HARRY'S BI-WEEKLY UPDATE 11.28.23

November 28, 2023

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

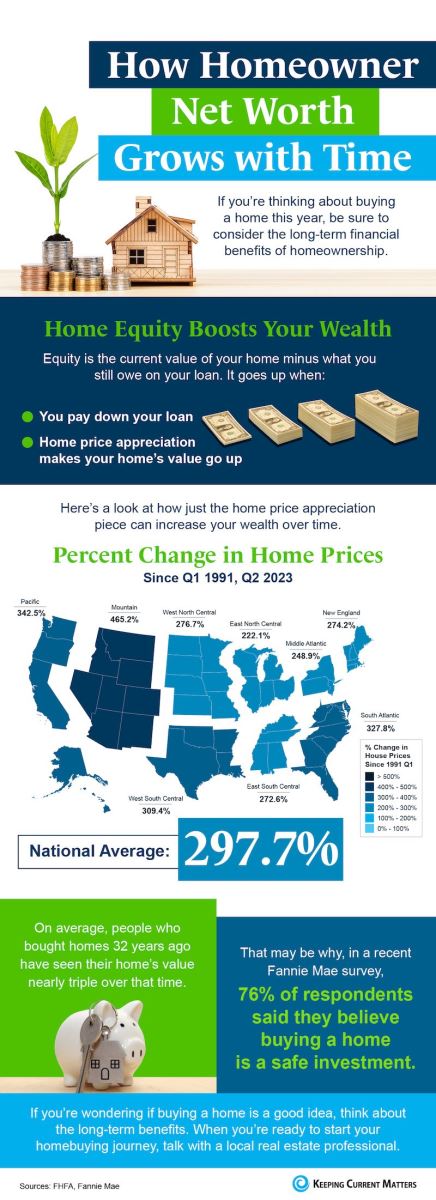

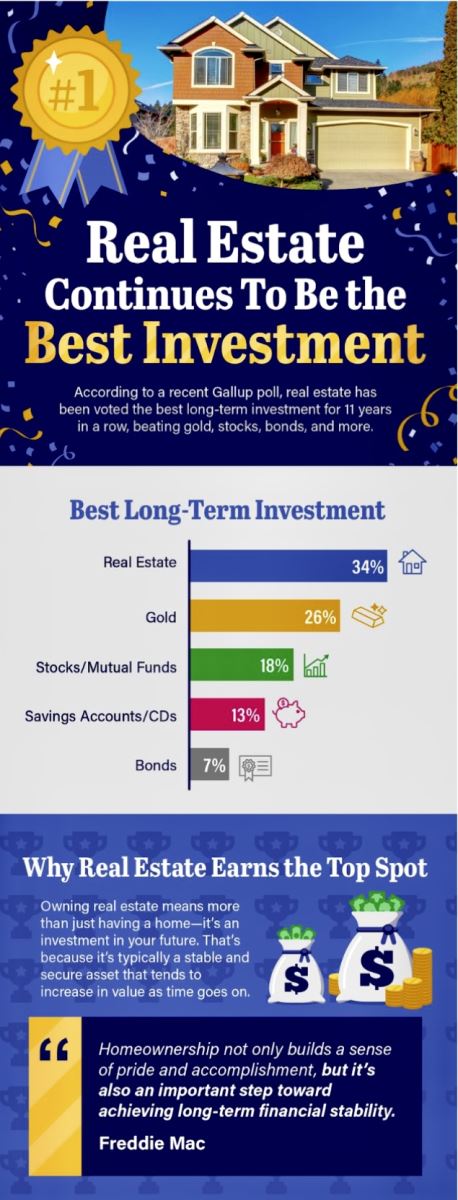

A HOME IS A GIFT TO YOURSELF AND YOUR FAMILY THAT JUST KEEPS ON GIVING

I hope everyone had a great Thanksgiving holiday. With all the turmoil in today’s world, I’m thankful every day that I live in the United States of America and most especially here in Colorado Springs. I hope and pray that 2024 will bring more peace to us all, no matter where we live or how we believe.

And I’m very thankful for YOU, my clients, friends, and clients to be. What I do, and have done for 51 years now, is help find “safe harbors” for people. After all, isn’t that what homebuying is all about? Finding the right place for a family to grow and prosper in a safe, happy and creative environment?

It gives me great pleasure when I can help find just the “right” fit for an individual family’s wants, needs and budget requirements. I work hard to make that happen and when I see how it all comes together…well, sometimes it’s like “magic”.

I certainly don’t claim to be a magician, and oftentimes my title of “real estate Therapist” comes into play here, but when I see how my hard work comes to fruition it truly makes me happy because I know from all my years in this business that finding the “right” home can make such a difference to a family.

And that’s not even taking into consideration that a home is often a family’s most valuable asset. With each passing year that asset is likely increasing in value, thus bringing even more financial stability and home equity.

So, with the holiday season upon us, I thought I’d remind you that your home is a gift you bought that keeps on giving and likely will do so for many, many years to come.

And when you are ready to put that equity to work either in another home or in an investment property, I’ll be here to help you along the way.

By now you know how to reach me…either by calling 719.593.1000 or by email at Harry@HarrySalzman.com. I’ll be available whenever you, your family, your co-workers or friends need me.

AND NOW ANOTHER WORD FROM ME…

If you’ve got a minute and 37 seconds, I’ve got some additional news for you. Click on the link below to hear my latest podcast:

Be sure to “subscribe” online to hear my “blurbs” when they are first available.

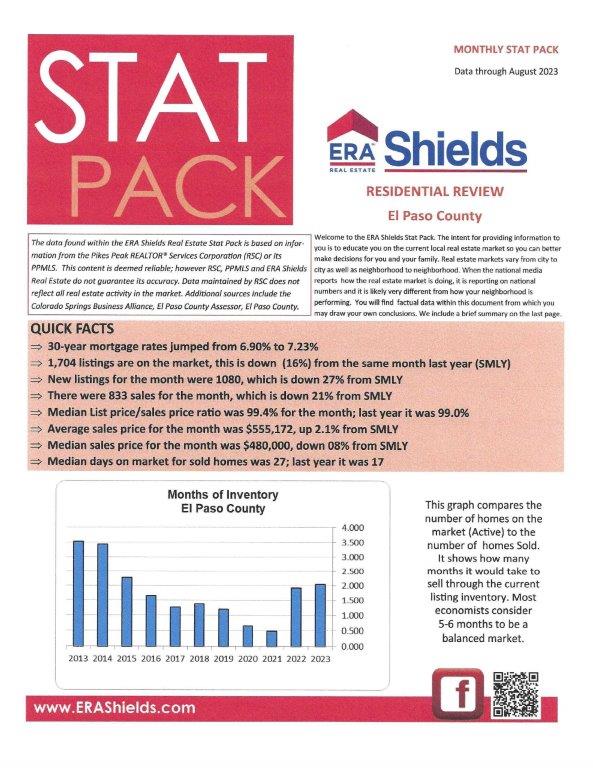

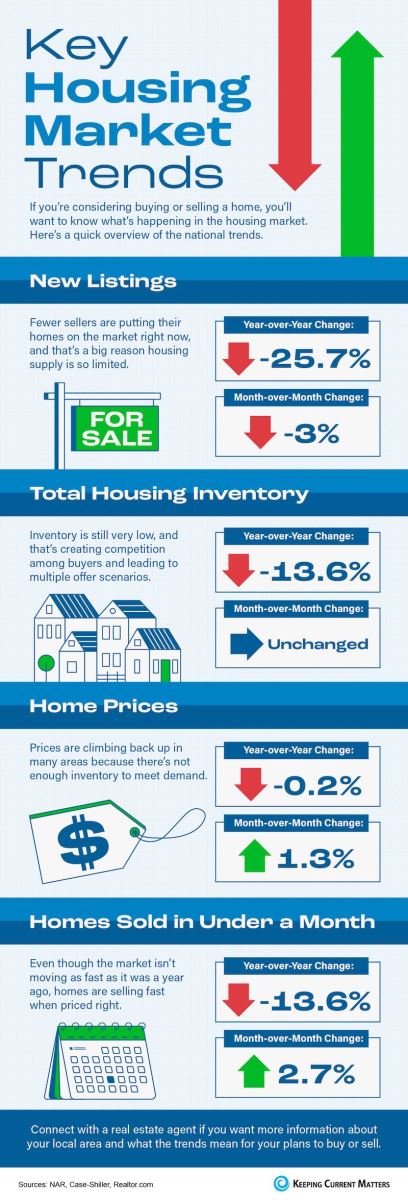

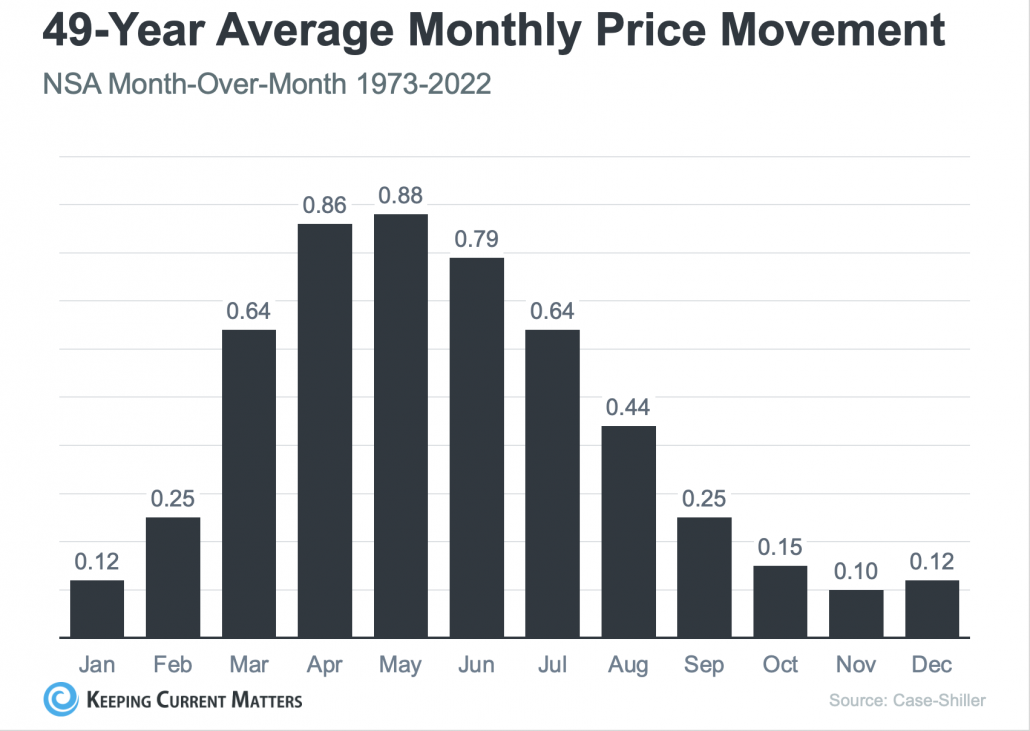

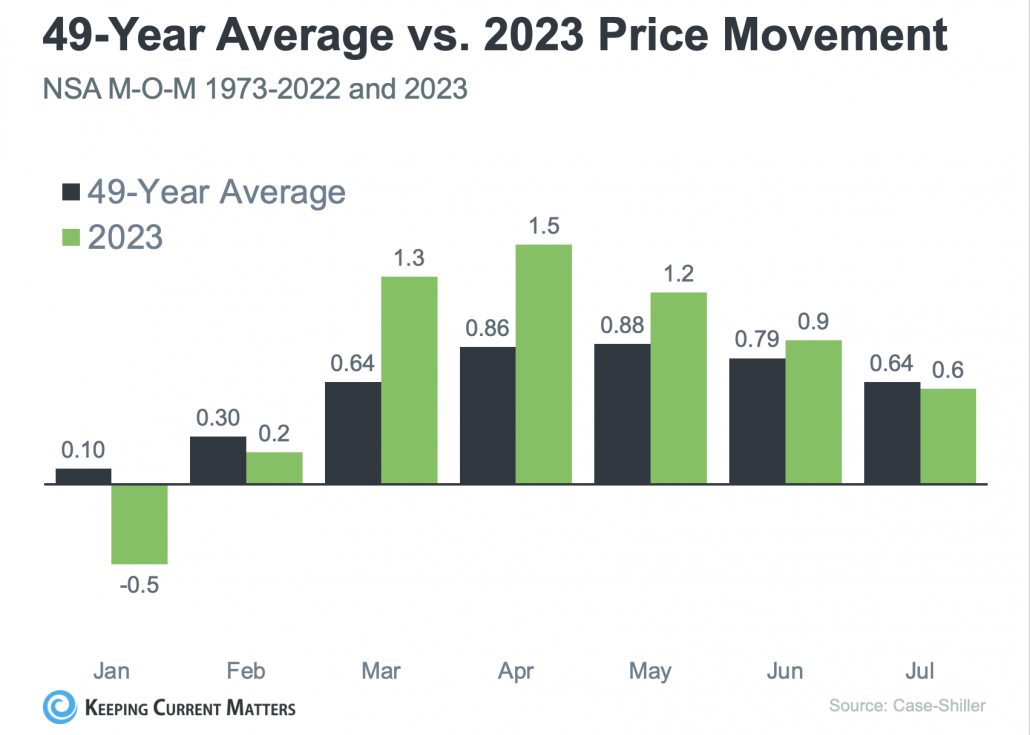

THE THANKSGIVING HOLIDAY MAY BE OVER, BUT HOMEOWNERS ARE THANKFUL EVERY DAY….an Infographic

Keeping Current Matters.11.24.23

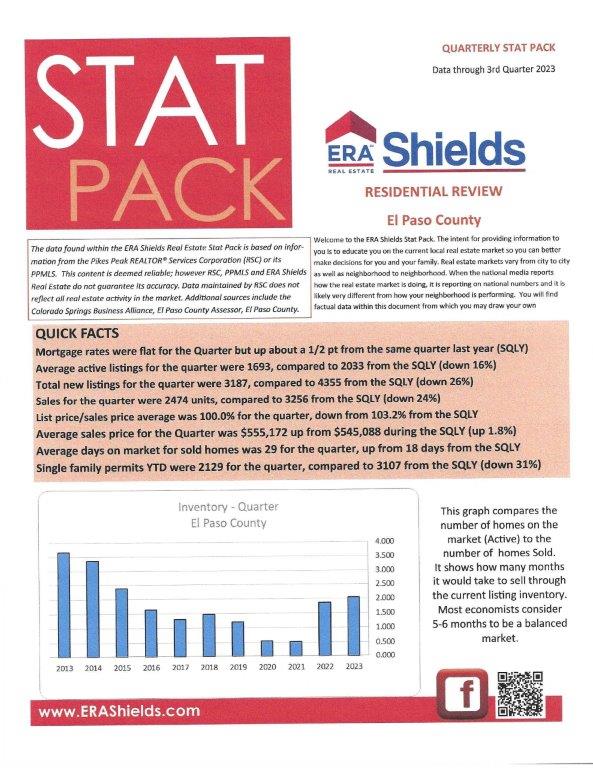

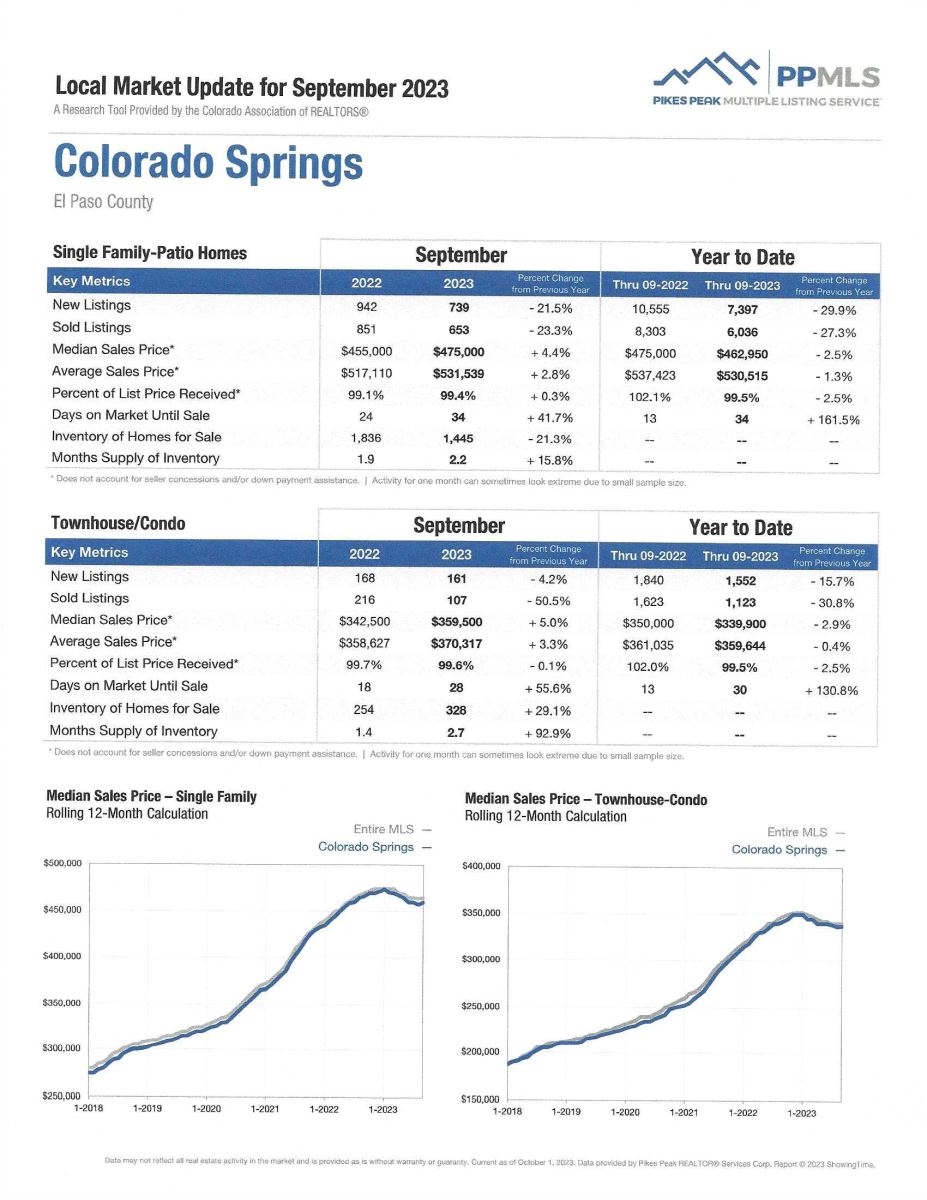

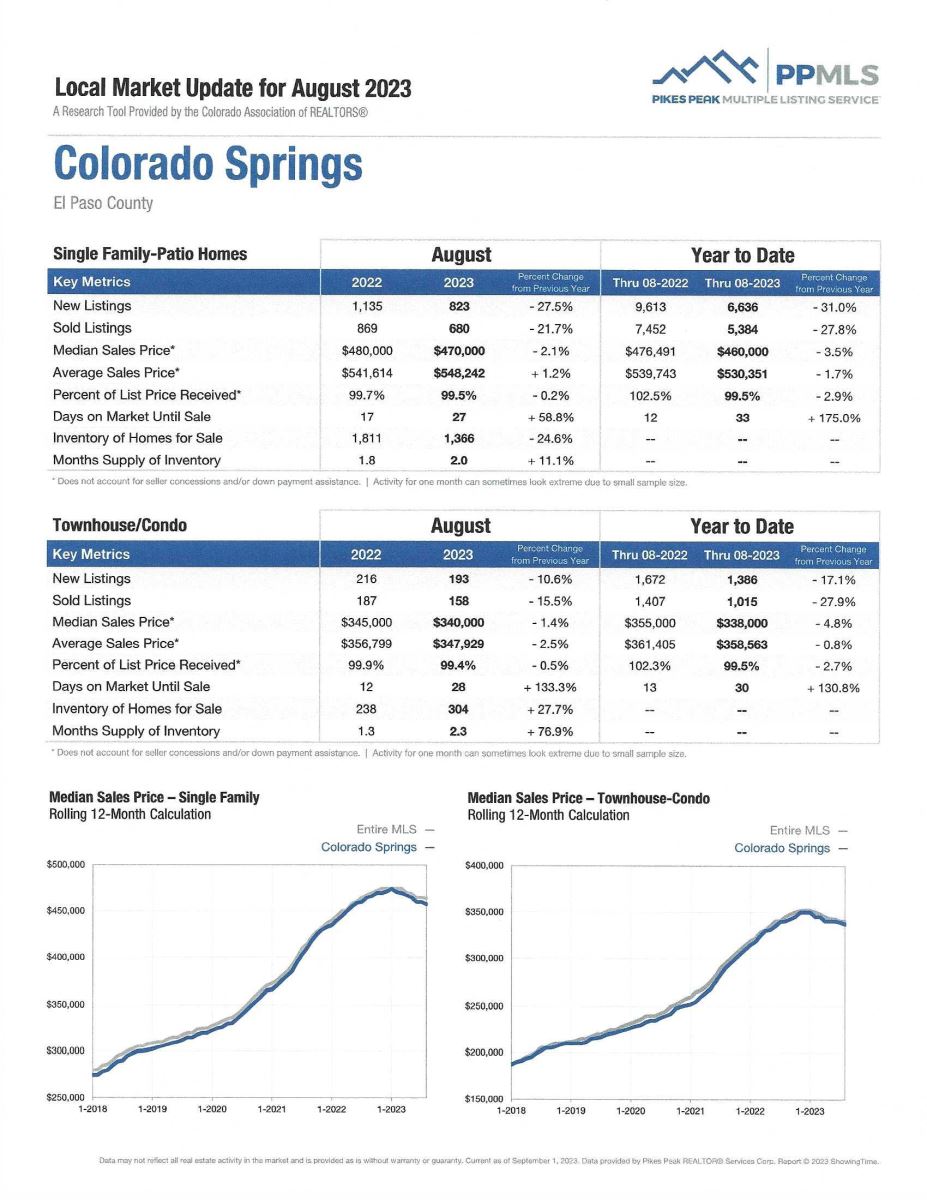

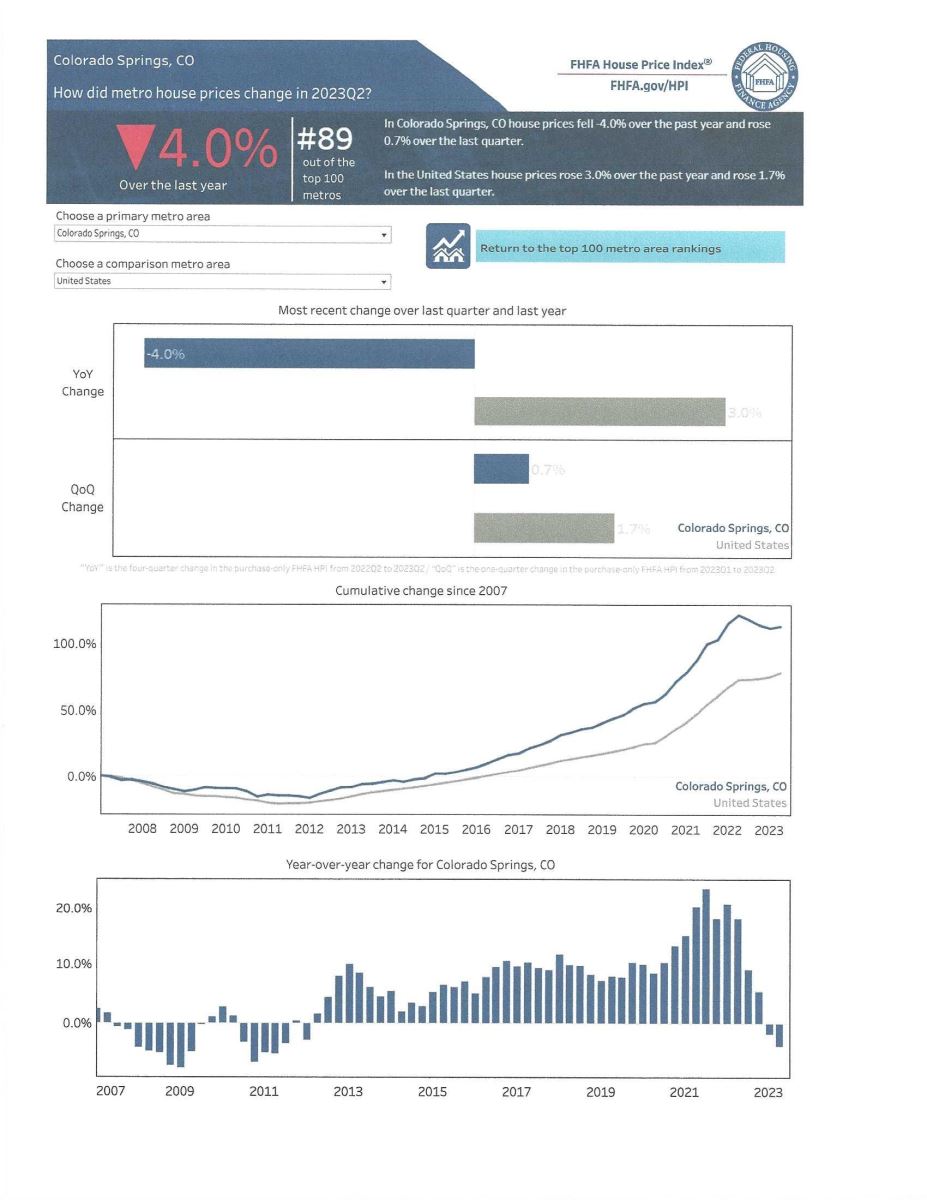

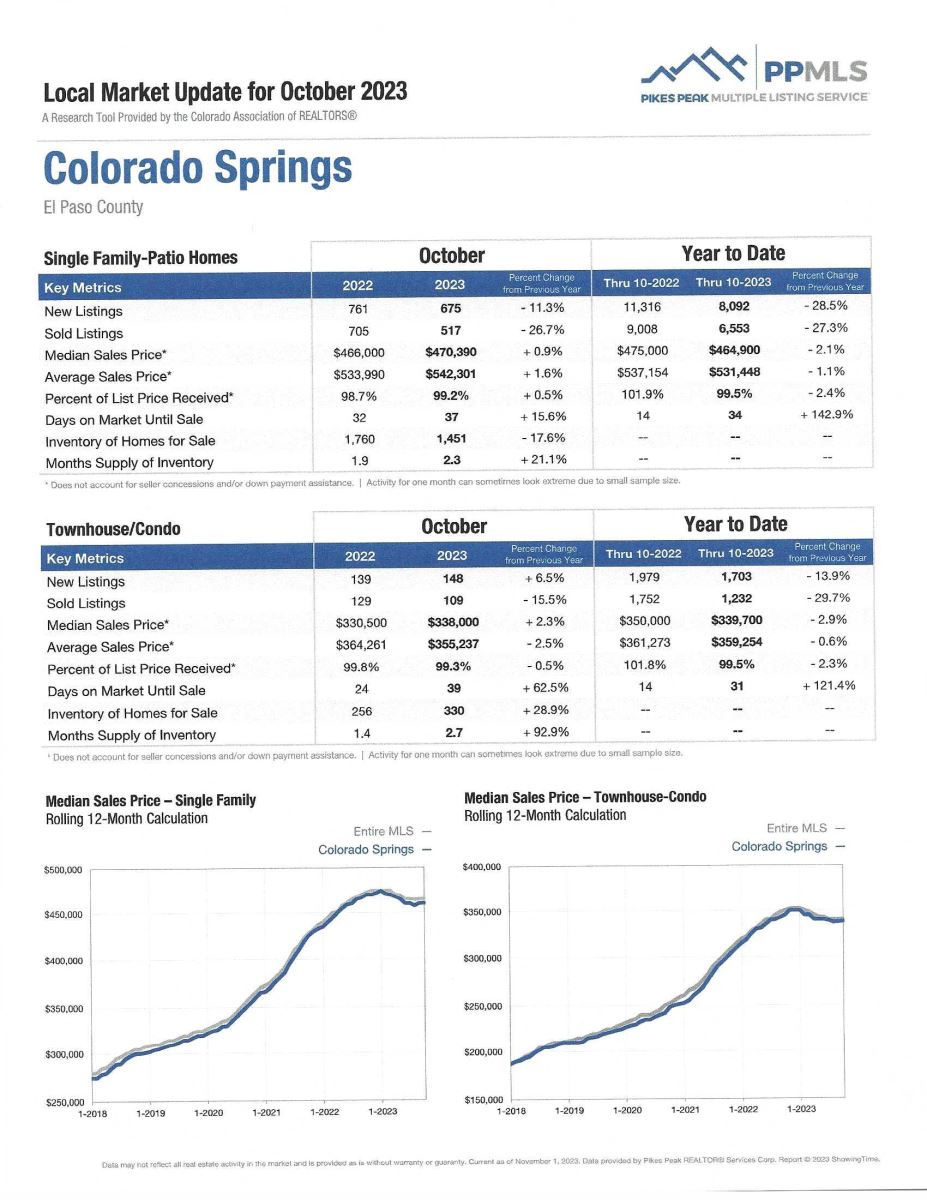

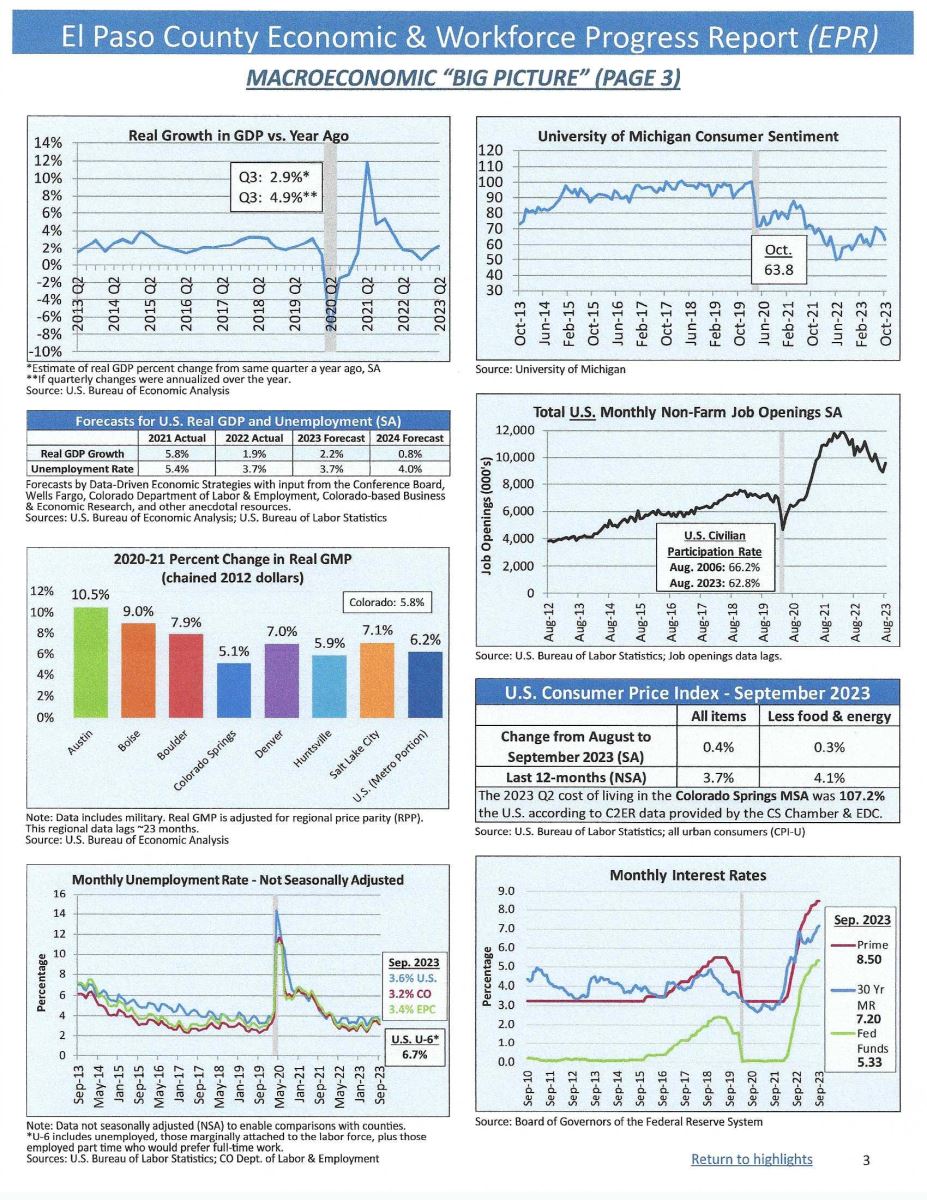

COLORADO SPRINGS HOME PRICES CONTINUE TO RISE IN THIRD QUARTER 2023

The National Association of Realtors, 11.9.23

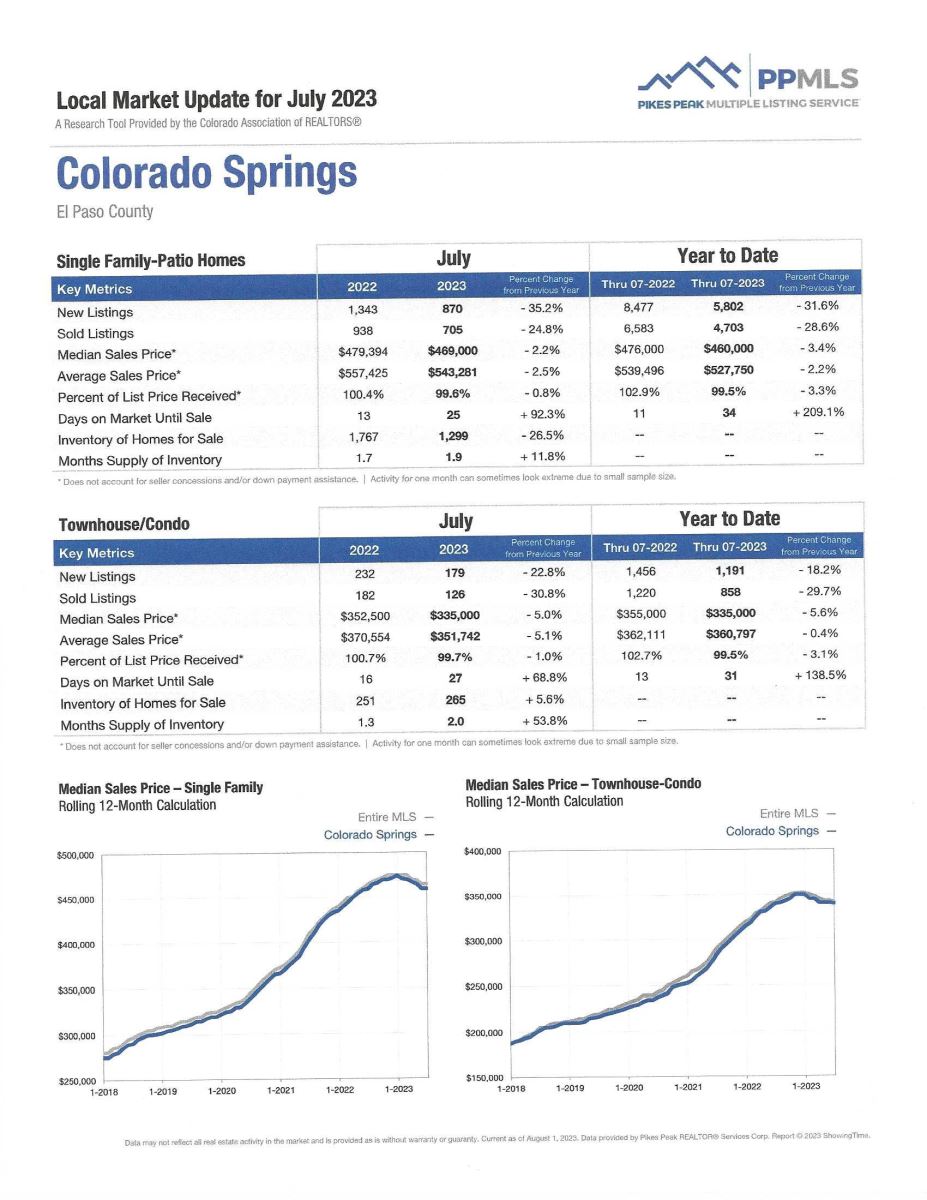

In the recently published report from the National Association of Realtors (NAR), single-family, existing-home prices grew in 82% of measured metro areas. This is up 58% from the previous quarter.

According to Lawrence Yun, chief economist for NAR, “Homeowners have accumulated sizable wealth, with a typical homeowner gaining more than $100,000 in overall net worth since 2009 and before the height of the pandemic.”

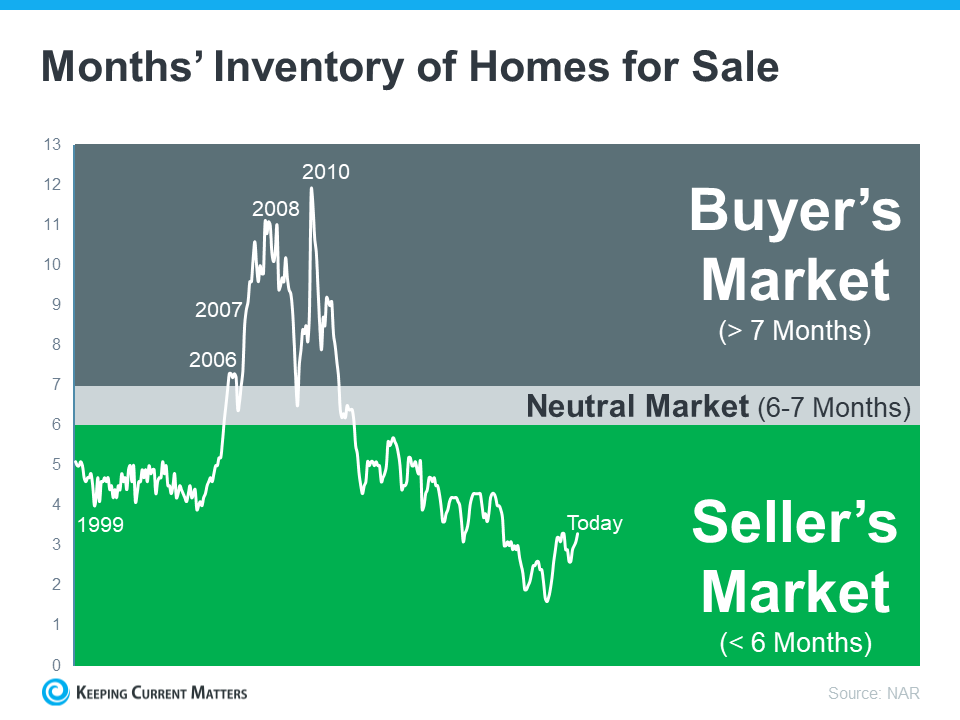

“However,” he added, “the persistent lack of available homes on the market will make the dream of homeownership increasingly difficult for younger adults unless housing supply is significantly boosted.”

The median price nationally rose 2.2% quarter-over-quarter to $406,900.

The median price of single-family homes in Colorado Springs rose 0.9% to $466,300 during the third quarter of the year, per NAR. This price reflects detached, single-family and patio homes but not townhomes or condominiums.

The median price in the Springs ranked 46th highest of the 221 cities surveyed.

To see all 221 metro areas in alphabetical order, please click here. To see them in ranking order, click here. Or click here to see what income levels are required to purchase homes based on either a 5, 10 or 20 percent down-payment.

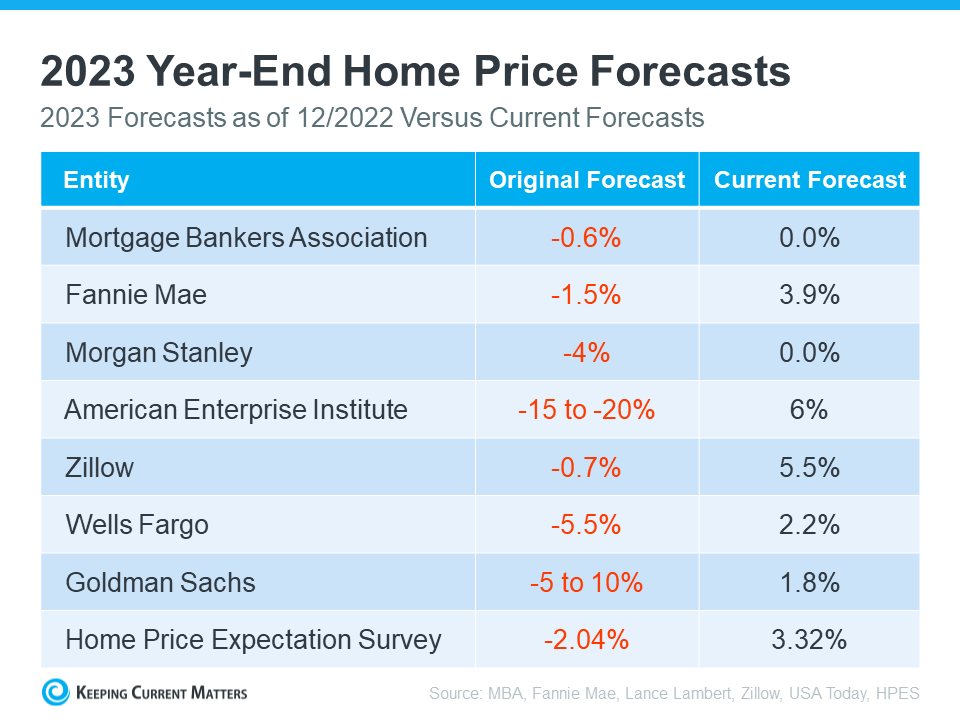

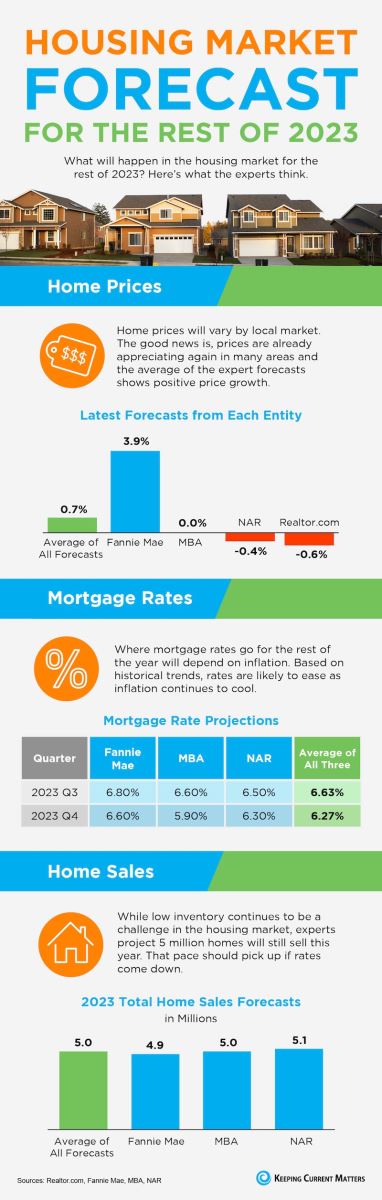

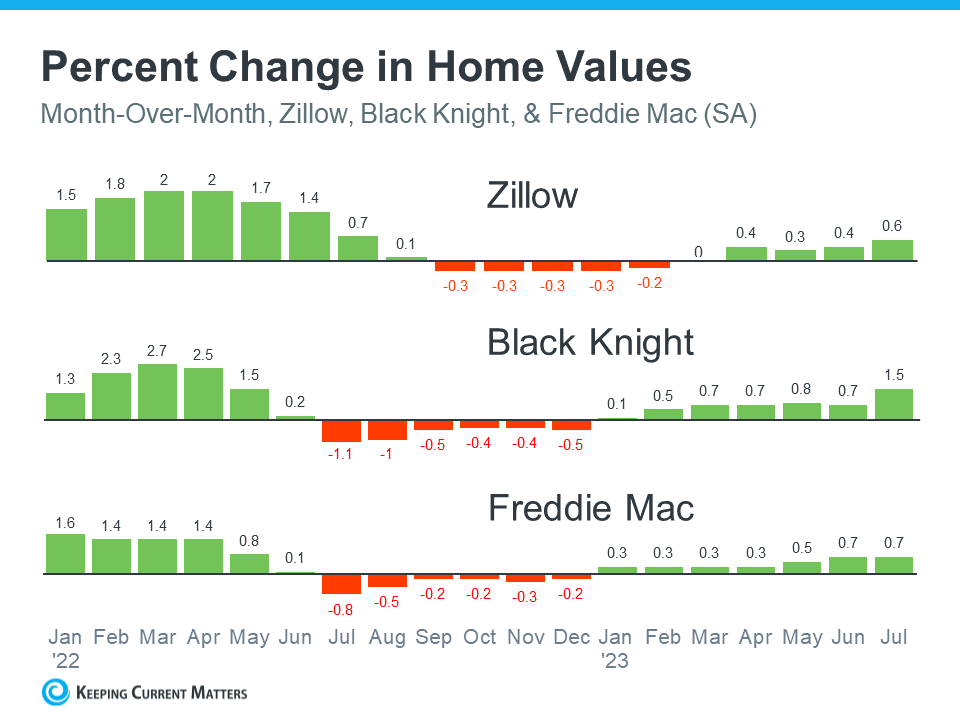

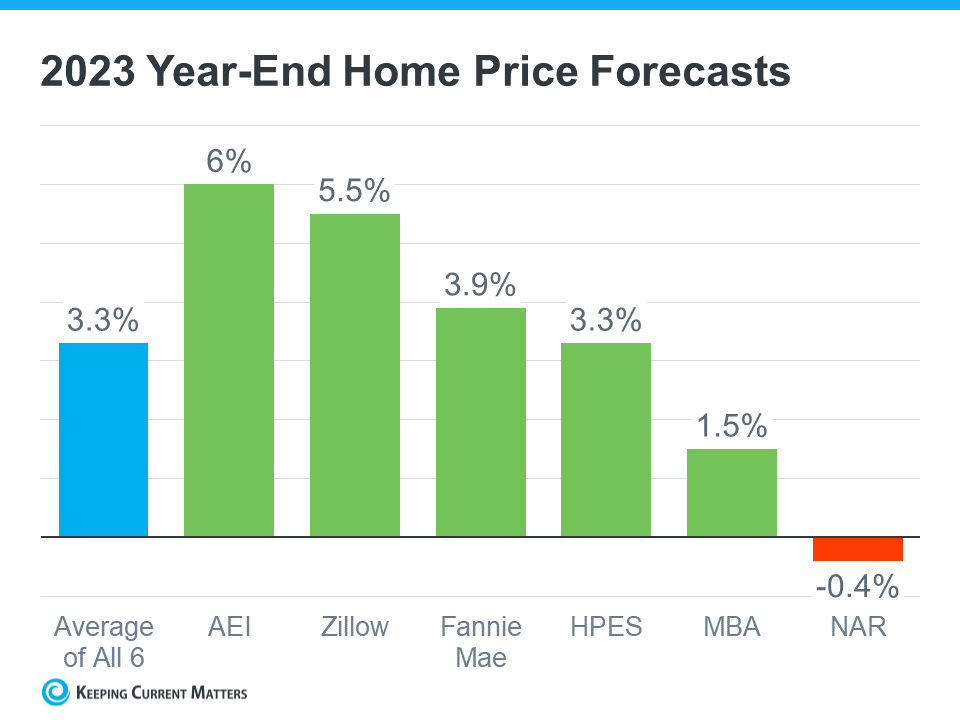

2024 HOUSING FORECASTS SHOW NO SIGN OF “SLOWDOWN” EITHER IN SALES OR HOME VALUES…an Infographic

Keeping Current Matters, 11.17.24

Bottom Line:

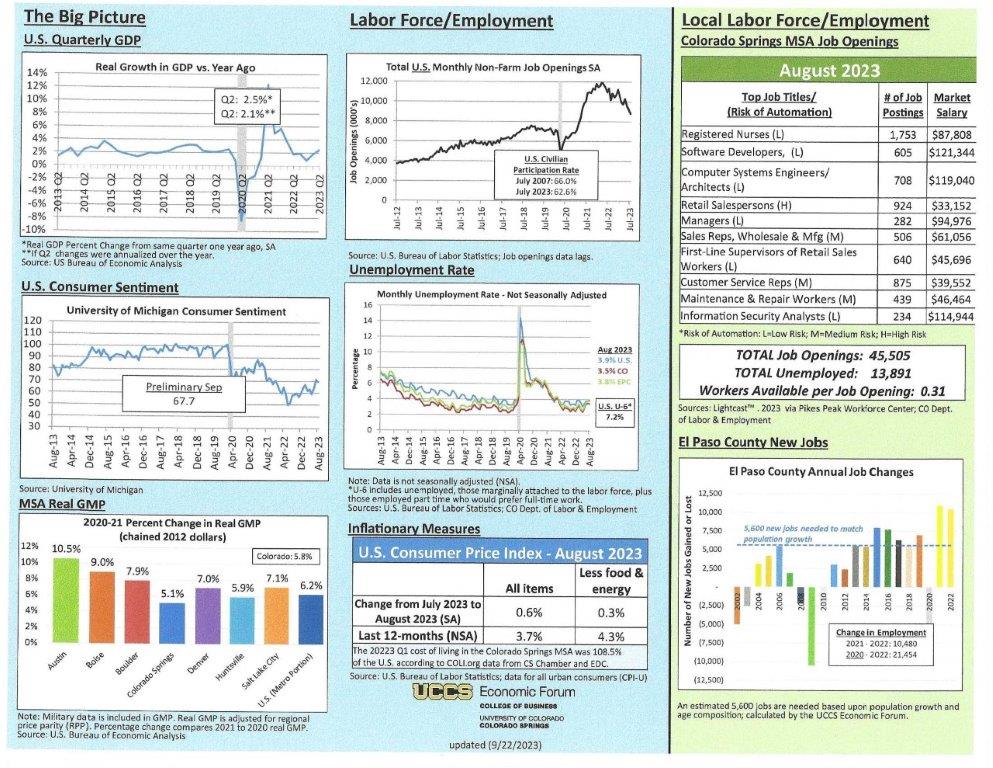

- If you’re thinking of buying or selling a home and wondering what 2024 will bring for the housing market, experts from Fannie Mae, MIBA and NAR forecast that home prices nationally will end this year up 2.8% and should rise another 1.5% in 2024. I certainly feel that Colorado Springs will likely see higher increases due to the number of new businesses moving into the area in the next several years.

- Also, homes sales nationally are projected to increase in 2024 which is good news because it means that experts are forecasting more activity as people continue to move. I predict the same for the Colorado Springs area.

SHARE OF U.S. HOMES BOUGHT WITH CASH HITS 9-YEAR HIGH

The Gazette, 11.19.23

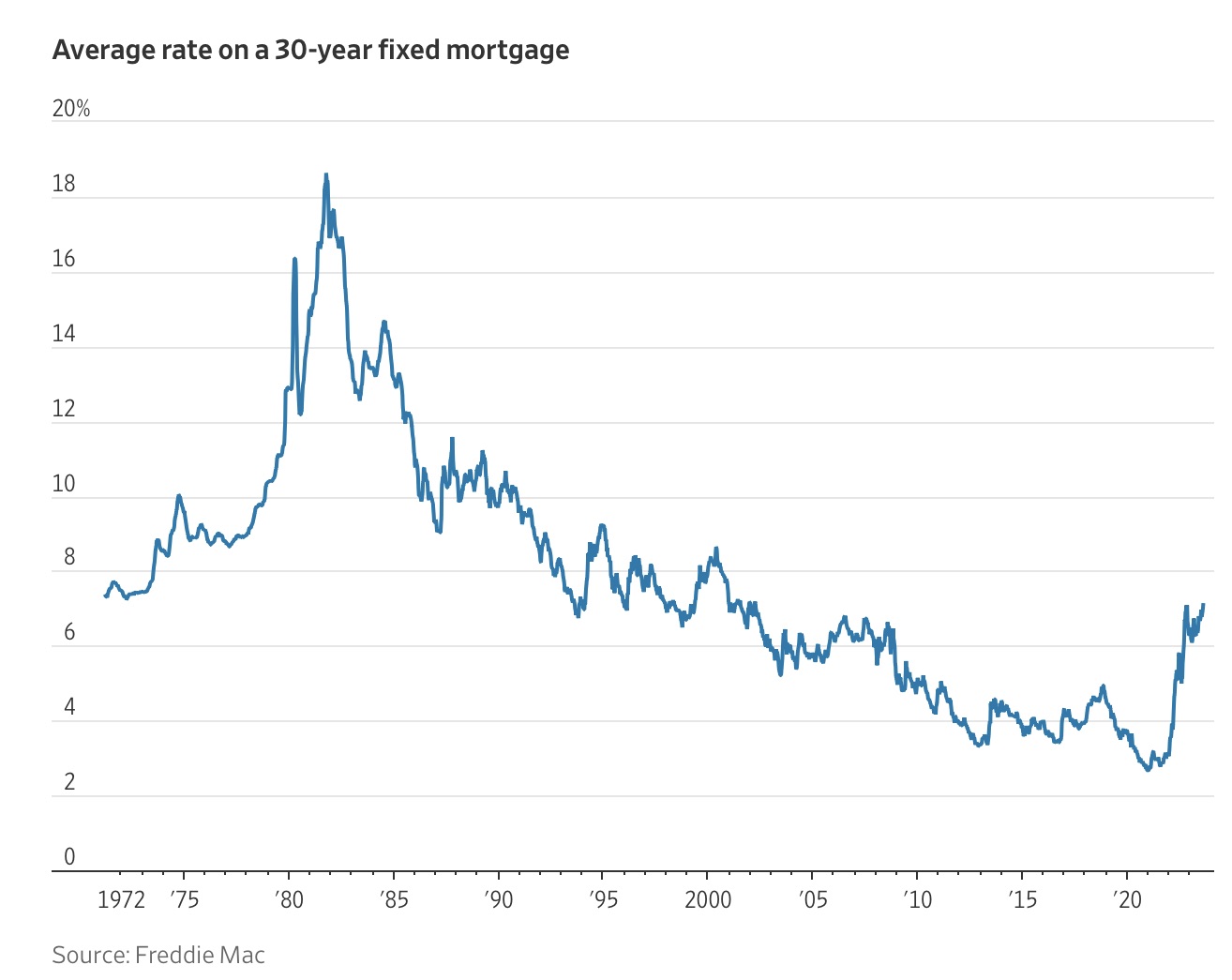

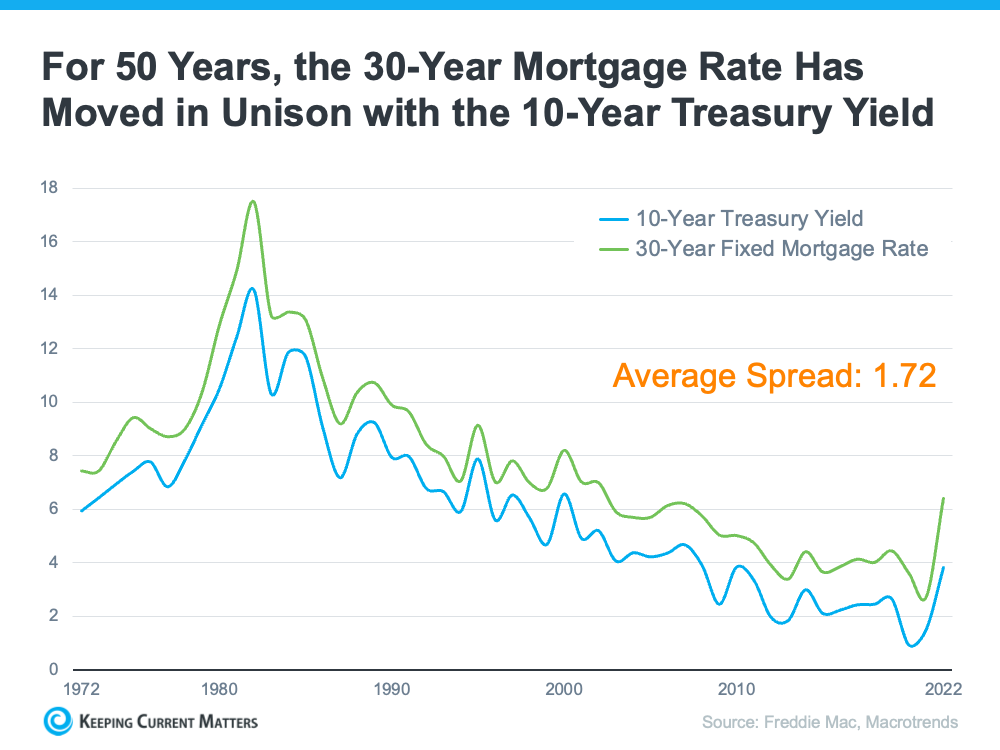

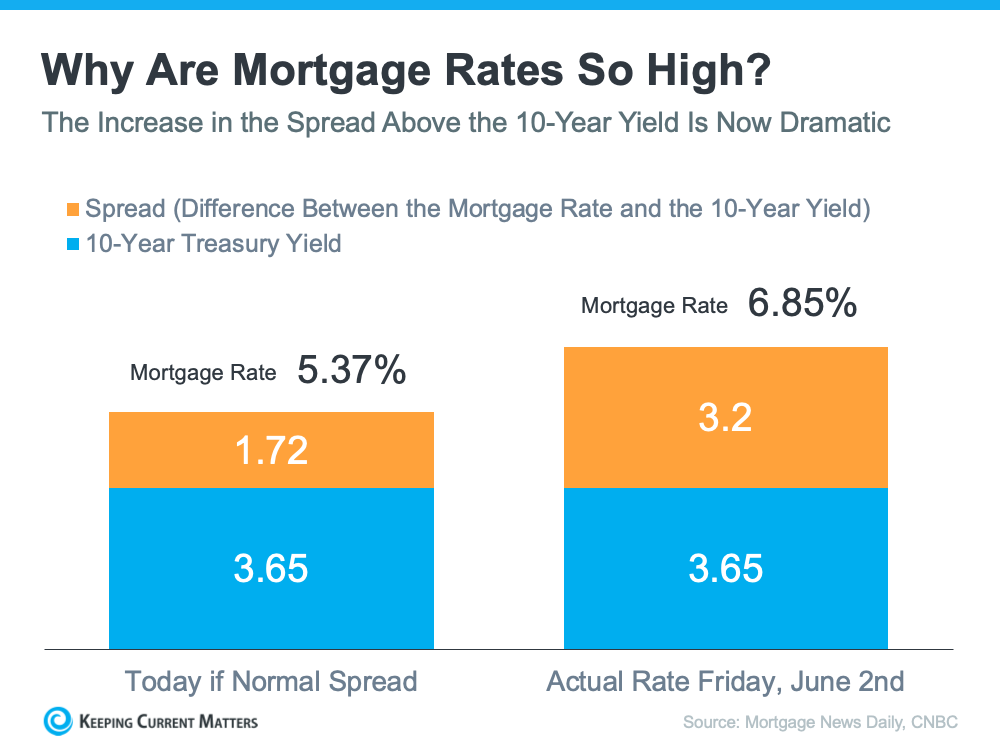

Homeowners who want to bypass the highest mortgage rates in two decades are increasingly forgoing financing and paying all cash.

Homes purchased entirely with cash, which means there was no reference to a mortgage on the deed, accounted for 34% of all sales in September, up from 29.5% a year ago and the highest share in nearly a decade, according to a Redfin analysis of home sales in 40 of the nation’s most populous meto areas.

With homes sales at a 13-year low in October nationwide, and even though the all-cash share of all sales increased, the number of all-cash transactions in September fell 11% from a year earlier Redfin found. In contrast, homes sales overall fell 23% in the same period.

“Were it not for those cash buyers, I think the housing market would be in an even worse position than now”, said Daryl Fairweather, Redfin’s chief economist.

Even homebuyers who use financing are electing to make bigger down payments in order to reduce the size of their mortgage.

The typical U.S. homebuyer put down 16.1% of the purchase price in September, the highest percentage in nearly a year and a half, according to Redfin.

I am seeing the same things with recent clients. Homes ARE selling, but more and more I find clients putting larger down payments or paying all-cash for their purchases. I expect this to change a bit once rates start to fall, but for now this seems to be the norm.

.png)

.jpg)