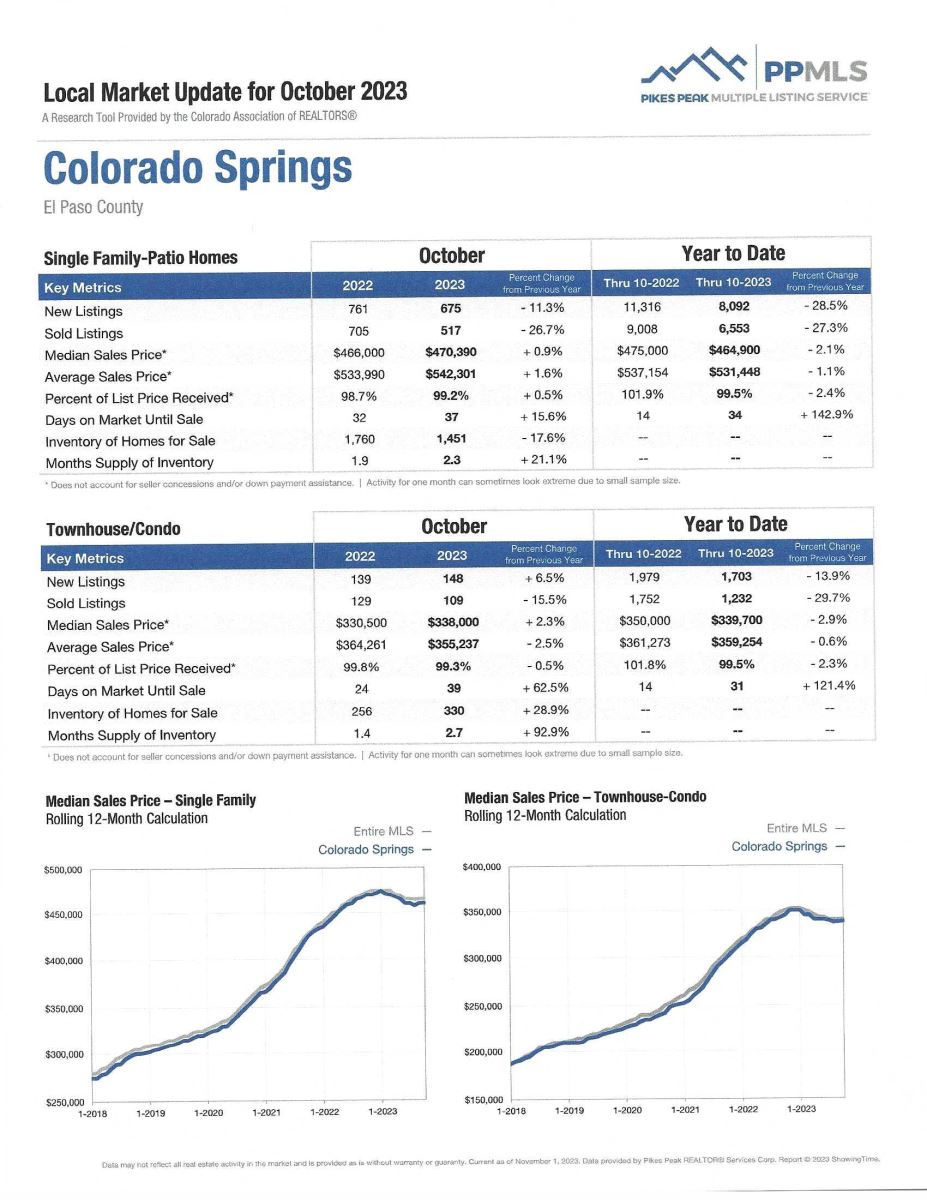

OCTOBER 2023 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year-to-Date one-year change:

- Sold Listings for All Properties were Down 23.9%

- Median Sales Price for All Properties was Up 2.6%

- Active Listings on All Properties were Down 9.5%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering in order to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

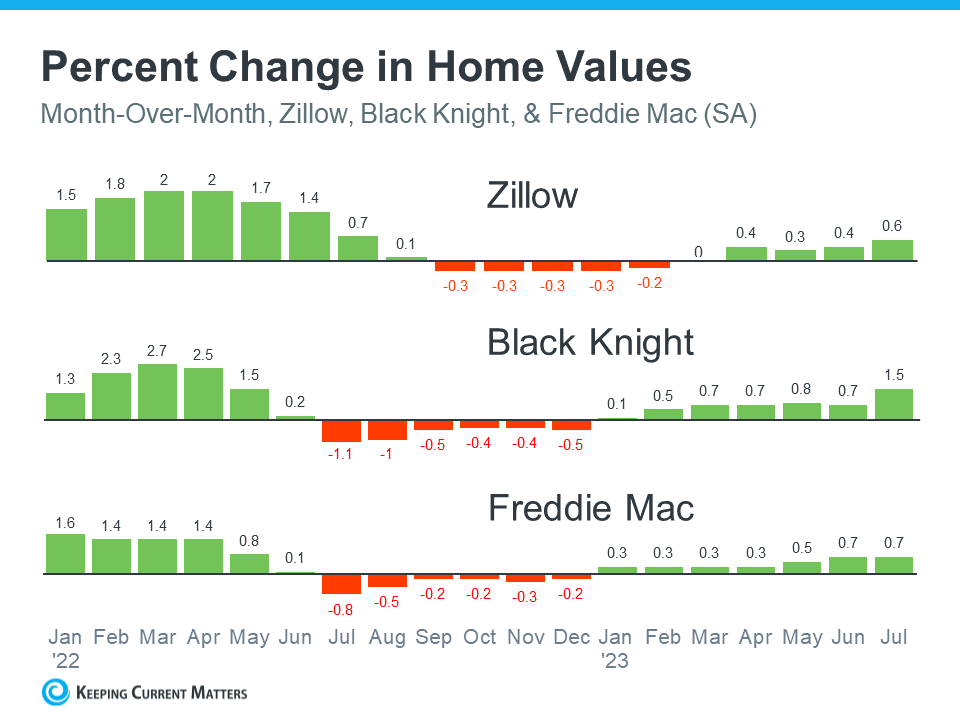

3 GRAPHS THAT PROVE HOME PRICES AREN’T FALLING

KeepingCurrentMatters, October 20,2023

You can see from the above statistics that our local home prices are rising, not falling, but for those who believe media reports that home prices will fall, here is some concrete evidence that home values are not going to fall like they did during the crash of 2008.

Data shows that home prices are NOT falling. Take a look at this graph showing three trusted sources and you’ll see that prices bounced back quickly after experiencing only minor, if any, declines last year:

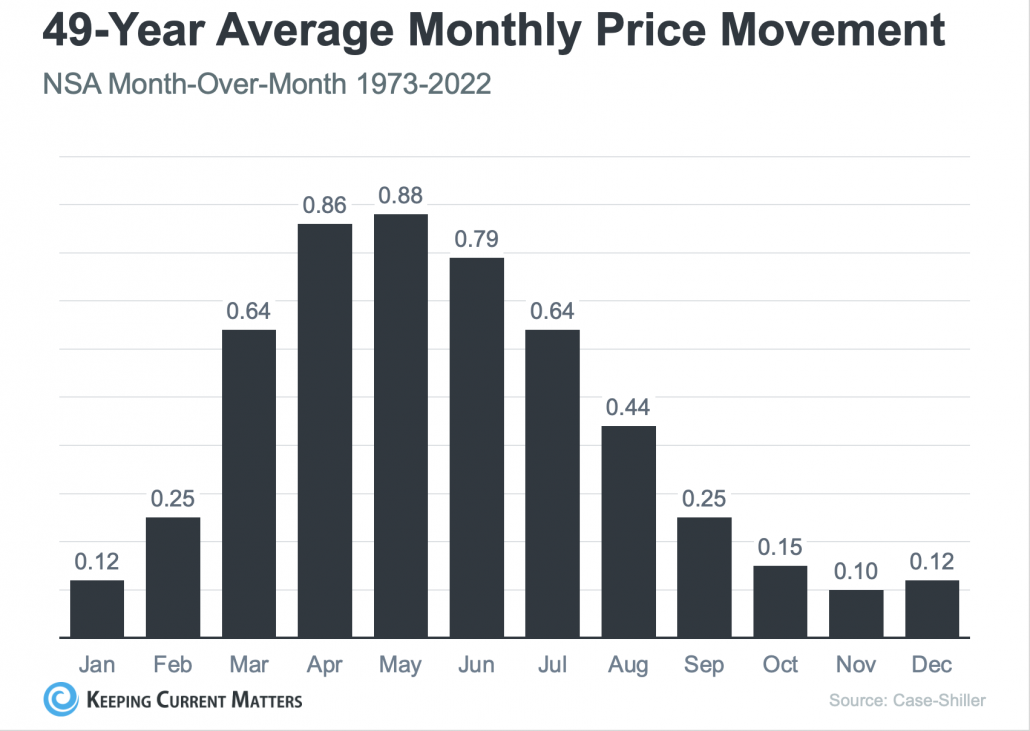

Home prices follow a predictable seasonal trend, and that trend is what’s starting to happen once again this year.

Just like the changing of the seasons, the housing market has its own cycles. To get a clear picture of what’s “normal” for the market, let’s look back in time for a minute.

Check out the graph below—it’s based on Case-Shiller data from 1973 to 2022 (unadjusted for seasonality). It will help you understand how home prices usually change throughout the year.

At the beginning of the year home prices grow, but not as much as they do in the spring and summer markets. That’s because the market is less active in January and February since fewer people move at that time of year.

As the market transitions into the peak homebuying spring season, activity ramps up and home prices go up a lot more in response. Then as fall and winter approach, activity eases again. Price growth slows, but still typically appreciates and that is what we are seeing now, both nationally and here in Colorado Springs. It’s a deceleration of appreciation, not depreciation.

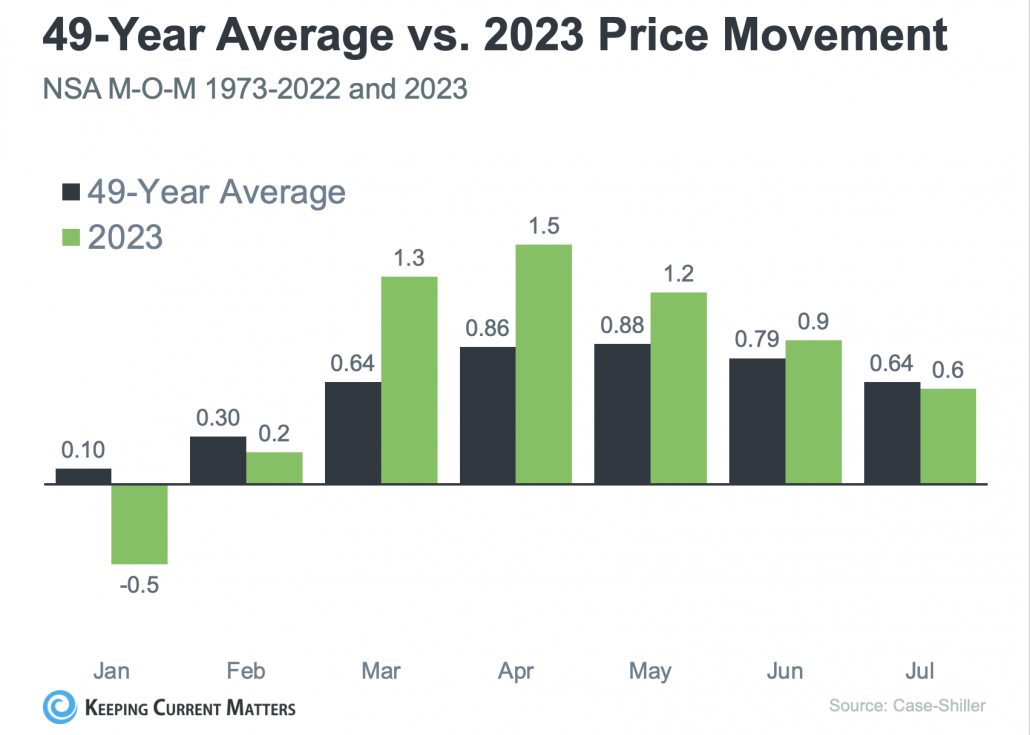

Look at this next graph. It takes the graph from above on the long-term trend and adds in the latest numbers available for this year. That way it’s even easier to see. The black bars represent the average home price movement over 49 years, while the green bars show what’s happening this year:

Prices are still going up, just a bit slower. Sometimes the media gets it wrong, thinking slower growth means prices are dropping.

But that’s not true—it’s just that appreciation is happening at a more typical pace.

These again are more examples of the fact that homes are NOT going to lose value and if you are looking to buy, the sooner you do, the sooner your home can start earning equity for you.

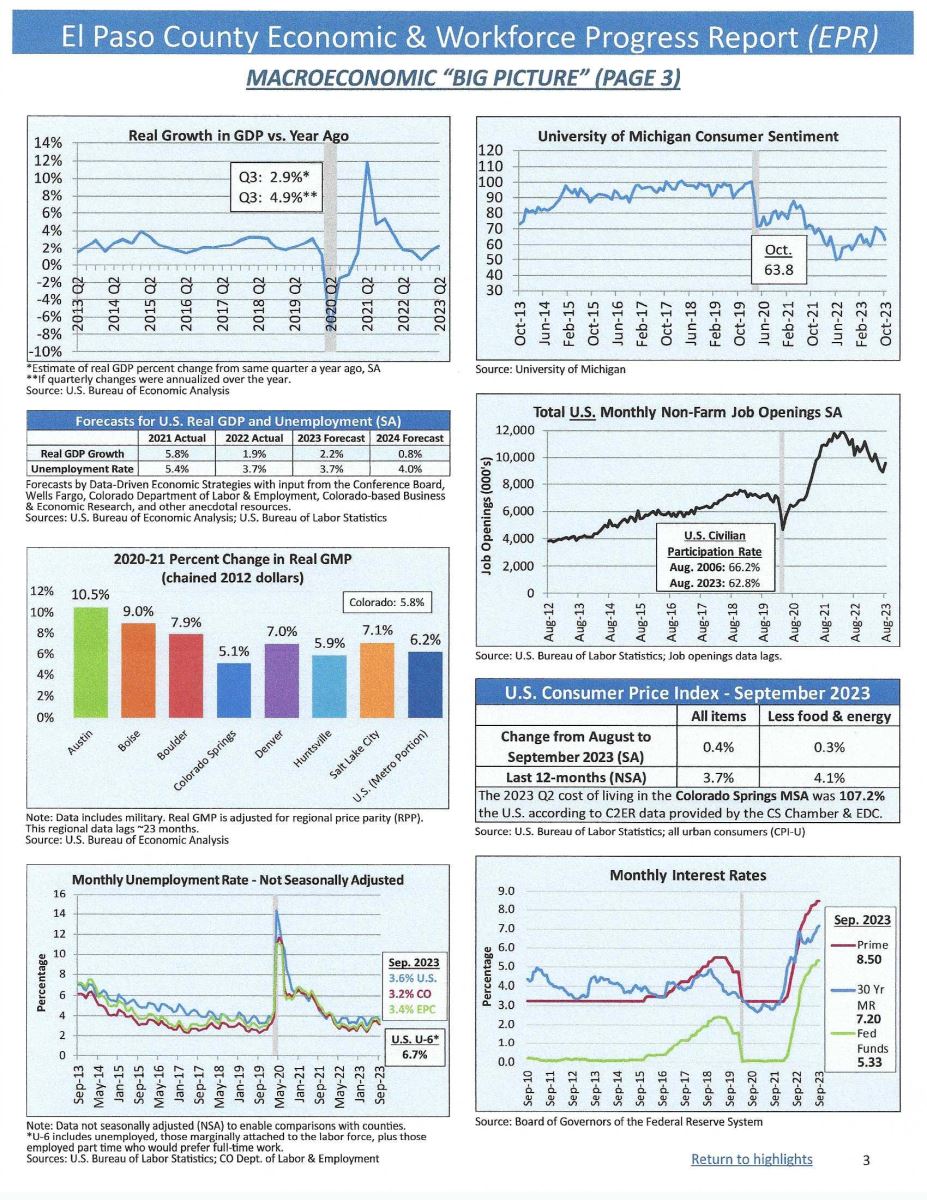

ECONOMIC & WORKFORCE DEVELOPMENT REPORT

Data-Driven Economic Strategies, October 2023

As always, I like to share the useful economic data I receive from our “local economist”, Tatiana Bailey. You will see in these charts what’s happening locally in terms of the economy as well as the most recent Workforce Progress Report.

This information is especially invaluable to business owners; however, I think you all will all find it worthwhile reading.

Below is a reproduction of the first page of statistics that I know you will find interesting and to access the report in its entirety, click here. If you have any questions, please give me a holler.

UCCS ECONOMIC FORUM MONTHLY DASHBOARD

Updated October 24, 2023, UCCS College of Business/Economic Forum

Here is the monthly report from the UCCS College of Business Economic Forum. I know several of you who enjoy statistics and use this information in your daily business life and I will share it as always.

To read the report, please click here.